Encrypted VC Why We Invest in Unibot

Why We Invest in Unibot Encrypted VCAuthor: Felipe Montealegre, Theia Blockchain CIO; Translator: LianGuaixiaozou

Note: Recently, Telegram Bot represented by Unibot has become popular. On July 13th, crypto VC Theia Blockchain announced its investment in Unibot. Let’s take a look at the investment logic of crypto VC in Unibot.

We are pleased to announce our investment in Unibot. Unibot allows you to trade on Uniswap through a Telegram bot, including regular trades, private RPC node trades (to avoid MEV), and limit orders. The Unibot team is quickly building integrations with other DeFi protocols.

Our investment decision in Unibot is based on the following points:

- ETHCC in the eyes of Arbitrum developers Scalability is a false demand, and it is still too early for a shared L2 sequencer.

- Investigation Confirms Cryptocurrency is the Future of France

- CZ Reissues Article from 6 Years Ago A Journey of a Thousand Miles Begins with a Single Step, Start Entrepreneurship from Small Matters

* Unibot has a large existing market – DeFi needs better UI tools.

* We have great confidence in the recent growth as the team sets the roadmap.

* Attractive valuation, about 10 times the return (calculated based on our average entry price).

* A top-notch team.

1. Large existing market

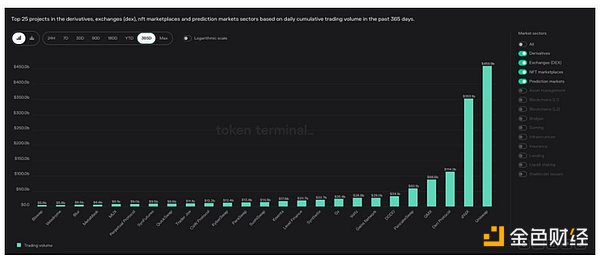

Daily trading volume:

Unibot: $1.1 million

Uniswap: $1.1 billion

We like to invest in protocols that can perform well without relying on recovering market trading volume. We believe that frontend applications will eventually account for more than 10% of the total DeFi trading volume. This is a market growth of over 100 times.

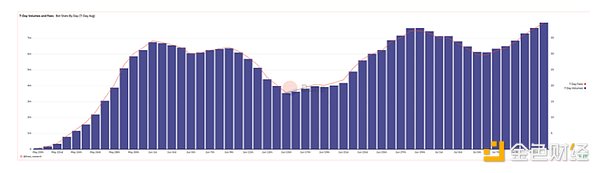

2. Unibot’s current development direction is a single business line – trading on Uniswap and will continue to grow.

We expect to see multiple new business lines in areas such as perpetual futures, options, structured products, etc.

We look forward to new frontend options (such as web applications) collaborating with the Gecko terminal.

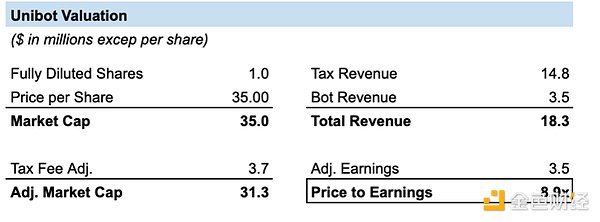

3. With an average entry price of $35 per share, the valuation is attractive, about 9 times the return.

Unibot’s revenue breakdown:

· Bot fees: A fee of less than 1% is charged for all trades conducted through the TG bot, currently amounting to $3.5 million per year.

· Taxes: A 5% fee is charged on all Unibot token trades, currently amounting to $14.8 million per year.

Valuation-related explanations:

· Market value: We assume that taxes will continue until the end of 2023 and deduct them from the purchase price (net cash flow).

· Returns: 40% of bot fees are paid as dividends, while 60% is reinvested by the team.

Our returns do not include taxes.

4. A top-notch Unibot team

We encourage you to try Unibot and see how attractive a good UI can be.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuaintera Capital Partner The Core Advantages and Ecological Status of Cosmos

- Opinion Chinese game teams are more suitable for exploring web3 compared to the West.

- AI economy may find an outlet in Web3.

- Polygon Vice President of Product 8 Thoughts After Attending EthCC

- Review the basic use cases of NFTs and ‘trade them to make money’.

- Comparative analysis of the development status of major EVM-compatible chains Which is better?

- Discoveries and views on the mainstream LSD stablecoin issuance protocol