An Exploration of Everything Behind Friend.Tech

Exploring Friend.Tech Inside OutAuthor: Javier Ang, Blockcrunch Analyst; Translation: LianGuaixiaozou

Friend.tech (FT), released on August 10, 2023, is a SocialFi platform deployed on Base. It evolved from another SocialFi project called Stealcam, which was built on Arbitrum. Developers reshaped the positioning of Stealcam and created Friend.Tech.

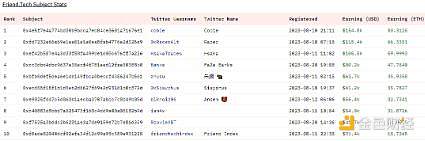

In just 12 days, FT achieved impressive results:

Attracted nearly 100,000 users with a fund inflow of 36,300 ETH (62.2 million USD).

- Base and Optimism launch shared governance and revenue sharing framework

- An In-depth Analysis of Aave Governance V2 A More Inclusive and Efficient Decision-making System

- Coinbase is in talks with Canadian banking giant to promote cryptocurrencies

Processed 1 million transactions with a trading volume exceeding 36,500 ETH (62.4 million USD).

Generated protocol fees of nearly 2,000 ETH (3.3 million USD), making it the second-highest platform in terms of fee revenue on August 22, second only to Ethereum.

Given the hype surrounding FT on Twitter and the support from investors such as LianGuairadigm, people can’t help but wonder:

What is FT exactly? Does it have the potential to shape the future of decentralized social media?

1. What is Friend.Tech?

FT is a social platform that allows users to buy and sell shares of creators. By holding these shares, users can access creators’ content and interact directly. In the current version, FT can be seen as an OnlyFans, but currently limited to text functionality.

What drives the FT frenzy is the speculative ability of users to invest in creator shares. On FT, the share price is determined by a joint curve, and the price adjusts dynamically based on the circulation of shares. Therefore, every purchase of new shares increases the share price, while every sale of shares decreases the share price.

The joint curve on FT naturally generates excitement. It provides better conditions for early investors, encouraging users to join quickly and buy shares. As the participation increases, the share price rises, and early adopters are incentivized to actively promote the platform, helping it grow. This dynamic creates a self-sustaining cycle of heat and expansion, making FT a focus of attention for the crypto-native community.

In addition, creators earn a 5% fee from each transaction, incentivizing them to promote their shares and convince users to buy. They often attract users by offering exclusive alpha access, community calls, and even revenue sharing.

2. Friend.Tech Strategy

Skeptics may say that FT’s service is not particularly innovative because its social features are similar to existing social media platforms like Twitter’s Subscriptions and OnlyFans. Furthermore, past efforts in financializing social networks, such as Steemit, Roll, and BitClout, ended in failure after a brief period of glory.

Their skepticism is not unfounded.

However, FT acquired 100,000 users in just 12 days and processed $62 million in transactions, sparking debate about whether it can take a different path. This is noteworthy, especially when other decentralized social networks have struggled to acquire users and many networks have died early.

The outstanding performance of FT so far can be attributed to the successful execution in the following aspects:

(1) Introducing FOMO:

Limited access: Registering for FT requires an access code, which can be obtained from existing members. This exclusivity makes everyone eagerly anticipate the access code on Twitter.

Stock priced according to the bonding curve: As mentioned earlier, the bonding curve benefits early adopters, creating a competitive frenzy among users, as everyone wants to get stock in advance.

Airdrop mechanism: Over a period of 6 months, app testers will receive a total of 100 million points, which are promised to be used for “special purposes” after the app is officially released. This indicates that these points may be exchanged for FT tokens. When users accumulate points based on their in-app activities and the number of referrals brought by access codes, they are naturally incentivized to use and promote FT. This smart strategy not only stimulates active user participation on the platform but also takes into account the prolongation of activities, cleverly encouraging users to form consistent usage habits and improve long-term user retention.

(2) Relatively good user experience:

Although the requirement to have ETH and bridge it to the Base chain may still be confusing and pose certain barriers to non-crypto-native users joining FT, the platform does ensure a smooth user experience for its crypto users, which is commendable.

Using Privy for a smoother user experience: Unlike many dapps that require users to associate their wallets or set up a new in-app wallet – often cumbersome to remember a 12-word mnemonic – using Privy provides a simplified approach. New users can simply log in with their Google or Apple accounts and fund the automatically generated wallet. This effectively reduces login barriers, alleviates users’ concerns about their original wallets being vulnerable to hacking attacks, and eliminates the need for a 12-word mnemonic. In addition, Privy eliminates the requirement to sign every FT transaction, enhancing the overall user experience.

Using PWA (Progressive Web App): Approximately 83% of social media interactions occur on mobile devices. However, listing crypto apps on Apple or Android app stores can be challenging. To address this challenge, FT cleverly released as a PWA, which functions similarly to a native mobile app and users can “download” the app directly from the FT website. This approach not only bypasses the restrictions of traditional app stores but also ensures a seamless user experience consistent with mainstream mobile trends. However, FT should still support browser-based access on desktop/laptop computers. This feature is likely under development, but there is a workaround available for now.

3. Is this really different?

The long-awaited question finally has an answer:

In my opinion, no, there is unlikely to be anything different this time.

Personally, I don’t think FT is as revolutionary as everyone is hyping it up to be – its current excitement is solely driven by the skyrocketing stock price. What’s important is that this is not sustainable, and the momentum of FT’s development may decline in the coming months, for the following reasons:

(1) Lack of long-term, sustainable incentives for using FT

The main stakeholders of FT can be roughly divided into three categories:

Creators: Those who actively manage their own channels and encourage users to purchase their stocks. The main motivation is to earn transaction fees.

Consumers: Those who buy stocks to access creators’ channels. The main motivation is to consume creators’ content or have the opportunity to interact with creators individually.

Speculators: Those who buy and sell stocks. The main motivation is to profit from trading stocks.

Among these three, speculators may be the first to leave. The nature of speculation means that early adopters usually see the most significant benefits. However, as the platform develops and the initial hype subsides, speculative activities decrease because active trading becomes less profitable. This is especially true for FT due to its progressive bonding curve. The stock pricing curve of FT is the square of supply, making its growth more exponential than typical bonding curves. As the stock price rises, attracting new users to invest will become increasingly challenging.

For example, Racer’s stock has only 202 shares, worth 2.55 ETH, equivalent to about $4,000. This means that the next shareholder will have to pay more than $4,000 to join the Racer “club”. Using the formula from 0xCygaar, the cost for the 400th participant will soar to 10 ETH ($16,000).

The continuously rising content cost of FT is fundamentally different from the popular models of other content social platforms. For example, platforms like Twitter and TikTok provide free content, while Twitter Subscriptions and OnlyFans offer exclusive content for a fixed monthly fee.

This pricing strategy means that on FT, good content is reserved for those with more financial resources. As a result, many users may find themselves only able to see limited or lower-quality content, reducing their participation in FT and making them part of the next group likely to leave.

When speculators and consumers leave the platform, they may sell their stocks, which could cause a downward spiral in stock prices. While this downward trend may bring short-term costs for creators, in the long run, there is unlikely to be enough purchasing demand to provide them with sustainable incentives. With the decrease in user engagement and content creation, the loss rate of speculators and consumers may accelerate, further dampening creators’ enthusiasm. This chain effect may foreshadow the decline of FT, as the platform’s value proposition to all stakeholders weakens.

(2) Conflicting Profit Mechanisms and Business Models

A deep study of creators’ long-term motivations reveals conflicts in profit mechanisms and business models.

On traditional content platforms, creators’ main source of income comes from sustained user stickiness and user retention. However, FT presents an unconventional model: creators profit from transaction activities, particularly through buying and selling stocks that grant access to their content. This model does not encourage stable, enduring relationships, and instead seems to welcome user attrition.

This model may create a misalignment of incentives between creators and audiences. Creators may be incentivized to exploit short-term transaction peaks rather than cultivate deep and lasting connections with their audience.

Although creators benefit when consumers purchase stocks, the exponential growth of stock prices inherently limits the buyer base, effectively setting a cap on the group size. Coupled with the fact that creators only receive one-time payments rather than ongoing income, the sustainability of this model becomes a concern.

In summary, FT’s non-traditional profit model – emphasizing short-term transactions rather than sustained user engagement – may misalign creators’ motivations and threaten the platform’s long-term sustainability.

(3) Lack of Sustainable Excitement

The success of social media platforms depends on their ability to trigger the release of dopamine in users, keeping them engaged and repeatedly coming back. While FT’s speculative nature and rising stock prices effectively stimulate dopamine and initially attract users, the participation cycle may be short-lived and unsustainable for the reasons mentioned above. Additionally, FT’s potential social chat feature does not seem ready to provide meaningful dopamine-driven incentives for users – incentives that are not present on other platforms.

In other words, creating an innovative, captivating, and enduring dopamine cycle is a challenging task. Numerous platforms, once hailed as the “next Facebook,” such as ClubHouse and Be Real, or those considered pioneers of the “decentralized social network era,” such as Steemit, Roll, and Bitclout mentioned earlier, have either disappeared after a brief appearance on the glamorous stage or ceased operations altogether.

4. Possible Updates

However, to be fair, FT has only been online for 12 days, and there may be more features to be launched in the future.

Since FT has achieved what most obscure platforms have failed to do – attract users, its next challenge is to retain as many users as possible.

Below I will propose some possible update suggestions that can help retain users:

(1) Strengthen communication and interaction dynamics:

Current situation:

Currently, shareholders are unable to view messages from other shareholders, and creators seem to be talking to themselves. In addition, communication is limited to text.

Improvement suggestions:

Differentiate between shareholder chatrooms and private messages with creators. Implement a “creators-only” message toggle in shareholder chatrooms.

Expand communication methods, including images, videos, and live streaming.

Introduce advanced financial features such as sharing trading fees with shareholders, establishing DAOs, and integrating governance tools. However, these may bring potential legal implications.

(2) Improve the sustainability of the profit model:

Current model:

As emphasized earlier, the steep joint curve of FT, coupled with their current profit strategy of charging a 5% fee on transactions, may not be sustainable in the long term as it could limit the potential number of users and incorrectly stimulate user attrition instead of retention.

0xCygaar claims that FT’s smart contracts are not upgradeable, primarily limiting modifications to protocol/entity fees and protocol target fees. However, there may be solutions to address these limitations.

Improvement suggestions:

Lower the aggressiveness of the pricing curve by converting it to a linear or even square root curve. While this may slow down the immediate stimulation from sharp increases in stock prices, in the long run, it promotes broader participation and sustainability.

Introduce a tiered membership model with monthly subscriptions for access to basic content. However, shareholders should enjoy premium privileges and benefits, such as exclusive information rights of creators or a certain percentage of creator’s income, including transaction fees and subscription revenue.

Introduce a distribution mechanism to enhance sustainability, especially when implemented with a reverse curve: early buyers have a longer distribution period than later ones. This approach not only rewards patience and long-term commitment but also stabilizes the platform, discourages speculative short-term behavior, and promotes continuous growth of FT.

(3) Enhance the discoverability of profiles:

Existing discovery methods:

Show a feed of friends purchasing stocks (where “friends” refers to people you own stocks of).

There is a feed prompt when another user acquires stocks you own.

Browse the stock price leaderboard of users on the platform.

User’s tweets on Twitter.

Improvement suggestions:

Have a prominently displayed feed when your Twitter followers or people you follow join FT or become FT members.

Show popular profiles from the past 24 hours.

Provide profile recommendations based on previous purchases.

Allow profile owners to create a personal profile page, explaining what type of content they will provide to shareholders (currently, most creators promote on Twitter rather than on FT).

An access pass is launched with symbolic fees that allows 24-hour access to creator content. It allows users to preview content before committing to sharing ownership and provides creators with diversified sources of income.

5. Having just an idea is not enough to attract users

Regardless of the ultimate result of FT, its recent performance provides an important insight for Web 3 builders and investors: while the ideas of decentralization and ownership are commendable, the ideas themselves are not the key drivers of adoption or success.

The crypto community strongly supports decentralized on-chain protocols, and there is little controversy over the choice of FT – whether it is the lack of on-chain posts similar to Lens or Farcaster, or the decision to bypass traditional ERC-20 tokens or NFTs and track internally through its smart contract.

When it comes to user-centric crypto applications, the temptation to satisfy speculative desires and leverage the “digital ascent” strategy has often proven to be a powerful catalyst for initial participation, while ideas can brew in the background and gradually roll out.

In the end, long-term success requires more than just temporary adoption or ideas. It is rooted in a sustainable strategy that truly meets user needs and improves lives. To achieve lasting impact, builders must prioritize genuine value and solutions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Morning News | ARK Invest and 21Shares Submit Ethereum ETF Application

- How far can Friend.tech, the new darling of Web3 social, go in the future?

- Is Chainlink (LINK) about to witness a 40% price breakthrough?

- LianGuaiWeb3.0 Daily | Three lawyers from the US SEC withdraw from the lawsuit against Ripple

- Retiring from Unibot Why am I optimistic about Unibot?

- Bitstamp will terminate its Ethereum staking service for US customers.

- THORChain Research Report More than just a DEX, revolutionizing DeFi