Analysis of the market in early trading on October 28: Thinking about this wave of "carnival"

The source of this article: Shallot , the original title "Calm is almost the same, write something about this wave of "carnival" thinking"

Author: simplification currency City

Written in the forefront, the entire article only represents a personal point of view.

- A picture to understand: blockchain listed companies are all sorted out

- Xiao Feng: Blockchain is not only a new technology, but also a new mechanism design.

- People's Daily official science blockchain (with full text)

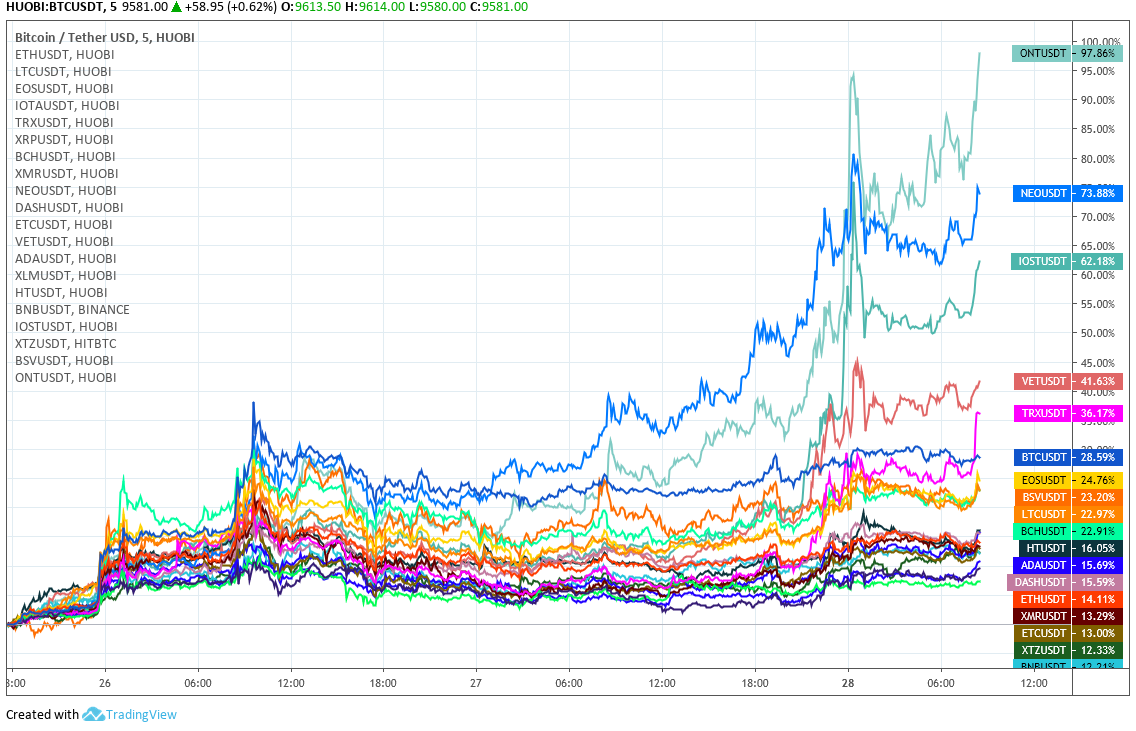

On the evening of last Friday, the chairman spoke up the chain and the currency circle. From the market performance of the weekend, the price of the currency did not “disappear” to the people in the two circles. In the short 48 hours, those few coins with a market value of the top are up by 120%, and more than 890%. At least, the increase is really awkward for people outside the circle. A-share opening, the performance of the US stock market doubling the price of the Thunder last Friday is also likely to reappear in the blockchain concept stocks, I believe that the "white swan" news incident caused by the speculation will not be in the next few days Completely eliminated.

But for this wave of market, from the first moment to the present, the author has not found a place to participate in this wave of currency circle "Pu Tian Tong Qing". Although I wanted to write something on the first day of Saturday, I always felt that it was not appropriate to sweep everyone's flushed face. So I still have been here today, with most of the currencies except the domestic public chain gradually To calm down, here are a few simple things to think about.

First of all, this "highest level of coverage" has been changed by various myths and even since the birth of the blockchain, and has not changed the current situation of extremely low pricing efficiency of Bitcoin and other mainstream currencies. The chairman’s report was widely spread by the media at 5 o'clock in the afternoon, but the market really began to rise. It was nearly 6 hours, which was only around 11 o’clock last Friday night. Started. For any financial asset of a global nature, this pricing efficiency is quite embarrassing. In 6 hours, it can be sent from Shanghai to Beijing by train.

Secondly, the report, which was even exaggeratedly referred to as the "sacred decree", saw the determination to vigorously develop blockchain technology throughout the whole period, but I did not see the content of the half-dollar relationship with the currency circle. Could it be said that on October 28, 2019, there are still people who think of currency and blockchain technology as one thing? On this point, I don't want to do too much expansion. Under the simple evidence, the current currency circle has basically formed a consensus point, that is, the platform exchanges such as BNB and HT are valuable, and the value support of these currencies is Corresponding to the profitability of the exchange, this means that the coins themselves are actually more like the “stocks” of the exchanges, and the speculation of these coins is related to the application of blockchain technology.

What's more, one thing that needs to be reminded is that China is still the world's most rigorous country for cryptocurrency regulation, a ban on the September 4th and two major mobile payment giants in China not long ago. Reiterating the banned attitude, we are always reminding us that even if the Chinese government promotes the application of blockchain technology, it does not prevent the Chinese government from still holding a clear ban on speculation. The original intention of the Chinese government to strictly control the financial market is to reduce the "risk of instability" as much as possible. Therefore, this Friday report that the performance of the participants in the currency circle is so "jumping" is likely to cause cautious attention of the regulatory authorities. It may even attract a new supervisory weight.

This Friday report, for domestic developers, is really worthy of excitement. However, for the first- and second-tier markets, especially the sickle and amaranth that are only in the secondary market, it is necessary to join in the fun, which really gives people a sense of sight that the monkey mountain is suddenly thrown into a basket of bananas. It is true that since the digital currency market is still in a very morbidly strong correlation situation so far, the increase in bitcoin prices will still drive other second-, third-, and even eight-line altcoins to strengthen collectively, but if you tell me This kind of emotional fluctuation means that these tokens that don't know which onions are the value of the investment are optional, then I can only, emmmmmmmm

In addition, the "Chinese government to promote the application of blockchain technology", the direct positive logic of Bitcoin, does not seem to be particularly pass. Bitcoin is a totem symbol since the birth of the blockchain, but whether the Chinese government’s focus will be on the upcoming digital currency of the central bank, even from the perspective of existing targets, Chain management should be the main beneficiary (more ridiculously, the domestic public chain tokens have risen, but after a full day of reaction, it really started to work on Sunday). For Bitcoin, it greets more of a challenge than a “boost”.

Finally, does this news really cause external hot money to enter the market and madly grab the coins? From a market perspective, there are objective reasons for this wave of rise during the weekend. At least the explosive increase in volume indicates that the news has attracted a lot of external capital inflows, but this "outbreak" did not reach that kind of "subversion." The level of sex. Take the trading volume of the fire currency exchange as an example. On October 26, the bitcoin volume actually hit a new high in the past two years, but compared with the volume of the day when the bitcoin price surged to around 14,000 US dollars at the end of June this year. From just about 10%, from this point of view, the inflow of external funds into the digital money market is not as crazy as the public opinion during the weekend, so the continuity of this staged outbreak still requires drawing a big question mark. .

The length of the early analysis of the occupation has written a little bit of thought above, and it is better to write something in the morning.

After a wave of BTC jumps over the weekend, I temporarily got rid of the box of the weak shock that was in the past month, and the first wave of the short-term high has just completed the decision to stabilize the half-digit of the rising callback. This morning, a new round of rally has come out. In the short term, BTC will continue to operate in a strong trend. For the existing disk, if it can give a second step back to the 9340 line and complete the stabilization decision in the short term, From the technical graphics point of view, you can continue to do more than one single chase, and look at the multi-target to see 9800, 10300. After the market volatility, even the volatility of the indicator correction stage will be greater than the performance of the previous month's bottom shock. Short-term trading follow-up recommendations pay attention to position control and set stop loss.

In addition, some of the risk points mentioned above may also lead to a risk of rapid retreat in the short-term market. Therefore, at this particular node, the conclusions drawn from the technical analysis can be referenced, but avoid excessive trust. , wind control processing is essential.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Huang Qifan: China's central bank may be the world's first central bank to launch digital currency (with full speech)

- Observation | More than 100 blockchain concept stocks: Who really has technology who just creates concepts

- Babbitt Column | The Struggle of Organizational Form: Comparison of Corporate System and Blockchain Self-Organization

- Ren Zeping: Bitcoin Research Report

- Research: US cryptocurrency holders grow 81% annually

- Evergrande Research Institute Libra Research Report: Blockchain Encryption Digital Currency

- Depth | Block rewards are about to be halved, is BTC still safe? (under)