TVL dilemma of ZkSync Era: The latecomers take the lead

ZkSync Era's TVL Dilemma: Latecomers LeadAuthor: @0xNing0x Source: Plain Language Blockchain

Is the L2 track wide enough to accommodate the third and fourth L2 giants? This is a real issue at present.

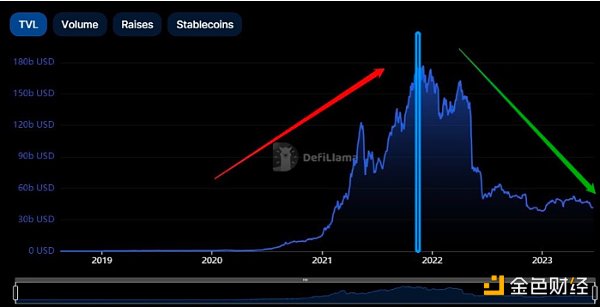

Looking at the on-chain TVL curve statistics from DefiLlama, we can describe the period from August 2018 to November 2021 as a period of incremental development, and the period from December 2021 to the present as a period of decremental development.

- Inventory of the current state of the TreasureDAO ecosystem

- Bellevue Bank: Stablecoins and DeFi may become the next target of the SEC

- Crypto Kernel: Freedom, Carrier and Utopia

During the incremental development period, on-chain TVL increased from $7,000 to $174.91 billion, and during the decremental development period, on-chain TVL decreased from $174.91 billion to $42.12 billion.

The main reasons for the on-chain TVL entering the decremental development period are:

— Epic monetary tightening cycle of the US Federal Reserve. Since March 2022, the Federal Reserve has raised the federal funds rate from 0-0.25% by 500 basis points in only 15 months. At the same time, the Federal Reserve is exerting full horsepower to shrink liquidity through quantitative tightening and balance sheet contraction. In this extreme situation, there is even a phenomenon of the interest rates of DeFi platform dollar-pegged stablecoins for borrowing and US Treasury bond yields being inverted. MakerDAO even invests in US Treasury bonds in the form of RWA to enhance protocol income, which was unimaginable in the incremental development era of DeFi.

— Bursting of on-chain financial alchemy bubble. The aggressive interest rate hike by the Federal Reserve caused the bubbles of the two major weapons for creating TVL, algorithmic stablecoins and CeFi lending, to burst rapidly. Taking only the algorithmic stablecoin project Luna and the CeFi lending project Celsius as examples, they together easily wiped out more than $30 billion of on-chain TVL.

— Bankruptcies and closures of the three largest crypto-friendly banks in the United States. In the US banking crisis of March 2023, all three of the US’s crypto-friendly banks, SilverGate, Silicon Valley Bank, and Signature Bank, went bankrupt and closed. Ordinary US institutions and retail investors have basically lost their deposit channels. In the decremental development period where the cake is constantly shrinking, if new L2s want to expand TVL, they must seize the TVL share of L2s (Arbitrum, Optimism) and new public chains (Aptos, SUI) that have the first-mover advantage. However, the data of the new L2s is obviously not very ideal. Here are the latest TVL data for the king-level L2s and new public chains:

Arbitrum One TVL: $2.08 billion

Optimism TVL: $771 million

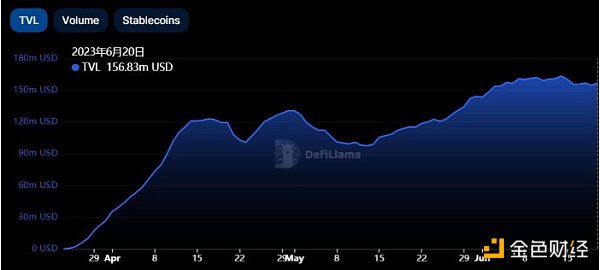

ZkSync Era TVL: $157 million

Starknet TVL: $13 million

Aptos TVL: $43 million

SUI TVL: $12 million

Although ZkSync Era’s performance is still relatively good compared to other Newbies, it is still far from the TVL scale of Arbitrum and Optimism.

Moreover, since June, ZkSync Era’s TVL growth rate has significantly declined, and its TVL scale has only increased by 10% in the past 20 days.

Furthermore, there are three major problems with the ZkSync Era ecosystem:

–High Rug rate of the first batch of ecological projects

–Lack of diversity in native assets, with MeMe coin as the main star native asset, and $CHEEMS dominating

–Mainstream DeFi protocols and mainstream trading platforms have not yet been integrated into ZkSync Era.

In addition to market environmental factors, the poor timing of ZkSync Era’s mainnet launch, choosing to launch at the end of the spring market, is also an important reason for this situation. Breaking the deadlock Faced with the current dilemma, ZkSync has two choices: –Learn from the dogmatic realism of Aptos and Sui, lie down technically in the bear market, temporarily give up the growth target of TVL and UAW Then, seize the moment of high market sentiment in a cycle of periodic trends, quickly complete the coin issuance, airdrop, and listing process, and design a high FDV and low MCap token economy, negotiate with market makers and trading platforms for cooperation, maintain the coin price at a high level, and finally partner with VC institutions to unlock and sell off the coins until the bull market arrives, and then vigorously market, taking advantage of the liquidity overflow of the Ethereum ecosystem. –Learn from the idealistic Build route of Arbitrum and Optimism, and persist in building ecology in the bear market, pursuing healthy growth of TVL and UAW But this is a difficult path. However, observing the information flow of ZkSync’s official Twitter account, the ZkSync team is more inclined to take this path, which is worthy of the crypto community’s praise. As a crypto maximalist who is always moved to tears, the following are some actionable suggestions I have for them: –Establish a clear and specific market positioning. Arbitrum’s market positioning is a chain of on-chain derivative trading, with its core product being GMX and a series of GMX Lego protocols. Optimism’s market positioning is a To B business cooperation chain, with its core product being the OP Stack, a one-click L2 issuance, and the on-chain ecosystem projects are also mainly mainstream DeFi protocols. Their market positioning is clear and specific. The just-announced Polygon 2.0 also has a clear and specific market positioning: One L2 Rule Them All (L2 cross-chain interoperability). And what about ZkSync Era? In the minds of ordinary users now, the market positioning of ZkSync Era is probably either the Lulu chain or the MeMe chain. ZkSync Era needs a specific market positioning, not an abstract grand narrative. –Unswervingly launch a round of Odyssey activities. Last week, the ZkSync community circulated news that the official launch of Odyssey was imminent, causing some backlash in the crypto community. This is because Linea’s infinite task PUA has made everyone wary of similar activities, and the ZkSync team subsequently denied the authenticity of this news. However, reviewing the growth curve of Arbitrum and Optimism, we can see that the Odyssey activity is one of the key driving factors for their TVL growth. This is because the prosperity and self-growth of the on-chain ecosystem of L2 require the on-chain TX and TVL to exceed a certain threshold. The Odyssey activity is a convenient way to quickly break through this threshold. –Kowtow to the trading platform and open up the cycle of the crypto economy. In the crypto world, although the trading platform is higher than the public chain in the food chain, the public chain team’s attitude is higher than that of the trading platform team, and many developers instinctively despise speculators. But now, the ZkSync team needs to converge its arrogant attitude, bravely kowtow to the trading platform, pay money when it is necessary to pay money, exchange resources when it is necessary to exchange resources, strive to connect to mainstream trading platforms as soon as possible, realize the listing of ZkSync native assets on CEX, and create the wealth effect. –Push forward the developer Grant plan. In addition to TVL and UAW, another key factor in the success or failure of L2 is the developers. In this regard, Starknet is very smart. When tokens are not yet tradable, it has already distributed token rewards to the developers of ecological projects. When distributing developer reward tokens, we should uphold the principle of swallowing the boat and leaking. It should be noted that in 2018, TRON successfully introduced a large number of developers in the bear market by relying on this strategy, and once surpassed Ethereum and EOS, becoming the most active public chain in the on-chain ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding the Ethscription protocol for creating NFTs on Ethereum using transaction data

- Interpretation of Bitmap Theory

- Conversation with Maverick: Two years of hard work have brought not only DEX.

- Increasing the validator balance limit from 32ETH to 2048ETH: Will it cause validator centralization?

- New action from Cyber Administration of China: Algorithm filing for every AIGC platform is at stake

- Do you really understand Uniswap v4?

- Vitalik: In-depth Understanding of Cross-L2 Reading – What are the Cross-Chain Proof Solutions