Opinion | Bitcoin's turning point signal may appear in December

The memories of the Great Recession in 2008 still deeply shocked the market today.

According to a recent survey, 20% of millennials in the United States said they "never" invested in the stock market, and 53% said that investing in the stock market would make them uncomfortable. Starting from the 2008 subprime crisis, the average debt of young Americans today has reached $ 34,144, an increase of 62% over 10 years ago.

Each economic adjustment has a profound impact on the structure of society. What is more terrifying is that the global population structure is about to turn around, and the aging population will exceed the number of newborn children. This time point is exactly 2020. And this trend will continue beyond 2050. By 2050, the birth rate of children will remain at 6%, while the growth rate of the aging population will remain above 16%.

- Is Coinbase's Crypto Rating Board useful?

- DeFi is a double-edged sword: decentralized finance in developing countries

- QKL123 market analysis | Looking forward to digital asset regulatory compliance, Hainan Province strives to be the first demonstration zone (1203)

People with money and spending power will become more conservative due to economic uncertainty, and young people will find it increasingly difficult to earn money

The huge changes in human society have only two constants and one variable: the constant is the demographic dividend and business cycle, and the variable is technological innovation. After understanding these three things, you can understand the past and future of human beings. History just keeps repeating, the core of the story has never changed, only the outer packaging of the story has changed.

From a global perspective, the middle class is gradually shifting from western countries to eastern countries. In the future, there will be only two countries in the world with a major middle class population, one is China and the other is India. This is also the core of the ideological transformation between the East and the West that will take 2020 as the inflection point.

It is precisely for this reason that Hong Kong has become an outpost of East-West ideology.

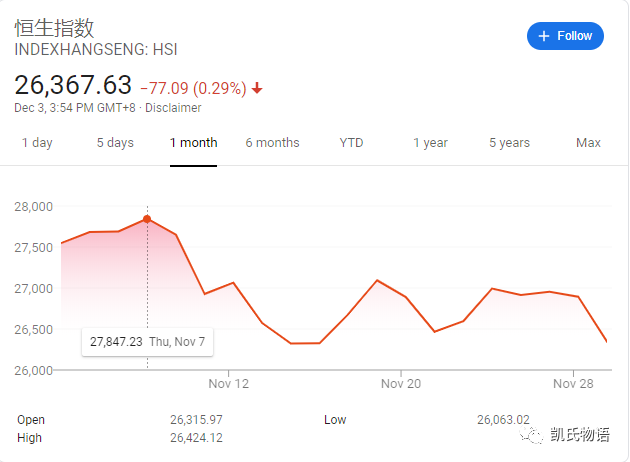

In the previous article, I talked about the core reasons for Ali's return to the Hong Kong stock market. If we look closely at the K-line of the Hong Kong stock market over the past period of time, we can see the obvious traces of the game between protecting Hong Kong and shorting. From November 8th, Hong Kong stocks reached the peak of the stage, and they have been shorted by strong shorts. On November 11, the gaps opened lower and fell. Until Ali Hong Kong's public offering, the HSI rose. The end of the 20th sale again saw a gap for several days and opened lower.

It was only interesting to go public on the 26th. Heng pointed out that it was a gap and opened high, but it was dropped by the Air Force of Wall Street. After the two days of 27 and 28, it was clear that the air gap opened low, but it was turned into a rise by the multi-arms who were long Hong Kong stocks. Until the completion of the delivery of Hong Kong stock futures. All the way down the next few days. It can be described as not thrilling.

Many people are discussing the so-called Bill of Rights signed by Trump. In fact, Trump has always expressed a mild attitude in this matter. I have quoted Trump in previous articles on Hong Kong. He is more willing to regard the Hong Kong issue as China's internal affairs. I tend to think that's what he really thinks. After all, he is a businessman. Shorting Hong Kong is the ideology of Wall Street in the United States, and Trump's main purpose is to be re-elected.

The US bill was initiated by Florida Senator Marco Rubio in Congress. Of course, all aspects involved are extremely complicated. As I mentioned before, there have been obvious ideological splits and even confrontations in the United States.

This bill will come into effect automatically if Trump does not sign it within 10 days. And if Trump vetoes and the bill is returned to Congress, it will exercise the 2/3 voting principle and will still pass. So Trump's agreement with the bill has no effect on the outcome. In the end, Trump could only agree to the bill to increase his political stack. This is a completely understandable manifestation.

But judging from this, Trump's good fortune seems to be coming. This matter originally stood on the opposite side of the Bill of Rights, but based on the final result, it could only be signed. Senator Marco Rubio of Florida originally wanted to pass the bill to give Trump a problem, and it turned out that Trump had broader support because of a forced signing. After all, confronting China is America's biggest political correctness. So after signing the Bill of Rights, Americans do n’t seem to support Trump, and it becomes the biggest political mistake.

Political correctness is the greatest magic realism.

Speaking of Trump, it is necessary to say that US stocks. Last week, US stocks broke 28,000 points and almost became his highlight of the year. Except for the drop in the early morning, the drop in the early morning was the largest drop in the past month, although the decline was not large. However, it is not difficult to see that the market's doubts about the economic situation have reached the point of self-doubt.

The last short-term decline in U.S. stocks may occur in December, thus preparing for the short-selling in the first half of 2020.

As mentioned earlier, the global population is exacerbating the inflection point of aging. According to the latest survey in the United States, the US pension and medical insurance systems have a clear gap in payable funds because they do not have sufficient funds. These funding gaps have been pushed to the market, monetizing benefits, and generating high returns that are much higher than the market can afford. In 2020, this funding game seems to be about to go smoothly.

The demographic change has created a situation where fewer and fewer contributors are supporting more and more demanders. In the end, there are only three solutions: cutting benefits, increasing taxes, and printing money. Obviously, printing money is the easiest and most convenient way. Because this is the least obvious solution.

For those who are rich and have good borrowing credit, capital is getting closer to zero cost. It's getting harder for those who don't have the money and good credit. In China, have we found the same truth? It is easier for the rich to borrow money, and those who often finance themselves through various loan instruments are constantly squeezed by the market.

As a result, we have also seen that the gap between the rich and the poor will widen.

From the perspective of society, the progress of science and technology has not allowed everyone to benefit explicitly, but some people have achieved higher benefits, and most of them bear the cost of technological progress.

Take China as an example, the undergraduate rate in China is less than 4%. Can you believe it? If you look around, there are no people who are not undergraduate around you, and it feels like everyone has attended the undergraduate course. For returnees, it seems that there are not many below the master's degree. This just shows that the degree of Chinese social fragmentation has far exceeded our imagination.

Although the admission rate has increased from 5% to 74% since the college entrance examination was resumed in 1977, the number of college entrance examinations in recent years has been approximately 9 million. However, let's calculate carefully, in the past 40 years, there were 95.77 million university graduates, of which half of the junior college, half of the three or more, China's 1.4 billion people, only 3.4% of the undergraduate rate.

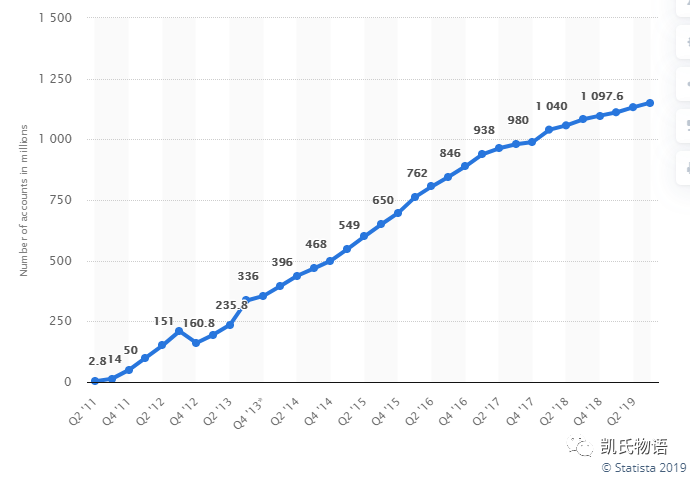

We look at the reading volume of the public account, the large ones are all 100,000+, but there are always details to reveal. Can't someone not know about People's Daily? The data of 18 years has published 8,122 articles, with a total of 86.92 million likes, which means that a single article has more than 10,000 likes. At 1% like rate, there are at least one million + views. But this is already the top self-media in China, People's Daily. You might say that you don't read People's Daily. However, based on China's total population, this figure is too small. Mi Meng, who has been titled, once had a head from the media, 14 million followers, and read only a few million +.

Will the advancement of blockchain bring a fairer phenomenon in human society? It may not be in the short term, but in the long term, the blockchain will complete the redistribution of human wealth in the next round of Kangbo cycle. Those who do not get on the bus may be severely cast aside by the times, thereby exacerbating social inequality.

In the past, China's rectification of blockchain regulation perfectly corresponds to the views of my article a month ago. Of course, I also saw a lot of articles describing the news about the currencyless blockchain and the major state-owned enterprises and central enterprises entering the blockchain. Will Ali, Tencent and Baidu be born from state-owned and state-owned enterprises? I will make a big question mark.

Don't ignore the power of long-term trends because of the country's short-term policies.

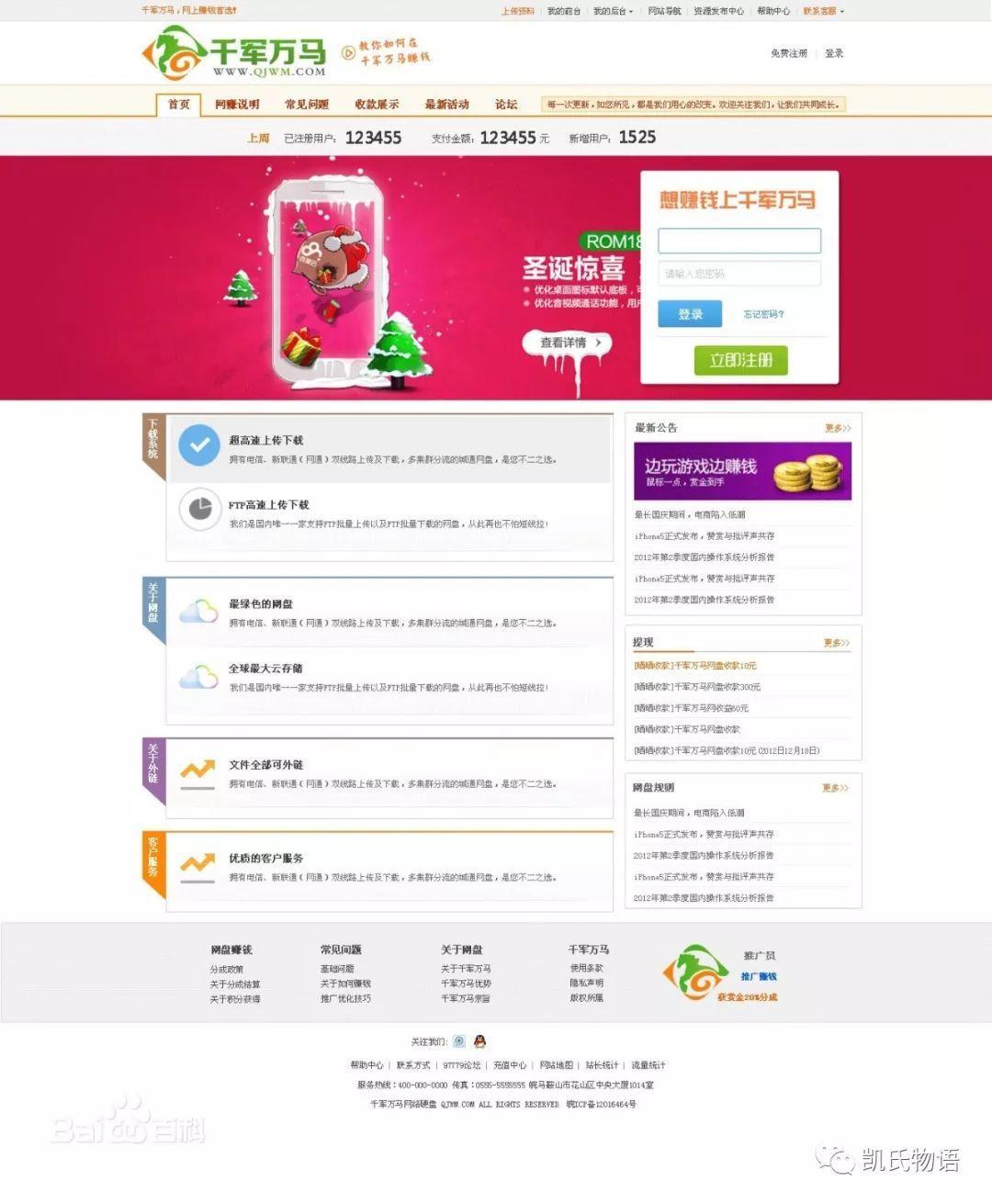

In 2005, a network called Thousands of Forces was founded. Its money-making model is to use downloading to make money, that is, after users upload and share content on the network disk, users will get a short URL. After the sharer gets the link, they can share the link on various platforms. After downloading, the uploader can make money, and the maximum income of 10,000 downloads is 880 yuan.

At that time, Internet content was very scarce and the threshold was very low. Sharing and downloading to make money is a way that ordinary people can understand, so it quickly developed into an extremely popular "online earning model". Later, for a long time, The profit model of all Chinese online disk companies is online earning + advertising. At that time, the borders were blurred, the policy was indecisive, and the law was not explicitly restricted. Entrepreneurs swarmed into this market, and finally died. Until 2012, Baidu, Tencent, and 360 paid for content gradually unified the market.

Any innovative model has vague boundaries, but it is also because of this that it is finally possible to remove the false truth.

In 2003, Tencent began to build a complete Q coin sales system. It quickly developed and became a huge virtual empire. Until 2006, Professor Yang Tao published an article discussing the properties of Q coins, and one stone caused thousands of waves. He put forward a point of view at the time: "If virtual currency functions as a currency, and this virtual currency is recharged by merchants at will, the total amount is not restricted, and it will inevitably have an impact on China's financial order."

Subsequently, in February 2007, 14 ministries and commissions in China and the central bank jointly launched a special crackdown on virtual currency transactions. Q coins returned to Tencent, and after the rise of mobile payments, WeChat Pay and Alipay became the heads of third-party supervision.

Q currency has not become a currency that affects China's financial order. Later, bitcoin led more and more digital currencies that affected the international financial order.

History should be viewed with a dialectical perspective. Whether it is a country, an enterprise, or an individual, they are thinking and understanding the blockchain in development. As I always think, there are 170 currencies in 233 countries (including regions) in the world. Everyone usually uses only two or three of them: national currency, international currency and investment currency, and there is at most one tourism Currency held by the country in the short term.

So in the digital currency world, there may not be more than 10 currencies that may eventually generate value. The rest are tokens, securities assets, similar to stocks. But what is the value? After all, it's data. It just changed from "big data" that was originally monopolized by institutions to "encrypted data" distributed throughout the network. The nature of digital currency is encrypted data. Digital currencies that do not contain encrypted data are worthless. So is a coinless blockchain a blockchain? Of course, after all, the man who was castrated was also a man.

The companies that are talking about big data are all Internet giants. In the future, there will be fewer blockchain projects globally that have encrypted data than today's Internet giants. Whoever masters the top-level cognition will have the wealth code of the next era. There is no right or wrong in history. There is only one thing that is not transferred by any individual power, which is called trend. Ultimately, all laws and regulations will change in response to trends.

In the past month, we have seen a large number of non-blockchain projects or projects under the cloak of the blockchain. Due to national regulations, a large amount of funds have fled from Bitcoin Ethereum. So brought a series of declines. In the short term, it has not stabilized. This wave of decline Ethereum's decline is more obvious, but still not in place.

Ethereum is likely to reach around 120 points to complete the final drop, and this pattern should not be to build a bottom slowly, but to quickly complete the bearish mood after a rapid decline. Bitcoin could fall to around 6,600. In any case, I believe what will happen in December will be the turning point of Bitcoin and digital currencies.

At this inflection point, we will see the confirmation of three things. One is that the US stock market ’s rising signal is confirmed, which will drive market sentiment. This will become Trump ’s highlight stage. The other is the smooth transition of the China-US talks, each of which is 2020 Prepare for the year; the last one is that Bakkt Exchange gradually masters the current spot cash futures trading, and the launch of Ethereum 2.0 upgrade.

This is exactly why I said that the next round of rise will be dominated by Ethereum. After all, the blockchain will start the era of technology and finance. Without iteration of technology, finance will become a game of funds.

We will all witness history together

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction to Technology | Deep Understanding of Zk-stark of Zero Knowledge Proof Algorithm——FRI Protocol

- Babbitt Original | Mainstream exchanges support Lightning Network, what does this have to do with ordinary users?

- Babbitt Column | Ethereum developers arrested, showing that the carrier that disrupts U.S. financial hegemony may be the public chain

- Suggested that the SEC "cut off" IPO underwriters, the NYSE also played IEO?

- 60% of Bitcoin has not been moved for nearly a year, investors prefer to store coins rather than trade

- Or the strongest outlet in the next 10 years: the era of industrial blockchain is officially coming

- Ethereum developers agree to upgrade network on January 6, ETH inflation rate will rise again