Analysis | The remainder is king: who can survive the spring?

Introduction

In November 2019, China launched a new wave of supervision of digital token exchanges. This week's special topic will summarize the characteristics of foreign compliance exchanges listed on the shelf, and explore which projects can persist until the spring of the blockchain industry.

Summary

- Global Blockchain Private Equity Financing Overwhelming Winter, November Dec. 66.4% MoM

- ECB executives: "We cannot sacrifice security" when talking about Libra

- Securities Daily: Digital assets will generate super enterprises

Topic: The remainder is king, who can survive the spring? In November 2019, China launched a new round of supervision of digital token exchanges. From a global perspective, compliance of digital asset exchanges is the general trend. At present, the digital assets of the compliant exchanges mainly include three categories: 1) Well-known public chains and operating platforms. 2) Compliance projects invested by industry-leading VCs. 3) Compliance and Stability Token. Domestic digital asset-related supervision is still in its infancy, and initial supervision may be stricter. The digital assets that can survive after this round of regulatory "fire" will become "real gold" and have the opportunity to shine on the fast track of the development of China's blockchain industry.

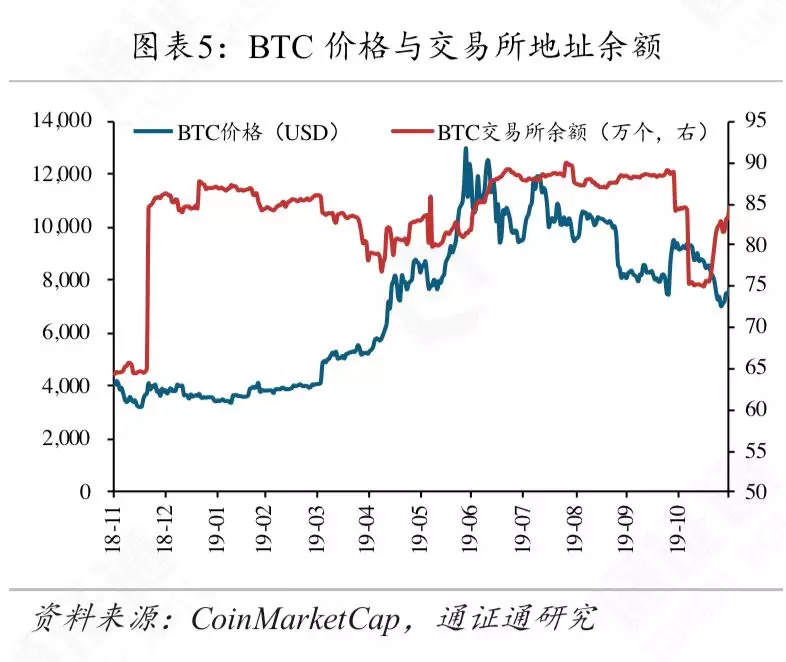

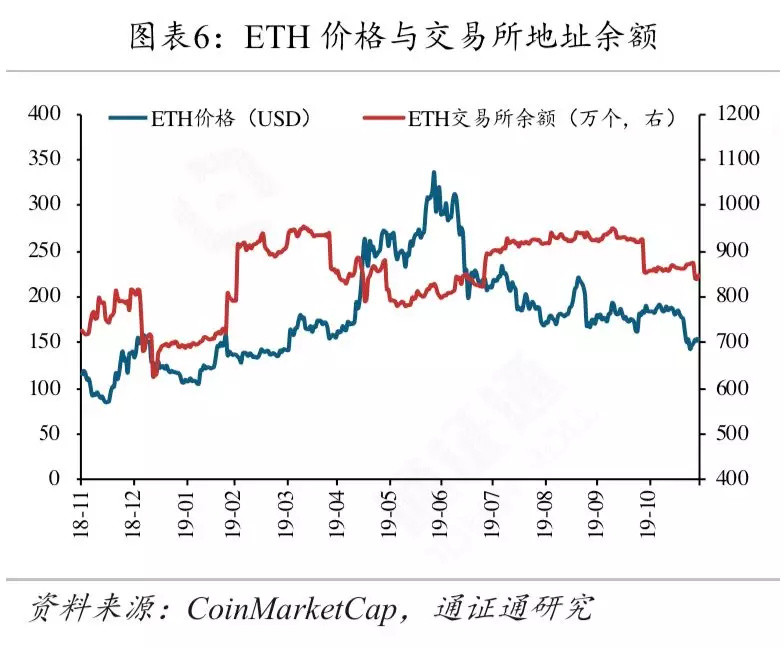

Quotes: Oversold rebound, confirm bottom. The ChaiNext Digital Asset 100 Index closed at 690.24 points this week, up 5.91%. The ChaiNext Digital Asset 100X Index closed at 1755.55 points, up 4.52%. The total market value of digital tokens this week was US $ 223.49 billion, an increase of about 5.8%; the average daily transaction volume was US $ 80.83 billion, an increase of 9.1%. BTC's current price is $ 7,761, a weekly increase of 6.4%, and the average daily trading volume is $ 25.4 billion. The current price of ETH is US $ 155.3, a weekly increase of 3.3%, and the average daily trading volume is US $ 8.33 billion. The BTC balance of the exchange this week was 846,100, an increase of 24,747 from last week. The exchange ETH balance was 8.475 million, an increase of 236,000 from last week. In the BICS secondary industry, the market share of payment settlement has increased.

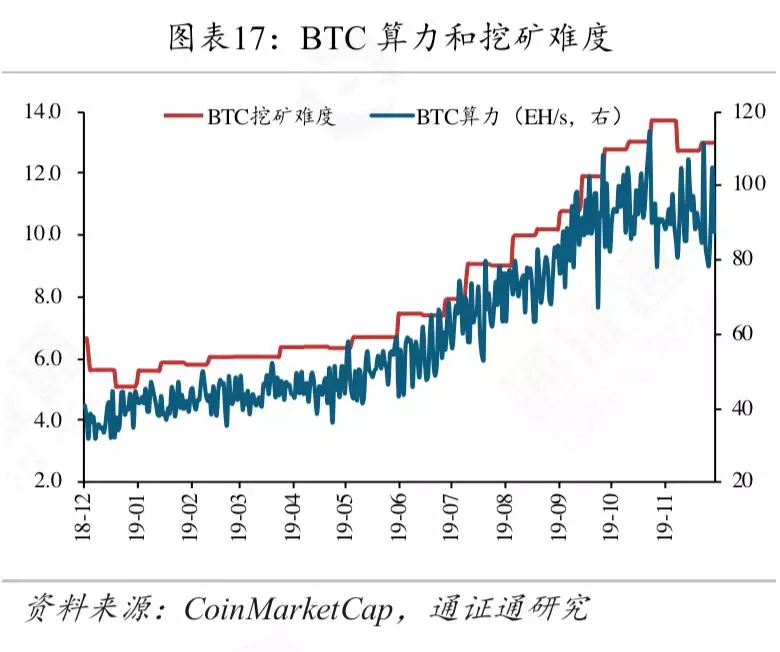

Output and popularity: BTC hashrate has picked up. The mining difficulty of BTC this week was 12.97T, which increased by 0.00024T this week; the average daily computing power this week was 91.12EH / s, which was an increase of 0.30EH / s from last week; the mining difficulty of ETH this week was 2538, which was an increase of 104 days from last week. The average computing power is 176.7TH / S, which is 3.7TH / S lower than last week.

Industry: Large institutions attach great importance to the crypto market. Kao EU Bank will be allowed to hold and sell BTC; Upbit's sudden theft event costs approximately $ 50 million; Bakkt will launch a cash delivery futures contract in Singapore; IBM applies for a blockchain patent that “prevents theft of anonymous drones” .

Risk warning: regulatory policy risks, market trend risks

text

1 Topic: The remainder is king, who can survive the spring?

1.1 A new wave of regulation is coming

In November 2019, China initiated a new round of supervision of digital token exchanges. According to media reports, Binance's Shanghai office was closed and office staff evacuated; some employees of the BISS exchange were investigated by the police; BiKi was continuously "criticized" by the Securities Times and the financial network name; IDAX exchange was filed for investigation … According to the Shanghai Securities News Data: Since 2019, a total of 6 newly discovered domestic virtual token trading platforms have been closed; 203 overseas virtual token trading platforms have been disposed of in 7 batches.

Compliance of digital asset exchanges is the general trend. The United States, Japan, Singapore, Hong Kong, China and other countries have issued regulations related to digital asset transactions. Exchanges that provide services to their nationals (or residents living in the above regions) must apply for corresponding licenses, such as the US Treasury Financial Crime The Money Service Business (MSB) financial license issued by the Law Enforcement Agency (FinCEN), the BitLicense license issued by the New York State Financial Services Bureau, and the virtual token exchange license issued by the Japan Financial Services Agency (FSA). The regulatory framework for domestic digital asset transactions is still lacking, but under the trend of vigorously developing blockchain technology, compliance and license of digital asset exchanges are the general trend.

1.2 Three Rules of Compliance Exchanges Listing Tokens

Coinbase is currently one of the world's largest compliant digital asset exchanges, with products such as Coinbase, Coinbase Pro (formerly GDAX), holding BitLicense licenses in New York and transfer transaction licenses in more than 40 states in the United States. Meets US regulatory standards. Binance.US is a compliant exchange launched by Binance specifically for U.S. users and holds a US MSB license. All bitFlyer, Coincheck and other transactions held by Japan with FSA licenses.

With reference to the Coinbase Digital Assets Standard published by Coinbase Pro, the standards for digital assets listed on compliant exchanges are more stringent than those on non-compliant exchanges. First, digital assets should comply with US securities laws and cannot be judged as securities under the SEC's securities law framework. Second, digital assets must not violate anti-money laundering, anti-terrorist financing, and other local government regulations. In addition, Coinbase will also comprehensively consider indicators such as the team's quality, technical capabilities, integrity reputation, governance policy, liquidity, economic model, and on-chain data of digital assets. For digital assets that have been financed through the sale of tokens, Coinbase will also evaluate the security, fairness and distribution ratio of the token sales process.

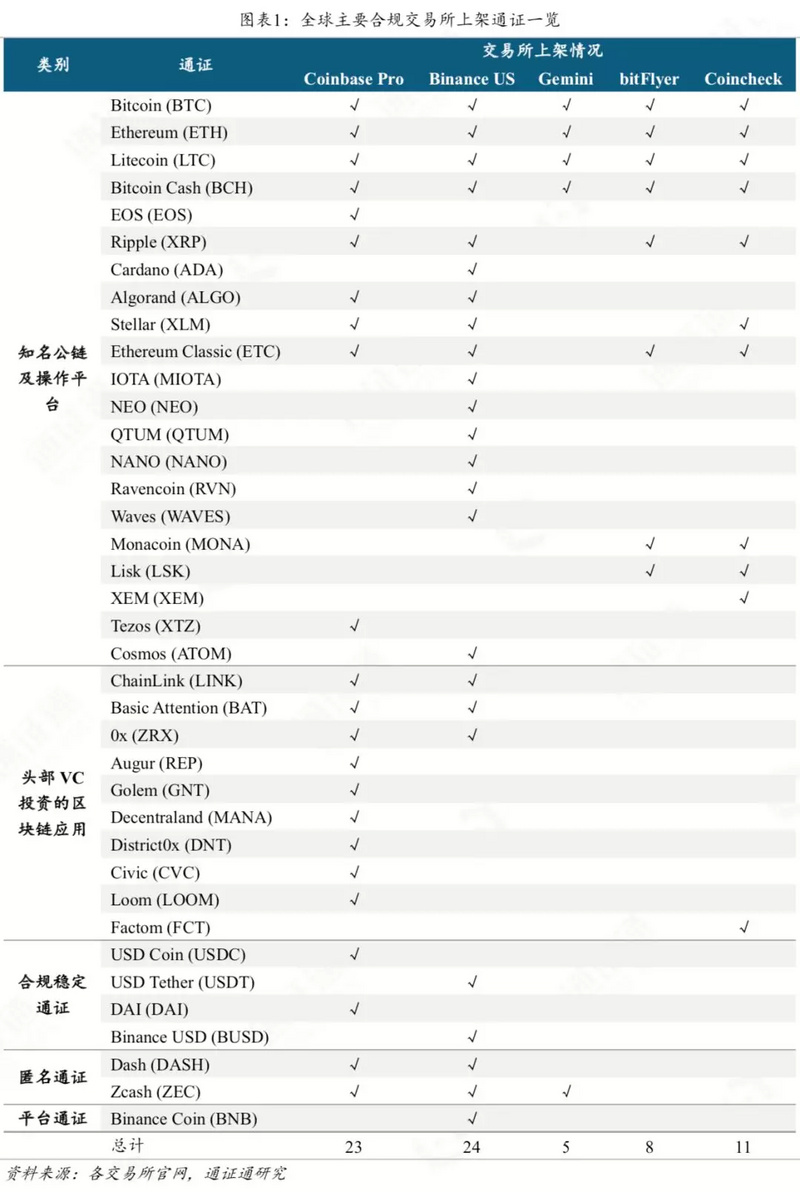

The following table lists the global major compliance exchanges.

The digital assets currently listed on compliance exchanges mainly include three types.

1) Well-known public chain and operation platform. Including Bitcoin, Ethereum, EOS, Cardano and other well-known public chain projects with a certain community and ecological foundation, as well as well-known blockchain projects such as Stellar and Ripple with payment settlement as their main purpose.

2) Compliance projects invested by industry-leading VCs. These projects are mostly based on the development of mature public chains or operating platforms, focusing on the implementation of decentralized applications. For example, the off-chain data interaction project ChainLink (LINK), the decentralized computing power leasing project Golem (GNT), the decentralized game concept project Decentraland (MANA), and the decentralized advertising platform Basic Attention Token (BAT) are all Coinbase Compliance projects invested with Binance's investor Fundamental Labs. In addition, District Capital and Nirvana Capital have also invested in several projects that have listed compliance exchanges.

3) Compliance and Stability Token. Coinbase only lists the Compliance Centralized Stability Token USDC and Decentralized Stability Token DAI, and Binance US lists USDT and BUSD.

Japan and the United States have different attitudes towards anonymous tokens. Anonymous token transactions are not disclosed on the chain, which is not convenient for tracking transactions and anti-money laundering supervision. In May 2018, the Japan Financial Services Agency requested Coinchek to remove the anonymous tokens XMR, DASH and ZEC, which means that the Japan Compliance Exchange cannot conduct anonymous token transactions. FinCEN and the Financial Action Task Force (FATF) stated that anonymous tokens are not completely prohibited, as long as there are corresponding controls to reduce the risks associated with anonymous tokens. Both Coinbase Pro and Binance.US can trade DASH and ZEC.

The platform token is expected to be listed on the compliance exchange. Binance.US launches Binance platform token BNB, indicating that BNB is not classified as a security under the current framework of the SEC.

1.3 The "leftover" is king, who can survive the spring?

The Hainan International Offshore Innovation and Entrepreneurship Demonstration Zone Construction and Blockchain Digital Asset Trading Technology Innovation High-end Forum was held in Sanya on December 1, 2019. At the meeting, Oke Group announced that it will establish a blockchain offshore digital The Asset Transaction Lab and the subsequent construction of the Blockchain Big Data Research Institute and the Blockchain Innovation Application R & D Center will accelerate the development of blockchain technology and industrial innovation.

The establishment of a digital asset trading laboratory will be an important step in the field of digital asset supervision in China. What kind of projects can survive the wave of regulation? Combined with the asset evaluation framework of overseas compliance exchanges and the analysis of the existing domestic blockchain project pattern, projects with the following characteristics are more likely to survive the big waves and sands.

1) Well-known public chains and operating platforms at home and abroad

2) Blockchain infrastructure and applications that serve the real economy and improve efficiency

3) Projects invested by well-known VC institutions at home and abroad

4) Token financing, illegal fund raising, and other violations of domestic regulations

Domestic digital asset-related supervision is still in its infancy, and initial supervision may be stricter. According to 36 氪 report, Li Xiaofeng, the director of the Institute of Financial Information Technology of the Central Bank, said: "Combined with practice, what is currently meaningful is that (digital token) is Libra, which has an impact on the status of the RMB. Digital currencies will bring financial foundation The construction of facilities will also bring about the question of how laws and regulations should be done. Our country is still cleaning up its portals. We must clear all kinds of exchanges and currency issuing institutions before the central bank will make its official appearance. The digital assets that can survive after this round of regulatory "fire" will become "real gold" and have the opportunity to shine on the fast track of the development of China's blockchain industry.

2 Quotes: Oversold rebound, confirm the bottom

2.1 Overall market: oversold rebound

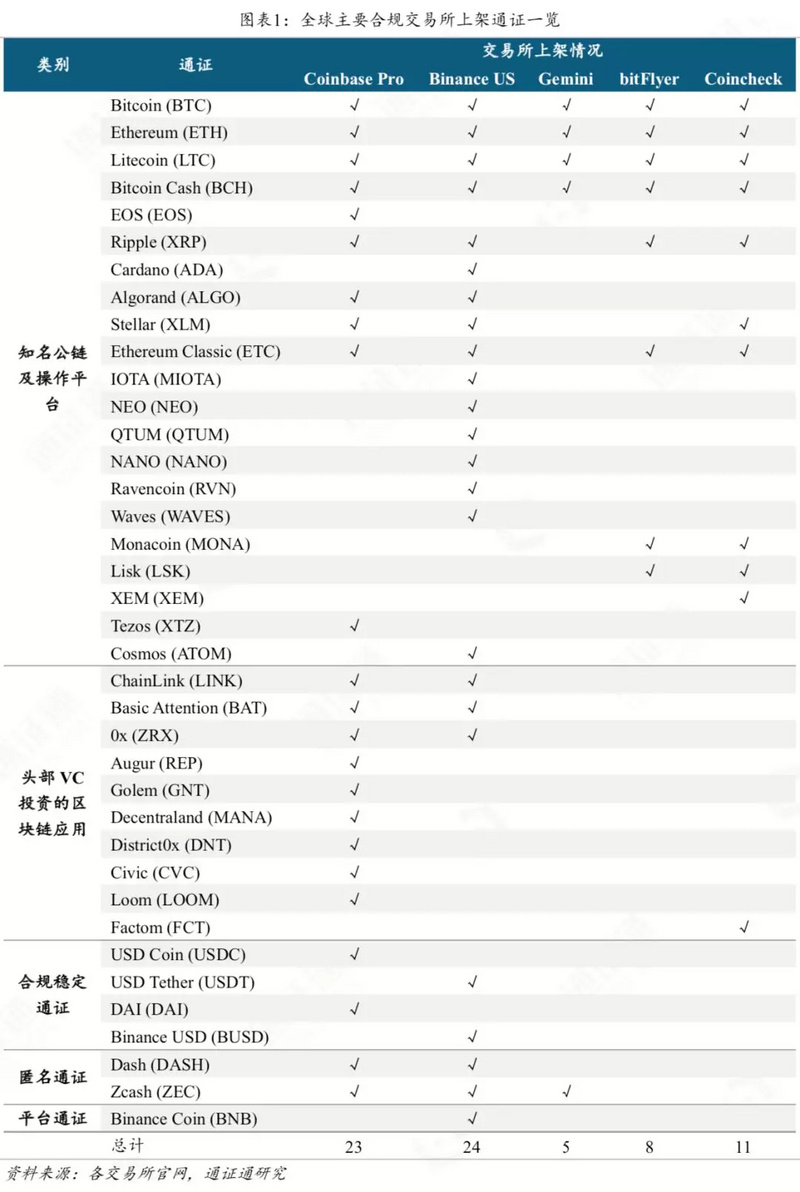

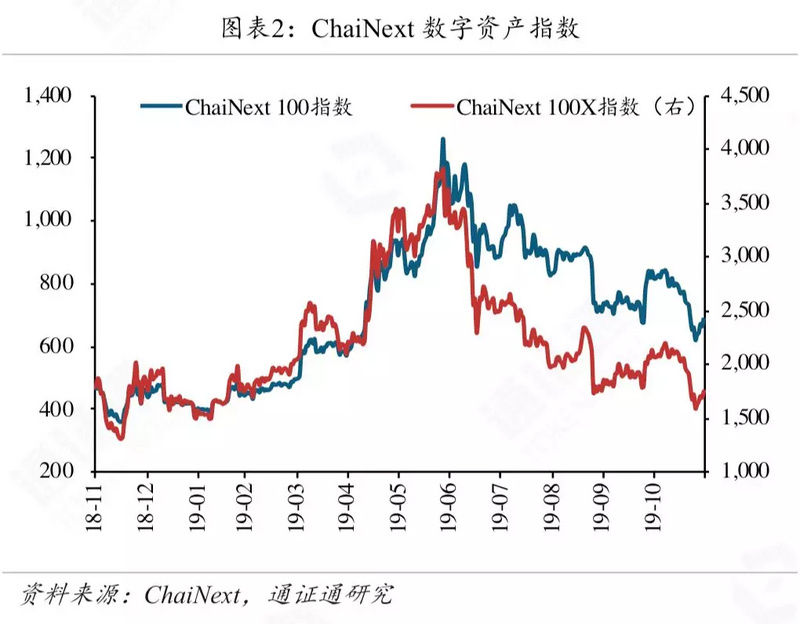

The ChaiNext Digital Asset 100 Index closed at 690.24 points this week, up 5.91%. The ChaiNext Digital Asset 100X (no BTC) index closed at 1755.55 points, an increase of 4.52%. The main circulation certificate is slightly weaker than BTC.

The total market value of digital tokens this week was US $ 223.49 billion, an increase of US $ 11.73 billion from last week, or an increase of approximately 5.8%.

The daily average volume of digital tokens this week was US $ 80.83 billion, an increase of 9.1% over the previous week, and the average daily turnover rate was 39.9%, an increase of 6.4% over the previous week. The market rebounded oversold this week, and the trading volume rose sharply.

The BTC balance of the exchange this week was 846,100, an increase of 24,747 from last week. The exchange ETH balance was 8.475 million, which was 236,000 less than last week. The exchange ETH balances all declined slightly, and the selling pressure in the market decreased.

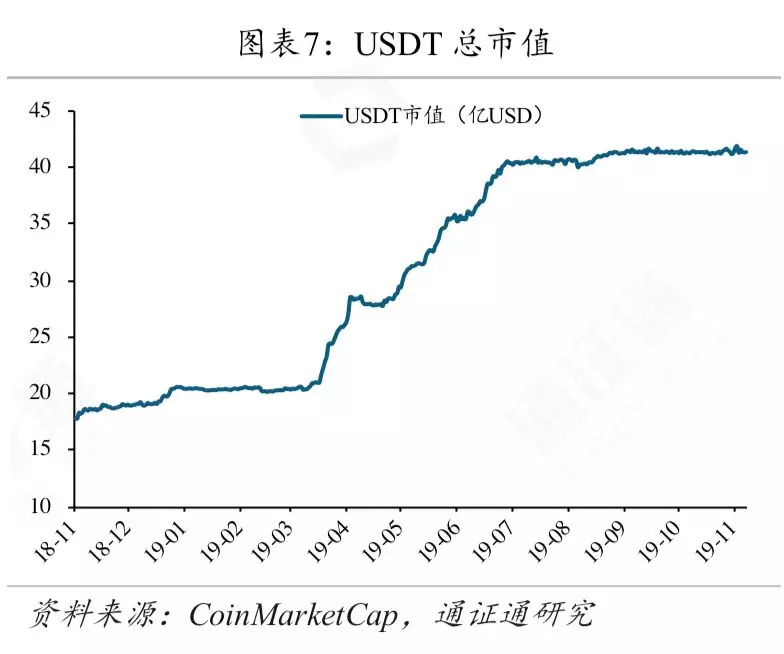

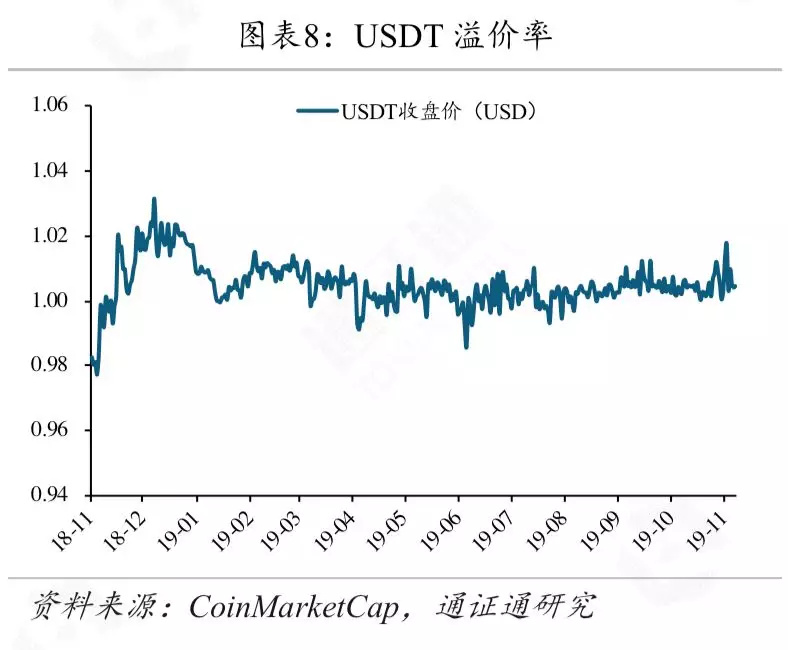

The market value of USDT is $ 4.127 billion, a decrease of $ 6.06 million from last week. USDT has a slight premium.

2.2 Core Tokens: Most Master Circulation Certificates Collectively Rebound

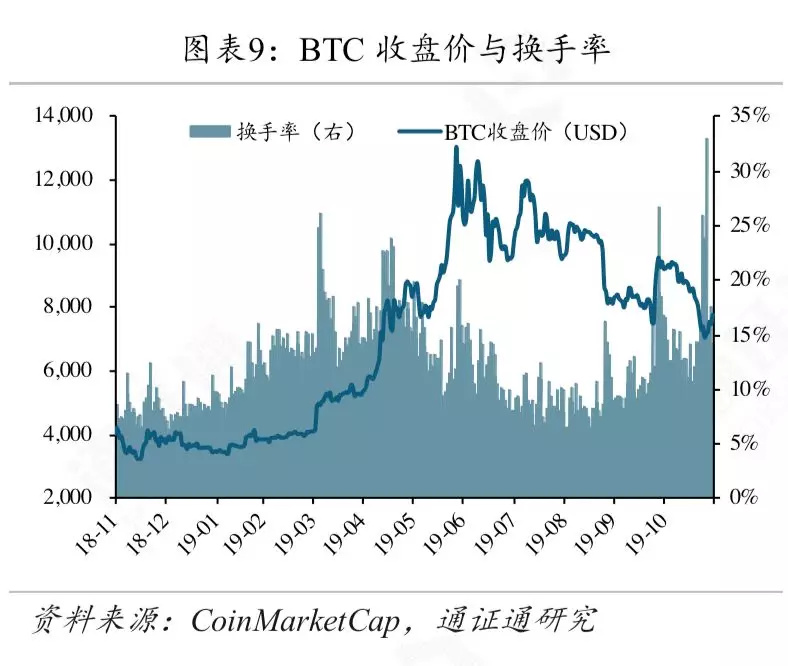

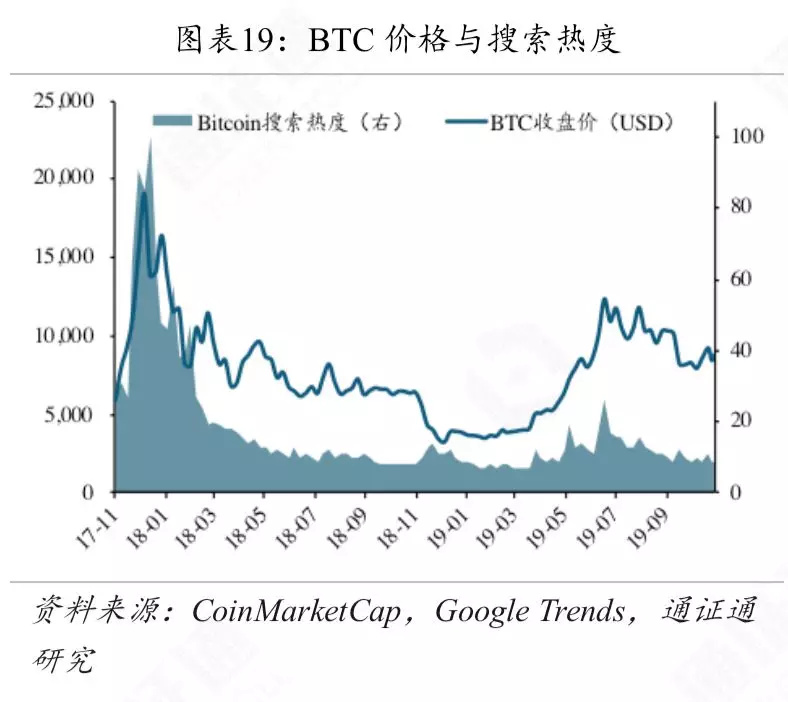

BTC's current price is $ 7,761, with a weekly increase of 6.4% and a monthly decrease of 15.7%. The average daily turnover of BTC this week was 25.4 billion US dollars, with an average daily turnover rate of 19.2%. BTC has rebounded, and a phased bottom may be confirmed.

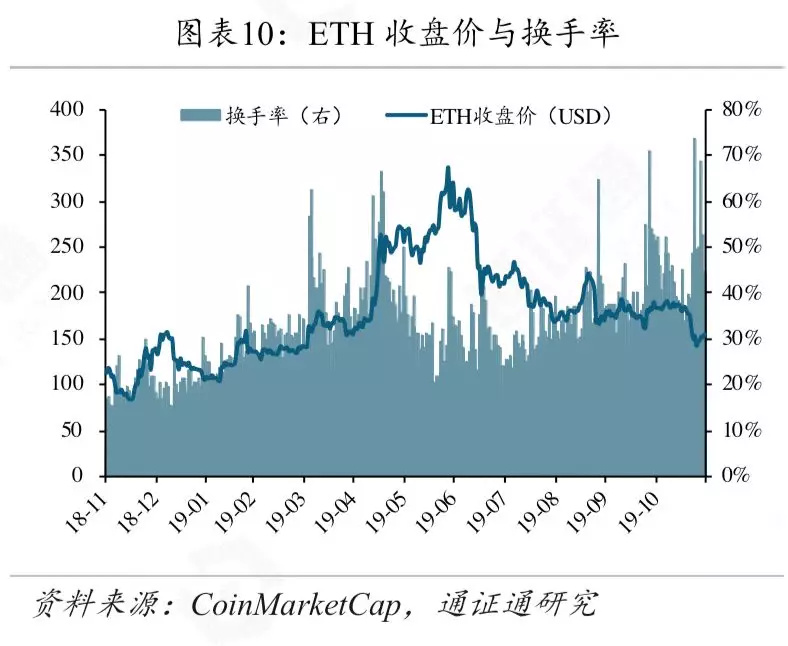

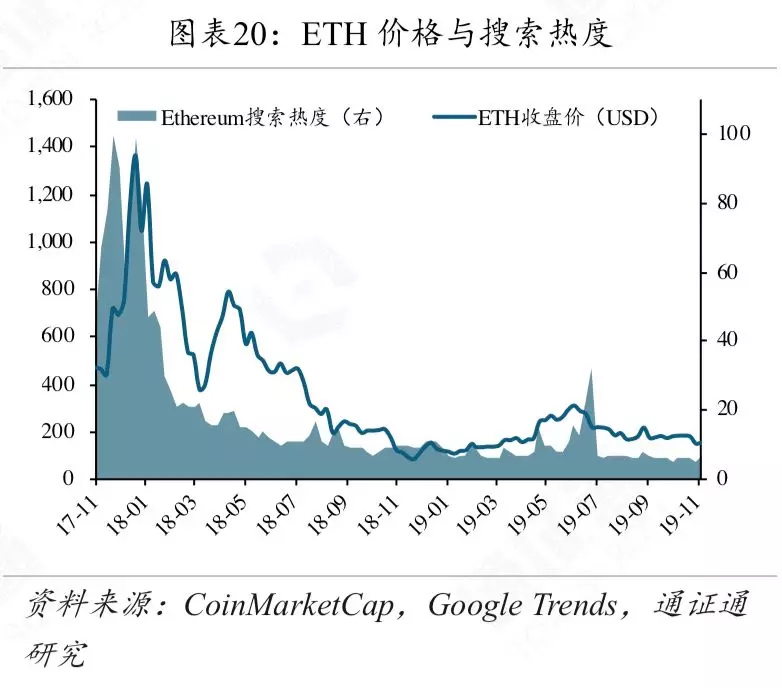

The current price of ETH is 155.3 US dollars, with a weekly increase of 3.3% and a monthly decrease of 15.9%. The average daily volume of ETH this week was 8.33 billion US dollars, with an average daily turnover rate of 51.1%. ETH linked BTC this week, the increase is slightly smaller than BTC.

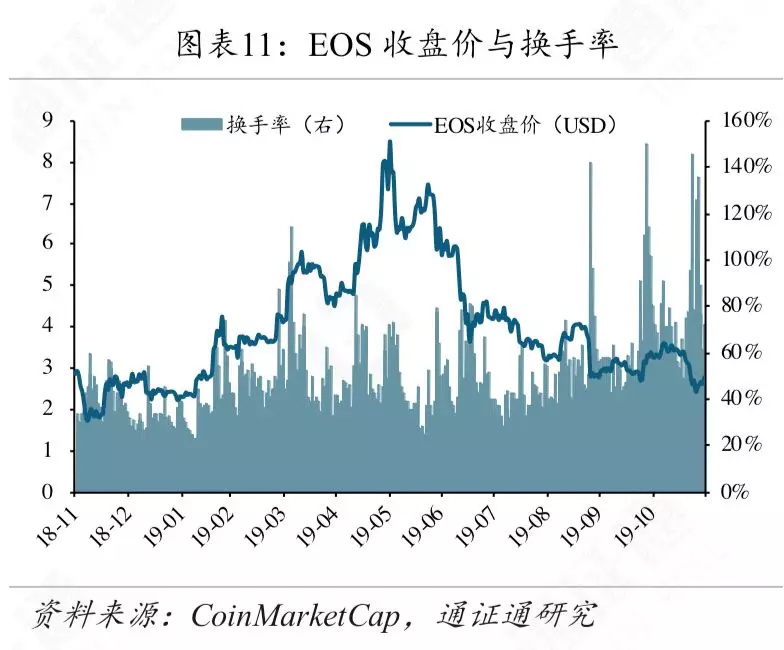

The current price of EOS is 2.8 US dollars, with a weekly increase of 6.5% and a monthly decrease of 15.1%. The average daily volume of EOS this week was US $ 2.25 billion, with an average daily turnover rate of 91.2%. EOS linked BTC.

XRP is currently trading at $ 0.23, with a weekly decline of 0.6% and a monthly decline of 22.4%. The average daily turnover of XRP this week was 2.76 billion US dollars, with an average daily turnover rate of 28.7%. XRP is weak.

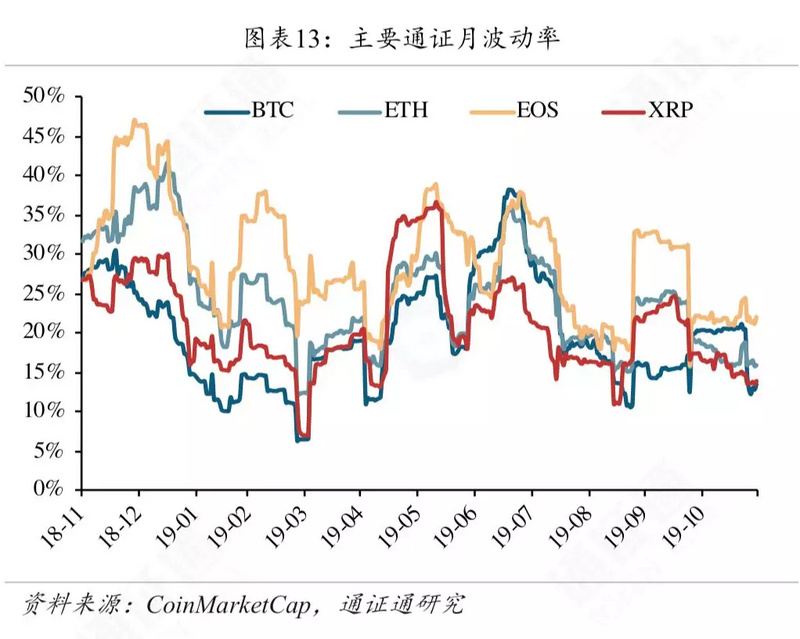

This week, the volatility of major tokens has shown a downward trend. BTC monthly volatility is 13.5%, down 7.0% from last week; ETH monthly volatility is 15.9%, down 2.7% from last week; EOS monthly volatility is 22.1%, down 2.2% from last week; XRP monthly volatility 14.0%, down 0.8% from last week.

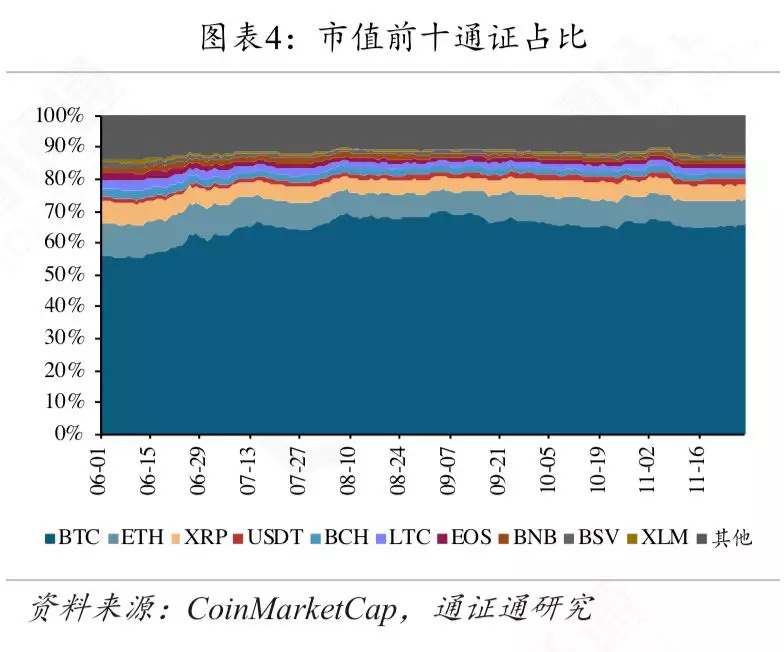

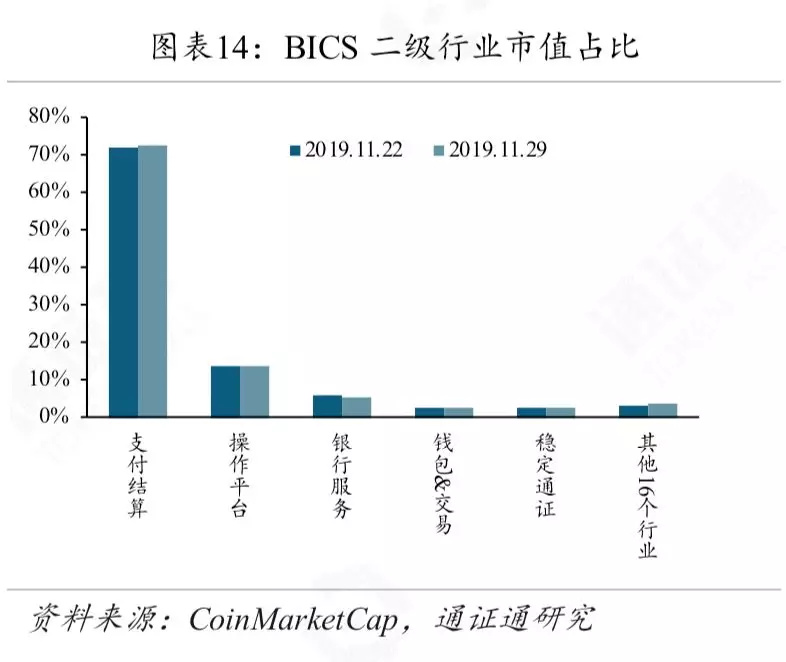

2.3 BICS industry: the proportion of payment settlement market value has increased

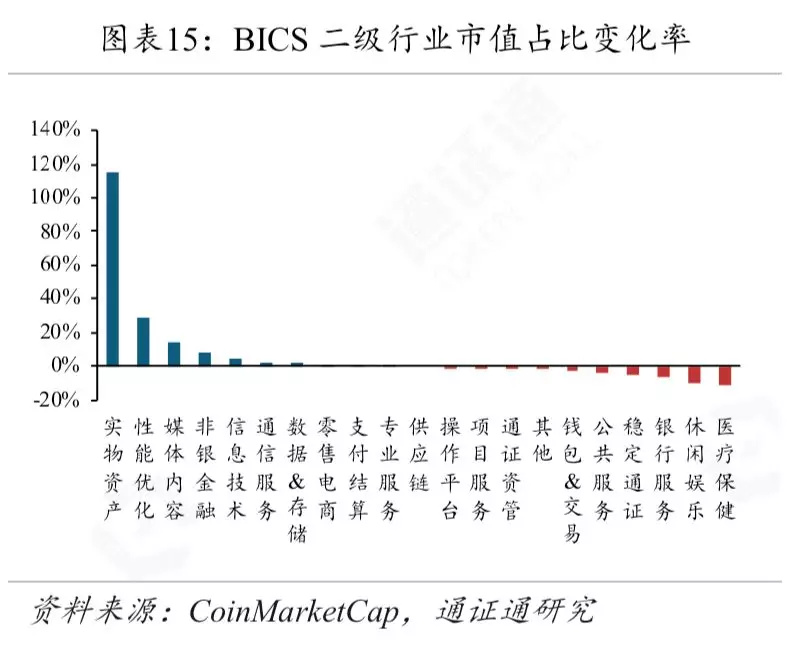

In the top five BICS (Blockchain Industry Classification Standard) secondary industries by market capitalization, the market value of the payment and settlement industry rose from 72.1% to 72.5%. From the perspective of the market value change rate, physical assets and performance The market share of optimized market value increased at a higher rate, and the market share of healthcare and leisure entertainment decreased significantly.

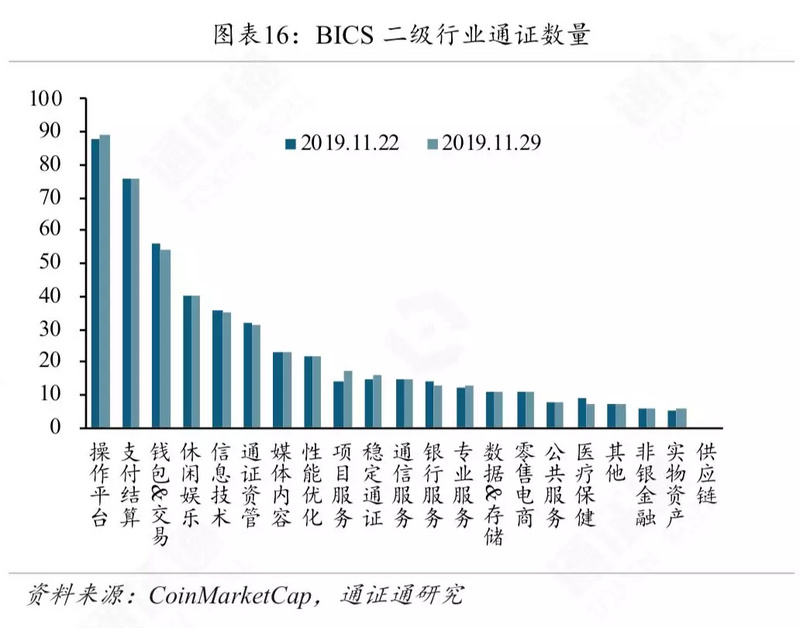

The BICS secondary industry that saw a significant increase in the number of tokens this week is project services and physical assets, and the decline is more obvious in medical care.

2.4 Market View: Periodic bottom or confirmed

BTC rebounded oversold and is currently consolidating around $ 7,500. Both rebound and support are strong. Given that both the long and short sides need time to re-gather their strength, it is expected that the market will fluctuate for a while. It is not ruled out that the bears will launch an assault counterattack. Investors should be cautious in using leverage or surrendering chips at this stage.

BTC low can gradually increase positions. In the long run, high-quality tokens have a lot of imagination. At the beginning of the bull market, callbacks are rare opportunities to increase positions. Investors can make asset allocation based on their own conditions.

3 Output and Heat: BTC hashrate has picked up

BTC mining difficulty and computing power increased slightly. BTC ’s mining difficulty this week was 12.97T, which is an increase of 0.00024T this week; the average daily hashrate for this week was 91.12EH / s, which was an increase of 0.30EH / s from last week; The average computing power is 176.7TH / S, which is 3.7TH / S lower than last week. BTC difficulty and computing power have increased.

This week, Google Trends calculated that the search term for Bitcoin terms was 11 and the search term for Ethereum terms was 7, which is an increase from last week.

4 industry news: big institutions attach great importance to the crypto market

4.1 EU banks will be allowed to hold and sell BTC

According to UBT, starting in 2020, European Union (EU) banks will be allowed to hold and sell BTC to customers. The European Union recently introduced a bill, expected to take effect next year, that would allow banks to provide users with a cryptocurrency token solution. The fourth new bill on money-laundering instructions will lift banks' bans on providing customers with crypto assets and storing those assets on behalf of customers.

4.2 Upbit's sudden theft incident, loss of about $ 50 million

According to multiple media reports and official confirmations, on the afternoon of November 27, 2019, Upbit, a well-known Korean exchange, was suddenly hacked and robbed 342,000 ETH at 12.6 noon, with a loss value of about US $ 50 million. After analysis, the security team believes that the stolen ETH of Upbit may be related to the APT (Advanced Persistent Threat) attack that has been active before. The characteristics of APT are long-term latency until it encounters a large amount of operable funds and a large amount is stolen at one time. .

Afterwards, Binance founder Zhao Changpeng tweeted that he would cooperate with Upbit and other industry insiders to ensure that if any inflow of funds stolen by hackers is found, the relevant accounts will be frozen immediately.

4.3 Bakkt to launch cash delivery futures contract in Singapore

According to Business Wire, Intercontinental Exchange (ICE) announced that its Bakkt will launch a BTC futures contract for cash delivery on December 9. The contract will be traded through ICE Futures Singapore, a subsidiary of ICE in Singapore, and cleared by ICE Clear Singapore, a clearing house. It is reported that these two institutions are overseen by the Singapore Financial Regulatory Authority (MAS), and its chief operating officer Lucas Schmeddes said: The launch of the cash delivery futures contract will bring convenience to Asian investors and global investors, and capital will Efficiently used to acquire or hedge the BTC market.

4.4 IBM applies for blockchain patent "preventing anonymous theft of drones"

According to Coindesk, computer giant IBM received a patent on November 12 that "prevents anonymous theft of drones." This patent uses an Internet of Things (IoT) altimeter to trigger when a package is lifted up, while tracking the package's Height, and upload the data to the blockchain platform.

IBM's solution is to equip the package with IoT sensors that only trigger when it detects a change in altitude "above a threshold." When the object is lifted by the drone, the sensor will be triggered. Once completed, the sensor will periodically update the height information of the package to the blockchain and the intended recipient.

Note: For some reasons, some terms in this article are not very accurate, such as: tokens, digital tokens, digital currencies, currencies, tokens, crowdsale, etc. If you have any questions, you can call us to discuss them.

For the original report, please refer to the research report released by [Tong Tong Tong Research]: "The remainder is king: who can survive the spring-Blockchain Weekly Report 1201"

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why do blockchain companies like to go to Hainan?

- How far is the fiat digital currency from us

- Bakkt launches bitcoin options contract next week, CME announces launch of options product plan

- Babbitt site 丨 Chinese and American listed companies discuss the blockchain, when will the industry usher in a novelty?

- Babbitt site | Policies are hot, Tokenfund is cold, where are the investment opportunities for blockchain in 2020?

- Depth | The next Singapore? Interpreting the Development Prospects of Hainan Blockchain from a Policy Perspective

- Read Ethereum in one article: Past, Present and Future