Zhou Hongyi strongly recommended | New Yorker 16000 words heavyweight article: blockchain is the only hope to return to the essence of the Internet

Source: The New Yorker Magazine

This article first appeared in the machine's energy

Compilation: Zhang Zhen, Edison, Rik

Source: Carbon chain value

- Jiang Zhuoer: How much does it cost for Bitcoin to rise to $100,000?

- Popular Science | Introduction to Cryptography (Part-1)

- Bakkt Bitcoin contract rose by 257% in a single day, exceeding 1100 copies

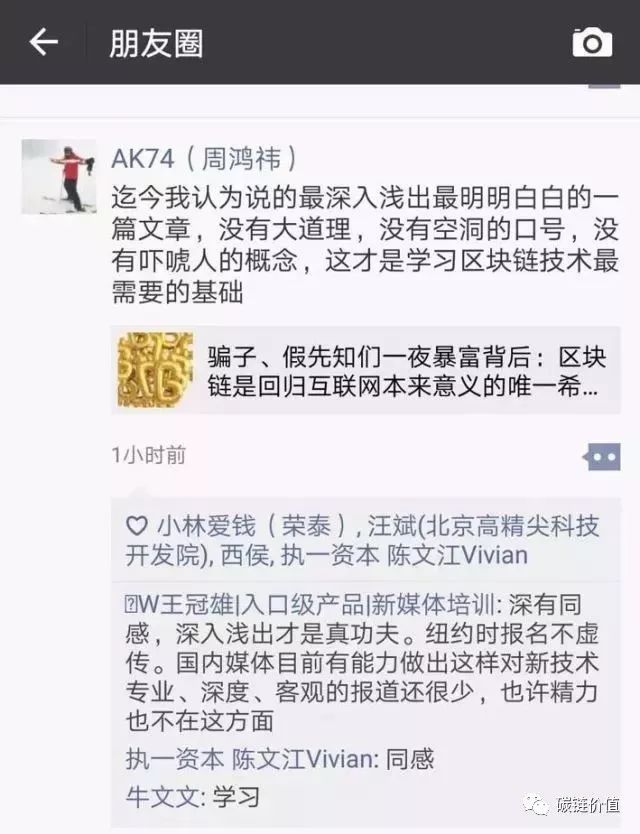

Zhou Hongyi, the founder of Qihoo 360, once said in a circle of friends: I think that the most in-depth and clear-cut article I have said so far has no reason, no empty slogan, no concept of scaring people. This is the learning blockchain technology. The most needed foundation.

This set of words does not make any sense. What really makes them valuable is that the word order is produced exclusively by me by a software called MetaMask.

Expressed in cryptography terms, it is a seed phrase. This set of vocabulary can be turned into a key, open a digital bank account, or authenticate online if it feels inconsistent. And it only takes a few steps to complete.

The computer tells me on the screen to keep my mnemonic safe: write it down or put it in a safe place on your computer. I hurriedly wrote 12 words on the sticky note, then clicked a button and it became 64 characters that seemed to be erratic:

1b0be2162cedb2744d016943bb14e71de6af95a63af3790d6b41b1e719dc5c66

This is called "key" in cryptography: it is a way of authentication, but it is very different from the way in which real-world keys are unlocked. My mnemonic can produce accurate alphabetical order every time, but it is not known how to reverse engineer the initial phrase of the key, which is why it is very important to put the seed word in a safe place.

The key of the key will be transformed twice to create a new string of characters:

0x6c2ecd6388c550e8d99ada34a1cd55bedd052ad9

This string of characters is the address of my Ethereum blockchain.

One

In the past year, the value of cryptocurrency bitcoin has increased by more than 1000%, and Ethereum and Bitcoin are in the same currency.

Ethereum has its own currency, the most famous of which is the Ethereum, but this platform not only has money, but its scope is more extensive. You can think of the address of Ethereum as a bank account, email address or a social security number.

Currently, it's a bunch of meaningless characters on the computer, but as long as I want to make any transaction, such as participating in a crowdfunding campaign or conducting an online referendum, the address will be given a temporary computer network. , verify the transaction. The results of the verification will once again be transmitted to a wider network, and more machines will enter a competitive state, performing complex mathematical operations, and the winner will record the transaction separately, in the history of Ethereum. Each transaction is subject to a standardized record.

Because these transactions are registered through an ordered "block" of data, this record becomes a blockchain.

It takes only a few minutes to complete the entire transaction. From my point of view, this experience is not much different from the usual online life.

But from a technical point of view, it is quite amazing. Some things were almost unimaginable 10 years ago. I managed to complete a secure transaction without relying on traditional institutions to build trust. There is no middleman; no social media network collects the data of my transaction in order to better carry out the accurate push of advertisements; there is no credit agency to track this activity in order to construct the economic credibility.

Is this platform making all this possible?

However, no one owns this platform. There is no wind to invest in this company to invest in Ethereum, because there is no such company.

As an organizational form, Ethereum is more democratic than any private company. There is no roar of authoritarian leadership. Just join this community and do some work, you are helping to drive the Ethereum ship.

Like Bitcoin and most other blockchain platforms, Ethereum is more like a hive than a formal entity. Its boundaries are vague and a flat hierarchy.

There is another side: in this hive, some people have accumulated billions of dollars in their net worth through their labor. On January 1, 2017, the value of Ethereum was only $8, and one year later, This value reached $843.

For this kind of change, you may be a contemptuous attitude and feel that it is not worth mentioning. After all, the loss of control over the value of Bitcoin and Ethereum is a typical example of irrationality. This mysterious technological breakthrough currently seems to be no different from credit card repayment on the login website. Why should we care about such a technology?

But this contempt is a short-sighted approach.

From the history of the development of the Internet, we have learned one thing. This software architecture seems to be mysterious, but once this technology develops into a broader calculation, it will release far-reaching power and affect the world.

If the mail standard was adopted in the 1970s, with the public key and key as a default setting, everyone from Sony to John Podesta (former US Secretary of State Hillary Clinton) will no longer receive large-scale mail. Troubled by hackers, millions of ordinary users do not have to use identity theft.

If the inventor of the World Wide Web, Tim Berners-Lee, adopted the positioning social identity protocol in the original standard, we may not have Facebook today.

The firm believers behind the blockchains such as Ethereum believe that a distributed trust network is an advancement in software architecture, and history will certainly prove its great significance. This expectation further pushes up the value of cryptocurrencies.

However, the Bitcoin bubble is likely to eventually become a real carnival in the blockchain. Many fans believe that the expectation of this new technology is not to replace our existing currency, but to replace our current concept of the Internet, while pulling the online world back to a decentralized equality system.

If you believe in the comments of these fans, the blockchain is the future. But this is also a way to return to the original meaning of the Internet.

two

Inspired by the infinite resources and global utopian dreams of the Utopia, the Internet seems to have become a scapegoat in the past years: it has become the root of all the social problems we face.

Russian hackers use false news on Facebook to disrupt democratic institutions; hate speech on Twitter and Reddit raging; the huge wealth of geek elites has intensified income inequality.

For many of us who have started using the Internet in the early days of the Internet, the last few years have given us a sense of corruption.

The Internet has promised to become a new media such as a large number of tabloids, blogs, self-built encyclopedias; the information giants that dominated the mass culture in the 20th century should have given way to a more decentralized system, a cooperative network and no longer a A hierarchical system of communication channels reflects the peer-to-peer architecture of the Internet itself.

Today's network is no longer Utopia, full of financial bubbles, spam and countless other issues. However, people always suspect that there is hidden progress behind the fall.

Last year, such luck finally collapsed. On the Internet, suspicion is not something new. The difference is that the voice of criticism is more from people who were previously highly respected by the Internet.

"We want to fix the Internet," Walter Isaacson said. He is the author of Steve Jobs's biography, which he said in an article he wrote a few weeks after Trump was elected.

"After 40 years of development, the Internet has become corrupt, not just the Internet but us." Google's former strategy officer, James Williams, told the Guardian: "The vitality of the attention economy is a structurally endangering human will."

Brad Burnham, managing partner of New York's top venture capital firm Union Square Ventures, complained on the blog about the additional hazards posed by quasi-monopoly in the digital age:

"In Facebook's non-differentiated content flood, publishers have found themselves becoming commodity content providers. A small change in Google's search algorithm can lead to the loss of a website's wealth. When Amazon decided to purchase goods directly in China and re-planned When demanding their own goods, manufacturers can only watch sales decline.” (Burnham's company invested in a company I established in 2006; when the company was sold in 2011, there was no financial relationship between us.)

Even the inventor of the Internet, Berners-Lee, wrote a blog that showed his worries that advertising-based social media and search engines created an environment that “shocks or false information specifically for attracting prejudice” , like wildfire, spread on the Internet."

For most critics, the solution to these huge structural problems is to either come up with new advice about the dangers of these tools, such as dropping our smartphones, keeping kids away from social media, or relying on strong Strong regulatory and antitrust efforts: Make technology giants subject to scrutiny as other industries that are vital to the public interest, such as earlier rail or telephone networks.

Both of these ideas are commendable: we should probably develop a new set of habits to manage how we interact with social media. It seems entirely wise for a powerful company like Google and Facebook to face the same regulatory review as a TV network.

But these interventions are unlikely to solve the core problems facing the online world.

After all, in the 1990s, not only the antitrust department of the Ministry of Justice questioned Microsoft's monopoly power, but also new software and hardware, such as the Internet, open source software and Apple products, which undermined Microsoft's dominant position.

Blockchain evangelists behind platforms such as Ethereum believe that a range of advanced technologies in software, passwords, and distributed systems have the power to solve today's digital problems. For example, the corrosive incentives for online advertising; the quasi-monopoly of Facebook, Google, and Amazon; the Russian false positive campaign.

If they succeed, their invention may challenge the hegemony of the tech giant more effectively than any antitrust rule. They even claim to provide an alternative to the capitalist winner-take-all model, without pushing wealth inequality to a level not seen since the robbers' aristocratic era.

This remedy is not yet visible in any product known to the average technology consumer. So far, the only blockchain project that has entered mainstream recognition is Bitcoin, but it is in a speculative bubble.

This bubble made the Internet IPO boom of the 1990s seem to be a neighbor's garage auction. There is a cognitive conflict that plagues all those trying to understand the blockchain: the potential power of this likely revolution is being actively weakened by the people it attracts, a group of veritable scammers, false prophets and hires. Soldier.

This is not the first time, and technologists pursuing an open and decentralized network have found themselves surrounded by a group of opportunists who want to get rich overnight.

The question is whether the real promise of the blockchain will last after the bubble bursts.

three

For some students in the history of modern science and technology, the decline of the Internet is an inevitable historical play.

Just like Tim Wu's "master switch" in his book published in 2010, all major 20th century information technologies have a similar development model. From the beginning, lovers and fans of curiosity and society, to the end of the continuous attention of multinational companies to maximize shareholder value. Wu calls this model a cycle, at least on the surface, and the Internet meets such cycles with convincing accuracy.

The Internet was originally a hodgepodge of government-funded academic research projects and hobbies. But 20 years after the World Wide Web first entered the public imagination, it was born in Google, Facebook, and Amazon—and indirectly from Apple—the most powerful and valuable companies in the history of capitalism.

The advocates of the blockchain do not accept the inevitability of this cycle.

They believe that, in fact, the Internet is more open and fragmented than previous information technology, and if we succeed in this fundamental, it could have maintained this state. The online world will not be dominated by the giants of the information age; our news platform will not be so vulnerable to manipulation and fraud; identity theft will be far less common; advertising revenue will also be distributed across a wider range of media.

To understand why, we can think of the Internet as two completely different systems that are stacked together, just like the geological layers in archaeological excavations.

One of them was a software agreement developed in the 1970s and 1980s and reached a critical mass in the 1990s, at least in terms of audiences. (A protocol is a software version of a common language that is a way for multiple computers to agree to communicate with each other. There are protocols that govern the flow of raw data on the Internet, some protocols that control the sending of email messages, and some protocols that define web page addresses.)

Then on top of them, another layer of web-based services — Facebook, Google, Amazon, Twitter — are basically these services that dominate the Internet world for the next decade.

The first layer—we call InternetOne—is based on an open agreement, which in turn is defined and maintained by academic researchers and international standards organizations that are not attributable to anyone.

You don't need to know how these software protocols work technically, you can directly enjoy the benefits they bring. The key feature they share is that anyone can use it for free.

If you want to create a web page, you don't need to pay the license fee to the company that owns the HTTP protocol; if you want to use SMTP to send email, you don't have to sell your identity to the advertiser. Like Wikipedia, the Internet's open agreement is the most impressive product based on the people in human history.

To understand how great and difficult the benefits of these protocols are, imagine what it would be if one of the key criteria was not developed.

For example, we use an open standard GPS to define geographic locations.

The Global Positioning System (GPS) was originally developed by the US military and was first used for civilian purposes during the Reagan administration. For about 10 years, it was used primarily by the aerospace industry until individual consumers began using it in car navigation systems.

Now that we have a smartphone that can receive signals from the GPS satellites above us, we use this extraordinary power to do everything from finding nearby restaurants to playing Pokemon Go to coordinating disaster relief forces. .

But what if the military excluded the global positioning system from the public domain?

Then, it is estimated that at some point in the 1990s, a market signal that consumers are interested in building accurate geographic coordinates may flow to innovators in Silicon Valley and other technology centers because they can project these locations to numbers. On the map.

There will be fierce competition between competitors for a few years, and they will put their own dedicated satellites into orbit to advance their unique agreements. But given the efficiency of verifying locations from a single common approach, the market will choose a dominant model.

Let's call that imaginary company GeoBook.

Initially, a full embrace of GeoBook would be a leap for consumers and other companies trying to build awareness in hardware and software. But slowly, a darker story will appear:

A single private company that can track the movements of billions of people around the world will build an advertising giant based on our mobile location. Any startup that tries to build a geo-aware application is vulnerable to the mighty GeoBook. A proper anger debate will be written to condemn the public threat of this big brother in the sky.

But it didn't happen, the reason is simple.

Geolocation, like web pages and email addresses and domain names, is a problem we solved with an open protocol. Because this is a problem we have not encountered, we rarely consider how well GPS has done its work and how many different applications have been developed on top of it.

Open, decentralized networks are very active and functioning well at the InternetOne layer. But since we settled on the World Wide Web in the mid-1990s, we have rarely adopted new open standards protocols.

After 1995, the biggest problems solved by technologists – many around identity, community and payment mechanisms – were left to the private sector. This brought a powerful Internet service layer at the beginning of this century, which we can call InternetTwo.

Although the inventors of the Internet Open Protocol are extremely intelligent, they have not put some key elements into the open agreement. These elements were later proven to be critical to the future of online culture. Perhaps most importantly, they did not establish a secure open standard to determine human identity on the web.

Units of information can be defined – web pages, links, messages – but people don't have their own agreements: there is no way to define and share your real name, your location, your interests, or (and perhaps most importantly) you and The relationship of other netizens.

This turns out to be a major oversight, because identity is a problem that can benefit from a proven solution.

It is the "base layer" infrastructure described by the founder of Ethereum Vitalik Buterin: platforms such as language, roads and postal services, business and competition are actually supported by the bottom of the public domain.

Online, we don't have an open market to buy physical passports or social security numbers; we have some well-known authorities that are mostly supported by state power, and use these authorities to prove to others that we are the one we claim.

But on the Internet, the private sector suddenly intervened to fill this vacuum. Because identity has the characteristics of a general problem, the market is strongly encouraged to define yourself and the people you know with a common standard.

The self-reinforcing feedback loop that economists call "increasing returns" or "network effects" comes into effect. After a period of experimentation with social media start-ups like Myspace and Friendster, the market determines what is essentially Identify the proprietary standards of yourself and the people you know.

This standard is Facebook.

Facebook has more than 2 billion users, and its scale far exceeds the entire Internet at the peak of the dot-com bubble in the late 1990s. Founded only 14 years ago, the growth of users has made it the sixth most valuable company in the world.

Facebook is the ultimate embodiment of the divide between the InternetOne economy and the InternetTwo economy. No private company has an agreement to define e-mail, GPS or open networks, but one company has data that defines the social identity of today's 2 billion people – and one person, Mark Zuckerberg, owns the vast majority of the company. right to vote.

If you think that the rise of a centralized network is an inevitable cycle, and the idealism of the early network open agreement is a frivolous misconception, then there is no reason to worry about how we gave up the vision of the InternetOne era. . It is whether we are living in a fallen country, there is no way to return to the Garden of Eden, or that the Garden of Eden itself is an illusion that will be destroyed by centralization.

In either case, trying to restore the architecture of InternetOne is meaningless; our only hope is to use the power of the state to control these corporate giants through regulatory and antitrust actions.

This is a variant of the old Audre Lorde maxim: "The master's tools will never dismantle the owner's house." You can't solve the problems that technology creates for us by providing more technical solutions. You need to find a foreign force that is comparable to the software and server fields to break down the monopoly group.

But in this analogy, the owner's house is a double-story building. The superstructure was indeed impossible to dismantle with the tools used to build it, but the open agreement below still has the potential to build better things.

four

Juan Benet, one of the most convincing advocates of the revival of the open agreement, is a programmer born in Mexico.

He now lives in a three-bedroom rental house on a suburb of Palo Alto, California, where he and his girlfriend, another programmer, plus a constantly changing guest, some of the guests belong to Benet's organization. : Protocol Labs.

On a warm day in September, Benet greeted me at the door in a black protocol lab sweater. The interior of this space is reminiscent of the incubator/association hall in HBO's Silicon Valley. Its living room is dominated by a row of black computer monitors.

In the foyer, the words "Welcome to Rivendell" are scribbled on the whiteboard, a tribute to Elven City in the Lord of the Rings. "We call this house Rivendell," Bennett said embarrassedly. "But this is not a good Rivendell. There are not enough books, waterfalls or elves here."

Benet, 29, considers himself to be the child of the first P2P revolution that had been briefly prospered in the late 1990s and early 2000s. The revolution was largely due to the illegal distribution of media like BitTorrent. The network of files is driven.

That initial prosperity was in many ways a logical extension of the roots of the Internet's decentralized open protocols. The Internet has shown that you can reliably publish documents in a mass-based network. Services like BitTorrent or Skype take this logic to the next level, allowing regular users to add new features to the Internet: creating a distributed (primarily pirated) media library, just like BitTorrent. Or help people make calls over the Internet, just like using Skype.

Benet sat in the living room/office at Rivendell and told me that with the rise of Skype and BitTorrent, the early 21st century was like "the summer of P2P" – its golden age.

"But later, P2P hit a wall because people started to like the centralized architecture," he said. "Partly because the p2p business model is driven by piracy."

Benet, a graduate of computer science at Stanford University, speaks in a way that reminds me of Elon Musk: When he speaks, his eyes glance at the air above your head, just as he is looking at an invisible word. To find the wording.

He is passionate about the technology being developed by the protocol lab, but is also keen to put it in a broader environment. For Benet, the transition from a distributed system to a more centralized approach is hard to predict.

"The rules of the game and the rules governing all of these technologies are very important," he said. "The structure we are building now will depict a completely different picture in the next 5 or 10 years."

He went on to say: "At the time, I knew very well that P2P was a special thing. But I didn't know how high the risk was at the time. I didn't realize that I had to take over the baton, now it's my turn to protect it. It is.

The protocol lab was Bennet's attempt to take over the baton. Its first project was a radical overhaul of the Internet file system, which included the basic scheme we used to locate the pages on the web.

Benet calls his system IPFS, which is an abbreviation for "InterPlanetary File System."

The current protocol HTTP downloads web pages from a single location and there is no built-in mechanism for archiving online pages. IPFS allows users to download a page from multiple locations at the same time, including the programmer's "historical version control", so that past iterations will not disappear from the history.

To support the protocol, Benet also created a system called Filecoin that will allow users to effectively rent unused hard disk space. (You can think of it as a kind of data for Airbnb)

"Now, there are countless standby or idle hard drives on the planet, so their owners are just losing money," Benet said. "So you can bring a lot of supplies online, which will reduce storage costs."

But as its name implies, the ambition of the protocol lab goes far beyond these projects, and Benet's larger mission is to support many new open source protocols in the coming years.

Why is the Internet going from open to closed?

Part of the explanation lies in the original sin of "inaction": When a new generation of programmers begins to solve the unresolved problems of InternetOne, as long as the programmer keeps the system closed, there will be almost unlimited sources of funding for investment.

The secret to the success of the InternetOne Open Protocol is that they were developed in an era when most people are not concerned about network networks, so they can quietly reach critical mass without having to deal with wealthy corporate groups and venture capitalists.

However, by the middle of the 21st century, promising new companies like Facebook can attract millions of dollars in financing even before becoming a household name. Moreover, private sector funding ensures that the company's critical software remains closed to capture as much value as possible for shareholders.

However, as venture capitalist Chris Dixon points out, there is another factor that is inherently more technical than finance.

"Suppose you want to build an open Twitter," Dixon said in a conference room at Andreessen Horowitz's New York office, where he was a general partner. "I'm called @cdixon on Twitter, so how do you store this information? You need a database."

A closed architecture like Facebook or Twitter puts all of the user's information—their actions, their likes and photos, their relationship maps with other individuals on the network—in a private database maintained by the company. Whenever you view your Facebook news feed, you can access a very small part of the database and only see information about you.

Running Facebook's database is an unimaginable and complex operation that relies on thousands of servers around the world and is supervised by the world's most prominent engineers. From a Facebook perspective, they provide a valuable service for humans: creating a common social graph for almost everyone on the planet.

This trade-off does make sense in the middle of the 21st century; creating a database that can track the interactions between hundreds of millions of people—not to mention 2 billion—is a problem that only one organization can solve.

But as Benet and his blockchain evangelists are eager to prove, such rationality may no longer exist.

So, when large technology companies have attracted billions of users and have hundreds of billions of dollars in cash, how can you make new underlying agreements meaningfully adopted in this era?

If you happen to believe that the Internet has caused significant and growing harm to society in its current incarnation, then this seemingly esoteric problem – the difficulty of adopting new open source technology standards – will ultimately have important consequences.

If we can't think of a way to introduce new infrastructure that rivals existing architectures, then we'll be stuck in the Internet forever.

The best result we can expect is government intervention to reduce the influence of Facebook or Google, or some kind of rebellion from consumers, encouraging the market to switch to less hegemonic online services, which is equivalent to local farmers. The market sells and abandons the digital version of large agricultural facilities.

Neither of these methods will subvert the basic impetus of InternetTwo.

Fives

In 2008, shortly after Zuckerberg opened its first international headquarters for his growing company, the first clues to the meaningful challenges of the era of closed agreements emerged.

A (or a group of) mysterious programmers distributed a paper to the e-mail address of cryptographic academic community members on behalf of Satoshi Nakamoto. This paper is called "Bitcoin: Peer-to-Peer Electronic Cash System", in which Nakamoto outlines a clever system for a digital currency that does not require a centralized trusted authority to verify transactions.

At the time, Facebook and Bitcoin seemed to be in completely different areas—one is a social media startup that thrives with VC support, lets you share birthday wishes, connect with old friends, and the other is an unknown email. The intricate solution for cryptocurrencies in the list.

But 10 years later, Nakamoto's ideas in this paper have made the biggest challenge to the dominance of Internet giants like Facebook.

The paradox of Bitcoin is that it is likely to become a truly revolutionary breakthrough and a huge failure as a currency.

As I have written, the value of Bitcoin has increased by nearly 100,000% over the past five years, making a lot of money for early investors, but it has also been labeled as a highly unstable payment mechanism. The process of creating new bitcoins has also proven to require incredible energy consumption.

History is full of stories about new technologies, and the initial application of these new technologies has nothing to do with the end use. All concerns about Bitcoin as a payment system may also prove to be such a kind of interference. It is a "sesame" that loses watermelon in the technical field.

Nakamoto positioned Bitcoin as a “peer-to-peer electronic cash system” in its original manifesto, but at its core, his (or her or their) innovations have a more general structure, and this structure has two key features.

First, Bitcoin provides evidence that you can create a secure database—the blockchain—distributed across hundreds of computers without an authority to control and verify the authenticity of the data.

Second, Nakamoto designed Bitcoin so that the work of maintaining a distributed ledger would itself yield a small, increasingly rare bitcoin payment. If you invest half of your computer's processing power to help the Bitcoin network do the calculations—and thus defend against hackers and scammers—you get a small bitcoin.

Nakamoto designed the system so that bitcoin becomes more and more difficult to obtain over time, ensuring a certain amount of scarcity in the system. If you help Bitcoin keep your database secure early on, you will earn more Bitcoin than later people. This process is called "mining."

For the purposes of our understanding, please forget everything else about Bitcoin's heat, just remember these two things:

What Nakamoto brings to the world is a way to agree on content without a database administrator, and a reward for helping to make the database more valuable without formal wages or equity. The way people do. Together, these two ideas solve distributed database problems and funding issues.

Suddenly, a method of supporting open protocols that did not exist during the early years of Facebook and Twitter emerged.

These two features have now been copied to dozens of new systems inspired by Bitcoin. One such system is Ethereum, which was proposed by Vitalik Buterin in a white paper when he was 19 years old. Ethereum does have its currency, but the core of Ethereum's design is not to facilitate electronic payments, but to allow people to run applications on the Ethereum blockchain.

Currently, hundreds of Ethereum applications are under development, from forecasting markets to Facebook cloning to crowdfunding services. Almost all products are in the pre-test phase and are not yet ready for consumer use. Although the application is in its infancy, the tiny bitcoin bubble has appeared in the Ethernet currency, which is likely to bring huge wealth to Buterin.

These currencies can be used wisely.

Juan Benet's Filecoin system will rely on Ethereum technology and reward users and developers who use its IPFS protocol or help maintain the shared databases it needs. The protocol lab is creating its own cryptocurrency, also known as Filecoin, and plans to sell some Filecoins on the open market in the coming months. (In the summer of 2017, the company raised $135 million in the first 60 minutes by providing certified investors with the “pre-sale” of the tokens that Benet said.)

Speculators can buy in ICO, but they are not buying private company equity and proprietary software as they would in a traditional IPO.

After that, digital currency will continue to be created in exchange for labor – in the case of Filecoin, that is, those who help maintain the Filecoin network. Developers who help improve the software can get these Filecoins, and ordinary users can also expand the network's storage capacity to provide Filecoin by providing extra hard disk space. Filecoin is a signal that someone has added value to the network somewhere.

Advocates like Chris Dixon have begun to use “tokens” rather than coins to refer to compensation in this labor transaction, emphasizing that such technology is not necessarily to destroy the existing monetary system. .

"I really like the symbolism of this token because it clearly shows that it is like a video game city." He said, "You go to the playground, where you can use these tokens. But we are not going to replace The US government. It is not a real currency; it is a pseudo-currency in this world."

Dan Finlay, founder of MetaMask, also responded to Dixon's point of view. He said: "The most interesting thing for me is that we have begun to plan a new value system. They don't need to imitate existing systems like money."

Whether it's true or not, ICO's ideas have inspired a lot of shadow sales, some of which are endorsed by celebrities who are unlikely to be blockchain enthusiasts, such as DJ Khaled, Paris Hilton and Floyd Mayweather.

In a blog post published in October 2017, Fred Wilson, founder of Union Square Ventures and an early advocate of the blockchain revolution, strongly opposed the expansion of ICO. "I hate it," Wilson wrote, adding that most of the ICOs are "fraud." The behavior of celebrities and others on the social media for this platform is terrible and may have violated securities laws. "

Perhaps the most striking thing about the surge in interest in ICO – and the already issued Bitcoin and Ethereum – is how much financial speculation has been attracted to platforms that are not actually used by ordinary consumers.

At least in the dot-com bubble of the late 1990s, ordinary people did buy books on Amazon or read newspapers online; there was clear evidence that the Internet would become the mainstream platform.

Now, the hype cycle has been accelerated, and billions of dollars are chasing a technology that almost no one can understand except cryptographers, not to mention how many people are actually using it.

six

For the sake of clarity, let us assume that hype is necessary, and that a blockchain platform like Ethereum is a fundamental part of our digital infrastructure. So how does a distributed ledger and symbolic economy challenge a technology giant?

Fred Wilson, a partner at Union Square Ventures, put forward a vision around another technology giant. Last year, the company clashed with regulators and public opinion – Uber.

"Uber is basically just a coordination platform between drivers and passengers," Burnham said. "Yes, it's really creative. There are a lot of features at the outset to reduce the anxiety of drivers, maps, and lots of Something worthy of praise."

But when Uber and other new services are developing rapidly, the market has a strong incentive to consolidate a leader. In fact, more and more passengers are starting to use the Uber app to attract more drivers, which in turn attracts more passengers. People have bundled credit cards on Uber; they have installed apps; there are more Uber drivers on the road. Therefore, the cost of switching to other competitor services will eventually become prohibitive, even if the CEO seems to be a jerk, or in theory, consumers should prefer a competitive market with a dozen Uber.

Burnham said: "At some point, innovation around coordination has become less and less creative."

The blockchain world has made different recommendations. Imagine a group like the protocol lab that decided to add another "base layer" to the stack.

Just as GPS gives us a way to discover and share our location, this new protocol will define a simple request: I am here, want to go there. Distributed books may record all users' past travels, credit cards, and favorite places—all the services that Uber or Amazon use to lock customers' metadata. For the sake of argumentation, call it the "transit" protocol.

The standard for sending "traffic" requests to the Internet will be completely open; anyone who wants to build an application to respond to the request can use it for free. The city can create a “traffic” app that allows taxi drivers to make requests. Bicycle sharing organizations, or rickshaw drivers, can do the same.

Developers can create shared marketplace applications where all potential vehicles can compete for your business through "traffic."

When you walk on the sidewalk and want to ride a car, you don't have to be loyal to a supplier before you say hello. You will simply announce that you are standing at 67 Madison Square and need to go to Union Square. Then you will get a series of competitive quotes. You can even get a quote from the Metropolitan Transportation Authority (MTA) in theory. It can create a service to remind users of "traffic" that it may be cheaper and faster to take the Rail Line 6 directly.

When Uber and Lyft have dominated the carpool market, how will “traffic” reach a critical mass? This is where tokens work.

Early users will receive “traffic” tokens that can be used to purchase “traffic” services or to redeem traditional currencies. As in the Bitcoin model, with the popularity of transportation, token distribution will become more and more embarrassing.

In the early days, a developer who developed an iPhone app with "traffic" might get a lot of tokens; Uber drivers who started using "traffic" as the second option for finding passengers could collect tokens as a hug. New system rewards; adventurous consumers will receive token rewards for using “traffic” early on because there are fewer available drivers than existing proprietary networks (such as Uber or Lyft) Much more.

When the "traffic" business soars, it will attract speculators who will mark the currency price of the token and expand its value to drive more people's interest in the agreement, which in turn will attract more Developers, drivers and customers. If the entire system ultimately works as its advocates believe, the result is a more competitive and fairer market.

All economic value is not obtained by shareholders of one or two large companies that dominate the market, but is distributed among a wider group: early “traffic” developers, app developments that make the use of the agreement more user-friendly The early drivers and passengers, as well as the first wave of speculators.

The token economy introduces a novel element that does not conform to the traditional model: unlike in the shareholder equity model, which has capital to create value, people improve the underlying agreements, help with bookkeeping (like bitcoin mining), and write on it. The application, or just use the service to create value. The boundaries between founders, investors, and customers are much more blurred than traditional corporate models; all incentives are clearly designed to avoid the outcome of the winner. At the same time, however, the entire system relied on an initial speculative phase – outsiders bet on token appreciation.

"You think about the Internet bubble of the 1990s and all the great infrastructure we got from it," Dixon said. "You basically accepted these results and narrowed them down to the size of the application."

Seven

Even decentralized cryptographic actions have their key nodes.

In Ethereum, one of the nodes is a Brooklyn-based organization called Consensys, founded by an early pioneer of Ethereum, Joseph Lubin. In November, ConsandaSys' Chief Marketing Officer, 26-year-old Amanda Gutterman, took me to the organization's headquarters. In the first few minutes of our stay together, she insisted on giving me a cup of coffee, only to find that the drip coffee machine in the kitchen was dry.

"If we can't even cook coffee, how can we repair the Internet?" she said with a smile.

Consensys is headquartered in the industrial city of Bushwick, adjacent to the pilgrimage site of the pizza lovers Roberta's, which is incompatible with the image of the "headquarters". The front door is full of graffiti and stickers; the stairwell in the door is still maintained in the style of the Kulich government.

In just three years, the Consensys network now has more than 550 employees in 28 countries and has never received any venture capital. As an organization, ConsenSys is not well suited to be classified into any common category: technically, it is a company, but it also has components similar to non-profit organizations and workers' groups.

The common goal of Consensys members is to strengthen and expand the influence and scale of the Ethereum blockchain. They support developers to create new apps and development tools for the Ethereum platform, including MetaMask software for generating my Ethereum address. But they also provide consulting services to businesses, non-profit organizations or governments to help them integrate Ethereum's smart contracts into their own systems.

The real test of the blockchain will revolve around identity issues, just like the online crises that have recurred in the past few years.

Today, your digital identity is spread across dozens or even hundreds of different sites: Amazon has your credit card information and your purchase history; Facebook knows about your friends and family; Equifax saves your credit Record history. When you use these services, you are actually requesting to lend some information about yourself to perform a task: order a Christmas gift for your uncle, or open Instagram to view the image of the office party last night.

But all of your different identity clips don't belong to you; they belong to Facebook, Amazon, and Google, and these companies are free to market information about you to advertisers without having to notify you.

Of course, you can choose to delete these accounts. If you stop using Facebook, Zuckerberg and Facebook shareholders can no longer rent your attention to their real customers, and you can't make money from you. However, you are not taking your identity on Facebook or Google. If you want to join another attractive social network, it is subject to Russian robots (Russian bots may be less infected, but you can't extract your social network from Twitter and save it in a new service. You You must build the network from scratch (and convince all your friends to do this).

Blockchain evangelists believe that this method is out of date.

You should have your own digital identity, including your date of birth, network of friends, history of purchases, etc. You should be able to freely call these identity fragments and lend them to services that you deem appropriate.

Since your identity has not been incorporated into the original Internet Protocol, and the management of distributed databases has been difficult before the advent of Bitcoin, this form of "autonomy" identity – as the saying goes – In the past it was actually impossible.

Now, this goal can be achieved.

Some blockchain-based services are trying to solve this problem, including a new identity system Uport, which is independent from ConsenSys and currently based on the Bitcoin platform Blockstack. (Tim Berners Lee is leading the development of a similar system called Solid, which will also allow users to have control over personal data.) The frameworks of these competitors are slightly different, but they are all based on solving the same problem. That is, how identity should exist in a truly decentralized Internet.

What can make a new identity standard based on blockchain out of the jurisdiction of Tim Wu? The latter contributed to this dominant position of Facebook. Maybe nothing can stop this trend. But imagine what role this sequence will play in practice?

Someone has created a new agreement through Ethereum to define your social network. It may be as simple as a series of other Ethereum addresses; in other words, this is the public address of those I like and trust.

This way of defining social networks may win the public's popularity and eventually replace Facebook's closed system of self-defined user networks. Maybe one day, everyone on the planet can use this standard to describe their social relationships, just as everyone on the Internet uses TCP/IP to share data.

Even if this new form of identity is ubiquitous, it does not create opportunities for abuse and manipulation, which in fact has become the de facto standard in closed systems.

Facebook-style services can use my social maps to filter news, gossip or music for me, but if the service annoys me, I am free to choose other options without switching costs. An open identity standard will give ordinary people an opportunity to focus on the highest bidders or choose to completely block them.

Gutterman believes that such systems can be applied to more important forms of identity, such as medical data. Your genomic data will not be private, they have no right to store it on their own servers, and your information will be stored in personal data files.

"Maybe I don't want many entities to see this data, but maybe I am willing to donate it to medical research projects." She said, "I can send my blockchain-based autonomy account to a research group, ( Allow) they and others do not use my data. I can sell them or donate them."

This is an advantage of blockchain-based identity standards because of the use of token architectures for closed standards such as Facebook. Many critics have observed that in the entire industry chain from content production to advertising sales, ordinary users create content on social media platforms with little or no compensation, and the media platform can capture all the economic value. .

A token-based social network will at least give early users a little bit of compensation, rewarding them for the appeal of the new platform.

"If someone can really create a social networking platform that allows users to have a portion of the network and get paid," Dixon said. "That would be quite convincing."

Is information more secure in a distributed blockchain than a firewall built by tech giants like Google or Facebook?

In this respect, the bitcoin story is actually very instructive: as a currency, it may never be stable enough, but it does provide a convincing evidence that distributed taxonomy accounts are highly secure. .

"Look at the market value of Bitcoin or Ethereum: $80 billion, $25 billion, I forgot specifically," Dixon said.

"This means that if you break through this system, you can take away at least $1 billion. Have you heard of "bug bounty"? Some people say, "If you crack my system, I will give you a million dollars," now, Bitcoin has accumulated billions of dollars in bug rewards in the past 9 years, but no one ever Cross its line of defense. This seems to be a good proof. "

The blockchain-based identity protocol is decentralized, which also increases the security of information.

In the identity system proposed by Blockstack, actual information about your identity, such as your social relationships, purchase history, etc., will be stored anywhere in the online space. The blockchain uses an encrypted security key to unlock information and share it with other trusted vendors. A central storage system with hundreds of millions of user data — called "honey pots" by security experts — is more attractive to hackers.

Which approach would you prefer: invade 100 million independent PCs, filter data one by one on each brain, and steal 100 million credit records; or invade an Equifax central storage system, and then in a few hours Involved in the billions of data.

As Gutterman puts it, "This is the difference between robbing a house and looting the entire village."

Too many blockchain architectures are subject to a set of predictions about how the architecture may be abused once it discovers a broader audience.

This is part of its own charm and power. The blockchain lends energy to the speculative bubble because it allows the vast majority of true supporters on the platform to share the token. It prevents any individual or small group from gaining control of the entire database. Its encryption mechanism is to prevent monitoring status or to block identity thieves. In this regard, the blockchain shows a politically constitutional family similarity: its rules are designed to look at the underlying ways in which the rule is exploited.

In Bitcoin and other undocumented currency communities, there has been a lot of anarchic liberalism; this community is full of words and phrases (such as "autonomy") that sound like the slogan of some militia organizations in Montana.

However, for those who want to distribute wealth more equitably and break the cartels of the digital age, blockchain thinking offers an enticing possibility that the community can disintegrate a high degree of concentration and explore a more democratic model of ownership.

In this sense, the blockchain concept can also be voiced by liberals, which provides an unofficial solution to capitalless behavior (such as information monopoly).

However, trust in the blockchain does not mean that it must be opposed to regulation if the design objectives of the regulatory system are complementary.

For example, Brad Burnham suggests that regulators should strongly support every citizen's control over "private data stores," including all aspects of citizen online identities.

But the government will not be required to design those identity agreements. They will be developed in the blockchain and open source to the public.

Ideologically, the task of storing private data will require the assistance of all parties in society: it is created as a public intellectual property, funded by Token speculators, and maintained with the support of regulatory agencies.

As with the Internet, the blockchain idea was a bit radical for the public, even with communityism, and at the same time attracted some resurgence of the most rash capital desires.

The first two phases of our online world are defined by open protocols and knowledge sharing; our second phase is gradually dominated by closed architectures and proprietary databases. We learned from this history that openness is better than closure, at least on the basic issues. But it is difficult for us to find a way back to the era of open agreements. Outside the field of research in the Department of Defense, it is unlikely that some savior-like next-generation Internet protocols will emerge, the first generation of Internet did so 50 years ago.

In the present, the blockchain seems to be the worst speculative capitalism, and it is hard to understand. But the beauty of open agreements is that those who find and embrace them early can harness them in new and exciting ways.

It is now that the blockchain is the only hope for reviving the spirit of the open agreement. Ultimately, its ability to deliver on its commitment to equality will depend to a large extent on the proponents of these platforms.

In the words of Juan Benet, they took over the baton from these early network pioneers.

If you think that under the existing Internet architecture, you can't change the system by thinking and FCC regulations alone, then you need new code.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Read the current situation and development trend of cryptocurrency wallet products

- Extreme market challenges major contract exchanges, BTCC contract performance is outstanding

- Paxos is approved to launch blockchain stock settlement platform, Credit Suisse and Societe Generale will participate in the first batch

- Large-scale shock consolidation, callback or boarding opportunities

- Weekly | China's blockchain industry is welcoming new opportunities, Libra has entered the crisis

- What do you feel after entering the blockchain?

- The high volatility period ends and the market enters the cooling phase