Quantitative analysis of the decentralization of the mainstream public chain: Bitcoin is not the first, second only to BCH

A few days ago, ZB's innovative think tank released the "Quantitative Analysis Report on the Decentralization of Mainstream Public Chains", which is different from many people's perceptions. BTC is not the highest ranked digital currency in decentralization. In reality, many people only pay attention to the rise and fall of the currency price, ignoring the most important essence of the blockchain project.

The original text of this report can be found in the ZB Innovation Think Tank public number. We don't need to know the specific calculation method behind this result. We only need to absorb a method to evaluate the quality of the blockchain project and have a general understanding of the decentralization of the current mainstream public chain.

Why pay attention to the degree of decentralization

- Babbitt Column | A Brief History of Blockchain: Where does the blockchain come from and win the Nobel Prize?

- Jia Nan submits the prospectus to the SEC: from the mining giant to the leader of the AI chip

- Blockchain station upwind, the industry warns of the risk of issuing coins

Where does the value of digital currency come from, and why is a bitcoin close to $10,000? It is a lot of questions that Xiaobai is easy to ask for the first time. Before you can find out the answers to these two questions, no matter what reason you invest in digital currency, you should be cautious.

The value of digital currency comes from consensus. A bitcoin costs $10,000 because many people think it is worth $10,000. The more people who have this idea, the stronger the price of Bitcoin will be, because when you want to sell Bitcoin, someone will use 10,000 dollars to pick up.

In fact, not only is the value of Bitcoin coming from consensus, but the RMB is the same, but the consensus of the RMB is much larger, and it is accepted by 1.4 billion people in China. You can exchange RMB for various goods and services, or you can deposit it at the bank to get interest, and then use it in the next few years. No one in the country will reject the renminbi, and it can flow smoothly in any trading behavior.

On the contrary, the consensus of the renminbi is not so strong. It may not be accepted by local businesses and the public. You can't exchange products and services if you have money, because it is difficult to spend the renminbi in the local area. The weakening of the consensus is actually equivalent to depreciation. Similarly, when more and more people feel that Bitcoin can't, the price will fall.

Let us assume an extreme case. If it is on a desert island that no one has ever been to, the renminbi will be worthless. Similar to the scene in the movie "A Good Play", is money worth the money on that island? Can I exchange food and water? Can I hire someone else to work? No, this is the collapse of the currency consensus.

The consensus of the renminbi is top-down and limited to China; the consensus of Bitcoin is that all people are spontaneous and extend to the world along with the network; this involves the issue of decentralization.

The next thing can no longer be exemplified by the renminbi, because the renminbi is one of the most successful currencies in the world, and most people see it from birth, so this is the world we understand: currency stability is seen as a kind of Normal but not the case.

In fact, in many countries in recent times, currency overshoot, currency abolition, and issuance of new currencies have occurred from time to time. You may have heard that Zimbabwe’s currency is almost the same as waste paper. One billion can’t buy a meal, which is the result of the government’s massive issuance of currency. The distribution of money is concentrated in the hands of a few people, which is called centralization.

Bitcoin is not printed by the machine, it is just a bunch of code. Everyone in the world can run a Bitcoin client. All clients add up to complete Bitcoin's output, transfer, and stored value functions. No one can control the entire system. This is called decentralization.

The stronger the degree of decentralization, the more people who hold the consensus on the digital currency, the wider the circulation, and the stronger the price. It can be said that decentralization is the essence of the blockchain: the higher the degree of decentralization, the stronger the blockchain attribute, otherwise it is no different from the existing database.

Quantitative method of decentralization

In order to maintain the operation of Bitcoin, there are multiple roles and divisions in the entire ecosystem, including: developers responsible for updating Bitcoin code; miners responsible for processing transaction information, maintaining system security; exchanges providing places to exchange bitcoins; wallet service providers Provide bitcoin addresses and nodes.

From a qualitative point of view, decentralization depends on the following six factors. The higher the degree of “redundancy” of each role, the more “substitute”, the higher the degree of decentralization.

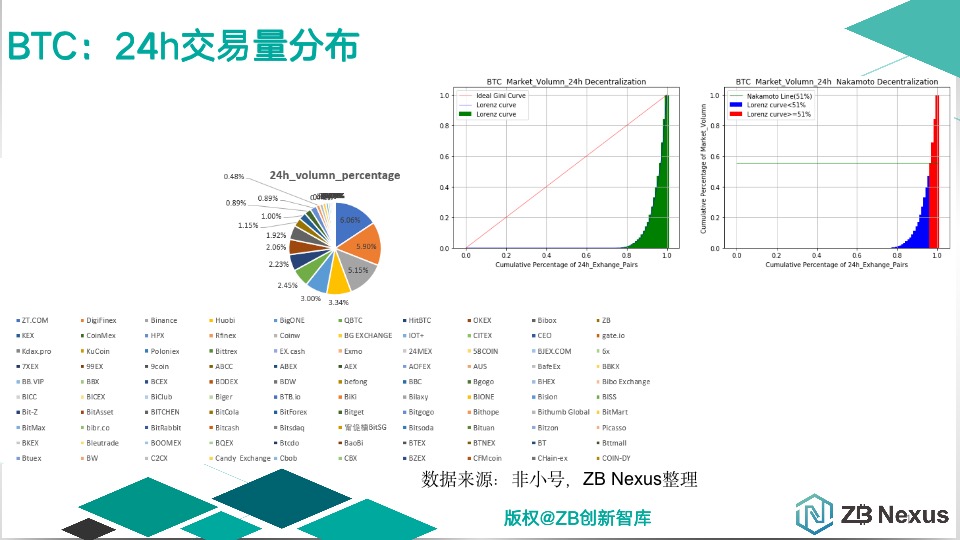

Trading: The more concentrated the 24h volume distribution, the lower the degree of decentralization;

Wallet: The more you use a single wallet, the lower the decentralization;

Mining: The higher the proportion of a single address or the excavated block in the mining pool, the lower the degree of decentralization;

Development: The fewer engineers submitting the core code, the lower the degree of decentralization;

Address: The more concentrated the number of currency holders, the lower the degree of decentralization;

Node: The more concentrated the distribution of countries and regions, the lower the degree of decentralization.

From a quantitative perspective, the idea of the Gini coefficient and the Lorenz curve, which measures the national income gap, can be transferred to the quantification process of decentralization. Because the Gini coefficient represents the concentration of wealth, the larger the Gini coefficient, the higher the concentration of wealth, that is, the lower the degree of decentralization of Bitcoin.

One problem here is that in all the roles of running Bitcoin, the upper limit of the Gini coefficient of the subsystem is not 1, for example, the upper limit of the miner should be 0.51. Because once you master more than 51% of the computing power, the entire Bitcoin system is subject to attack and the possibility of transcripts.

The Gini coefficient calculated by taking "24h trading volume distribution" as an example

By calculating the Gini coefficient of each subsystem in the quantitative analysis, the lowest value should theoretically be used to measure the degree of decentralization of the entire blockchain network. This is a good understanding, as if a frequently cited example is how much water a bucket can hold, depending on how short the shortest plank is.

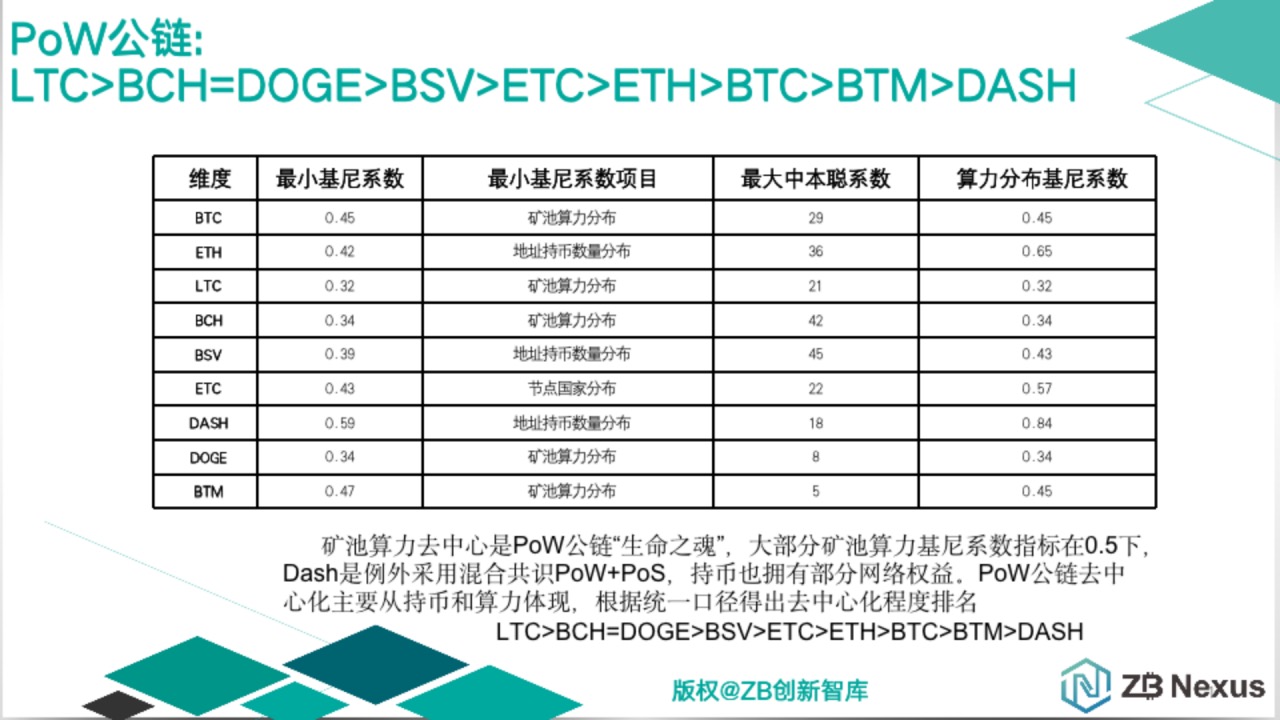

Decentralized degree ranking

Here directly quote the results of the ZB Innovation Think Tank report:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How many blocks of the blockchain company have a daily limit of more than 100 in the “chain”?

- Blockchain changes: Do it well, don't come.

- Digital Money and Electronic Payment: Opportunities and Challenges for Global Governance

- Node campaign is just a form, the future effect is the kernel | 8 Q

- China's blockchain ambition: Who is it?

- World Blockchain Conference · Wuzhen second batch of surrounding activities exposed, want to give a ticket to see here!

- The regular army is coming, what should the blockchain industry do next?