Ren Zeping: Bitcoin Research Report

Source of this article: Zeping Macro

Text: Evergrande Institute Ren Zeping Ganyuan Shi Lingling

Intern Li Xinyi also contributed to this article

Guide

The October 24 meeting emphasized that the integrated application of blockchain technology plays an important role in new technological innovations and industrial changes. It is necessary to use the blockchain as an important breakthrough for independent innovation of core technologies. The application of blockchain technology has been extended to digital finance, Internet of Things, intelligent manufacturing, supply chain management, digital asset trading and other fields.

- Research: US cryptocurrency holders grow 81% annually

- Evergrande Research Institute Libra Research Report: Blockchain Encryption Digital Currency

- Depth | Block rewards are about to be halved, is BTC still safe? (under)

Bitcoin pioneered blockchain technology and pushed blockchain technology to the public eye. As an important breakthrough for independent innovation of core technologies, the future blockchain will greatly promote the application of digital currency and other fields.

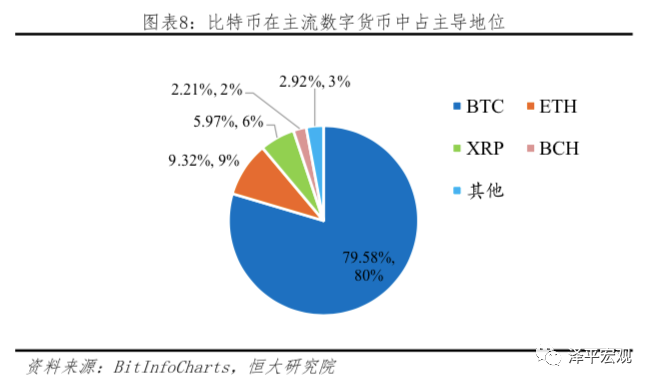

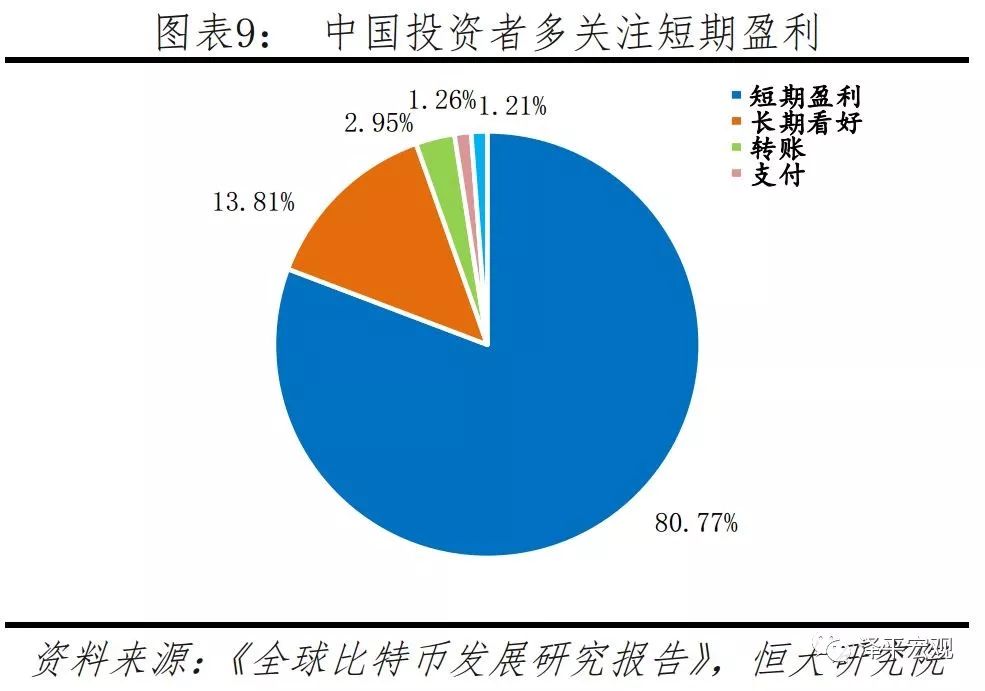

As of October 25, 2019, Bitcoin closed at $8675.6125 per unit, with a total circulation of 17.845 million and a market capitalization of $154.82 billion, accounting for approximately 70% of the total market value of mainstream digital currencies. According to the Global Bitcoin Development Research Report, China's bitcoin transactions account for 80% of global Bitcoin transactions. According to a sample survey of users of the Firecoin Net, 80.77% of Bitcoin investors aim at short-term profit, and only 13.81% of users choose to hold for a long time.

Why is Bitcoin developing rapidly? Is there a long-term investment value? Is it a digital gold, a currency revolution or a speculative bubble that cuts leek? Following the "Blockchain Research Report" and "Libra Research Report", this article will introduce the technical basis, historical development, market status, and domestic and foreign regulatory policies of Bitcoin at the textbook level, and analyze the reasons for the bitcoin skyrocketing, investment value and risk.

Summary

Bitcoin is a typical representative of decentralized virtual currency, creating blockchain technology, featuring decentralization, limited total volume, transaction security, and information disclosure. Bitcoin was born in the 2008 financial crisis, stemming from concerns about central banks and mistrust of inflationary currencies. The first published bitcoin exchange rate in October 2009 was $1,0903 bitcoin, which was calculated by generating the electricity consumed by a bitcoin. With the influx of speculative funds, regulatory easing, and the fact that countries have successively identified them as digital currencies and payment methods , Bitcoin once rose to $19,187.78 per unit in 2017. In the past 10 years, it has experienced a sharp rise and fall, forming a variety of forks and altcoins.

Speculative demand is the intrinsic reason for the skyrocketing price of bitcoin, including trading activities such as disguised exchanges and ICO financing. The relatively loose regulatory attitude of the developed economies such as the United States to Bitcoin is an important external factor for the continued expansion of Bitcoin's asset bubble. Comparing the four characteristics of the physical currency, it is found that Bitcoin can't compete with the physical currency such as gold in terms of universal acceptability and value stability, but it can satisfy the uniformity of value, and it is difficult to compare with the physical currency in terms of lightness and portability. Advantage. The biggest obstacle to the replacement of credit currency by Bitcoin is the decentralized nature. Bitcoin without credit basis cannot function well in currency. Drawing on Bitcoin-related technologies, the primary starting point for the development of central bank digital currency is to supplement and replace traditional physical currency.

While recognizing Bitcoin technology innovation, attention should be paid to the risks arising from its own operating mechanism. For new things, you should observe more and learn more and prevent risks . In order to protect the financial security of Chinese investors and maintain the stability of the financial market, the government's regulation of bitcoin trading activities has gradually tightened, and the development of private cryptocurrency is expected to be limited. At the same time, the People's Bank of China is strengthening research and development on digital currency. Virtual currency such as Bitcoin has been incorporated into its own regulatory system. While recognizing the risks of virtual currency itself, we cannot deny the innovation and development potential of blockchain technology. The research and development of the central bank's digital currency conforms to the development needs of the times, guarantees the national credit, adheres to the principle of centralized management, and maintains the national monetary sovereignty while providing efficient services.

Risk Warning: Bitcoin can't be traded if it is too strict; hackers bring a lot of risk events; violent fluctuations in bitcoin prices make it difficult to stabilize monetary functions

text

I. Background introduction

1. Virtual currency: the product of Internet popularity

Virtual currency refers to a non-physical currency that exists widely in the Internet world and is distinguished from real entities by media. The usual form of existence is a string of numbers recorded on a certain network account. With the popularity of personal computers and the development of Internet technologies, people's online activities have exploded. As a kind of trading medium in the network world, virtual currency is widely distributed in the fields of e-commerce and internet finance, which brings convenient transaction and payment experience to network users.

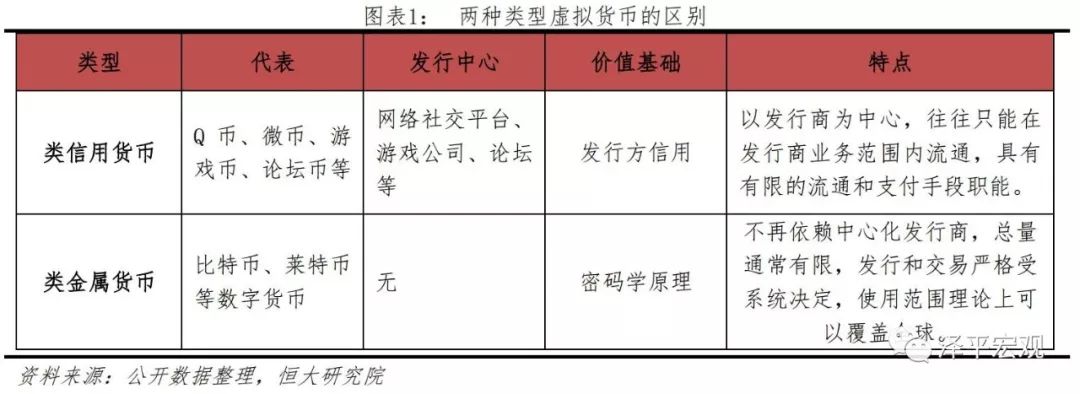

According to the different distribution methods of virtual currency, it can be divided into two categories: one is based on Tencent's Q coins, Shanda's coupons, various forum coins, game coins, and distribution centers. Legal virtual currency, like credit currency, is often a credit currency, and its issuance is determined by the centralization agency. One type is decentralized metal-like virtual currency represented by bitcoin and other digital currencies. Just as the production of precious metals in real life is limited, the amount of currency-issued monetary currency is often strictly limited by algorithms. The main differences between them are as follows:

2. Bitcoin: representative of decentralized digital currency

The concept of Bitcoin was originally proposed by Nakamoto in 2009. It is a digital currency in the form of P2P. Its production and trading rely on the open source software released by Nakamoto Satoshi and the P2P network built on it. As a representative of decentralized virtual currency, Bitcoin has developed rapidly in recent years and has become the most influential virtual currency in the global market.

Bitcoin pioneered blockchain technology , which uses blockchain data structures to validate and store data, uses distributed node consensus algorithms to generate and update data, and uses cryptography to ensure data transmission and access security. Script code consists of a smart contract to program and manipulate data in a completely new distributed infrastructure and computing paradigm.

We can simply define that Bitcoin is generated by a computer, the total number is strictly limited, the transaction security is high, the data is difficult to lose and corrupt, and the historical transaction records are distributed in the Bitcoin network. Unlike the credit currency issued by the central government, the value of bitcoin depends on people's trust in the Bitcoin system algorithm rather than the government. Bitcoin transactions are based on an electronic cash system implemented by peer-to-peer technology. It allows both parties to make online payments directly. It does not require the clearing and settlement of intermediate authorities, which improves the efficiency of transactions and settlements and saves the cost of cross-border transactions.

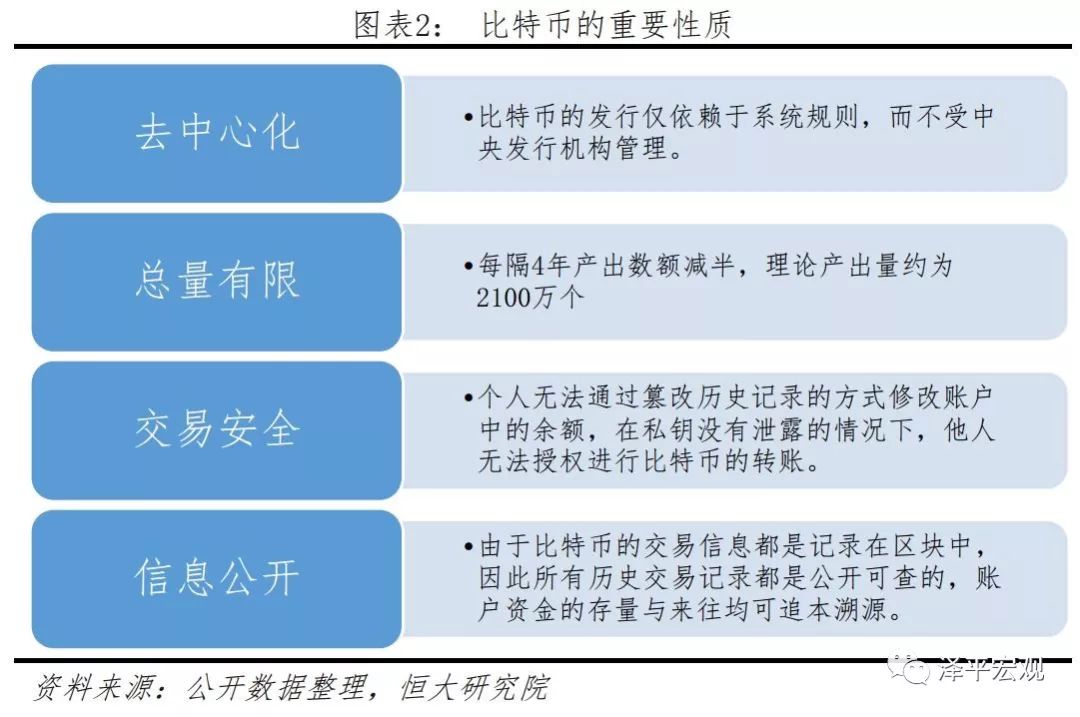

Bitcoin mainly has four characteristics: the system sets the distribution method, there is no central issuer; the annual issue number is halved every four years, and the final amount is limited; the balance information is difficult to tamper with, the transaction security is guaranteed, and the overall system stability is strong; Historical transaction records are public.

3. Bitcoin production methods

The production of bitcoin has the characteristics of calculating the output and smoothing the benefits . The production process of Bitcoin is to find a random number through a large number of calculations. A specific function is used to make a value in the block meet the requirements of the system. The new block is generated, and the user who successfully calculates the random number satisfying the requirement obtains the system reward. . In order to increase the probability of their own success, the participants maximized their share of the total network computing power by improving the performance of their own mining chips and expanding the scale of mining equipment.

The mining pool model has gradually become the mainstream of mining. Assuming 1000 people are involved in mining, each time donating 50 bitcoins, the expected time for a single miner to successfully dig the mine is 1000 10 minutes, that is, the expected return is 50 bitcoins in about 7 days, but the real time may be longer. Or shorter, the profit of the miners is highly volatile. If the 1000 participants join together to form a “mine pool”, all mining gains are equally divided by all participants, and the actual earnings of each miner will be smoothed to 0.05 bitcoins per 10 minutes, and the stability of earnings will be greatly improved. .

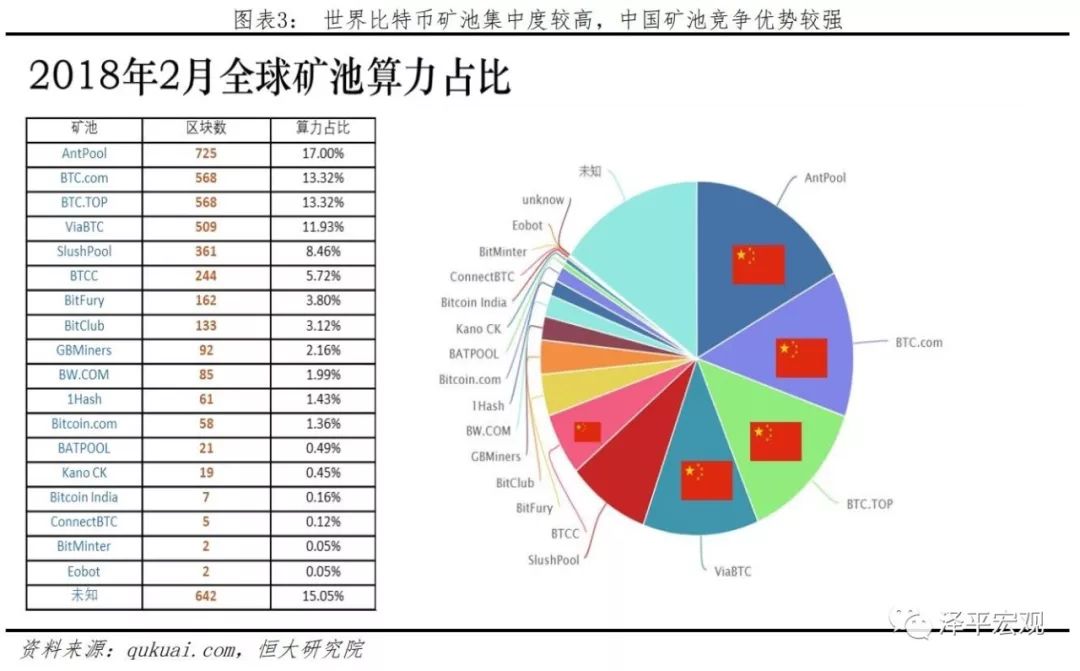

Investors can either participate in the calculation of their own mining equipment in the mining pool, or directly use the funds to rent the mining pool to share the pool revenue. At present, the concentration of the global Bitcoin mining pool is relatively high, and the calculation power of the top ten mining pools has reached 80%. The domestic famous Bitcoin commercial mining pools have F2Pool, BTCCPool, AntPool, BWPool, etc., on a global scale. Have a strong competitive advantage. The mines use a lot of electricity and are generally built in areas with abundant electricity and low electricity prices.

The bitcoin trading market is highly concentrated. In overseas markets, mainstream exchanges occupy most of the market share, and the new exchanges differentiate their positions to acquire customers. In the domestic market, the bitcoin trading platform before 2017 showed the situation of China Fortune Network, OKcoin and Bitcoin China. In September 2017, the central bank and the seven ministries and commissions issued the “Announcement on Preventing the Risk of Subsidy Issuance Financing”, requiring various ICOs. Stop immediately, and major trading platforms have ceased to operate.

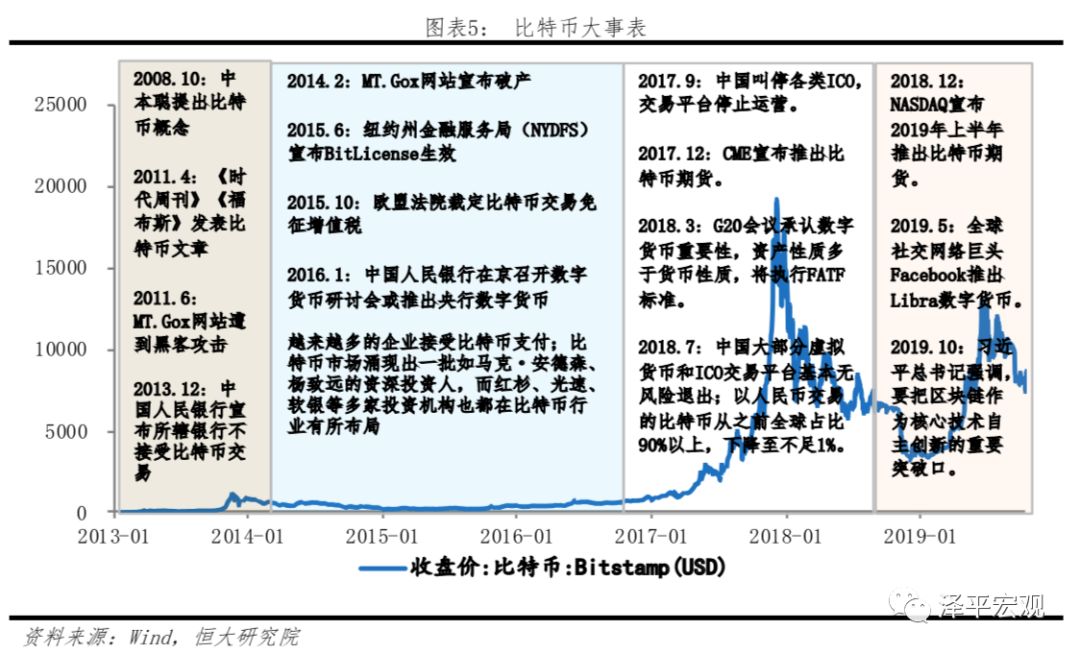

4. The development path of Bitcoin's hundred thousand turns

Since the advent of Bitcoin in the past 10 years, from the initial game of self-entertainment of programmers to the digital assets of the world, it has been repeatedly questioned. In the past 10 years, the value of Bitcoin has achieved an alarming increase in volatility. As of October 25, 2019, Bitcoin has been exploited in a total of 17.845 million pieces, with a total of 600,900 blocks, a price of $8675.61, and a total market value of more than $154.8 billion, making it an eye-catching asset allocation in the world. ring. As a controversial new asset, Bitcoin is affected by macroeconomic conditions such as international economy, monetary policy and foreign exchange policy, as well as factors such as trading platform supervision, grey industry demand, and blockchain technology development. The development of Bitcoin can be summarized as the following four stages.

The first stage: 2008.10-2011.6 the rise of new things

Bitcoin was born in the 2008 financial crisis, stemming from concerns about central banks and mistrust of inflationary currencies. The first published bitcoin exchange rate in October 2009 was $1,0903 bitcoin, which was calculated by generating the electricity consumed by a bitcoin. In May of 2010, Bitcoin was first given the “money” payment method attribute: a Florida Florida programmer exchanged a $25 pizza coupon with 10,000 bitcoins, which gave birth to the bit. The first fair exchange rate of the currency: 0.25 cents / bitcoin. In July of the same year, the news released by the Bitcoin client was mentioned by the famous news website Slashdot, which brought a lot of new users to Bitcoin. The price of Bitcoin rose to 0.08 USD in the next five days. With the increasing attention of public opinion such as Time Magazine and Forbes and the rise in the variety of Bitcoin convertibility, its price has soared.

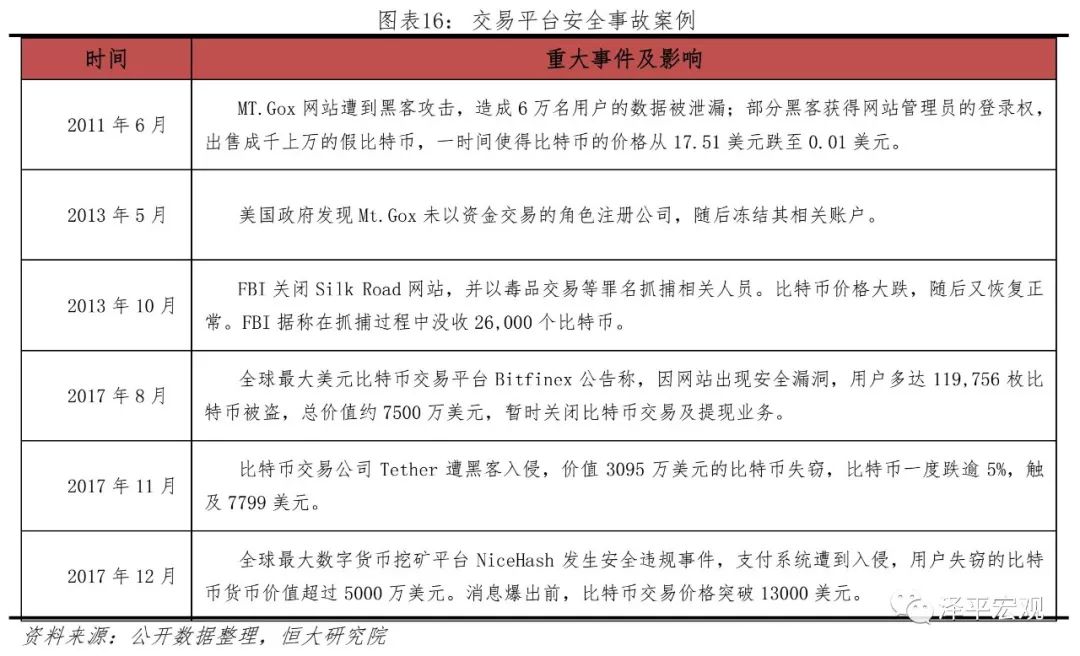

The second stage: 2011.6-2013.12 two bursts of foam

On June 19, 2011, the MT.Gox website carrying more than 70% of bitcoin transactions was hacked, causing the data of 60,000 users to be leaked. Some hackers obtained the login rights of webmasters and sold a large number of fake bitcoins. For a time, the price of Bitcoin fell from $17.51 to $0.01. In the following six months, many platforms were hacked, and the Bitconinica platform was permanently shut down due to two attacks. These disasters made the Bitcoin trading platform and Bitcoin investors fully aware of the security risks posed by hackers.

After the vicious incident, 2012 became a year for Bitcoin to restore market confidence. During the year, the first Bitcoin magazine was born, the first credit default swap transaction for Bitcoin only took place, and commodity and service providers began to accept bitcoin payments. The price of Bitcoin returned to $13.41 at the end of 2012. In 2013, with the market recovery, the influx of a large number of Chinese investors and the volatility caused by short-term events, bitcoin prices rose to $100 in April, and remained volatile in the range of $60-140 in October.

On December 5, 2013, the central bank issued a circular prohibiting Chinese banks and payment institutions from directly or indirectly participating in Bitcoin exchange transactions. The ban applies only to government-owned banks and government-approved payments, and ordinary Chinese citizens can still trade free bitcoin as a commodity. On December 18, 2013, bitcoin prices fell to RMB 2011 (about US$330) in China. The bursting of the bubble this time reflects the market risk caused by differences in attitudes towards Bitcoin regulation.

The third stage: rebound after the weakdown in 2014.03-2016.11

The price of Bitcoin in 2014-2016 is generally "U" type. In the past three years, the MT.Gox website, which was once a smash hit, was hacked and went bankrupt; more and more companies accepted bitcoin payments; the Bitcoin market emerged with a number of such as Mark Anderson, Yang Zhiyuan, and Li Ka-shing. Senior investors, and many investment institutions such as Sequoia, Lightspeed, Softbank, etc. are also in the Bitcoin industry.

The fourth stage: 2017-2018 crazy bull market again after disillusionment

At this stage, the influx of a large number of speculators and institutional investors, market acceptance and technology upgrades have stimulated bitcoin to enter the crazy bull market. However, the fiery market of Bitcoin did not last long, and the price quickly fell after the price reached a high point. The huge drop made the high-end speculators lose their blood, and the dispute over Bitcoin became more and more heated.

The fifth stage: the year of repair of the 2018-2019 bitcoin market

A new wave of risk-seeking rebounds in the global market has brought a round of capital inflows to Bitcoin and other digital assets that are seen as chasing risks. The vigorous development and policy support of blockchain technology has also provided an optimistic environment for the Bitcoin market.

5, chaos like the beginning: forked coins and altcoin

Bitcoin traders use a uniform set of rules (data structures) that are key to securing bitcoin transactions and circulation, while Bitcoin wallets determine the validity of each trade by identifying transaction records on the block. Sex. So why is Bitcoin bifurcated?

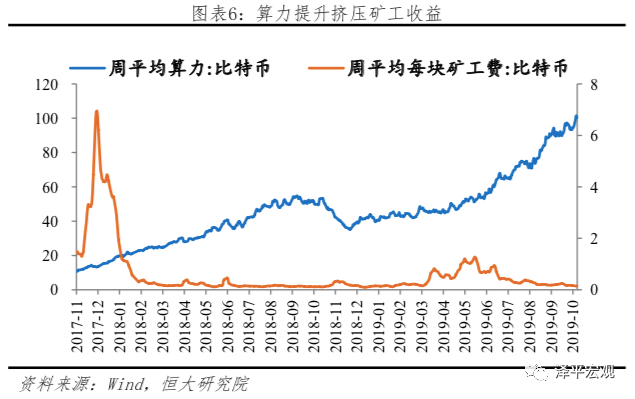

The block size limit of Bitcoin has reduced the mining revenue and the mining cost remains high. In order to prevent the overload risk of the Bitcoin network and encourage the entire network to participate in mining, Nakamoto first limited the block size of Bitcoin to 1M. But as bitcoin acceptance increases, mining and trading demand increases, the 1M block size limit makes the network prone to congestion. The increase in the computing power of the whole network has caused the difficulty and cost of bitcoin mining, and the income of miners is also reduced by the difficulty of mining. According to the data released by BTC, as of October 24, 2019, the average weekly power of Bitcoin was 98.87EH/s, while the data on October 19, 2018 was only 51.41EH/s, an increase of 92.3%. The difficulty has also increased rapidly, reaching the current 13.69T from 7.18T in the same period last year.

Bitcoin is concentrated in a small number of interest groups, and newcomers seek new ways of participation. In the 10 years since the birth of Bitcoin, about 17.84 million bitcoins have been mined, and most of the bitcoin is concentrated in the Bitcoin development team and a few large mine owners, so the new virtual currency trader Looking for a virtual currency with potential for appreciation.

In this context, two mainstream upgrade improvement strategies have been proposed on the market: hard forks and soft forks. The hard fork is simply a new node formed on the blockchain during the mining process. Due to the relatively independent mining behavior of the miners, some of the calculations may continue to mine at the new nodes to form a bifurcation. A new specification. New specifications are often released and will only be released when the majority of nodes agree. At this time, if the old node does not accept the upgrade and continues to maintain the original blockchain, the block generated by the new node cannot be identified by the old block, and this divergence causes a hard fork. The soft fork is a bidirectional compatible specification design. The blocks generated under the new specification can be identified by the old nodes, and the blocks generated by the old nodes can also be identified by the new nodes. This upgrade method will not Produces true forks for fine-tuning bitcoin data structures.

The technical upgrade of Bitcoin has been on the line, but the improvement scheme proposed by the development team is different, which makes a variety of forked coins such as BCH, BTG, B2X, BCD, SBTC and BCHC appear on the market.

At the same time as the rapid development of Bitcoin, some development teams were inspired by the design of Bitcoin. Through the improvement of Bitcoin's algorithm, a wide variety of other virtual currencies were created. The most active one is Litecoin. The birth of Litecoin was inspired by Bitcoin and technically has the same implementation principle aimed at improving Bitcoin. There are three significant differences compared to Bitcoin: First, the Litecoin network can process one block every 2.5 minutes (rather than 10 minutes), thus providing faster transaction confirmation. Second, it is expected to produce 84 million Litecoins, which is four times the amount of money issued by the Bitcoin network. Third, the computational complexity of the encryption algorithm used by the workload proof algorithm is slightly lower than that of bitcoin, which reduces the difficulty of mining.

Virtual currency similar to Litecoin is based on the implementation of Bitcoin. More or less changes are made. Technically speaking, it is not difficult, but it will cause market confusion. Whether it is Bitcoin's forked or altcoin, these so-called improvements or upgrades do not deviate from the implementation of Bitcoin. However, the emergence of these currencies will not only divert the power of Bitcoin, but also lack the authority to regulate the issuance and circulation of these currencies. Hundreds of virtual currencies will emerge in a short period of time, making it difficult to ensure the safety of investors through supervision. .

Second, behind the skyrocketing bitcoin: speculative demand and inadequate regulation

Bitcoin transactions have been active since 2013, and prices have shown an explosive upward trend. From the lowest price in 2013 of 66.34 US dollars / to the historical highest price of 19187.78 US dollars / month, the value has increased nearly 300 times. What is the reason for the rich myth of Bitcoin? We believe that we need to discuss the reasons for the crazy rise of Bitcoin from speculative needs and regulatory levels.

1. Bitcoin speculation demand dominates price increase

Bitcoin has many advantages as a trading product: easy account opening, low trading threshold, low handling fee, 24-hour trading and no geographical restrictions. These advantages have led to a rapid increase in bitcoin trading volume, with a daily turnover from the lowest point of 2.86 million US dollars, 2017 On December 21, the year reached $21.8 billion.

Bitcoin is dominant in mainstream digital currencies, and Chinese investors are more concerned about short-term earnings. As of October 25, 2019, Bitcoin closed at $8675.6125 per unit, with a total circulation of 17.845 million and a market capitalization of $154.82 billion, accounting for approximately 70% of the total market value of mainstream digital currencies. According to the Global Bitcoin Development Research Report, China's bitcoin transactions account for 80% of global Bitcoin transactions. According to a sample survey of users of the Firecoin Net, the investors of Bitcoin are mostly 30-39 years old, and the proportion of investors with high school education or above is more than 80%, and the proportion of IT practitioners is the total number of users. About 35.45%, 80.77% of Bitcoin investors aim for short-term profit, and only 13.81% of users choose to hold for a long time.

Bitcoin may be used as part of a channel to bypass foreign exchange controls. China has a foreign exchange quota of up to 50,000 US dollars per person per year. In 2016, the RMB depreciation was large. Some domestic investors sought investment channels other than gold, or bypassed capital controls to transfer funds overseas. They buy bitcoin on domestic exchanges, then transfer those bitcoins to an overseas exchange, and ultimately sell the bitcoins to get dollars or other foreign currencies. According to the Wall Street Journal reported on November 7, 2016, Chinese investors bought Bitcoin aggressively as the yuan fell. The total global trading volume of Bitcoin reached 47 million in the week of October 24, 2016. The trading volume of the three major bitcoin exchanges in China accounted for 98% of the global trading volume in July-October 2016.

ICO has become a new financing method in the blockchain field. ICO (Initial Coin Offering) refers to financing through the issuance of crypto tokens and quickly leading the blockchain startup financing. Compared with the IPO financing method, ICO has the characteristics of small regulatory restrictions, fast financing, and is not subject to cross-border financing laws. On March 19, 2018, the US House of Representatives passed the “RegA+ Regulation Amendment Act”, which increased the ceiling on corporate securities issuance by 50% to $75 million and can be applied to ICO issuance. In September 2017, Filecoin's financing reached US$257 million. In 2018, Russia's Telegram has accumulated a total financing of US$1.7 billion, creating a new record for ICO project financing. However, the ICO project has high requirements for investors and blockchain related knowledge. The international community is still not perfect in the supervision of ICO financing model, and there is no mature legal mechanism to protect the legitimate rights and interests of investors.

2. Insufficient supervision provides a relaxed environment for speculation

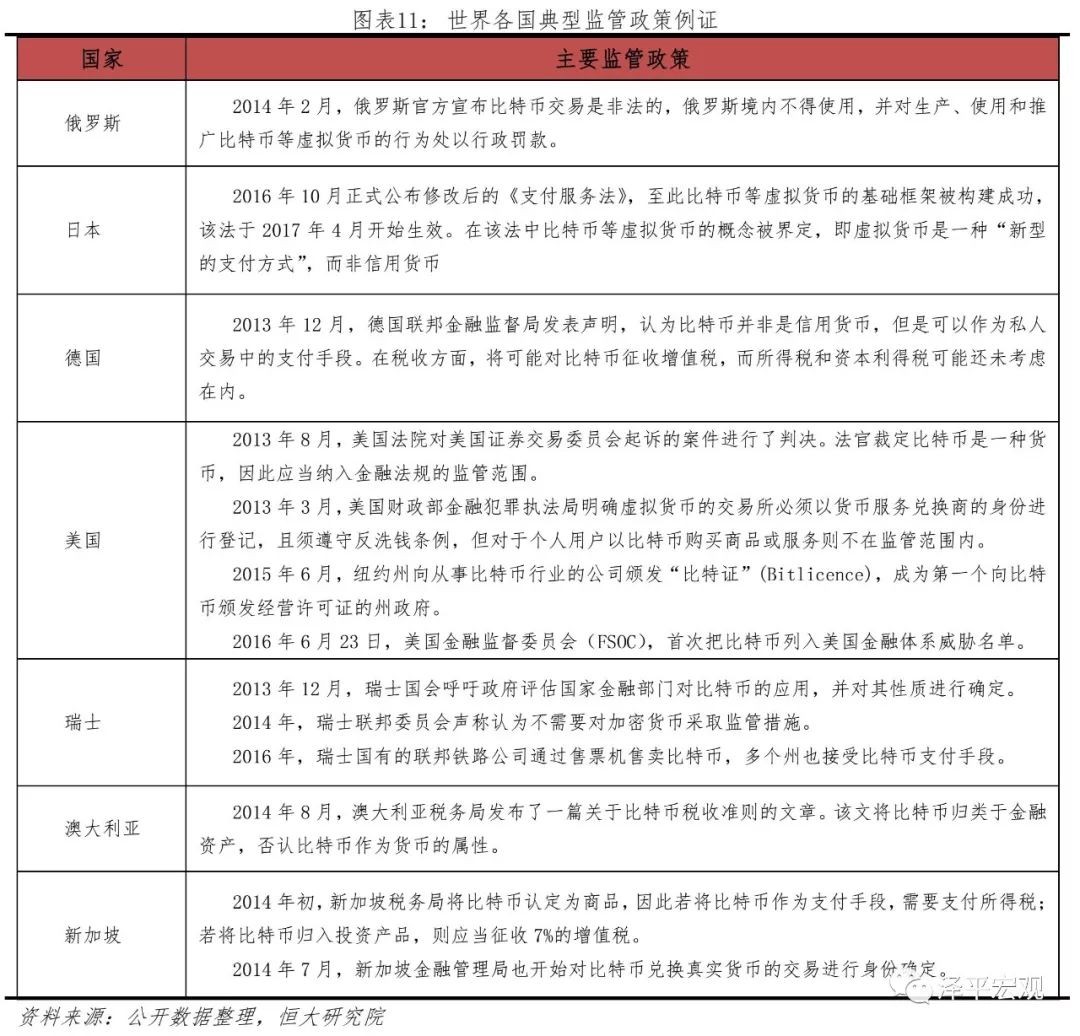

Inadequate regulation is an important external factor in the birth of the bitcoin price bubble. Due to the large differences in the development of financial markets, central government power, and investor conservatism in the world, countries have different attitudes toward Bitcoin. At present, only Russia, Iceland, Bolivia, Ecuador, Kyrgyzstan and Vietnam are the only countries that have adopted a strict ban on Bitcoin. In developed economies such as the United States, Germany, Switzerland, and Australia, the regulation of Bitcoin is relatively loose, and it is only included in its own regulatory framework.

Comparing the regulatory policies of different countries and regions, it can be seen that countries such as the United States and Singapore have relatively loose regulation of Bitcoin, and it is clear that Bitcoin does not have credit currency status, but can be used as a financial asset for investment. China, France, Japan, the European Union and other countries and regions have introduced stricter regulatory measures for Bitcoin. Bitcoin is not considered to be a real currency and cannot be used as currency in the market. However, relevant legal policies have not been established. Investor interests. We believe that the relative easing of regulation and the relative delay of legislation are important external factors for the continued expansion of the Bitcoin bubble.

Third, bitcoin investment: in essence, not money, investment still needs to be viewed

According to the form of currency, we can divide the currency into two categories: physical currency and credit currency: physical currency is mainly used as the general equivalent of commodity exchange, and metal currency is the most representative one; in the 1930s, The global economic crisis has caused global panic and financial chaos, forcing the major capitalist countries to break away from the gold standard and the silver standard. The currency that the state provides credit endorsement came into being, the so-called credit currency.

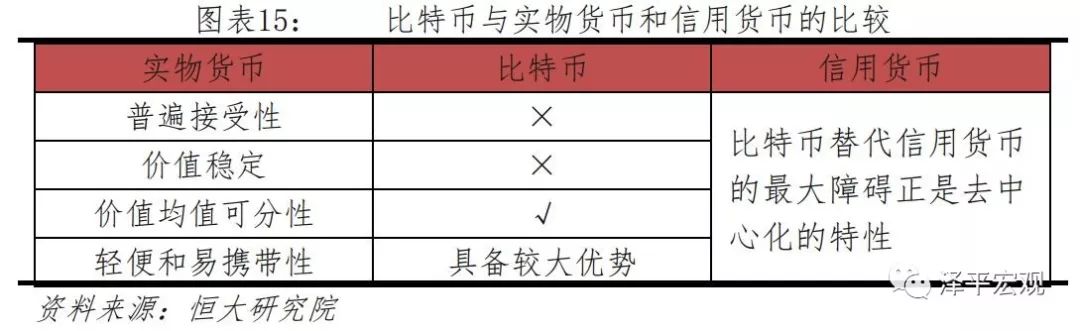

1. Bitcoin and physical currency

The physical currency is the initial form of money produced in the process of commodity exchange, and is the general form of value of the commodity trading medium, based on its own value as a commodity. Goods that can act as physical currency have the following characteristics: 1 universal acceptance; 2 stable value; 2 value average separability; 4 light and easy to carry. The metal currency is the most representative physical currency. Among them, gold as a physical currency still plays a role in economic activities. Next, we will compare the similarities and differences between gold and bitcoin according to the four characteristics of the physical currency, and then explore the bitcoin substitution. The possibility of physical currency.

From the perspective of universal acceptability, gold possesses the dual attributes of commodity and currency. Hu Entong (2005) believes that these two attributes play a role in historical development at the same time, but the degree of highlighting of the two attributes is different at different times. From the perspective of commodity attributes, gold, like other general commodities, plays a role in real life, such as in the fields of jewelry and electronics industry, and the exploitation of gold also reflects the labor value of human beings. From the perspective of currency attributes, Wang Suzhen (2014) believes that the essential characteristics of money are generally acceptable. Before the collapse of the Bretton Woods system, gold was the most widely accepted currency and was used as a general equivalent to measure the value of other commodities. Even under the current credit currency system, gold is still the value base of all credit currencies and can be used as a settlement tool worldwide. The history of gold is almost as long as the history of mankind. From the initial fanaticism to the role of becoming a special commodity to play a trading medium, gold's position in human trading activities is difficult to replace. Under the classical gold standard system, gold is linked to the currency of a country, and the value of each currency is measured by a certain amount of gold. Even after the collapse of the Bretton Woods system, a country’s gold reserves are still used to balance the balance of payments, maintain or influence exchange rate levels, and play a special role in stabilizing the national economy, curbing inflation, and improving international credit.

For Bitcoin, first of all , bitcoin is essentially a product of the development of computer technology. As a series of numbers recorded on the carrier, it has no use value in life. There is a view that the mining process of Bitcoin consumes electricity, and the power consumption can reflect the intrinsic value of Bitcoin. This is a one-sided understanding. Bitcoin mining is a reward for computers that solve mathematical problems. This process is not a value creation activity involving humans, but a mathematical game recognized by developers and participants. Therefore, Bitcoin does not have a use value, its mining process cannot reflect the value of labor, and there is no commodity attribute similar to gold. Secondly, from the perspective of currency attributes, Bitcoin's acceptance range is quite limited. Currently, there are not many companies that accept Bitcoin as a means of trading, and it is affected by the tightening of global regulations and the volatility of bitcoin prices. Major social media. The platform also began to reject virtual currency such as Bitcoin . Twitter issued an advertising ban on March 26, 2018. In order to avoid potential fraud and cause the public to lose a lot of money, the platform will ban virtual currency ICO and sales advertising. Facebook and Google have previously made similar decisions to ban virtual currency advertising. Well-known forums and social networking site Reddit also announced that they would stop accepting bitcoin payments.

From the perspective of value stability, the price of gold is affected by many factors. Jiang Xianling (2017) shows that the London gold spot price cycle is opposite to the economic development cycle under the long cycle; the medium cycle shows the characteristics consistent with the commodity price cycle; Short-term gold prices are greatly affected by sudden factors, and investor sentiment and expectations are the main reasons for fluctuations. However, the intrinsic value of gold, that is, the labor time value contained in commodities, is long-term unchanged, because gold mining technology has not experienced major breakthroughs for many years. Since the birth of Bitcoin, the debate over its intrinsic value has never stopped, mainly because Bitcoin itself does not contain labor time value and is not linked to any physical assets, which also causes the price fluctuation of Bitcoin to be extremely intense. We calculate the COMEX gold price and the bitcoin price from January 30, 2013 to October 25, 2019. The standard deviation of the two is 104.16 and 3674.84 respectively. The price fluctuation of Bitcoin in the same period is much greater than that of gold. Stabilizing this point, Bitcoin can't compete with gold.

From the perspective of uniform value divisibility, the smallest unit of bitcoin is Cong, and one bitcoin is equal to 100 million Cong. In theory, the value of gold is evenly divided.

From the perspective of lightness and portability, in the context of the small amount of transactions in the early stage of human society, the business activities of various countries can be settled in the form of gold coins and gold bars. Gold is light and portable with respect to other metal currencies. Because the same quality of gold can represent more value . With the development of society, gold can not be adapted to the rapid growth of transaction volume and is gradually replaced by substitute currency and credit currency. In this respect, Bitcoin has the advantage that physical currency such as gold can't match. Bitcoin's storage and transactions rely on Bitcoin wallet and Internet environment. By connecting your account to the network, you can achieve global scale. Transfers and transactions, so convenience is often considered a huge advantage of Bitcoin.

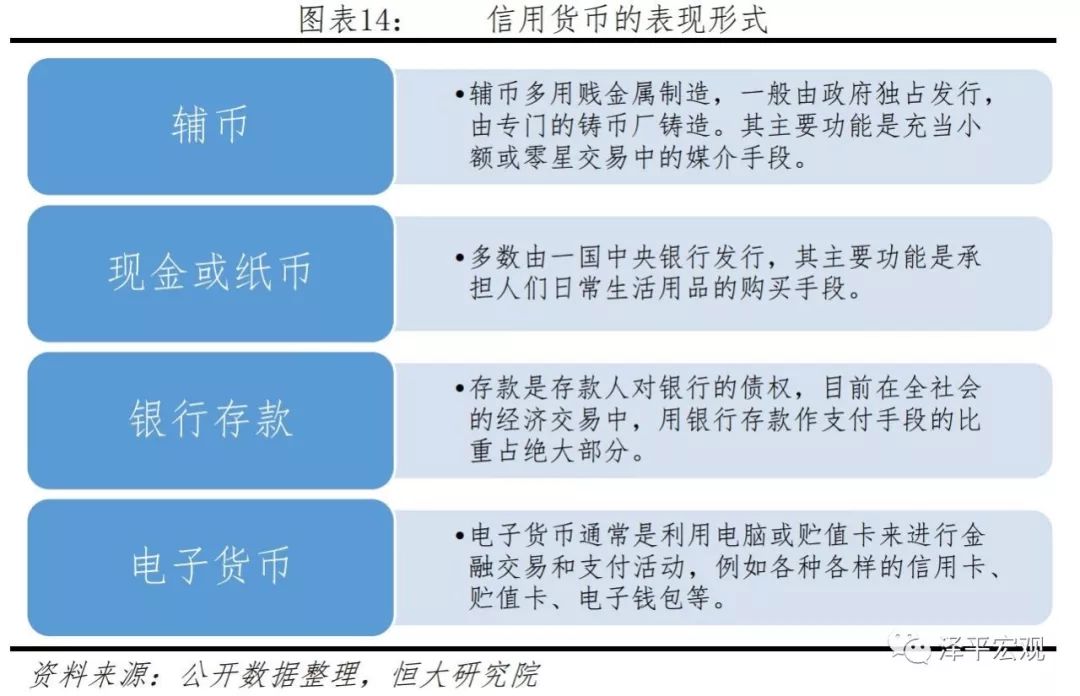

2. Bitcoin and credit currency

The credit currency is stipulated by national law. It is mandatory to circulate a currency that does not use any precious metal as an independent function of monetary function. Its value is far lower than its monetary value. At present, the currencies issued by countries all over the world are basically credit currencies. Credit currency representations include tokens, cash or banknotes, bank deposits, and electronic money.

Keynes's "Monetary Theory" points out that the money of account is a currency that represents debt, price, and general purchasing power. This currency is the original concept in monetary theory. Yan Junhong (2002) shows that the essence of money is credit , and the essence of money development is the diminishing transaction costs. The credit currency is essentially a kind of debt that is granted by the state body, and its circulation ability is imposed by the law. This is the guarantee that the credit currency has general grantability. Generally speaking, credit currency has the following characteristics: 1 value symbol; 2 debt currency; 2 mandatory and legal; 4 national entities can regulate the issuance of credit currency.

The biggest obstacle to replacing coin currency with bitcoin is the decentralization . This feature means that Bitcoin lacks the issuer, and teams with development capabilities are likely to develop new digital currencies, forked coins, and altcoin in theory can have the same functions as Bitcoin. So what kind of virtual currency should we use to trade is a problem that cannot be reached because there is no law that gives the mandatory circulation of virtual currency such as Bitcoin . The lack of credible countries or organizations endorsing them, and not linking with any physical assets, Bitcoin does not exist as a credit basis for money, and naturally does not function well in currency. Even when sovereign states declare bitcoin illegal, bitcoin may be worthless.

Bitcoin can't replace credit currency. Compared with physical currency, bitcoin is theoretically feasible in terms of uniform value divisibility, and its huge advantage in portability and portability cannot be ignored. Therefore, we believe that the reference to Bitcoin related technology is necessary. Yao Qian, the director of the Central Bank Digital Currency Research Institute, also pointed out that in the article “Technical Considerations of the Central Bank’s Digital Currency”, the primary starting point for China’s R&D central bank digital currency is to supplement Replace traditional physical currency. But the essence of Bitcoin is not money, and its investment still needs to be watched.

Fourth, the future of Bitcoin: limit the development of private cryptocurrency, accelerate the development of central bank digital currency

1. The risk of Bitcoin: the inherent risks arising from its own operating mechanism

Behind the myth of Bitcoin's creation, there are many potential risks hidden. The design mechanism of Bitcoin has caused it to be different from the previous currency, and there are many trait problems. – Market risks, over – market issues, storage transaction risks, operational risks, privacy-related risks, and legal and regulatory risks .

Market risk: First of all, whether bitcoin is used as an asset investment or as a trading medium, any bitcoin holder will face market risk caused by bitcoin price fluctuations. Bitcoin, which lacks the issuer, is almost uncontrolled and is easily affected by external factors. The lack of a value base makes it difficult to determine the intrinsic value of Bitcoin. Such uncertainty may cause losses to investors. Unstable currency may reduce the incentives for investors to hold Bitcoin and make it difficult for merchants to use Bitcoin pricing, a volatility that hinders the further expansion of Bitcoin's circulation.

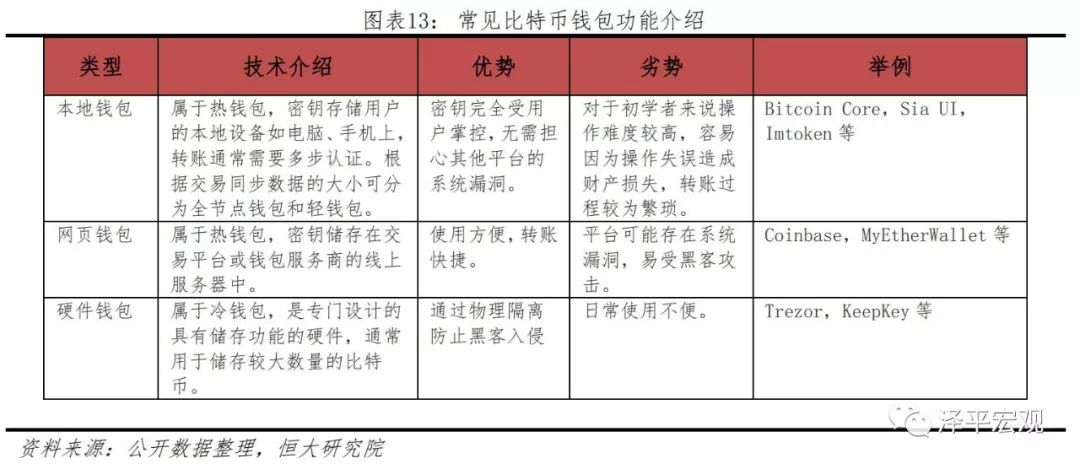

Storage risk: The bitcoin that the holder has to mine and purchase must be stored in various electronic wallets. The online platform's e-wallet often has insufficient security factor and is vulnerable to hacking and bitcoin. The offline wallet has hidden dangers of loss or damage. If the computer is not backed up and damaged, it is also possible to permanently lose Bitcoin.

Trading risk: The irreversibility of bitcoin payments also increases trading risk. If Bitcoin is sent due to mistakes or fraud, the Bitcoin system does not have a built-in mechanism to solve this problem. Although buyers and sellers can voluntarily agree to correct the mistakes, there is no mechanism for the Bitcoin agreement to force the funds back. Irreversibility makes Bitcoin at a disadvantage in trading competition: all other things being equal, consumers should prefer a payment system that avoids false payments.

Privacy-related risks: Bitcoin also poses a potential risk to investors' privacy. Bitcoin transactions are actually non-real-name systems, and the transaction information for each account is completely public, except that the actual holder of the account is unknown. However, the use of bitcoin for goods purchases and online payments often requires a mailing address and a real name. In principle, the identity of the Bitcoin user can be obtained from these sources, which poses a risk of privacy leakage for the user.

Policy risk: Finally, the Bitcoin system faces different laws and regulations in different countries. Legislation on the taxation of bitcoin income and the protection of bitcoin assets in various countries is relatively weak, and the legitimate rights and interests of investors may be difficult to obtain effective protection. At present, in China, bitcoin regulation has the following shortcomings: 1) The definition of bitcoin law is vague . At present, the connotation extension of China's "virtual currency" has no explicit provisions or explanations, and it itself is a vague concept. There are loopholes and gaps in legal supervision. In specific cases or practices, the law cannot play a guiding role. 2) The value of Bitcoin is difficult to identify . The price fluctuation of Bitcoin is fierce, which makes the value of Bitcoin judged inaccurate. When the interests of Bitcoin traders are damaged, it is difficult to be properly handled. It is possible that some crimes convicted and sentenced due to the value of Bitcoin will be erratic and vulnerable. The law is majestic and affects subsequent judicial remedies. 3) The jurisdiction is unclear and the applicable law is not available . In the case of bitcoin infringement violations, a series of legal disputes such as the jurisdiction of the possessor, the court of jurisdiction, and the place of infringement have become a major issue in the judicial field. When Bitcoin cross-border crimes, how to determine judicial power is even more difficult to reunify national treaties or rules, increasing the difficulty of resolving international cases.

2. China's regulation of bitcoin

With the rise of Bitcoin worldwide, Chinese investors have also begun to flood into the bitcoin market, becoming an important force in bitcoin transactions. In June 2011, Bitcoin China Trading Platform was launched, mainly as a service provider for Bitcoin trading and trading. Domestic Bitcoin began to be concerned. In May 2013, China’s CCTV “Economic Half Hour” introduced the new bitcoin to the Chinese audience for the first time. This is the first time that the official media of the Chinese government introduced Bitcoin, which is considered a positive signal. The bitcoin trading volume in the Chinese market ranks first in the world. However, with the rapid development of Bitcoin, there have been many altcoin transactions and illegal ICO financing projects in China. In order to protect the financial security of Chinese investors and maintain the stability of the financial market, the government's supervision of bitcoin trading activities has gradually tightened.

In December 2013, the central bank and other five ministries issued the “Notice on the Prevention of Bitcoin Risk”, which considered Bitcoin to be a virtual commodity and required financial institutions and payment institutions not to use Bitcoin as a product or pricing unit, and not to engage in Bitcoin directly. Buying and selling services, and not providing clearing, settlement and other services for Bitcoin transactions. This creates a fence between Bitcoin and the financial industry to prevent the spread of bitcoin risk to the financial industry and lead to more serious systemic risks. The major banks also responded quickly to regulatory requirements and banned the provision of services for Bitcoin. After the notice was issued, the market violently shocked and the bitcoin price suffered a setback. Since then, the price of bitcoin has dropped by 70% from the peak of 8,000 yuan, and once fell below 2,000 yuan.

In March 2014, the central bank issued the “Notice on Further Strengthening the Prevention of Bitcoin Risk Prevention”, prohibiting domestic banks and third-party payment institutions from providing services such as account opening, recharging, payment, and cash withdrawal of the Bitcoin trading platform.

Stop illegal ICO activities and clear the relevant exchanges. As of the first half of 2017, China's ICO market has begun to take shape, raising funds of 2.6 billion yuan. At the same time, however, the lack of government-regulated ICO activities has led to a large number of mixed ICO projects, the lack of clear norms of the issuer, the lack of appropriate management of investors, the irrational behavior of investors, the market bubble and the illegal exploitation of money laundering. Such hidden dangers. In September 2017, the central bank and the seven ministries and commissions issued the “Announcement on Preventing the Risk of Subsidy Issuance Financing”, requiring all types of ICOs to stop immediately and the relevant trading platforms to stop operating. At this point, Bitcoin is clearly restricted in China.

On January 12, 2018, the China Internet Finance Association issued the “Risk Tips on Preventing Disguised ICO Activities” , pointing out that a model called “Migration of Virtual Digital Assets with Mining Machines as Core” (IMO) is worthy of vigilance and risks. .

On March 28, 2018, Fan Yifei , deputy governor of the central bank, said in the 2018 national currency gold and silver work video conference that in 2018, internal management and external supervision will be strengthened, and various types of virtual currency will be cleaned up.

On August 24, 2018, the five ministries and commissions , such as the China Insurance Regulatory Commission, jointly issued the “Risk Prompt on Preventing Illegal Fund Raising in the Name of “Virtual Currency” and “Blockchain”, stating that such activities are based on “financial innovation”. The Ponzi scheme of "borrowing new and old" is difficult to maintain for a long time.

On February 21, 2019 , at the 2019 National Monetary and Gold Work Conference of the People's Bank of China, Fan Yifei, deputy governor of the central bank, said that in 2019, the central bank's digital currency research and development should be further promoted and virtual currency monitoring and supervision should be strengthened.

3. Central Bank Digital Currency: China is at the forefront of the world

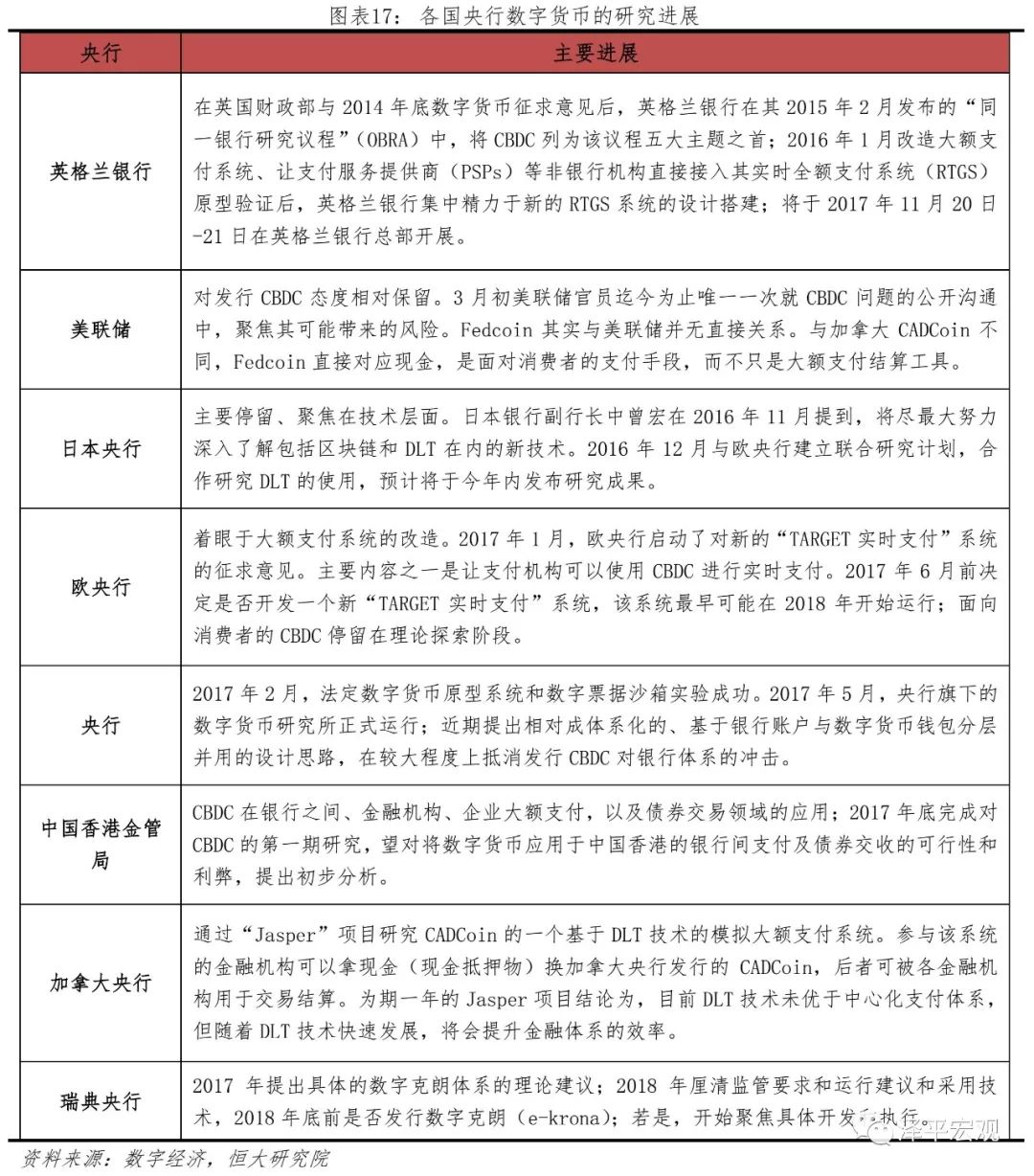

The central bank's credit currency is supported by the national credit endorsement and has the statutory mandatory circulation capacity. The cryptocurrency such as Bitcoin is based on the principle of cryptography. Because of the lack of credit endorsement and the issuer, the value of the currency is vulnerable to changes in external policies and speculation, and the scope of acceptance is relatively limited. With the rise of bitcoin and blockchain technology, the central bank's digital currency has become a key research area in various countries. Many central banks such as the United Kingdom and Canada have indicated that they will be involved in this field, but no central bank has come up with practical applications. Sheng Songcheng (2016) believes that digital currency technology innovation cannot replace the central bank's currency issuance and monetary policy, and is expected to play an important role in reducing the cost of issuance, ensuring the security of funds and improving the efficiency of transactions.

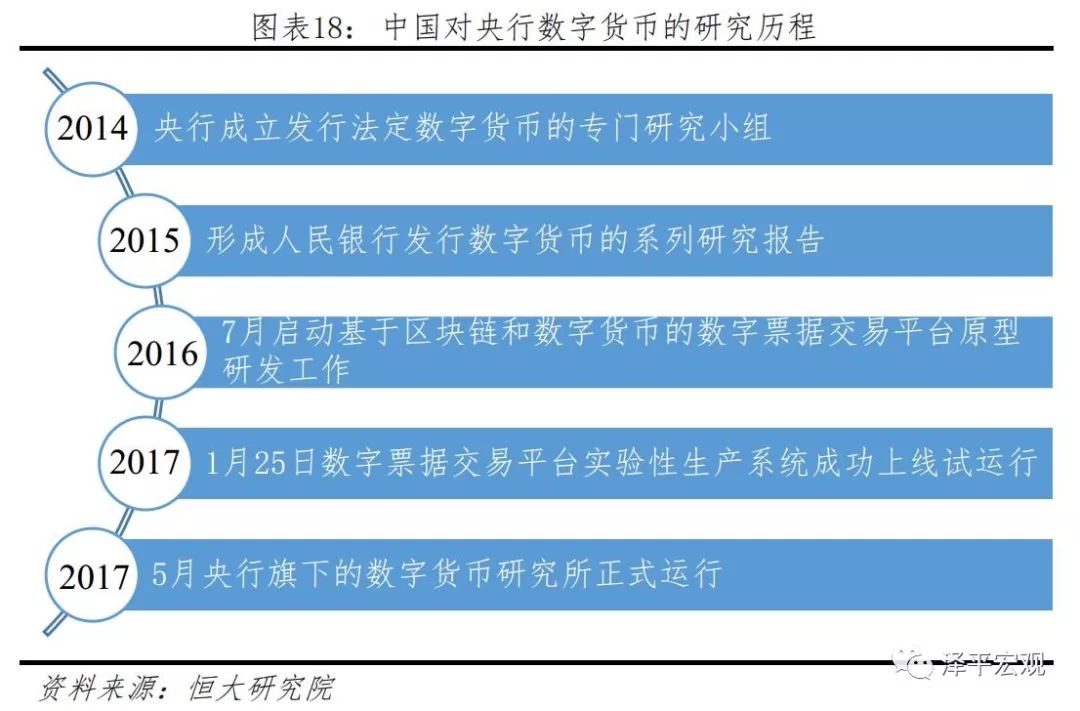

China started early in the development of legal digital currency and developed rapidly . In 2014, the central bank of China set up a special research group to demonstrate the feasibility of the central bank issuing legal digital currency. In September 2016, the preparatory group of the bill trading platform and the preparatory group of the digital currency research institute set up a digital bill trading platform preparatory group to start the number. Closed development of the bill trading platform. On January 25, 2017, the experimental production system of the digital bill trading platform was successfully put into trial operation, successfully completed the digital ticket issuance, acceptance, discounting and re-discounting business based on blockchain technology, realizing the breakthrough progress of the digital bill business. It is a milestone in applying blockchain technology to the financial sector.

There are two modes for the operation of legal digital currency: one is that the central bank directly issues digital currency to the public; the other is to follow the traditional “central bank-commercial bank” dual model. Fan Yifei, deputy governor of the central bank, wrote the article "Some Considerations on the Digital Currency of the Central Bank". The second model (double-layered delivery system) is more in line with China's national conditions. This model still uses the current banknote issuance and circulation model. The central bank issues digital currency to the commercial banking business library. Commercial banks are entrusted by the central bank to provide services such as legal digital currency access to the public, and together with the central bank maintain legal digital currency issuance. The normal operation of the circulation system. The advantage of the "central bank-commercial bank" dual model lies in the central bank's credit guarantee, which has unlimited legal compensation; it is conducive to fully mobilizing market resources to promote innovation and competitive selection; it is conducive to decentralization of risks; avoiding the direct issuance of digital currency by the central bank. The “squeezing effect” affects the investment and loan capacity of commercial banks.

Virtual currency such as Bitcoin has been incorporated into its own regulatory system. While recognizing the risks of virtual currency itself, we cannot deny the innovation and development potential of blockchain technology. The research and development of the central bank's digital currency conforms to the needs of the development of the times, but it must be guaranteed by national credit and adhere to the principle of centralized management in order to maintain the national monetary sovereignty while providing efficient services.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Should blockchain transactions be rolled back? Vitalik's small investigation sparked a big discussion

- Passing the cryptography, the legalization of the industry is not far behind?

- In the blockchain competition, China's goal is the first!

- Interpretation | Political Bureau set, blockchain industry welcomes gold development

- Depth | Block rewards are about to be halved, is BTC still safe? (in)

- 2019 cryptocurrency trend observation: the market is cold, but still has opportunities

- Regarding the blockchain technology that the country pushes, we have given you five key points.