The First Step of Ethereum Modularization: Introduction and Working Principles of Proto-danksharding

Ethereum Modularization: Introduction & Working Principles of Proto-dankshardingAuthor: Christine Kim Translation: Lynn, MarsBit

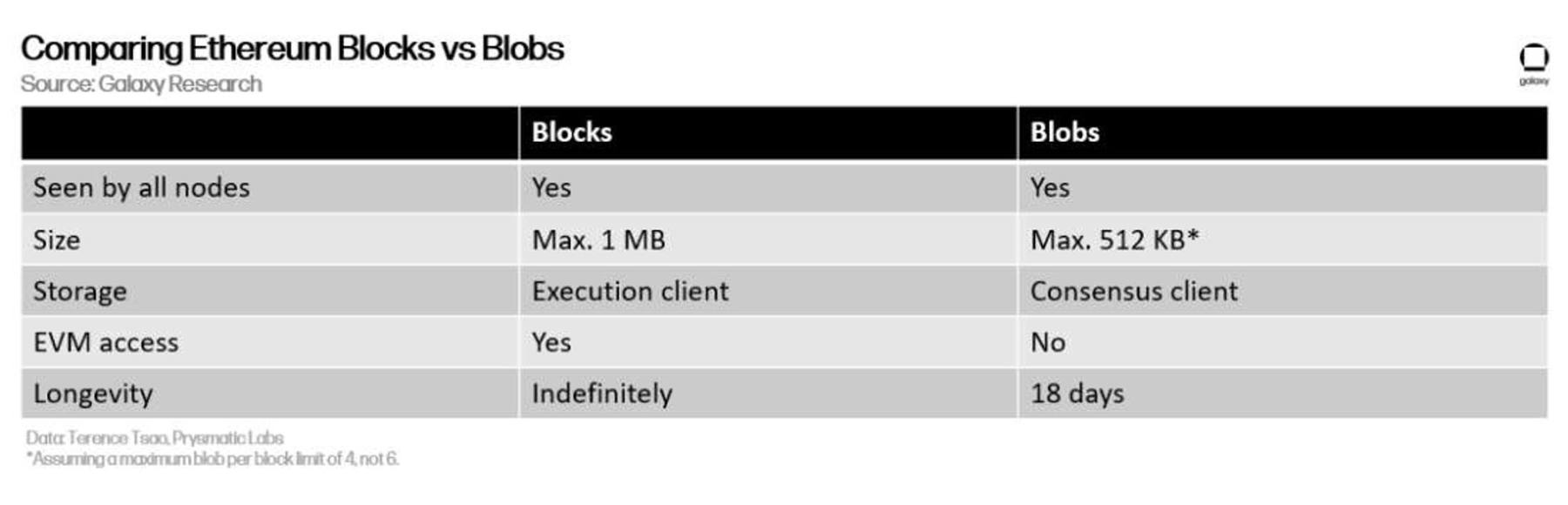

With the completion of the merger and the upgrade of Shanghai, Ethereum has successfully transitioned from Proof-of-Work to Proof-of-Stake consensus protocol. The next major project on the Ethereum development roadmap is Ethereum Improvement Proposal (EIP) 4844, also known as the “native database.” The code change aims to improve the scalability of rollups built on top of Ethereum. EIP 4844 is named after Ethereum core developer “Protolambda” and Dankrad Feist, and introduces a new transaction type called blobs, which increases the data and storage requirements of Ethereum blocks and creates a new pricing market that separates blobs from regular transactions.

Rollups are protocols that rely on Layer 2 blockchains (such as Ethereum) for data availability (the ability to widely disseminate and temporarily store batches of transaction data). In general, smart contract-based rollups rely on Ethereum’s data availability as well as transaction settlement (validation) on Ethereum. These rollups specifically read data from the DA layer such as Ethereum and execute efficient transactions and smart contract code. Rollups built on top of Ethereum rely on batched transaction data included in Ethereum blocks to achieve transactional authenticity. Sorters batch and compress user transactions in a cost-effective way to submit to DA layer actors.

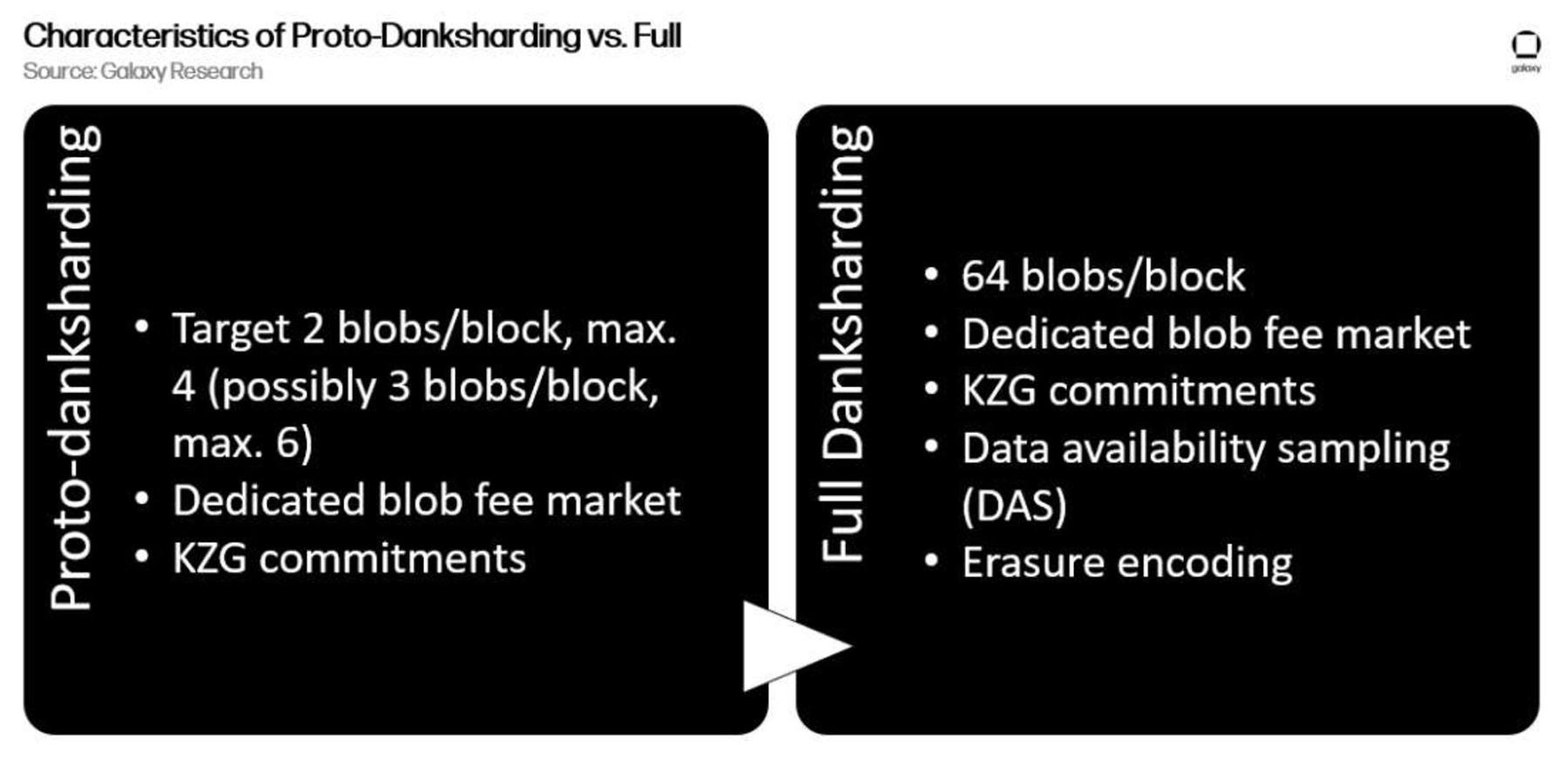

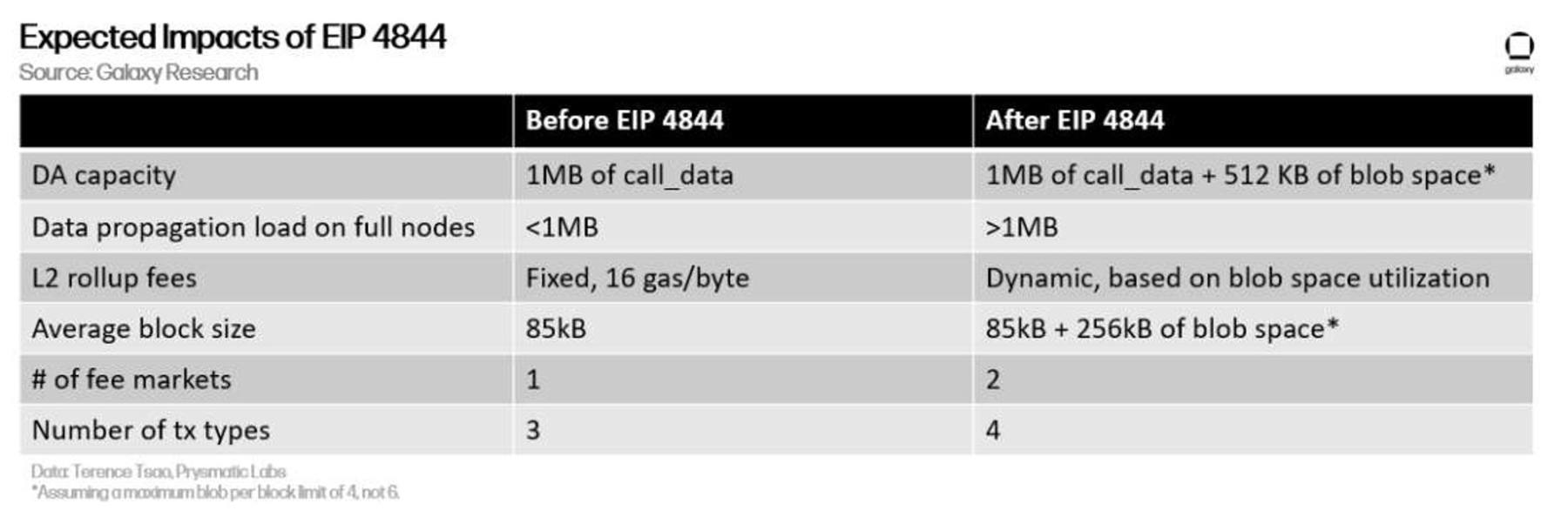

Typically, the cost to publish a large amount of data to Ethereum is high, in part because the network permanently stores the data as part of the “CALLDATA” field in transaction history. With EIP 4844, each block will create an additional 512kB or 768kB of data space for rollups. Ethereum core developers are weighing how much additional space should be created for blob transactions. It is important to note that the data published to this space will be stored for approximately three weeks. Due to the transience of data verified through blob transactions and the independent pricing market of blob pricing isolated from other types of transactions, the cost of rollups publishing data to Ethereum will theoretically be greatly reduced. Over time, developers plan to introduce data sampling techniques so that blob data does not need to be downloaded in full by Ethereum full nodes for verification, further reducing the cost of rollups. Proto-danksharding is a prelude to full danksharding that will allow Ethereum nodes to download fragments of blob data to determine the availability of complete blobs.

- AI robots are opening up new horizons

- AI can’t save 618 either.

- Understanding How Proto-Danksharding Accelerates Ethereum’s L1 Rollup Scalability

This report delves into the details of how EIP-4844 works, the limitations of the original sharding, the evolution of EIP-4844 to a fully empty plan, and some considerations about the direct benefits to end users and decentralized application (dapp) developers when the code changes are implemented as planned in the fall of 2023. Given that the focus of the original danksharding was on supporting the Layer 2 rollup ecosystem and modularly extending Ethereum, the code changes to be implemented in the next Ethereum upgrade will be a significant testbed for the application of modular blockchain papers at scale on one of the world’s largest public blockchains.

Background

EIP-4844 is considered to be an Ethereum scalability upgrade. However, it should be noted that the changes to this code do not substantially increase or introduce improvements to Ethereum’s transaction capabilities itself. Proto-danksharding lowers the cost of publishing large amounts of data to Ethereum, thus lowering the operational costs of rollups. EIP-4844 is considered an improvement to Ethereum’s scalability because it makes Layer 2 networks built on top of Ethereum more cost-effective, but this code change does not improve Ethereum’s scalability as a general-purpose blockchain for transactions and smart contract code execution.

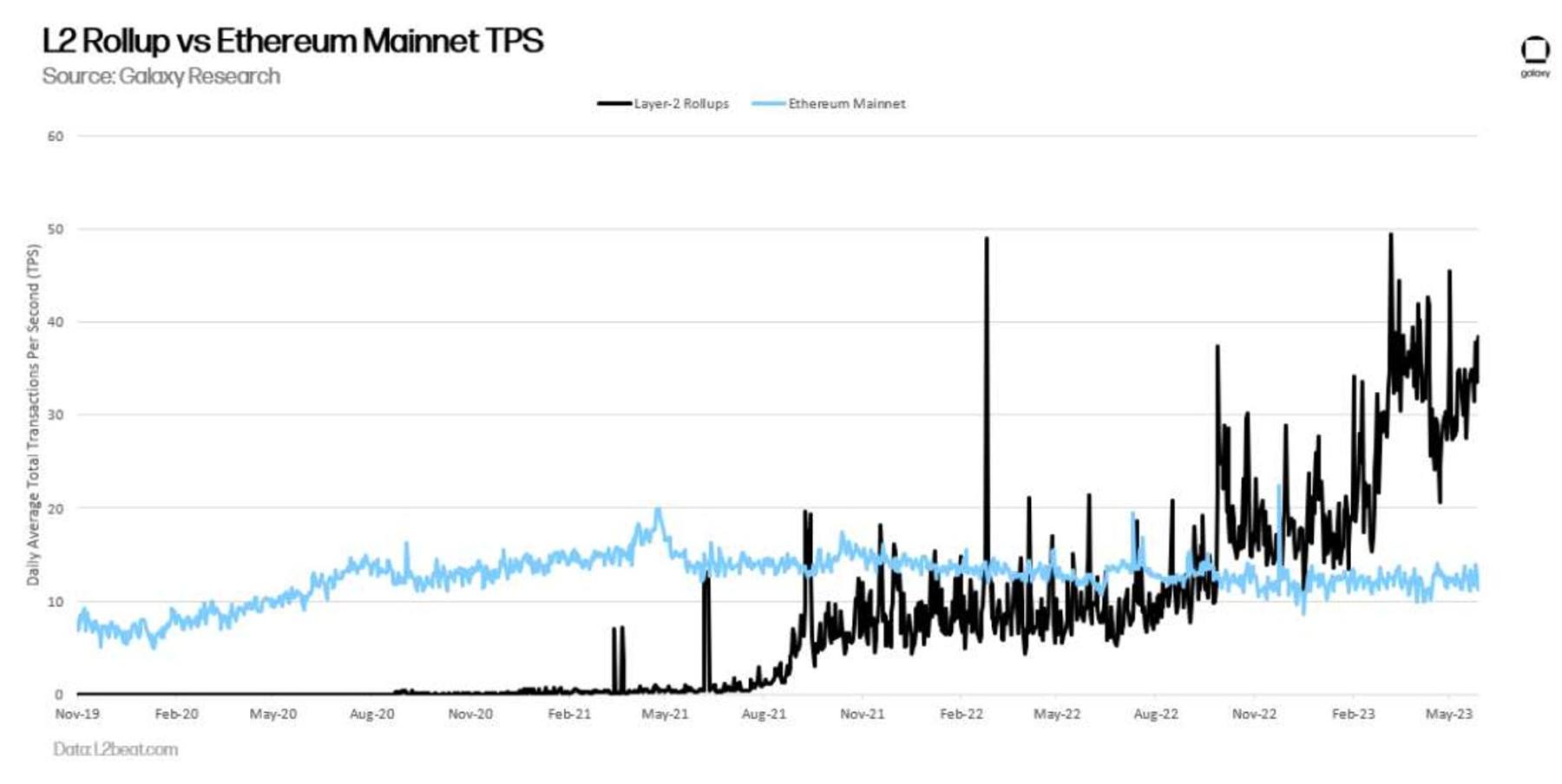

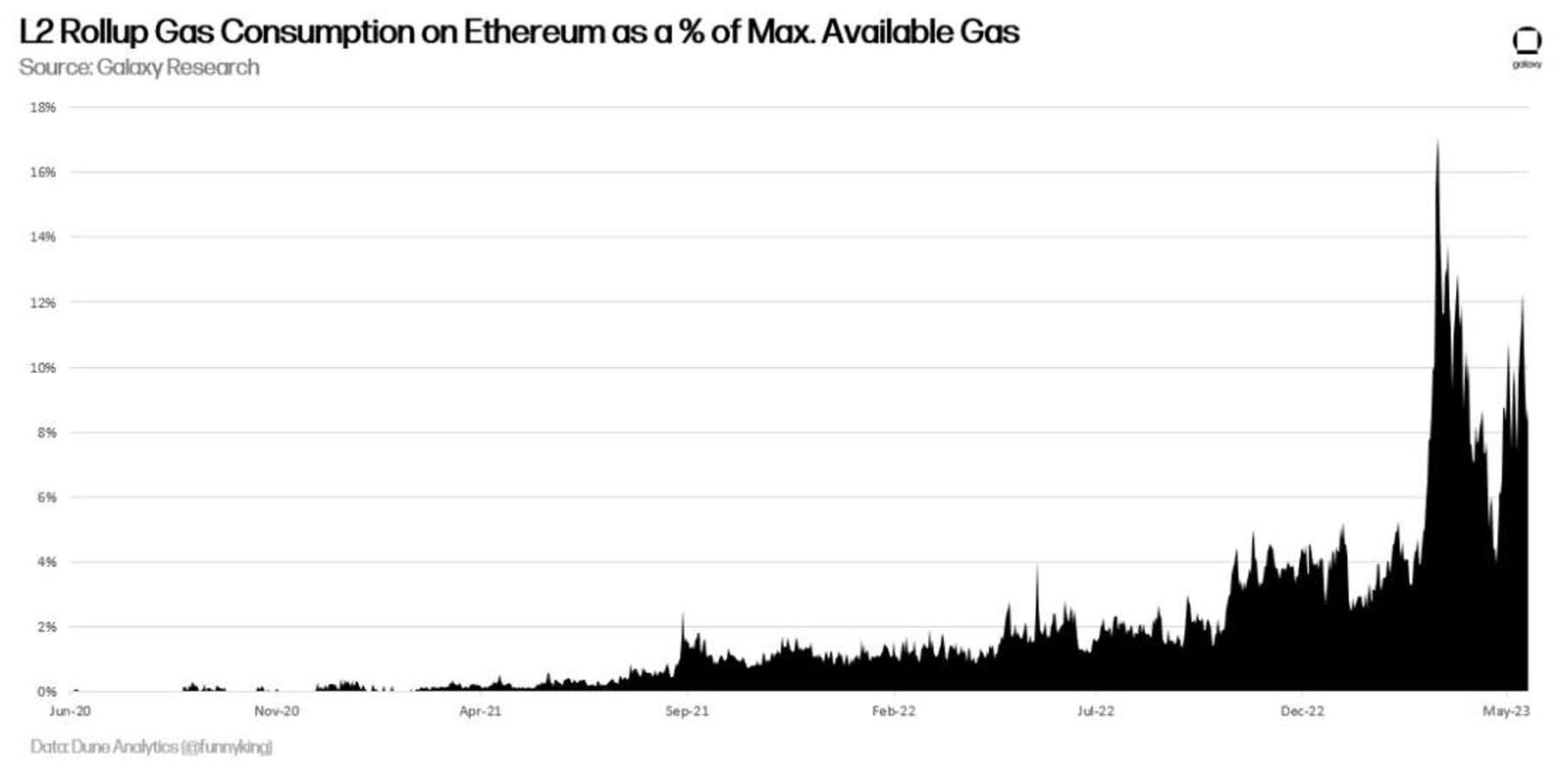

Over the past four years, transaction activity on Ethereum rollups such as Arbitrum, Optimism, StarkNet, zkSync, and Polygon zkEVM has been increasing. L2Beat.com estimates that the total transactions per second (TPS) implemented on all Layer 2 networks is 3.8 times the daily average TPS on Ethereum.

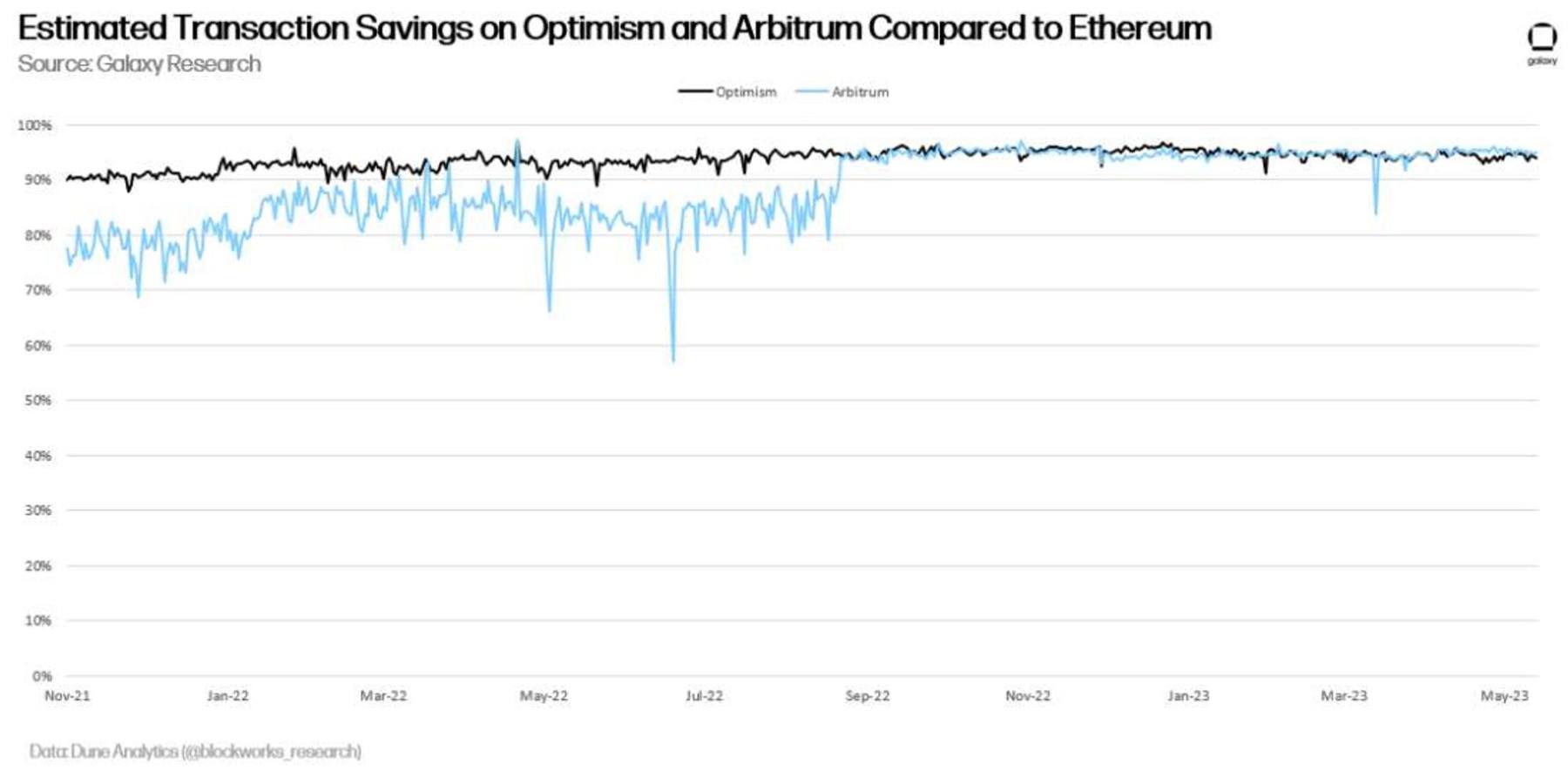

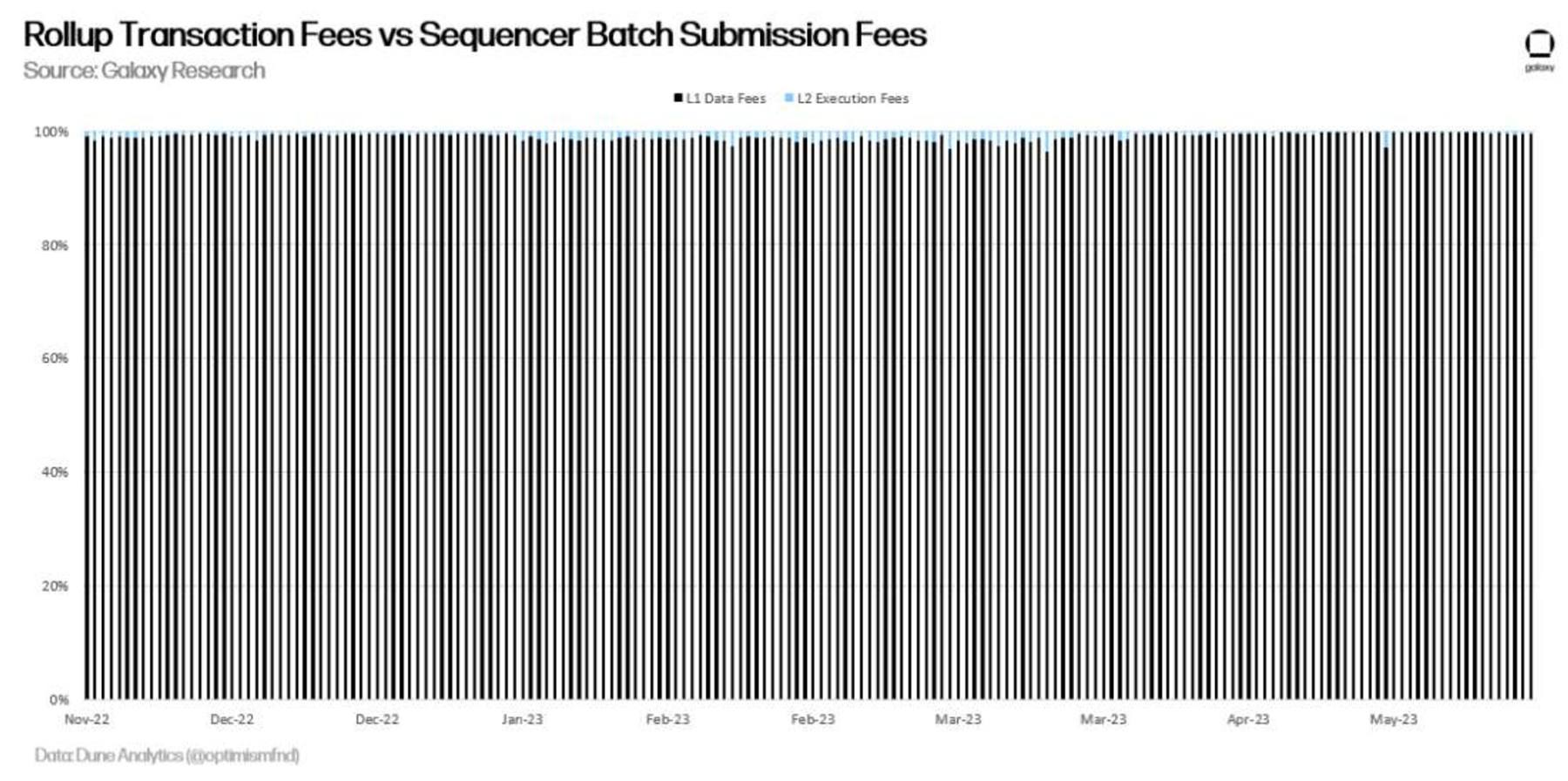

According to data provided by Blockworks Research through Dune Analytics, rollups save end users and dapp developers more than 99% of gas fees compared to the cost of deploying code and transactions directly on Ethereum.

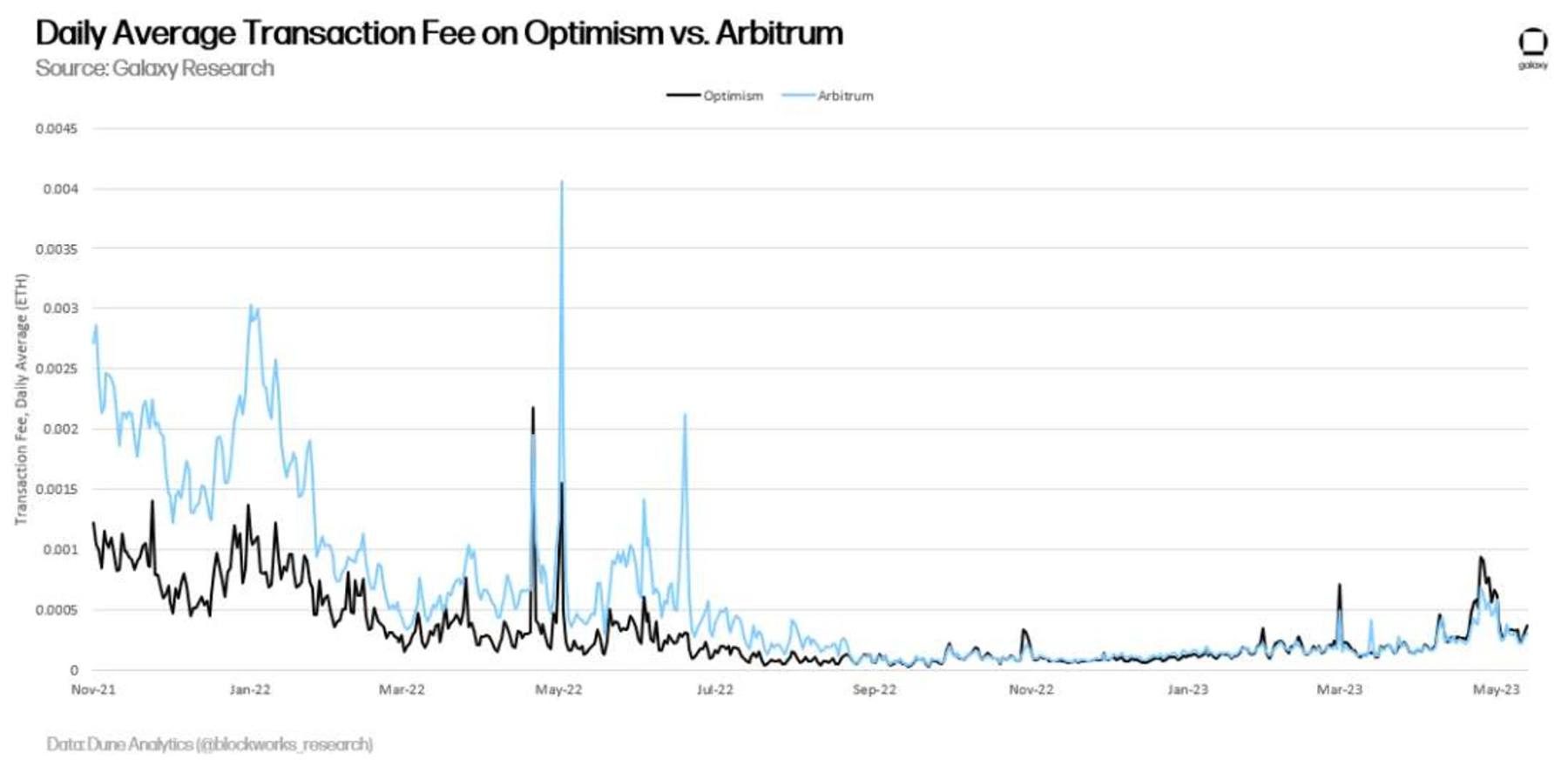

As of June 13, 2023, the cost of sending transactions on the two most popular Ethereum rollups, Optimism and Arbitrum, trends towards around $0.03 to $0.05. However, in cases of frequent on-chain activity and network congestion, these costs can sometimes soar to over $1.

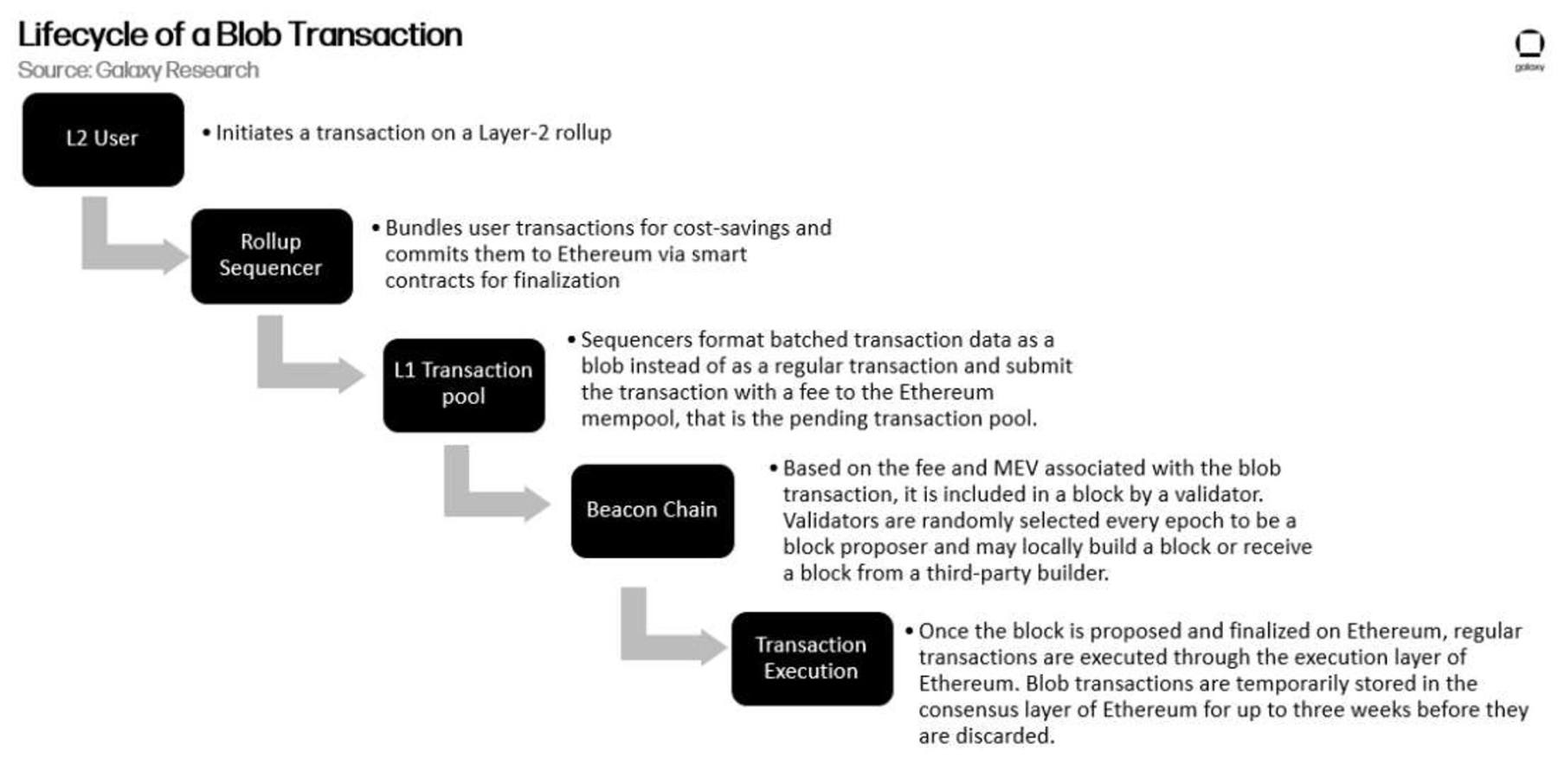

EIP-4844 aims to reduce rollup costs by introducing a new transaction type, Binary Large Object, or blob. The following is a step-by-step explanation of the lifecycle of a blob transaction as defined by EIP-4844:

EIP-4844 does not affect how regular transactions submitted to the Ethereum mempool are included in blocks or how the fee market that determines Ethereum block space prices operates, but it does increase Ethereum block storage requirements. The additional data space is for attaching blob transactions to blocks. Blobs are like sidecars that can be attached to Ethereum blocks without affecting or crowding out existing block space used to process regular transactions. Blob block space will be auctioned off according to its own fee market, following the fee market design of EIP 1559. For more information about EIP 1559, please read this Galaxy Research report. Initially, blob transactions will have virtually no cost. After that, if more than half of the blob block space (at least 256kB) is utilized for a block, the cost of blob transactions will increase by 12.5% per confirmed block. For every block where the blob block space is not fully utilized, i.e., where the blob block space is filled less than 50%, the cost of blobs will decrease by 12.5%.

Blob transactions will not be stored on Ethereum indefinitely, but rather on Ethereum’s consensus layer (CL), the Beacon Chain, and will be purged from CL nodes after three weeks. Proto-danksharding will allow for a maximum of four blobs per block, with each blob able to contain up to an additional 128kB of data. The maximum limit of 512kB of blob space per block may change as tests for EIP-4844 are underway. Developers are actively discussing the possibility of increasing the limit from four blobs to six. Each blob is an opportunity for a single rollup sorter to confirm a batch of transactions onto Ethereum. With approximately 7,094 blocks produced per day on Ethereum, assuming a limit of four blobs per block after EIP 4484, up to 28,376 blobs can be processed per day at most. (This is a theoretical maximum and may never be reached in practice due to the dynamic nature of blob fees. The cost of processing the maximum number of blobs per block continuously is prohibitively expensive for a sorter.)

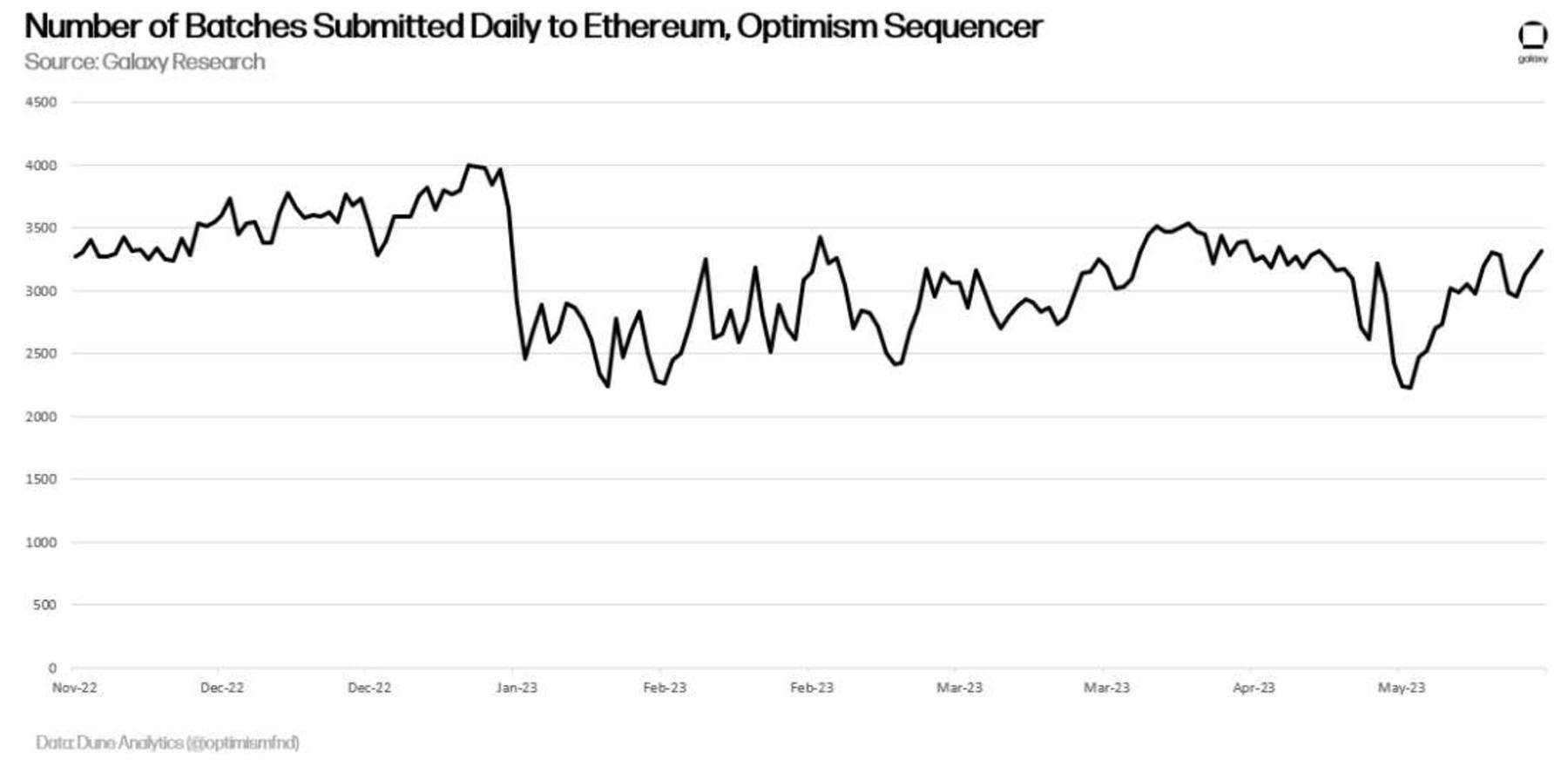

Over the past six months, the Optimism sequencer, which runs on Optimism, has been the second-largest Ethereum rollup in terms of transaction activity, submitting approximately 3,126 transaction batches to Ethereum every day.

Arbitrum’s confirmed transaction volume is about twice that of Optimism and, like Optimism, relies on sequencers to submit data to Ethereum via CALLDATA to complete transactions. Other examples of popular rollups on Ethereum include, but are not limited to, Polygon zkEVM, zkSync, and StarkNet. On Optimism, over 90% of fees come from Layer 1 CALLDATA fees.

The introduction of dedicated data storage space, no matter how small at the outset, is intended to reduce the cost of using Ethereum as the DA layer for all Ethereum-based rollups. Rollup developers conservatively estimate that rollup fees will be reduced by 100% to 900% from the activation of EIP 4844. However, these estimates may change based on the increase in rollup adoption and activity in the several months before and after the original database activation.

The cost of blob transactions, while initially cheaper than regular transactions at the activation of EIP 4844, may quickly rise if the number of rollups built on top of Ethereum increases. Additionally, while each blob is intended to provide the opportunity for a single sequencer to publish up to 128kB of data, rollup sequencers may coordinate to have a single blob contain data from multiple rollups. Ethereum developers are aware that, due to the limited number of blocks and the possibility that a single transaction batch may not fully utilize all 128kB of data space in each blob transaction, there may be a secondary market for pricing blobs. While preventing the emergence of off-chain secondary markets is a priority, rather than introducing higher levels of protocol complexity to prevent this possibility, developers are currently taking a “wait-and-see approach” with the introduction of blobs through EIP 4844 and plan to further optimize EIP 4844 in the future.

The original hash lays the foundation for introducing more advanced technologies to further reduce blob costs without increasing node computational load. Called full abandonment, the full vision for blobs is to increase the maximum number of blobs per block from 4 to 64.

Complete Danksharding

Four blobs add 512kB to Ethereum block size. Six blobs will add an additional 768kB to Ethereum block size. As previously stated, the extra block space is strictly used for blob transactions and does not permanently store data like regular block space. The full vision of EIP 4844 is to introduce up to 64 blobs to Ethereum and achieve this without significantly increasing block validation node compute load. To achieve complete danksharding, Ethereum needs to implement two technologies: Data Availability Sampling (DAS) and Erasure Encoding.

Data Availability Sampling (DAS)

With the goal of verifying Layer 2 rollup transactions, DAS ensures that all data fragments bound by the sequencer have been published to the chain. Full nodes are randomly selected to download a piece of data from a blob and generate a data availability proof. The more times full nodes sample the data, the greater the probability of deterministic assurance that all data has been provided from the sequencer without withholding important data. For nodes, the process of sampling data is less computationally intensive than downloading the entire blob data, but theoretically provides the same data availability guarantee. Similar to the original abstention, blob data sampling under full abstention will ensure that transactions from the sequencer have been verified and published on the chain for any user or network stakeholder to evaluate. Users and stakeholders then have a period of time to view these transactions, confirm that they have been finalized on DA layer like Ethereum, and build new batches of transactions based on the previous batch.

Through DAS, Ethereum developers are confident in increasing the number and size of blobs released to Ethereum without adding node compute load. Additionally, developers plan to further reduce node compute load in future upgrades through implementations such as historical expiry proposals. According to Dankrad Feist, Ethereum researcher, over time Ethereum will become more like a “public bulletin board than an archival system,” pushing the responsibility for maintaining full copies of transaction history onto network stakeholders who frequently use this data such as Layer 2 rollups and blockchain infrastructure companies like Infura, Alchemy, and Blockdaemon. While EIP 4844 introduces blobs as an early example, it demonstrates that all transactions may one day become storage on Ethereum.

Erasure Coding

Erasure coding technology strengthens the ability to sample data. If a malicious sorter withholds a few blocks of data anywhere between 1% and 49% of the blob data, probabilistic transaction sampling may result in some samples being proven to have been returned as correct right from the beginning, rather than incorrect. Erasure coding ensures that if at least half of the blobs are verified, the rest of the blobs can be reconstructed. This technique is effective only when the data is represented as a polynomial, that is, an expression with two or more algebraic terms. The most common form of erasure coding relies on Reed-Solomon (RS) codes, which is an advanced mathematical formula that can solve for missing data based on enough known data fragments. Intuitively, sampling alone may not effectively guarantee the availability of a large amount of data, especially when assuming a malicious sorter withholds a single piece of data from a blob. Erasure coding introduces data redundancy to the blob, so the malicious sorter necessarily needs to withhold a significant portion of the blob data in order to withhold any amount of data.

The coupling of DAS with erasure coding is the basis of completely blank technology. These technologies are also behind certain DA layer technologies, such as Polygon Avail and Celestia. In many ways, the vision of supporting modular blockchain computation is being tested on a small scale through other blockchain projects and will be tested on Ethereum, in part through blanking the original code and carefully testing it through full code blanking.

KZG Commitments

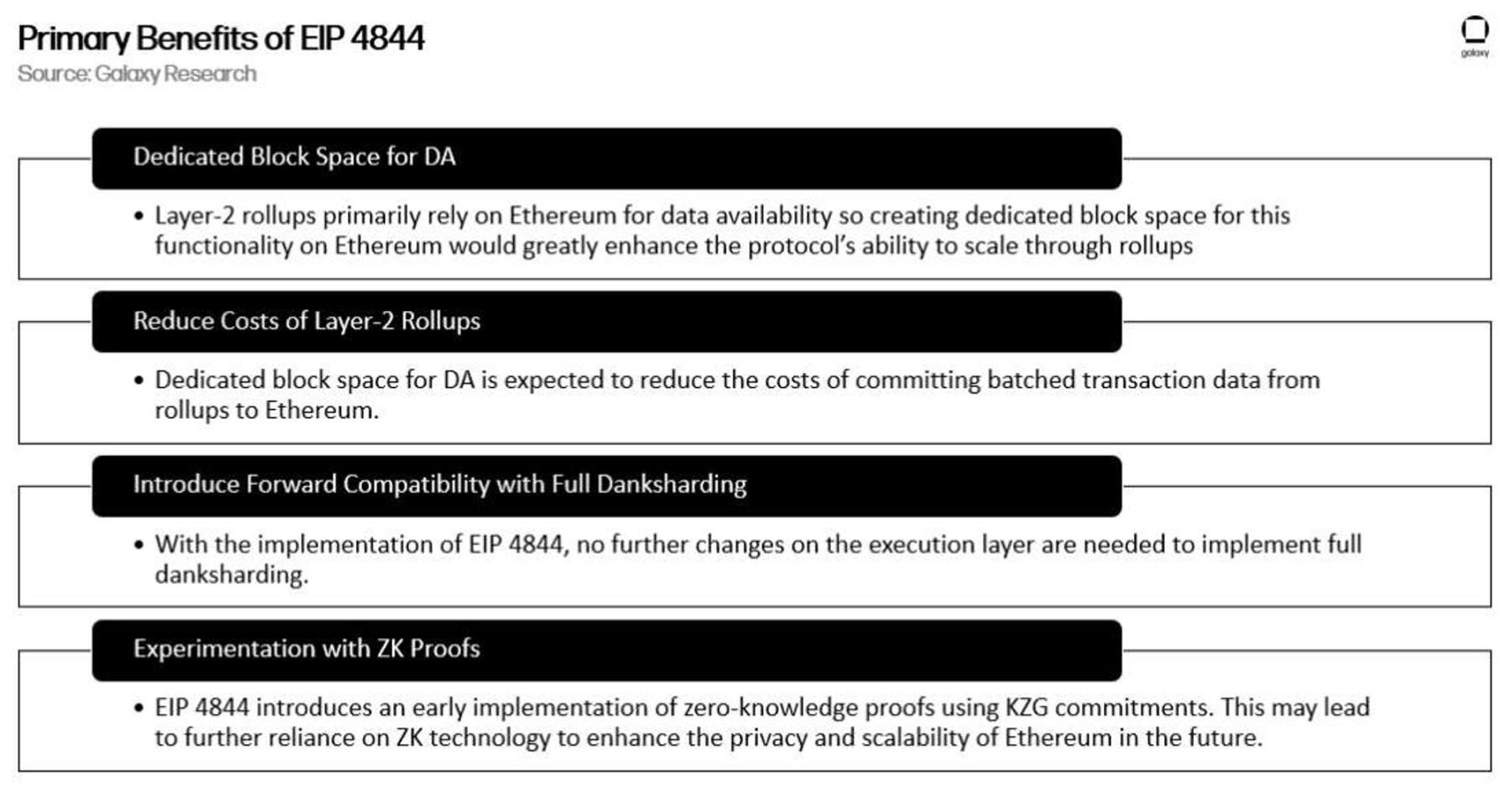

Before DAS and erasure coding can be implemented on Ethereum, full blanking needs to implement KZG commitments. Kate Zaverucha Goldberg (KZG) commitments are a zero-knowledge (ZK) proof system that can evaluate a polynomial without revealing the entire polynomial. Large data objects such as blobs can be efficiently manipulated and proven by computers if they are first represented as polynomials. EIP 4844 is important in that it introduces KZG commitments as part of the validation and proof generation process for blobs. For Layer 2 rollups that depend on ZK proofs, KZG commitments can represent the calculation of transactions and the state of the rollup protocol. In the context of EIP 4844, KZG commitments can check the attributes of a blob without needing to read the entire contents of the blob transaction.

KZG Ceremony

The KZG commitment scheme used to validate blobs depends on a secret value generated once via a trusted setup. Some cryptographic protocols, such as Zcash, Tornado Cash, and Filecoin, rely on trusted setups to securely generate a secret value for repeated on-chain computations. The EIP 4844 trusted setup ceremony is set to begin in January 2023. It has received close to 100,000 contributions from the Ethereum community. As background, a trusted setup ceremony is a one-time program that generates a piece of data for a cryptographic protocol from contributions from more than one party. The goal of combining entropy from multiple contributions in a trusted setup ceremony is to generate a secret value that is almost impossible to regenerate or guess. It is critical that the final value generated from a trusted setup ceremony cannot be regenerated.

As of May 2023, the KZG ceremony is still open for contributions and may close several months before EIP 4844 is activated on the mainnet. Most of the ceremony contributions are made through a publicly accessible website funded by the Ethereum Foundation. Users connect with their Ethereum addresses and automatically run calculations, create randomness, and improve the security of secret values. Additionally, there are other contributions created through unique events involving music, large groups of people, animals, and even a marble machine.

Mr. Moloch's Ephemeral Album II, a music event contributing entropy to the KZG ceremony.

Benefits and Impact

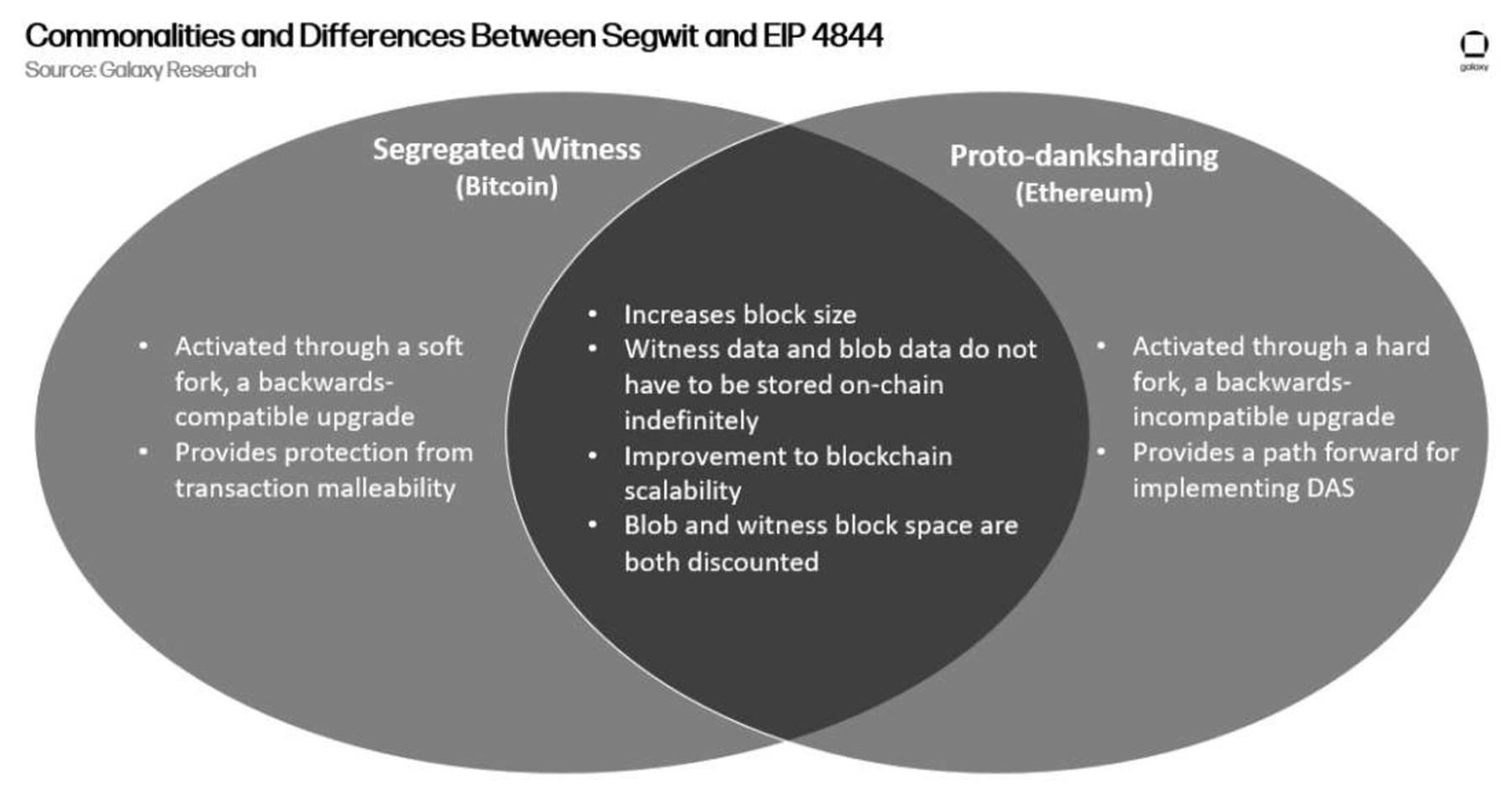

Introducing blobs on Ethereum and segwit on Bitcoin have many similarities. Both code changes introduce modifications to the way data is stored on-chain, resulting in an increase in effective block size and supporting the existence of Layer 2 protocols. However, one of the main differences between segwit and EIP 4844 is the expected long-term impact of these code modifications. While segwit was designed to address a direct vulnerability in the protocol code and support the creation of the Lightning Network in the short term, the motivation behind EIP 4844 was to lay the foundation for further scalability optimizations such as DAS and ultimately perform well as an optimized DA layer. Proto-danksharding enhances Ethereum’s ability to support Layer 2 rollups and service rollup orderers while encouraging end-users to transact on rollups instead of directly on Ethereum in the long term.

Compared to data that fills regular Ethereum block space, blob block space differs in several key attributes. First, the gas cost for blob transactions is expected to be cheaper than for regular transactions due to their ephemeral nature. Second, while dapps, developers, and end-users can easily retrieve regular transaction data stored in Ethereum blocks and interact with smart contracts through the Ethereum Virtual Machine (EVM), which is Ethereum’s execution environment, blob data will be comparatively harder to retrieve and interact with. Blob data will be stored in Ethereum’s CL, so it can only be accessed in limited operations, namely transaction confirmation and finalization.

Looking to the future, one of the metrics to watch for the impact of EIP-4844 is the reduction in rollup costs. Using the CALLDATA field in Ethereum transactions to publish batched transaction data to Ethereum costs 16 gas per byte. On the other hand, the cost of blobs will be almost free to start and then gradually increase. In addition to the cost of blobs, another metric to watch for the impact of EIP-4844 will be the data propagation load on full nodes. Regular Ethereum transactions are less than 1kB in size, meaning Ethereum nodes can easily propagate this data without requiring high bandwidth. However, blob transactions can individually reach 128 kB in size, meaning blobs require nodes to do more computational work to propagate.

Below is a table summarizing several metrics related to evaluating the impact of EIP-4844:

Like the case of Bitcoin’s Taproot upgrade, it is difficult to predict all the utilizations of blob transactions and blob block space, aside from the expected use case of handling Layer 2 rollup transactions. Given that the adoption of Layer 2 rollups over the past few years has been unstable and subject to extreme fluctuations, it is also difficult to accurately predict to what extent EIP-4844 will reduce the cost of Layer 2 rollups. Layer 2 rollups have been undergoing their own significant upgrades and improvements over the past few years. In August of last year, Arbitrum Nitro completed its Nitro upgrade, reportedly increasing transaction throughput by over 7 times. Optimism completed its Bedrock upgrade on June 6, 2023, with the goal of reducing end-user fees by 10% and introducing other improvements that affect the user experience.

As rollup capacity and functionality built on Ethereum continue to evolve, it is difficult to accurately predict the extent to which EIP-4844 will impact the cost and activity of Layer 2 rollups. In summary, the expected benefits of EIP-4844 for Ethereum are:

Focus and Considerations

The idea of EIP-4844 was conceived at the ETHDenver Ethereum conference in February 2022. The first EIP 4844 testnet was launched in August 2022. Since then, the Ethereum client teams have iterated on the code and released four additional testnets. As developers work to launch their sixth dedicated testnet, there are still some outstanding questions surrounding the implementation of EIP-4844. As of May 2023, some ongoing discussions around the implementation of EIP-4844 include:

De-SSZify EIP-4844 specifications: For several months, developers have been discussing the ideal way to serialize the new blob transaction type. Initially, developers were leaning towards introducing early SSZ iterations in EL through blob transactions. Unlike CL, Ethereum’s EL traditionally relies on a serialization format called RLP. Eventually, developers plan to upgrade all transaction types from RLP to SSZ, but given that the path from RLP to SSZ is still unclear and certainly not ready for implementation in Cancún, developers have decided to work towards removing SSZ from EIP 4844, at least from the EL side.

KZG commitment library: People have been paying attention to the readiness of the KZG commitment library, which provides implementations of the KZG functions defined by EIP-4844’s polynomial commitment specification. However, some key aspects of the library are changing, making it difficult for the Ethereum client teams to use and integrate these libraries into their codebases.

Testing through Geth (EL) clients: EIP-4844’s testing is based on a forked version of the Geth (EL) client. Developers are actively working to migrate the tests for EIP 4844 into the main Geth codebase.

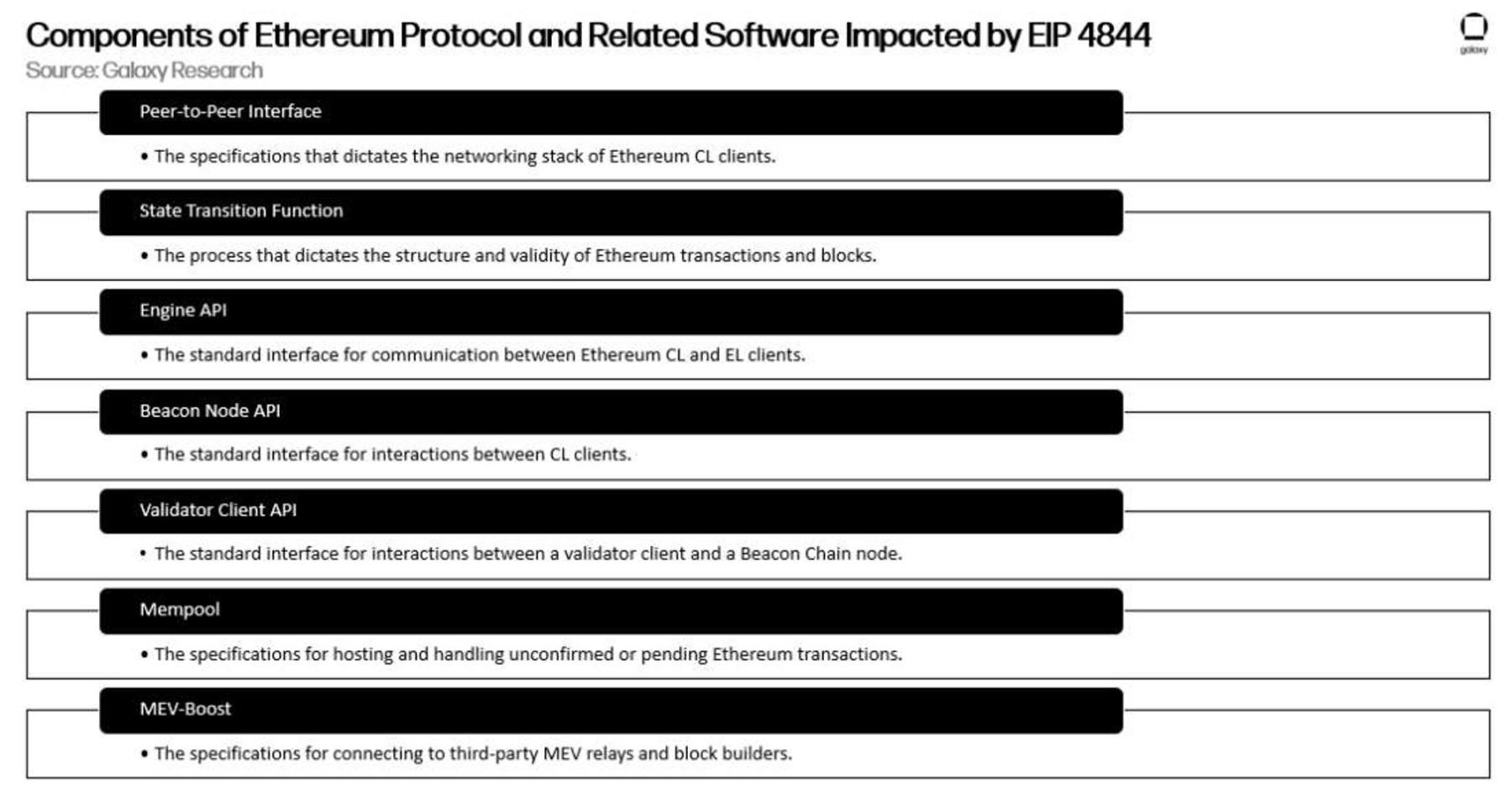

MEV-Boost testing: MEV builders and relayers haven’t started seriously testing blob transactions yet. Developers are exploring how to incorporate testing of MEV-Boost-related software as early as possible in the EIP-4844 development process.

Blob fee market design: The fee market for blobs is based on the design of EIP 1559. EIP 1559 increases the gas cost of transactions by 12.5% in either direction based on block space capacity. However, the implementation of EIP 1559 on Ethereum has brought high volatility to block size. To avoid similar results for the use of blob block space, developers are considering alternative parameters for blob gas fees.

Decoupling blob propagation from block propagation: Block data is clearly more important in the propagation of Ethereum nodes. Therefore, developers are exploring strategies to decouple blob propagation from block propagation so that transaction processing speeds are not hindered by blob activity.

Blob transaction mempool during chain reorgs: In the case of chain reorgs, regular transactions are reinserted into blocks. Due to the decoupling of blob propagation from block gossip, there is no direct way to ensure that all blobs in the mempool can be reconstructed after reorgs. Developers are considering how to handle blob transactions in the case of a temporary chain split.

Handling blob transaction loss: Unlike transactions that can be easily canceled by users after being submitted to the mempool, blob transactions are much more difficult and resource-consuming to propagate, and once broadcast, they should not be easily canceled or replaced. Developers can penalize blob transactions that are invalid after being submitted to the mempool.

According to the scope of the next Ethereum upgrade, known as Cancun on EL and Deneb on CL, the activation of EIP-4844 on the Ethereum mainnet is tentatively expected to occur in the fall or winter of 2023. Any upgrade on Ethereum requires extensive testing and coordination. Since the merge, Ethereum’s protocol has expanded and become noticeably more complex. The following is a partial description of Ethereum’s protocols and related software that must be updated when preparing for the Cancun upgrade.

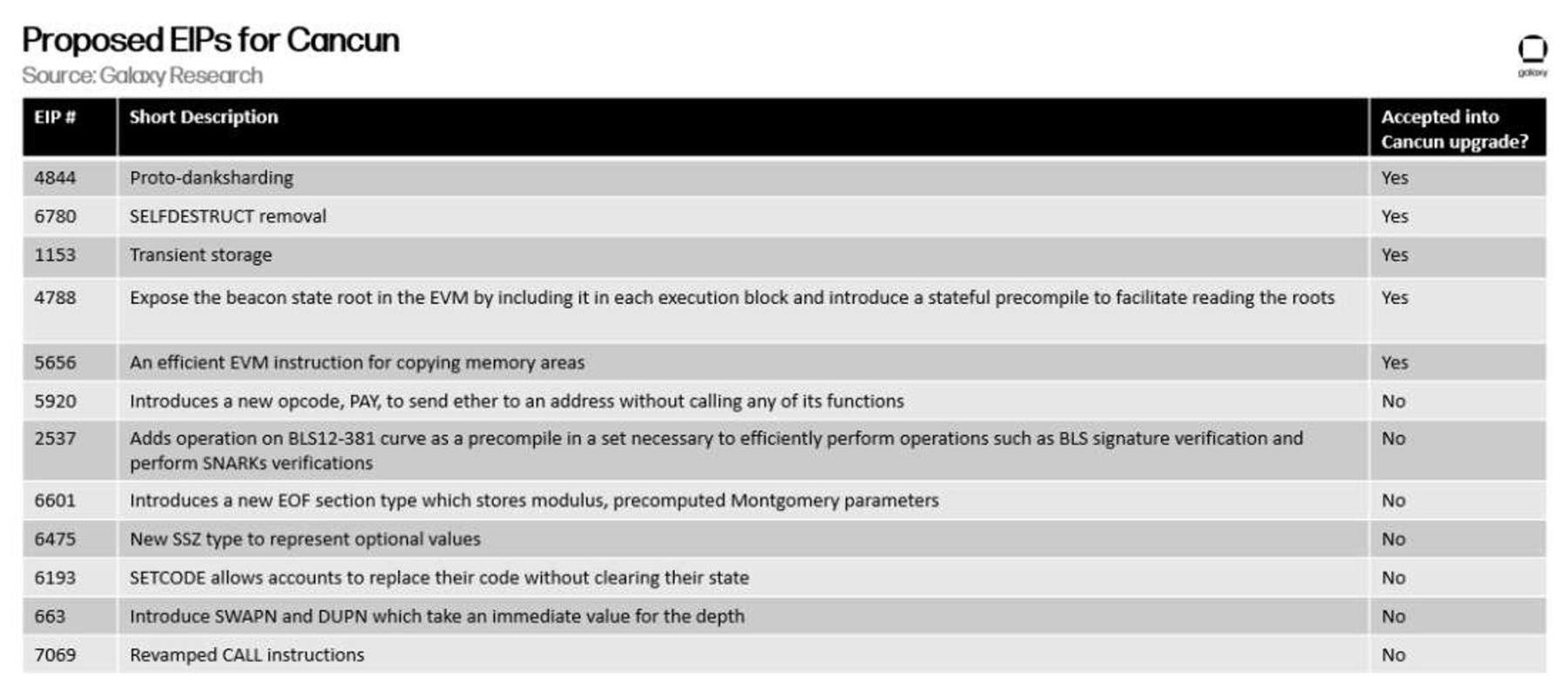

In addition to EIP-4844, the following four EIPs will be launched in Cancun:

-

EIP 6780, SELFDESTRUCT only in the same transaction: This EIP changes the functionality of the SELFDESTRUCT opcode so that the SELFDESTRUCT opcode can be deprecated with minimal impact on existing smart contracts.

-

EIP 1153, Instantaneous storage opcode: This EIP introduces an instantaneous storage opcode, which behaves the same as the storage opcode, except that the data is discarded after each transaction, making smart contract design more concise and saving gas for end users.

-

EIP 4788, Beacon block root in the EVM: Expose the beacon chain block root in the EL block header to allow proof of CL state in the EVM. This will improve trust assumptions for staking pools, re-staking constructs, smart contract bridges, MEV protocols, and more.

-

EIP 5656, Memory copy instruction: Introduce a new EVM instruction for copying memory regions, providing an efficient means of building data structures and deploying computationally intensive operations on Ethereum.

Similar to the process of upgrading Shanghai, Ethereum core developers are prioritizing the activation of EIP-4844 as the primary code change for entering Cancun. Therefore, due to the complexity of EIP-4844 and the significant amount of time and work required for thoroughly testing the code changes, developers have decided to reject all other EIPs proposed for Cancun, except for the four mentioned above. Our idea is to keep Cancun as streamlined as possible, only including other EIPs if their complexity is minimal or if they have a high degree of urgency. The urgency of EIP-4844 takes precedence over other EIPs that have had their priority canceled for the upgrade, which is a controversial topic that highlights Ethereum’s need for improvements beyond scalability.

On the Need for EIP-4844

EIP-4844 is an upgrade that will lower the cost for end-users to send transactions and deploy smart contracts. While transaction activity on rollup was high for a while, causing transaction fees to increase to over $1, since January 2022, fees on rollup, as well as Ethereum in general, have been relatively low. As of June 14, 2023, the majority of Layer 2 rollups have ETH transfer fees that are often below $0.20.

If there are no high fees or transaction congestion on Ethereum, there is no economic incentive to move economic activity to rollup. Based on Ethereum’s 8-year on-chain activity history, the rise in fees is only a matter of time and once again highlights Ethereum’s need for scalability solutions. However, in the short term, EIP 4844 cannot further reduce fees on Ethereum without a catalyzing event or narrative that drives on-chain activity.

Even if a catalyst that drives economic activity and growth for Ethereum-based dapps emerges before and after the activation of EIP 4844 this year, it is unclear whether Ethereum inflated with transaction activity will meaningfully move to rollup to take advantage of cost savings. Although cheaper to use than Ethereum, and even much cheaper today, rollup is in its infancy and cannot yet provide users with the same level of security, usability, or decentralization as Ethereum. Most rollups on Ethereum today may never reach parity with L1, as rollup technology is evolving, and new rollup designs are making current rollups obsolete.

Ethereum stands out as the world’s most secure and decentralized general-purpose blockchain, supporting thousands of dapps and also being operable and composable through standards like ERC-20 and ERC-721. While convolution developers are designing proof systems that support trust-minimized bridges and funding efforts to increase client diversity to eliminate reliance on multisig wallets, these efforts will take years to develop and deploy. At this stage of development, rollups are competing with other Layer 1 blockchains that also do not offer users and transaction activity the same high guarantees around network uptime, finality, or interoperability as Ethereum. Today’s rollups are not an attractive alternative to Ethereum.

Over time, rollups are expected to become more attractive, but code changes like EIP 4844 are unlikely to drive the adoption or activity of rollups before they can boast higher levels of decentralization, usability, and security. For most end-users of Ethereum, EIP 4844 has virtually no impact on their experience. For the few end-users who already use rollups, or who migrate to using rollups due to native database reasons, the effect will be cheaper fees, an improvement that does not matter for the security or interoperability of rollups.

It can be said that the sorter’s migration from CALLDATA to blob data will free up regular block space for end-users of Ethereum. Over the past 3 years, only an average of 2% of available block space has been used by Layer 2 rollups. Therefore, the impact of rollups’ migration from CALLDATA to blob data on available block space is minimal. Secondly, the increased usage of rollups by Ethereum’s end-users may lead to an increase in bridging activity, which could subsequently offset the minimal decrease in block space usage by the sorter.

The Urgency of EIP 4844

In the past 12 months, the cryptocurrency industry has been rocked by a series of protocol failures, hacks, high-profile bankruptcies, and criminal prosecutions. More broadly, the macroeconomic condition in the aftermath of the pandemic, rising inflation rates in some countries, notably the US, rising interest rates, have also led to a general decline in economic activity in both cryptocurrency and traditional financial markets. Additionally, government agencies like the US Securities and Exchange Commission (SEC) are increasing regulatory scrutiny on the cryptocurrency industry, keenly eying blockchain-based applications and services, among which those built on top of Ethereum are the most valuable and popular. Here are a few examples of headline news related to cryptocurrency and regulation since early 2023:

-

In February, the cryptocurrency exchange Kraken was sued by the US Securities and Exchange Commission for selling unregistered securities through their staking service, which led to them shutting down the staking service in the US.

-

In March, European parliamentarians voted in favor of an anti-money laundering bill that requires decentralized autonomous organizations, decentralized finance protocols, and non-fungible token markets to comply with the same due diligence measures as traditional banks and financial institutions.

-

That same month, the New York Attorney General (NYAG) filed a lawsuit against the cryptocurrency exchange KuCoin, and in the same lawsuit classified ETH as a security.

-

In April, the US Treasury Department released a report affirming that decentralized finance protocols need to comply with US anti-money laundering and sanctions laws.

-

In June, the US SEC sued the world’s largest cryptocurrency exchange Binance for violating federal securities laws.

-

That same month, the US Commodity Futures Trading Commission (CFTC) won a lawsuit against the decentralized autonomous organization (DAO) Ooki DAO for providing unregistered commodities.

As concerns over a cryptocurrency bear market and global economic recession intensify, legislators and regulators around the world continue to evaluate and assess the policies and rules that can and should impact access to and activity on Ethereum. In order for Ethereum to achieve its vision of becoming the world computer, Ethereum core developers must work to mitigate centralizing trends and strengthen anti-censorship qualities not just at the protocol layer but also at the application layer.

Over the past year, there has been increasing attention from the Ethereum Foundation and other high-profile Ethereum stakeholders to the phenomenon of maximum extractable value (MEV) precisely because of its centralizing effects. To mitigate the negative externalities of MEV, Ethereum core developers have partnered with Flashbots to establish MEV-Boost, an additional software for Ethereum validators to run in order to earn combined MEV without being centralized by the power of MEV. However, MEV-Boost is a stopgap measure that can only solve the problem of MEV in the short term and has centralizing effects of its own, which can be mitigated by implementing a protocol-native version of MEV-Boost, called Protocol-Based Sender (PBS), proposed by individual protocol proposers. For more information on MEV-Boost, please read this Galaxy Research report.

To some extent, the fact that EIP 4844 was prioritized as the primary code change to go into Cancun reflects the Ethereum core developers’ prioritization of scalability through rollups over other long-term initiatives and goals. After the Cancun meeting, deprioritizing other EIPs with similar original database complexity was another area of consideration around EIP 4844, indicating the Ethereum core developers’ sense of urgency to prepare for the upcoming transaction execution primarily taking place on rollups rather than on Ethereum as a DA layer.

However, considering recent trends in politics, regulation, and on-chain activity, prioritizing the original database ahead of EIPs like PBS and other initiatives intended to enhance Ethereum’s anti-censorship capabilities is not entirely based on demand or urgency. It is also based on the readiness of EIPs. A major upgrade to the availability of the Ethereum Virtual Machine (EVM) called the EVM Object Format (EOF), which was canceled from the merge, Shanghai, and recent Cancun upgrades, was due to a lack of preparedness for code changes among Ethereum core developers. EIP 4788 is an upgraded version aimed at improving EVM’s trust-minimized access to the Beacon Chain to support decentralized staking pools and other dapps built on Ethereum, which was evaluated for readiness at Cancun and accepted for upgrade on June 8, 2023.

Below are the proposed environmental implementation schemes to be included in the Cancun meeting and their status as of June 2023:

EIP 4844 doubles down on the idea of achieving long-term scalability through modularity, despite rollup technology being in its infancy. Modular blockchain design may undergo enormous changes in the coming years based on ongoing research and new technologies. The discussed EIP 4844 is a complete precursor to proto-danksharding, which is necessary for Ethereum to compete as a DA layer with highly optimized DA layers like Celestia. Based on the impact of EIP 4844 on Ethereum, the timing and idea of full sharding on Ethereum may change.

Conclusion

EIP 4844 is not a game-changing upgrade for Ethereum’s scalability since it does not reduce costs for Ethereum end-users. Proto-danksharding reduces the cost of rollups, primarily benefiting rollup users and operators. EIP 4844 sets Ethereum on a meaningful path to expansion through modularity and offloading transaction execution activity to other protocols. The benefits of the original database will primarily be confirmed by the rollup sorter paying for block space on Ethereum. The secondary impact of the original database will be felt by end-users and application developers initiating transactions eventually migrating from Ethereum to rollups over time.

Since 2022, transaction activity on rollups has increased while fees have decreased. Additionally, several breakthrough innovations have added to the confidence of Ethereum core developers and other Ethereum stakeholders in rollups as the future technology of scalable blockchain design. However, it is unlikely to achieve or be ready for full-scale adoption of the entire potential of rollups in the short term, certainly not before the expected activation of EIP 4844 in the third or fourth quarter of 2023. After EIP 4844, if there is no meaningful transaction activity migrating to rollups, proto-danksharding will not affect or reduce Ethereum’s fees. Ethereum end users will continue to suffer from the same high fee fluctuations and network congestion unless they submit transactions through rollup sequencers, which are typically centralized and operated by a single entity.

More than a silver bullet for solving Ethereum scalability issues, it is the first step towards turning Ethereum into a modular blockchain, primarily supported by Layer 2 rollups for transaction execution. EIP 4844 lays the foundation for the next step of complete abstraction and the use of polynomial commitments for DAS. For further reading on the Ethereum Layer 2 landscape, read this Galaxy Research report. In many ways, EIP 4844 is a vote of confidence in modular blockchain theory, and will encourage further experimentation with rollups on Ethereum. Modularization as a solution for scalable blockchains fundamentally reshapes Ethereum’s primary function from a general-purpose blockchain serving end users and application developers, to a DA layer serving sequencers.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Due to recent advancements, Web3 usernames may receive more adoption.

- TVL dilemma of ZkSync Era: The latecomers take the lead

- Inventory of the current state of the TreasureDAO ecosystem

- Bellevue Bank: Stablecoins and DeFi may become the next target of the SEC

- Crypto Kernel: Freedom, Carrier and Utopia

- Decoding the Ethscription protocol for creating NFTs on Ethereum using transaction data

- Interpretation of Bitmap Theory