A paper reveals: "The Eye of the Government" and "Encryption World Perspective" Chainalysis

"…no one in the company is concerned about our software ethics. There was a fear that law enforcement would abuse power through our software…and then he left."

The above is a partial evaluation of the owner of the Chainalysis staff (have been resigned or still in service). The anonymous person suddenly opened an AMA on the Chainalysis blockchain forensic ability on the r/Bitcoin channel on Reddit, and once again made the encryption community This type of blockchain analysis company is afraid of the potential destructive power of the encrypted world.

In fact, no matter how the leading company in the blockchain analysis field of Chainalysis, PR, can't make users have enough trust for them – after all, its revenue structure and main service customers have a high degree of "construction" characteristics, and its The controversial incidents that occurred several times on the body made the user's doubts difficult.

- 5G Chain Network (Global) Industry Innovation Summit will be held in Nanjing

- "Weika" related proceedings were blocked and the amount of pyramid schemes was up to billions of dollars.

- Bitcoin price research – price formation

01 "Government Banquet" SVIP

The blockchain analysis company, established in 2014, has three main customer types: government, financial institutions, cryptocurrency exchanges, and bitcoin transaction analysis software to help them comply with compliance requirements, assess risks, and identify illegal activities. Other services, the current valuation has exceeded 1 billion US dollars, 2018 revenue is about 8 million US dollars.

Since its inception, Chainalysis has completed three rounds of financing, totaling $53.6 million | Source: Crunchbase

According to Forbes, the company's co-founder, CSO Jonathan Levin, said that half of the company's revenue comes from cooperation with different governments and regulators.

According to public information, the US federal government is the company's top government customer. The relationship between Chainalysis and the US government stems from the investigation of Mt Gox, the world's largest exchange, in 2014, clarifying 65,000 missing bits. The flow of coins.

Shortly thereafter, the company announced that it had helped the government crack down on several cybercrime incidents, including the famous Silk Road Darknet market, in which the government departments involved in the case included the US Federal Bureau of Investigation (FBI) and the Drug Enforcement Administration ( Drug Enforcement Administration, referred to as DEA).

By 2017, Chainalysis has become a heavyweight in the government: Jonathan Levin represents Chainalysis and Coin Center (a non-profit blockchain association supported by industry heads such as A16Z, Circle, Digital Currency Group, Polychain Capital) In promoting related research and policy promotion) Executive Director Jerry Brito, The Identity and Payment Association Chairman Scott Dueweke, Stanford Law School Lecturer, former Federal Attorney Kathryn Haun (later became a partner of A16Z), And representatives of Elukic's Vice President of Business Development, Luke Wilson, who is also a key player in blockchain analysis, were invited to participate in the Virtual Currency: Financial Innovations organized by the Financial Services Committee of the US House of Representatives (Financial Servie Committee) Hearings with the theme of National Security Implications.

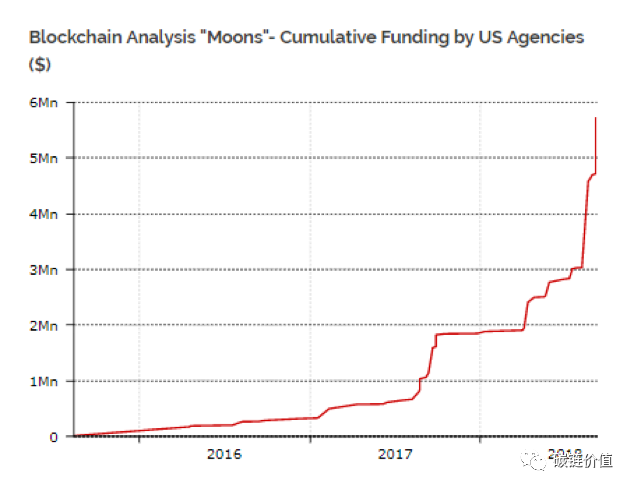

The good performance in the past cooperation, the increasing awareness of the company, the ICO, the cryptocurrency market chaos, WannaCry similar to the ransomware, etc., the federal government system has significantly increased the service purchase of Chainalysis, and has been present since then. Ascending posture.

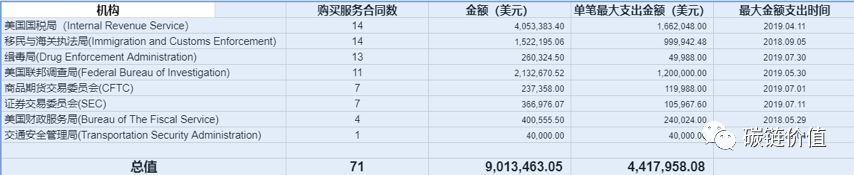

So far, several powerful and powerful departments in the federal government have purchased the services of Chainalysis. According to the public information of the Federal Procurement Data System (FPDS), as of August 24, the federal government includes the US Internal Revenue Service, the Immigration and Customs Enforcement Bureau, the Drug Enforcement Administration, and the US Federal Bureau of Investigation. Eight departments signed a total of 71 contracts with Chainalysis for a total amount of USD 9,013,463.05.

As of the 24th of the 19th, the US federal government procurement of Chainalysis service statistics | Source: Federal Procurement Data System (FPDS), carbon chain value production

From the above table we can see several interesting phenomena:

1) The three units with the maximum amount of single expenditure are: US Internal Revenue Service, FBI, US Immigration and Customs Enforcement Bureau. These three departments are obviously powerful departments, not only have violent organs, but also have the review authority. The largest of the several departments in the table;

2) The maximum expenditure time for a single amount is in the column, 5 departments are all in 2019, and 3 departments are in 2018, accounting for more than 60% in both the number and the amount. To a certain extent, the number of services purchased by the federal system in the blockchain analysis/forensics has indeed increased year by year. Further, the value will continue to rise for a period of time;

3) Compared with the report made by Diar in September last year, the federal government purchased a total of 5.7 million US dollars for such services at that time. In this statistic, the total amount of service purchases of Chainalysis by several departments of the federal government is almost A value of 2 times shows the strength of Chaininalysis's leading position, and it also confirms the government's strong demand for blockchain analysis/forensics services from the side – its curve is almost 90 degrees tangent.

According to Chainalysis employees who opened AMA privately, the Homeland Security Investigation Bureau, the US Department of Alcohol, Tobacco and Firearms, the Secret Service, the CIA and other other federal law enforcement agencies are also users of the software. However, it is unclear whether the agency in the mouth of the anonymous person has signed a service purchase contract with Chainalysis.

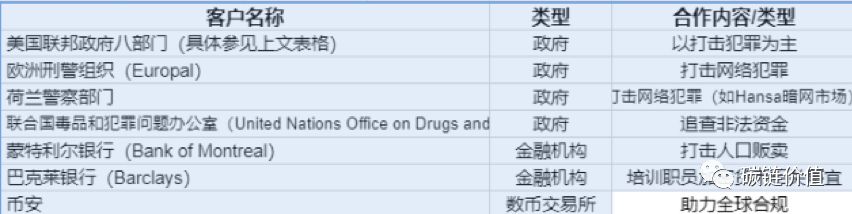

Beyond the US government, Europal, the Dutch police department (Chainalysis assisted the Dutch police in banning Hansa, one of the world's largest dark-net markets), the UNODC and other government departments, the currency in the exchange, Coinbase and financial institutions such as Barclays Bank and Bank of Montreal have partnered with or have worked with Chainalysis to purchase blockchain analysis services or compliance solutions.

It should be pointed out that because Chainalysis is generally silent about its customer name and the form of cooperation with customers, and the disclosure of the number and amount of purchase contracts for the Chainalysis service in the public information is not complete, therefore, Chainalysis is invited to become a guest. The number of institutions, especially government agencies, obviously has more room for imagination.

While strengthening its own business capabilities to gain the favor of government-represented organizations and organizations, Chainalysis is also building a team that is more suitable for its highly compliant business characteristics, introducing a number of “in-system” or near-institutional person.

02 "Ken is Miaohong" team

Michael Mosier, the chief technical consultant who joined in June, has held various government positions for more than a decade. He has served in the Department of Justice (DOJ), the Office of Foreign Assets Control of the Ministry of Finance (OFAC), the White House National Security Council, and the US Treasury Department of Finance. Criminal Law Enforcement Network (FinCEN).

Joining Moiser, Jesse Spiro, Head of Global Policy at Chainalysis, although not from the government system, travels year after year in a power/funding revolving door from a financial risk management solution provider called Refinitiv. The company is part of the Blackstone Group, the world's largest alternative investment company, and Thomson Reuters, one of the world's largest media and information groups.

According to CoinDesk's June report, the two staff members will work with Kristofer Doucette, the company's government affairs department, in the Washington office of Chainalysis, who has worked in the US Treasury for more than 14 years, before and after the treasury under the Treasury. And the Financial Intelligence Agency (TFI), the Foreign Assets Control Office, and the Office of Intelligence and Analysis (OIA).

Chainalysis is still recruiting Information Security VP, VP Public Sector, and Federal Account Executive (FAE) in Washington, DC, where FAE will "cooperate with defense, intelligence, law enforcement, and state/local entities." "to help companies investigate illegal cryptocurrency activities."

The three members who founded Chainalysis also each have a very senior industry experience. Co-founder and CEO Michael Gronager is a former COO and consultant to Kraken, one of the world's largest exchanges (jobs in April 2013 – October 2014 and November 2014 – May 2015), co-founder, CTO Jan Moller served as the lead engineer for the wallet Mycelium recommended by Bitcoin.org from February 2013 to January 2015, while another co-founder and CSO Levin was previously co-founded by Coinmetrics, another well-known blockchain analysis company. People and CEO.

03 Controversy continues, or become the next "Cambridge analysis"?

In terms of business development of Chainalysis, teams familiar with government operational rules, compliance-oriented management, and good relationships with large traditional institutions such as the government and banks are all boosters. However, for the crypto world that advocates the spirit of freedom and self-government, this often leads to considerable resistance and controversy.

Source: Reddit

In April 2015, a document entitled “Chainalysis Roadmap, Private and Confidential Version” was accidentally leaked and widely spread in the encryption community. This document discloses a series of features that will appear in the current and future of the Chainalysis API. For example, customers of Chainalysis can retrieve information on the chain faster based on transaction hashes, cluster names, categories, and more. And the company is still developing a higher performance API. The document also details Chainalysis's pricing plan. For example, institutional customers pay $500 a month for access to a range of features: unlimited surveys, shared fraud databases, and completed API access.

Although this is a document in the early days of the development of Chainalysis, it basically shows the company's ambition to exhaust the information of a certain blockchain. This document also caused a lot of resentment in the community. Many people appealed to users. We turned to the privacy-enhancing way of accessing the encrypted world, such as lightning networks, dark networks, and coin sorters.

Today, the weapons in the hands of Chainalysis are far more powerful than the file leaks. The monitoring tools such as KYT and AML have also covered BTC, ETH, BCH, LTC, TUSD, PAX, GUSD, USDT, USDC, BNB, Maker, Dai. 15 kinds of cryptocurrencies.

It is said that Chainalysis can track, visualize and deconstruct most of the information in Bitcoin transactions, considering its growing business and fast-growing revenues (reuters reported in April this year, the company said it was only The contract revenue of the Asia-Pacific region has increased by 16 times. It is hard to imagine that the company does not have enough confidence to push this monitoring level of Bitcoin to other blockchains. This is obviously a more complicated situation than the one described in the leaked document four years ago.

When the anonymous Chanalysis of the privately-owned AMA was asked the most unethical thing his company had done, ta replied:

"1. Transparency. 2. Combats systems designed for anonymity, thereby reducing (people) interest in cryptocurrencies and the market. Forcing people to use other cryptocurrency platforms that we cannot track."

But to be fair, the data collection itself is very bad. The bad thing is that the data after the concentration is abused. What is terrible is that Chainalysis can't escape such suspicion.

In March of this year, when explaining to financial news media Cheddar why Coinbase acquired Neutrino, Christine Sandler, head of institutional sales at the company, said that Coinbase had previously had a data breach – customers' data was sold to third parties by Coinbase's suppliers:

“We know the background of some people in Neutrino… but for us, it’s very important to stay away from existing suppliers. They sell customers’ data to us, for us, control the data and have us The proprietary technology that can be leveraged to keep data secure and protect our customers is very attractive. "

Chainalysis responded by saying that it can only access the transaction data, cannot access the customer's identity information, and it does not store the information. As for whether it has a cooperative relationship with Coinbase, it is irresponsible:

“Unless we issue a joint statement, we will not comment on who the partner is and how to cooperate to make any comments. ”

Template-style caliber and a somewhat vague attitude make it difficult to separate Chainalysis from the responsibility of data breaches.

04 How to deal with Chainalysis in the world of encryption?

Further, we can assume that the services that the government and financial institutions purchase from Chainalysis, where are the data monitoring and collection boundaries? How will these data be used after being submitted to relevant organizations? Most importantly, will this data become a "weapon"? Also, will these institutions use the "data bombs" in their hands to do evil? Will Leviathan's difficult discipline be repeated in the world of encryption?

More alarmingly, in addition to external analysis, Chainalysis also runs the Electrotum node in person (which once accounted for 10% of all Bitcoin nodes), and internally discussed whether to conduct dust attacks in order to track transactions (dusting) Attacks, although in the end the company decided not to do that, it still requires the encryption community to be wary – freedom is not natural.

What can we do? Anonymous people gave a few suggestions: use Coinjoin, Wasab (allegedly, Chainalysis or temporarily helpless software) and Bitcoin hybrid tools like Samourai Whirlpool; try not to use mobile wallet; use Monroe to guarantee privacy .

However, in the final analysis, the most important and most protective of us may be to never stop defending and pursuing freedom. After all, this may be the singularity of the blockchain universe explosion.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The centralization of EOS, is the Chinese consortium backing up?

- Blockchain Security Science: Witch Attack

- Cross-border dialogue | How do Haier, Fast, Sany, Changhong and other well-known companies view the digital economy?

- Bank of England Governor: Libra-like digital currency will be the best option to replace the dollar system

- The undead black swan: from ICO to IEO

- The number said that 50 star blockchain projects fell below the issue price, and more than 10 projects were nearly zero.

- QKL123 market analysis | Bitcoin suddenly pulled up, the altcoin weak linkage (0826)