Jiang Zhuoer: How much does it cost for Bitcoin to rise to $100,000?

Author: Jiang Chelsea

Today I talk about a financial knowledge point (but many people misunderstand): the relationship between capital and total market capitalization .

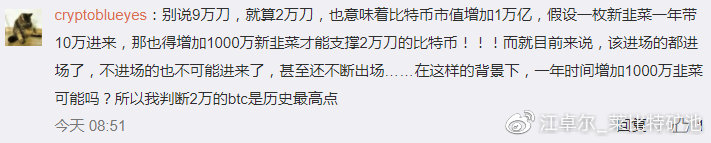

The reason for writing this is to see a typical cognitive error in the comments:

- Popular Science | Introduction to Cryptography (Part-1)

- Bakkt Bitcoin contract rose by 257% in a single day, exceeding 1100 copies

- Read the current situation and development trend of cryptocurrency wallet products

1. Can you answer correctly?

First ask you a question:

A stock fund with a net worth of 10 billion shares held by the fund. Excuse me, the fund has a 50% discount and 5 billion yuan (including stocks) sold to you . Are you willing to buy it?

Give you 1 minute to think

Spend 5 billion to buy 10 billion worth of stocks, which is a big bargain?

The answer is: you must first look at what stocks the fund holds.

Is there a difference between the A stock with a market price of 1 billion yuan and the B stock with a market price of 1 billion?

Of course there is a difference, and it may be different. This is a concept we want to mention: the virtual market value .

Second, the virtual market value

You have 100 million shares in your hand, and the price per share is 10 yuan. Is it worth 1 billion yuan in real money (red area)?

No, no, the stock of 1 billion yuan (or altcoin), and 1 billion real money, the difference can be big .

You have to sell this 1 billion market capitalization in the market, and the exchange of real money (red part) may be far less than 1 billion.

The price of each price in the market is limited.

You have to sell 100 million shares. If you are willing to buy 10 yuan, you may only have 3 million shares, 9 yuan and 5 million shares. The lower the price, the more you pay, you may have to sell 2 yuan to sell the 100 million shares. After selling together, you only got 300 million real money in total .

Where is the "wealth" of 700 million yuan left? No, no, the 700 million yuan is just a virtual value, and it is never real money. Multiply the last transaction price of 10 yuan by 100 million shares, and the total market value of 1 billion yuan, and the real 1 billion real money, the gap between 1% and 99% is possible . The greater the proportion of 100 million shares in total share capital, the greater the percentage difference. If a total of 110 million shares are sold, 100 million shares will be sold to more than 90% of the price.

“Total market value” is just a statistical value, not real money.

This is an important knowledge point in the economy, and there is a more vivid statement:

The price is three-dimensional

Third, how to use the virtual market value to make money

In fact, it is very simple. Just use the statistical value of “total market value” to change the real money of people with low cognition . For example, at the beginning of the example, how did the fund's 10 billion stocks come? It may be that the fund only spent 3 billion yuan to buy a few stocks and gradually made it .

Review this picture again. Since the stock of 1 billion shares has been sold down, it can only sell 300 million real money, which means that if 300 million yuan of real money is spent, the control is getting higher and higher. Next, as long as you spend a small amount of money, you can push up a large total market value .

But in the end, the 1 billion market value has been made, but it is only imaginary. If it is sold again, it can only sell 300 million real money and silver. If it is busy , what should we do?

Simple, this stock is gradually bought with funds, and it is better to sell the fund to low-aware retail investors: Look, my fund (the altcoin) is very good, and it is profitable 20% every year. Now the fund holds the market value. 10 billion yuan of stock, sell you 10 billion real money , you are not losing.

Have you seen it? It is this consequence that it is not good to learn and improve cognitive ability. I still don’t know how to sell it.

Fourth, how to push up the virtual market value

In fact, it is very simple, the key point is: control degree / lock position .

Therefore, platform currency / POS currency / mode currency all like to play locks, you have to hold XXX coins in order to get some kind of benefits (such as fee reduction), a large number of coins can be locked up, with a small amount of money, you can pull up Very high market value .

When you see this model, you must be clear: the behavior of this unified lock warehouse brings a huge market value. Once the locked coins are swarmed out and trampled on each other, don’t say that the waist is squatting. Ankles .

What's more interesting is that if this lockout is dispersed by N people, then the "virtual" value may be very "real" , the most typical is the house price. From the perspective of trading, especially in the case of large-scale purchases and high transaction taxes, the price is actually very virtual. For example, the total number of residential units in Shanghai is 9.13 million sets. In 2018, the volume of second-hand houses in the whole year is 160,000 sets, which means that there are only 1.8 sets of transactions for every 100 sets of houses. The 1.8 sets of transactions determine the price of the remaining 98.2 sets. From the point of view, there is no doubt that it is very virtual .

But in fact, house prices are under the consensus of the market, and they are rock-solid. A large number of smart people choose to store their wealth in real estates that cannot be issued because of the indiscriminate use of legal currency. In the case of (respectively, in order to crack down on real estate speculation), high taxes and fees The low transaction volume (equivalent to high lockouts) caused by the policy has pushed the house price up to a jaw-dropping level . In the ascending channel, the price is not only rock-solid, but also rising.

5. How to push up the virtual market value of Bitcoin

Bitcoin itself is a currency with a very high natural lockout. In the early days, a large number of coins were lost. Many of the coins in the back were in the hands of the loyalty of the coin, and the bitcoin was very small in the early days, so it created an amazing The multiples of the increase : the first time halved 583 times, the second halved 129 times.

In the past, there was a painful thing in the death loyalty coin – spending money on the currency, and it took a lot of perseverance to raise the currency and not sell it to improve life . The last round of the bull market was very interesting. At the price of 6000 RMB, when I borrowed money to mine the coins, an early old man (previously called P2PBUCKS, now called TumbleBit) bought a coin at 6000 RMB. Mercedes .

Don't look at the four seas now a pair of milk kings, the left sentence "Eternal bull market is coming", the right sentence "Don't wait to go up and then regret", in fact, only psychological over-compensation only:)

I can judge the position of the cycle, only investing and not spending – I don't have a driver's license until now, go out by drip, live by renting a house – and most people are ordinary people like the four seas, just a chance to step into it. The currency circle can neither accurately determine the current cycle position, nor delay the satisfaction, and resist the consumption . Therefore, although the death loyalty is a currency, in the long run, it will still be able to sell the coin because of the need for consumption, the price of the currency can not help but improve the life, and reduce the lock position .

In this round of bull market, an important financial instrument has finally matured – mortgage currency borrowing . Although the previous round of bull market also has a platform for mortgage currency borrowing, such as China National Capital (CHBTC.com) Ba Rong (8R.com), fire money pawn shop (dangpu.com), I also borrowed money, but after all, the market is small Immature, and later both platforms were turned off.

In this round, there have finally been some more professional mortgage lending platforms, such as Wu Jihan's new financial company Matrixport.com and Zhao Dong's Renren Bit.com. In the past, although the loyalty of the loyalty was nominally rich, it could only be used . Most of the positions were sold at a loss. The Mercedes-Benz in the Four Seas had already valued a high Ferrari. It is not difficult to have a Bugatti Veyron in the future. – But now diehard has a new choice: mortgage currency borrowing consumption.

For another major short: the miners are paying for the electricity bill, there is also a new option. When the electricity bill is relatively low, the miners can choose the mortgage currency to borrow money to pay the electricity bill, thus greatly speeding up the currency .

6. Security of mortgage currency loans

6.1, the security of the currency price

At this point, loyalty borrows money to consume better. Daily consumption is extravagant, and it doesn't cost much. Big items (buy a car to buy a house) try not to buy as much as possible. The leverage ratio is very low, enjoyment, and can be greatly improved. The mentality is more affordable .

The main risk is that the miners borrow money to pay the electricity (or buy a mining machine):

First of all, once leverage is used, there must be a level of enlightenment, but it must be active rather than being forced . For example, the platform requires 90% of the mortgage rate to be closed (and the remaining residual value is returned to the platform), which is preferably 90%. Before taking the initiative to charge the USDT, you can avoid the extra loss of 10%. Some platforms have a flat line (for example, 85%), so it is more active. To take the initiative as an active stop loss, don't fall back and make up the money .

Secondly, the essence of the mortgage currency borrowing fee lies in: the initiative is flat at the time of loss (the loss is limited to 20%~30%), and the rise is always uneven (the excess profit of the currency price is increased by several times) . In fact, as long as the price of the currency rises, the currency that was previously mortgaged (sold earlier than it is sold) has already been returned, and the rest is purely earned. Depending on the platform, you can choose to withdraw the excess collateral or borrow more money. In short, don't leave extra money on the platform .

6.2, platform security

The most important aspect of the platform is transparency: you can see where your coins are . If it is the same for individuals to borrow from individuals, it is best to use a 2/3 signature wallet. A trusted private person holds a private key to ensure that the other party cannot use the currency at will . If not, at least ensure that The currency is placed in an address and does not move .

The reason for this is that some models in the market are very dangerous :

1. Some unscrupulous platforms, but no source of borrowing funds, but empty gloves and white wolves: after getting the mortgage, sell 65% of them to the mortgagor, and then take the remaining 35% of the coins, through a combination of futures or options. , simulate the holding of the currency position. The reliability of this kind of simulation is very low, and the position may disappear with the appearance of black swan (violent fluctuations, platform pull-out lines, high-end premiums in futures, losses on the exchanges, and closures) .

2. Some platforms or funds will use the mortgage currency to lend to other people to increase interest income. But there is no safe way to make money in the world. – There is no way to pay attention – any method of making money is accompanied by considerable risk. Otherwise, if 20 million coins are invested in making money, can you earn 22 million? Currency? This means that the borrowed currency may not be returned after a few dozen times.

Therefore, you must be able to see where your currency is. If you can't see it, you don't have to borrow it. If you have to borrow it, you must agree on the way to raise the money (or increase the loan) so that if there is risk, the most loss will occur. Tens of percent , instead of a few times the price of the currency, the funder tells you that your currency has been lost due to XXX accidents.

Seven, summary

1. "Total market value" is just a statistical value, it is a virtual value, not real money.

2. Increasing the “locking position” is an important means to push up the “virtual market value”.

3. Developed mortgage currency loans can reduce the “dead loyalty to sell coins” and “miners sell coins to pay electricity” and increase the lock market of the bull market.

4. The mortgage currency loan will be injected into the blockchain market by means of mortgage lending.

So how much does it cost for Bitcoin to rise to $100,000?

Not good, but the required capital multiple will be less than before, because the lockup is improved 🙂

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Extreme market challenges major contract exchanges, BTCC contract performance is outstanding

- Paxos is approved to launch blockchain stock settlement platform, Credit Suisse and Societe Generale will participate in the first batch

- Large-scale shock consolidation, callback or boarding opportunities

- Weekly | China's blockchain industry is welcoming new opportunities, Libra has entered the crisis

- What do you feel after entering the blockchain?

- The high volatility period ends and the market enters the cooling phase

- Quantitative analysis of the decentralization of the mainstream public chain: Bitcoin is not the first, second only to BCH