Xiao Lei: The renminbi is absent from the libra currency basket, and the purpose of the United States has been achieved.

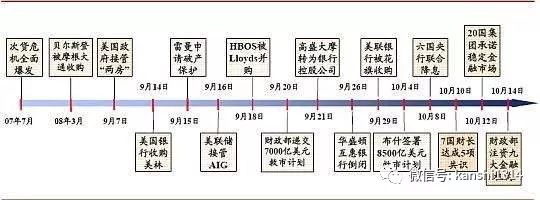

In 2009, the world was still full of anger over the world economic and financial turmoil caused by the US subprime mortgage crisis. On the one hand, the Fed maintained ultra-low interest rates, and on the other hand began to increase the implementation of QE.

As the world currency, the US dollar has many countries with US dollar reserves. It has no say in the Fed’s monetary policy and can only passively accept the shrinking and dilution of US dollar assets.

Zhou Xiaochuan, then president of the People's Bank of China, called for the expansion of the use of the International Monetary Fund's (IMF) Special Drawing Rights (SDR) to gradually replace the existing reserve currency with SDR.

- Vitalik: Ethereum 2.0 has no unresolved research challenges

- French digital currency regulations will be approved at the end of the month to approve the first batch of legitimate enterprises

- IMF Report: The Rise of Digital Currency

At the time, SDR was a special form of super-sovereign currency, which was mainly composed of four currencies, including the US dollar, the euro, the Japanese yen and the British pound. In the SDR weight, the dollar accounts for more than 40% and has a veto. But in any case, SDR has at least a slightly more endorsed asset.

At the end of 2015, under the continuous efforts of the Chinese government, the SDR endorsement assets included RMB, and the weight of the RMB was second only to the US dollar and the euro, surpassing the Japanese yen and the British pound. It is considered to be the most important step in the internationalization of the RMB. .

But the problem is that the application scenario of SDR is very limited, and it has little to do with the world's various trades, let alone the payment of ordinary people and the problem of cross-border capital flow.

In 2017, IMF Managing Director Lagarde said at a meeting, please forget Bitcoin and consider "IMF Coin". Lagarde believes that the future world currency is more likely to come from the IMF, and SDR has become The possibility of future digital currencies , whether SDR can replace the existing international currency, is not an unreliable assumption. Lagarde said that the IMF needs to be prepared.

What IMF didn't expect was that his plan started to have an executor, but the executor was not an IMF.

In the blink of an eye, on June 18, 2019, US Internet giant Facebook announced that it will introduce a blockchain-based digital currency (libra), which is used for international payments and the flow of funds. Its endorsement assets are the world's major legal currency. And reliable government bonds.

Just two weeks later (July 6, 2019), IMF Managing Director Lagarde hinted at the Bank of England forum that the organization intends to launch a global currency like Bitcoin, IMF Coin, under the Special Drawing Rights (SDR) mechanism. Designed to replace the existing world reserve currency.

The problem is that no one seems to care about the IMF's plan.

On July 15, 2019, Marcus, head of the libra digital currency project, announced in advance his testimony to be issued in the US House of Representatives, in which Libra's endorsement assets were clearly defined as the US dollar, the euro, the Japanese yen and the British pound.

Unfortunately, Libra's endorsement assets do not have RMB. And if the IMF is to promote IMF Coin, the third largest weight of the SDR will become an important endorsement currency.

So if China wants to participate in this competition, is it to support the IMF Coin, or to push its own digital currency, or to find a way to intervene in the Libra system? I think this problem needs to be considered.

For China, I personally feel that it is unrealistic to expect the IMF Coin to make a difference. The IMF itself is also a system based on the US dollar system. Because the IMF is more inclined to focus on developing countries, especially China. The right to speak, the United States is very dissatisfied, threatening to withdraw from the IMF.

We can boldly speculate that if Libra endorsement assets are added to the renminbi, what method will the United States use to complete Libra?

Moreover, the IMF has too many things to do. Its organization has existed for more than half a century. The bureaucratic atmosphere is serious, it is far from the Internet, and it cannot avoid the various restrictions and endless discussions of governments. The IMF has nothing to do. Touching the channels of individual users, so waiting for IMF Coin to compete with Libra is actually unrealistic. That is to say, the renminbi wants to take advantage of IMF Coin's ride, I am afraid it will cost a lot of time.

Libra, which is most likely to achieve the ideal of the IMF's world currency, has no renminbi in its currency basket. What is more noteworthy is that there are no Chinese companies in the more than 30 initial institutions that Libra is working with. More than 90% are American companies, and there are also some companies in the UK, Canada, France, Sweden, and the Netherlands.

From the perspective of China, it may be difficult for the US government to approve the birth of a new world currency to challenge the status of the dollar, so you should not care too much about libra. But as the leadership thinking of the United States, there are two problems in the United States that are actually more difficult to accept.

The first problem is that the United States will never give up its position of leading innovation in the digital currency and global payment business. That is, the United States will not give up its leadership in the future digital currency industry; the second problem is Libra will never be opposed to the US dollar and US interests.

The libra project leader stated clearly that “ Facebook will not issue Libra digital currency until we fully address regulatory issues and obtain appropriate licenses. Libra will work with the Federal Reserve and other central banks to ensure that Libra does not compete with sovereign currencies or intervene in monetary policy. In fact, the regulatory and sovereign currency here is specifically the United States and the United States dollar.

So what reason does the US have to stop the launch of Libra? The congressional discussions and so-called proposals only increased Libra's exposure, reduced the cost of Libra's promotion, and exported a lot of Libra's ideas and the "sublime" ideals that it hopes to achieve. This invisibly stimulates users' desire for Libra. .

So the so-called regulatory pressure in the United States may not only make libra abortion, but more likely to give libra the ability to continuously deliver Libra features and build brand advantage. At the same time, it has achieved the goal of hunger and thirst marketing. Delaying the release of libra in various ways may be a strategy.

If you look at Marcus's testimony, Libra has not only changed the product structure or goals because of the disputes of various parties and the pressure from regulators in various countries in recent years. Instead, it has unabashedly announced the introduction of new ones. The purpose of world currency.

From Marcus’s testimony, building the world currency is the only direction. In other words, libra did not cater to regulation, turning libra into an equity asset, or similar to the usage rights and incentives of so-called software in many digital currencies (such as EOS or Ethereum, etc.), not an internal credit system. Libra is going to be the world currency and to be a payment tool.

The original words of Marcus in the testimony are:

From the time when Zhou Xiaochuan called for the expansion of the use of SDR in 2009, the emergence of libra after ten years is actually not a very long process. During the period, another thing was that Bitcoin grew from zero to more than $100 billion in market capitalization, and it was not affected by the attitudes and views of central banks and regulators.

Finally, I suggest that you focus your attention on the attitude of countries towards libra, and seriously consider what kind of world currency the world needs in the future, how Libra will develop, and how such a world currency will dominate new global interests. Distribution pattern. In other words, the national level should look at the benefits, not the right and wrong, because when you are here to entangle and decide the right or wrong, people are finalizing the rules of the game that are most beneficial to them.

Text / Xiao Lei

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin fluctuates frequently, does it hold money (HODL) or trade?

- Bitcoin fluctuated within a narrow range, and the market once again adjusted back. How did the follow-up market develop?

- Hearing Prospects | Bullying Congress White, not saying how to make a profit, what are the loopholes in Libra's congressional testimony?

- Comment: The hearing is imminent, why is the United States jealous of Libra?

- Blockchain Weekly | US SEC approves first token sales, blockchain promotes regulatory progress

- A picture proves that there are a large number of cleaning transactions on the exchange

- Meng Yan: Analysis of the Difficulties in the Design of the Economic Model of Double-passed Cards