Out of the shadow of the epidemic, the minefield prepared for halving

Source: Hive Finance

Editor's Note: This article has been deleted without altering the author's original intention.

Due to the outbreak of the new crown pneumonia epidemic, the upstream and downstream of mining mining were temporarily affected at the beginning of the year. With the formal resumption of work at each port, the mining industry is gradually back on track. Whether it is a mining machine manufacturer, a mining pool, a mine owner, or a miner, they are preparing for a real hard battle-Bitcoin is halved.

- Dubai establishes first blockchain KYC platform, licensed companies can open digital bank accounts instantly

- What does the world's richest man think of cryptocurrencies and blockchain?

- How do startups break the game and win the industry first? 丨 Babbitt Industry Welcome Class

The third Bitcoin mining reward halving is expected to occur on May 11 this year. At that time, Bitcoin block rewards will be reduced from 12.5 to 6.25 per block, and Bitcoin inflation will be reduced from 3.72% to 1.79% It is 2% below the dollar's target inflation rate.

Mining machine manufacturers such as Bitmain have begun to push for new products. Miners are actively preparing for operations, and mines around the world are also operating at high speed.

There is only two and a half months left to halve the distance. Historically, the first two Bitcoin halvings have spawned a bull market. However, for mining practitioners, halving is like "crossing the robbery". After the "harvest" is reduced, the price of bitcoin directly determines the two destinies of miners: making money or encountering mining disasters.

Since the beginning of the year, Bitcoin's entire network computing power and mining difficulty have continued to rise, approaching historical highs. Under the prosperity of the mining circle, the uncertain market conditions brought uncertainty, and mining professionals reminded that the need to raise awareness of risk control.

Mining mining affected by epidemic weakened

At the beginning of 2020, the outbreak of the new crown pneumonia epidemic disrupted the pace of mining mining in preparation for halving the output of bitcoin.

Since the beginning of the year, Shenma Mining Machinery has issued a notice that the manufacturer's Spring Festival holiday end time has been extended from January 30 to February 9, and arrangements related to production, delivery, after-sales delivery and maintenance have been delayed due to the impact of the epidemic. The mainstream domestic mining machine manufacturers are also affected. Artem Eremin, the product manager of ASIC mining machine retailer 3Logic, revealed that the mining machines of Bitmain and Jianan Yunzhi have also been delayed for at least one week.

Shenma Mining Machine Delayed Announcement

The delay of the producer directly caused the mining machine dealers to face the situation that they could not ship. A mining machine merchant in Shenzhen Huaqiang North SEG Electronics Market revealed that the market opening time has been repeatedly adjusted. It was originally scheduled to open on February 10, and was later postponed to open on the 18th. "The currency price has increased a lot in the past period. It's a good time to sell a miner, but you can only watch and worry. "

The relevant person in charge of the Shenzhen-based Panda mining machine told Hive Finance that during the epidemic, off-line businesses such as mining machines and mines will inevitably be affected, including logistics delivery, reduced manufacturing efficiency, and some mines are also facing maintenance vacancies .

Jiang Zhuoer, the founder of Leibite mining pool, revealed on February 4 that one of his mines in the outskirts of Xinjiang was forcibly closed by police to prevent resumption of work.

Mines that have not been forced to shut down also face problems such as untimely updating of mining machines and inability to repair. A mine owner said in an interview with the media that the new machine scheduled a year ago could not be delivered during the epidemic, and the damaged machine could not be repaired in time. "Half the time, the expansion plan can only be temporarily suspended."

A mine related person disclosed to Hive Finance that under the epidemic, the main problem they faced was that some offline activities and promotion could not be completed. For the needs of some customers, we cannot face to face. In response, they established an online office platform to minimize the impact of the epidemic. "Fortunately, the capital chain is healthy, so there is little pressure on cash flow."

Relatively speaking, online businesses such as mining pools are less affected by the epidemic. BTC.com mining pool related people told Hive Finance that the business has no impact, everything is running as usual, after the year, customers' docking for the mining pool will be carried out in an orderly manner.

With the success of the epidemic prevention work, various enterprises have gradually resumed work, and many mine circle practitioners have recently stated that the impact of the epidemic situation has gradually weakened.

On February 14, Zhang Wencheng, the sales director of Shenma Mining Machinery, said that the company's production has resumed and some logistics are smooth, but not all mines can enter. Due to the inability to inspect the site and mining machine manufacturers, large-scale investment may be affected to some extent.

Honeycomb Finance learned that at present, mining machine manufacturers such as Bitmain, Jianan Yunzhi, and Panda Mining Machinery have also resumed work. With the gradual flow of logistics, mining machine manufacturers can basically produce and sell as usual.

Mining preparations halved in all aspects of mining

After gradually emerging from the haze of the epidemic, the mining circle began to fully meet the halving.

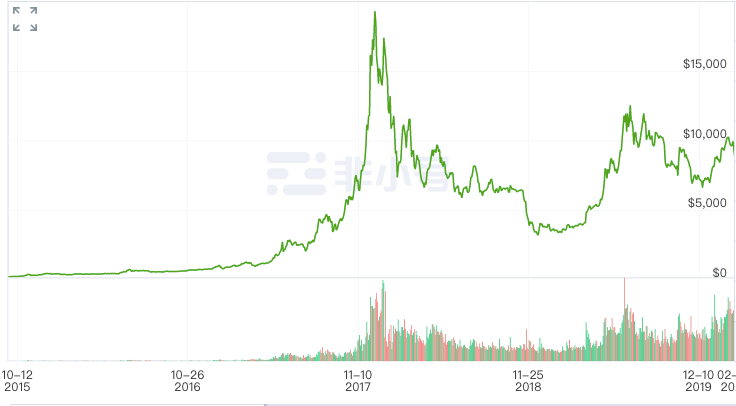

On November 28, 2012, Bitcoin halved for the first time, and the price rose from $ 13.49 to $ 1047.5, an increase of 77.65 times; the second halving occurred on July 10, 2016, and Bitcoin soared from $ 620 to $ 18,711, more than 30-fold. For miners, Bitcoin halving is a quadrennial event.

The increase in network-wide computing power reflects the increase in mining enthusiasm for miners. On February 28, Bitcoin's entire network hashrate exceeded 117.79E, and the hashrate increased by more than 17% during the year.

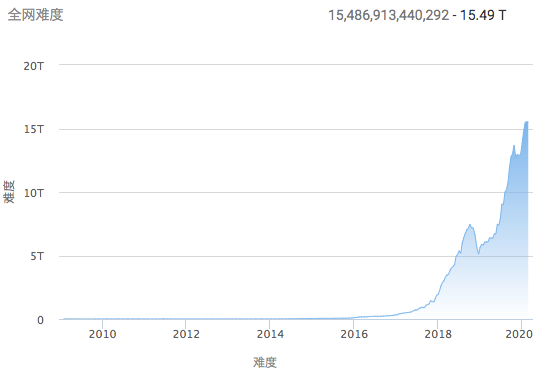

The increase in computing power also brings an upgrade in the difficulty of mining. According to BTC.com data, the mining difficulty of the entire network on the 28th was 15.49T, which was close to the highest value in history. Compared with the same period last year, the mining difficulty increased by 1.55 times.

Bitcoin mining difficulty is close to the highest point in history

The relevant person in charge of Panda Mining Machinery told Hive Finance that the current mining machine market is in short supply. As the market rebounds, mining revenue has increased by nearly 50%, and the demand for mining has increased.

At present, major mining machine manufacturers are actively increasing production capacity and launching new machines with stronger energy efficiency ratios. Cora Jiang, Director of Global Market of Oblivion Observation, observes that large mining machine manufacturers are starting to push new, miners are also looking for mines, and upstream and downstream companies in the mining circle are looking for new opportunities. Half, once again activating the vitality of the entire industry. "

Bitmain took the lead. On February 27, the company announced the latest mining machines S19 and S19Pro equipped with 7nm chips, shouting the slogan of "reaching the top of computing power". It is reported that two new mining machines will be on the market soon.

Although the "first share" of the mining circle, Jia Nan Yunzhi, has not launched a new machine recently, it has also made great efforts in marketing. According to Shao Jianliang, the CEO of Jianan Blockchain, Jianan Yunzhi has launched a number of solutions such as mining machine mortgage, 0 yuan purchase, and installment purchase to increase sales. In addition, miners can lock in mining revenue by purchasing options and other products.

With the increasing market demand for mining, Mars Finance also entered the market across borders.

The old miner Lu Feng felt the restlessness before this round of halving. He told Hive Finance that halving preparations began in the second half of last year. At the end of last year, the market price fell, and the minimum bitcoin price dropped to $ 6,600. The Ant S9 miner has reached the shutdown price. However, in order to meet the halving, most miners do not want to stop mining, while looking for low-cost electricity, while upgrading or updating the mining machine to improve mining efficiency.

A man posted a halving countdown poster in the circle of friends every day. He is the operator of a mine in Balangshan, Kangding, Sichuan. At the end of April, the flood season in the southwestern region was approaching. In addition to the halving effect, his mine began to recruit a large number of miners to make appointments for hosting.

Opportunity and risk coexist

The mine circle before the halving was really lively. Especially under the first two bull-making effects, the miners are full of expectations for this halving. However, many people in the industry believe that the essence of mining is leveraged investment. Before halving, blind mining without countermeasures is like gambling, and mining disasters and bull markets are sometimes separated by a line.

In essence, halving the mining reward each time is like a robbery for miners. Mining Association COO Yu Yang once said that with the income halved and the cost unchanged, the profit of the miners was not halved, but shrunk to one third of the original. This is because the difficulty of mining is constantly increasing, and the payback period of the mining machine has also become longer. Therefore, miners should be fully prepared before halving.

Shenyu, the founder of the F2Pool mining pool, said that mining is actually a mid-term bullish option on the currency being mined, so to take a financial mentality to mine, miners need to hedge and manage risks.

Shenyu revealed that he completed the replacement of a new generation of mining machines before the Spring Festival, and chose a high point for partial hedging. He suggested that before and after the halving, miners should try to make decisions in advance, such as replacing lower-power mining machines and looking for cheaper electricity prices. When the market is better, hedging is done to protect the income.

From the perspective of the growth of the entire network's computing power, many miners have bet on halving the market. OKina mining pool leader Alina said that if the price of the currency does not rise as expected after halving bitcoin, the mining cost of the miners will be higher than the revenue, and the mining is likely to reshuffle within a period of time.

"After halving, the big miners can cover the cost, and even buy mining machines, dormant, etc. and make a lot of money when the market is good." Alina believes that the possibility of halving to bring mining disasters is not great, but for miners There are both opportunities and risks, and miners should raise their awareness of risk control.

According to the rule of the last Bitcoin halving, after the Bitcoin halving was completed in July 2016, the price of the currency did not rise slightly. It was not until one year later that the price of Bitcoin rose rapidly from $ 2400 to a maximum of nearly 20,000. US dollars. For miners, whether they can survive the halving "accumulation period" is particularly critical.

The bull market only arrived one year after the last bitcoin cut

Shao Jianliang said that mining builds the intrinsic value of bitcoin. After bitcoin production is halved, the miner's income decreases. However, due to the imbalance between the supply and demand in the market, the price will be used to compensate for the value. However, in the process of halving, miners need to think more.

He reminded that miners should focus on observing two indicators when mining, one is the daily output and consumption of the mining machine, and the other is the change and growth of the computing power of the entire network in order to respond in time.

Halving the current mining opportunities and risks co-exist, mining personnel need to consider whether they can withstand the pain of shrinking revenue. In this period, the competition is more forward-looking and risk-conscious.

What preparations did you make before halving?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Falling $ 1,400 a week, will Bitcoin's bull market return?

- DeFi product designer, Chinese community strategist … 16 new positions unique to the crypto industry

- Bitcoin Weekly | Coin price plummets, Binance welcomes net Bitcoin inflows for six consecutive days

- The biggest investor asks Jack Dorsey to step down, can we still see pro-Bitcoin Twitter?

- Known as Bitcoin 2.0, it almost died? A quick glance at the past and present of ETC

- BM's latest work: The trade-offs behind blockchain

- "This coin can be reminisced, but it was gone at that time."