Six pictures analyze the status quo of stable coins

2019-2020 will be the most important year for the use of stable coins

Through a recent report from Blockchain 's research team, Blockdata , you can see how much action the entire stable currency industry has done in the past 18 months or so. After the success in 2018, we can foresee that more innovative projects will be launched in 2019, achieving another strong growth. In order to take care of readers who do not understand the stable currency, we first briefly introduce what is a stable currency.

What is a stable currency?

Stable currency is a cryptocurrency collateralized by the value of the underlying asset. It was born to solve the volatility and stability of traditional cryptocurrency. The high volatility of decentralized cryptocurrencies is considered a major obstacle to the widespread adoption of digital assets. Stabilizing coins can be used to solve this problem, providing a stable means of exchange and the value of digital storage in a volatile market environment.

The advantage of stable currency

- Xiao Lei: The renminbi is absent from the libra currency basket, and the purpose of the United States has been achieved.

- Vitalik: Ethereum 2.0 has no unresolved research challenges

- French digital currency regulations will be approved at the end of the month to approve the first batch of legitimate enterprises

- As mentioned earlier, the stable currency was designed and created to minimize the price volatility of the cryptocurrency , as shown in the above chart (since the beginning of 2017), these fluctuations are between 5% and 160%. These huge price fluctuations are not suitable for small payments. The stable currency can be used for daily transactions like legal tender because of its small fluctuations.

- Most token-based blockchain projects are conceived without any valid use cases. Therefore, the speculative nature of these digital assets puts them at greater risk. The value of a stable currency comes from the underlying assets linked to it – whether it is fiat money, commodities or other assets that can be quantified and proven to be of value.

- Just like the supply of legal tender money that can be controlled by central banks around the world, some stable currency projects can control the number of digital tokens through algorithms, thus maintaining the price stability of digital tokens, thus increasing investor confidence and promoting project innovation. And growth.

- The stability, security and scalability of stable currencies provide a bridge between traditional money markets and digital assets. Investors can firmly invest in encrypted assets through stable currencies.

- Finally, stable currency can be used as a liquidity tool for digital exchanges that offer crypto asset transactions. Compared with traditional financial markets, the liquidity of the encryption market is still weak, resulting in price fluctuations. These problems can be solved by using stable coins.

Insufficient stability of the currency

- Financial regulators still believe that stable currency violates some securities laws because central institutions control the price movements of these digital assets.

- Most stable currency projects are essentially centralized , which is contrary to the nature of the decentralized blockchain movement.

- Some stable currencies linked to cryptocurrencies or commodities are susceptible to increased price volatility , and prices can be extremely volatile in the event of a market crash. The gray areas involved in the collateral behind these stable coins make it even more ambiguous.

- The stable currency linked to the legal currency needs to be like the central bank 's trust in centralization . Under the influence of external geopolitical factors, the central bank is prone to instability.

Six pictures reveal the status quo of stable currency

The report then presents some of the main findings shown in the chart below:

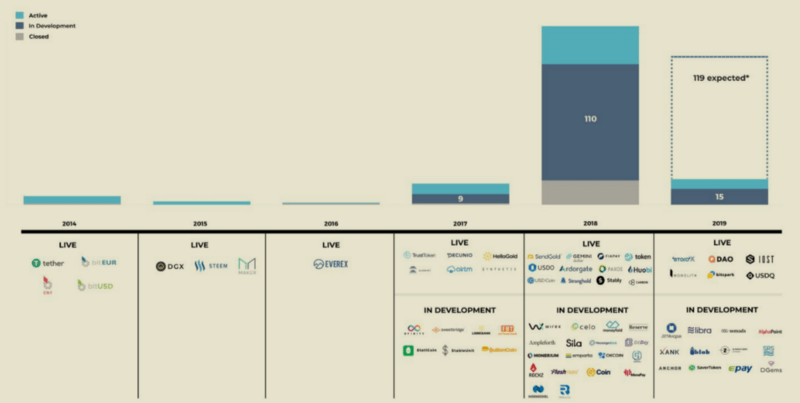

1. Only 30% of the stable currency is still in use, and other stable currencies are either under development or have closed down.

2. Off-Chain is the most popular form of collateral for stable currency projects (legal or commodity guarantees).

3. The stable currency linked to the US dollar is the most active, most popular, and the lowest failure rate, while 67% of the closed stable currency is linked to gold .

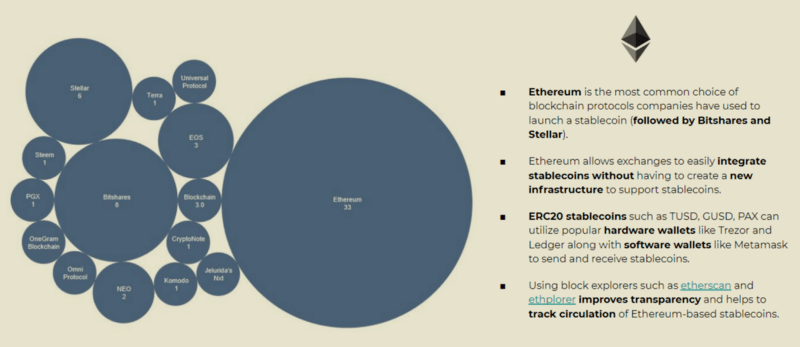

4. 50% of all active stable currencies were developed on the Ethereum network. The Ethereum network is the most popular launching platform for these projects.

5. Tether raised the most funds of all projects through the IEO – $1 billion, which is half of the $2 billion raised by the top 15 stable currencies.

6. From 2019 to 2020, it will become the most used year for stable coins. Since the beginning of 2017, 134 kinds of stable coins have been put into use, and only 15 kinds of public offerings are currently available.

If you want to read a detailed report, you can click on Tether , which is currently the largest stable currency project. Ironically, however, the project has been mired in price manipulation and audit disputes for most of its existence. The second is the high-profile and ambitious decentralization project Basis , a stable cryptocurrency protocol using the algorithmic central bank. Regrettably, the project was involved in a regulatory dispute with the authorities and was eventually closed in December 2018 after 17 months of operation.

Article source: Xank blog https://xank.io/cn/blog/the-current-state-of-stable-coins-in-six-charts/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- IMF Report: The Rise of Digital Currency

- Bitcoin fluctuates frequently, does it hold money (HODL) or trade?

- Bitcoin fluctuated within a narrow range, and the market once again adjusted back. How did the follow-up market develop?

- Hearing Prospects | Bullying Congress White, not saying how to make a profit, what are the loopholes in Libra's congressional testimony?

- Comment: The hearing is imminent, why is the United States jealous of Libra?

- Blockchain Weekly | US SEC approves first token sales, blockchain promotes regulatory progress

- A picture proves that there are a large number of cleaning transactions on the exchange