World Coin Hard to Talk About Fairness?

World Coin Fairness Difficult to Discuss?When ChatGPT is hot, Worldcoin is cold.

Everyone is confused.

It only took 3 hours from the official announcement of a major update to the official launch of Worldcoin token WLD on the trading platform.

Not only did the sudden launch bring a sense of urgency, but what’s even more terrifying is the indifference of the users after the release.

- Must-read in the evening | Understanding the ‘World Coin’ by OpenAI Founder in One Article

- Opinion Stack’s ability for generalized decentralization is worth paying more attention to, while the narrow decentralization between components such as L2 internal Sequencer and Verifier is more important.

- Worldcoin The Dystopian Nightmare of Cryptocurrency

Unlike Sam Altman’s other product ChatGPT, it is still difficult to get started with Worldcoin. And with Sam’s shift from UBI to a tendency towards Proof of Personhood (PROOF OF PERSONHOOD) for Worldcoin, it may take some time to see Worldcoin’s AI-driven UBI have the same significant impact on the real physical world as ChatGPT.

(UBI, Universal Basic Income, refers to unconditional, qualification-free, non-qualifying examination, where every member can regularly receive a certain amount of money, distributed by a group organization to all members, in order to meet the basic living conditions of the people, and to implement basic human rights through economic security.)

And based on the current situation of receiving one WLD token per week, it is still too early to discuss meeting basic living conditions.

Although Worldcoin often participates in various encrypted conferences, integrates many mainstream protocols, and the token “airdrop” method is very Web3, from the situation on the first day of the token’s listing, Worldcoin has not received the favor of the crypto community – although this is currently its main supporter.

Centralized distribution

With the aura of OpenAI, both the crypto community and the tech community have high expectations for Worldcoin. However, apart from the sudden incident, the token launch of Worldcoin is no different from ordinary token sales. The only thing worth noting is that in the entire process of token launch, only five market makers have obtained a large number of tokens.

As a world-class project with the original intention of UBI, the most important thing for the token launch is to list on many mainstream trading platforms and allow market makers to provide sufficient liquidity for community users in the mainstream crypto field to purchase – the only group that can purchase WLD at the first time, and may also be the group that needs UBI the least.

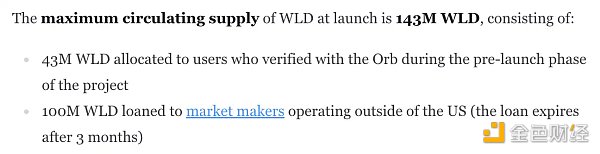

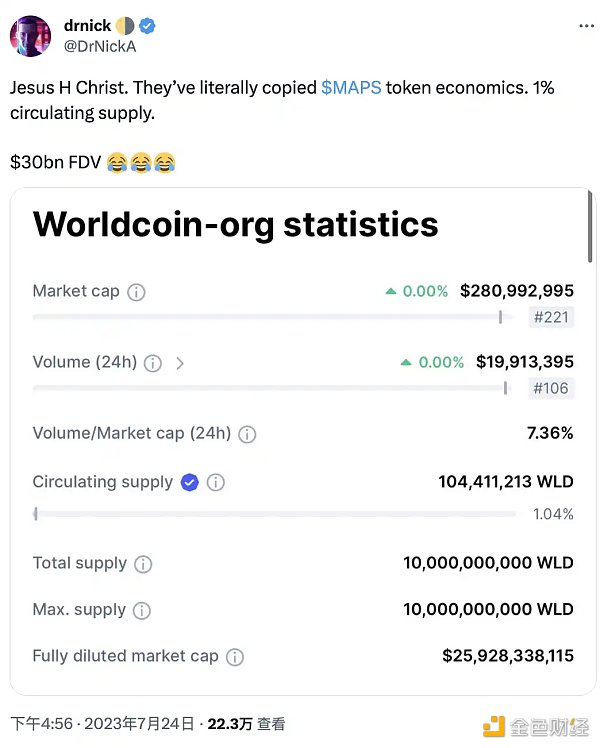

The maximum circulating supply of WLD at the time of its launch was 143 million WLD, including: 43 million WLD allocated to users who passed the Orb verification in the pre-launch stage of the project; 100 million WLD lent to market makers operating outside the United States (due after 3 months).

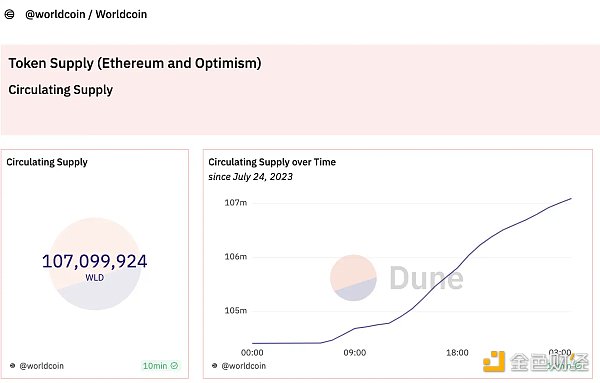

Although more than 2 million users participated in the registration, the initial maximum circulating supply was 143 million WLD, but according to the data provided by Worldcoin, the current circulating WLD is only 107 million. This means that the token holdings of market makers currently account for 93.3% of the circulating supply, more than 14 times that of the community. The level of centralization in the initial stage of token distribution far exceeds that of mainstream crypto platforms like Binance’s IEO projects.

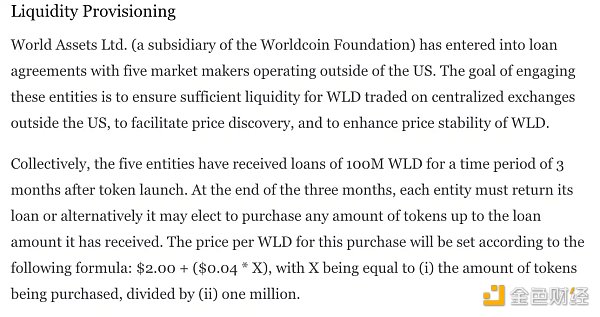

Not only that, it seems that the Worldcoin project has quietly set a “fair” price for WLD through market makers. Five market makers borrowed WLD tokens from World Assets for a period of 3 months and returned them upon expiration. If unable to return, WLD tokens need to be purchased according to the following formula: $2 + (0.04 X loan amount / million).

The simplest and roughest calculation, if these 5 market makers evenly divide these 100 million tokens, it means that each of them will receive 20 million WLD tokens at a price of $2.8.

Of course, these market makers who have the power to “kill or support” WLD tokens should not act recklessly. It is believed that the cooperating institutions of Worldcoin are also not ordinary players. Not only can ordinary secondary market users not speculate on the game between these five parties, but we also have no way of knowing the specific terms of borrowing and market making. We can only say that Worldcoin has forcibly implanted the concept of $2 for those who are concerned about the price of WLD tokens in this way.

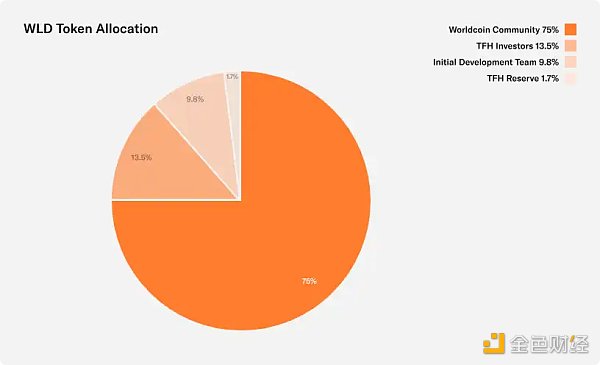

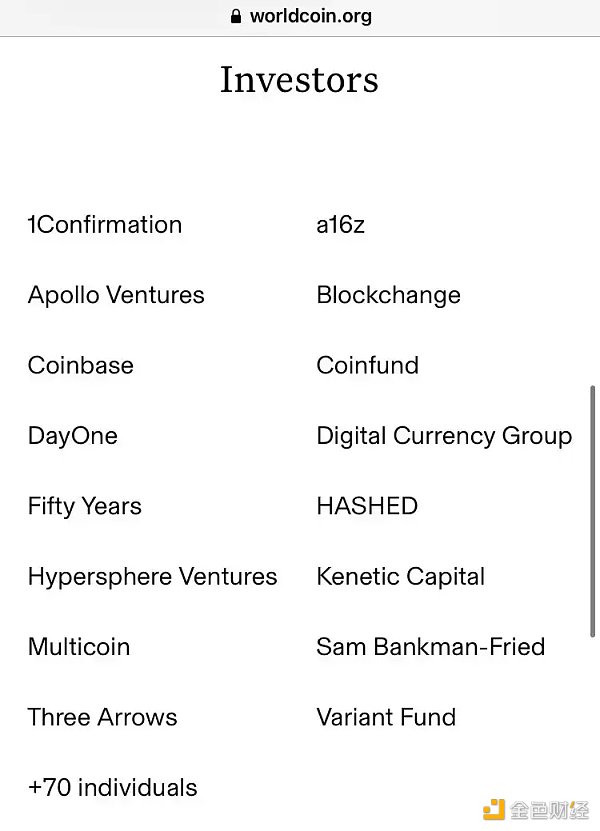

In addition to the common practice of secretly pricing in the crypto circle, VCs, as a common presence in the crypto circle, naturally cannot be absent. Worldcoin, which has obtained multiple rounds of large-scale financing, has naturally allocated enough tokens to investors. According to previous reports by ChainNews, the valuations of Worldcoin’s first two rounds of financing were $1 billion and $3 billion respectively. If calculated at the current price of $2 for WLD, Worldcoin’s market value is $20 billion. Previously, top investment institutions such as a16z and Coinbase Ventures that participated in Worldcoin’s investment undoubtedly received excess returns.

Token distribution: Community Fund 75%; Investors 13.5%; Team 9.8%; TFH Reserve 1.7%

Among the many investors in Worldcoin, we can also see the founder and CEO of the bankrupt crypto trading platform FTX, Sam Bankman Fried (SBF), and the bankrupt well-known crypto fund Three Arrows (3AC). Even Kyle L Davies, co-founder of 3AC, directly released a bold statement today, “If my investment theory is correct, the 3AC venture portfolio will be the best-performing portfolio in 2023. Congratulations to Worldcoin.”

Market Maker Discussion

Although Worldcoin’s official website states that it believes in the inherent worth and equality of every individual, the fact that market makers hold over 95% of the actual initial distribution has sparked a lot of discussion.

For example, a 400,000 WLD order in the early stages of listing on the Bybit platform has sparked widespread discussion. This certainly does not belong to any community member, as the 400,000 WLD tokens accounted for about 40% of the total amount received by the community at that time.

BlockTower founder Air LianGuaiul believes that the current situation of WLD is a common market manipulation model in the cryptocurrency market. LianGuaiul also explained this situation in a long tweet:

-

This common cryptocurrency market manipulation model can create a valuation of over 10 billion US dollars for startups.

-

Lock the capital of founders and investors and airdrop a small portion of tokens to retail investors.

-

Then provide more tokens to market makers and incentivize them with options to maintain the token price at a certain level.

-

The result is that retail investors see the price and liquidity on the trading platform, but the tokens that match the price are less than 5%, usually less than 1%. The media rush to report the “success of the project”, VCs record it on their books, and raise new funds based on false returns.

-

Then, 3-18 months later, when the tokens are unlocked, retail investors, who believe that the value of these tokens should be as such, are dumped by insiders.

LianGuaiul said that there may not be a real “conspiracy” because some “participants” may not truly understand the game they are involved in. This is the power of incentives. Even without any explicit coordination or conspiracy, market manipulation and volume pumping can still occur. This is because if the incentive mechanism is properly designed, participants may naturally take these actions to maximize their interests.

Wintermute CEO Evgeny Gaevoy also stated that it is more suitable for token issuance to choose mature market makers rather than using AMMs. He also gave an example, stating that if AMMs are used, about 40% of the capital raised by the project needs to be invested to ensure a better experience, which is too risky for the project party.

Anything can be discussed besides fairness

Regarding the situation where WLD has extremely low token circulation and a high total token market value, many users have expressed that this is similar to the notorious “Sam coins” Serum, Oxygen, and MAPS on Solana due to SBF.

Vance Spencer, the founder of Framework, also sarcastically said that the launch with a $30 billion FDV is one of the fairest things he has seen.

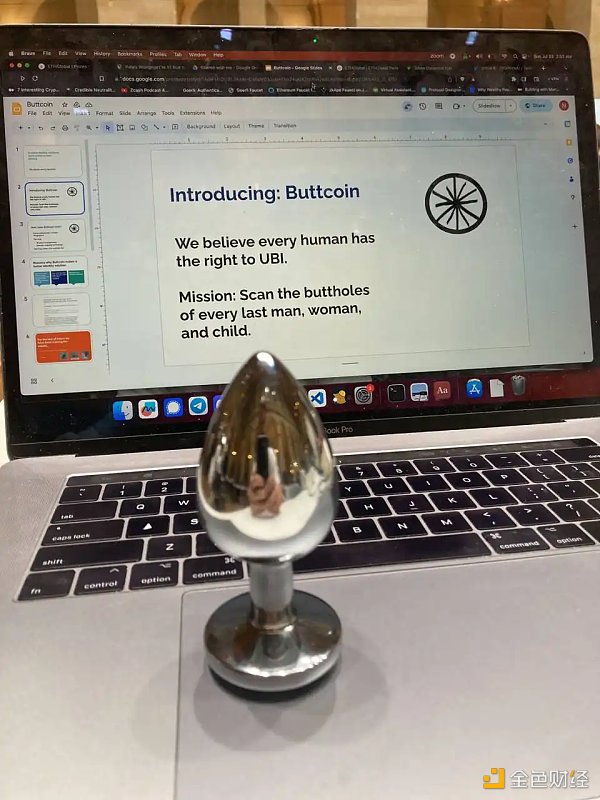

In fact, even before the release of WLD during ETHCC, community members made a satirical project called Buttcoin, pointing directly at Worldcoin. In the sarcastic introduction of the project, Buttcoin jokingly stated the reason why it is more meaningful than existing identity solutions: anyone can take a photo of your eyes, but you only send your butthole photo to people you trust.

After the token sale, blockchain detective Zach pointed out that:

-

The most shocking thing is how the Worldcoin team boasted about how many users they have. In reality, they have been exploiting people in developing countries. It also raised the issue of black market sales of Worldcoin accounts.

-

Zach quoted a report from Coindesk, stating that Worldcoin increased its internal stake from 20% to 25%. However, in the early Worldcoin introductory video, it claimed that WLD is better than BTC; BTC is only controlled by a few wealthy individuals.

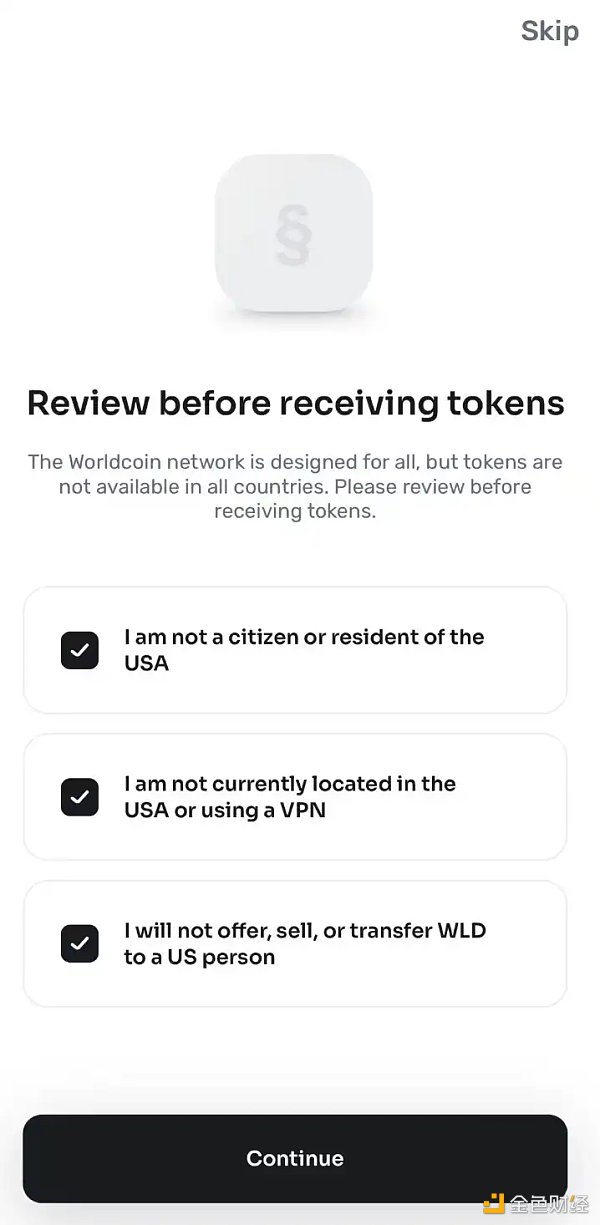

US users cannot use World APP

There are also many users on Twitter who post meme images related to eyeballs and irises to indicate that they will not sacrifice their privacy for tokens.

The Bitcoin community also does not buy into the way WLD scans people’s eyes, believing that Worldcoin represents slavery, while Bitcoin symbolizes freedom.

In “What do I think about biometric proof of personhood?”, Vitalik praised Worldcoin for using technologies and concepts such as Layer2, ZK, and decentralized governance. He also expressed concerns about Worldcoin’s privacy, inability to be widely adopted, centralization, and security. He also stated that he hopes to create open and democratic mechanisms to avoid the central control of project operators and the domination of wealthy users, which is particularly important in decentralized governance.

For individual users, in the face of the current situation of WLD’s release, would you choose to join this global consensus protocol of proof of personhood, which is formed by one WLD coin every week?

Regardless, judging solely from the current progress, it seems difficult for Worldcoin to achieve its ambitious goal of acquiring 1 billion users by 2023.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Game of Trust Rollups Controlled by Multisig and Committees

- DID Identity System General Knowledge (Part 1)

- Rollup as a Service Economic Mechanism Analysis How can service providers increase profits?

- Interpreting Unibot related data

- Summary of the 9 key points of Ethcc consortium chains, beware of the assumption of honest majority, integration of Cosmos and Ethereum ecosystems…

- Encrypted VC Why We Invest in Unibot

- ETHCC in the eyes of Arbitrum developers Scalability is a false demand, and it is still too early for a shared L2 sequencer.