County Youth Engaged in Cryptocurrency Trading Lost 130,000 Yuan and Returned to the Construction Site to Repay Debts Again

Youth in County Lost 130,000 Yuan in Cryptocurrency Trading, Returns to Construction Site to Repay DebtsYang Yi, 24 years old, is just an ordinary young man from a county town. After dropping out of high school, he followed his parents to work on construction sites in the city. Perhaps he would spend more than a decade working there, saving money to build a house and start a family in his hometown, and then return to the construction site to continue working, just like his father.

But then, virtual currency emerged, becoming the biggest variable in his life.

Yang Yi followed people online to speculate on Bitcoin, playing with contracts and using leverage to “buy coins,” and making profits by predicting the rise and fall of currencies. For Yang Yi, who didn’t have enough capital, this was a lower threshold way to play, but with equal risks and opportunities.

When searching for “contracts” on the internet, warnings such as “playing with contracts will lead to death” always pop up. Despite this, there are still people eagerly desiring to strike it rich in this wealth game. Like Yang Yi. The yearning for “getting rich” was like a bottomless vortex, drawing him into the world of cryptocurrencies over and over again.

- LianGuai Encyclopedia | What is a known plaintext attack

- An Exploration of Everything Behind Friend.Tech

- Base and Optimism launch shared governance and revenue sharing framework

In the past, he didn’t have the ability or luck to catch any of the fast-moving trains of wealth in his time. Now, he is addicted to this game of betting small to win big, thinking that he can finally grasp the lever to move wealth and achieve social mobility, even though it is actually a scythe that is harvesting him.

Part One: “New Continent”

Recalling the first time he clicked into the online cryptocurrency exchange, Yang Yi thought of the fable of Pandora’s Box. After opening the “box” of virtual currency, his life fell into a numb cycle: trading coins, borrowing money from online lenders, and repaying debts on the construction site.

But at that time, Yang Yi thought he had discovered a “new continent.” In the exchange’s derivative community, hundreds, if not thousands, of people were active every day. People shared their trading experiences, discussed strategies, and even taught courses. Yang Yi, like a brave adventurer entering a new game, absorbed the “beginner’s tutorials” in the community.

It was in 2019. In February, the valuation of Bitcoin was still $3,500, but by the time he entered in June, the peak had already surpassed $10,000. The value of this invisible currency had tripled in just four months.

The “HODLers” holding Bitcoin saw their assets appreciate in this wave of prosperity. Some contract players, through correct judgments of the market’s ups and downs, also achieved significant gains. They showed off their enviable screenshots of their assets in the community, complimented and sought advice from each other in the comments. Looking at those dizzying numbers in the screenshots, Yang Yi felt for the first time that wealth was so close to him.

Yang Yi secretly rejoiced, feeling that he had found an easier way to make money. More importantly, this gave him hope of leaving the construction site.

Yang Yi dropped out of school during his sophomore year of high school and went to his father’s construction site. His family is located in a small town in Liupanshui, Guizhou Province. In that town, people like him are not uncommon. Many of his classmates had already dropped out of school when he was in junior high. The options are also limited: loitering on the streets; or leaving the town to find a job in the county. If they go further, they usually wear safety helmets and join the construction projects in big, medium, or small cities.

The work of construction workers is extremely hard, and sometimes they face even more dangers. In his first year at the construction site, his father fell from a scaffold that was two to three meters high, shattering his knee and fracturing his bones. He had to lie in bed for two weeks. Since they didn’t have insurance, the contractor only paid 20,000 yuan for medical expenses and hastily settled the matter.

This made Yang Yi have a strong aversion to the life at the construction site. After getting involved in the cryptocurrency community, he fantasized about being able to have multiple times his wealth overnight, just like those players in the community. This way, he could escape from the world that was full of dust and noise, and finally have the ability to relieve the burden of life from his parents.

The scaffolding at the construction site, without any protection, with two people standing on it. The one on the right is Yang Yi’s father.

He made his first attempt by investing a hundred yuan, playing with contracts.

Contract trading corresponds to spot trading. If you have enough capital, you can directly buy currencies and wait quietly for their appreciation. This is a relatively safe way to play, but for Yang Yi, relying on hoarding coins to make a profit is too slow and requires capital. As a young man with no money, he is directly blocked from this way of playing.

And contracts are similar to futures in the stock market. By predicting the rise and fall of currency prices, you can make a profit. More importantly, with leverage, it can double the invested capital and thus double the profit. With a capital of 10,000 yuan, buying Bitcoin with a leverage of 100 times, when the price of Bitcoin rises by 1%, the capital will double, directly making a profit of 10,000 yuan.

However, if you choose the wrong direction, the loss is also 100%. As long as the price of Bitcoin falls by 1%, the entire 10,000 yuan capital will vanish. Losing all the capital like this is called “liquidation.”

In the cryptocurrency community, many people have frequently been liquidated due to market turbulence, ultimately losing everything. But some people have risen due to their operations and courage, with the support of high leverage, and overnight, they became rich and legendary.

2. Dying Before Dawn

Those stories of making big profits with small bets in the contract market were the beginning of Yang Yi’s obsession with cryptocurrency trading.

During the day, he worked with his master at the construction site, and whenever he had free time, he would open his phone and learn from experienced traders about the ups and downs of currency prices, and predict the future trends. At night, even after washing up, he would not rest and would engage in contract trading on the exchange. First, he would convert cash into stablecoins, set the leverage ratio, and then judge the rise and fall to decide whether to buy or sell. Each choice is related to the outcome of this money: doubling or liquidation?

The outcome often ends in “liquidation”. Before this happens, the platform will issue an early warning. If additional margin is not added in time, the principal will be “liquidated”. Even if the margin is added, there is no guarantee that the next variable will be favorable, and often both the principal and profits will be lost.

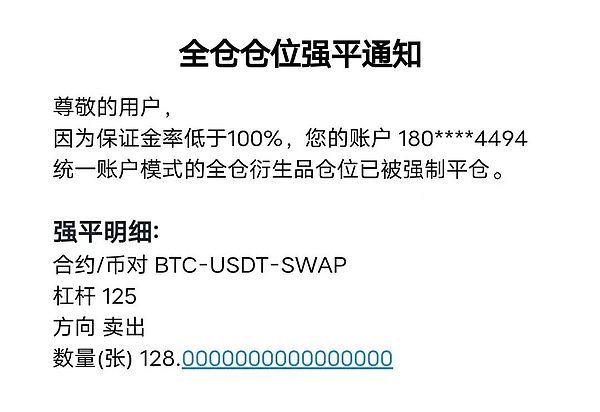

Email notification received by Yang Yi after being “liquidated” (i.e. forced liquidation)

After losing a few hundred yuan, Yang Yi felt dissatisfied and believed that his skills were not good enough. He became more cautious in his operations, but his desires grew stronger. The amount of money invested increased from a few hundred to a thousand, and the leverage ratio went from tens to hundreds. The money in his bank account decreased, while the numbers in the trading software appeared and increased, only to return to zero again.

He was almost being pushed around by contract trading. Every night, he felt like he was walking on a tightrope in mid-air, with his heart fluctuating along with the curve. The real-time fluctuations of his assets made it impossible for him to sleep peacefully. He couldn’t lie down for a few minutes before getting up to grab his phone again.

Within less than a month of trading coins, he lost over 40,000 yuan, which he had saved up from two years of work. He also owed 60,000 yuan in online loans. He finally stopped because he couldn’t come up with the money to re-enter the market. In the end, Yang Yi didn’t feel anything. The only thing he was unwilling to accept was that he lost the opportunity to enter the market again and the possibility of “earning the money back”.

Yang Yi finally understood what some contract players meant by “dying before dawn”. Almost every time he invested money, it couldn’t last through the night. There was one time when he was so tired that he fell asleep holding his phone. When he woke up the next day, his money was gone, leaving only a short message in his mailbox saying “You have been liquidated”.

He rarely made money. Even if he did, he always waited for it to continue rising, only to be met with a curve turning in the opposite direction, causing his money to be “liquidated” along with the principal and profits.

Now, Yang Yi understands that contracts are a gamble for those at the bottom of the cryptocurrency market. Wealthy people can afford to invest a large amount of spare money and play with small leverage. But they can only take on dangerous leverage ratios, using their savings, living expenses, and even borrowing to chase the possibility of “financial freedom”. This continent is not the profit-driven arena he imagined.

In various communities in the cryptocurrency circle, Yang Yi has seen many people torn between their lives and desires. Some seek help inside, asking what to do after suffering losses; some write long articles reflecting on how they ended up where they are today. And there are also some people who disappear after leaving messages about jumping off buildings. He doesn’t know if these people ever saw their own dawn.

III. The Only Straw

If he had money, a stable job, and a family of his own, Yang Yi believes he would never touch the cryptocurrency market again. But since he has nothing, trading coins is like the matchstick in a fairy tale that he can’t help but strike again and again.

This young man, who is fighting in the cryptocurrency circle, has always been seen as a well-behaved child in the eyes of his parents: calm, quiet, and methodical. The only time he didn’t listen to the adults was when he insisted on going to the county to attend high school.

In their high school, about half of the students can go to college, mostly at the second or third-tier universities. He ranked in the middle to lower part of the class, and if he persisted until the college entrance examination, he might be able to get into a third-tier university.

But just half a year into high school, he wanted to drop out. It had nothing to do with his grades, he just simply felt that “studying is useless”. He posted his thoughts on Baidu Knows, and was persuaded by an internet friend to continue studying for another year. But by the time he reached his second year of high school, he still dropped out. “Many of my classmates who got into third-tier universities didn’t end up any different.”

In the small county town, the trajectory of life seems to be predictable from birth.

The most direct reference is his own father. After graduating from junior high school, his parents went to work at construction sites in Wenzhou, while he went to the county school and started living in a boarding school. His parents could earn seventy to eighty thousand yuan in a year from the construction site. In order to make a living, they left their hometown to work in nearby big cities, which was a very common choice in the local area. Many children in the county were separated from their parents at an even earlier age and became “left-behind children”.

But Yang Yi longed for a warm and stable home and didn’t want to follow in his parents’ footsteps. After working at the construction site for half a year, he started looking for opportunities to return to the county. He first went back for the conscription physical examination, but he was disqualified due to “hyperextension of the elbow joint”. Then he found a job at a karaoke bar in the county, but the monthly salary was only two thousand yuan. In the end, he had no choice but to return to the construction site.

Working at a karaoke bar in the county, Yang Yi described himself as “tired of this kind of bleak life”

Life entered a dead end: if you work at the construction site like your parents, you can’t be with your family; if you want to start a family in the county, a monthly salary of two thousand yuan is obviously not enough; stable and satisfactory jobs are not open to this young man without education and skills.

Scarcity, despair, and the resolution of having nothing have given rise to great desires. Despite continuously losing his capital and loans, Yang Yi could not stop fantasizing about getting rich overnight.

In the summer of 2021, Yang Yi traded cryptocurrencies for the second time and lost more than twenty thousand yuan. This made him feel fearful and he felt like “no matter how I play, I always lose.” He deleted all his cryptocurrency friends and trading software, determined to stop trading cryptocurrencies.

At that time, he didn’t realize that shortly after he left the circle, a legend was born.

In the cryptocurrency circle, almost everyone knows about “Liang Xi” (凉兮). This name is always associated with three numbers: 519, 1000, 1000.

“519” refers to the virtual currency crash event on May 19, 2021. Data shows that the total amount of liquidation reached 6.28 billion US dollars, equivalent to 40.4 billion yuan. On that day, while countless people were abandoning their positions and fleeing, Liang Xi turned 1,000 yuan of initial capital into 10 million yuan using high leverage. He was only 17 years old at the time.

No one ever thought that it would be a child who would seize this historic plunge. The initial capital of 1,000 yuan is almost the “starting threshold” that everyone can reach. Holding a thousand yuan to enter the market and become a millionaire, Liangxi has realized this almost absurd possibility.

Although the ten million profits on Liangxi’s body have now turned into debts, at least in that year, he got everything. He became rich overnight, gained popularity, and the founders of several trading software successively gave Liangxi dream funds, rewarding his “spirit of becoming more courageous with setbacks.”

In the midst of one stimulation after another, Yang Yi’s determination kept loosening.

Four, Pole Vault and Sickle

Last year, he came to Shanghai to work as a delivery driver with a friend, also for money. He heard that “you can earn 20,000 yuan a month.” This was the first big city he had been to after leaving his hometown. In this city, delivery drivers run around like bees.

A photo taken by Yang Yi while delivering food in Shanghai. He feels that the people in the photo are like ants, “busy and orderly in their own ways.”

He came in February, didn’t run fast enough, and didn’t earn much money. In early April, he was under lockdown, with ten people in one room, competing for orders on Meituan from morning to night. After the delivery drivers were released from the lockdown, he and his friends lived under a bridge and delivered food all over the city. By May, he had become familiar with the business and rarely exceeded the delivery time. In June, he saved some money.

Desire may have arisen at this time. “Going there, I will see a wealthier life.” Yang Yi paused for a moment and said, “I feel that the gap is too big.” Shanghai made him yearn for a better life. Delivering food and working on construction sites wore out his body and were not a long-term solution. Looking around for options, only cryptocurrency trading was left, a pole vault that he could grab in his own hands.

In late June, Yang Yi embarked on his cryptocurrency trading journey for the third time. He invested 5,000 yuan on the first day, but it didn’t work out. He still had the remaining 20,000 yuan he saved from delivering food, which was his entire savings.

For money, he ran around during the lockdown, unable to return to his rented room. He and his delivery driver friends spent the night in parks or under bridges. For more money, Yang Yi gritted his teeth and threw it in. The spending speed exceeded his own expectations, and after two days, he was left with only enough money for meals.

Yang Yi’s car is filled with supplies to be delivered.

He was very sad and originally planned to stop at this point, but then he thought, “If I’m going to do it, I’ll do it big.” Coincidentally, the credit limit of a loan app on his phone suddenly skyrocketed. He first borrowed 50,000 yuan, and then another 30,000 yuan. It was difficult to stop the situation from developing to this point. He continued to download other loan apps and eventually borrowed over 130,000 yuan.

On July 1st, Yang Yi spent all the money. At half past ten in the morning, he posted the word “useless” in his circle of friends, announcing the end of this gamble.

During this period, he did consider stopping, but in the end he convinced himself that there was no turning back. He was always afraid that there would be a big fluctuation in the next second after he stopped, and he would regret stopping. It would be better to put his hope of turning the tide on the next trade until the end. Even the 700 yuan he used to eat would be invested in it.

“I feel like I have nothing to start with, that’s why I want to take a risk.” He said, “The less chance I have, the more fanatically I want to create opportunities for myself.”

When trading coins became a game of wealth, most people’s motivation was to become rich through it. They didn’t know what the Lightning Network was, didn’t understand the forks of Bitcoin, or even what ICO stood for. These ordinary investors who failed to understand the essence of blockchain rushed into the market, becoming the most primitive fighters on the coin trading arena, and also the victims forced to promote the appreciation of Bitcoin anonymously.

After being liquidated multiple times, Yang Yi now admits that ordinary people like him entering the market are just waiting to be taken advantage of. “We all know that we are the ones being taken advantage of, but we still want to grab meat inside the lion.” He joked to himself. “If we can’t grab meat, soup is fine.”

Five. Where to find a way out

Last year, he owed a debt of 130,000 yuan, and the debt collectors called his home. It was only then that his parents found out that he had taken a different path in an unseen place.

For this small-town family, a debt of 130,000 yuan was not easy. His mother cried for him for the first time, and Yang Yi felt uncomfortable. He listened to his parents’ advice and went back to work on the construction site. His family raised the money for him and relieved him of the debt.

But Yang Yi didn’t want to stay on the construction site forever. He had dropped out of school six or seven years ago, and the days on the construction site alone had occupied almost five years of his youth.

“The construction site is too dangerous,” he sighed. Two years ago, he worked on a construction site owned by a pair of brothers. One minute, the brother of the foreman was still chatting with him, and the next minute, a wooden board on the crane slipped and fell on the brother’s head, and he died. The terrifying crane, the accident-prone trucks, the steel bars and pits on the construction site, all made him want to escape from here.

In his diary, Yang Yi wrote:

Is the construction site my destiny in this lifetime? No, when I recover from my injuries, I will come out again. Even if I am covered in scars, I don’t want to live a life of seeing the end at a glance.

He is twenty-four years old this year, planning to work on the construction site until Chinese New Year. As for next year’s plans, Yang Yi counted on his fingers: construction site, factory job, food delivery. “But none of these are what I want.”

A while ago, Yang Yi saw a rainbow when he finished work at the construction site. This was the “closest he had ever been to a rainbow.”

At the beginning of last year, he paid a tuition fee of 500 yuan and joined a self-study group for a vocational diploma. The teacher sent them online course videos and asked them to study in their free time and check in on the group after completion.

Yang Yi persisted for half a month. He would study until midnight after finishing his food delivery job at 10 pm. He often fell asleep in the midst of the teacher’s endless words due to exhaustion. Eventually, he gave up, feeling that he was not the type of person who had “free time.” He no longer remembers whether the unfinished ideological and political course was on Marxism-Leninism or Mao Zedong Thought.

For him, the best days may have been during his student years. In high school, a friend lent him a small book about Bill Gates, which he placed under his pillow and read several dozen pages every night. Just before dropping out of the second year of high school and going to work at the construction site, his roommates joked with him, asking if he was going to be the next Bill Gates.

At that time, he thought that the future would be full of opportunities, just like what was written in business books. However, after stepping out into the world as a young person without education or skills, he found that every step was difficult. For many people, just staying alive was already a challenge.

While working as a food delivery rider in Shanghai, there was a rider ten years older than Yang Yi who heard that he was involved in the cryptocurrency circle and came to talk to him. The older rider had lost 400,000 yuan from stock trading when he was young and was still paying off the debt. “These things are not something we can play with,” he said to Yang Yi. “We only know how to throw money into them.”

But Yang Yi was not someone who would easily give up. When asked if he would still speculate on cryptocurrencies, he hesitated for a moment and said somewhat helplessly that if given the chance, he would definitely still play. On his desktop, he still had a dedicated folder for cryptocurrency software, containing ten different exchange and information apps. He could never completely let go of that tiny bit of hope in his heart.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- An In-depth Analysis of Aave Governance V2 A More Inclusive and Efficient Decision-making System

- Coinbase is in talks with Canadian banking giant to promote cryptocurrencies

- LianGuai Morning News | ARK Invest and 21Shares Submit Ethereum ETF Application

- How far can Friend.tech, the new darling of Web3 social, go in the future?

- Is Chainlink (LINK) about to witness a 40% price breakthrough?

- LianGuaiWeb3.0 Daily | Three lawyers from the US SEC withdraw from the lawsuit against Ripple

- Retiring from Unibot Why am I optimistic about Unibot?