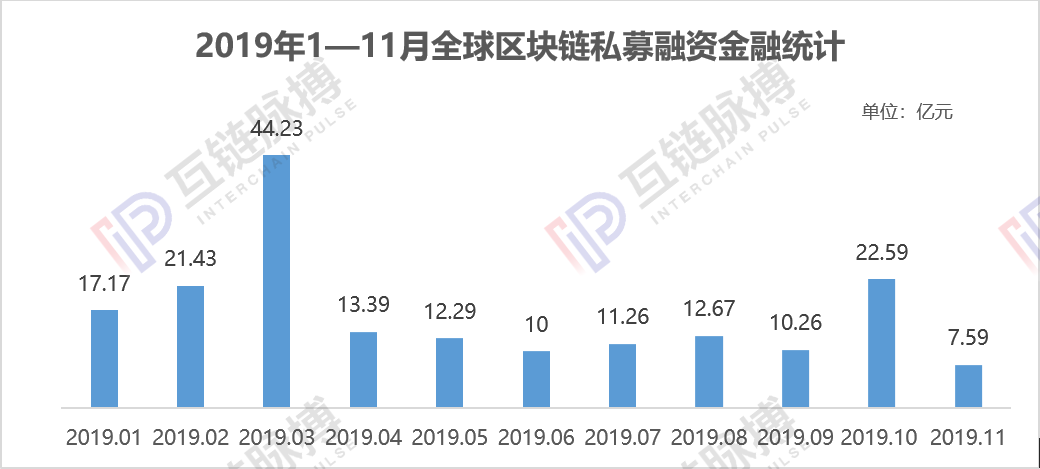

Global Blockchain Private Equity Financing Overwhelming Winter, November Dec. 66.4% MoM

In November 2019, the global blockchain private equity financing market sharply cooled, and the amount of financing fell to its lowest point this year.

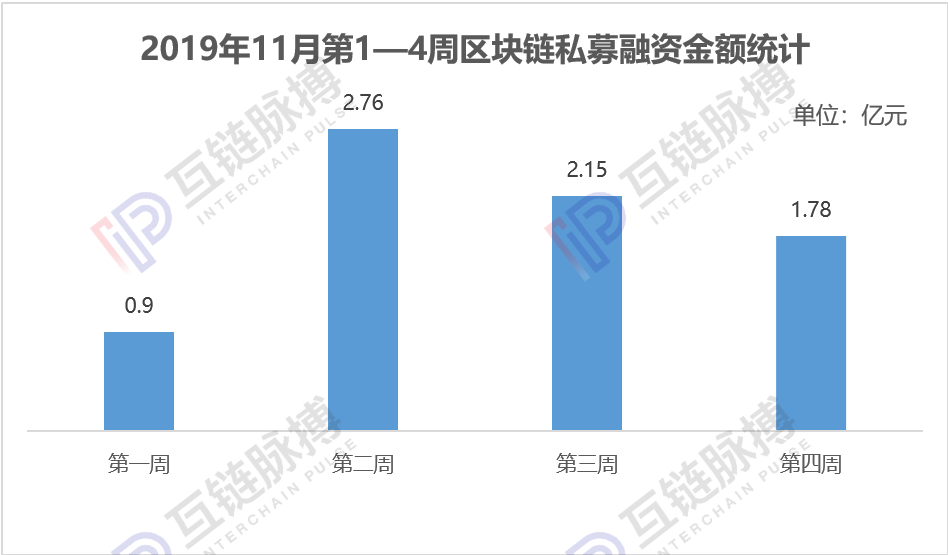

According to the statistics of the Interlink Pulse Institute, in November 2019, a total of 43 financings were obtained in the global blockchain field, a 14% decrease from the previous month, and the total financing amount was approximately 759 million yuan, a 66.4% decrease from the previous month.

(Drawing: Interlink Pulse Academy)

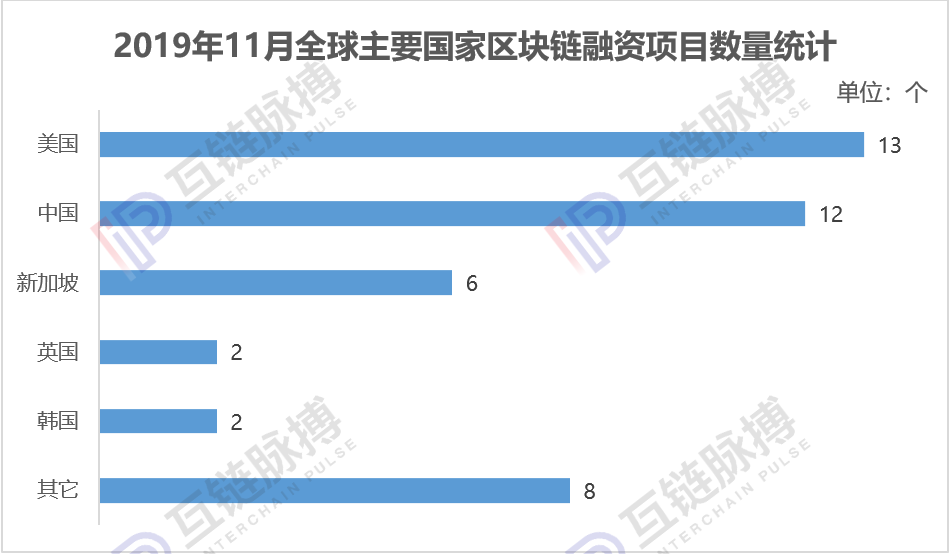

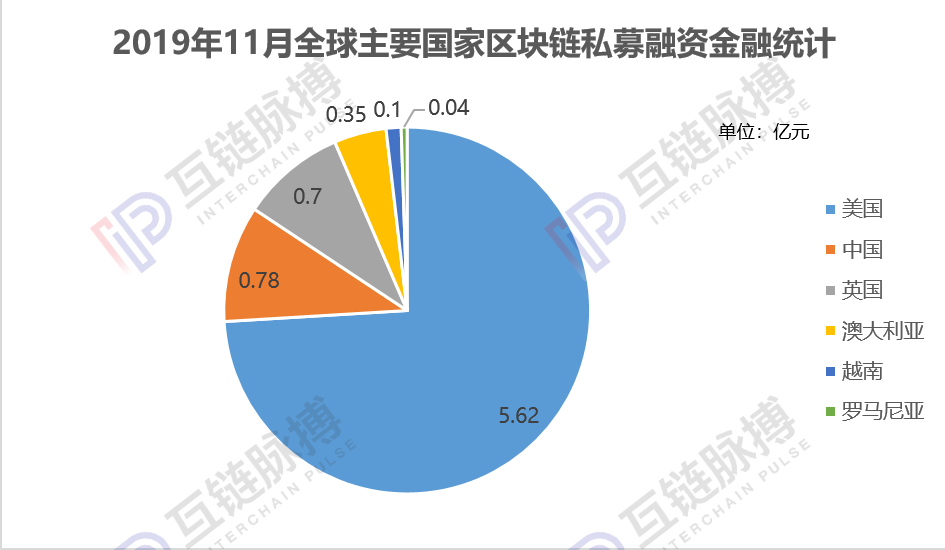

Especially in the Chinese market, after the supervision and rectification work in many places, the blockchain investment and financing market overnight. Of the 43 financing projects, 12 were in China, with a financing amount of only 78 million yuan, a decrease of nearly 90% from October.

- ECB executives: "We cannot sacrifice security" when talking about Libra

- Securities Daily: Digital assets will generate super enterprises

- Why do blockchain companies like to go to Hainan?

The US blockchain private equity market is also cooling. According to the statistics of the Interlink Pulse Research Institute, in November 2019, 13 blockchain projects in the United States were financed, with a financing amount of about 562 million yuan, a 52.1% decline from the previous quarter.

(Drawing: Interlink Pulse Academy)

(Drawing: Interlink Pulse Academy)

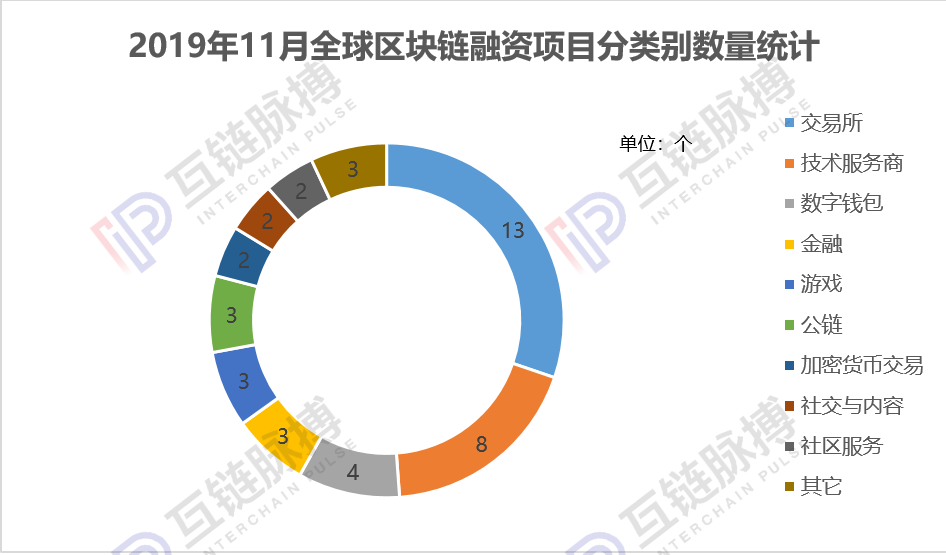

From the perspective of industry distribution, the most promising capital in November is exchanges and technology service providers. Of the 43 projects that received financing in November, all 13 were traded, accounting for 30.23%. However, although there were a large number of financing projects on the exchange in November, most of the projects did not disclose the financing amount. At present, the publicly countable financing amount is only 50 million yuan.

Among them, the larger amount of financing is Australia's BB.VIP exchange, which received US $ 5 million (about 35 million yuan) financing; BiKi.com, NVEX, HomiEx and other exchanges registered in Singapore have also successively obtained Financing, but did not disclose the specific financing amount. In addition, the decentralized exchange OpenSea also received US $ 2.1 million (about 15 million yuan) in November.

(Drawing: Interlink Pulse Academy)

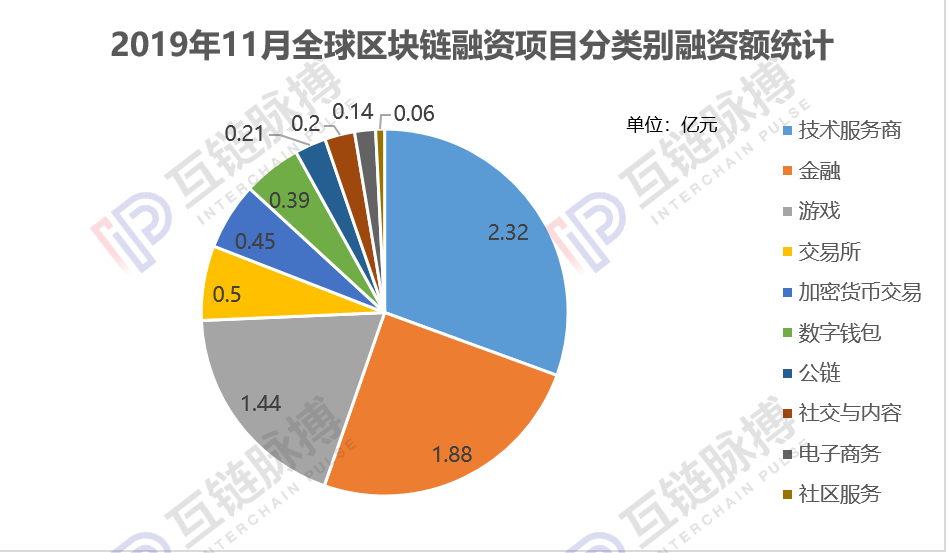

In the field of technology service providers, a total of 8 projects were financed in November, with a financing amount of about 232 million yuan.

Among them, the largest financing amount is Bison Trails, a U.S. blockchain infrastructure as a service provider, which raised US $ 25.5 million (about 180 million yuan) in financing; and Arweave, a British data storage blockchain protocol service provider, also received 500. 10 million US dollars (about 35 million yuan) financing. In addition, China's chain security technology, which focuses on the formal verification platform of the blockchain, also received 10 million yuan in financing.

Finance and gaming are the two most attractive areas after exchanges and technology service providers. According to the statistics of the Interlink Pulse Academy, in November 2019, there were 3 financing projects in the financial and gaming fields, with financing amounts of 188 million yuan and 144 million yuan, respectively.

(Drawing: Interlink Pulse Academy)

In the financial field, the largest financing amount was the Compound_finance project in the United States, which raised US $ 25 million (about 176 million yuan) in financing; another financial related project, Radpay, received US $ 1.2 million (about 8 million yuan) in financing.

In the field of games, American startup Mythical Games has raised $ 19 million (about RMB 134 million) in financing; Vietnam ’s blockchain game developers have received $ 1.46 million (about RMB 10 million) in financing.

(Drawing: Interlink Pulse Academy)

In addition to the above-mentioned areas, in November, a lot of financing projects emerged in the digital wallet and public chain areas, but the amount of financing was not large.

For example, in the field of digital wallets, Bitski in the United States has received 1.8 million US dollars (about 13 million yuan) in financing; China's Hofubao and MduKey projects have received millions of yuan and millions of dollars in financing, respectively. In the public chain field, only HBSworld in the United States has announced that it has received $ 3 million in financing, and other public chain projects have not disclosed the amount of financing.

According to the analysis of the Interchain Pulse Research Institute, compared with the global blockchain private equity financing market in recent months, the 7-month high of the financing market in October is just a reflection of the past. The winter of the blockchain investment and financing market has not gone away. And, in the next two months, the global blockchain private equity financing market may usher in a real cold winter.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How far is the fiat digital currency from us

- Bakkt launches bitcoin options contract next week, CME announces launch of options product plan

- Babbitt site 丨 Chinese and American listed companies discuss the blockchain, when will the industry usher in a novelty?

- Babbitt site | Policies are hot, Tokenfund is cold, where are the investment opportunities for blockchain in 2020?

- Depth | The next Singapore? Interpreting the Development Prospects of Hainan Blockchain from a Policy Perspective

- Read Ethereum in one article: Past, Present and Future

- 8 exchanges hold more than 1.95 million BTC, direct calls from investors are too dangerous