Hot discussions among peers, uncovering the little-known stories of market maker DWF Labs and Lianchuang.

Hot discussions uncover the untold stories of market maker DWF Labs and Lianchuang.Author: Huma, Crypto KOL

Translation: Felix, LianGuaiNews

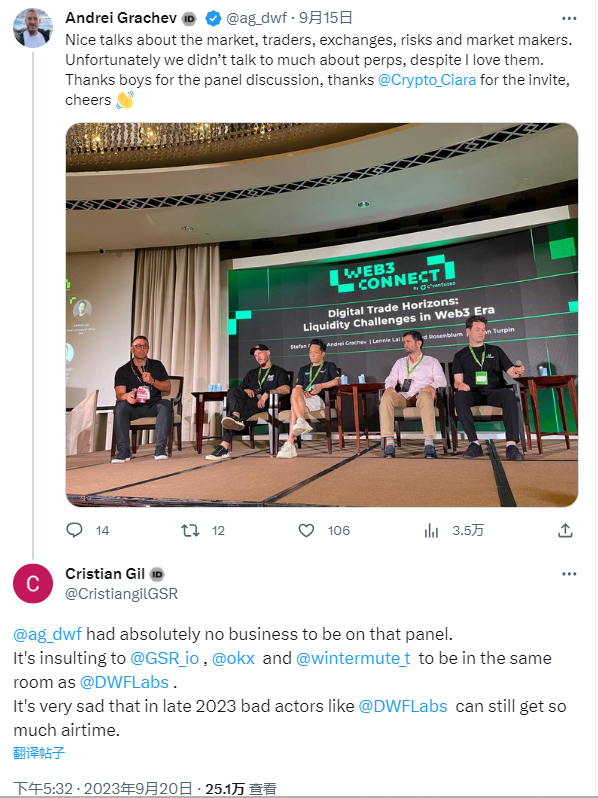

DWF Labs has recently caused controversy. At the Web3 Connect forum held during Token 2049, market makers DWF Labs, GSR, Wintermute, and OKX gathered to discuss. In the event photos shared by market maker GSR, the photo of DWF Labs co-founder Andrei Grachev was removed.

- Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.

- Weekly Notice | The deadline for FTX customers to submit claims will be September 30th; Bitget old users need to complete KYC verification before October 1st.

- Unveiling SBF’s Defense Draft of up to 250 pages I did what I believed was right.

Accounts related to GSR on platform X stated that DWF Labs had no qualifications to join the group discussion and that sharing the same space with DWF Labs was an insult to GSR, Wintermute, and OKX. Wintermute CEO Evgeny Gaevoy liked the post.

In response, DWF Labs co-founder Andrei Grachev said, “I never thought you would be so afraid of us. Yes, we are stronger than you in terms of technology, trading, and business development. You have started to collaborate with competitors and complain like a child, slandering us. Well, our market-making service is excellent, and we will devour your market share like eating a cake, while you are powerless. You will soon see your resume in my email.”

This is not the first time DWF Labs has caused trouble. Earlier, The Block revealed that DWF Labs’ multimillion-dollar investments in crypto startups should not be called “investments” but rather over-the-counter transactions. DWF Labs’ combined operation model of “investment + market-making” has sparked heated discussions in the crypto community. DWF believes that Wintermute instigated The Block to smear them because Wintermute’s founder and CEO Evgeny Gaevoy is a member of The Block’s board of directors and a shareholder.

Recently, crypto KOL Huma reviewed the history of DWF Labs and Andrei Grachev, and it seems like the “fig leaf” has been lifted.

Unveiling DWF Labs

A year ago, DWF Labs was unknown in the crypto field, but now they are at the center of the crypto stage. They describe themselves as a market-making and investment company. Where did DWF Labs come from? Who are the founder Andrei Grachev and the team members? In the following text, we hope to present all the information collected so far in an objective manner.

Andrei Grachev’s Background

Andrei Grachev appeared in the Russian crypto community around 2017. Before that, he worked in the logistics industry, far away from the tech field. He was the founder of several logistics companies, but they have all closed down. In the crypto community, he introduced himself as a successful trader and partner of Crypsis Blockchain Holding.

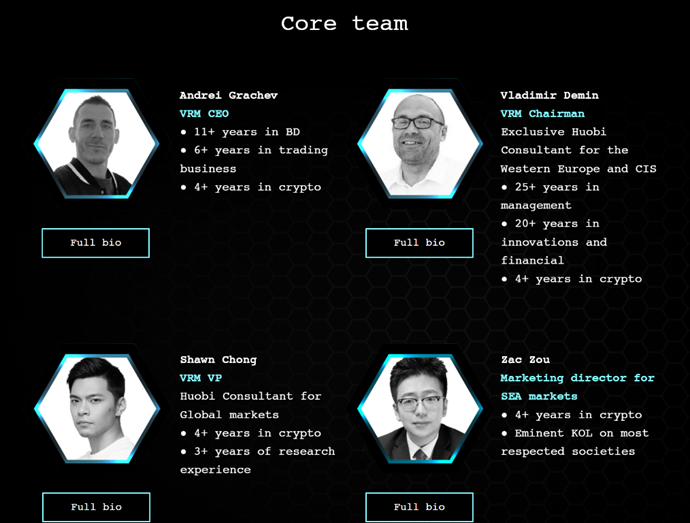

In addition, Grachev served as the vice president of RACIB in 2018. RACIB is a non-profit organization closely related to VEB (Foreign Economic Bank), a state-owned bank. Their main goal is to promote cryptocurrency regulation in Russia. In 2019, Grachev became the head of Huobi Russia. His partner at RACIB was Vladimir Demin, who later became the head of Huobi Russia after Grachev. Vladimir Demin is also a senior manager at VEB Ventures, a venture fund of a major state-owned bank in Russia. Demin and Grachev later co-founded VRM.trade (the predecessor of DWF Labs).

Grachev also led a suspicious project called http://Export.online, which was originally intended to launch 1C0 but had to be abandoned due to the bear market in 2018. Some project investors reported that Grachev misappropriated approximately $157,000 of investment. According to LinkedIn profiles, Andrei Grachev is the CEO of the organization, and Vladimir Perov is the CTO. Vladimir Perov is now also working at DWF Labs.

In addition, according to the aforementioned Forklog article, the owner of a company called DAS Index accused Grachev in 2019 of not repaying his $10,000 debt, at which time Grachev had already become the head of Huobi’s Russian branch.

VRM.trade

Demin and Grachev jointly created a high-frequency trading company called VRM.trade. It is currently unclear what they are doing and how large it is. They claim to have a daily trading volume of $1 billion to $20 billion. Here is Grachev’s AMA about VRM and his self-report at the time.

VRM team members (source the same as above):

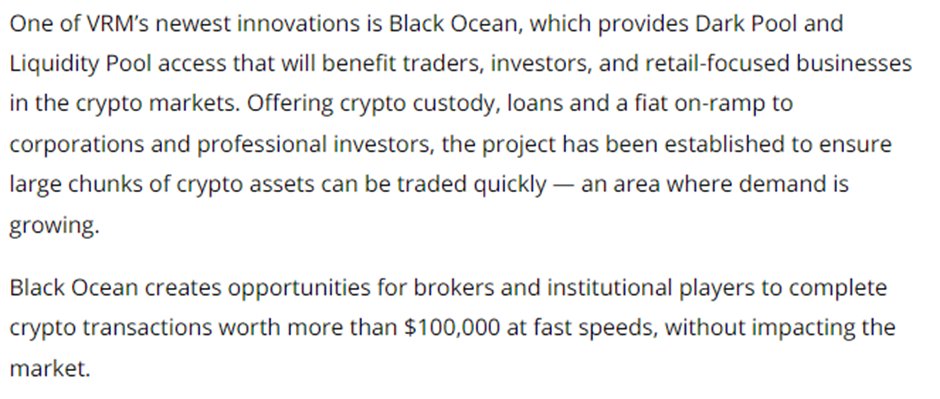

Zac Zou is now also working at DWF Labs. In addition, Zac Zou is the founder of HTR Trade. VRM and LD Capital invested in HTR Trade together. The VRM team also created their own OTC platform called Black Ocean.

Here is a list of VRM’s partners, including LD Capital, YGG, and AKG Ventures, three Chinese-backed investment institutions.

FLY (Franklin Token)

FLY is the native token of the Black Ocean exchange. The whitepaper can be found here. According to CoinGecko data, the price of FLY has been declining since the beginning and now has a market value of $350,000.

Interestingly, their X and Medium accounts still seem to be “active”:

DWF Labs

So, where did DWF Labs suddenly come from? DWF is a rebranding of VRM. The last tweet from VRM Trade was on May 31, 2022, and the DWF Labs domain was registered on May 30, 2022. Is there a specific reason for the rebranding? It is still unknown.

On March 20, 2023, DWF Labs sent $7.5 million USDT to a wallet, which transferred $163,000 to a wallet labeled “AyeletNoff” on OpenSea. Ayelet Noff is the founder and CEO of the PR agency SlicedBrand: Was this money intended to get more media attention for DWF or to help market projects invested in by DWF? This is still debatable.

Conclusion

The investigation into the history of DWF Labs concludes here. The author does not form any opinions on these matters but merely aims to objectively provide this information.

Related reading: Interview with DWF Labs: We are not “market makers” but liquidity providers.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data Analysis 37 listed companies in South Korea hold approximately $160 million in cryptocurrency assets, which tokens are preferred?

- Friend.tech is gaining momentum alongside Telegram, how will the veteran social protocol Lens Protocol counterattack?

- Overview of International Cryptocurrency Regulatory Agencies

- What do legal experts think of the SBF trial?

- FTX Reappearance? JPEX Embezzles User Assets and Is Involved in a High-Value Fraud Case

- Behind the Balancer attack incident In addition to the downsizing of the security team, we should pay more attention to the hidden concerns of centralized front-ends.

- Where are the criminal risks of crypto market makers?