zkSync Dex Showdown: Syncswap vs iZiswap

zkSync Dex Comparison: Syncswap vs iZiswapAuthor: Alex Xu, Mint Ventures

2023 is a big year for L2.

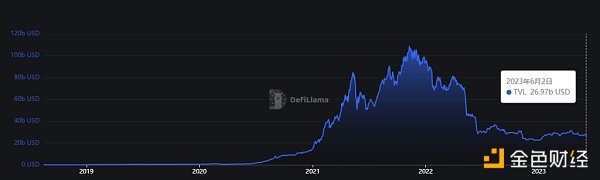

While the TVL (total value locked) of various public chains represented by Ethereum remains low, the TVL of L2 has been growing rapidly this year, breaking new records.

- Comparison of the performance of Optimism and Arbitrum in the past three months

- Understanding DeFi Protocols Without Oracle

- Application and Progress of ERC-6551 “NFT Binding Account”

Source: https://defillama.com/chain/Ethereum?tvl

Source: https://l2beat.com/scaling/tvl

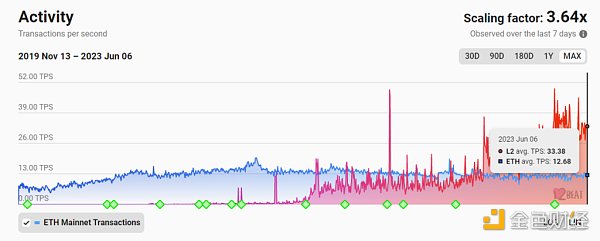

In addition to on-chain funds, on-chain active data also confirms this. Since the actual TPS (transactions per second) of L2 surpassed Ethereum effectively in October last year, this data has increased rapidly this year. The current actual TPS of the L2 network is about three times that of Ethereum. This data will obviously continue to rise in the future.

Below: Comparison of L2 actual TPS and Ethereum

Source: https://l2beat.com/scaling/activity

In addition to business data, the KanKun upgrade coming in October this year will also greatly reduce the cost of L2, promoting users and applications to further migrate to L2.

In terms of competition, L2 is similar to L1, with a strong network effect built by users, developers, and funds, second only to stablecoins in the Web3 world. Its first-mover advantage is obvious.

In the OP Rollup field, the Arbitrum and OP duopoly has been established. In the future, there may be Coinbase’s L2 Base based on the OP stack, but there may not be too many new players who can enter the game in the short term.

The war in the ZK Rollup field has just begun. As a long-term direction supported by the Ethereum Foundation and Vitalik, ZK will inevitably occupy a place in the increasingly fierce L2 war in the future. After Arbitrum completed its airdrop earlier this year, zkSync became the next highly anticipated L2 airdrop project. Its TVL and user activity have continued to rise. In less than three months after its launch, it has become the second-largest L2 in terms of TVL, second only to Arbitrum and Optimism, and also the largest ZK Rollup project in terms of TVL and user volume. The types of on-chain projects are gradually becoming more diverse, including DeFi infrastructure and meme projects like Cheems.

Overall, zkSync has taken the lead in the competition of the ZK L2.

Dexs: The Infrastructure for User and Fund Convergence

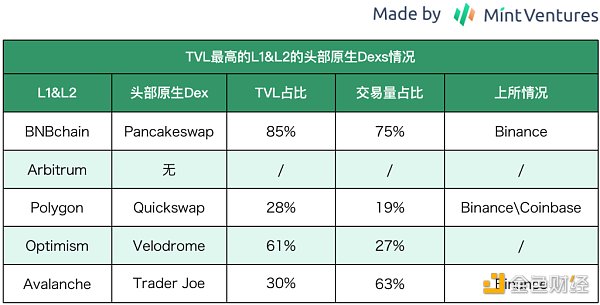

Dex, lending, and stablecoins are the most basic financial trio for L1&L2. However, by referring to the development of L1 and L2 in the past, it is easy to find that the head “native Dex” on each chain often has only one. Here, the author has two criteria for defining “head”, at least one of which should be met:

-

Business data such as TVL and trading volume are far higher than competitors, and at least one market share exceeds 50%.

-

The tokens have been listed on first-tier exchanges such as Binance.

Data source: Defillama Time: June 7, 2023 Table: Mint Ventures

As the head Dex of the chain, relative to other competitors, it enjoys more advantages, such as:

-

It occupies a leading position in the user’s mind and is more likely to become a priority platform for user transactions and market-making behaviors, and has higher trust.

-

Business advantages make it easier to be favored by other partners, become the first stop for liquidity deployment, or cooperate in launching blocking businesses.

-

Convenient traffic, head Dex is more likely to be mentioned and quoted in various business rankings, information, and research reports, and get more free exposure and natural traffic.

-

The cross-border network effect advantage formed by leading liquidity and trading volume.

-

The token is more likely to be listed on the head Cex, and receive liquidity premiums and more holding users.

As a newer L2 ecology, users, funds, and developers are all in the early stages of growth, and the market pattern of other chain’s brand projects has not yet been solidified (such as Uniswap V3 and Aave), and native projects still have time to compete for and consolidate their positions.

However, the future Dex pattern of zkSync will most likely be the same as other L1&L2, with only one head native Dex (or occupied by Uniswap V3).

So the question is, who will become the head native Dex of zkSync in the future?

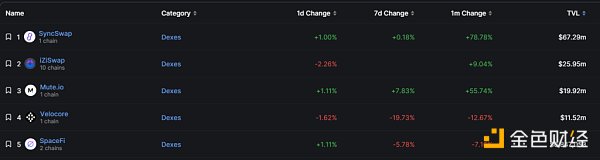

zkSync Dexs Market Pattern

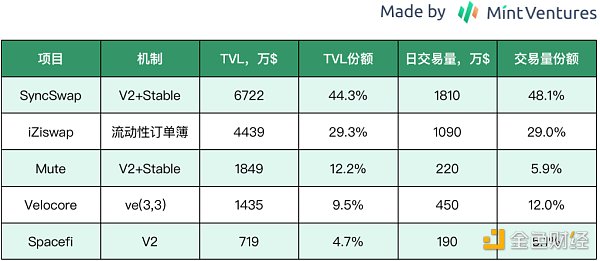

Currently, there are many Dex projects on zkSync, each with different mechanisms, but there is a trend towards concentration of market share based on business data.

Data Source: Defillama and project official data Time: June 6, 2023 Table: Mint Ventures PS: Here, [share] is calculated based on the total business volume of the top five DEXs

In terms of business mechanism, three out of the top 5 DEXs (SyncSwap, Mute and Velocore) adopt the V2 dynamic pool + steady pool model, among which Velocore also operates a liquidity market business with a ve(3,3) mechanism similar to Velodrome on the economic model.

However, from the perspective of TVL and trading volume, the top tier DEXs in zkSync are currently SyncSwap and iZiswap, and the future top DEX is most likely to emerge from these two.

Syncswap vs iZiswap

Next, the author will sort out and compare the basic situation of these two first-line DEXs in the zkSync ecosystem, mainly covering project mechanism design, business indicators, economic model, and team situation, etc.

Syncswap

Mechanism design

Pool type

Overall, Syncswap does not have too many innovations in the product mechanism of DEX, and it adopts the multi-pool mechanism commonly used in ve(3,3) type projects. Currently, it mainly includes the Classic Pool based on Uniswap v2 (mainly applicable to transactions with large exchange rate fluctuations) and the Stable Pool based on Curve (applicable to transactions with stable exchange rates).

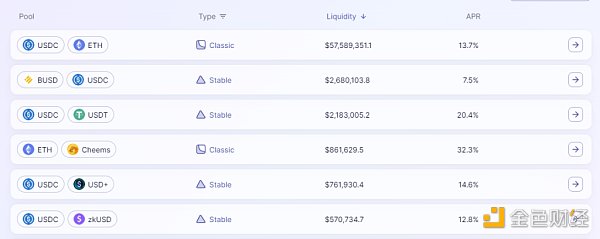

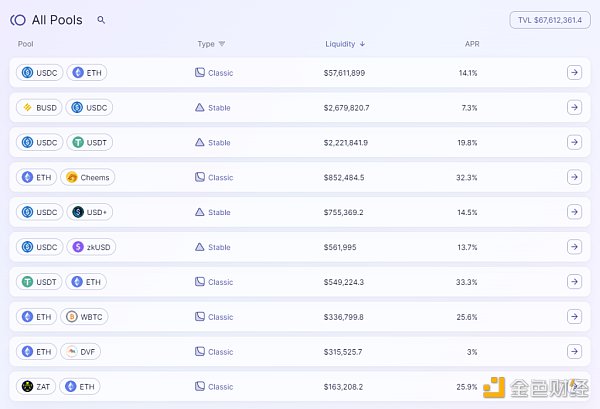

The following figure shows the pool list of Syncswap

Source: https://syncswap.xyz/pools

Trading fees

Syncswap calls its fee mechanism “Dynamic Fees”, but in fact, it is not the dynamic fee mechanism we understand (the higher the asset price volatility, the higher the fee rate to compensate for LP’s impermanent loss), perhaps a more accurate expression should be “custom fees”.

Specifically, Syncswap’s fees include the following functions:

-

Adjustable fees: Different pools can set different fee rates, with a maximum of 10%.

-

Directional fees: Set different fees according to the direction of the transaction (buy/sell), such as 0.1% for buying and 0.5% for selling.

-

Fee rate discount: Obtain a discount on trading fees based on token collateral.

-

Fee allocation agent: Can directly allocate the pool fees to an external address.

As we can see, Syncswap’s Dynamic Fees are not actually “dynamic” but rather have more customizable permissions.

Business Performance

We analyzed Syncswap’s business situation from four angles: transaction volume, number of users, liquidity, and transaction fees (LP fees and protocol revenue).

Transaction Volume and Number of Users

Syncswap itself does not provide a complete transaction volume data dashboard. Based on on-chain data, we conducted statistical analysis on Syncswap’s 7-day and 30-day transaction volume. In the past 30 days (2023.5.8-6.7), the transaction volume was 431,351,415 USD, corresponding to a daily average transaction volume of 14,378,380 USD. The 7-day (2023.6.1-6.7) transaction volume was 103,743,812 USD, corresponding to a daily average transaction volume of 14,820,544 USD.

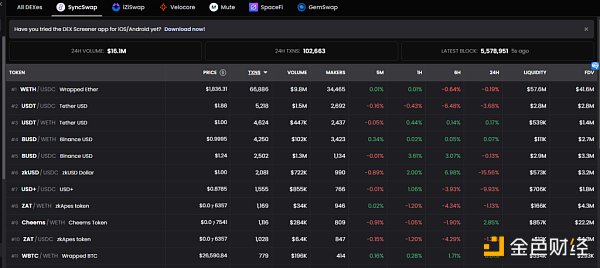

These transaction data roughly match the 24-hour transaction volume statistics of Dexscreener and the official various Pools.

Below: Syncswap’s 24-hour transaction volume

Source: https://dexscreener.com/zksync/syncswap

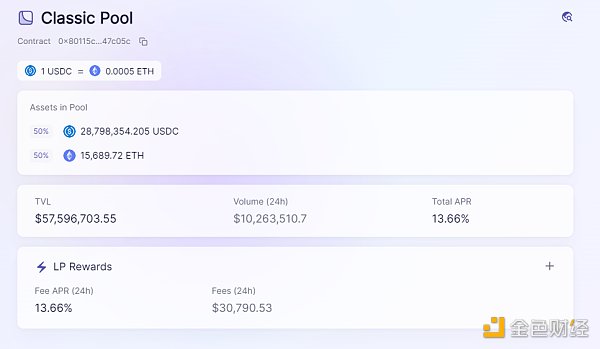

Below: Business data of the pool with the largest transaction volume in Syncswap, with a daily transaction volume of about 10 million USD

Source: https://syncswap.xyz/pool

Among the transaction volume composition, the ETH-USDC Pool accounts for the largest share, at 60.8%, followed by stablecoins, and the true zkSync native asset transaction volume accounts for less than 5%.

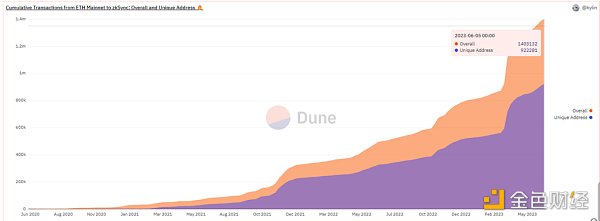

Also based on on-chain data, from 2023.5.8-6.7, Syncswap’s monthly active addresses were 843,692, and the weekly active addresses from 6.1-6.7 were 247,814. As of 6.5, the number of independent addresses in zkSync was 922,000, which also means that nearly 91.4% of addresses have interacted with Syncswap in a month.

Source: https://dune.com/dev_1hermn/zksync-era

Liquidity

The total liquidity of Syncswap is 67.61 million USD, of which the ETH-USDC Pool accounts for 57.61 million USD, accounting for 84.5%.

Source: https://syncswap.xyz/pools

Among the top 10 liquidity pools, zkSync’s native non-stablecoin assets are Cheems (meme) and ZAT (NFT), accounting for only 1.5%.

Transaction Fees and Protocol Revenue

The author has analyzed the protocol revenue of the top 10 pools in Syncswap by trading volume on June 9th, as follows:

Data source: Syncswap official website Time: June 9, 2023 Table: Mint Ventures

Data source: Syncswap official website Time: June 9, 2023 Table: Mint Ventures

According to the table above, it can be seen that the protocol revenue of ETH trading pairs accounted for 90.6%, which is the main source of fees and revenue. Additionally, Syncswap’s fee split ratio for Cheems and USD+ (Tangible’s stablecoin) is only 10% and 20%, respectively, with most of the revenue being shared with LPs, indicating a clear intention to attract this part of liquidity.

What is noteworthy is that Syncswap currently has not issued tokens or launched liquidity or trading subsidies, making it a relatively rare DeFi project that can achieve positive returns. Of course, this is closely related to the fact that both zkSync and Syncswap have not yet issued tokens, and there are many airdrop hunters interacting.

Economic Model

Although Syncswap has not officially issued tokens yet, it has already announced some information about the token, which is SYNC with a total supply of 100 million tokens.

In terms of token rules, Syncswap has partially referred to Curve’s ve model, and holders need to convert SYNC to veSYNC to obtain token utility, including:

-

Voting governance

-

Protocol fee dividends

-

Transaction fee discounts

However, in terms of the specific unlocking mechanism, it is different from Curve. After choosing to unlock, veSYNC has a linear unlock period of 6 months, with 50% of the tokens available on the 20th day after choosing to unlock, and the remaining 50% continuing to unlock linearly.

Nevertheless, the token economic model of Syncswap is still incomplete, as it does not mention the token distribution ratio, release speed, or whether the ve model is used to guide the token pool emission. However, based on the overall mechanism of the current project, Syncswap is more like a ve(3,3) Dex project.

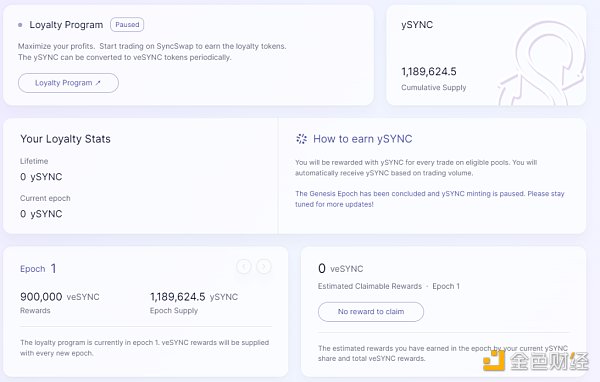

Additionally, although the SYNC token has not been listed, Syncswap has launched a token incentive program, the “Loyalty Program.” The program mainly incentivizes fees generated by specific trading pairs, similar to “transaction mining.”

Source: https://syncswap.xyz/rewards

The token mining rules of the Loyalty Plan are as follows:

-

Users trade on designated trading pairs, and the more transaction fees generated, the more ySYNC reward tokens will be obtained. The number of ySYNC obtained = the transaction fees contributed by the user.

-

An epoch refers to a plan cycle. Except for the genesis epoch (epoch1), which lasts for one month, subsequent epochs last for one day.

-

Users can exchange rewards based on ySYNC, but the rewards are issued in veSYNC. If the user wants to sell, they need to unlock veSYNC first.

The genesis epoch of the Loyalty Plan is from April 10th to May 10th this year, with a total reward of 900,000 veSYNC. The final ySYNC obtained by participating users is 1,189,624.5, which means that users paid a total of $1,189,624.5 in transaction fees on designated trading pairs during the activity, and the cost of obtaining 1 veSYNC is approximately $1.32.

However, the Loyalty Plan is currently suspended, and only one phase was completed.

Team and Financing

The Syncswap team is anonymous, and the team size and personnel are not clear. Currently, there is no disclosed financing news.

iZiswap

Mechanism Design

iZiswap is one of the products of iZUMi Finance. iZUMi is a DeFi project that provides multi-chain liquidity services (Liquidity as a service, LaaS). iZiswap is its Dex product for liquidity services. Other products currently launched outside of iZiswap include:

-

LiquidBox: A liquidity incentive service based on the centralized liquidity (Uni V3 and its derivative modes) mechanism. It can help the project party customize liquidity incentives based on price intervals.

-

Bond financing service: Provides project parties with financing methods similar to convertible bonds in traditional finance.

This article mainly focuses on the top Dex competition in the zkSync ecosystem, so it will mainly focus on the situation of iZiswap on the zkSync network.

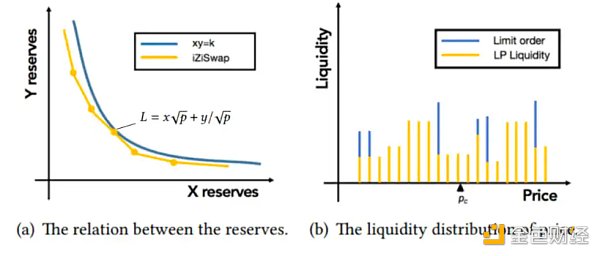

The main innovation of iZiswap is the proposal and implementation of DL-AMM.

DL refers to Discretized Contentrated Liquidity. DL-AMM does not use the constant product formula and places liquidity on discrete price points. Each price point follows the constant sum formula L = X * √P + Y/ √P.

Countless discrete price points are connected to form a complete AMM price curve similar to Uniswap, as shown on the left in the figure below.

Source: https://assets.iZUMi.finance/paper/dswap.pdf

Liquidity in DL-AMM is divided into two types: LP liquidity and limit order liquidity, which are combined and distributed in different price ranges, as shown on the right.

The former is dual-token liquidity, while the latter is single-token liquidity, targeting the exchange of another token at a specific price. Once the target price is reached, the liquidity will be exchanged and will not be exchanged back (Uni V3 can also achieve limit order logic by hanging one-sided liquidity in a small range, but it will be exchanged back to the original token when the price returns) and will be kept in the contract until the user withdraws it.

Additionally, based on the point-like distribution of iZiswap liquidity, it also provides a trading interface version of the order book (iZiswap Pro) to provide users with a trading experience similar to CEX.

Source: https://iZUMi.finance/trade

Speaking of liquidity order books, it is easy to associate them with the better-known Dex project Trader Joe, which launched Liquidity Book (LB for short) in November 2022. It also uses a point-like distribution of liquidity and uses a constant and formula instead of a constant product for liquidity at specific price points.

For more information on Trader Joe, please read the author’s research report “Meeting the Second Spring with Arbitrum? A Comprehensive Analysis of Trader Joe’s Business Status, Token Model, and Valuation Level.”

In fact, the concept of liquidity order books in Trader Joe is likely to have originated from DL-AMM proposed by iZUMi. iZUMi’s paper on DL-AMM “iZiSwap: Building Decentralized Exchange with Discretized Concentrated Liquidity and Limit Order” was released in November 2021, while iZiswap was launched in May 2022 (first on BNBchain), both far earlier than Trader Joe’s LB function. Trader Joe also acknowledged and referenced iZUMi in its V2 white paper.

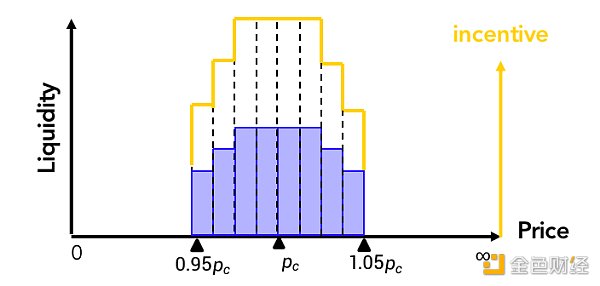

In addition to DL-AMM, iZUMi also designed a liquidity incentive service based on concentrated liquidity, LiquidBox. The liquidity mining incentive based on V2 is simple: users pledge LP certificates to receive token rewards, which incentivizes liquidity for all price ranges. However, the incentive design for V3, DL-AMM, and BL with concentrated liquidity is much more complex.

Assuming a token with a price of $100, an LP provides liquidity in the range of $95-$105 with $1000, while another LP provides liquidity with $1000 in the range of $10-$20 (single-sided). The former’s liquidity utilization efficiency is much higher than the latter’s. If the V2 model is used to provide the same reward according to the liquidity value, it is clearly unreasonable.

For users, LiquidBox is a place for them to deposit liquidity and receive incentives. For incentivizers (usually token project parties and iZUMi), they can allocate the obtained liquidity to different intervals to achieve the liquidity goals they want.

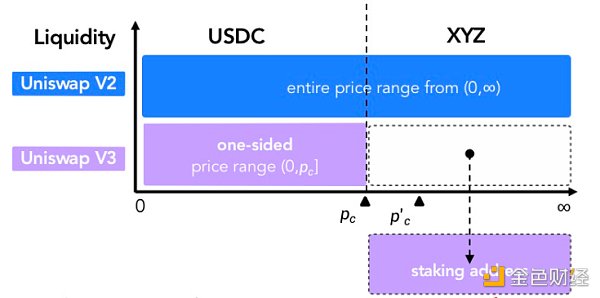

LiquidBox provides three schemes, which are jointly decided by the liquidity incentivizers (usually token project parties and iZUMi):

1. One-sided mode (oneside): The project token in the liquidity deposited by the user will not be stored in the pool, but will be pledged separately to reduce the quantity of project tokens in the pool and reduce resistance when rising; the other half of the value currency (ETH or stablecoin) will be allocated to the left of the current token market price to strengthen the buying side when falling. For the project party, this actually achieves the effect of “increasing the token buying side and reducing the token selling side”. For users, if the price of the project token rises, there will be no impermanent loss caused by “selling all the way up”. Of course, if the token falls, since the project token has not been sold at a high price, the impermanent loss caused by the fall will be amplified for users. So this can be understood as a mechanism that encourages users to pledge tokens and not sell, and jointly (3,3) make the market.

Comparison of one-sided mode and V2:

Source: iZUMi document

2. Fixed range mode (Fix range): This is relatively easy to understand, that is, to incentivize liquidity in a fixed price range, which is more suitable for stablecoins and packaged assets.

Source of incentivization in fixed range: iZUMi document

3. Dynamic mode (Dynamic Range): Users participate in liquidity mining by providing liquidity in the range of (0.25Pc, 4Pc) of the current price (Pc). The width of the price range can also be set by the project party, such as (0.5Pc, 2Pc). The advantage is that there will be better liquidity around the market price range, but if the token price fluctuates violently beyond the user’s initial market-making range, the user will also need to frequently withdraw LP and re-pledge while bearing impermanent losses, resulting in higher operating costs.

Currently, in practice, most of the active LiquidBox users choose the dynamic mode.

Additionally, LiquidBox supports LP participation and incentive rewards for Uniswap V3 and iZiswap, with most of the open incentive pools on the zkSync network.

Business Performance

Transaction Volume and Number of Users

The author uses on-chain data to compare the data of iZiswap with that of Syncwap. The transaction volume for the past 30 days (2023.5.8-6.7) was 195,025,494 USD, corresponding to an average daily transaction volume of 6,500,849 USD. The transaction volume for the past 7 days (2023.6.1-6.7) was 60,007,769 USD, corresponding to an average daily transaction volume of 8,572,538 USD.

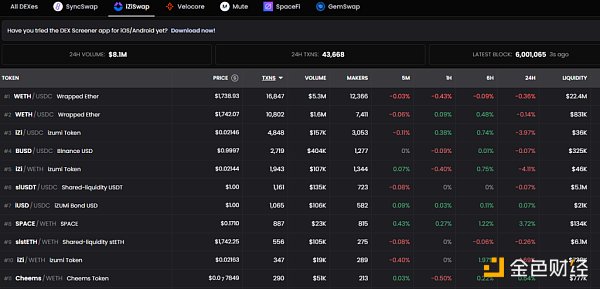

The above transaction data is roughly consistent with the 24-hour trading volume statistics of Dexscreener and the official pool statistics.

Source: https://dexscreener.com/zksync/iziswap

Source: https://analytics.iZUMi.finance/Dashboard

Like Syncswap, the ETH-USDC trading volume of iZiswap is more extreme, with the two pools accounting for 85.8% of the daily total trading volume, followed by stablecoins and their own token IZI.

Also based on on-chain data, the number of monthly active addresses for iZiswap from 2023.5.8-6.7 was 301,993, and the number of weekly active addresses from 6.1-6.7 was 102,938, which is about 35-40% of Syncswap’s active addresses.

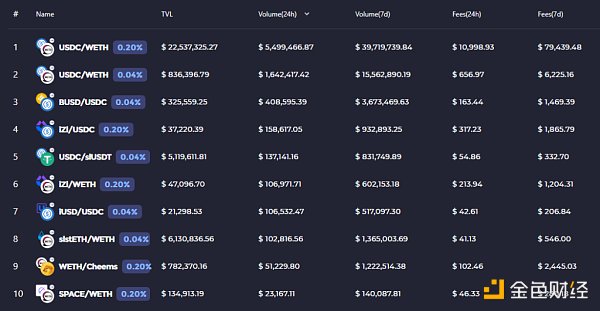

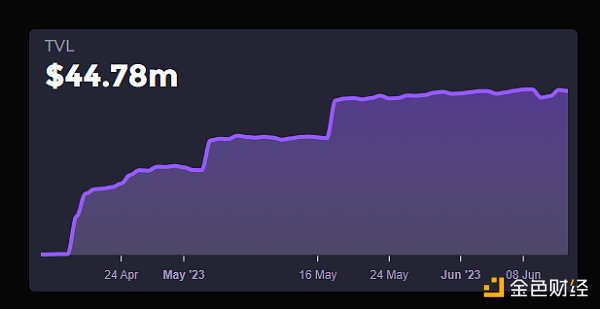

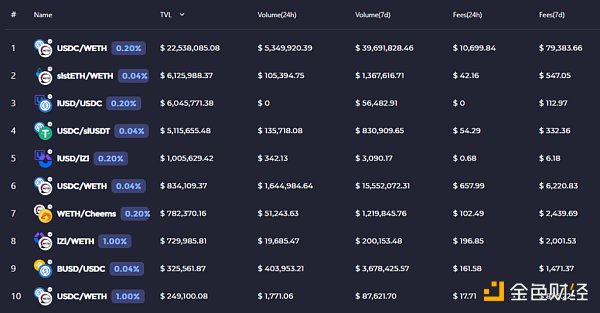

Liquidity

There is a big difference between the liquidity data provided by iZiswap official and by Defillama. The current liquidity displayed on the official dashboard is 44.78 million USD, while Defillama’s data shows 25.95 million USD.

iZiswap official disclosed liquidity data

Defillama’s TVL statistics ranking on zkSync

The reason is that the liquidity officially reported includes many stablecoins and wrapped assets issued by iZUMi, such as iUSD (debt financing stablecoin) and slstETH, slUSDT (wrapped assets based on Ethereum collateral, cross-chain issuance), as shown below.

However, in the current market environment, the promotion of self-operated stablecoins and packaged assets is difficult because of the single-point risk of third-party acceptance of assets. Most users and mainstream defi do not accept third-party issued packaged assets. At the same time, according to iZUMi feedback, the current packaged assets represented by slstETH are still in the preparation period and have not officially begun operation. Therefore, when observing TVL, we use the data collected by Defillama, which is more indicative.

After proposing the TVL of the aforementioned packaged and self-operated stablecoins, iZiswap’s TVL is similar to Syncswap, with the ETH Pool accounting for 86.8%.

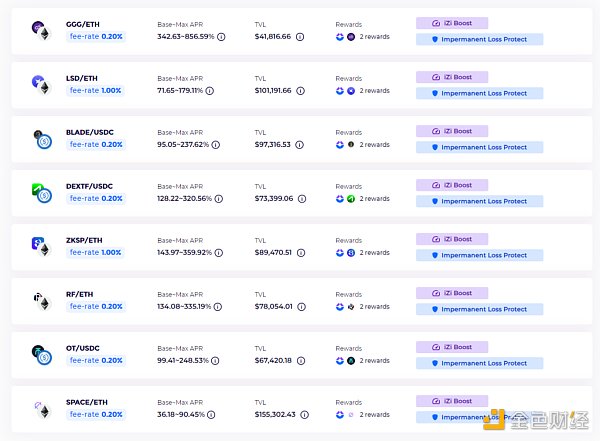

As for liquidity incentives, currently, the number of LiquidBox mining pools opened by iZiswap on zkSync is not small, and all adopt a dual incentive model of project party tokens + IZI tokens.

Source: https://iZUMi.finance/farm/iZi/dynamic

The author calculated the token rewards for the current dual mining and found that most of the total token rewards for liquidity incentives are contributed by the project party. However, there are also a few pools where the value of IZI tokens is higher due to the decline in the value of project party tokens.

As of June 14, 2023, the total amount of 8 LiquidBox liquidity incentive tokens for IZI on zkSync is 60180/day, worth about $1208.

Transaction fees and protocol revenue

The iZiswap data dashboard displays the fee generation situation for each Pool. The following is the sorting of the top 10 weekly fees.

Data source: iZiswap official. Date: June 14, 2023. Charting: Mint Ventures

Data source: iZiswap official. Date: June 14, 2023. Charting: Mint Ventures

PS: Protocol allocation revenue refers to the income allocated to IZI token users, which is 25% of the handling fee.

Compared with Syncswap’s daily protocol revenue of $11,631.4, iZiswap’s daily protocol revenue is $6,312.5. However, according to the token design, 50% of the revenue will be used to repurchase iUSD and as market funds, which is equivalent to only 25% of the handling fee being allocated to IZI token users.

Economic model

iZiswap is a product module of iZUMi and is currently the main revenue-generating module. In terms of business volume and development prospects, zkSync is currently the main area for iZiswap.

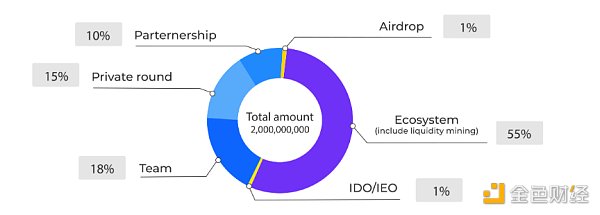

Total amount, allocation, and supply

iZUMi’s project token is IZI, with a total supply of 2 billion, distributed across Ethereum, BNBchain, Polygon, Arbitrum, and zkSync.

The token distribution and release schedule are as follows:

Source: https://docs.iZUMi.finance/tokens/tokenomics

According to CMC data, the current total supply of unlocked tokens is 787,400,000, of which 276,091,843.3IZI is in ve staking.

Token Usage

IZI’s token usage plan includes three purposes:

1. Governance Voting: Used to vote on the token’s emission direction (not yet online)

2. Staking Rewards: After staking, you can receive a 25% allocation of IZI’s iZiswap fee buyback distribution

3. Yield Acceleration: After staking, you can accelerate your own mining on LiquidBox, up to 2.5 times, similar to Curve’s boost mechanism

The intrinsic value of Dex tokens in the ve model comes from two main sources: 1. the governance value of commanding liquidity, whose price is determined by the liquidity price of the corresponding Dex and is affected by the liquidity procurement demand of other projects on the same chain; 2. the cash flow discount of fee dividends.

At present, the ve voting function of iZiswap has not yet been launched, and 50% of the transaction fee distribution is diverted by the bond repurchase module, suppressing the intrinsic value of the token.

Team and Financing

According to the information disclosed by Rootdata, Jimmy Yin, a graduate of Tsinghua University, is the founder of iZUMi Finance, and the team currently has a scale of 20+ people.

According to data disclosed by Rootdata, iZUMi has conducted four rounds of financing in the past:

-

November 2021: Seed round, $2.1 million, corresponding to a valuation of $14 million

-

December 2021: A round, $3.5 million, corresponding to a valuation of $35 million

-

May 2022: Convertible bond financing through Solv, $30 million, for liquidity operations

-

April 2023: Fundraising in the form of a fund through Solv, $22 million, for liquidity operations

It is worth noting that iZUMi’s recent two rounds of financing did not use the direct sale of tokens, but instead used bond or fund raising to raise funds. The use of funds is not only for project expenses and team recruitment, but also for liquidity operations (market making). The operating income can be used for team income and financing returns.

Conclusion

In the competition of zkSync head DEX, Syncswap is relatively straightforward in terms of product mechanism, and there is basically no impressive native innovation. iZiswap’s product has more rich native exploration, but whether it can be translated into user and capital growth is currently not optimistic. Because from the specific business data, Syncswap has a clear lead in both TVL and trading volume, and its tokens have not yet been distributed. The expected project airdrop has strong appeal to users’ funds and transaction behavior, enjoying lower operating costs (while iZiswap still has daily token incentive expenses).

However, the problem that both parties currently face is that due to the recent birth of zkSync, there are not enough native projects with vitality, and most of the liquidity and trading volume of the two DEXs are related to ETH.

In the future, more native projects will be born on zkSync. Which platform will these projects choose to deploy initial liquidity? Is it zkSync, which has a more leading business, or iZiswap, which has more mechanism gameplay? This also leaves some suspense for subsequent competition. In addition, Uniswap had previously voted in October 2022 to deploy V3 to zkSync, and may enter this brand new market at any time, bringing greater competitive pressure.

We look forward to future developments.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the chances of decentralized exchanges completely replacing Binance and Coinbase?

- Join if you can’t beat them? Why did Binance hastily get involved in the L2 battle?

- BNB Chain has launched the opBNB testnet, a Layer 2 network based on the OP Stack.

- South Korean professor tracking Do Kwon’s funds: Signs of Terra’s collapse were present in early 2019

- Who are the winners in the EVM innovation wave?

- Attention drawn to Ethscriptions, an Ethereum NFT protocol that competes with Ordinals, with over 30,000 minted in just a few days since launch.

- Comprehensive Review of the Polygon zkEVM Ecosystem: Slow but Steady