Analysis | From Libra's perspective, how to govern the crypto market

If you told Bitcoin Core in 2009 that Facebook would develop a cryptocurrency, you would be laughed at. At the 2019 Bitcoin Conference in San Francisco, Libra was an inevitable topic on most panels.

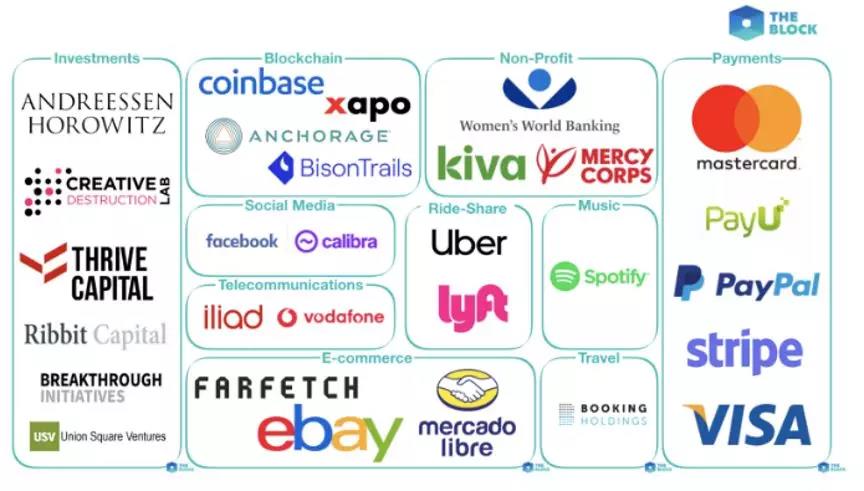

Announces founding members of Libra Association

Despite the meaningful contributions of Fidelity, Square, and JP Morgan over the years , I think the breadth and scale of the Libra Association marks a milestone in the legitimacy of the cryptocurrency industry. In this article, I will focus on the under-reviewed aspect of governance that I believe will cause or undermine the project.

- Participated in more than 100 cases of blockchain application schemes, and the chief engineer of Thunder Chain came to Xin to explain the multi-domain on-chain methodology

- Research report: What are the blockchain projects worth watching in March?

- 6 UAE banks build KYC platform, Moody's rating is positive

Whether a group of organizations can successfully coordinate around building and maintaining the public interest remains to be seen. In addition, it is unclear whether this public interest is sufficient to incentivize organizations with priority conflicts and complex competitive dynamics, especially the inevitable regulatory pressure that ensues.

In this article, I will introduce:

Currency board

Libra's design is actually similar to a currency board , which is a monetary authority that maintains a fixed exchange rate with foreign currencies. The currency board issues local banknotes and coins fixed on foreign currencies (called reserve currencies or anchor currencies) into circulation. Anchor currency is a powerful international transaction currency (for example, the US dollar). The value and stability of the local currency is directly related to the value and stability of the foreign anchor currency. The most prominent example today is Hong Kong, which operates a currency commission called the Hong Kong Monetary Authority . Historically, the United States has also maintained the special situation of the currency board, that is, the value of the US dollar is linked to the value of gold, not foreign currency.

Special Drawing Right

However, Libra is not 1: 1 linked to any currency. Instead, it has a floating exchange rate based on the underlying asset basket. In this sense, Libra's design is also similar to the special drawing right , which is an international currency reserve currency created by the International Monetary Fund (IMF) in 1969 as a supplement to the existing capital reserve work of member countries. It is essentially a synthetic reserve asset composed of a basket of fiat currencies. The SDR basket is reviewed every five years by the International Monetary Fund and currently includes the US dollar (41.73%), the euro (30.93%), the renminbi (10.92%), the yen (8.33%), and the pound (8.09%).

Similarly, for Libra, one of the most important governance decisions is the management of reserves, because it supports the stability of the currency and the effectiveness of the network. More broadly, governance will focus on developing networks and allocating funds for socially impactful causes.

Libra's governance model

Libra Association

The Libra Association is an independent, non-profit membership organization based in Switzerland. It currently consists of 28 founding members and hopes to have about 100 members by mid-2020.

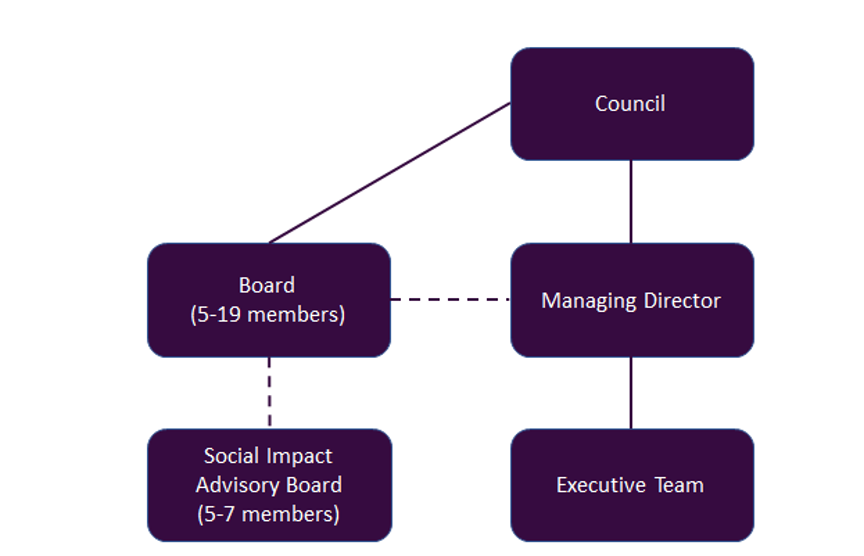

High-level organizational structure of the Libra Association

Libra Association Board

The association is managed by the Libra Association Board, which is composed of one representative from each validator node. They collectively make decisions about network and reserve management, where major policy or technical decisions require two-thirds (ie, majority) consent.

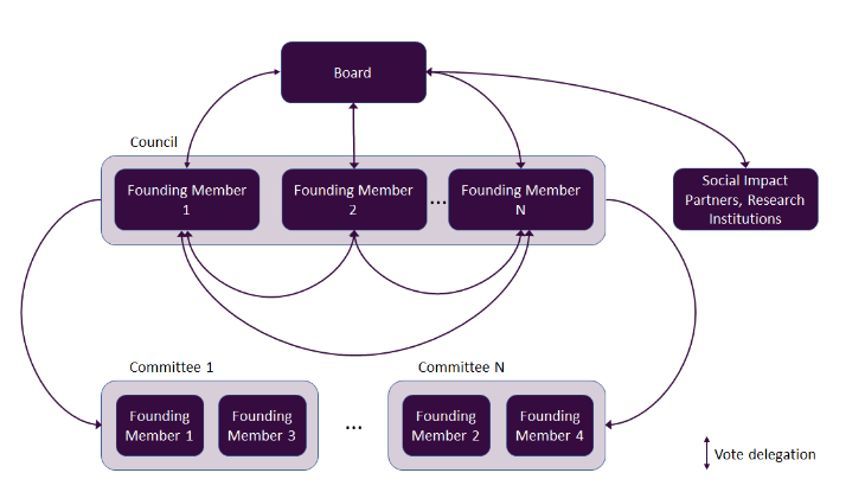

Voting rights in the council are directly proportional to the shares, and the voting rights of any individual founding member are restricted to avoid concentration of power. Each investment of 10 million US dollars has one vote in the council, but a founding member can only be represented by one vote or the greater of the total votes of the council. This cap does not apply to validator nodes that can join the network only by detaining Libra.

In addition, a party entitled to be represented on the council may delegate its voting power to the other party. That is, founding members with voting rights above the ceiling will provide excess votes to the board of directors for delegation to a social impact partner (SIP) or research institution. The board can evenly distribute the excess votes not allocated to the board among other founding members to maintain the relative total voting power of the founding members compared to other verifier nodes.

In addition, the council can delegate many of its administrative powers to the management committees and council committees of the association, but retains power to overturn decisions made and retains key decisions, the most important of which requires an absolute majority.

Voting delegation within the Libra Association

Governance Model Analysis

Libra's approach combines traditional corporate structures with decision models similar to proof-of-stake, with several important differences.

In traditional corporate structures, shareholders own the company. The ownership can be 100% in the hands of one person, or it can be distributed among thousands of people. Although shareholders may not be involved in day-to-day management or have no direct voice in decision-making, major shareholders play an important role in influencing company decisions, such as voting for elections and removing board members. Similarly, in Libra, shareholders are actually validators who vote directly on key decisions.

In addition, in traditional corporate structures, the board's main responsibility is to protect shareholders' investments. The board is responsible for drafting and revising the company's articles of association, appointing committees, and appointing people who report to the board (such as the CEO). This is not the case with Libra, as most of these responsibilities remain with the Council.

Check and balance

Obviously, the council is the most important governing body because it has the power to change the governance structure itself. Although the council's checks and balances are limited, since the council's decisions can be replaced by the council, this problem can be alleviated by requiring major changes to the vast majority of votes. Of the 28 members, one vote gives each member approximately 3.6% of the voting rights, and 19 members will be required to pass the vast majority of votes. This seems reasonable and will continue to improve as the association grows, but it will be a problem if the size of the board shrinks significantly, for example, a five-member board will give each member 20% of the voting power And asked four members to pass a majority vote.

When members can delegate voting rights to other founding members, balanced representation becomes more complicated, as power may be concentrated in even smaller groups of companies. To alleviate this, the council limits the total number of votes for a given company type. Specifically, investors and companies focused on cryptocurrencies, or socially influential partners, are unlikely to have more than 33% of the total voting power in the Security Council.

Although there is a cap on the total number of board members, there is no cap on the percentage of these members on the board. For example, if there are 28 members of the board of directors and 5 members of the board of directors, the 33% cap on crypto companies will result in a cap on 9 crypto companies, all of which can be formed by the board if the vote is passed. Even if only 3 crypto companies were voted through a five-member board, it was enough to get the majority in favor of decisions in favor of those companies.

In addition, the Social Impact Advisory Committee (SIAB), led by non-profit organizations and academic institutions, appears to have limited influence. Although it does make funding recommendations that could affect the network, the board must approve those recommendations. The board must also approve SIPs as nodes, which directly affects the voting rights of these SIPs on the board.

Politics and conflict of interest

With only 28 to 100 members of the Security Council, politics should be expected. After all, individuals from the organization know how to play the game. Here, I define politics as the use of power, from individuals and informals to organizations and formalities, to influence decision-making in a way that serves individuals or groups.

In the Security Council, this looks like individuals are supporting decisions that are beneficial to their organizations or alliances based on common interests. Speculative scenarios include:

• Appointment of managing directors with personal relationships with the organization

• Changed founding membership criteria to higher annual income threshold

• Change governance policies to lower the total voting ceiling for certain types of organizations. I hope the board has more opportunities on this issue; of the 19 members, each member has about 5.3% of the voting power, and a maximum of 10 members are required to vote.

Related to this is a potential conflict of interest, which may take the form of investor / portfolio companies, competing company / product and personal relationships.

In the early stages of the network, when founding members face greater regulatory, financial and reputational risk, one of the most important questions I think to ask is:

What is the motivation for the company to participate? When pushed to the top, will it be strong enough to compete with regulators and governments?

Some might say that the $ 10 million buy-in for founding members is a great design choice because these members have real skin in the game. At a minimum, each member will likely have a full-time employee dedicated to maintaining their validator nodes, which is estimated to cost $ 280,000 per year (note: this virtually excludes the possibility of individuals running their own nodes).

However, for most companies, the money was just a sum of money, not in the bank account of the Libra Association, as the New York Times reported that members had signed a non-binding agreement on the project, and seven members said " They have no obligation to use or promote digital tokens, and they can easily withdraw. "

At the individual company level, the issue of incentives becomes more apparent. Let's take Visa as an example. Visa processed 124.3 billion transactions and $ 8.2 trillion in payments in 2018. In contrast, according to Blockchain.com, Bitcoin processed 81.4 million transactions and $ 397 billion in payments in 2018, several orders of magnitude lower than Visa. Why does Visa support a project that bypasses their network and nibbles about 2% of exchange fees?

Let's assume this is a hedging scheme, in which most of the global payments are transferred to the crypto payment track (because Visa can still earn fees through value-added services at the top of the network, similar to Coinbase charging for Bitcoin purchases Fee method) and have the opportunity to seize 85% of those who still have cash transactions.

Let's look at Libra's target market-underfunded people. If Libra succeeds in serving this population, Visa will have a large and growing market that could last for generations. But there is a problem. According to Index, more than half of the less than $ 1.7 billion came from seven countries: Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan; in more than half of the places, cryptocurrencies were banned, Facebook was unable to operate freely, and / Or severe regulatory restrictions due to money laundering and anti-crime issues.

What happens if the U.S. threatens to revoke Visa's money changer license because its node is verifying transactions in one of these countries? Will Visa continue to be a validator and active member? My bet is not, because Visa is not worth putting your current business at risk.

Until that happens, regulators will not just stay on the sidelines. The US House Financial Services Committee recently drafted a bill entitled "Keep High Technology Away From Finance Law", which proposes to act as a financial institution or issue digital currency for technology companies with annual revenues of more than $ 25 billion And a fine of $ 1 million per day. Facebook, one of these companies, has no plans to fight with regulators. Calibra head David Marcus wrote in testimony from a U.S. Senate committee:

"Facebook will not provide the Libra digital currency until we fully address regulatory issues and obtain proper approval."

It has no plans to fight with the central bank. Marcus continued:

"[Libra Association] will work with the Federal Reserve and other central banks to ensure that Libra does not compete with sovereign currencies or interfere with monetary policy. Monetary policy happens to be the province of the central bank."

I believe this strategy runs counter to Libra's target market. Although Libra intends to create a network that can operate in any country, in reality, it is creating a network that must comply with each country's regulatory regime. This means that if the Libra government believes that currency and banking have weakened their power, they may not be able to reach these countries. Even if the association is made up of different companies, the court can be ordered to take action against legal entities in those countries.

To resolve this issue, either Libra needs to limit its scope of operations, or local regulators need to change their position on cryptocurrencies, or enable those regulators that can provide adequate KYC / AML guarantees while minimizing transaction review (mistakes) Report) and technology that maximizes privacy guarantees to individuals.

Other potential results

Libra has multiple situations. Here are what I think are possible, from happy to sad:

• Public support: Regulators tried to stop Libra but faced strong public opposition. Relying on grass-roots support, a “rising of lawyers”, and limited resources from regulators, the association cannot compete with lobbying. Regulators have revised and amended regulations (for example, abolished capital gains tax on small purchases) to support the adoption of Libra and other cryptocurrencies.

• Launched but not used: We re-evaluate whether people need or evaluate licensed cryptocurrencies. Perhaps the idea of a stablecoin that retains reserves still exists, but we're back to unlicensed and unreviewed crypto assets like Bitcoin. In the process, millions of individuals learned the concept of an unfixable, autonomous currency.

Upcoming news: Strong opposition from regulators has scared away current and future founding members, resulting in fewer than five members required to launch the network. Maybe regulators consider Libra to be safe, and like Basis, the $ 10 million has been returned to the founding members, and everyone goes home almost unscathed.

in conclusion

Libra takes a thoughtful approach to its governance model, and its transparency provides a new standard for consortium-based blockchain projects. It blends old ideas with new developments and tries to provide checks and balances on the network when allowed, while developing innovations in completely unlicensed encrypted networks. Despite problems with the alliance's structure, incentive models, and regulatory strategies, the resources of the association support the possibility of successfully launching the network and long-term adoption of Libra.

Article source: https://medium.com/zenith-ventures/libra-a-governance-perspective-d1c2d9c87f65

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt launch | Deputy Governor of the Bank of England: strengthen supervision of stablecoins, plan central bank digital currency

- Blockchain landing in philanthropy, alliance builds to test entrants' capabilities

- Forgotten crypto assets: daily trading volume of over 5000 tokens only accounts for 2% of the market

- How does the blockchain technology solution fit into the industrial ecology? 丨 Babbitt Industry Welcome Class

- For the record, shake the "mask", resume work monitoring, the blockchain can be used in this way

- The United Nations actively embraces blockchain and has used the technology to achieve tangible results

- Babbitt Original | Zeroing out, getting rich in the market, do you know these three big futures players?