Within 26 days, the price of Bitcoin has doubled: What is the real reason behind the big rally?

Source: CointelegraphChina

Editor's note: The original title was "Bitcoin soared 2 times in 26 days: What is the real reason behind the big rally?" ". This article has been modified without changing the author's original intention.

In less than a month, the price of Bitcoin (BTC) has tripled, soaring from $ 3,600 to $ 7,350. Traders believe that multiple factors have contributed to this surge, but there may be three main factors.

- The latest report of CoinMetrics: after halving BCH and BSV, miners will distribute more computing power to BTC in a short time

- BCH production cuts soon, shortcomings in computing power

- The dynasty of bitcoin miners: track S9 and S17 miners through nonce distribution

The three factors are: a substantial increase in spot purchases, a plunge below $ 4,000, and Bitcoin's immediate return to its main support level.

Factor one: Bitcoin spot transaction volume rises

The decline on March 13 caused BTC to fall from $ 8,000 to $ 3,600 within 24 hours, and there was a surge in the purchase volume of Coinbase, Kraken, Binance, Bitfinex and other spot exchanges.

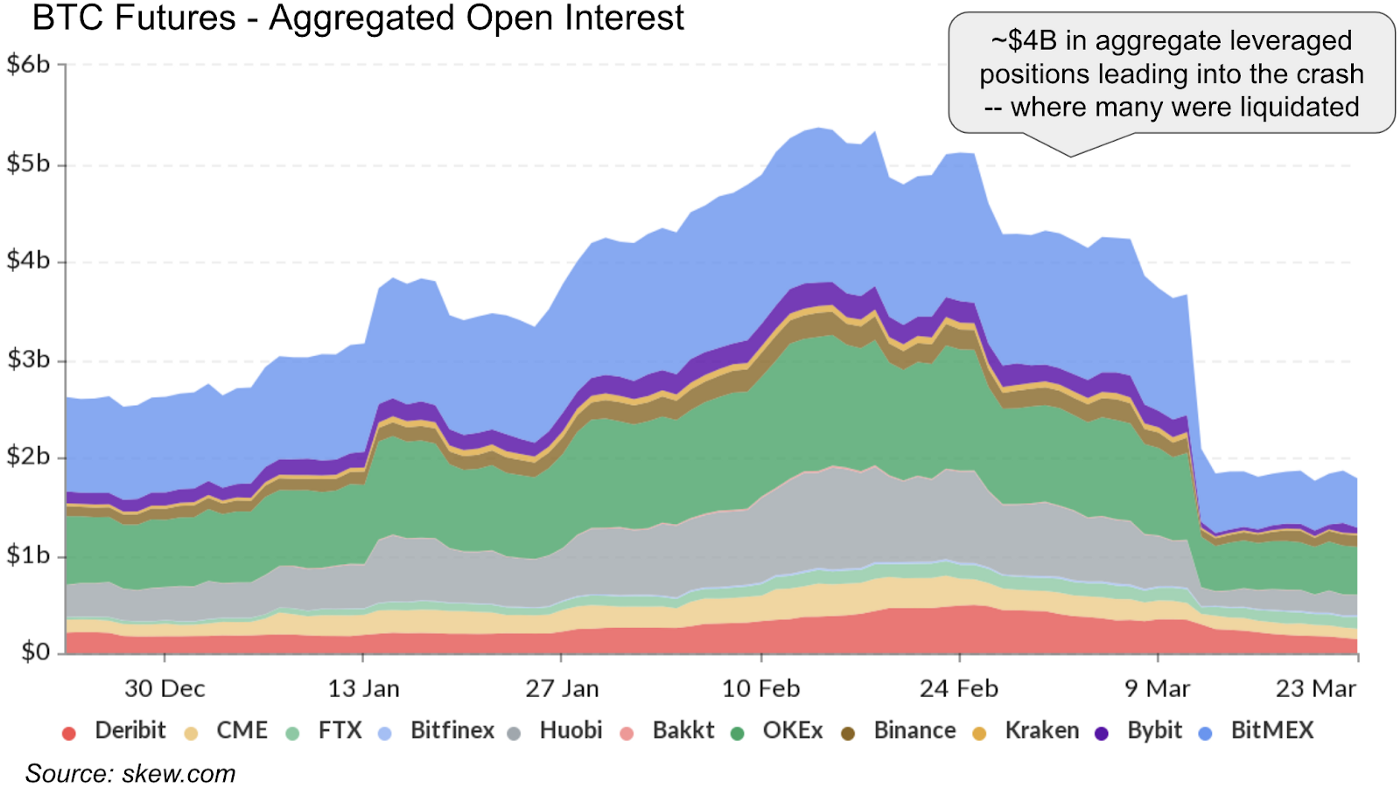

At the same time, open positions (used to describe the total number of long and short contracts opened at a particular time) fell sharply on mainstream futures exchanges (including BitMEX, Binance Futures and OKEx).

Summary of open contracts for Bitcoin futures Source: Coinbase, Skew

The sharp decline in open positions on futures exchanges and the apparent increase in spot purchases have essentially caused a market shift. The spot trading market began to control the price movements of Bitcoin, not the futures market.

The futures market usually causes dramatic fluctuations in the price of Bitcoin, because traders use leverage (borrowed funds) to trade cryptocurrencies, while in the spot market, investors buy and sell Bitcoin without borrowing funds.

This change stabilized the market, allowed Bitcoin prices to rebound without a major correction, and had relatively low volatility.

Factor two: BTC should not fall below $ 4,000 at the beginning

On March 31, Coinbase published a blog post detailing the market trend after Bitcoin's plunge to $ 3,600.

The exchange said that most users of the platform bought bitcoin after a sudden drop, and added that waterfall liquidation caused bitcoin's decline on the futures exchange to be much lower than the spot exchange.

Coinbase explained:

"Waterfall liquidation is most prominent on BitMEX, which provides highly leveraged products. During the sell-off, the bitcoin trading price on BitMEX is much lower than other exchanges. Until BitMEX maintains when volatility is highest (due to DDoS attacks), The waterfall liquidation was suspended and prices rebounded quickly. When the dust settled, Bitcoin hovered around US $ 5,000, which had plunged below US $ 4,000. "

This opens up a theory that Bitcoin should not fall to $ 3,000 at the beginning, which explains why bitcoin quickly rebounded to $ 7350 in a V-shape.

Factor three: rapid recovery to key support

Since the beginning of 2018, the $ 5,800 level has been an important support area in history. Avoided the bitcoin price falling between 3000 and 4000 US dollars, except in December 2018.

Bitcoin price quickly recovered from the $ 3,000 range to $ 5,800 within seven days. After three tests in March, the price of $ 5,800 became a strong bottom, allowing Bitcoin to continue its upward trend.

Several well-known traders said that after breaking through $ 7,300, the resistance of $ 7,700 may be the next area where Bitcoin will explore in the near future.

Original link: https://cointelegraph.cn.com/news/bitcoin-spikes-by-2x-in-26-days-whats-actually-behind-the-big-rally

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- March scan of data on the bitcoin chain: the month of the plunge and shuffle, all three HBO trends are revealed

- 2020 Blockchain Development Report: Financing transaction activities are shifting from the US to China, CBDC is about to appear

- Lawyers' View | From the Telegram ban, see the legal risks of ICO in the US

- Billionaire Michael Novogratz: The recent stock market rally is a trap, I chose to increase Bitcoin

- Babbitt Column | DeFi Review Special: Maker's Leap of Faith

- Statistics: Bitcoin miners received $ 380.1 million in revenue in March, a 25% drop compared to February

- How is the central bank preparing for digital currency? Cooperation Agency Action