2019 cryptocurrency trend observation: the market is cold, but still has opportunities

Author: TheBlockCrypto

Compile: LeftOfCenter

Comments: LeftOfCenter, Xiaomao MAO, Pan Zhixiong

Source: Chain smell

- Regarding the blockchain technology that the country pushes, we have given you five key points.

- Industrial innovation is an important breakthrough direction of blockchain

- Xinhua News Agency: China's blockchain industry has broad prospects for development

The 20-year period has passed, and blockchain media TheBlockCrypto summarizes some of the phenomenal events in the cryptocurrency industry in the past half year, as well as some micro-trends that are happening in the subtle. The chain is hereby compiled, our three editors LeftOfCenter, Xiaomao Brother MAO and Pan Zhixiong also supplemented the interested part, hoping to provide some guidance for the builders of the cryptocurrency. Although the market is not good now, there are opportunities in the trend.

1. Payment transactions cannot meet the increasingly diversified banking needs of the cryptocurrency industry, such as instant payment networks, SEN and Signet, and hosted services.

1. The bank began to provide encryption operation services.

With the maturity of the cryptocurrency industry, many banks have begun to offer encryption-friendly services. In the following list of banks offering cryptocurrency operations, the average value of crypto-friendly banks totaled $5.2 billion, with a median of $1.6 billion. One-third of them have cryptocurrency-friendly banks that offer hosting as a supplementary business.

LeftOfCenter: Challenger Bank Learn about it.

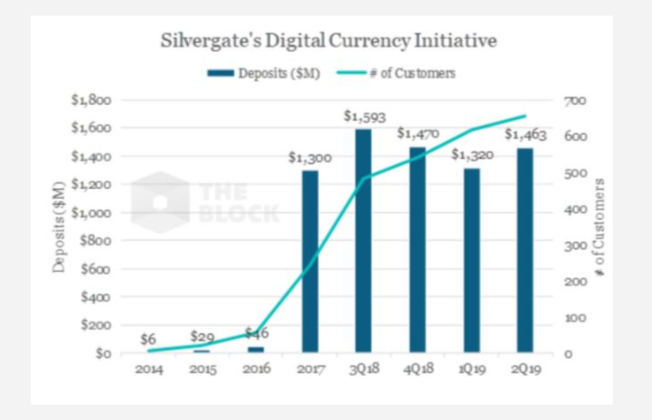

MAO: Xiaomao's large state-owned banks can be said to be biased towards “encrypted and friendly banks”: In the list of the top 50 listed companies in the global exploration blockchain announced by Forbes in 2018, all three Chinese banks are among the top five, ICBC First, CCB second; Zhou Xiaochuan, then president of the People's Bank of China, considered the digital currency project supported by the central bank in 2014. China's upcoming release of the central bank digital currency (CBDC) is also a matter of course; China Construction Bank launched earlier this month. When the BCTrade 2.0 blockchain trade finance platform was launched, its information director stated in the press conference that “actively deploying blockchain technology and exploring the application scenarios of blockchains is the mission and responsibility of new technology promoters”. 2, Silvergate Bank (digital bank deposits rebound)

After two consecutive quarters of decline, customer deposits related to cryptocurrencies changed in the second quarter of 19th. Silvergate customers grew 6% to 655, and digital currency plan deposits increased by $144 million (up 11%) to $1.5 billion.

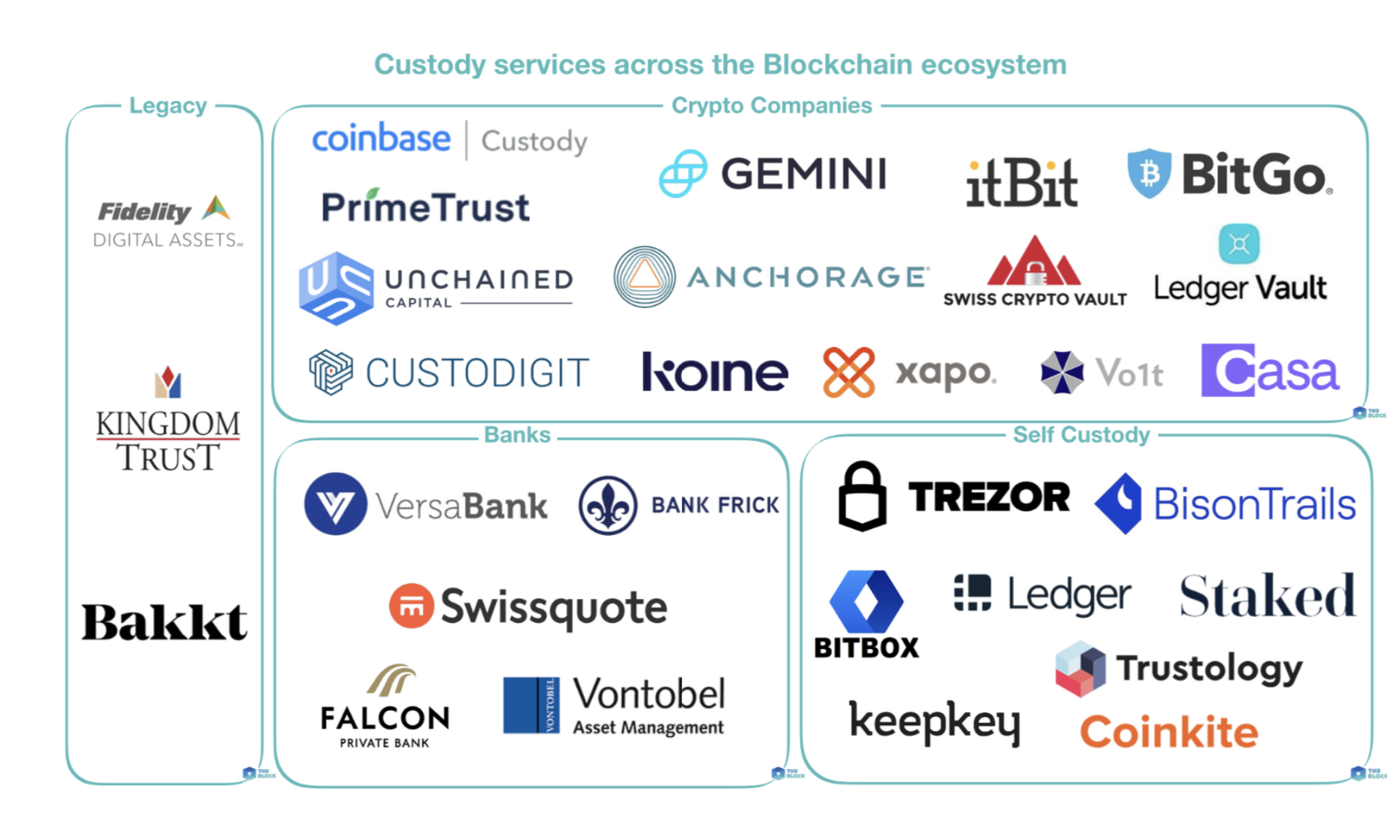

3. Managed service maps in the entire blockchain ecosystem

As the cryptocurrency industry matures, retail consumers need to choose investment funds that require compliant hosting solutions, and cryptocurrency services continue to increase. Many crypto companies, traditional financial companies and even banks are beginning to provide security solutions. A company that is divided into 4 different managed service solutions, namely encryption companies, banks, established custodians and self-hosted

2. STO ecological development is slow, lack of token selection, transaction volume and infrastructure construction

MAO: STO is one of the most promising markets. One of the reasons for the slowdown in development is the compliance factor. It is expected to see a breakthrough in STO after the relevant regulations and supervision are continuously improved.

3. Although IEO is only slightly better than ICO, what happened in 2019 tells us that as long as you can make money, no matter how bad the project is, investors will invest.

1. Although the IEO model is not sustainable, the currency has relied on it to highlight the encirclement

The first exchange issuance model (IEO) refers to the first token fundraising activity initiated by the exchange. IEO is a popular gameplay in 2019. Unlike ICO, the IEO project sells a relatively small amount of tokens (<10%). The hard top limit is $10 million. Earlier this year, the Onkyo Exchange spurred the model through the Binance Launchpad, and since then, about 180 projects have raised funds through the IEO. Although the market value of the exchange's tokens has fallen by 43% in the past four months, the market value of exchange tokens has increased by 255% compared to the beginning of the year.

The data shows that IEO tokens cannot maintain value for a long time. The rational strategy to maximize profitability is to invest only in IEO projects initiated by top-level exchanges (such as currency security, OKEx, and currency), but not for long-term holdings.

2. ICO Bubble: At least 89% of ICO projects are at a loss

The relevant dataset shows that each ICO project raised an average of $36.2 million, with a median of $18 million. A total of nearly $14 billion was raised.

In terms of the US dollar, only 10.8% of the ICO projects evaluated received positive returns, while only 7.7% performed better than Bitcoin.

LeftOfCenter: As long as the profits are much higher, the earth can also tilt up.

MAO Xiaomao: Many IEO projects are products that are shoddy in order to catch up with this trend. This is one of the original sins that the model cannot be sustained.

4. The spot trading market has become too crowded and has begun to integrate. In 2019, many crypto exchanges joined the futures and derivatives markets, robbing BitMEX of its dominance.

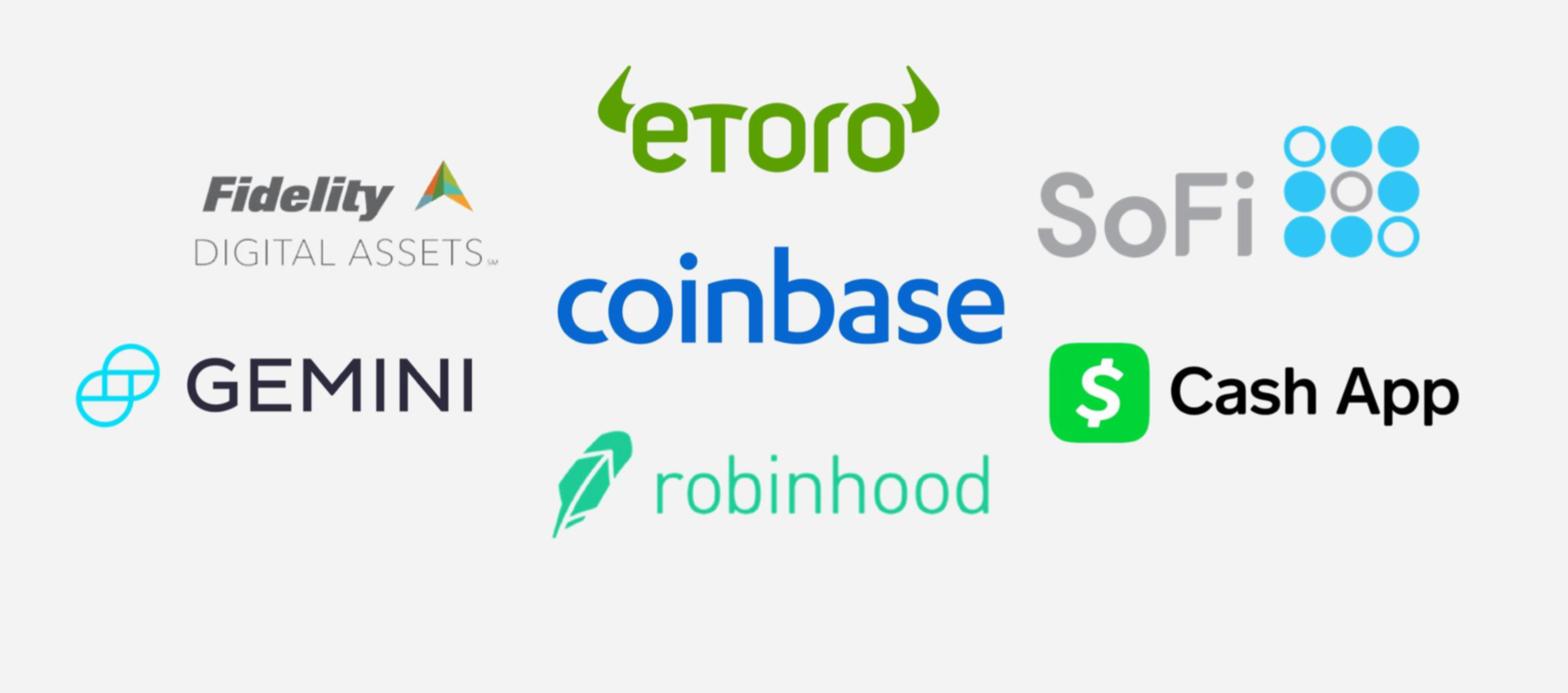

The channels for retail investors to purchase cryptocurrencies have gradually increased, including SoFi, mobile payment company Square's application Cash App and eToro.

On September 26, 2019, investment application provider SoFi has launched a cryptocurrency transaction service that will be available to 800,000 users. The service is offered through a separate entity, SoFi Digital Assets, LLC, with a minimum order amount of $10 per transaction and a maximum order amount of $50,000 per person per day. SoFi charges up to 1.25% for encrypted transactions.

As bitcoin price volatility slows, Bitcoin derivatives transactions are exploding. Data tracking companies Skew and BitcoinTradeVolume.com estimate that the number of derivatives traded per day is between $5 billion and $10 billion, more than 10 to 18 times the spot amount of Bitcoin. The dominant players are Asian exchanges such as BitMex and Binance, which support Bitcoin and some small-currency futures contracts and offer more than 100 times leverage and perpetual contracts.

In 2019, many crypto exchanges joined the futures and derivatives markets, robbing BitMEX of its dominance. The world's largest cryptocurrency exchange has launched futures more than a month ago. There are currently more than 34,000 registered users, and futures are about $500 million a day. On October 18th, the currency provided 125 times leverage. In addition, there are more and more new entrants. On October 18th, Boston-based Circle Internet Financial Ltd. announced that it will split the Poloniex acquired by the exchange 18 months ago and hand over Poloniex to the company. Supported and operated by Asian companies of Polo Digital Assets, Ltd., Poloniex will focus on international market operations and serve international clients outside the US to provide free derivatives services.

LeftOfCenter: Coinbase Pro recently updated the fee structure, increased retail fees, reduced the cost of large households and institutions, and became increasingly unfriendly to retail investors.

Pan Zhixiong: When bitcoin prices are no longer soaring and falling, investors need more leverage to get higher potential gains.

5. Bitcoin prices have recently risen by 300%, but the latest bull market is not driven by retail investors. The data shows that almost no new retail investors have joined the bull market this time.

1. In July this year, bitcoin rose to $13,000, which was not driven by retail investors.

Analysis of network traffic data shows that the price of bitcoin rose to $13,000 in July this year was not driven by new retail investors.

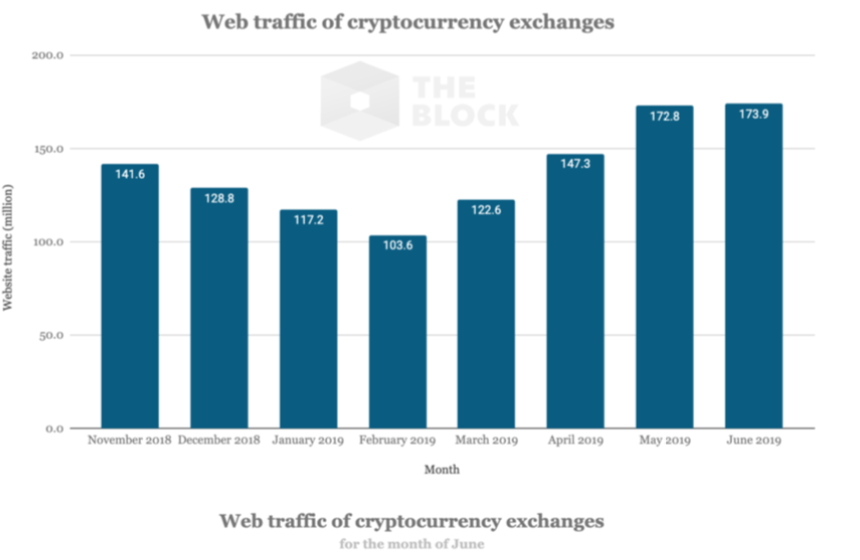

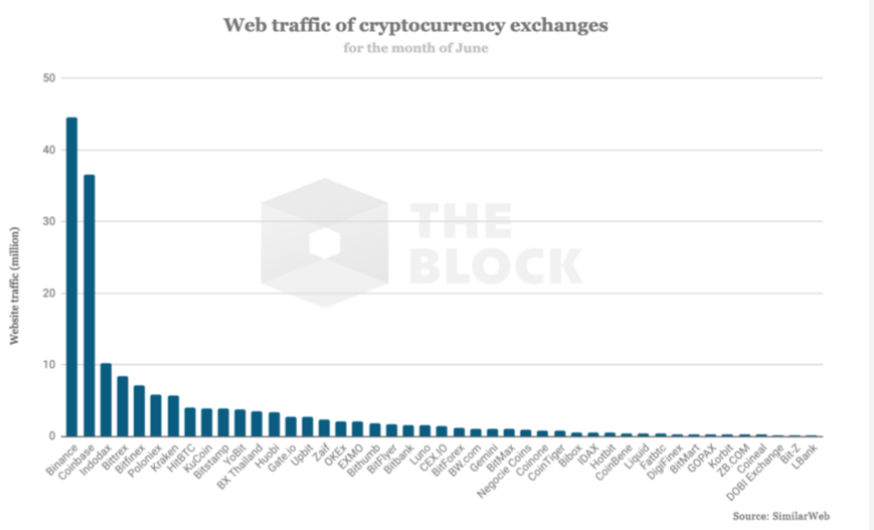

2. In June of this year, cryptocurrency exchanges reached 174 million visits.

In June of this year, the total number of cryptocurrency exchanges reached 174 million, which was basically the same as the previous month (May). However, since February, bitcoin prices have risen by more than 250%, while cryptocurrency transaction traffic has only increased by about 68%.

In June, the number of visitors to the website traffic was the highest, close to 45 million, and Coinbase ranked second with 36.5 million. Most of the remaining exchanges have less than 10 million visits. Bitwise's top 10 real-time exchanges (Binance, Bitfinex, Coinbase, Kraken, Bitstamp, BitFlyer, Gemini, itBit, Bittrex and Poloniex) accounted for 66% of the total exchange network traffic in June, in Bitwise audited transactions In addition, the exchanges with large trading volume in June include Indodax, HitBTC, KuCoin, YoBit and BX Thailand.

Single exchange website traffic in June

Single exchange website traffic in June

Pan Zhixiong: In fact, most people are only in the circle from High. Which application domain can open the fast channel of the cryptocurrency world and the real world? IoT, DeFi, games, payment systems? I have been trying, and I have never concluded.

6. Competing for stable currency market share, whether it is a company or a country, starting to lay out digital currency

1, Libra

Social media giant Facebook announced that it will issue a stable currency, Libra, and has attracted the attention of national regulators. Three hearings have been held.

2. Starting to lay out digital currency at the national level

The People's Bank of China CBDC is about to issue digital currency, and Bank of England Governor Mark Carney has called for a "synthetic hegemonic currency" that will help get rid of the dollar exchange rate.

3. Stabilizing coins endorsed by enterprises

JPMorgan Chase announced that it will launch a stable currency called JPM Coin that represents the dollar held in the account. In fact, JPM Coin is not only a stable currency, but also a settlement token that will be used to settle payments between JP Morgan Chase customers. In addition, Wells Fargo and beaus are developing a dollar-linked stable currency that will run on the company's first blockchain platform.

MAO: Libra lets us see how hard it is to do something that can make a difference at a large company or at the national level. Many people don't realize how valuable China's upcoming central bank digital currency (CBDC) is. It's no wonder that Facebook's Xiaozha has been telling China in the inquiry. The blockchain market has a large number of early believers, but there is no way to shake the mainstream market. The introduction of digital currency by the central bank is undoubtedly a positive for accepting cryptocurrencies in the mainstream market.

7. Development of the lending market: unmanaged solutions mainly through Bitcoin hosting and DeFi services

8. Changes in the distribution of industry funds: M&A slows down, investment is distributed in multiple vertical areas, and more diversified

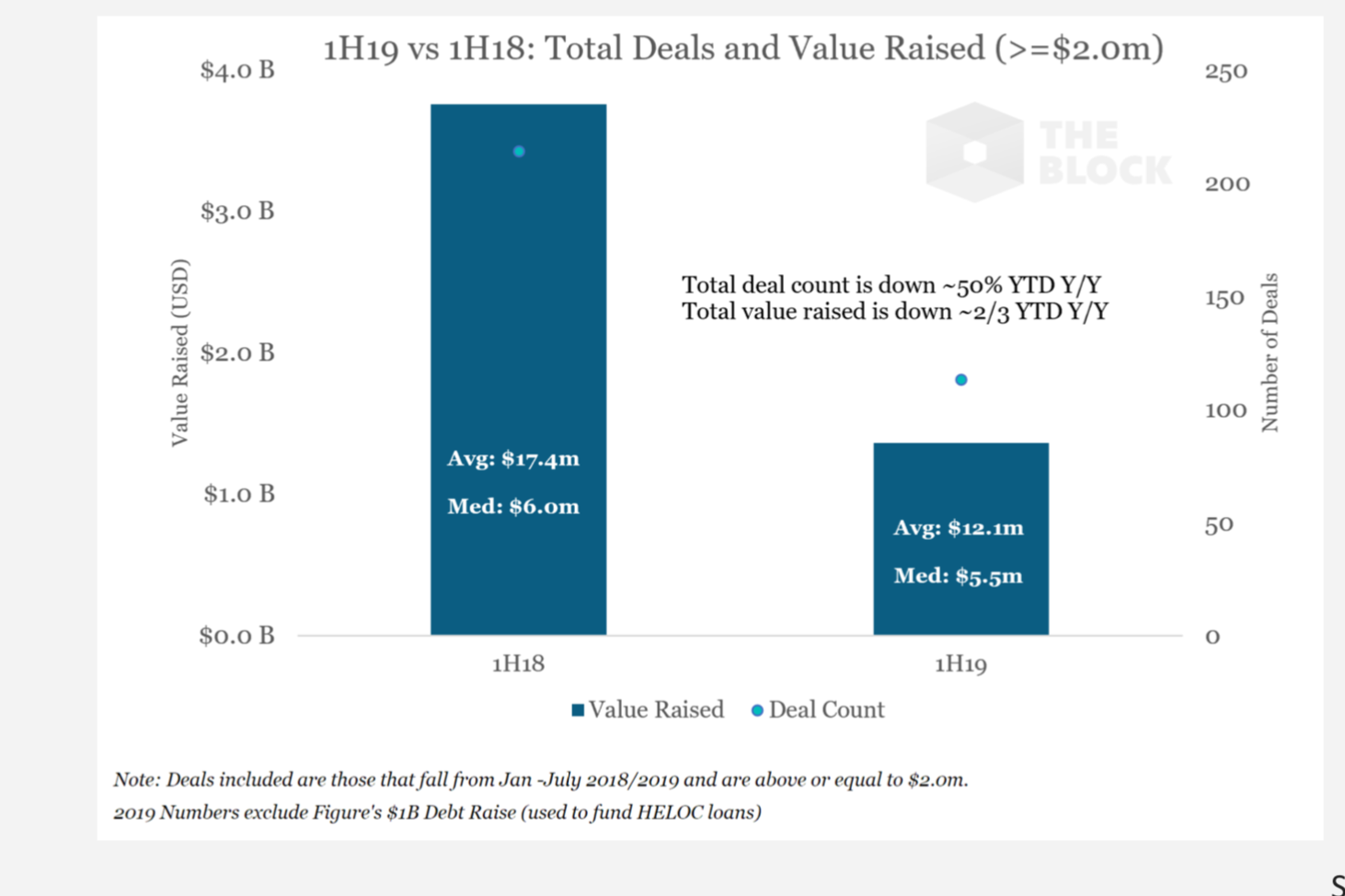

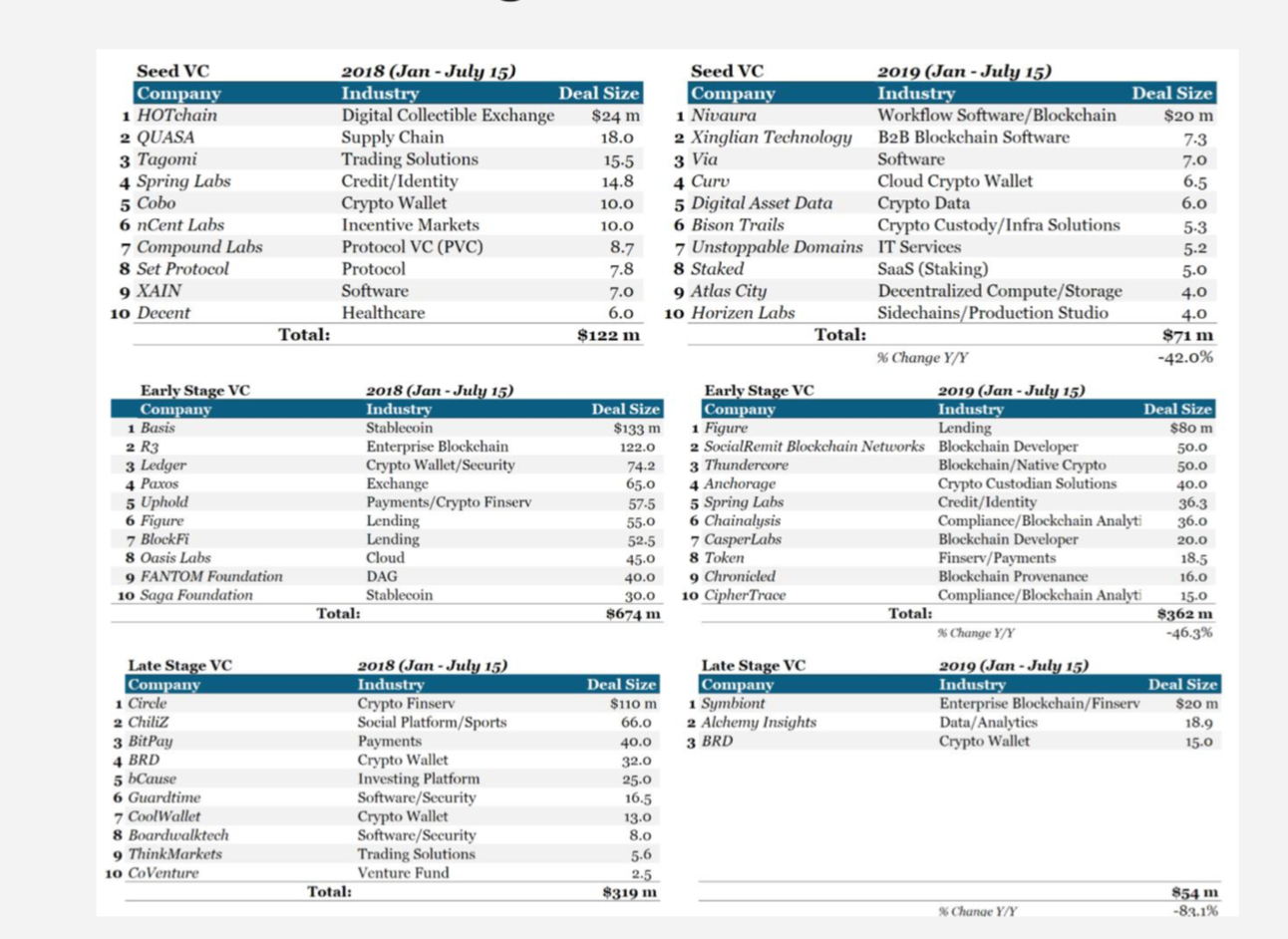

1. The investment scale is slowing down

Encryption and blockchain In mid-2019, the financing scale fell by 2/3 year-on-year, and the number of financing fell by 50%.

The data shows that the mid-year data for 2018 shows that the average financing size is $17.4 million, with a median of $6 million. In the same period of 2019, the average financing size was $12.1 million, with a median of $5.5 million. The year-on-year decline was 2/3, and the total number fell by 50%.

2. The 2019 M&A slowdown

In the late 2018, the scale of venture capital was 319 million US dollars. Compared with the same period of 2018, the number of venture capital investments in late 2019 was only 3, and the asset size was 54 million US dollars, a drop of 83.1%.

9. The trading volume of stable coins has been tilted, and the weight of supply and demand of USDT is biased towards Ethereum Network.

On July 30th, the ERC20 version of USDT (ERC20-USDT) reached a market volume of USD 380 million. The surge in USDT stable currency trading on Ethereum has a wide-ranging impact on the entire cryptocurrency market, including Bitcoin, which means that transactions generated for trading media may be subject to various assets anchoring the currency. . For any deflationary cryptocurrency that wants to compete for the status of the media, it is not easy to compete with a less volatile currency.

LeftOfCenter: From another perspective, isn't this a way to incorporate legal currency assets into a decentralized system?

10. The emergence of emerging complex financial products (zero coupon bonds, CFD, TRS, interest rate futures and swaps), a credible alternative to existing financial systems

1. Ethereum Mobile Wallet Ecology

Developers hope that in the next adoption cycle, demand will be driven primarily by real applications beyond passive speculation. The continued expansion of the Ethereum mobile wallet market has laid an important foundation for the next adoption cycle.

2. Open financial value proposition

One of the ways to think about the value proposition of open finance should be to combine the following attributes: 1) no permission required; 2) transparency; 3) liquidity

The Yield Protocol, a research partner of Paradigm, proposed a framework for issuing high-guaranteed zero-coupon bonds on the Ethereum blockchain, and Dan Robinson, one of the world's largest cryptocurrency investment funds, published a paper. Describes a new framework for the issuance of cash and physical settlement zero-coupon bonds at Ethereum, the Yield Protocol, which can be used to settle settlements based on the price of a certain target asset at a specific date in the future. An asset provides a mortgage guarantee to generate a token yToken.

3. Some emerging and complex financial products emerging in the field of open finance

1) DIPOR: LIBOR for the open financial version

LIBOR, the London Interbank Offered Rate, is the benchmark interest rate for major banks around the world to borrow from each other in the international interbank market. It is also the basis for global interest rate related products: loans, bonds, interest rate swaps, mortgage bonds, etc. With the development of open finance based on blockchain, demand for lending, interest rate swaps, and total return swaps has soared, so the emergence of similar open financial market-driven benchmark interest rates (Decentralized Inter-Protocol Offered Rate) More and more necessary. DIPOR, LIBOR as an open financial version, is an on-chain prediction of the weighted average lending rate for a particular cryptocurrency. Ideally, DIPOR provides a suitable rate reference for different segments of the market by calculating the specific cryptocurrency platform rates.

2) Balancer: Multi-dimensional automatic market maker

The Balancer system consists of a number of public and private liquidity pools that can support up to "n" assets and are not subject to a unified meter

3) dYdX: Unmanaged Margin Trading Agreement

4) Rainbow Network: Decentralized Exchange of Synthetic Assets under the Chain

5) Nexus Mutual: Membership Insurance Alternative

6) Various derivatives based on stable currency DAI

7) Set Protocol: A solution for abstracting a basket of tokens.

11. Web 2.0 applications are beginning to emerge, such as the emergence of mobile wallet + French currency deposit channels (Wyre, Moon pay, Ramp, etc.), which has greatly improved UI / UX.

On October 16th, blockchain payment provider Wyre launched the Widget tool, which supports the purchase of cryptocurrencies using Apple Pay and Google Pay, making sending cryptocurrencies as easy as sending iMessage.

Pan Zhixiong: What is more radical than these projects is the recently released Escher. The access network Zelle and the clearing service ACH directly open the exchange channel of the US dollar and the lightning network, because the lightning network is the infrastructure for the payment scenario.

12. Various bitcoin-based services and solutions emerge in an endless stream. For example, VeriBlock inherits the security of Bitcoin in a very "creative" way.

1. Veriblock uses Bitcoin blockchain to protect alternative networks

As one of the safest blockchain networks, Bitcoin's block space is the most valuable. Because of its high security value, some companies are looking for some clever ways, such as using Bitcoin as a data repository through the OP_RETURN scripting language. VeriBlock is one of them. By using the OP_RETURN script and the Bitcoin blockchain, the Bitcoin blockchain provides security for another blockchain, and in the process inherits Bitcoin security.

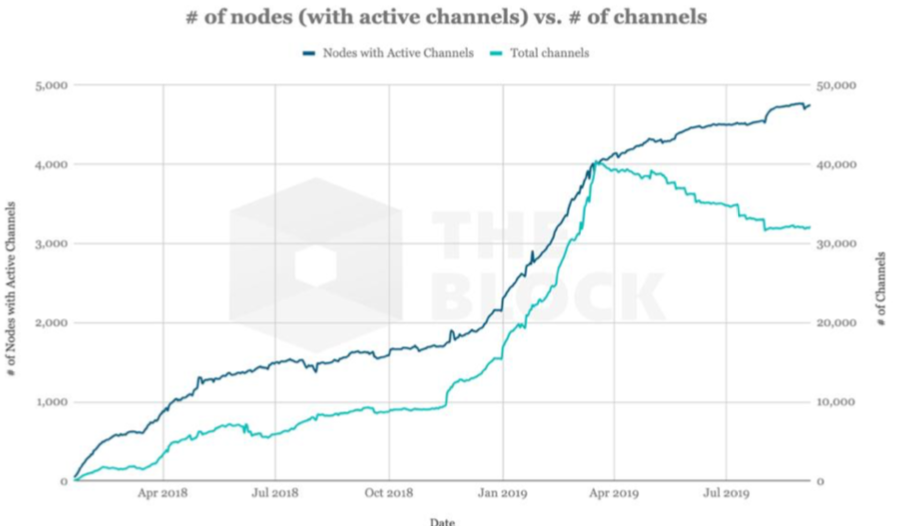

2. Although the lightning network developed rapidly and became more decentralized, a single entity controlled nearly 61% of the network capacity.

Less than 20 months after the main online line, Lightning Networks currently has 32,200 channels and 4,800 active channel nodes with a total carrying value of $8.6 million. From January 2019 to April 2019, the node grew the fastest, which may be related to the release of Node Launcher and Casa's hardware Lightning Node, making it easier for non-technical users to run a node.

Less than 20 months after the main online line, Lightning Networks currently has 32,200 channels and 4,800 active channel nodes with a total carrying value of $8.6 million. From January 2019 to April 2019, the node grew the fastest, which may be related to the release of Node Launcher and Casa's hardware Lightning Node, making it easier for non-technical users to run a node.

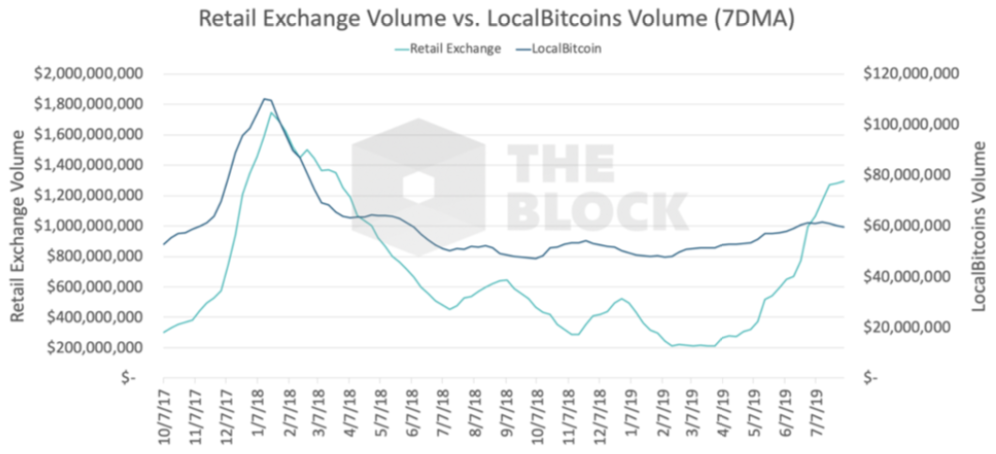

3. LocalBitcoins does not seem to affect the transaction volume after removing the "Current cryptocurrency" option.

LocalBitcoins, one of the largest and best-known OTC trading platforms, was established in 2012 and offers a variety of ways to implement P2P trading in Bitcoin, including cash deposits, bank transfers, and removed " Presenting cryptocurrency today"

On June 1st, LocalBitcoins announced that according to local regulations, the company's well-known OTC platform LocalBitcoins quietly removed the option of “now cryptocurrency”. After the announcement, it was reported that LocalBitcoins banned P2P users from losing to other platforms. .

4. BlockFi and Lolli: two financial technology companies focused on bitcoin value

Although the two companies focused on Bitcoin financial technology offer slightly different products, both hope to generate a revenue model by establishing financial services that are loyal to customer relationships. The ultimate goal of these strategic efforts is to guide new Admission is easier for users and educates millions of users to use bitcoin.

In September of this year, Chain News reported that Canadian yoga apparel brand Lululemon and Bitcoin rebate platform Lolli cooperate to provide consumers with up to 18% bitcoin rebate discount, which will be from September 23 to September 26. For a total of 4 days, after 4 days, it will return to the original 1.5% bitcoin rebate rate. Founded in March 2018 and headquartered in New York, Lolli is a Bitcoin shopping rebate application that operates like a credit card rebate program: When consumers place orders through Lolli to a brand partner, they can get Bitcoin rebates.

Pan Zhixiong: The culprit of Bitcoin crowding has been found: Veriblock. For Bitcoin believers, the most noteworthy thing in the last quarter of this year is that the next major version will update 0.19.0.

Xiao Mao Ge: The more prosperous the bitcoin ecology, the better the development of the entire industry.

13, there are a large number of easy-to-run full-node products on the market, such as Node Launcher, Nodl, Raspiblitz

Pan Zhixiong: In addition, HTC has launched a blockchain mobile phone Exodus 1s that can run Bitcoin all nodes, but the premise is to prepare a 400 GB SD memory card for the mobile phone, which is a bit ahead and a little magical. But maybe Coda's blockchain SNARKs recursive technology can be integrated into other blockchains, and the blockchain node can actually run on the phone, but what is the significance?

LeftOfCenter: Lowering the threshold of becoming a full node will allow more people to join the network, which will become flatter and more decentralized.

14. Developers are considering ways to properly balance decentralization and ease of use. For example: using Neutrino for an unmanaged lightning wallet

15. Large banks are still on the sidelines due to lack of credit system, too small scale and concerns about regulators.

16. Considering the amount of false trading, etc., the regulator believes that the market needs supervision and the opportunity adopted by the ETF渺茫

Pan Zhixiong: Even if Zuckerberg was crazy about selling China threats at the hearing, Libra was admitted to have a lot of ways to go. Bitcoin ETFs may be a little earlier than Libra.

17. Over-the-counter trading is changing. OTCs such as Genesis and Cumberland are beginning to improve technology and user experience, and arbitrage compression has led to a lot of layoffs.

In February of this year, cryptocurrency market maker Cumberland launched a single-vendor platform, Marea, which allowed institutional investors to interact with Cumberland through a screen interface rather than trading via phone or Skype. This will upgrade Cumberland to an experience level similar to traditional asset classes such as stocks.

18, a new digital asset hosting solution MPC (Secure Multiparty Computing)

19. Compliance has become a business and advertising model, which has at least led to the beginning of mainstreaming Bitcoin.

LeftOfCenter: In addition to a trend 20 , in addition to the mainstream currency, there are some cryptocurrency and blockchain applications that really have usage scenarios, such as the attention-based token BAT released by the privacy browser Brave, which has recently been integrated with many applications, Twitter, Reddit, Wiki rewards and other mainstream Internet services are covered, and the growth data is also very good, with 8 million monthly lives, more than 2.8 million daily lives (about the same as last summer), and recently proposed ZKP-based decentralized virtual The privacy network solution VPN0, the use case may be integrated into Brave's utility token BAT, the traffic relayer can get BAT compensation, and then BAT has another usage scenario. I believe that in addition to BAT, there are other cryptocurrency and blockchain applications, not necessarily the public chain that is widely concerned, but the one that has taken its own path on the road of practice. Welcome everyone to follow up.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- CCTV News Public Issues: The "blockchain" that has been frequently named recently is awkward?

- How to choose the "forked road" of the blockchain, the alliance chain or the public chain?

- The so-called "heavy weight" is becoming "heavy and bad", only one correct decision can be made…

- The peak moment of the blockchain

- Let the data speak: the world has shifted from digital tokens to digital currency

- The blockchain has been adjusted again and the multi-shares have risen. What are the “chain-bearing” of 89 A-share concept stocks?

- A ladder is needed between the value gaps.