"2019 Blockchain Panoramic Scan": Global Policy

Senior Analyst: Li Xueting

Production: Planet Daily Odaily

The blockchain has gone through 2019 in enthusiasm and noise.

This "young" technology, which is still a toddler, has been trotting towards the second "decade" by its own financial attributes and crazy speculators. It has also been restored to rational investors and the followers. Regulators continue to squeeze the bubble.

- Interpretation of the head of China Telecom's blockchain business R & D: Why do telecom operators do blockchain?

- 4D long texts talk about decentralized storage

- Looking ahead to 2020 | Coinbase: What have cryptocurrencies experienced over the past 10 years?

Whether it can call itself an industry or industry, in addition to the total capital scale, the continuity of various business links, the integrity of infrastructure and landing projects, the integration with other industries, and other judging criteria, the blockchain must also listen to the supervision and say .

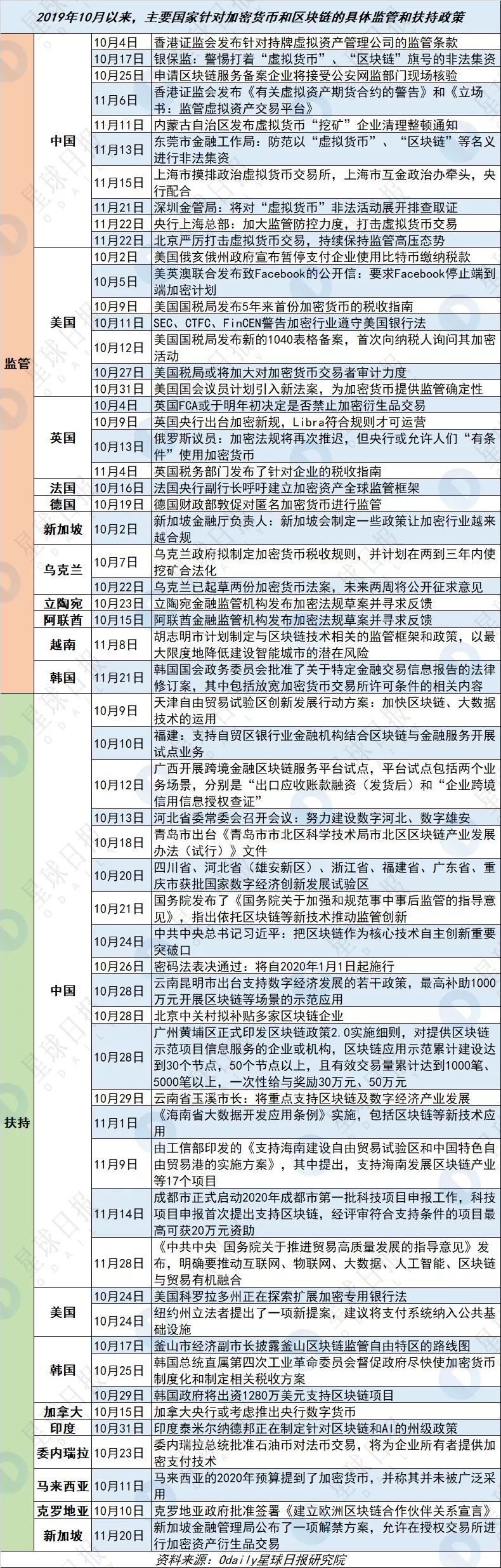

In October 2019, China promoted the blockchain as an "important breakthrough in independent innovation of core technologies" with unprecedented importance. Local governments have issued a number of programmatic documents to support their innovation and layout. In addition, Huang Qifan, deputy director of the China International Economic Exchange Center, announced: "The People's Bank of China is likely to be the first central bank to launch digital currencies in the world." Regardless of the technical level or the field of financial applications, official institutions have demonstrated their overall takeover and leadership in the world. Ambition.

For the supervision of other digital currency related activities, domestic policies have become stricter. Financial regulators in Beijing, Shanghai, and Shenzhen have launched investigations into illegal digital currencies and have already achieved initial results.

Looking at overseas mainstream markets, the US SEC has not yet nodded in applying for a Bitcoin ETF, but is the first to release Bakkt. Bakkt, as the first “futuristic exchange” for bitcoin futures delivered in kind, paved the way for the next stage of mainstream digital currency derivatives.

The US Securities Act's update on the registration exemption of securities products, and the prolonged battle between the Token Classification Act and EOS and TON have attracted much attention and will continue to affect the future development of the industry.

In short, the blockchain that is moving into adulthood is no longer an unrestrained child. How to balance social supervision and technological innovation, and let the "chain" and "coin" develop in an orderly manner has also become a topic explored by governments around the world.

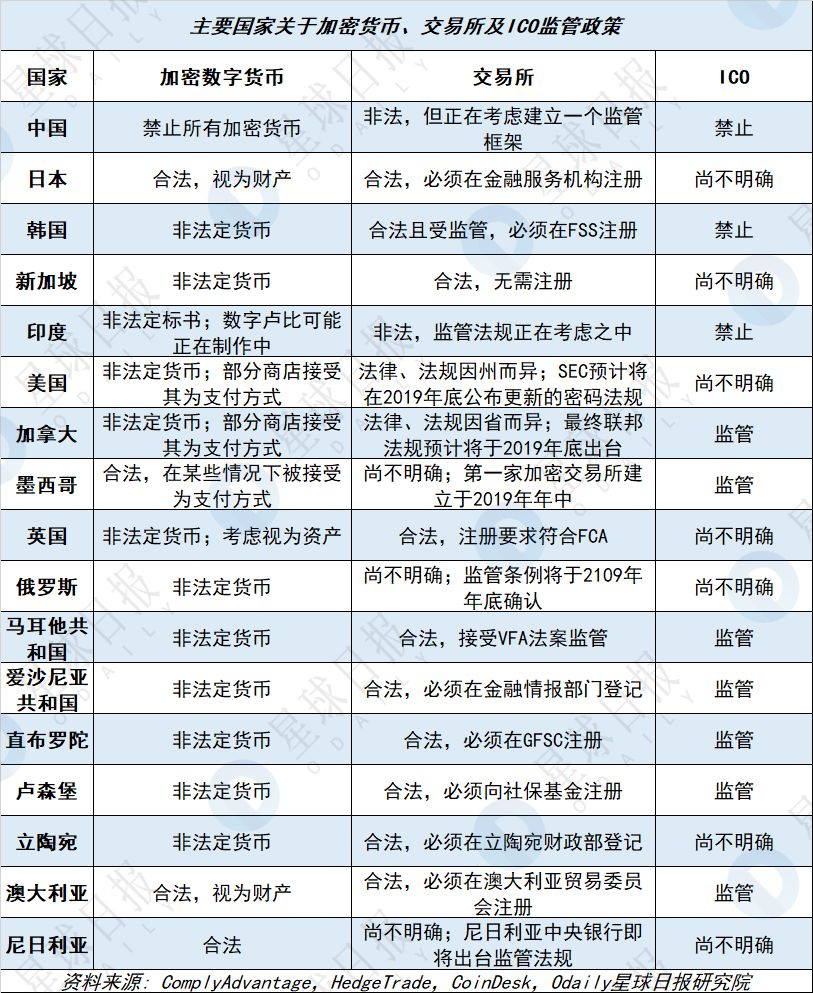

At the beginning of 2020, we updated the regulatory attitudes of major countries on cryptocurrencies, exchanges, and ICOs on the basis of the world map of the digital currency-related regulatory policies (October 2018) , and sorted out the country's Cryptocurrency and block chain supervision or support policy details, and the progress of the central bank's digital currency is summarized and summarized into the following three tables.

- Asia

- Europe

- North America

- Latin America

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SheKnows End of Year Debate | Talking about Bubble Discoloration? Layout of blockchain, capital will never sleep!

- Blockchain landing application 2019 statistics: government affairs and finance occupy half of the country, and China's blockchain landing volume has reached the world

- Can Andrew Yang's White House Crypto Party be held successfully in 2020?

- Comment: Regulatory sandbox and blockchain coexist and help innovation

- Supervision stick, giant "encirclement and suppression", how does the crypto industry redeem itself?

- Interviewed 800 crypto traders in 75 countries around the world. What did they find?

- Ethereum implements Muir Glacier upgrade, V god praises Sparkpool mining pool