Analysis: Aggregation Theory in DeFi

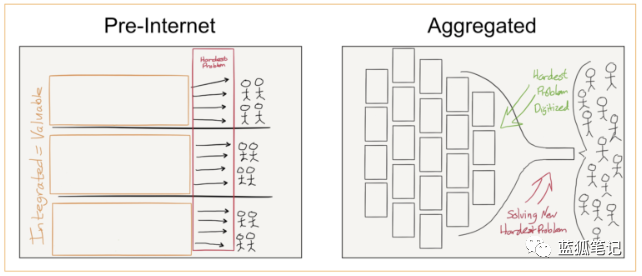

Traditional and digital value chain

Aggregation theory is used to explain and understand how companies rise, such as Google, Facebook, Netflix, Uber, and AirBnB, how to subvert their traditional counterparts and build a near-monopoly position in their industry. It ultimately comes down to the value chain, which is a consumer market that includes suppliers, distributors, and consumers, and how these value chains change as the Internet evolves.

(stratechery.com/2015/aggregation-theory/ value chain for the former Internet and post-Internet)

(stratechery.com/2015/aggregation-theory/ value chain for the former Internet and post-Internet)

In the former Internet world, supply and distribution were integrated, think about editing content + newspapers, video content + broadcast capabilities, taxis + dispatch. In all of these cases, distribution is difficult and expensive and is a difficult problem to solve. This leads to scarcity of supplies, and you won't be creating and editing content unless you have a distribution channel. Of course, companies with distribution channels will integrate backward into the supply sector, and their main challenge is to maximize and protect their supply value.

The core disruption of the Internet is to dilute distribution costs to almost zero. Instead of printing edits to thousands of newspapers, they are imported and published on the web. The impact is the modularity of supply: there is a large amount of commoditized supply across the network. This is a sign of true digital disruption: when the supply of an industry is digital and modular, existing players are starting to worry. It also means that for all financial technology innovations, they are not really disruptors. (Blue Fox Note: That is to say, financial technology does not have a large number of suppliers like the content field, so the innovation of financial technology has not really subversive. But when DeFi arrives, everything may change. )

- Quantum Chain Shuai Chu: Only by jumping out of the "framework", the future application of blockchain can achieve greater development

- Twitter Picks | Spring in Ethereum? BitPay Announces Support for ETH, $100 Million Real Estate Chain Ethereum

- The Queensland Real Estate Institute of Australia will launch a blockchain leasing agreement platform to empower the leasing industry with smart contracts

The existing business model is so threatened, because the most difficult problem of business has changed from “How to protect and maximize my limited supply?” to “How to manage these huge scattered supply for customers?” Just as Ben Thompson The change in this problem has led to a shift in the focus of the value chain:

“This fundamentally changes the platform for competition: distributors no longer compete on the basis of exclusive supplier relationships, in which consumers and users are secondary. On the contrary, suppliers can be commercialized, which leads to consumers. / User becomes the first priority."

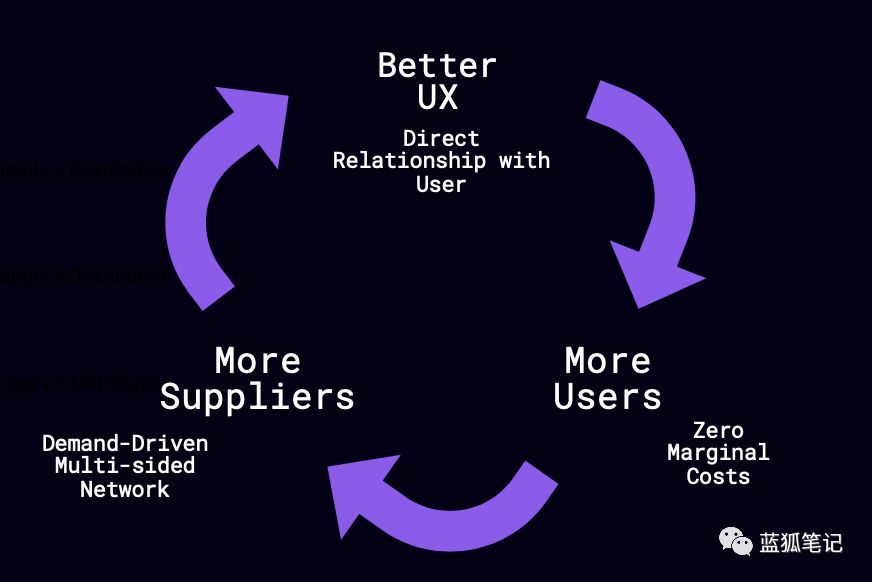

Polymerization theory network effect + driving factor

Supply management becomes a key issue for aggregators. With the oversupply of digital goods, users have found the greatest value in planning and supply discovery. Google search results and Netflix recommendations offer curated options, although Uber and Lyft automatically assign the best choices to users – but both approaches rely on turning a large supply into a convenient user experience. Consumers are seen as the highest priority, and UX becomes the starting point for aggregators' flywheels.

Aggregator flywheel and driving factors

Aggregator flywheel and driving factors

The agile cycle of aggregators is very straightforward: getting more users with better UX management offerings will motivate more vendors to join the aggregator's platform, which increases the user experience and keeps the loop. This led to the winner-take-all scenario, in which one or two aggregators attracted all users and suppliers.

As mentioned above, this is fairly straightforward, but the underlying drivers show the true characteristics of the aggregator. The user experience is very important because the aggregator has a direct relationship with the user. These users are added at zero marginal cost, allowing the platform to scale. The platform must be a demand-driven network where vendors are allowed to acquire users when they join.

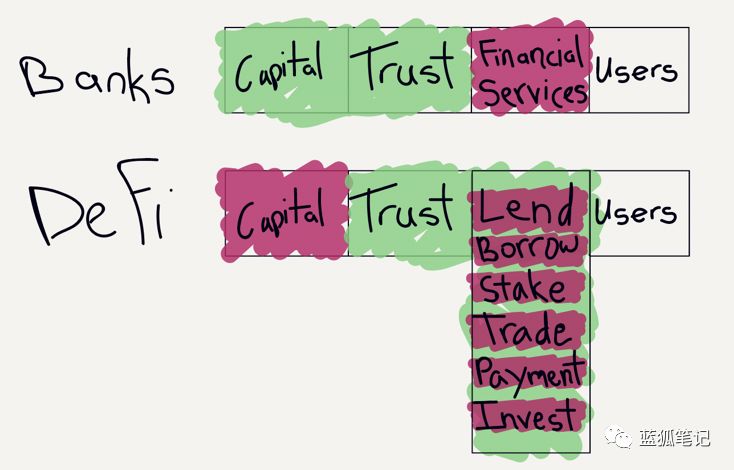

DeFi: Capital Modularity

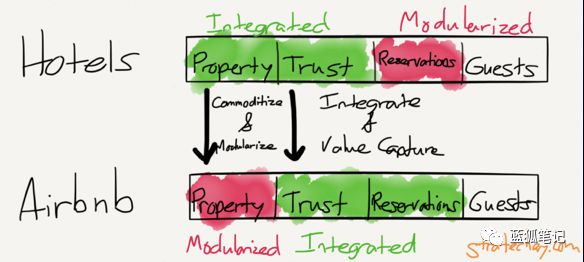

It's worth knowing in detail how aggregators are formed and how they succeed, because things get more complicated in DeFi's open ecosystem. However, at the macro level, the process is the same. The AirBnB example is particularly relevant to the DeFi industry.

Stratechery.com/2015/netflix-and-the-conservation-of-attractive-profits/

Stratechery.com/2015/netflix-and-the-conservation-of-attractive-profits/

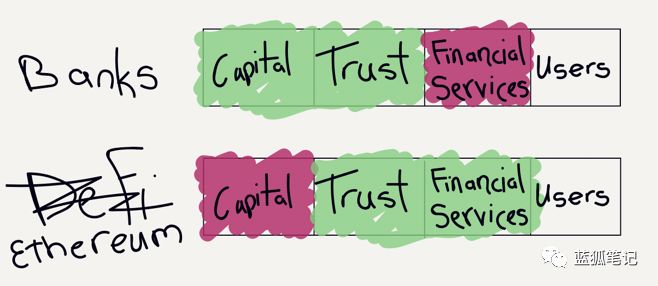

We can see that the hotel has traditionally integrated real estate and trust. You can see the building with the Hilton logo and you will believe that you can spend a safe night there. Reservations are handled one by one by the hotel, so it is modular and each hotel has a relationship with the guests. On the other hand, at AirBnB, it modularizes the home of people's homes and integrates trust and booking directly into the core experience of their app, which is in the hands of users.

The statement mentioned by Ben Thompson is highly relevant to the DeFi field:

“The commoditization of trust hurts the hotel far more than you think… Travelers in the days before Airbnb will take trust as a priority. In other words, the platform trust built by Airbnb does not mean a homestay room. And now it is more trustworthy than the hotel; instead, the hotel’s trust advantage has been offset, allowing B&Bs to compete on new vectors, including convenience, cost and environmental factors."

This is of course an opportunity represented by DeFi. In our modular capital (with our own bank), we integrate trust and financial services directly into the functions of the ecosystem.

This is where DeFi is interesting, however, because financial services are different from reservations. They are a diverse set of features, and the same users need access to all features. As a result, DeFi products actually look more like the following products: Personal financial services aggregate users and suppliers, and then aggregate themselves.

Aggregate aggregators: composability and DeFi value chain

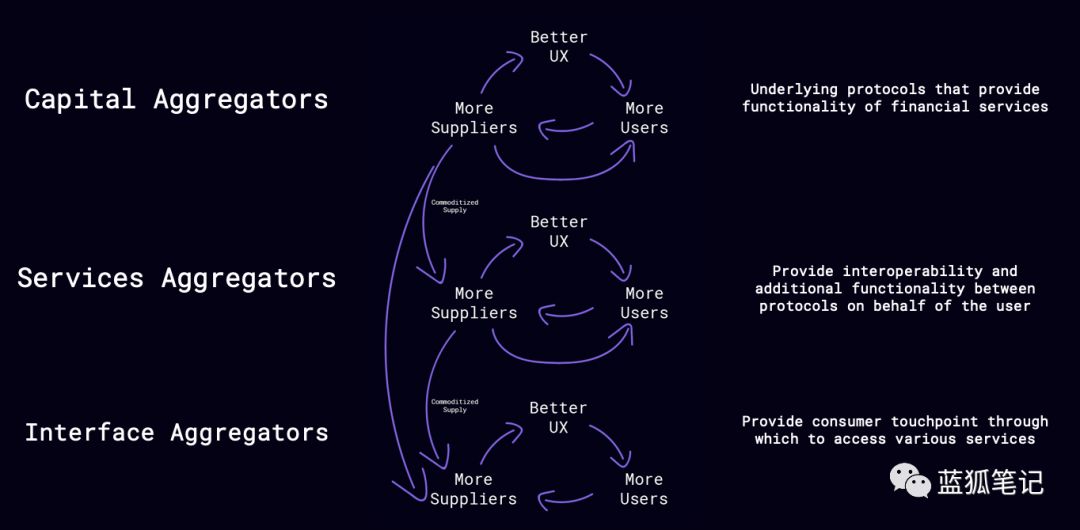

Unlike traditional aggregators, traditional aggregators exist in closed systems and data silos. DeFi aggregators exist in open ecosystems and are modular in nature, the so-called “money LEGO”. This means that we have capital aggregators, service aggregators, and interface aggregators.

Capital aggregators, such as Compound, Set, b0x, dYdX, etc., are the underlying protocols that provide financial services. Because they offer better UX, win more users, and attract more suppliers, they naturally aggregate at a higher level.

These higher-level aggregators will get more users and vendors, which means that the key to their success is that they are easy to integrate and secure, not the user experience. This leads me to believe that at this level, there is no winner, especially service aggregators (such as Topo) route capital through algorithms rather than brand reputation or user interface.

If Uber/Lyft's competitors want to challenge the dominance of these apps, they need super unique value pillars to win users and suppliers. (Blue Fox note: that is, at least 10 times more overwhelming advantage) If a platform wants to challenge Compound, what they need to do is to provide better rates, easier integration, higher security, and some Platforms (like Topo) to get the necessary liquidity.

At the level above the capital aggregator, we have service aggregators that provide interoperability between protocols while adding extra functionality. This is where Topo, Totle, Staked, Dex.Ag, idle Finance, MetaMoneyMarket, etc. are located.

The core belief here is that modular supply is inherently confusing. When we talk about new market structures and incentives around people's finances, it's very powerful to provide users with an easy way to understand that they are effectively allocating funds.

Unlike capital aggregators, user experience is the highest priority at this level, as service aggregators seek abstract complexity and automated decision making while choosing to have both users and integration from above.

At the top of the value chain, there are interface aggregators, such as wallets, asset managers, etc., which provide users with a single point of contact to access the underlying functionality. Interface aggregators focus on having users, the authorization of traditional aggregators, and the starting point for aggregating flywheels. However, the flywheel must start with a differentiated UX. It is not clear whether this is possible in an open system where anyone can insert and copy functionality.

We can see this in the products of Zerion, Argent, DeFiSaver, and Instadapp, all of which basically abstract the same underlying smart contract to provide the same functionality. This is not to say that these services are useless because they are critical and high quality products, and this is just a question of whether the strategy can have a significant network effect.

Obviously, this is just an oversimplified description of the current ecosystem, and we see that things related to services and interface aggregators are changing. The two teams try the user experience in a slightly different way, and over time they will fit into their own methods.

More questions than answers?

From the above aggregated aggregator model, one of the clear conclusions is that open ecosystems operate very differently than closed ecosystems. We see that all of the above aggregators have some imprints of traditional aggregators (users' zero marginal cost, demand-driven network, and ever-increasing user experience quality).

Ultimately, this means that aggregation theory is not the ideal framework for evaluating the cumulative value of platforms based on DeFi networks. It raises more questions than answers. Is liquidity king, or is the user king? What is the impact of splitting existing agreements? What happens when a more conservative wallet provider with a large user base enters the field?

Focus: Ethereum as aggregator

Although DeFi does not provide a clear answer by aggregating theoretical lenses, it does provide an effective framework for DeFi as a whole.

Although only time can tell us how the Ethereum platform generates value, we have seen the effect of Ethereum's aggregated winner-take-all. Its core user experience brings users and vendors to its network, which is not seen in other blockchains, and projects built on it will only lead to a better user experience and other builders and users. .

It is nothing new to say that Ethereum will win DeFi games, but aggregator theory provides more weight for this assertion than just saying "Ethernet has more developers". It is the user experience created by these developers that accelerates the virtuous circle of aggregators.

——

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Non-serious discussion on blockchain finance from "self-tearing" (2): reality and current situation

- In just one year, the founder of the coin printing moved the cheese of the old club

- With $394 USDT and $12,000 bitcoin, Kraken has a two-time price anomaly. Have you sold it?

- Viewpoint | Deposit Charges, Negative Interest Rate Era and Bitcoin

- Heavy! Yao Qian’s speech: Digital Assets and Digital Finance

- Viewpoint | How far is DeFi's road?

- The Hedera Hashgraph project launched the main network, and some people called it to question that it was retrogressive.