Aside from the lack of tokens, why is it said that Coinbase’s Base chain does not violate US laws?

Why is Coinbase's Base chain said to comply with US laws despite the lack of tokens?Base does not custody user funds and there are no related legal issues.

Written by: Adam Cochran, Partner at Cinneamhain Ventures

Translation: Luffy, Foresight News

Coinbase’s L2 scaling network, Base, has gained popularity due to the success of friend.tech. However, blockchain analytics firm ChainArgos has pointed out that Base may violate US federal laws. In response, Adam Cochran, partner at Cinneamhain Ventures, wrote an article criticizing ChainArgos’ view as a misconception lacking technical and legal knowledge. He believes that decentralized L2 is fully compliant with US laws. Foresight News has translated Adam Cochran’s tweet:

- Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.

- An Analysis of the ‘Nintendo’ of the Cryptocurrency World Treasure DAO

- PEPE plummeted by 16%, and the founder behind it was exposed a 97-year-old photographer who used the money from selling coins to buy a Lamborghini.

Coinbase’s Base chain does not violate federal laws.

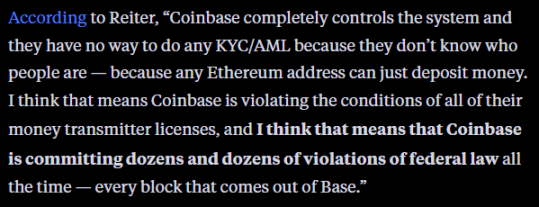

ChainArgos’ view is a dishonest legal argument and lacks technical knowledge. They are attempting to sell more on-chain risk monitoring/reporting software to L2, which they do not need. Ultimately, ChainArgos either has a malicious interpretation or lacks technical understanding of the meaning of “custody” in blockchain or the actual meaning of L2.

Let’s analyze why Coinbase’s L2 network does not violate any laws.

First and foremost, in this debate, the concepts related to futures, licensed exchanges, OTC broker-dealers, and money transmitters are often confused.

So we must first clarify the meaning of “custody” in cryptocurrencies.

When you hold, control, or transfer user funds, US laws on money transmission apply.

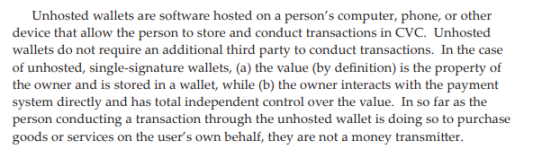

FinCEN (FIN-2019-G001) provides clear guidance, with the key point being key control in the concept of “non-custodial wallets”:

This makes sense, as when you deposit cryptocurrencies into a custodial wallet, Coinbase becomes a money transmitter. However, if your keys are in MetaMask, then MetaMask is not an MSB (Money Services Business). It is only a tool you use to interact with the wallet.

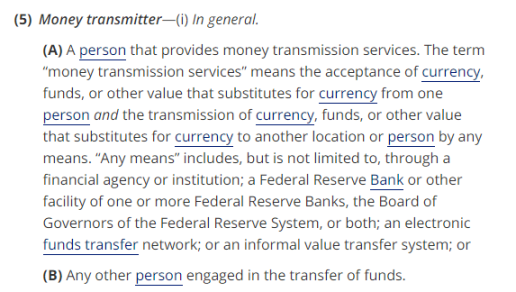

In fact, one of the few explicit laws in the US financial industry is the definition of “money transmission” – if any of the following criteria are met, you are a money transmitter:

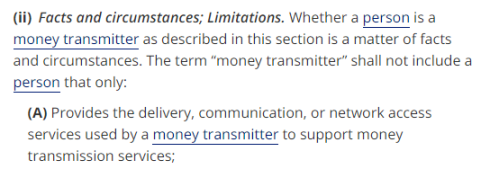

This led some legal enthusiasts in the 90s to believe that internet service providers were actually money transmitters. At that time, the legislature enacted section (ii)(A), which specified that service providers offering communication and delivery networks are not money transmitters.

Base is a public blockchain network based on the OP Stack, providing communication for self-custodied wallets and DApps, and anyone can participate.

Although its sorter is currently centralized, it does not automatically mean that it is a custodian.

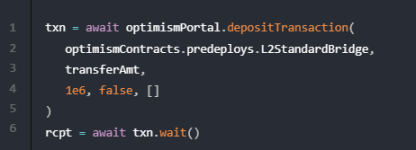

You can use “OptimismPortal” to transfer currency between L1 and L2. The Merkle tree will continue to publish the state back to Ethereum L1, and the underlying bridged assets are stored in the cross-chain bridge of L1.

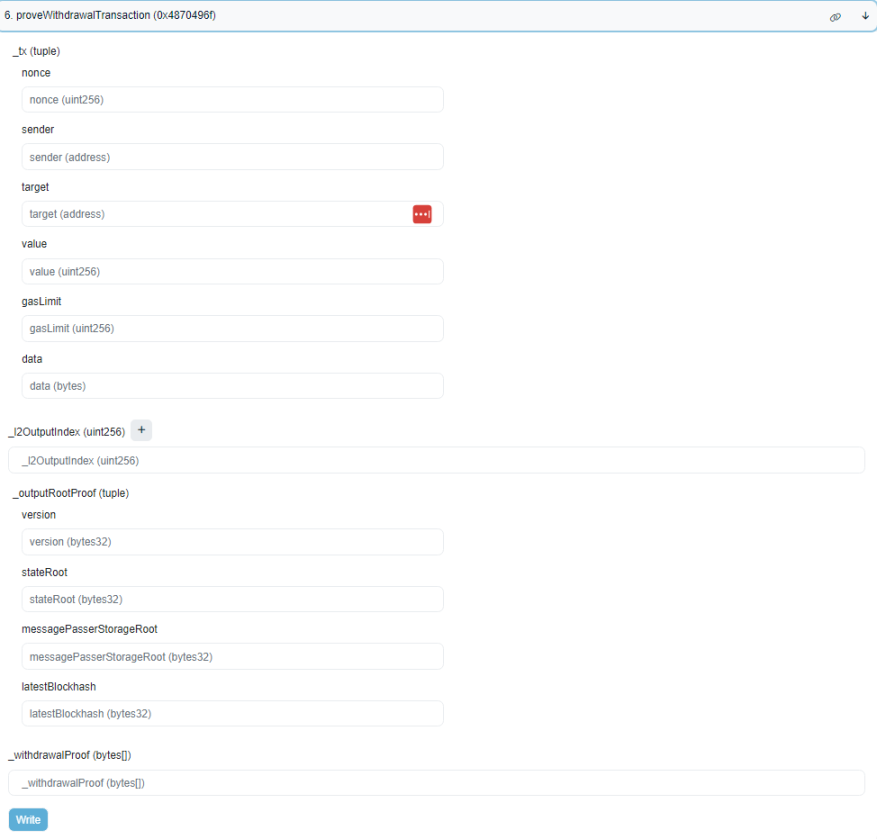

This means that even if Coinbase shuts down all servers and disappears completely tomorrow, you can still:

- Sort it yourself (with a 12-hour delay) to include the transaction in L1 without going through L2.

- Delay the withdrawal for 7 days.

You sort the following transactions yourself. After the transactions are included, you call the following transactions on the Ethereum L1 Base bridging contract and publish the Merkle proof of your withdrawal transaction.

Then, even if Coinbase shuts down the Base network tomorrow, you can regain control of your assets.

So far, let’s review and summarize:

- Coinbase does not operate markets on Base.

- Coinbase does not control your keys on Base.

- If Coinbase shuts down all infrastructure tomorrow, you can still transact.

- And you can withdraw your assets from L1 at any time.

The ChainArgos team said that because any address can deposit funds into Base, this may bring legal troubles to Coinbase.

In fact, on the contrary, it is because it is an open and permissionless network layer that makes such behavior legal.

Coinbase performs KYC/AML on transactions conducted through Coinbase and also has on-chain monitoring tools.

But the legal responsibility does not extend to their Base chain or the DApps running on it.

Although there is still more work to be done in terms of security and robustness for decentralized L2, they are already sufficiently decentralized in terms of legality. In their simplest form, they are just smart contracts.

It is this fundamental technological difference that defines the boundary between L2 and centralized L1 sidechains, which is also why Coinbase has not established some PoA private operational networks.

If L2 is an MSB, then all blockchain networks and all smart contracts are de facto currency transmission agencies.

This is foolish and ridiculous, and the legal and technical expertise of anyone who puts forward such a view should be questioned.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deep analysis of governance risks, capital risks, and protocol risks of LSD.

- AI FOMO sweeps the world profits surge 8 times, NVIDIA emerges as the biggest winner.

- Experience the Tu Dog hype type SocialFi platform friend.tech it may be boring and even ridiculous at times, but it has unlimited potential.

- What is the security foundation of the post-POS era? A quick look at the newly proposed theory in the Ethereum community, Proof of Validator

- An Overview of Scroll’s Early Ecosystem What Opportunities Exist for Leading Players in zkEVM?

- The wave of Layer1&Layer2 has arrived, taking stock of the token bridging steps and potential opportunities of various new chains.

- How much selling pressure remains after the hacker account has liquidated 300,000 BNB?