6 dimensions explain how the Ethereum network responds to the global market under the impact of coronavirus

Compile: Unitimes_David

On February 12, the Dow Jones, Nasdaq and S & P 500 closed at record highs. A month later, global stock markets triggered a meltdown to curb panic selling, in which the US stock market suffered its biggest one-day decline since the 1987 crash (1). The market performance on March 12 proved that traditional finance and decentralized finance (DeFi) are still closely related . As the traditional market fell on Black Thursday on March 12, the size of the digital currency market also shrank, and the prices of ETH and BTC fell by more than 40% within 24 hours.

In recent weeks, numerous applications, platforms, and exchange teams have shared analytical statistics and demonstrated their efforts to ensure high availability of the system during times of market turmoil. Based on the principle of openness and transparency, this article hopes that by analyzing the performance of the Ethereum network at this unique moment in economic history, we will have a deeper understanding of the future direction of digital networks and finance .

- Depth | Panorama of Global Digital Currency Regulatory License

- DeFi Review: Beyond the critical DeFi network effect

- Netizens broke the news: Reddit is suspected of developing the reward function of blockchain

The six conclusions listed below were drawn from market data analysis last month. With the help of ConsenSys' analysis suite Alethio (2), Alethio API (3) and custom report tool (4), we can help us get the answer.

1. Ethereum network computing power remains stable. Miners continue to work

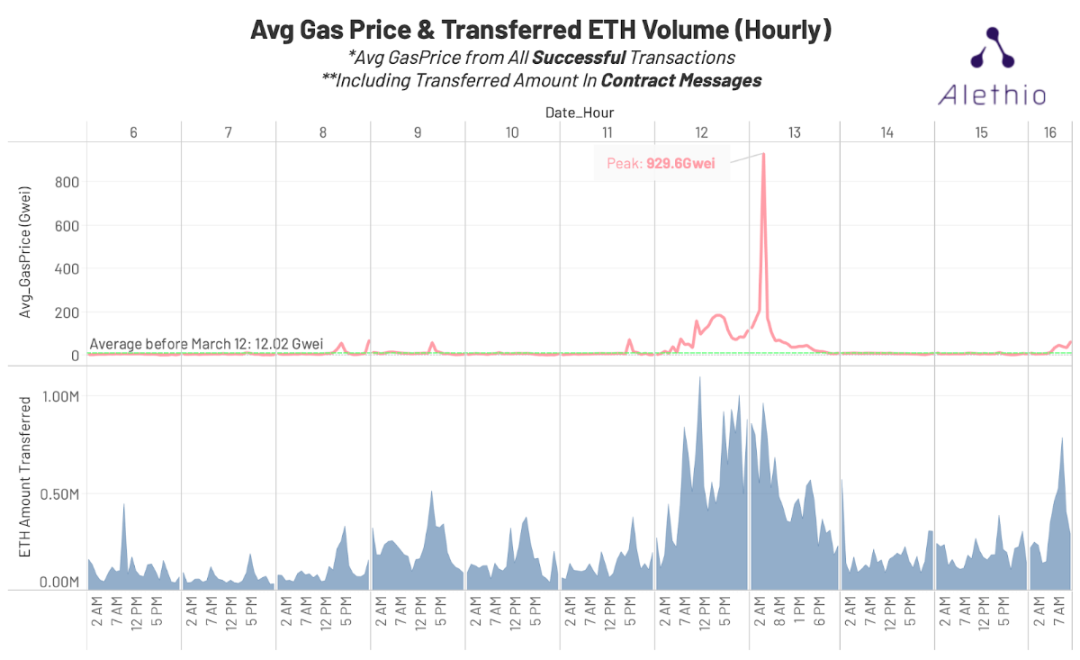

2. Gas prices have soared, but soon returned to normal. Ethereum's incentive mechanism works

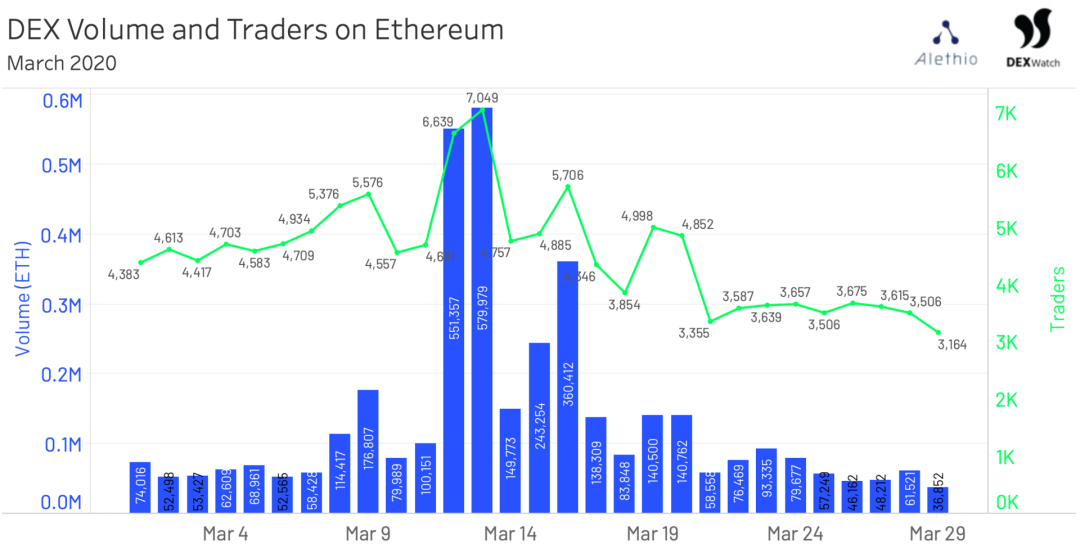

3. Decentralized exchange (DEX) trading volume reached a record high without downtime

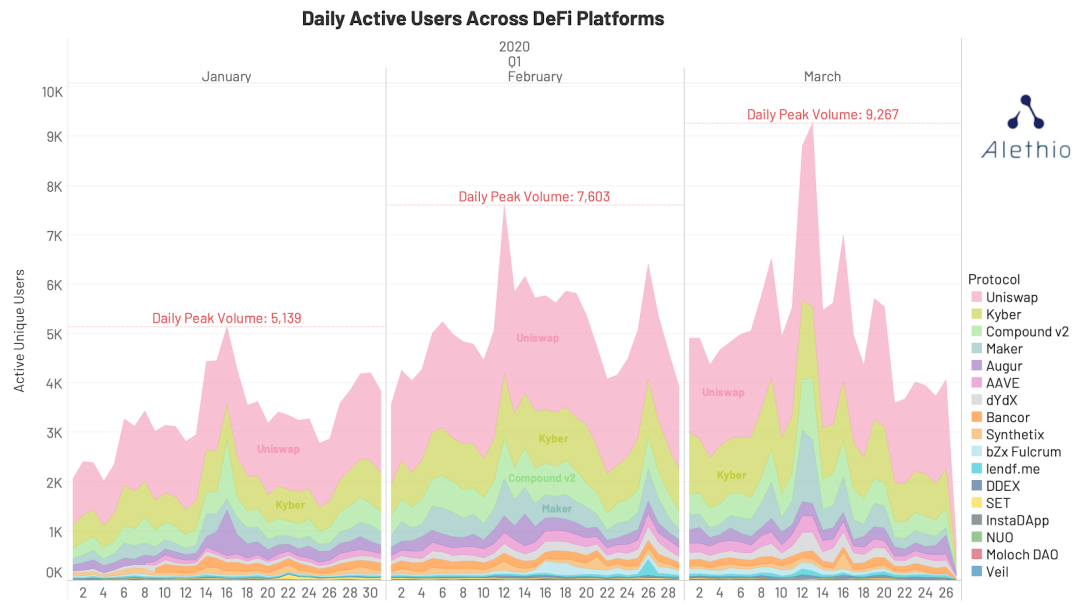

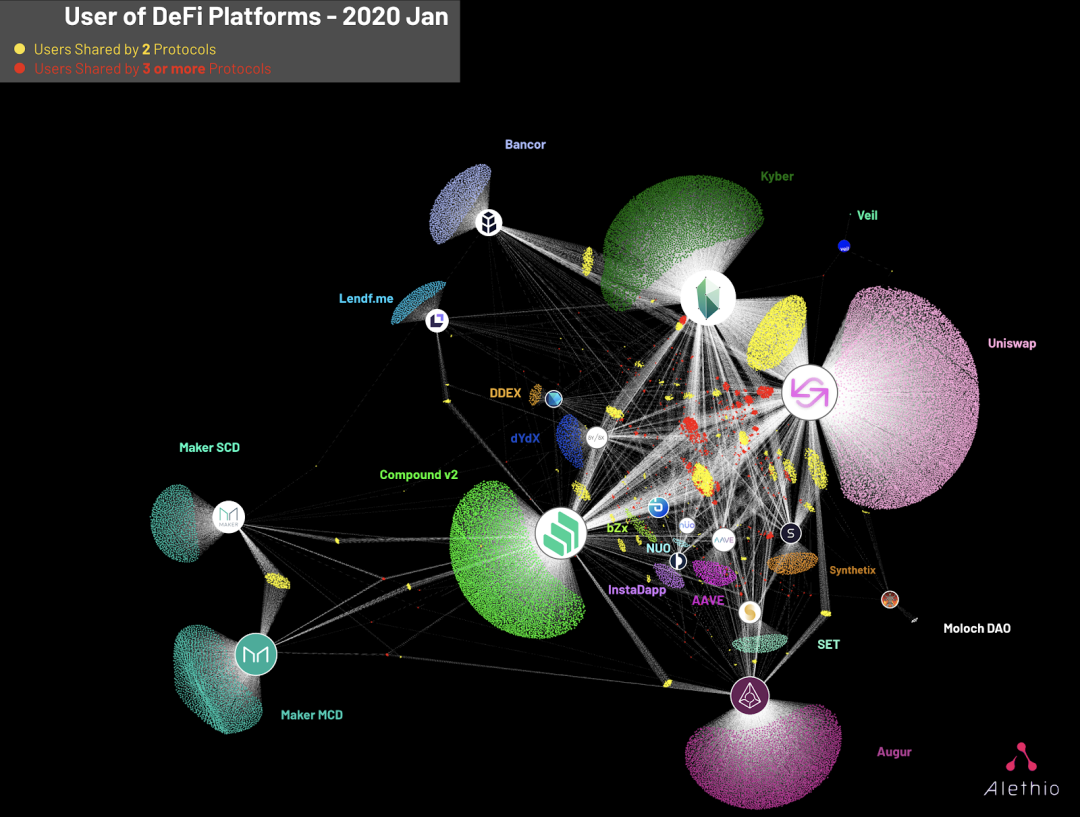

4. The interoperable DeFi protocol allows users to quickly interact and transfer assets across platforms

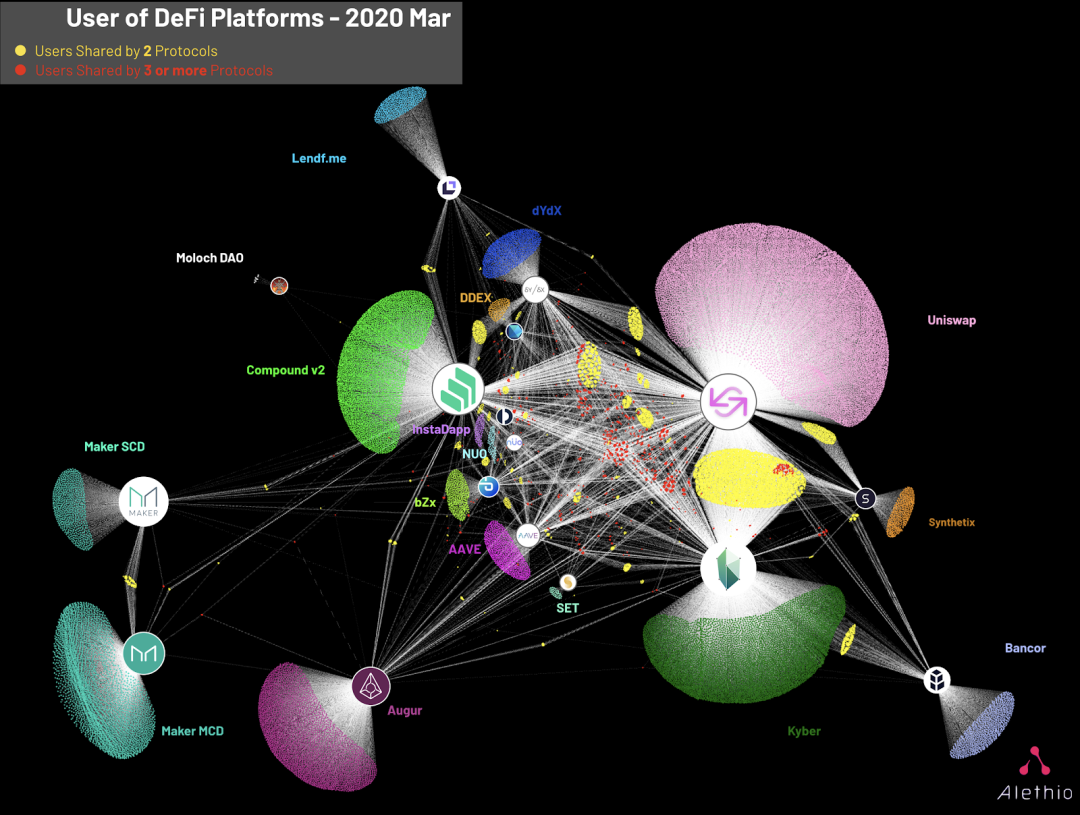

"Black Thursday" increased the overlap of users of each DeFi agreement (such as the dense yellow cloud in the March chart above that shows the overlap of users interacting with Uniswap and Kyber), indicating that this part of DeFi users can easily exchange assets and exchange them on the exchange To move between. DeFi protocols like Kyber also aggregates on-chain liquidity resources such as Uniswap and other DEX, so that users can call a single smart contract function to more effectively perform price discovery.

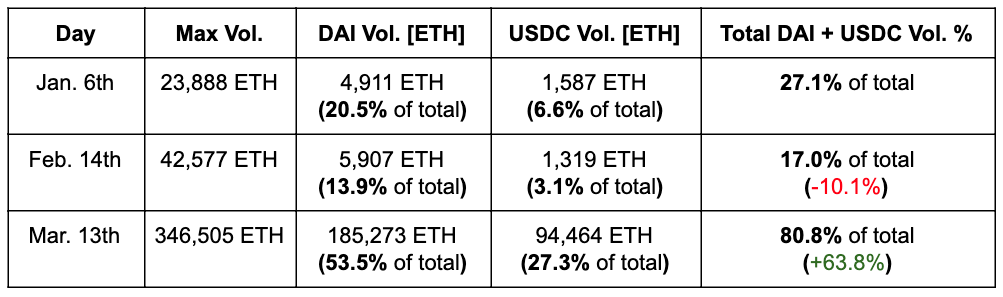

5. The demand for stablecoins is huge. The lack of Dai ’s mortgage test Maker ’s full decentralization commitment, and also the viability of stablecoins secured by cryptocurrencies in the short term

Stablecoin is a crypto asset whose value is linked to fiat currency or a basket of assets to prevent fluctuations. Stable coins like Dai that are collateralized by digital currencies require Ethereum's native token ETH as collateral to be hosted in smart contracts. As digital currency holders maintain liquidity while reducing asset risk, the market value of stablecoins continues to rise.

As many people have analyzed, the stablecoin Dai underwent a unique stress test last month . On March 12, we used Codef's DeFi Score (8) to observe a sharp decline in Dai Pool's DeFi score (the score rated the DeFi loan platform based on factors such as smart contract risk, mortgage, liquidity, and centralized risk).

The increased Gas fee on the Ethereum network has affected the Maker agreement. The price of MCD-Medianizer on the Maker's chain is stuck in the transaction queue, so the price update is delayed. This allows some Vault owners to save their mortgage debt positions (CDP), but it also means that once the price oracle is updated, other CDPs will be liquidated immediately and completely. In addition, some liquidators conducted debt auctions in advance by raising the handling fee, taking advantage of the delay in feeding prices, and won a total of more than 8 million US dollars of ETH collateral at the price of 0 Dai.

Combining these anomalies, users of the entire DeFi community have put forward discussions on requirements similar to traditional market fusing, and also related to whether these events are inherently anomalous or whether the system works as designed. In the days after the market turmoil, MakerDAO added USDC, a more centralized and stable currency backed by fiat currency, as collateral on the platform, and recently auctioned MKR tokens worth US $ 5.3 million to repay debt, making Dai The exchange rate continues to remain at US $ 1.

Dai's instability caused by price shocks has always been a challenge for the compliance of the DeFi ecosystem. Stable currency still represents a major improvement in traditional payment methods, but stable currency backed by fiat currency is more reliable at least in the short term . The results of the stress test conducted by Maker last month seem to prove that the DeFi protocol does work as designed, but it needs to continuously optimize its currency strategy and price oracle to deal with special liquidity events.

6. Encrypted assets are related to traditional assets, but data transparency is an essential difference

For many investors, cryptocurrencies remain an investment option in a broader portfolio and have not been fully used to hedge the unpredictability and opacity of traditional markets . The continuous improvement in the macroeconomics of attracting users and DeFi (using Dai as an example) means that the decoupling of traditional and decentralized finance (DeFi) will be a longer story.

Rick Reider, BlackRock's global chief investment officer, seems to understand the confusion of global market participants well: "If you don't know where the safest asset in the world is, it is almost impossible to know where other assets are." During this period, the transparency of the Ethereum network will continue to help us explore.

Lex Sokolin, Global Head of Global Fintech at ConsenSys recently wrote: "We will get rid of this crisis, this is a new belief system." A new belief about trust, transparency, and perhaps most importantly, the health of our system system.

Original link:

Related Links:

(1) https://www.investopedia.com/terms/s/stock-market-crash-1987.asp

(2) http://aleth.io/

(3) https://aleth.io/#api

(4) http://reports.aleth.io/

(5) https://news.bitcoin.com/hashrate-follows-price-bitcoin-halving/

(6) http://dex.watch/

(7) https://dex.watch/exchange/Uniswap

(8) https://defiscore.io/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research | Blockchain technology is expected to restructure the international payment model

- 930 days, witness the blockchain speed of Xiong'an New District

- The Secret History of Bitcoin: Bitcoin and Space Travel

- MOV announces the first list of federal nodes, from open applications to open ecosystem

- Analyst: Bitcoin is picking up steadily and may hit a record high in the coming months

- Bitcoin Technology Weekly 丨 Lightning Network usher in a major update, the 0.168 BTC channel limit will disappear

- QKL123 market analysis | BCH computing power switch, BTC computing power soars, what will happen to BSV tomorrow? (0409)