Bitcoin hardcore OG meets secretly every year, this is their hot topic of discussion this year

Written by: Jameson Lopp, CTO of keys.casa, and founder of statoshi.info and bitcoinsig.com

Source: Chain News

"Satoshi Nakamoto Roundtable" is an annual secret gathering of the Bitcoin community OG (original gangster, veteran of the industry). Participants use a strict invitation system and no keynote speech. Before the meeting, the specific meeting site will not be announced. Community Bilderberg Conference ". This year's Nakamoto Roundtable is the sixth gathering of the event, which will be held in Cancun, Mexico, in early February 2020. After the meeting, the hardcore old cannon in crypto punk, Jameson Lopp, CTO of keys.casa, recorded the hot topics he was interested in at the party: fiat channel, Bitcoin cash machine, BIP 174, charity …

New year, new round of Satoshi Nakamoto. This annual "non-conference" initiated by Bruce Fenton (now the executive director of the Bitcoin Foundation) has become a winter holiday. I have participated in this round table in both bull and bear environments. The atmosphere is very optimistic this year, and we are at the dawn of a banner year.

- Analysis: XRP price is related to its Twitter activity, and has a stronger correlation with gold than BTC

- Gold, BTC plunged, why did hedging tools fail?

- Out of the shadow of the epidemic, the minefield prepared for halving

Lianwen Note: "Non-conference", English for unconference, is an open, equal, and free conference. There are no guests, no guests, no keynote speeches, no prescribed breaks, and the entire conference is free to open the microphone.

There are eight different "stacks" in this non-meeting, and no one can have an overview of all topics. Here are some topics from the first day, you can spy on the leopard:

In order to learn more, I chose several topics that I was not familiar with. From the discussions I attended, I gained the following insights.

Fiat money deposit channel and newcomers get on the train

There are two payment methods for the Bitcoin-related fiat channel: push vs. pull. Push payments are difficult to reverse, including wire transfers and certified checks. "Pull payments" include ACH (Automated Clearing House) and credit cards. There is a risk of refunds. Institutions often use push payments, while retail or retail consumers often use pull payments.

A big challenge with accepting ACH payments is that you may have to wait several days before you know if the payment information is valid. There are bank authentication services that help improve the certification process, but they require users to surrender their bank login credentials, which poses huge privacy and security risks. You should assume that any service that requires you to provide a bank login will be able to view every transaction you have made in the past.

There are rumors that banks often mark any transaction involving "Bitcoin" or "cryptocurrency" in the remarks column, and savvy merchants will give themselves a name that does not sound like a financial company. Of course, this trick is only useful if your business is small enough to avoid radar scans. If it is a company with a large-scale cash business, such as a Bitcoin automatic teller machine (BTM) operator, it may face the risk of account closure.

Many cryptocurrency exchanges process their credit card processes through the European Union instead of the United States, because in Europe, credit card payments and card networks are processed directly, while the United States requires these businesses to be processed through a commercial bank, which adds additional Review risk. Another way to handle credit card business in the United States is to create a bank escrow account for each of your users and replenish them in a manner similar to "cash advance." The disadvantage is that prepaid cash often has a single commission of about 5%, and if it is not repaid in time, it will charge more than 20% of interest.

To prevent credit card theft (someone steals someone else's credit card to buy bitcoin, and the payment will be returned when the card owner finds and reports the loss), a simple way is to add a unique code to the authorization string to verify whether it is The real owner of the credit card. This authorized call will not charge the card, only the card owner needs to log in to his credit card account to find the unique code. You can also use third-party services like Riskified, and they even offer a money back guarantee.

Interestingly, there are rumors that Coinbase has experienced very few credit card refunds, so once a refund dispute occurs, Coinbase is too lazy to argue with customers, because the more refund disputes, the greater the risk of credit card processing on the platform.

Stablecoins are another way for new users to get on the bus, but the issue of custody of stablecoins also brings additional risk of default. In many cases people do not understand the escrow of collateral. For example, when the custodian declares bankruptcy, can the collateral be guaranteed not to be confiscated? This aspect may not be legally protected.

Another warning is about DAI, that it provides unlimited leverage, and its mechanism of action may be similar to auction rate preferred shares, which was exactly a decade ago by the well-known American bond management agency Pacific Investment Management Corporation (PIMCO) Where the ditch capsized.

I'm not familiar with this concept, so I did a bit of research:

Auction interest rate securities are determined by periodic auctions held every 7 days, 28 days, or 35 days. During the auction, holders have the option to sell their bonds. By early 2008, such auctions had generally failed to attract enough buyers. At auction auctions, bondholders face a serious contraction in debt yields due to the illiquid flow of such securities. In order to stop the flow, some Wall Street institutions began to buy back unsold bonds. But when the financial tsunami struck in 2008, banks were forced to strengthen their capital reserves, they withdrew, and were no longer the last straw to save lives, and the market collapsed.

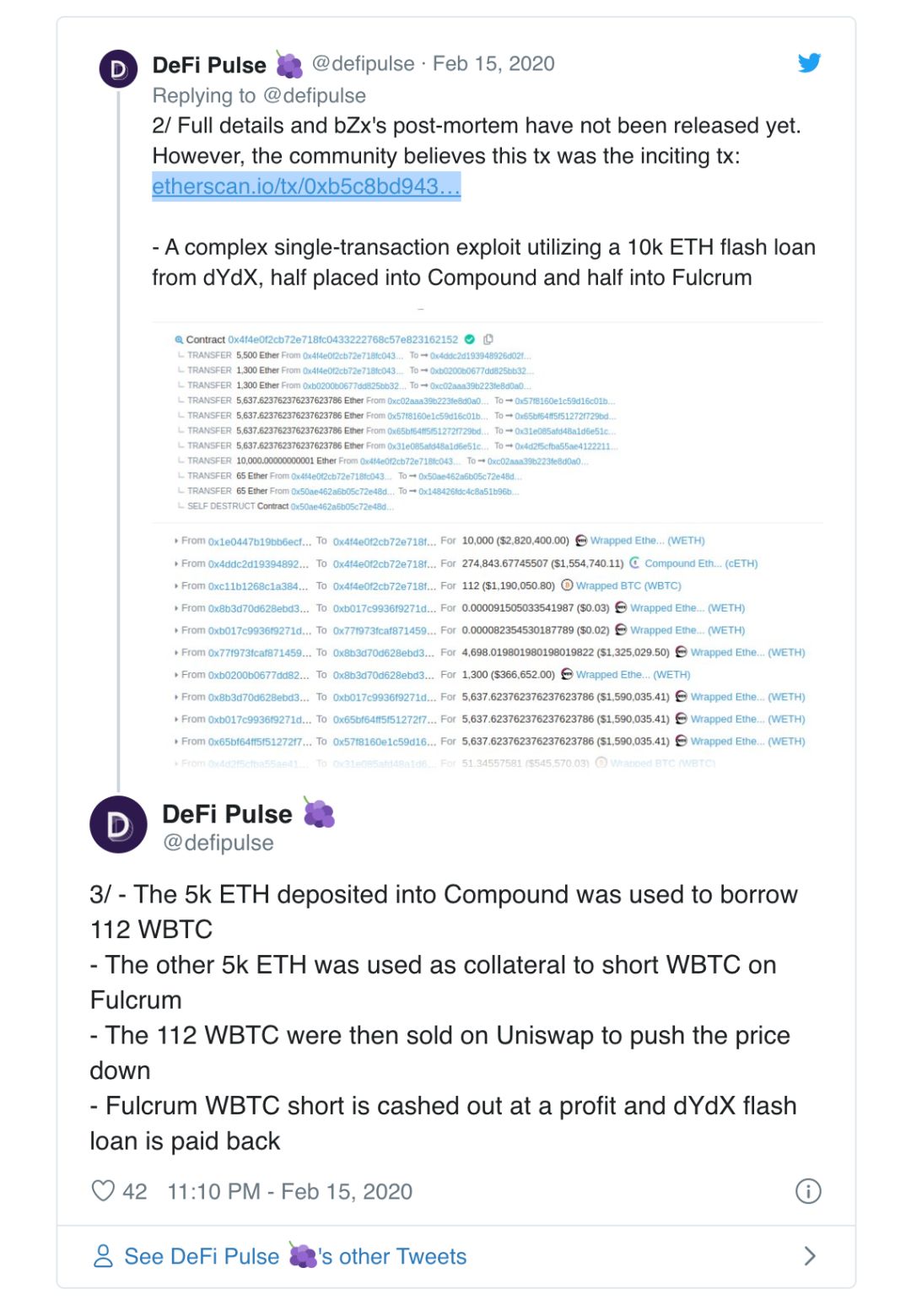

Coincidentally, one week after Nakamoto's roundtable conclusion, the events in the DeFi field reminded me of this warning; the situation should be that someone took advantage of the complex interactions between multiple DeFi systems to find a way to manipulate the market.

2 / Full details and ex post review of bZx have not been made public. However, the community sees the following deal as the originator:

https://etherscan.io/tx/0xb5c8bd9430b6cc87a0e2fe110ece6bf527fa4f170a4bc8cd032f768fc5219838

-A complicated single transaction that borrowed 10,000 ETH from dYdX using Lightning Loan, half invested in Compound and half invested in Fulcrum

3 /-Deposit 5,000 ETH in Compound for loan 112 WBTC.

-An additional 5,000 ETH on Fulcrum as collateral for short WBTC

-Then the 112 WBTCs were sold at Uniswap to suppress the WBTC price

-WBTC on Fulcrum takes a short profit to cash out and then repays the Lightning Loan on dYdX

Bitcoin ATM

One of the benefits of the Bitcoin Cash Machine (BTM) is that it is less dependent on traditional banking channels; users only need to access two anonymous assets, cash and Bitcoin, and users do not need to worry about censorship by intermediaries. However, BTM operators still face many difficulties.

Many BTMs can buy and sell bitcoins, and this two-way transaction form can realize cash circulation. Smart operators will even adjust rates to promote arbitrage, in order to stimulate users to help the machine rebalance. Some even proposed a "worker bee rebalance system", which tells Bitcoin users that they can move cash from a BTM to a nearby BTM to make money. Early BTMs struggled to get cash transport services, but by 2020, companies like Brinks and Guarda have started offering similar services.

From the actual BTM operators we have contacted, we know that the purchase amount accounts for about 90% of the BTM transactions, and the sale amount accounts for only 10%. Obviously, the price elasticity of BTM to demand is very small, which means that if BTM increases the handling fee from 5% to 20%, the operator thinks that this will not drive customers away. That's why you see a lot of BTMs (bid and ask) with extremely high spreads-because they can do that.

Another factor may be that BTM does not show the spread or rate to the user; the customer only wants to invest X dollars, and it does not care what the actual market price is. BTM operators who are also conducting stablecoin transactions have noticed that the transaction value of stablecoins is much lower, which can be explained to some extent: when you buy a crypto asset denominated in US dollars, the commission will be particularly prominent.

BTM operators are optimistic that in the long run, the cash flow of buying and selling will stabilize, along with the reduction of regulatory uncertainty and other business risks, fees will decrease.

Regarding anti-money laundering / know your customer (AML / KYC) regulatory requirements, different BTM operators have different approaches. When the transaction amount is less than $ 300, some BTMs rarely require any customer information, and some BTMs are set at $ 3,000. This is primarily based on state rather than federal law, and depends on the speed and tightness with which operators are willing to enforce regulatory requirements. Competition in this area is becoming fierce, and some BTM operators will report that other operators are too lax about their customers' ID requirements.

The demand for altcoins is very low. Some people mentioned that Litecoin has the highest demand, probably because of its faster transaction confirmation time. Unfortunately, integrating Lightning Network on BTM is not feasible because its average transaction size exceeds the actual limits of the protocol.

There is something weird. We have heard that traditional banks increasingly hate ATMs because ATMs are losing money. On the other hand, due to the saturation of the ATM market, it is said that some ATM operators have begun to enter the BTM business. The installation contract of ATM is basically divided into spheres of influence by region and has a lock-up period of many years; however, these contracts do not cover BTM, so if operators extend their business to BTM, they can expand their territory and put BTM machines to competitors Next to the ATM.

As a business that is still in its infancy, much of BTM's transactions actually come from the inner cities of American cities with high crime rates. BTM machines facilitate various scams and crimes, and operators must deal with the corresponding issues; they receive a large number of requests from law enforcement agencies, and they generally resolve and comply quickly. Some of the most common crimes include:

- Aiming at the emotional scam of older women, they are required to send money overseas.

- Falsely claiming to be an IRS / law enforcement agency, asking the other party to pay to avoid jail time.

- Money laundering by swiping. Someone buys credit card information on the dark web, uses those cards to buy goods, and sells them to a buyer at a great discount. Buyers will go to BTM to exchange cash for bitcoin and remit it to criminals, who will then exchange cash back and use the profits to buy more stolen credit card information.

- There is also a suspicion that some gangs save high profits of drug trafficking in Bitcoin, and there is also a saying that gangs will destroy BTMs on rival gang sites.

- There have been many cases of BTM theft in recent years.

Northamptonshire police are tracking three men robbing a Costcutter convenience store. One of them coerced the store clerk with a knife, and the other smashed a Bitcoin cash machine with a sledgehammer to separate it from the store wall. They snatched a bitcoin cash machine. https://www.northants.police.uk/news/2019-03-15/bitcoin-machine-stolen-far-cotton-robbery-%E2%80%93-witness-appeal

In Vernon, Canada, two men broke into a Simply Delicious food store and stole cash from a Bitcoin cash machine in the store. They stole 2 cash drawers with about $ 4,000 in them, but left a third cash drawer with $ 50,000 in it! https://www.vernonmorningstar.com/video/thieves-smash-way-into-vernon-business/

The thief blatantly smashed an empty Bitcoin cash machine, ignoring the traditional cash machine full of cash next to it, which puzzled the manager of the store in Philadelphia. https://cryptonews.com/news/watch-thieves-wrench-open-a-bitcoin-atm-leaving-a-regular-at-5616.htm

Network of trust, identity and reputation

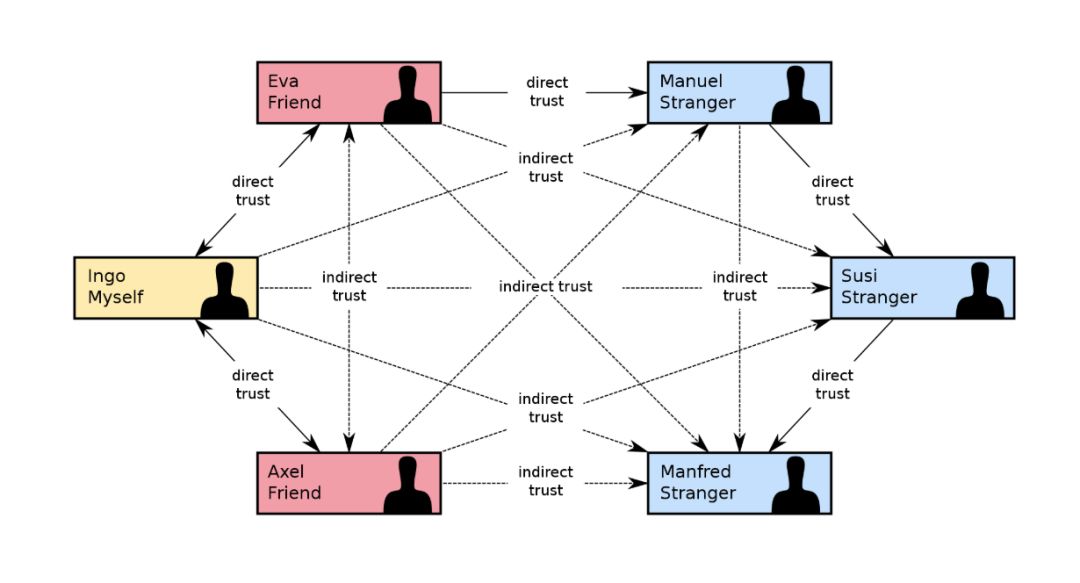

Early bitcoin transactions were conducted through over-the-counter markets, and these markets have built a network of trust rating systems. Nowadays, many OTC transactions take place in private chat rooms that require member guarantees to enter. "Soft guarantee" means that someone only uses their own reputation as a guarantee. A "hard guarantee" means that someone has promised to assume financial responsibility for any transaction in which the guaranteed member fails to keep its promise. Therefore, it seems that we have actually degraded from a network of trust in the strict sense to a network maintained by the administrators of the private trading community.

Generally speaking, reputation is built by the testimony of others, that is, someone proves that you can or cannot be trusted to do what you say and do. Interestingly, it is impossible to create some kind of global reputation points through a network of trust, because it may be subject to a sybil attack, and Bitcoin OTC transactions do happen. However, you can create personalized scores, which are calculated based on the reputation people share with each other.

The idea of giving everyone a global reputation score is also scary, because it can be manipulated by the public. For example, a person may anger the world for a highly controversial post or action, and his reputation will be ruined for the rest of his life. However, a hypocrite may confuse the public and attract a large number of fans to give him a high reputation. He will not be punished when he hurts an innocent person, because a little negative evidence will soon be overwhelmed. Therefore, do not create some kind of global reputation scoring system. You should start with your trust in the network and weight the scores based on the reputation of the person who testified.

We also have to give up the idea that one identity has only one reputation. An identity can actually have an infinite variety of reputations, depending on the type of interaction he / she has with others. For example, a bad taxi driver is not necessarily a lazy gardener-your reputation should be different in different services.

Sovereign status is your personal control, not a grant from an authority. In the Internet environment, this is a reasonable explanation of online identity. However, in the physical world, a large number of people, such as refugees fleeing a country, do not have identity cards issued to them by the authorities. These people urgently need such an identity system.

There are several self-dominated identity systems:

- Blockstack

- Handshake

- ION

Blockchains are just weird public key databases; their real value is to provide you with a way to unlock, without the need for a trusted third party. However, any identity system that wants to run on a large scale needs to be able to handle billions of public keys and the regular operation of those keys. Putting such large-scale data into a decentralized network rashly will most likely cause many problems.

How the sovereign identity system responds to the challenge of capacity expansion is an interesting topic.

Bitcoin as a revenue-generating asset

Almost everyone in this field wants more bitcoin, so if you design a financial instrument, generating revenue in bitcoin is obviously more attractive than fiat currency. It is generally believed that fully managed products will become more competitive in the future, and product competition will mainly focus on the rate of return.

Personally, I am cautiously skeptical of using revenue-generating services because I used similar services in 2016. At that time, a way to make money was to lend Bitcoin to financing traders on Bitfinex. As a result, when Bitfinex was hacked, the loss was shared equally among all users, with each person losing 30%. Although I was never a Bitfinex user, I indirectly put some money there, so I was also affected. As the saying goes, there is no reward without risk. I believe that in a sufficiently long time frame, similar events have recently occurred in these various forms of lending systems.

To say a particularly interesting thing, recently through a brokerage and margin trading system of my broker, I started to lend my Grayscale Bitcoin Trust GBTC, although its annualized income was only 1% to 2%. However, all of these loans have full collateral at several mainstream banks, and my counterparty is an institution that manages trillions of dollars of assets, so the probability of default for these products is extremely low. Of course, low risk, low return.

Chainnote: GBTC, the Grayscale Bitcoin Trust, was launched in April 2018 and is known as "the first publicly listed security to invest separately and obtain value from the price of Bitcoin", which enables investors in the public market to Bitcoin in a regulated and protected environment. GBTC is the closest investment tool to exchange-traded funds (ETFs) because it enables investors to invest in Bitcoin without having to worry about storage or custody.

Another danger today is remortgage. When you mortgage your assets to someone or an institution, they turn around and use the collateral you provided as their own collateral to borrow money, which is remortgaging. This is obviously risky because it causes these services to become part of the reserve. If too many creditors ask, this could lead to catastrophic "bank runs."

Another risk is that the loan servicer may not provide security protection for the assets held as collateral, that is, if the lender is bankrupt for any reason, the assets held as collateral may not be protected and may be protected. Involved in bankruptcy proceedings and used to reallocate to creditors. You could easily fall into a situation like MtGox's bankruptcy, where it would take years to recover the remaining funds.

BIP 174: Partially Signed Bitcoin Transactions

I have been working on the Bitcoin multi-signature wallet for the past five years, and the lack of standards is a nightmare. The good news is that BIP 174 came up with a standard about how to serialize partially signed transactions. Each hardware and software wallet seems to have its own unique serialization and is not compatible with the serialization of other wallet software. As a result, before PSBT (Partially Signed Bitcoin Transactions), multi-signature wallets that could use a variety of wallet software could not actually be created, which also caused a potential single point of failure.

We have already deployed PSBT in Casa as part of our Coldcard integration work, and we hope to see other hardware equipment manufacturers follow suit!

Source: https://xkcd.com/927/

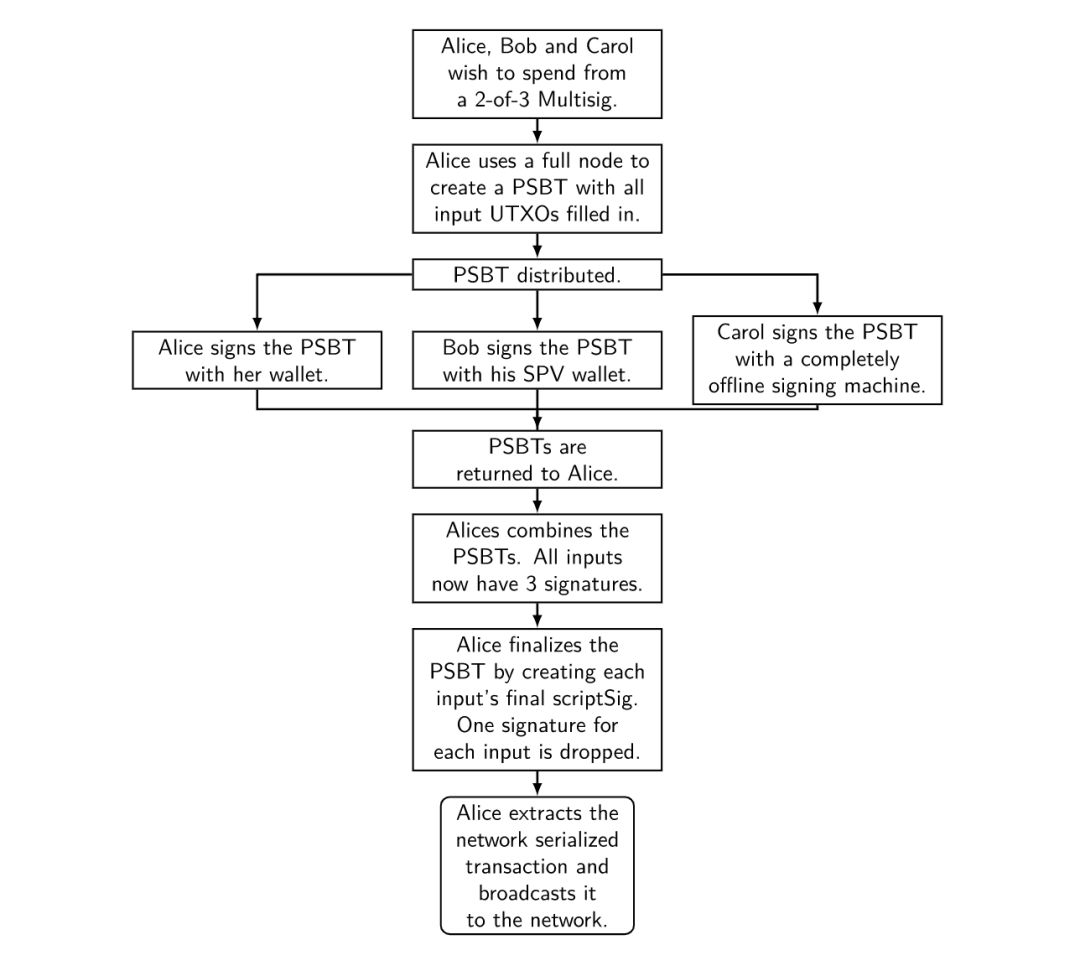

PSBT allows us to consider the structure of the transaction (and all its complexity) separately from the actual signature of the transaction, which should be fairly straightforward. As shown in the figure below, the PSBT workflow allows non-interactive signatures for transactions using different software. Anyone who collects enough PSBT can merge the partially signed transactions generated into a fully signed transaction.

PSBT format also has a nice additional security feature that allows you to pass XPub and derived paths with transaction information, so that the signature software can verify that the changes have been returned to the target wallet.

Looking forward, we expect that the scalability of PSBT will enable it to support the unique features of various wallets, but first, we must let everyone support the standard!

There is also work in progress to increase PSBT support for lightning transactions on hardware devices. However, some non-standard attributes of lightning transactions require more work from hardware manufacturers.

charitable

Bitcoin's long-time HODLers have found that they can now play a greater role due to asset appreciation. If you donate value-added bitcoin directly to a charity, this will have tax benefits, because if you convert bitcoin to fiat money before donating, there will be capital gains tax.

In addition, tax deductions are also available for donations to eligible institutions. If you want to donate Bitcoin to charity, you can refer to my resource list. Please note that if you intend to donate more than $ 5,000 worth of bitcoin in the United States, you will need to complete a tax form 8283, obtain a third-party identification of bitcoin (you know), and have the grantee sign the end of the form.

Another perspective is that after the appreciation of Bitcoin, individuals can play a more direct role than institutions because they are more flexible. The bureaucracy slows down the decision-making process, and individuals who make autonomous decisions do not need to reach consensus with others.

In addition, Bitcoin allows us to send money to places that were previously difficult to reach. We can fund people who can't even get the services of traditional financial institutions. Oppositionists who can fight for human rights can be financed, and financial institutions will block their use of payment networks due to government orders.

The interesting point is that using Bitcoin to fund those efforts to further the development of Bitcoin is particularly challenging. If organized, such activities are likely to encounter resistance from people because they fear that incentives will be distorted. So probably the best option is for individuals and companies to directly fund some developers.

Back to construction!

If we have to summarize the Satoshi Nakamoto round table in 2020, then one sentence: 2020 will usher in a bull market!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dubai establishes first blockchain KYC platform, licensed companies can open digital bank accounts instantly

- What does the world's richest man think of cryptocurrencies and blockchain?

- How do startups break the game and win the industry first? 丨 Babbitt Industry Welcome Class

- Falling $ 1,400 a week, will Bitcoin's bull market return?

- DeFi product designer, Chinese community strategist … 16 new positions unique to the crypto industry

- Bitcoin Weekly | Coin price plummets, Binance welcomes net Bitcoin inflows for six consecutive days

- The biggest investor asks Jack Dorsey to step down, can we still see pro-Bitcoin Twitter?