In-depth Analysis and Prospects of Friend.tech Token Model

Analysis and Prospects of Friend.tech Token Model· Abstract

Driven by the token economy, Friend.Tech social platform emerged in August 2023 and has become one of the most representative applications in the field of SocialFi today. The platform provides KOLs (Key Opinion Leaders) with a unique opportunity to tokenize and trade their social influence. While gaining high attention, the platform’s token economy model and business strategy also face severe challenges.

In this report, we combine analysis of on-chain data to explore and delve into Friend.Tech’s rigid token economy model. We discovered:

-

The exponential increase in token prices brings substantial profits to KOLs, but it also limits the size of their fan community. 99.94% of account token holdings are concentrated in the 0-100 range, and token prices are primarily below 4 ETH.

-

The rigid pricing mechanism of the tokens leads to a rapid decline in trading volume after the token price reaches a high level. The average daily number of transactions only reaches 7 on the first day, and then remains at 1 or below. The future prospects for sustained returns in the current token economy model are uncertain.

- Non-technical personnel’s blockchain account abstraction (AA) study notes

- Interpreting the technical and security factors behind the massive Gas consumption of the Binance Wallet aggregation

- Zero-knowledge proofs from the perspective of non-technical personnel How did it become the third major technological innovation in the history of blockchain development?

-

The explicit arbitrage opportunities in the token economy model attract a large number of speculators and trading bots, contributing to 90.6% of the platform’s total trading volume. However, only 18.6% of speculators become “smart money” (profitable), with half of the profits earned by 10.8% pure speculators without binding social accounts.

Finally, after conducting in-depth analysis of Friend.Tech’s market performance, user behavior, and core economic logic, we make the following comments on the problems and prospects currently exposed by Friend.Tech:

-

Friend.Tech has relatively low sustainability in its economic model. Higher holding costs and lower profits after the token price rises may discourage users, inevitably leading to a decline in trading volume. To maintain platform activity, the project can only rely on attracting new customers, but its sustainability remains to be observed. A simple improvement would be to charge a low percentage fee for high-priced keys, ensuring profitability while also guaranteeing trading volume.

-

Friend.Tech may have potential for development in social functions. Firstly, the arbitrage opportunities of the tokens may promote users to spontaneously promote the project. Secondly, the connections between its users are relatively close compared to other social platforms and tend to engage in mutual benefits, which is a good demonstration of the SocialFi model. However, the user experience that needs improvement and a business model that can be easily replicated may affect its prospects.

We hope that this report can provide reference for the future development path of the Web3 industry.

1. What is FRIEND.TECH?

The latest work of a pioneer in the SocialFi model

As the hottest concept in the Web3 field after DeFi (Decentralized Finance) and GameFi (Game Finance), the SocialFi (Social Finance) model combines decentralized financial services with social media, giving users a new way to directly derive economic value from social interaction and content creation.

After developing two popular Web3 social applications that embody this concept, TwitterDAO and Stealcam, developer Racer launched the blockchain social platform Friend.Tech on August 10, 2023, which also follows the SocialFi model and allows users to engage in one-on-one private chats with other users through cryptocurrency transactions.

This application that directly links social influence and economic value is particularly attractive to users who are enthusiastic about discussing cryptocurrencies. It provides an opportunity for ordinary users to directly communicate with cryptocurrency Key Opinion Leaders (KOLs) on social platforms and offers KOLs a new way to monetize their influence.

Friend.Tech links influence value with economic value

How Friend.Tech works:

-

Users bind their Twitter (X) accounts in the application, and each account corresponds to a set of Keys (initially referred to as Shares during the initial launch), with no limit on the number of Keys per account.

-

Each set of Keys starts with a quantity of 0. Users can receive their first Key for free on the platform to activate subsequent features.

-

Users can purchase Keys from other users to become holders, granting them the privilege of engaging in one-on-one private chats with those users.

-

Users can buy multiple copies of Keys from different users (including themselves) and sell their owned Keys to the platform.

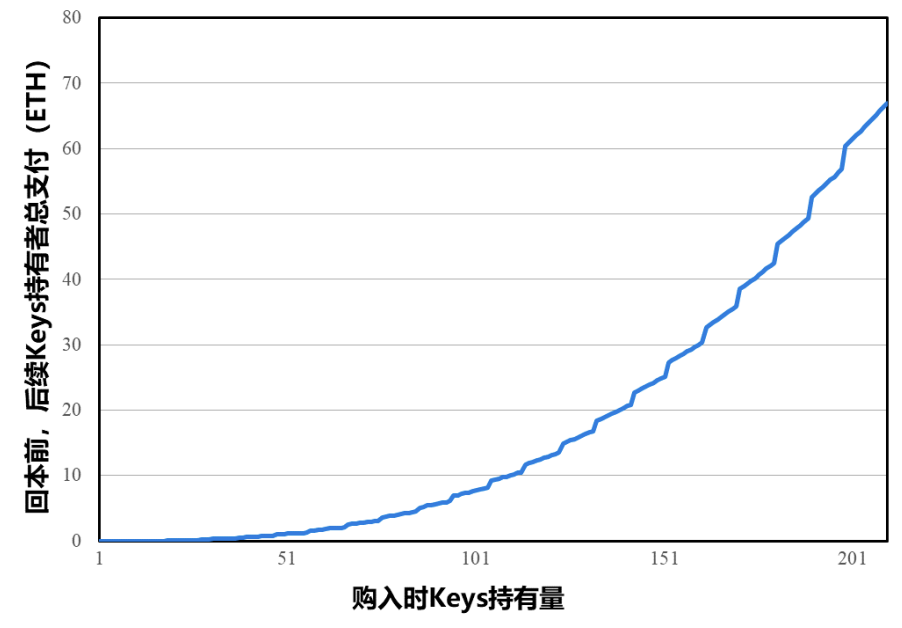

Friend.Tech operates on the Base chain (Ethereum Layer2 network), and the list of Key holders (Base chain wallet addresses) and the number of Keys held are stored in a smart contract. Transactions are conducted using ETH. Friend.Tech accounts need to be linked to a Twitter (X) account to obtain a blockchain address. However, it is worth noting that, due to the open nature of smart contracts, addresses can be generated and interacted with the smart contract without entering the app interface. For now, we refer to all addresses as users.

Figure 1 Friend.Tech application interface

II. Tokenomics: Token Economy Concepts and Analysis

Rigid Economic Model

The pricing of Keys does not follow the traditional order book or the commonly used Automated Market Maker (AMM) pricing method in decentralized exchanges. Instead, it adopts a fixed pricing formula based on the total amount of the token held on the platform.

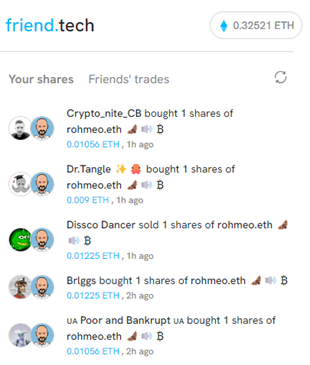

Figure 2 Relationship between Keys held and price (ETH)

- When a Key is purchased, the user needs to deposit:

-

When a user sells Keys, the platform returns:

In actual transactions, users need to pay an additional 10% fee when purchasing Keys (5% of which is allocated to the creator of Keys, and 5% is allocated to the Friend.Tech project for development, support, and community building); when selling Keys, users can only receive 90% of the total amount, with another 5% being allocated to the creator of Keys, and 5% being allocated to the Friend.Tech project. In other words, if a user sells a Key at the price they bought it, they will lose 20% in fees.

The two 5% mentioned below are collectively referred to as protocol revenue.

Although the book value of Keys increases exponentially with the increase in holdings, i.e.:

-

For every increase of 1 in holdings, the book value of Keys increases by:

-

For every increase of N in holdings, the book value of Keys increases by:

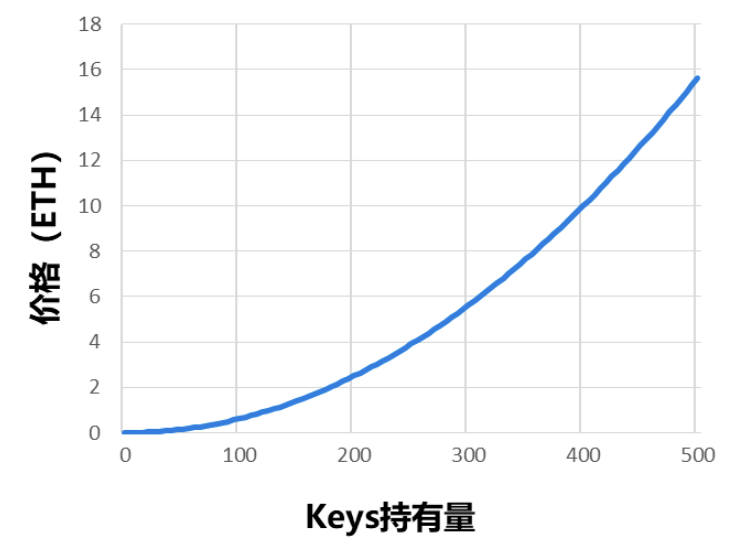

However, due to the existence of fees, even if the holdings of Keys continue to increase, selling them does not necessarily result in continued profits. In fact, the holdings of Keys need to increase by 10.6% from the time of purchase for users to break even; before breaking even, the total costs incurred by incremental users will exponentially rise. If a user purchases the 200th share of a certain Key, they will need to wait for subsequent users to purchase 22 Keys (total payment reaching 68 ETH) in order to break even from the sale.

Figure 3: To obtain book income after purchasing Keys at different times, you need to wait for the amount paid by subsequent users

The advantages and disadvantages of the rigid economic model are very obvious

Regarding this economic model, we propose the following analysis and assumptions, and will use on-chain data to verify them.

This research data is derived from the Base chain's Friend.Tech smart contract (0xcf20). As of September 19th, there have been 6,456,148 transactions directly interacting with the contract, involving 3,049,066 instances of Keys buying and selling.

Firstly, we believe that the pricing model for Keys has positive intentions:

-

It avoids the problem of low order volume and price fluctuations during the early cold start. Moreover, the price difference between buying and selling increases the motivation of Keys holders to promote the project: there is only profit potential if the number of Keys held continues to increase. This creates conditions for the early success of the project. (See section 3.1 for more details)

-

The opportunity to directly communicate with KOLs undoubtedly has certain value, so investors who can identify potential KOLs early on are more likely to gain advantageous investment opportunities. (See section 3.3 for more details)

-

KOLs will also receive generous rewards for providing one-on-one interactive social value. (See section 3.4 for more details)

-

Due to the high cost of profit from buying Keys in the later stage (including the time and opportunity cost of waiting for other users), it is unlikely that Keys will be excessively speculated. (See section 3.4 for more details)

However, we have also discovered some potential issues with this rigid economic model:

-

The fixed pricing economic model encourages users to buy low and sell high for profit. Due to the monotonically increasing price of Keys, entering early in the transaction stage will definitely yield profits, so the platform will attract a large number of speculative users, even bots. (See Section 3.3 for details)

-

There is a limit to the number of Keys holders. The value of one-on-one chats with KOLs is limited, and when the price of Keys truly reflects its value, rational fans will find it difficult to buy Keys at a premium. (See Section 3.4 for details)

-

The platform’s activity decay cycle is short. When Keys holders reach a high level and the early low-priced Keys have all been sold, users who hold Keys at a high price are usually rational social users or investors who need to wait for Keys to appreciate in the long term. At this time, Keys will have value but no market. (See Section 3.5 for details)

-

The platform cannot sustain profits from existing users. When all the Keys held by a KOL become high-priced Keys, it will be difficult to attract subsequent transactions. If the platform wants to maintain growth, it needs to continuously find new KOL resources to enter. (See Section 3.5 for details)

Finally, we will discuss the ultimate question of the SocialFi model at the end of the report:

Does the project really promote social interactions? (See Section 3.6 for details)

Section 3: Tokenomics: On-Chain Data Verification

3.1 – Performance in the First Month of Testing

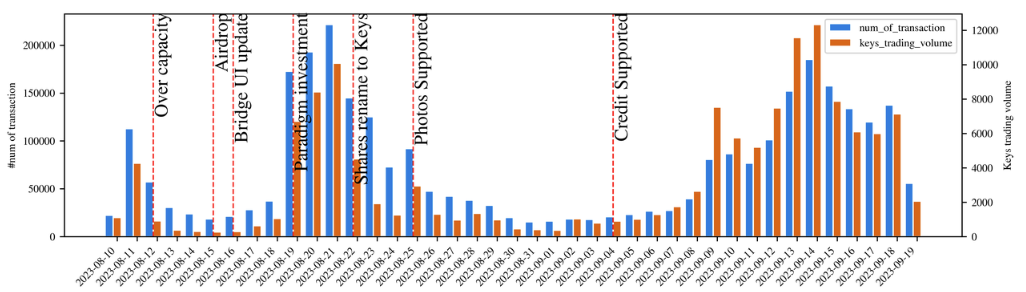

Although still in the six-month testing phase, Friend.Tech achieved great success immediately after its launch. The platform went live on August 10th and recorded 17,556 Keys created, 136,000 daily transactions, and over 4,000 ETH in transaction volume on August 11th. After Web3 leading investor LianGuairadigm announced the completion of seed round financing on August 19th, Friend.Tech platform ushered in a new wave of enthusiasm, with the daily transaction volume reaching a peak of over 10,000 ETH and the transaction volume reaching 525,000 on August 21st. The project generated over 500 ETH in daily revenue, even surpassing main chains and popular applications such as Tron and Uniswap. From August 10th to September 19th, Friend.Tech had a total of 206,706 users, 203,953 Keys created, 258,859 Keys held, 3,049,066 transactions, and 139,530.09 ETH in transaction volume.

Figure 4: Daily transaction count and transaction volume of the project (as of September 19, 2023)

For a social network project, attracting nearly 140,000 users within a month (whether or not they participate in social interactions) is already sufficient to demonstrate the growth potential and profit prospects of SocialFi applications.

3.2 – Three Main User Types

The majority of users have balanced income and expenses, but income is distributed in a long-tail manner.

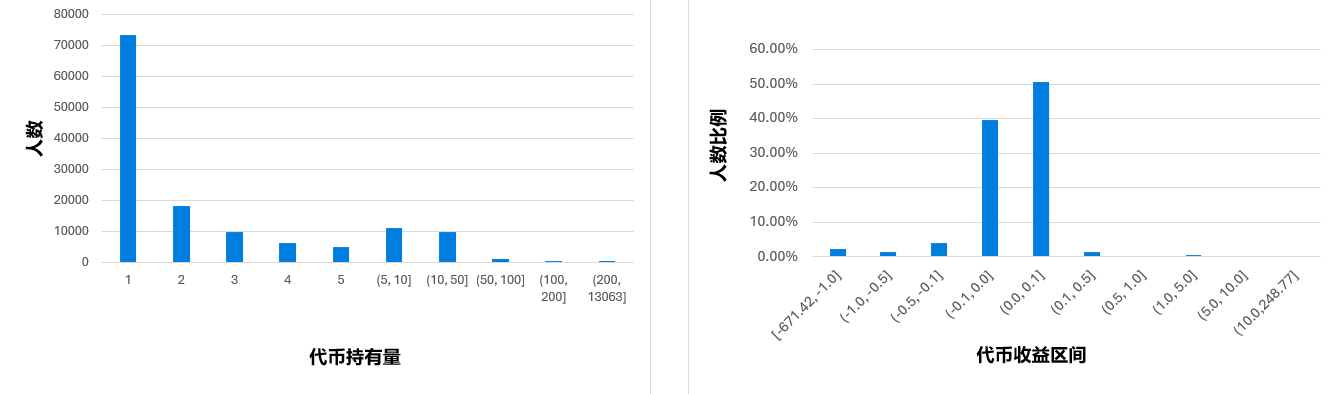

In general, most users only hold one Key, and a small number of users participate in additional Keys transactions (Figure 5). Without considering transaction gas fees, 90.2% of users have income within the range of -0.1 ETH to +0.1 ETH. 52.6% of users have positive income, but only 2.17% of users have income exceeding 0.1 ETH. The top 100 users with the highest income have a total income of 4311.64 ETH, accounting for 47.9% of the total income of 9004.58 ETH, with a user ratio of less than 0.1% (Figure 6).

Income is only calculated based on realized profits/losses, and unrealized profits/losses (such as the difference between the market price and cost price when Keys have not been sold) are not included in the calculation.

Figure 5 Distribution of Total Keys Holdings Figure 6 Distribution of User Income

We classify users on the platform into three categories:

- Light participants: Most users lightly operate their own social networks and actively try Keys trading, but the trading frequency is low and the income is limited. They are mostly individual users who follow celebrities and participate in the community under the guidance of public opinion or airdrops.

- Crypto KOLs: They create value for the community and attract followers to enter the platform and purchase Keys in order to have the opportunity to communicate directly with them. The profits of this group of users mainly come from the 5% protocol share of Keys trading. We define 4,718 users who have earned protocol income exceeding 0.1 ETH and have bound their Twitter (X) accounts as KOLs.

- Profit-driven speculators: They usually do not operate social networks, but choose to actively trade popular Keys to profit from price differences. More extreme speculators monitor popular or potentially promising Keys using bots and trade automatically. We define 44,843 users who have participated in trading with a total amount greater than the total amount of Keys they have traded (including buying and selling their own Keys and others) as speculators.

The latter two types of users have higher trading frequency and/or income, and there may be cross-overlapping (for example, a KOL may also deeply participate in speculative trading). This report will focus on analyzing the latter two types of users.

3.3 – Behavior and Profits of Speculators

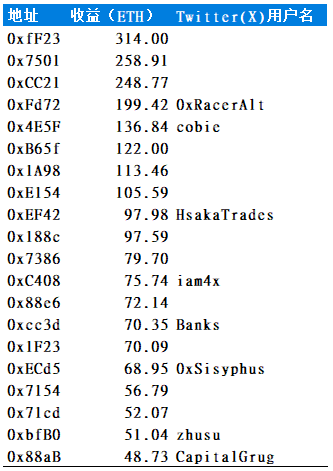

Among the top 20 users with the highest total income, there are not only well-known figures in the cryptocurrency industry such as Cobie and Zhusu (Table 1), but also a large number of users who have not bound their Twitter (X) accounts, indicating that their trading activities on Friend.Tech can be considered as speculative behavior.

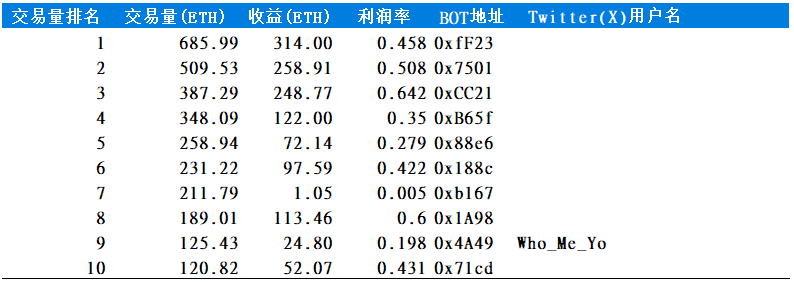

Table 1 Top 20 Users with Highest Total Income (ETH)

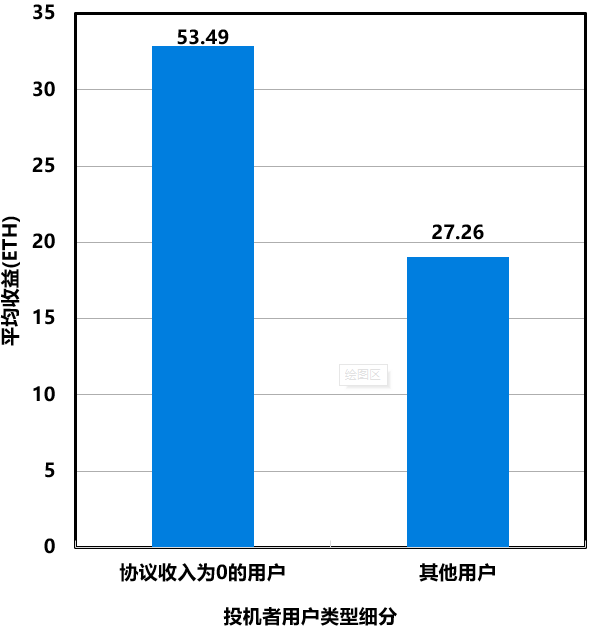

Among the top 100 users with the highest community income, there are 65 speculators and 52 KOLs, indicating that 13 KOLs are also involved in speculative activities. Among these speculators, 45 of them have zero protocol income. The average income of these users is 53.49 ETH, higher than the average income of the remaining 55 users, which is 27.26 ETH (Figure 7).

Figure 7 Comparison of Total Income between Users with Zero Protocol Income and Other Users

Speculators contribute a large amount of trading volume

Speculators (21.7% of the total number of users) contribute 78.9% of the total trading volume and 88.4% of the total trading amount on Friend.Tech. Although the trading volume of speculators is only 28.8% related to KOLs’ Keys, the trading amount accounts for 82.5%. Overall, the prosperity of the platform is built on the activities of speculators, and the main trading target of speculators on the platform is the Keys created by KOLs.

Speculation ≠ “Smart Money”

However, only 8,346 (18.6%) speculators are considered “smart money” with a total profit. Among them, 900 (10.8%) are not linked to social media. The total profit of “smart money” is 5443.32 ETH, and the profit of accounts not linked to social media accounts for 60.9% of the total profit of “smart money”.

Approximately 186 Suspected Bots

If Web3 tells us anything, it is that human speculation efficiency can never beat robots. Robot users in the Friend.Tech community immediately buy keys at a cheaper price when other users create keys; or they monitor popular keys, buy them at a low price during the fast growth period, and sell them at a high price to profit. In just two weeks, there have been 186 robots similar to MEV appearing on Friend.Tech. They purchase keys in the same block where users create or sell keys (sometimes even buying dozens at once). We call these types of transactions “snipe” transactions. The robots have completed a total of 27,648 snipe transactions, with a transaction volume of 463.21 ETH. Including both “snipe” and non-“snipe” transactions, these robot users have achieved a total profit of 2553.84 ETH, accounting for 28.3% of all user profits.

Table 2 Top 10 Suspected BOT User Trading Volume

3.4 – KOL Behavior and Profit

KOLs Can Achieve Stable Profits

For most users in the cryptocurrency community, the fundamental appeal of Friend.Tech lies in the opportunity to chat privately with KOLs. Therefore, most early transactions revolved around KOL account keys, allowing KOLs to earn substantial protocol income in this trading frenzy.

A total of 86.5% of users have protocol income. Among them, 4,718 users have protocol income exceeding 0.1 ETH, accounting for 93.2% of the total protocol income of all users, with an average of 1.37 ETH.

The top 3 KOLs with the highest protocol income are 0xRacerAlt, cobie, and HsakaTrades, with incomes of 202.57 ETH, 139.19 ETH, and 134.18 ETH, respectively. Calculated based on the average price of ETH from August 10th to September 19th, their daily income is approximately $6,000-8,000 USD.

Figure 8 Example of KOL Account

Clear Limit on the Number of Keys Holders for KOLs

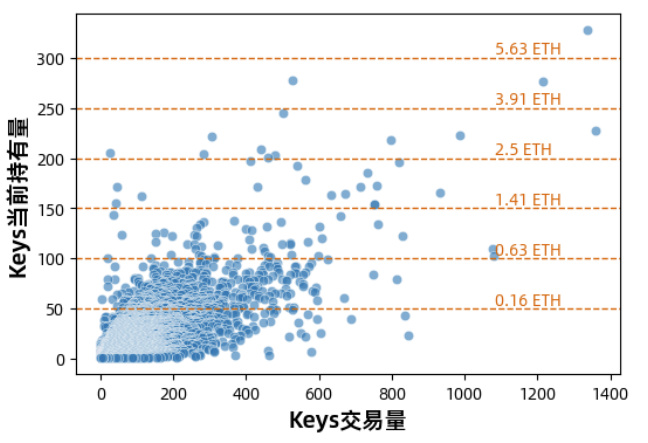

However, a more obvious characteristic within the community is that the number of keys holders per account has a clear limit. 99.94% of accounts have key holders below 100, meaning that the price of keys is below 0.6 ETH. Even for top-level KOLs, the ceiling for the number of keys they hold is generally around 250, with prices below 4 ETH (Figure 9).

Figure 9 Relationship between Keys trading volume and current Keys holdings

Self-holding is not always a good strategy

If users have confidence in their own social influence, they may adopt a trading strategy similar to robots, which is to start holding their own Keys early and sell them at a high price when fans start buying their Keys to make a profit. In fact, 18.9% of users have adopted this strategy. Among them, 29.3% (11,493) have made a positive return, with an average return of 0.28 ETH. The ratio of speculators with positive returns is 18.6%, but the average return is 0.65 ETH. However, the more Keys users hold, the narrower the range of their profits and losses, which means that it is difficult to achieve high profits with this strategy, but it is indeed an ideal means to avoid huge losses.

KOLs have a higher proportion of self-holding Keys, with 68.1% (3,211) having purchased their own Keys, and 535 have arbitrage through their own Keys, with an average return of 0.14 ETH (up to 3.89 ETH), which is not high compared to their protocol income. The top 3 KOLs with the highest protocol income, 0xRacerAlt, cobie, and HsakaTrades, have hardly participated in the trading of their own Keys.

3.5 – Lack of platform persistence

Figure 10 Relationship between number of Key holders and Key trading volume Figure 11 Relationship between Key age and average Key trading volume/amount

On-chain data shows that the continuous increase in the price of Keys does lead to a stagnation of trading (Figure 10), with the speed decreasing close to an exponential function. Similarly, the longer the creation time of Keys, the significantly lower the daily average number of transactions and trading volume/amount (Figure 11). The peak of Keys trading occurs on the day it is created, with an average of 7 transactions per day, dropping to 2 on the second day, and not exceeding 1 on the third day and thereafter. This characteristic is caused by the token economic model: early Keys are more profitable.

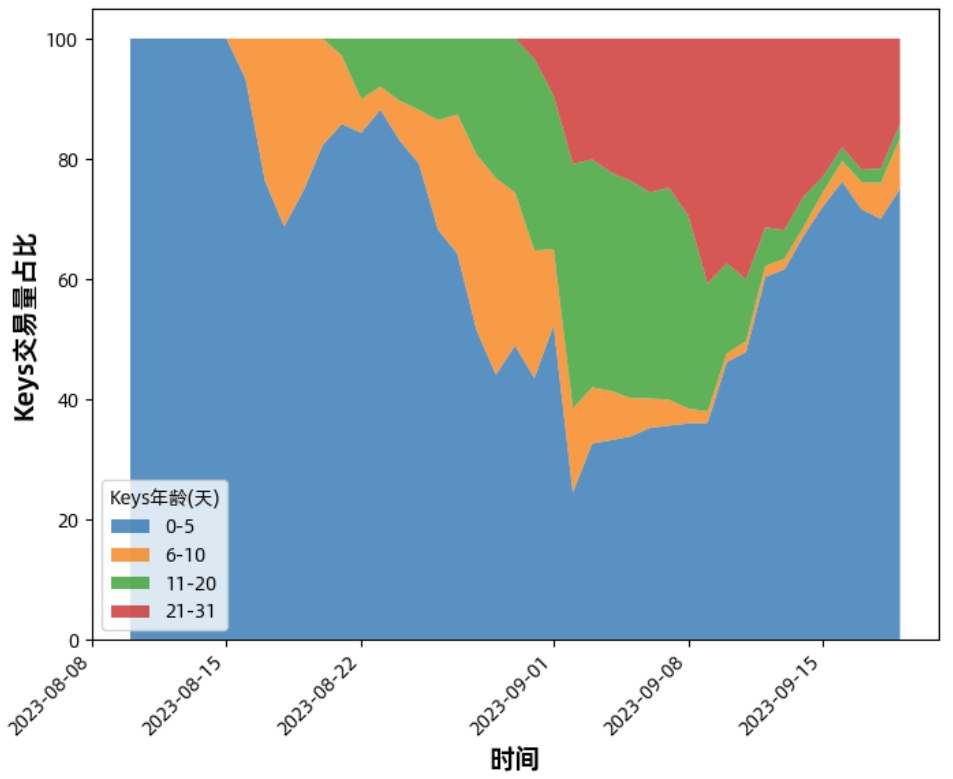

Figure 12 Proportion of Keys trading volume for different Key age types over time

It has been over a month since the project started, and to this day, nearly half of the daily trading volume is still contributed by new Keys. If the project faces a lack of resources to obtain new KOLs in the future, the platform’s trading volume may face an unsustainable situation, and the platform’s persistence will face significant challenges.

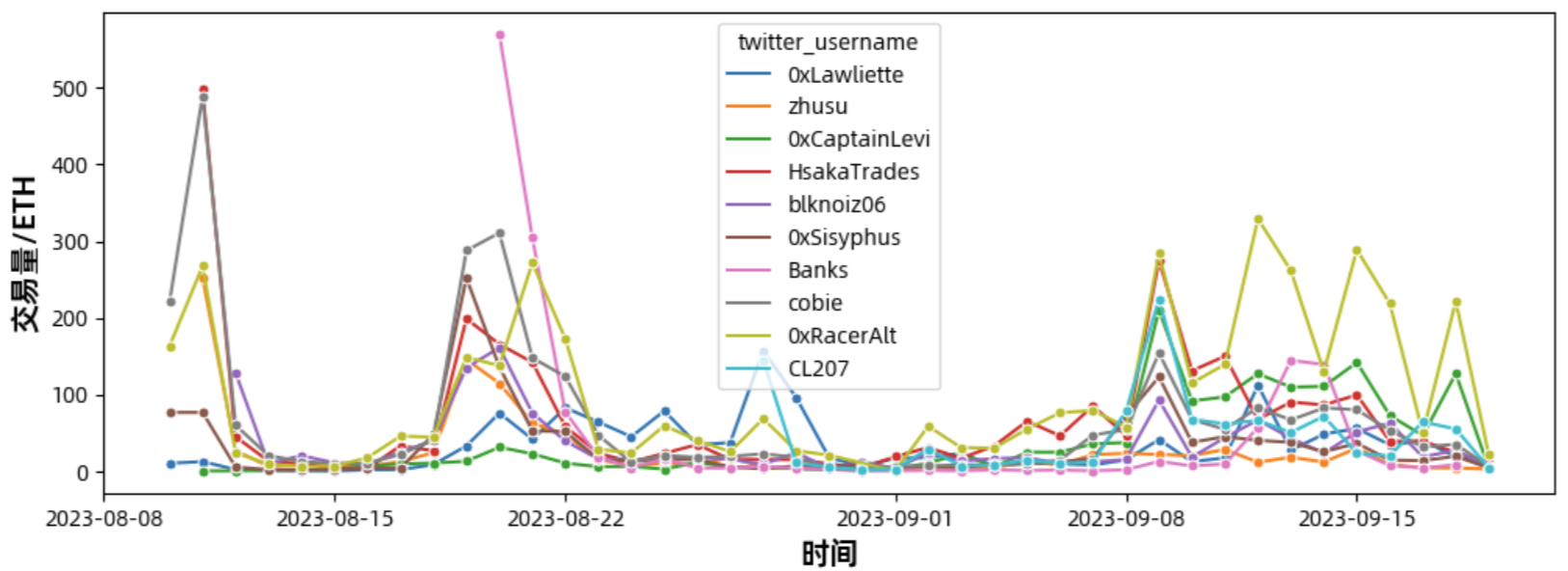

Figure 13 Trading volume of top KOLs' Keys over time

The trading volume of top KOLs’ Keys plays a role in protecting the overall project’s trading volume, and it should become more resilient over time. However, it is not difficult to see that except for 0xRacerAlt and 0xCaptainLevi, the overall trading volume of the top 10 KOLs’ Keys still shows a downward trend. If the top KOLs fail to protect the market, the project’s persistence will be undermined.

3.6 – Social Network between Users

Aside from its financial attributes, Friend.Tech is ultimately a social platform. Based on the holding relationships of Keys, 79.2% (110,000) of the 140,000 users on the platform can be connected within the same community, meaning they are connected through friends of friends. Although the social circles of users on the platform are not large at this stage: on average, each user only has three to four friends, and the largest Key Opinion Leaders (KOLs) have only a few hundred friends, the connections between friends are relatively close: the probability that a friend’s friend is also your own friend is about 41.3%, which is much higher than any existing social platform.

At the same time, we also observed reciprocal behavior between platform users, meaning users purchasing Keys from each other. Although establishing one-on-one chat channels is redundant in terms of software functionality, this behavior significantly increases social connections between users. 13.5% of social relationships on the platform are reciprocal.

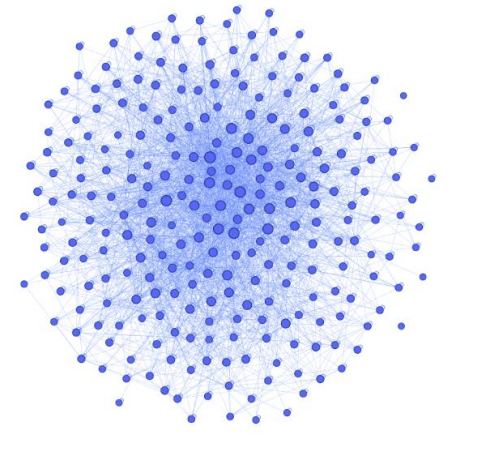

Figure 14: Social Network between KOLs on the Friend.Tech platform

The size of the nodes in the figure is proportional to the number of followers of the KOLs

Chapter 4: Summary and Outlook

4.1 – Application Deficiencies

- Currently, the application is still in its early stages, and the core social functions are relatively simple, with few highlights that attract user retention. At the same time, the lack of verification measures leads to fraudulent activities (such as impersonating the @punk9O95 account on Twitter), frequent network connection failures, message delays, and application crashes, which hinder normal usage.

- Given the open nature of blockchain, the platform cannot restrict users from bypassing the front-end interface and directly interacting with smart contracts, such as generating Keys without binding a Twitter (X) account. This seriously affects the original intention of the platform to tokenize social influence and weakens the effectiveness of the token economic model.

- Furthermore, the binding relationship between Friend.Tech addresses and Twitter (X) accounts can be obtained from public APIs, which undoubtedly increases concerns and worries about privacy issues for decentralized social products.

Of course, the above issues can be classified as reasonable bugs during the testing phase, and we believe that any competent technical team can gradually resolve these issues. What is truly worth noting is that the Friend.Tech business model has a relatively low replication threshold, which can be seen from its response to competitors’ strategies. On August 15th, Friend.Tech announced that users would not receive airdrop points from its platform if they interacted with other similar products. This practice was strongly opposed by community users, leading the community to be forced to retract this decision and publicly apologize on August 29th. The founder’s admission of “fear and zero-sum thinking” in the open letter clearly demonstrates Friend.Tech’s vulnerability in the SocialFi model – the possibility of facing fierce competition in the future.

4.2 – About Web3-Driven Social Networks

Eurybia firmly believes that the long-term development of Web3 relies on attracting and retaining users who are not influenced by token speculation. Starting from Maslow’s hierarchy of needs, areas such as basic needs, employment and health, and emotional belonging are all promising fields for development, but they are also filled with uncertainties.

Rebuilding a social network is not an easy task. Apart from the competition with existing platforms and the pressure to maintain content quality, the cost of platform migration for users on social networks is particularly high compared to other products. Simply attracting users from other platforms is not enough; more importantly, it is about transferring the users’ friends and their friends to the new platform. In the Web2 world, there are only a few new products that can shake the established social media giants, with the distant example of Google+ and the recent one being Clubhouse.

However, Web3 does have its unique advantages: token incentives are the most direct and transparent way to acquire users.

Friend.Tech has attracted 260,000 users in one month, which is already an impressive achievement. However, the current Web3 social platforms generally have flaws such as rough token economic models and inflexible smart contracts, which undoubtedly have a negative impact on the sustainability of the platforms.

For Friend.Tech, we believe that its current economic model lacks sufficient sustainability. Although the price of Keys is unlikely to be impacted by reduced transactions, the decrease in transaction volume will pose profit challenges for the platform and its creators. At least until the Keys trading market between fans takes shape, the effect of attracting new users through token appreciation has obvious limits. We also observed that the community is implementing promotional strategies such as airdrop points, hoping that this can effectively alleviate the platform’s sustainability issues.

Web3 projects often attract users through token airdrops and speculative strategies for profit-making purposes. However, the challenge in the Web3 field has always been how to successfully convert this group of users into genuine users of platform services (social networking, gaming, etc.). Generally speaking, speculative users are relatively less interested in platform services compared to users who are interested in the content. If they take away the maximum economic benefits but contribute the lowest user stickiness, then is the token subsidy strategy (if it is a cost for the project) still reasonable? This is a question that all practitioners committed to promoting the mass adoption of Web3 need to deeply consider.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Third Major Technological Innovation in the History of Blockchain Development – Application of Zero-Knowledge Proof Technology

- Bankless Dialogue with Vitalik The great vision of ETH is to truly create an independent open technology stack.

- Exploring DeFi Economic Models Design and Evolution of Incentive Mechanism

- Layer2 Public Chain Token Valuation Model Analysis

- Cosmos, Polkadot V.S Layer2 Stacks Chapter (1) Technical Solution Overview

- Interview with Mysten Labs Product Director Why is Sui’s technology particularly suitable for enterprise services?

- Puffer Finance Research Report LSD Track, a technology-driven seed player with dual staking and dual rewards.