Analyzing the RUNE protocol from both bullish and bearish perspectives.

Analyzing the RUNE protocol from bullish and bearish perspectives.Author: Sleeping in the Rain, Source: Author’s Twitter @qiaoyunzi1

$RUNE is a recently widely discussed token that has risen due to two positive developments from @THORChain and has become a gathering place for the air force due to the positive developments.

Today I hope to analyze the two updates of the protocol from two perspectives: bullish and bearish, including patterns, flywheels, and risks.

Bullish

The first update is “Streaming Swap”, which simply means executing cross-chain by splitting large orders into small orders, making the user’s exchange experience (price) more friendly – with less slippage. This feature does not directly affect the token price, but there is a transmission process caused by the increase in data.

- County Youth Engaged in Cryptocurrency Trading Lost 130,000 Yuan and Returned to the Construction Site to Repay Debts Again

- LianGuai Encyclopedia | What is a known plaintext attack

- An Exploration of Everything Behind Friend.Tech

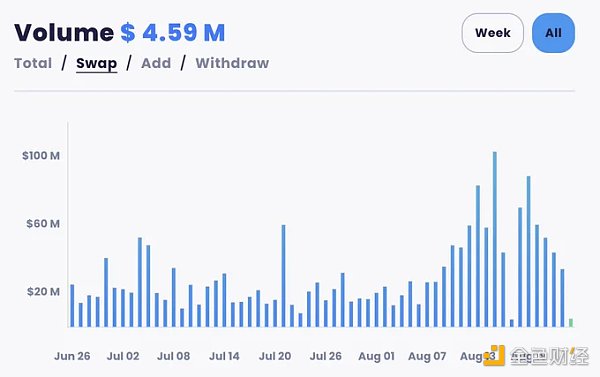

I will look at the data changes in the following graph for a more intuitive understanding – after the launch of Streaming Swap, Thorswap data has a noticeable increase, but after a brief increase, the trading volume begins to decline significantly. Whether the impact of Streaming Swap is lasting remains to be seen over time.

Another important feature is Lending, but Lending is more complex, so I will spend a relatively long length of text to simplify the logic. (Personal understanding, if there are any misunderstandings, please correct me)

To simplify the mode of Lending, we can understand it like this:

If we deposit $10 worth of $BTC as collateral, Thor will convert it into Tor.BTC, and the path is as follows: BTC -> RUNE -> destroy RUNE to mint Tor.BTC. If the LTV is 30%, then we can borrow 3 TOR (accounting unit, 1 TOR = 1u). If we want to borrow 3u of ETH, the protocol will mint 3u of $RUNE and exchange it for $ETH to give to the user. Repayment is calculated based on the borrowed amount in USD, not based on the value of the token.

Next, let’s introduce its most important concept: no liquidation, no interest rates, and no maturity date.

Why does Thor dare to do this? It’s because it turns your collateral into $RUNE. Of course, it doesn’t need you to repay the loan. Its goal is to minimize your desire to repay – it has already converted your core assets into $RUNE.

When you withdraw your collateral, if the value of $BTC/$RUNE remains unchanged, then no additional operations are needed. But if the price of $BTC relative to $RUNE increases, then Thor needs to mint additional $RUNE to make up for the difference.

For example, if 10u of $BTC doubles to 20u and the price of $RUNE remains the same, then it needs to mint an additional 10u (inflation).

So, it actually doesn’t want you to withdraw your collateral and not repay the loan, so it can continue to maintain the state of destroying $RUNE. (The minimum loan term is 30 days)

This is a small flywheel constructed by Thor.

Of course, Tor.BTC is not completely supported by $RUNE, but by 50% $RUNE + 50% $BTC, which reduces the protocol’s risk exposure. In other words, if the collateral appreciates, it only needs to mint half of the $RUNE to repay the collateral.

This is what I understand as the fundamental motivation of no clearing, no interest, and no expiration date – converting your core assets into protocol native tokens. From a long perspective, both new products (Streaming Swap increases user trading volume, and Lending involves multiple token conversions, also increasing trading volume) will increase ThorSwap’s trading volume and definitely be bullish with the burning of $RUNE.

Currently, the protocol lending only supports $BTC and $ETH, and support for more Layer1 assets will be added in the future. Lending is also a DeFi Lego of Tor.Asset, and Thor may launch new products adapted to Tor.Asset in the future to increase the capital utilization rate of ThorSwap LP.

Bearish

If the bullish reason is deflation, then the main reason for being bearish is the potential risks brought by the lending product to the protocol. Although the protocol can control the debt scale through circuit breakers, it is also possible that during the rise, especially when $RUNE does not perform well compared to the collateral assets, it will cause excessive inflation of $RUNE (up to a maximum of 15 million, with an upper limit of 500 million).

If the upper limit is reached and the collateral assets continue to rise (mainly depending on the ratio of Asset/$RUNE), it will be impolite, and more risks – bad debts will arise, and the protocol can only solve the bad debt problem through the treasury funds.

In essence, Thor’s Lending module shifts the risk to the protocol itself and $RUNE holders. Moreover, Thor’s lending involves several swaps, which will cause significant wear and tear, and the user experience is not friendly.

At the same time, the protocol controls the loan limit to 500 $RUNE (approximately $7-8 million now), and the loan limit of the protocol will increase only with the increase in the amount of $RUNE burned. With the expansion of the lending scale, it is highly probable that the upper limit of 15 million $RUNE will not meet the demand for redemption.

Although Thor has an upward spiral, it also risks burying itself in a death spiral – if the newly issued 15 million $RUNE and treasury funds cannot meet the requirements for redemption, then Thor will enter a death spiral.

Therefore, we can understand why Thor’s collateralization ratio is set at 200%-500%, not giving users the opportunity for high leverage, and why the protocol reduces the LTV of borrowing as the collateral increases. However, a lower LTV will reduce the adoption of the product, leading to the failure of the upward spiral.

Therefore, Lending has become a relatively mediocre product, which does not contribute much to the improvement of the protocol. It is a pity to abandon it without any taste. What else can you do if you are not bearish?

After reading this analysis, what will your choice be? The red pill or the blue pill?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Base and Optimism launch shared governance and revenue sharing framework

- An In-depth Analysis of Aave Governance V2 A More Inclusive and Efficient Decision-making System

- Coinbase is in talks with Canadian banking giant to promote cryptocurrencies

- LianGuai Morning News | ARK Invest and 21Shares Submit Ethereum ETF Application

- How far can Friend.tech, the new darling of Web3 social, go in the future?

- Is Chainlink (LINK) about to witness a 40% price breakthrough?

- LianGuaiWeb3.0 Daily | Three lawyers from the US SEC withdraw from the lawsuit against Ripple