DeFi is a double-edged sword: decentralized finance in developing countries

Source: Medium

Compilation: First Class (First.VIP)

Decentralized finance, also known as DeFi, can be used to solve the pain points in the traditional financial industry. For example, when asset review and trust mechanisms in many developing countries will further slow down the process of lending and transactions, banking will no longer be possible. ( More on DeFi can be found in the Babbitt-First Class column "Science: What is DeFi and How Does DeFi Work?")

- QKL123 market analysis | Looking forward to digital asset regulatory compliance, Hainan Province strives to be the first demonstration zone (1203)

- Introduction to Technology | Deep Understanding of Zk-stark of Zero Knowledge Proof Algorithm——FRI Protocol

- Babbitt Original | Mainstream exchanges support Lightning Network, what does this have to do with ordinary users?

But if DeFi can be implemented effectively, these problems can be solved in a shorter period of time, while creating space for new technologies to flourish in countries with limited banking operations. For the rural poor who lack the technology and communication, DeFi can improve their living standards. Whether you start a business in agriculture, commerce, or other fields, using DeFi eliminates the need for loans and mortgages.

Compared with developed countries, the investment and banking methods of developing countries (ie financial derivatives and sovereign bonds) may still be underdeveloped. But with the launch of DeFi, it can provide new investment options through BTC, ETH, or stablecoins, which allows investors to store their funds in places other than traditional banks.In addition, the income earned through crypto speculation can be Increasing the level of consumption, thereby creating a larger middle class, guiding more countries into the take-off stage of economic development, or it can also be used for future corporate investment.

Since the cryptocurrency market is independent of the central bank and its monetary policy, which means that its value and economic growth are also independent of the country's own economic conditions, it may give people more incentive to invest in value and returns Cryptocurrencies that are larger than traditional banking (this is why people in Venezuela and Argentina have turned to cryptocurrencies). In addition, because it can reduce the fees such as Western Union, the cost of transfers is also reduced, and it may also limit capital flight, but such regulations have no effect on DeFi.

In both cases, DeFi and cryptocurrencies can cooperate against the traditional financial industry and promote each other to create a competitive market. In the current situation, the financial markets of developing countries are just inert, that is, credit Junk bonds rated BB or lower.

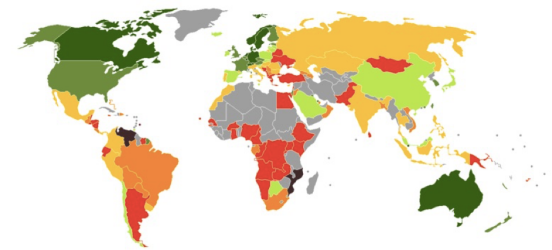

Above: Countries / regions rated by Standard & Poor's abroad (March 2019)

Other uses of blockchain: healthcare-related assistance and donation projects, government census registration, and the use of fund accountability to learn lessons from past projects, while its decentralized ledger can provide transparency and solve funding Poor management. If this technology is used effectively, future projects may have greater effectiveness and coverage.

Least developed countries (LDCs) with little or no infrastructure (read more: Paul Collier's The Bottom 1 Billion) are probably the easiest places for such systems to thrive because they do not have With the existing infrastructure, there is no industry to compete with.

If all these technologies can be effectively used, it can help many developing countries to step into modern society without having to take the tedious steps experienced by other developed countries. For example, India has almost no fixed line, but has directly moved to smartphones.

Restrictions

But many developing countries may not have cryptocurrency laws and DeFi regulations. Therefore, if losses are caused by investment or speculation, or if the crypto / DeFi wallet is stolen, the risk is even greater, as there is no law that can help users to hold anyone accountable. In the near future, more regulations will be needed in this area: EU countries are beginning to make progress in this area, but of the 10 sub-Saharan African countries that mention cryptocurrencies, nine are banned from using cryptocurrencies, and Only South Africa has announced that it will levy taxes on those who also own cryptocurrencies. (Note: There are 54 countries in Africa.)

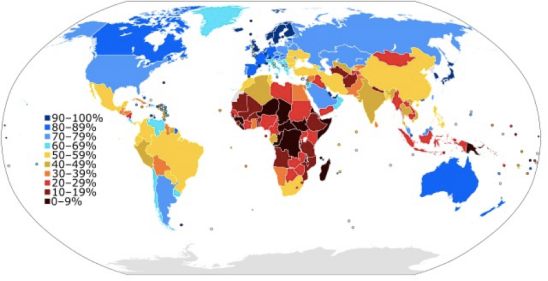

Above: Internet users as a percentage of each country's population in 2015

This is compounded by other problems in many developing countries, such as the lack of Internet infrastructure and the possibility that mobile networks may not even be available in rural areas. It is conceivable that DeFi and blockchain also need infrastructure to make it possible. The digital divide in the United States / EU is mainly due to age, but in developing countries, the digital divide is exacerbated not only by age but also by income, urban and rural residence, and literacy rates. Therefore, DeFi may only benefit the "Internet veterans" in developing countries, but not the poor rural areas that need assistance.

If there is a digital divide, then DeFi is not financially inclusive.

Although from the perspective of aid organizations, some non-governmental organizations may not realize the economic (but not financial) potential of blockchain, and the time it takes to set up such a system and lack of experience may also cause costs More expensive. For example, each institution has an IT company and technical staff, but not every institution has a small team dedicated to blockchain. It can take years to make this "standard", and most people working on blockchain are related to cryptocurrencies (due to higher demand and higher wages).

In addition, although DeFi is important, other assistance programs that provide funding for education, health, etc. can also be considered exceptions. As the advantages of other projects become more apparent, more and more non-governmental organizations have rich experience in education, health and other projects, which means that the blockchain may be at a disadvantage.

Another problem is barriers to entry due to political red tape and corruption, which means that it will take longer to build such infrastructure, resulting in higher costs. And because there are no laws related to blockchain and cryptocurrencies, such projects cannot even be carried out.

In addition, whether in developed or developing countries, many people have not received sufficient education on how to use cryptocurrencies and blockchains safely.

Most people in the United States and the European Union are "heard of it" at best, so it's hard to imagine what's going on in developing countries. In addition, in hindsight, when the credit / debit card was first launched in China, many people did not plan to use it because they could not “see” the transfer of money, so distrust and uncertainty about the new system would be Delayed its landing speed. (This is already the case with developed countries' cryptocurrencies, and the speed of landing in developing countries need not be said).

Conclusion

In short, if DeFi can be successfully implemented in developing countries, then whether in financial, economic and social welfare, or from rural inclusive finance to government transparency to the census, there will be numerous advantages.Blockchain and DeFi can help developing countries step into modern society.

In the current environment, however, there are still many constraints to achieving this goal, due to the need to consider legitimacy or existing economic infrastructure. From the donor's point of view, the lack of experience and knowledge in building such infrastructure means that various problems will arise during the implementation process. Even if such systems are built, the assistance goals of these projects may be unwilling Accept unfamiliar things, or they will only be accepted by the new generation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Ethereum developers arrested, showing that the carrier that disrupts U.S. financial hegemony may be the public chain

- Suggested that the SEC "cut off" IPO underwriters, the NYSE also played IEO?

- 60% of Bitcoin has not been moved for nearly a year, investors prefer to store coins rather than trade

- Or the strongest outlet in the next 10 years: the era of industrial blockchain is officially coming

- Ethereum developers agree to upgrade network on January 6, ETH inflation rate will rise again

- Does Bitcoin need an account? The developer thought it was necessary, and it took 1 year to design the system

- Views | Qian Xuening: If the central bank's currency issuance is fully digitized, the current bank's electronic accounting system will need to undergo significant changes