DeFi Review: Beyond the critical DeFi network effect

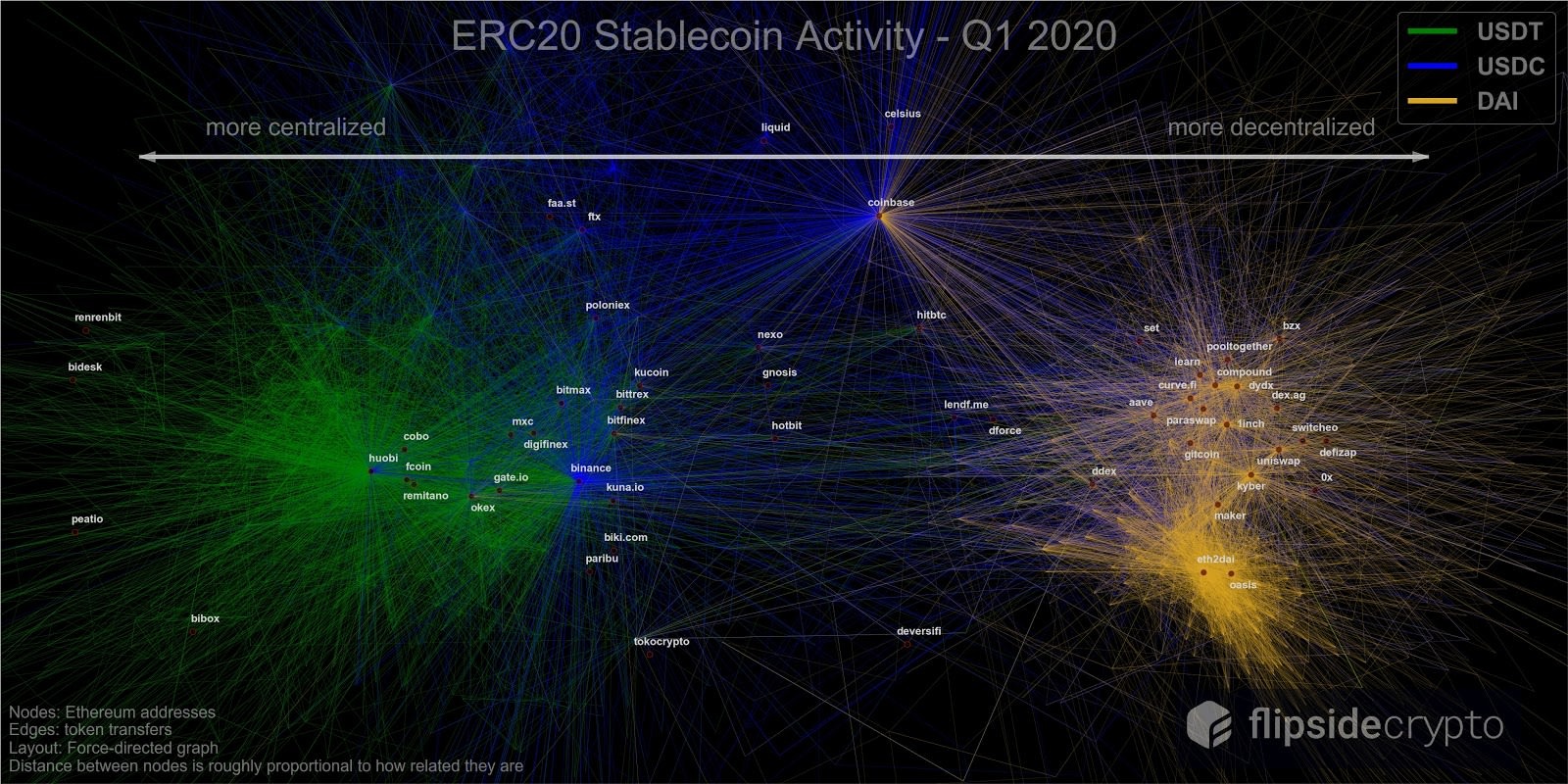

The blockchain data blog Flipside recently released the heat maps of the three major stable currencies in the first quarter of this year. The amount of information is very huge (it is recommended to open the link, click on the image, and zoom in to watch carefully). Beyond the "critical mass" and beginning to show a network effect that conforms to "Metcalfe's law", DeFi's Big Bang may have begun.

https://flipside.substack.com/p/daily-mover-stablecoins

The green line in the figure is the USDT transaction, the blue line is the USDC transaction, and the yellow chain is the DAI transaction. Each node is an Ethereum address. The closer the nodes are to the more frequent transactions between each other.

- Netizens broke the news: Reddit is suspected of developing the reward function of blockchain

- Research | Blockchain technology is expected to restructure the international payment model

- 930 days, witness the blockchain speed of Xiong'an New District

By carefully studying this picture, we can obtain many "geopolitical picture" of the current digital currency world

-The USDT ecological trading center is Huobi, the DAI ecological trading center is the decentralized exchange eth2dai, and the USDC ecological trading center is composed of Binance and Coinbase.

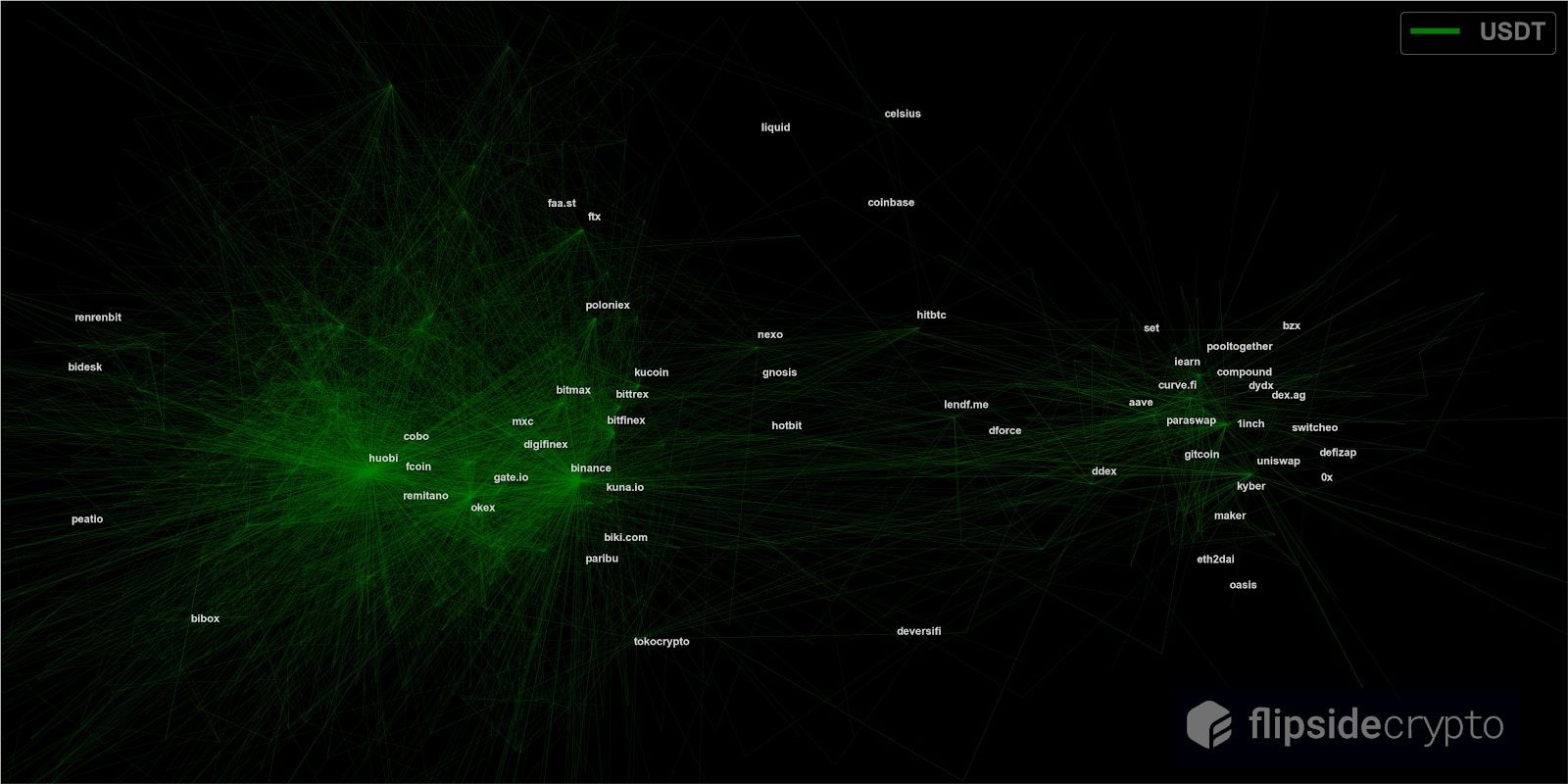

-The USDT trading ecosystem is highly centralized. Except for Huobi, OK, and Binance, other nodes have not clearly formed a central radiation effect. In terms of scale, Huobi ’s USDT radiation circle is significantly stronger than OK and Binance. ; In general, USDT only has a radiation effect and has not yet formed a network effect.

-USDT is beginning to expand into the DeFi world. Although USDT is still used less in the large DeFi ecosystem, the radiating structure of USDT is beginning to form on 1inch, curve.fi, iearn, kyber, etc., and there is a network effect. sign. Although Lendf.me does not form a USDT radiation structure with other DeFi, it is the closest to the CeFi world in the DeFi camp, which means that there are more identical users between Lendf.me and centralized exchanges.

-USDT transactions in the DeFi world are more transactions between DeFi, and USDT transactions between DeFi and centralized exchanges are very sparse, and it is difficult to judge the source of centralized exchanges from the graph. This means that USDT's trading ecology in the DeFi world is self-generated and has nothing to do with any centralized exchange.

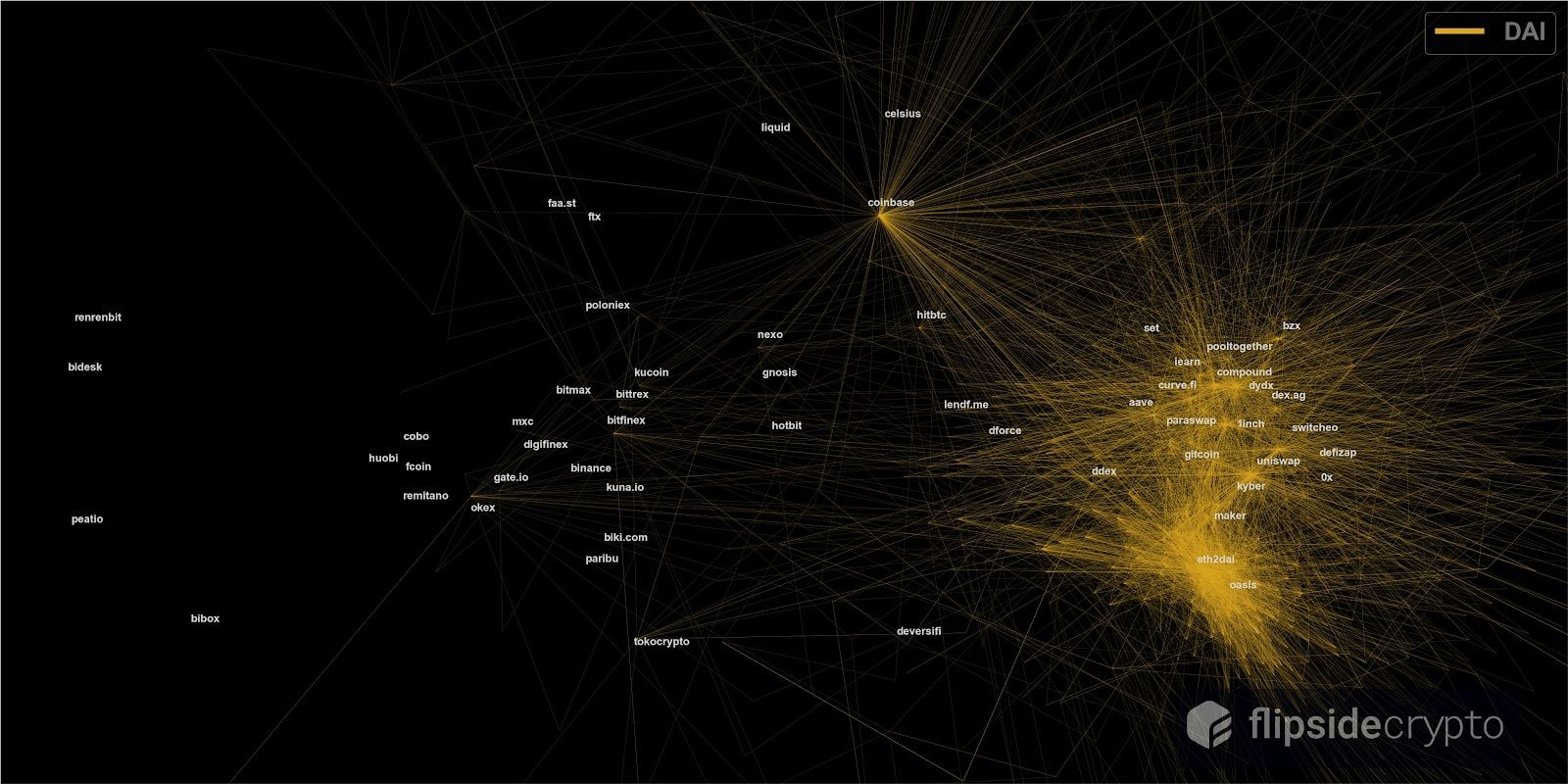

-DAI trading ecology is relatively multi-centered. In addition to the radiation ecology centered on eth2dai and oasis, Kyber, Compound, dydx, Uniswap, 1inch, and Coinbase have established active trading radiation circles centered on themselves; The relationship between the trading centers is relatively close, closer, showing a trend of flourishing and prosperous, and the network effect is stronger than the radiation structure.

-Compared with the trading scale of USDT in the DeFi camp, except for the relatively independent Coinbase, Dai rarely trades on the left centralized exchange. Only on OK and Bitfinex can Dai's very weak radiation structure be found.

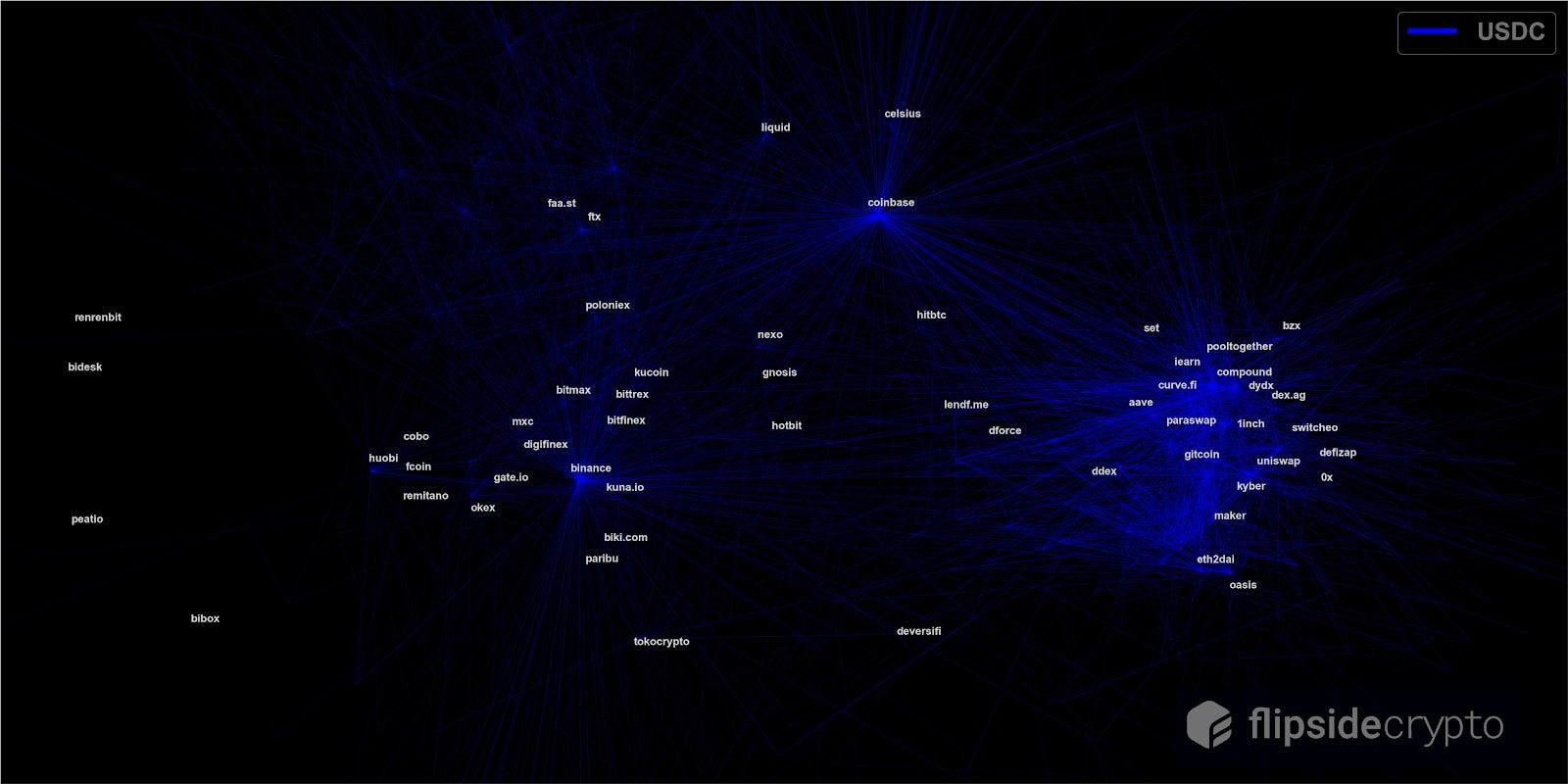

-The USDC trading ecosystem shows a weak centralization feature. Although Coinbase and Binance are the two major trading centers of USDC, they do not show a strong central radiation structure like Huobi USDT, and their respective radiation networks are sparse, although looking at Coinbase ’s USDC transactions are more intensive, but from the perspective of the density and distance of surrounding projects, Binance ’s USDC ecology is more abundant. The biggest highlight of the USDC trading ecosystem is actually not the two centralized exchanges, but the DeFi galaxy on the right, Compound, dydx, 1inch, uniswap, and kyber all form radiation structures of varying sizes, especially Compound. The USDC transactions between these DeFi projects are very frequent, and a significant network effect above the radiation structure has been formed within the DeFi world.

-Although USDT and USDC are both centralized and stable currencies, the radiation centers of USDT and USDC in DeFi are obviously different. The DeFi radiation centers of USDT are various decentralized exchanges, while the DeFi radiation centers of USDC are compound , Dydx led all kinds of lending applications.

-From the perspective of exchanges, the transactions between Coinbase and DeFi are the closest. USDC and DAI have intensive transactions between Coinbase and DeFi. The transaction between Binance and DeFi is not obvious and needs to be observed later, and there seems to be no transaction between Huobi and OK user accounts and DeFi.

Conclusion: Metcalfe's law is in effect, DeFi is showing magical network effects

The comparison of DeFi's USDT, USDC and DAI trading network graphs, with the control variable method, just shows us that in the early, mid and mature stages of the development of DeFi's network effect, USDT is the least used in DeFi and the latest, but it The early structure of the network effect began to form between DeFi nodes. DAI is the most used and the earliest in DeFi, so we found a very obvious and uniform network effect in DAI ’s DeFi transaction, and the network effect structure of USDC in DeFi is just right. Between USDT and DAI, it is in line with USDC being later than Dai, but earlier than the application of USDT in DeFi.

Through the above comparison, we were pleasantly surprised to find that even though DeFi is still in the early stages of development, DeFi has passed the "critical mass", and active network effects have appeared between applications, showing the famous "Metcalfe's law" , That is, the value of a network is equal to the square of the number of nodes in the network, and each new transaction / user gets more opportunities for information exchange because of other transactions / users, which is manifested as greater transaction margin value and more The small transaction marginal cost makes the DeFi network have strong externality and positive feedback. The richer the DeFi application, the greater the value of the network, the greater the demand for mutual calls between DeFi, and the more DeFi users many.

We can see that Metcalfe's law in DeFi will be reflected in the increasing utility of the transaction, that is, the fair will create a new transaction. And the network effect of DeFi depends not only on the number of people participating in DeFi transactions, but also on the degree of connection between DeFi and the value of exchanges between them. This is why, even though USDT is not used much in DeFi, we can still find the network structure of USDT transactions in DeFi. At present, the DeFi world has surpassed the "critical mass", the entire DeFi system has begun to show an expansion structure, and according to Metcalfe's theorem, the number of DeFi transaction nodes and users will increase exponentially in the future.

In the centralized exchange world on the left, no similar network effect structure has been found (perhaps because the centralized exchange integrates all financial functions into one and does not require external transactions). Compared with centralized exchanges, the advantages of DeFi's borderless open innovation, composability and compliance neutrality have only just emerged, but it has already produced a network effect. In the future, as more DeFi applications are launched, DeFi's network The effect will be even more amazing, I believe it will soon surpass the CeFi world on the left.

For more DeFi knowledge, please follow Acala Network

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Secret History of Bitcoin: Bitcoin and Space Travel

- MOV announces the first list of federal nodes, from open applications to open ecosystem

- Analyst: Bitcoin is picking up steadily and may hit a record high in the coming months

- Bitcoin Technology Weekly 丨 Lightning Network usher in a major update, the 0.168 BTC channel limit will disappear

- QKL123 market analysis | BCH computing power switch, BTC computing power soars, what will happen to BSV tomorrow? (0409)

- Depth | How to invest in blockchain infrastructure in a macro cycle?

- Yangchun has arrived in April, and cryptocurrencies continue to rise against the trend?