AI robots are opening up new horizons

AI robots are expanding possibilities.After a few days of rebound, the market once again became sluggish today. The Shanghai Composite Index fell slightly by 0.47%, while the Shenzhen Component Index and the ChiNext Index both rose slightly. However, with more than 3,500 stocks falling in the two markets, the differentiation was very obvious.

However, the AI concept is still the main force behind the market, and today’s robotics sector has once again pushed the AI concept hype to a new high.

As the saying goes, the wind is turning, and the AI concept is shifting from upstream software represented by large models, computing power, and data to downstream application hardware represented by the robot industry chain.

This wave is even stronger.

- AI can’t save 618 either.

- Understanding How Proto-Danksharding Accelerates Ethereum’s L1 Rollup Scalability

- Due to recent advancements, Web3 usernames may receive more adoption.

Why robots?

Recently, there have been more and more positive policies, news, institutional discussions, and research coverage about robots.

Today, it was reported that Huawei has established a new company called Jimo Machine, with a registered capital of 870 million yuan. Its business scope includes the manufacturing of electronic components, engineering and technical research and development, and its layout targets robots and intelligent manufacturing.

At the same time, a well-known securities firm released a research report on humanoid robots yesterday, stating that investment in robots is still in the 0-1 stage this year, and that space is not a problem, which has attracted a lot of attention in the industry.

In fact, there are still many institutions that have recently released in-depth research reports on the humanoid robot industry chain and are bullish on the industry’s prospects.

In addition, recently, the Shanghai Municipal Government issued the “Three-year Action Plan for Promoting the High-quality Development of Manufacturing Industry in Shanghai (2023-2025)”, with the goal of striving to achieve an industrial robot usage density of 360 units/10,000 people by 2025, which has also ignited the market’s enthusiasm.

Similar policy benefits have been increasing this year.

In particular, on January 19 of this year, the Ministry of Industry and Information Technology and 17 other departments jointly issued the “Action Plan for the Implementation of the ‘Robot+’ Application”, which focuses on 10 major application fields, including manufacturing, agriculture, construction, energy, commerce and logistics, medical health, old-age care services, education, commercial community services, safety emergency, and extreme environment applications, and provides clear guidance. Such policy-driven benefits have long laid the groundwork for the market’s positive outlook on the robot concept.

Policy-intensive releases, strong institutional outlook, and strong funding all come together to create a raging fire.

Today, the top of the A-share gainers’ list is almost entirely related to the robot industry chain, such as reducers, sensors, automation equipment, machine vision, and so on.

At the individual stock level, at least more than 20 stocks highly related to the robot industry have surged.

Last month, Fengli Intelligence went up several 20CMs, and its stock price rose from 21 to 67 in a few days, becoming the strongest leader in the robot concept. In this wave, several individual stocks seem to be copying their homework, and some have been continuously trading for three or four boards.

The opening of a new technology cycle usually has three basic elements:

First, a major technological breakthrough that lowers costs with a broad market outlook. Second, there exists a large amount of idle capital left over from the old technology cycle. Third, it triggers a larger-scale industrial revolution.

These three elements undoubtedly apply to intelligent robots, which embody the most cutting-edge technology of humanity.

The emergence of AI large models is the key trigger for this technology cycle.

Now, countries have plenty of support policies for the development of the intelligent robot industry, and the future market space of the industry itself is also incredibly huge, especially after AI large model technology has achieved a historic leap forward in promoting artificial intelligence. Many giant enterprises’ interest in investing in the AI robot industry is unprecedentedly high.

The imagination of the future of this industry is rapidly opening up. With more and more giant capital entering the game, it will probably become another major theme in the stock market following AI.

The pattern is opening up

Whether it is industrial robots or service robots, they are all carriers of various functions in the AI era and are comprehensive collections of various high-end software and hardware technologies.

On the other hand, the depth of the robot’s industrial chain is extremely wide, involving many concept companies. This is the A-share market, where as long as part of the individual stocks become popular, it is easy to form a speculative effect.

Generally speaking, the performance of a technology growth industry theme follows the hype rule of at least three rounds of industry chain from top to bottom:

The first round is the appearance of new technology or new products of giants, which ignites market attention. For example, the AI large model of major giants appears;

The second round is the promotion of related industry chains driven by the explosion of giant products. For example, large models promote the explosion of orders for computing chips, servers, and key supporting industries in the industry chain;

The third round is the promotion of downstream application scenarios and industry verification of explosive products, stimulating the prosperity of downstream enterprises.

Even in the end, it may spawn more sub-industries or commercial needs to feed back to the upstream and middle of this new technology industry.

From the perspective of value release, the concept of AI has begun to show signs of the second and third rounds of hype.

Currently, the intelligent robot industry, especially the humanoid robot, is the big wind outlet moment.

On May 16, Huang Renxun, the founder of NVIDIA, threw out the concept of “embodied intelligence” at his ITF World 2023 semiconductor conference, which caused a new wave of attention to the robot concept.

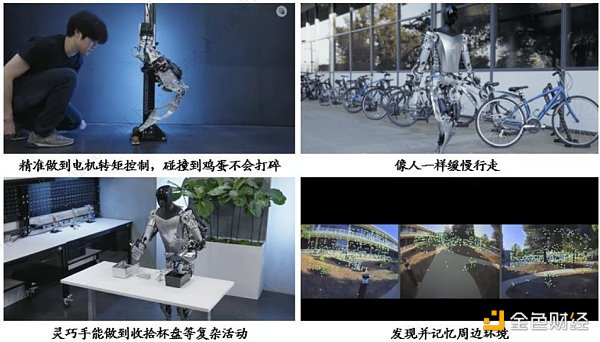

On May 17th, Tesla released the latest demonstration video of the Optimus humanoid robot at the 2023 Shareholders’ Meeting. Compared with the iron frame that was mocked and lifted onto the stage at the October conference last year, Optimus has undergone very large iterations within 8 months, walking more naturally and flexibly, and can better perform various complex and fine mechanical operation tasks.

Musk directly threw out the heavyweight view: Tesla’s long-term value will mainly come from humanoid robots, and future demand will reach 10 billion units. If the ratio of robots to humans is 2:1, the demand will reach 20 billion units.

Currently, the Optimus robot has not yet reached the mass production stage, and the cost is still high. If it is produced on a large scale, even if the price drops to $20,000, 20 billion units will mean a market size of $4 trillion.

This size, the value is afraid to exceed its automobile industry.

If anyone else says this, he will definitely be sprayed to death by public opinion and brick experts, but Musk’s satellites are enough to attract attention to the robot industry even if everyone does not believe it.

Only Tesla’s own humanoid robot has such a huge output. What about other competitors? What about robots in other industries and categories?

Currently, there are still many problems to be solved by humanoid robots. In the three core abilities of perception, decision-making, and human-machine interaction, the first two abilities have been well achieved through various sensors, advanced computing power, and increasingly powerful AI models. However, there are still many difficulties to be overcome in the ability of motion control, such as complex movements, fine manipulation, sensitive response, and endurance.

It is still a long way to go for humanoid robots to iterate to the level of “embodied intelligence” mentioned by Huang Renxun, but it is probably only a matter of time. The current technology is still advancing rapidly, and time will shorten quickly.

Currently, the application scenarios of humanoid robots are still very limited, and they can only perform simple tasks with human assistance. The degree of intelligence is far from meeting human expectations.

However, in the long run, if more breakthroughs can be made in motion control, the commercialization scenarios of service robots represented by humanoid robots cannot be underestimated.

Nowadays, many developed countries, including us, are facing development pressure from aging populations and labor shortages. At the same time, the continuous internal upgrading of industries increasingly relies on robots to achieve efficiency improvements. All of this is the place for intelligent robots.

Currently, there have been many works of humanoid robots from technology giants, such as the robot from Boston Dynamics, which has made advanced progress in motion control. In addition to excellent recognition and perception capabilities, it can already perform a series of difficult full-body movements such as jumping, diving, rolling, somersaulting, and dancing in a dynamic environment with obstacles.

Although Boston Dynamics’ technology has not been directly applied to civilian use, it is enough to show that the high-difficulty movements of robots can be overcome, and what is lacking at the civilian level is only time.

Conclusion

Actually, looking at the market performance, the market sentiment today is still relatively subtle.

First of all, the macro-level data is still very weak. In the past, the annual e-commerce promotion on June 18 was so competitive and lively, but this year, all major platforms are almost quiet, which is surprising. There is not even a slightly complete announcement, and even the headlines have not been reached.

E-commerce promotion data can truly reflect the real trend of national consumption. With such performance, it indicates that the rise of consumption is still a long way to go.

Therefore, the recent performance of cyclical sectors such as catering and tourism, real estate, and logistics transportation is not surprising.

At the same time, today’s acceleration of the afternoon decline of SMIC International caused its A shares to fall more than 7%, causing speculation and concerns in the market.

All these performances are reflecting that the market’s confidence is still quite weak and cannot withstand any changes.

Before seeing more positive policy or macro data reversal signals, the market’s fund operation is to wait and see, even if the relative valuations of many industries’ blue chips already look very attractive.

Because of such a market environment, it also leads to funds being more willing to hold together in high-growth and high-certainty themes such as AI.

Crowd trading is becoming more and more crowded, and it is rotating in order of the upstream, middle and downstream industries of the AI+ concept.

How far will robots go in trading? Let’s wait and see.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- TVL dilemma of ZkSync Era: The latecomers take the lead

- Inventory of the current state of the TreasureDAO ecosystem

- Bellevue Bank: Stablecoins and DeFi may become the next target of the SEC

- Crypto Kernel: Freedom, Carrier and Utopia

- Decoding the Ethscription protocol for creating NFTs on Ethereum using transaction data

- Interpretation of Bitmap Theory

- Conversation with Maverick: Two years of hard work have brought not only DEX.