Analysis: XRP price is related to its Twitter activity, and has a stronger correlation with gold than BTC

Source: CointelegraphChina

Editor's Note: The original title was "Ripple Price and Trading Volume Relevant to its Twitter Activity"

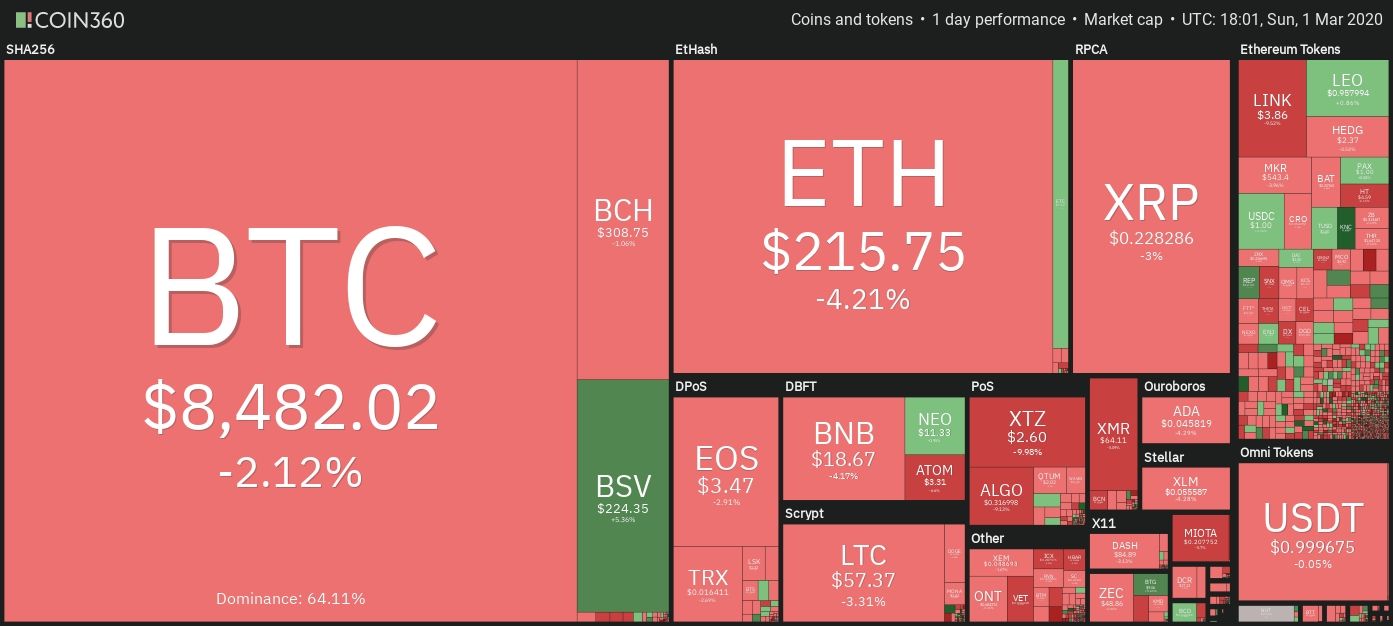

In the past two weeks, as Ripple (XRP) returned to the price of $ 0.23 at the end of January today, its gains since February have been wiped out. Most of the declines appear to have been caused by large-scale adjustments in traditional markets, which led to a sharp decline in Bitcoin and many altcoins.

- Gold, BTC plunged, why did hedging tools fail?

- Out of the shadow of the epidemic, the minefield prepared for halving

- Dubai establishes first blockchain KYC platform, licensed companies can open digital bank accounts instantly

According to Cointelegraph, analysts currently believe that this adjustment is a major setback, raising doubts about the long-awaited bull market outlook.

Cryptocurrency market daily overview. Source: Coin360

Ripple is one of the most frequently mentioned cryptocurrencies on social media platforms, especially Twitter. As discussed in the previous analysis, it is mentioned that there is a certain relationship between the daily tweet volume of Bitcoin (BTC) and its transaction volume. This introduces a new topic, whether a lot of information about Ripple on social media also affects its turnover or return on investment.

Is Twitter and Ripple closely related since 2018?

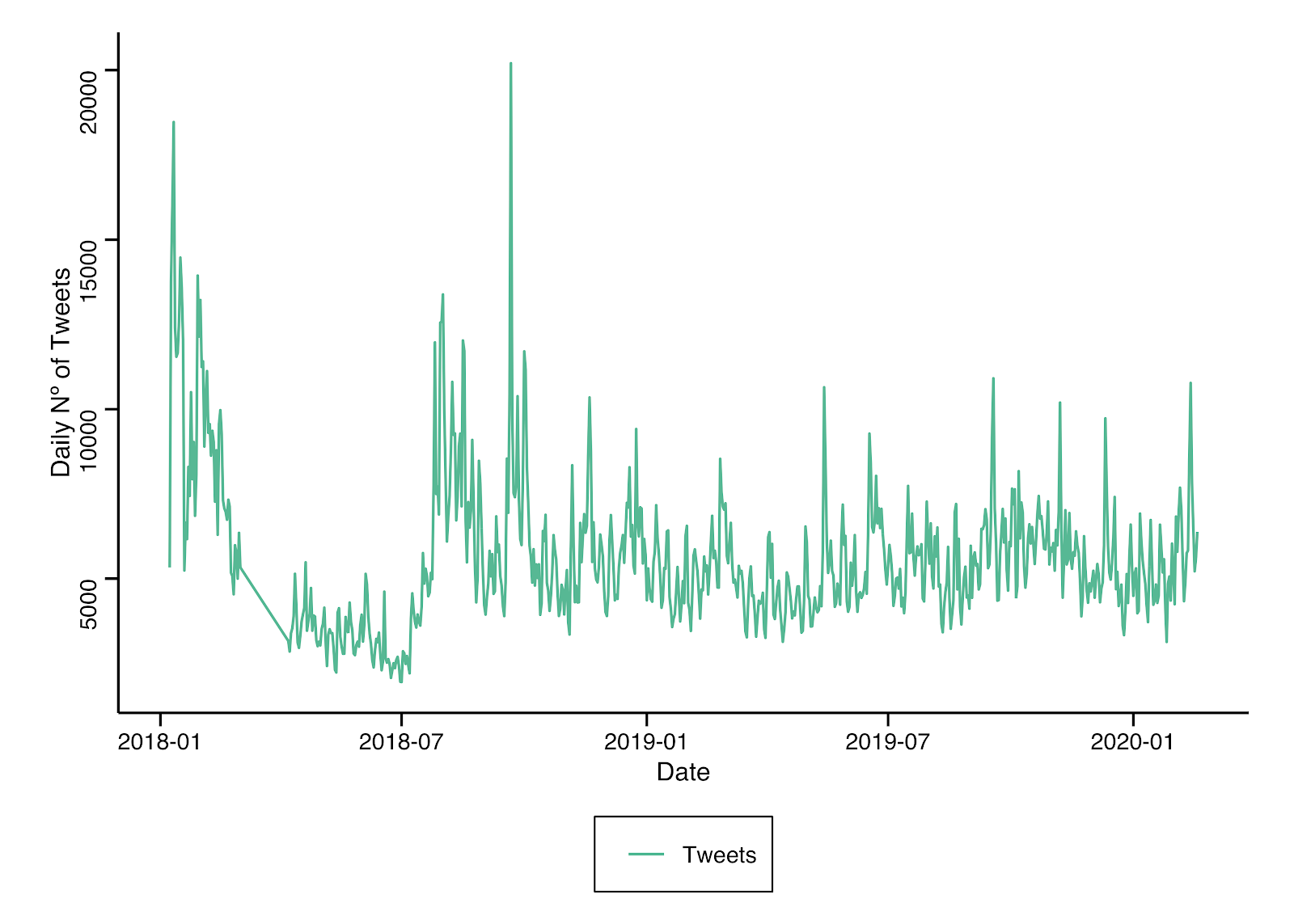

In the long run, the number of tweets referring to Ripple is relatively consistent with its annual average since 2018. In 2018, the average daily number of tweets referring to Ripple was 5,937. In 2019, the average number of tweets per day was slightly reduced to 5,364. However, the average number of tweets in January this year was small (5001 tweets). On January 6, Ripple prices rose by more than 12%, and the peak number of tweets was 6,919.

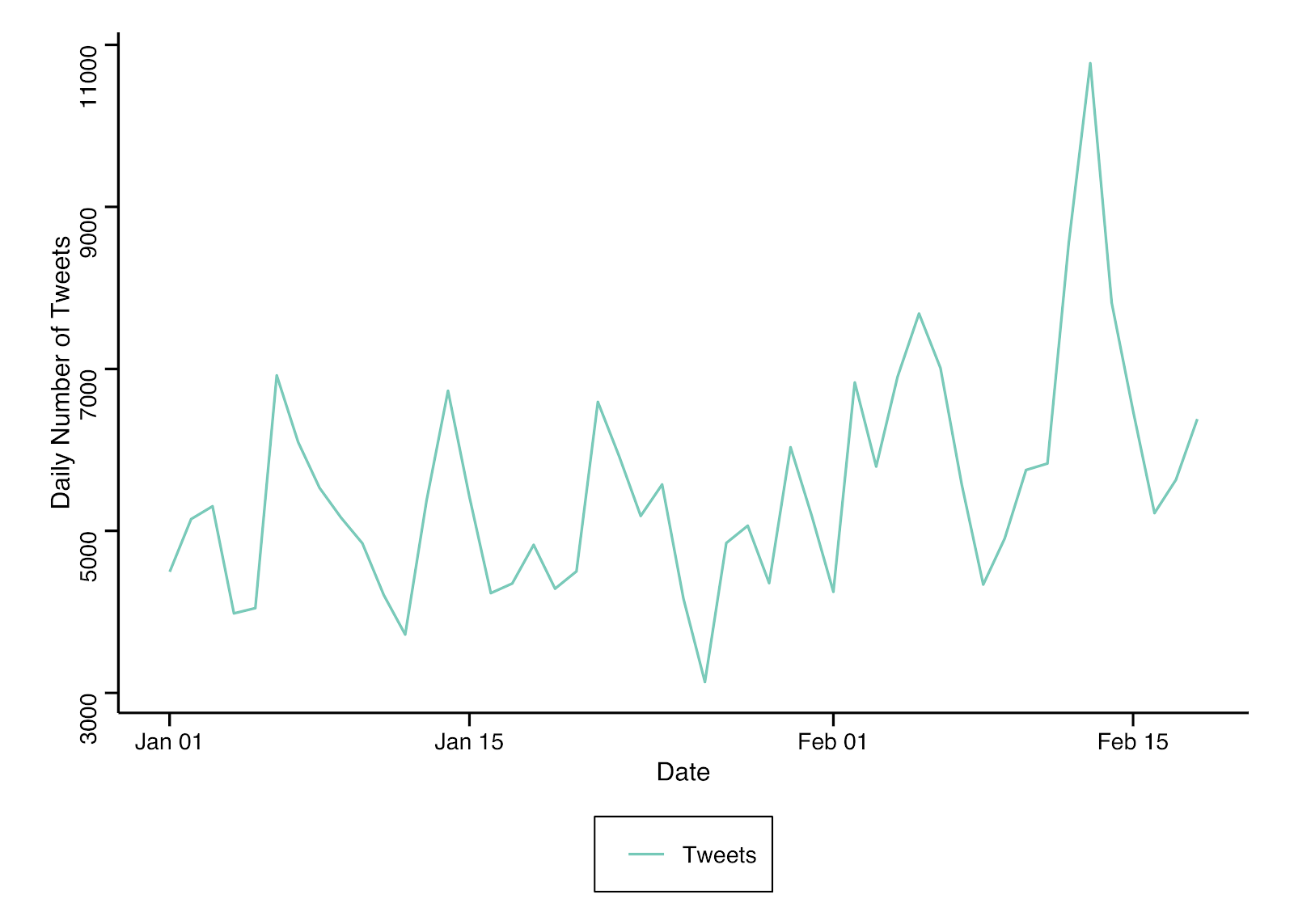

Recently, the average number of tweets observed in February increased to 6,429, much higher than the earlier average.

Daily Tweets from January 2018 to February 2020

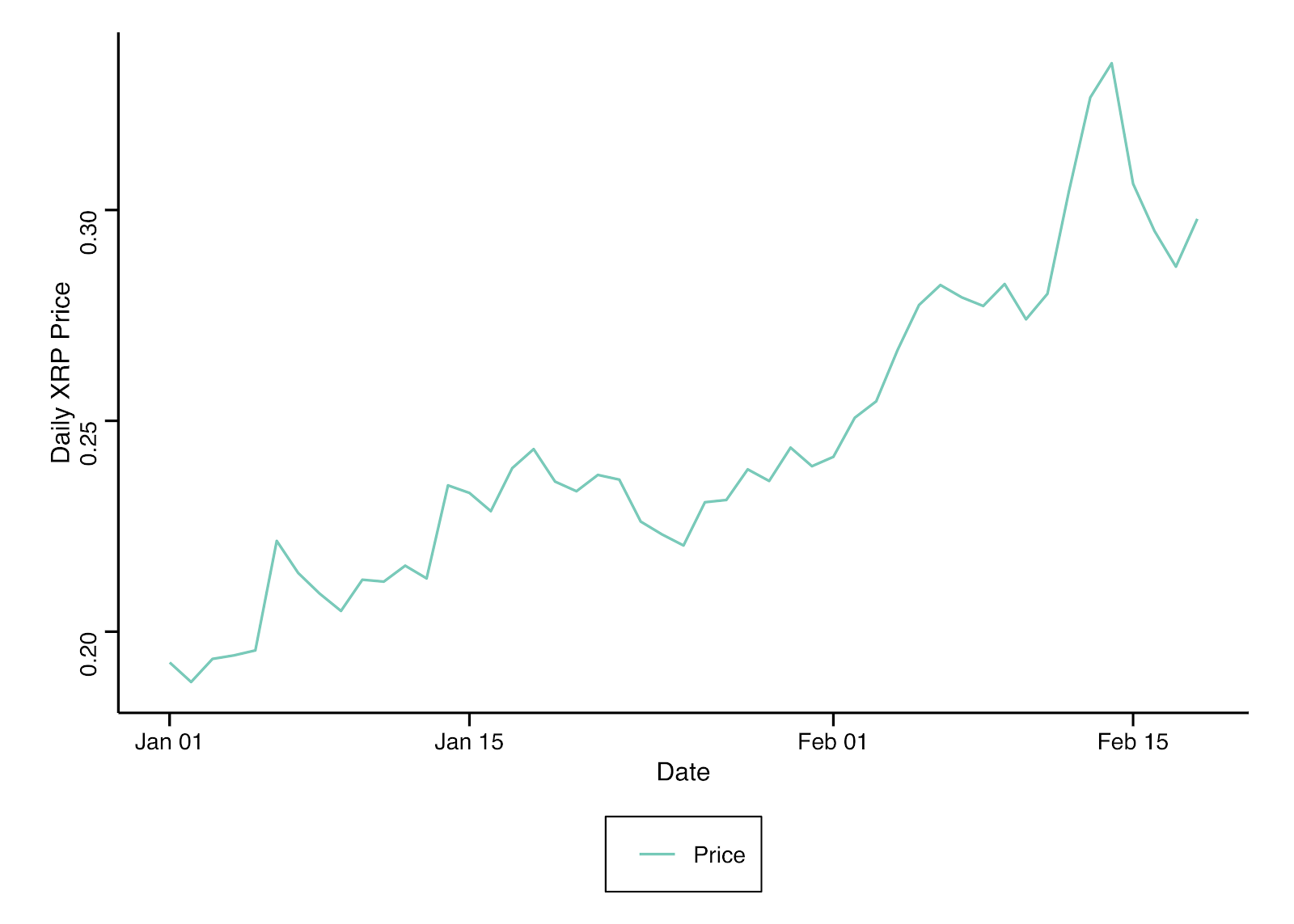

Following the average upward trend in February, the correlation between the number of daily tweets and Ripple prices in 2020 reached the highest level since 2018, reaching 62%. In addition, the correlation between the two variables this month was 60%, much higher than the 12% in January.

However, this relationship was much lower in previous years: in 2018, the correlation between the number of tweets and Ripple prices was set at 35%, while in 2019, there was almost no correlation-only 7%.

A correlation of 0% means Ripple returns have nothing to do with the number of tweets. A 100% correlation means that the number of Ripples and tweets are moving in exactly the same direction, while a -100% correlation means that they are opposite.

A little positive impact on return on investment

The uncertain trends seen in correlations have led us to other analysis methods. In these analyses, we have found a small and clear connection between the number of tweets per day and Ripple's return. In 2019, when the number of daily tweets increased by 1%, the return of Ripple on that day increased by 0.032%. However, in 2018, there were no major relationships.

In the first half of 2020, we observed a slightly higher impact-when the number of tweets per day increased by 1%, Ripple's return would increase by 0.059%.

Ripple daily line trend from January 1, 2020 to February 18, 2020

This stronger relationship between Ripple and trading volume mentioned in the tweet is also reflected in the higher correlation shown in 2020 compared to other years. However, when we look at the impact of the number of tweets today and the Ripple return of tomorrow, we did not find a significant relationship, that is, tweets cannot predict future returns.

Daily Tweets from January 1, 2020 to February 18, 2020

Stronger relationship between tweets and volume

When it comes to the relationship between the number of tweets and Ripple's daily flow, a higher degree of influence is detected. Any year (2018, 2019, 2020) included in the analysis showed a significant relationship between these variables. The strongest impact will happen again in early 2020-when the number of tweets per day increases by 1%, XRP trading volume will increase by 1.215% on the same day. This relationship appears slightly lower in 2019 (0.916%) and 2018 (0.926%).

What's more, the relationship between the number of tweets per day today and the Ripple volume of tomorrow is also significant in the past few years, although it is slightly lower than the observation of the effect on the same day.

Once again confirming that 2020 is the strongest relationship-when the number of tweets per day increases by 1%, Ripple ’s trading volume will increase by 0.972% the next day. In 2018 and 2019, this numerical relationship was set to 0.741% and 0.871%, respectively.

Ripple and Bitcoin: 2020 Outlook

Ripple and Bitcoin have compared other characteristics, such as the correlation between the two currencies and gold. In early 2020, the term "digital gold" changed, and Ripple's price was more closely related to gold than Bitcoin.

According to Cointelegraph, the number of tweets referring to Bitcoin each day affects Bitcoin's daily trading volume, whether it is the same day or the next day. However, when the same parallel relationship is established, in the case of Ripple, it is found that there is a strong relationship between the returns in 2019 and 2020, and at the same time, there are comparable and significant results on the impact of Twitter on Ripple's trading volume.

Looking ahead, investors should be aware of the consistency of these relationships over the years and pay attention to Ripple's social indicators.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What does the world's richest man think of cryptocurrencies and blockchain?

- How do startups break the game and win the industry first? 丨 Babbitt Industry Welcome Class

- Falling $ 1,400 a week, will Bitcoin's bull market return?

- DeFi product designer, Chinese community strategist … 16 new positions unique to the crypto industry

- Bitcoin Weekly | Coin price plummets, Binance welcomes net Bitcoin inflows for six consecutive days

- The biggest investor asks Jack Dorsey to step down, can we still see pro-Bitcoin Twitter?

- Known as Bitcoin 2.0, it almost died? A quick glance at the past and present of ETC