Winter is over, is spring still far behind? 10 pictures review how the cryptocurrency in the first half of 2019 came out of the trough

This article is intended to convey more market information and does not constitute any investment advice.

The first half of 2019 has passed and we miss it very much.

In the past six months, we have witnessed the active self-help of the IEO carried out by the exchanges in the winter, witnessed the innovation of the blockchain project, and witnessed the entry of traditional technology finance giants;

We have also witnessed the growing maturity of regulatory policies, witnessed Facebook's launch of Libra, and the opening of the encryption world to 2.7 billion users, witnessing the first public opinion of domestic government officials to pay attention to digital currency and encryption assets, and affirmation of the domestic development status.

- The gathering of the public coffee, the Ethereum Technology and Application Conference was held in Jingsheng University

- Libra Research Report of CCID Research Institute of the Ministry of Industry and Information Technology: Advocating China's Active Promotion of Digital Legal Currency Construction

- How should the banking industry use blockchain technology?

We have also witnessed the rise of Bitcoin from less than $3,500 to more than $10,000, and the total market capitalization of the encryption market has risen from $122 billion to $366 billion – a full three-fold increase.

Behind the amazing growth, we are also seeing efforts from the cryptocurrency industry, traditional technology finance companies, and government regulators. When looking back at how the cryptocurrency came out of the trough in the first half of 2019, a history of stagnation began.

Bitcoin prices have more than tripled in 2019

In the first half of 2019, Bitcoin staged a magnificent market trend.

In the past year, Bitcoin has been caught in a bear market with a minimum price of less than $3,200. In 2019, driven by the industry's IEO self-help, large-scale technology finance companies, and external funds, the bitcoin price rebounded strongly. In early April, mid-May, and mid-June, the price rose sharply. The highest price hit. The $13,970 is more than three times the beginning of the year.

The mainstream media has also adjusted its judgment on the cryptocurrency market as Bitcoin has repeatedly shown strong growth momentum. On June 22, Bitcoin broke through $100 million. The Wall Street Journal and Bloomberg pointed out in a subsequent commentary that the bitcoin has not only shown that the cryptocurrency market has begun to recover, but also shows the driving force behind the rapid return of the market. In 2017, bitcoin rose mainly by retail investors. Driven by high speculative sentiment, but this time more because of the true value of Bitcoin.

Industry self-help, the exchange opened the IEO boom

At the beginning of 2019, with the success of the currency update Launchpad, the IEO model surfaced.

In March, the head exchanges such as Firecoin and OKEx successively launched IEO-like services, and based on the advantages of their own exchanges, recommended high-quality projects for users. The IEO model transfers the risk of the project side to the exchange. Using its own resources and project experience, the exchange can complete the audit of the submitted projects, while also suppressing technical risks such as phishing and malicious attacks. The advantages of users, funds, and flows of the exchange can provide more effective assistance for project dissemination and fund collection.

In the case that the market is still in a bear market, IEO has injected vitality into the market and brought about a “three-win” situation – investors can purchase the project Token at a low price, and sell profit after the project Token open transaction; the project party obtains Better exposure and marketing opportunities can better build the community; the exchange will use the new IEO project to drive new users, activate transactions, and push up the price of platform coins to get more fees.

A report released by data analysis agency Inwara at the end of May showed that in 2019, the IEO project raised about $375 million more than the ICO project. In the past, all IEO projects have raised a total of 1.6 billion US dollars, of which about $1.4 billion was raised in 2019, accounting for 87.5%.

JPMorgan Chase launches its own cryptocurrency JPM Coin

On February 14, JPMorgan Chase, the largest financial services institution in the United States, announced the launch of its own cryptocurrency JPM Coin, which kicked off the entry of large financial technology companies in 2019.

JPM Coin will serve as a payment transaction tool between instant billing users. JPMorgan plans to move cross-border payments and bond issuance to the blockchain. To achieve this goal, it uses faster blockchain smart contracts rather than slow-speed traditional technologies such as wire transfers.

JPM Coin is positioned in stable currency and is pegged to the US dollar in a 1:1 ratio. JPMorgan Chase has positioned it in three major scenarios:

2) for securities trading;

3) Used to replace the US dollar circulating in the JP Morgan Chase business.

Umar Farooq, head of the JPMorgan blockchain project, said that if the blockchain is to be used on a large scale, JPM Coin can make payments on networked devices.

Bakkt, the crypto exchange of the parent company of the New York Stock Exchange, will test bitcoin futures trading on July 22.

On May 13, the New York Stock Exchange parent company Intercontinental Exchange (ICE) submitted two application documents to the US Commodity Futures Trading Commission (CFCT) detailing the specific operational mechanisms of two different bitcoin futures products. Following the parent company's pace, ICE's crypto exchange Bakkt announced that it will test bitcoin futures trading in July. The test is based on the two bitcoin futures products described in the application.

Bakkt was founded in August 2018 and was founded by the New York Stock Exchange's parent company, the Intercontinental Exchange (ICE). In January 2019, Bakkt announced the completion of the first round of financing of 183 million US dollars, with a valuation of 740 million US dollars. Investment institutions include well-known companies such as Starbucks and Microsoft.

In June, Bakkt was released to launch a mobile payment app called “Bakkt Pay”, which entered the hot payment market. Bakkt Pay is expected to focus on the new cryptocurrency payment field, and also cooperate with Starbucks, Microsoft, large supermarket chain Whole Foods, telecom giant AT&T, chain department store Nordstrom, and the world's largest game retailer GameStop to expand its use.

The Ethereum Foundation provides a $19 million budget for Ethereum 2.0, and Vitalik announces that it has achieved all research breakthroughs in Ethereum 2.0.

On May 22, the Ethereum Foundation unveiled the first year of Ethereum's budget plan for the next year. With a budget of up to $30 million, it will be used in three major areas: Ethereum 2.0, the existing Ethereum network, and engineer training education.

As a major project for the coming year, the budget for Ethereum 2.0 is $19 million. Regarding the high budget challenge issued by the outside world, Eitafang founder Vitalik said that the team has achieved all the research breakthroughs of Ethereum 2.0.

Ethereum's early promise was to create a decentralized world computer in exchange for the cost of executing anyone's code. To realize its potential and extend DApp to millions or even hundreds of millions of users, Ethereum must address key issues related to scalability and performance. To this end, Ethereum developers have launched an ambitious “Ethereum 2.0” roadmap, which includes key designs such as PoS and shards.

The collapse of the cryptocurrency market in 2018 was largely due to the failure of the Ethereum's function of issuing coins, and a large number of blockchain projects based on Ethereum were falsified. However, in the “Top 50 Blockchain” list published by Forbes in April, 22 well-known companies based on the Ethereum development blockchain service prove that Ethereum still has a strong consensus foundation. Therefore, the important positive news that Ethereum 2.0 continues to transmit not only affects the fundamentals of ETH, but also improves the cryptocurrency market.

EOS releases social network Voice to broaden usage scenarios

On June 1st, EOS launched the social product Voice at the first anniversary conference. According to reports, Voice can ensure that quality content receives more rewards, and the proceeds will not be taken away by the commercial companies behind, but used to promote community development. In addition, Voice said it will encourage real users to be active on the Internet and actively fight against robot accounts.

After 2019, DApp activity has fallen dramatically, and most are still gaming applications. In this context, EOS created a usage scenario by extending the social network Voice to expand the boundaries of the DApp. Voice is based on the EOS public chain network, but has its own token Voice Token. Users who create, share, discover, and distribute content on Voice will receive a Voice Token reward. EOS founder BM said that Voice is based on the EOS public chain, but users do not have to pay for RAM, CPU, etc., EOS development team Block.one will provide these resources for users.

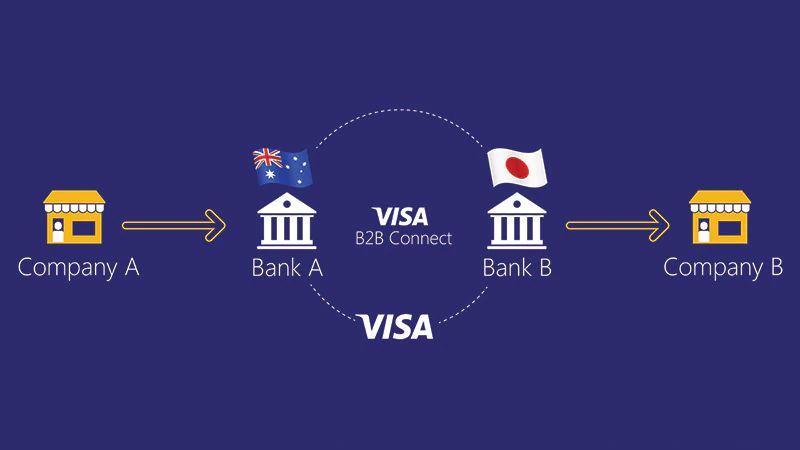

VISA Launches Blockchain Payment B2B Connect, Entering $12.5 Billion Cross-Border Payment Market

On June 12th, U.S. payment giant VISA announced the launch of a blockchain-based cross-border payment network "B2B Connect." B2B Connect is based on a blockchain and incorporates Hyper Ledger technology. According to VISA, B2B Connect has covered 30 trade channels around the world and will expand to 90 markets by the end of 2019. It has only one goal – making cross-border payments faster and cheaper.

Most cross-border payments today are still implemented through the Society for Worldwide Interbank Financial Telecommunication (SWIFT). SWIFT is a Belgian organization founded in 1973 and currently has more than 10,000 members of financial institutions. Despite its long history, the SWIFT system is very inefficient because few banks are able to connect directly to each other. A payment from Kansas City, USA, to Nairobi, Kenya, passes through banks in New York, London and other places before arriving at the destination. Every bank will charge. It is therefore difficult to track the progress of the transfer and predict how much it will cost for this cross-border payment. Taking into account the currency exchange rate between different countries will undoubtedly make people even more headaches.

B2B Connect is said to be a good solution to these problems. It uses a distributed ledger technology that allows banks to connect directly, and the transferee can see the cost of a cross-border payment in advance. Cross-border transactions can be settled quickly within one or two days and are more efficient. VISA said that B2B Connect focuses on high-value B2B transactions above $15,000, which accounts for about 10% of the global cross-border payment market, around $12.5 trillion. The launch of B2B Connect provides a good illustration of the application and value of the blockchain in the financial sector.

14 international financial institutions such as UBS jointly issued the currency to launch the USC cryptocurrency

On June 4th, 14 financial institutions represented by UBS Group AG launched a “bitcoin-like” cryptocurrency for cross-border transaction settlement. The cryptocurrency that is highly anticipated is called "utility settlement coin" (USC).

The USC is reminiscent of JPM Coin's launch of JPM Coin in February of this year, when many people also doubted the determination of large financial institutions to lay out blockchains. However, just a few months later, the market continued to spread the news of the blockchain finance of traditional financial institutions such as Fidelity, TD Ameritrade and ErisX. Now with the launch of USC by 14 financial institutions such as UBS, Barclays Group, Nasdaq and Credit Suisse, the determination of traditional financial institutions to take over the new blockchain and crypto-asset markets is undoubted.

Facebook launches Libra, a cryptocurrency project, which opens the world to 2.7 billion people

On June 18th, the Facebook cryptocurrency project Libra white paper was officially released. According to the white paper, Libra's mission is to create “a simple, borderless currency and financial infrastructure that serves billions of people.”

Specifically, Libra's goal is to be a stable digital cryptocurrency, all using real asset reserves as a guarantee. It inherits several characteristics of the new digital currency: fast transfer, security through encryption and easy and free Transfer funds across borders. Libra's scheduled release date is the first half of 2020.

Facebook Libra has received worldwide attention since its release. According to Vitalik Buterin, founder of Ethereum, Facebook Libra is a big plus for the encryption industry. Its influence, the connected 2 billion users, the existing funds and developer resources hide huge opportunities.

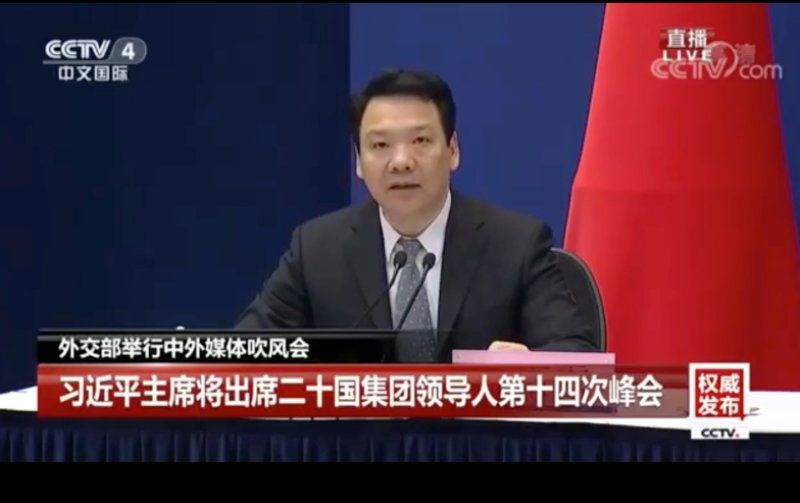

Chen Yulu, deputy governor of the central bank: China pays attention to the application of digital currency and encrypted assets in the financial field

On June 24, on the eve of the G20 summit, Chen Yulu, deputy governor of the central bank, delivered a speech at the briefing of the Ministry of Foreign Affairs. Chen Yulu said, "China is concerned about the application of new technologies in the financial sector, including digital currency, encrypted assets, etc. China has done a good job in this regard. "

With Facebook's launch of the cryptocurrency project Libra and bitcoin prices exceeding $10,000, the central government's focus on cryptocurrencies has also increased. The speech of Chen Yulu, deputy governor of the central bank, was the first public opinion of the central government to publicly pay attention to digital currency and encrypted assets, and at the same time affirmed the status quo of domestic development.

On June 25th, the English version of the People’s Daily’s Global Times published a commentary stating that “China cannot be absent from the era of global digital currency competition”. The Global Times believes that China must participate in this round of digital economic competition. "With the advent of the global digital economy competition era, it is necessary for Chinese industries and regulators to conduct more dialogue on digital currency, understand and even encourage digital currency. Otherwise, China may fall behind in the new financial landscape."

Interactive moments:

Produced | Mars Financial APP (ID: hxcj24h)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Counterfeit currency attacks on the currency circle: how to prevent it effectively?

- Babbitt column | Dovey Wan: Bitcoin is not a safe haven, yet

- Weekends are rising? Since May, 40% of BTC's rising prices have occurred on weekends.

- Where is the development bottleneck of DeFi? What is the opportunity?

- Reddit will accept cryptocurrency rewards, this time without robots

- Coinbase: Bitcoin is becoming mainstream in the US, and nearly half of institutional investors are considering holding cryptocurrencies

- Encrypted Currency and Stratum Crossing (1): Bitcoin is your only chance to "slap the table"