Ants start rendering blockchains: three major strategic speedup leads?

Author: Wang Ruchen

Source: Quark Review

You should note that in the beginning of the year 2020 (natural year), Ant Financial and Alibaba Group each sent similar messages.

On New Year's Day, Ant Guanwei announced that the company's blockchain service has landed in nearly 50 application scenarios; On January 2, the Dharma Institute released the top ten technology trends in 2020, one of which emphasized that large-scale production-level blockchain applications Enter the masses.

- Babbitt Column | Blockchain industry to land, these areas still need to be greatly improved

- Ethereum price history: from 2015 to 2020

- 66% of Bitcoin transactions have adopted Segregated Witness (SegWit), more mainstream exchanges will support

By accident?

Quark's judgment is that they reflect the key trends of Ali Group, especially Ant Financial, in the coming year. That is, the landing of the blockchain, when it reaches a speed-up cycle, will show a trend of efficiency and scale.

Why do you see it? It seems difficult to find out at a glance.

Let's take a look at Ant Financial as the center.

Before starting, let's remind a predetermined event: In February 2020, the Ant Financial Open Alliance Chain will be officially launched.

At the Wuzhen Summit of the World Blockchain Conference on November 8 last year, Li Jieli, the head of the Ant Blockchain BaaS platform, announced that with immediate effect, the alliance chain will be open beta and officially launched 3 months later. , Ma Shitao, chief solution architect of Ant Blockchain, confirmed the news again, and emphasized that participants will be able to develop blockchain applications at low cost.

You know, after several years of clarification of the concept, although the public chain can reflect the idealism of the blockchain, the alliance chain is regarded as the mainstream service form of large-scale landing in the future. Ant, Tencent and many well-known companies and institutions at home and abroad all hold this position.

This means that Ant New Year's Day announced the application of nearly 50 scenes, it seems to be laying the groundwork for the alliance chain in February, while at the same time suggesting a round of opening up and large-scale expansion process. That is, it reflects the overall strategic thinking of Ant Financial. The Dharma Institute's forecast report, although standing on the industry side, can also be regarded as providing framework support for the large-scale landing of the Ant Group and even the Alibaba Group, thus serving the medium and long-term strategy.

Here, the main analysis is still ants. So, what are the aspects of Ant Financial's overall strategic thinking as the blockchain moves down?

Quark believes that it should focus on the following:

I. Strengthening the fintech dimension and further establishing the status of industry leader;

2. Strengthen a new round of opening up, promote the accelerated landing of applications, and promote the construction of new ecosystems;

3. Speed up the three major strategies (technology, domestic demand, globalization) and promote growth;

Fourth, pave the way for potential IPO goals, especially by leveraging blockchain business models to strengthen competitiveness differences and enhance value space.

V. Complying with policies and trends …

Analyze them one by one.

Strengthening the Fintech Dimension

You know, the world's most valuable unlisted technology unicorn is not WeWork, Airbnb or the like, but China Ant Financial, which is also the world's largest financial technology company.

The ant certainly advocates "Techfin". It can reflect more "technological" attributes of ants, and it can also show deeper and wider open thinking. However, for the sake of narrative, it is still referred to collectively as "Fintech".

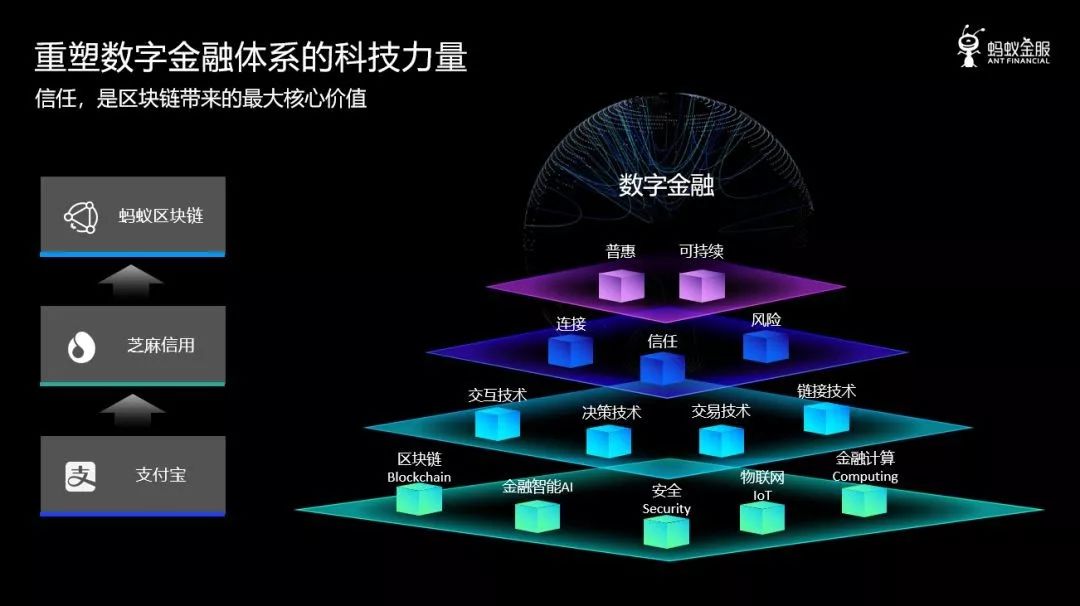

The source and core of the ant system is Alipay. It is one of the technical cornerstones of the contemporary Chinese trust system. Based on an excellent gateway and guarantee mechanism, starting from it, the Ant Financial fintech ecosystem of today is constructed. During the period, Yu'ebao, Sesame Credit, and small programs promoted the trust mechanism from the e-commerce world to mass society and social services, showing the benefits of technology popularization and sinking.

As of now, Ant's four major business areas are mobile payment, digital finance, intelligent technology, and internationalization. As you can see, it has long gone beyond the concept of payment and presents the characteristics of infrastructure services. Among them, "smart technology" is becoming the underlying ability to support itself and the entire ecology.

In 2019, before the merger of financial cloud business and Alibaba Cloud Intelligence, Ant was the most complete and independent ecosystem of technological elements in the global financial technology field. After the merger of the financial cloud, in addition to data intelligence, financial-level distributed architecture technology, financial-level SAAR, and PASS-based enablement, the ant's underlying technology element is a very critical system, which is the blockchain.

(Reminder: Financial Cloud's integration into Alibaba Cloud's architecture in 2019)

Previously, other technical elements were discussed more. At this moment, the new year begins and a new cycle, the blockchain has become its core issue. Because it is based on the core technology, but it is not a single technology form. At its core concept, it is a re-upgrade of Alipay and Sesame Credit, and it represents a new and extensive trust system and collaborative system.

In other words, the blockchain at this moment can better reflect the global fintech characteristics of ants than other technical elements. As far as agenda setting is concerned, a new cycle has indeed come.

Of course, "fintech" must reflect the "technological" attributes. Technical capabilities are critical. So, as you can see, Ant emphasized that it started to lay out the blockchain explicitly 4 years ago. 2016-2018, for 3 consecutive years, the Ant Blockchain patent was approved the first in the world. It has already surpassed 1,000 in 2018. A few days ago, two key patents were approved by the United States Patent and Trademark Office (USPTO): one aims to reduce the time to verify block data and can greatly improve efficiency; the other is to help participants set the validity period of transactions in the blockchain network . Obviously all are low-level technologies.

The alliance chain that will open next month will definitely involve more. This will further strengthen the hard core strength of Ant and even Ali Group's global blockchain field, and the "fintech" label of Ant will be more obvious.

Promote the application to accelerate the landing and promote the construction of new ecology

Information on nearly 50 application scenarios announced on New Year's Day, covering a diverse and rich field. Tmall Double 11 a month and a half ago was even more concentrated.

Ant New Year's Day is no doubt a platform open signal. It means that the blockchain is applied to the cycle of large-scale landing. The open alliance chain, which will be launched next month, will become a key efficiency symbol. At the same time, it also marks that a new round of ecosystem construction is about to begin.

Many people question whether the alliance chain can become a mainstream service. Ideally, it does not better embody the inherent spirit of the blockchain than the public chain. However, the verification efficiency, upgrade and expansion, maintenance cost, incentive structure, and excessive user sovereignty of the public chain are all problems. It's too idealistic. Focusing on the private chain within the enterprise goes against the spirit of the blockchain. The alliance chain is a compromise between idealism, commercialization, and inclusive practice. It takes into account efficiency, quality experience, and fairness.

The ant focuses on the open alliance chain and has its genes in it. One is the 20-year background of the open platform from the Ali Group, and the other is the five-year practice of the ant itself. Its field has always been the largest convention on supervision, openness, fairness and efficiency. The concepts embodied in the evolution of ants are similar to the open alliance chain.

After years of accumulation, Ant has innovated many classic blockchain applications. Needless to say, finance and retail are more focused on multi-party trust mechanisms, and they are committed to solving the credibility of data, things, assets, and people. The efficient and effective cross-organizational collaboration has already made people see vast business opportunities. To some extent, it covers a wider area than the existing ecological unit of Ali Group.

Combining the ecological advantages of Ali Group, the ant blockchain has reached a new stage of opening up. At this level, it is actually the same signal as the prediction of the large-scale production-level landing of the blockchain in the research report of the Dharma Institute. A large-scale commercial cycle is coming. 2020 should be the key year for the large-scale implementation of the blockchain.

The above two aspects are exactly the parts that Ant has focused on in the blockchain field in the past 4 years. Before that, Xianxian Jing emphasized three things: first, independent research and development, to resolve the bottleneck of large-scale commercial technology; second, to explore application scenarios; and third, to build an open platform to jointly build a prosperous ecology. We believe that at this moment the cycle of implementing the third thing, that is, building an open platform.

Naturally, this is equivalent to saying that ants will face new ecological construction tasks. As mentioned above, the scope of cross-domain and cross-organizational collaboration of the blockchain is much larger than the existing ecosystem elements of the Alibaba Group. Participants will be more diverse. How can they stand on their own and integrate with the outside world to form a new open and joint construction? The mechanism is not easy.

Driving the three major strategies to accelerate growth

Do not separate the ant blockchain from the ant's current overall strategy. It must serve the latter.

At the 20th anniversary celebration of Ali Group, Xiaoyaozi announced three major strategies in the next few years, namely domestic demand, globalization, big data and cloud computing. This is also a growth strategy. Reduced here in Ant, the latest description is domestic demand, globalization, and technology. You can also experience from the four business segments defined previously: mobile payment, digital finance, smart technology, and internationalization.

A few days ago, in synchronization with Ali Group, Ant Financial took a new round of organizational restructuring. Sun Quan was promoted from president to CEO, and Jing Xiandong continued to serve as chairman. In terms of specific division of labor, Jing Xiandong is mainly "main and external", focusing more on globalization, intelligent technology, talents, finance, war investment, etc. Sun Quan is mainly "main", responsible for Alipay business group, digital finance, CTO line, CMO line , Great Security Line, Intelligent Customer Funding Department, Comprehensive Risk Management Department, Customer Service and Rights Protection Department, and other mid- and back-office lines, focusing on domestic demand and digital transformation opportunities in the local industry.

This division of labor seems to be in line with the advantages of the two, but I am afraid there are differences.

In the adjustment letter of the organizational structure, Jing Xiandong emphasized at the beginning that a key value of Alipay in the past 15 years is to build a trust mechanism. At this moment, he believes that new technologies, including blockchain technology, will continue to "dead" with the problem of "trust" and further implement the business position of "let the world have no difficult business". At the same time, he emphasized that "the world is huge and the demand is huge. Consumers and small businesses in many countries have much stronger demand for digital technology than expected."

He rendered the value of a new round of digital technology elements. You have to see that the unit where the blockchain is located is the "smart technology", which was personally grasped by Jing Xiandong. We can appreciate the inherent urgency.

At the same time as the organizational structure was adjusted, Ant officials emphasized that they will comprehensively accelerate the three major strategies of "globalization, domestic demand, and technology."

When an organization emphasizes "speeding up", it actually means that a new open mechanism has been formed. It not only accommodates the organizational elements of an enterprise through structural adjustments, but also accommodates specific extension mechanisms, especially the birth of open platforms.

The progress of New Year's Day rendering of blockchain scene applications is no accident. It conveys Jing Xiandong's heart as the chairman and the first position of intelligent technology. The open alliance chain, which will be launched in February, is expected to become a key node in the speed-up of Ant's "technology" strategy.

Naturally, the blockchain signal is placed in three major strategic backgrounds, which must also include growth demands. As mentioned earlier, blockchain is also a multilateral trust mechanism. It has more synergistic and linked elements, which are higher than the existing ecological elements of Ali Group. Reflected on the supply side, it will bring new business opportunities for digital empowerment. Moreover, in addition to business attributes, from a business logic and marketing perspective, the blockchain seems more like an outpost.

In 2020, the fighting power of ants should be very powerful.

Potential IPO target: blockchain favors valuation

Many industry changes brought about by strong supervision in the financial technology field, as well as the equity transfer between Ant and Ali Group, once weakened the topic of Ant IPO, and some even said that Ant has no hope of IPO.

I don't believe it. In addition to the relative complexity of the equity behind Ant, leaving Alibaba and seeking to withdraw sooner or later, fintech has already become one of Ali's and even China's leading global symbolic fields: it is not only playing a more standardized mechanism for digital transformation in many industries, but also in globalization. In terms of value, it also has a strong output value.

From the three major strategies and long-term goals of Ant and Ali Group, Ant IPO will definitely be the next key event. We even think that in the existing multiple business areas, Ant is still most likely to be the first to go public separately.

For two years, Jing Xiandong and others have said that there has been "no timetable" and the company will continue to focus on its core business. A week ago, in late December last year, the outside world reported that the IPO of the ant, said that it will be listed in A + H mode. Ant officials said they would not comment on market rumors.

But it's not like nothing is coming. We believe that the “tech finance” positioning completed earlier and the organizational structure adjustment completed the previous year, especially Sun Quan's transfer of posts, the equity transfer between the group this year, the integration of financial cloud business and Alibaba Cloud, and even this new round of architecture Adjustment (Sun Quan was promoted to CEO) has many purposes such as remodeling, enriching leadership and improving governance structure, strategic coordination, business focus, and cost structure optimization.

The newly adjusted three strategic speed-up guidelines and the implied growth demands cannot be ruled out as a signal that the financial model will perform in 2020 after the optimization of the business model. It shows that even without a specific IPO timetable, all the trends convey an unusual taste.

So, what is the relationship between the release of the blockchain application scenario on New Year's Day and the IPO?

Very relevant. Just now, Ant is the world's most valuable unlisted technology unicorn and the world's largest financial technology company. Whether it is the "new finance" in Ali's ecology, the development trend of fintech, the global influence of Chinese fintech, or the three major ants' strategies, the "fintech" attribute needs to be further strengthened.

The elements that reflect the competitiveness of "fintech", in addition to the practice of mobile payment and digital financial scenarios, are more in the area of smart technology.

Over the past two years, Jingxian Dong has repeatedly emphasized the value of this element. This time he caught it in person, showing an urgency. And Sun Quan attaches equal importance. Don't say that he has been in charge of Aliyun's territory in the past many years, even after changing jobs. At the Hangzhou Yunqi Conference last year, Sun Quan emphasized that today's finance must be driven by technological innovation, and the future financial center must be a technology center. Since Facebook launched libra, the US financial center is moving from New York to Silicon Valley. While China's financial centers used to be in Beijing and Shanghai, Shenzhen and Hangzhou are now playing an increasingly important role.

According to Quark, this is a wonderful trend judgment. He also hinted at the value of Ant and Ali Group to global fintech.

Blockchain is the core element of intelligent technology. Compared with other single or limited technologies, although it is also a technology form, it has a broader vision of integration and collaboration and more elements. If it is said that AI is more reflected in micro data intelligence, blockchain is more focused on the coordination of social and macro factors. It will not only help build consistency for the diversity, multiple maps, and global layout of the Ali Group's economies, but also help break down the barriers of various organizations such as enterprises, industries, and society, and build broad and multilateral trust.

New Year's Day renders the progress information of the blockchain, and will also launch the open alliance chain next month, which will help strengthen the ant's intelligent technology landscape, thereby improving the entire fintech service capability. At this moment, on the eve of the new round of opening, it will definitely help raise the valuation of ants.

Of course, the outside world will still pay attention to what competitiveness the ant blockchain has. We have just mentioned that Ant has four major businesses: mobile payment, digital finance, intelligent technology, and internationalization, which are reflected in financial technology. It has the world's most complete technology, products and platform system. Of course, some will combine the resources of Ali Group, especially cloud services and ecosystems.

The same goes for ants on the blockchain:

1. It has the most blockchain core patents in the world, and the core market distribution tends to be balanced;

2. A complete BaaS platform.

It mainly includes two aspects, namely BaaS Core, in addition to self-developed financial-grade blockchain platforms, as well as third-party public chain platforms; BaaS Plus, in areas related to contracts, security, and authentication, also has complete technical solutions.

3. Rich and diverse BaaS platform solutions and application scenarios;

4. The upcoming alliance chain. This is an open ecosystem;

5. Ali Group's cloud computing infrastructure and diversity ecological support.

As you can see, the entire system of the ant blockchain has both an independent and proven financial and economic level blockchain platform platform capabilities and a large open mind. At the same time, it has many obvious advantages in many aspects such as people's livelihood, commerce, and government affairs. From the perspective of technological development strategies, under the support of commercial and financial-level application scenarios and global layout, Ant has polished a large-scale production-grade blockchain open platform with adaptability to global deployment, high reliability, and transportability. Dimension, high security features.

As of now, although many giants are defining the development model of the blockchain, some concepts are very advanced. For example, the virtual currency launched by FB once attracted global attention. But no matter the underlying patents, products, platform construction, or the most critical scenes, no one can match the progress of Ant Financial and Ali Group.

At this moment, emphasizing the blockchain does not rule out that it is creating opportunities for discourse penetration for potential IPOs, which has caused the outside world, especially investors, to pay attention to the ant blockchain value system. For the Ali Group, naturally, there is also a positive effect of market value management.

(K chart of Alibaba Group Hong Kong stocks day)

Of course, behind this leading situation, there are also factors in the Chinese market. In the past wave, China's mobile Internet application has led the world. Its conceptual innovation and practical results have established confidence for big countries. It is driving many fields to embark on a new round of digital transformation. Blockchain has become a key industry. Symbol.

Therefore, the last focus, that is, the compliance policy and trend vent mentioned earlier in the article, does not need to explain more. Powerhouses have become the clearest regions of global blockchain policy. The guidelines issued by leaders of the authorities in late October last year, for example, emphasized that blockchain should be an important breakthrough in independent innovation of core technology, clarify the main attack direction, increase investment, focus on overcoming a number of key core technologies, and accelerate the promotion of blockchain technology and Industrial innovation and development are generating rich changes in many regions, industries, institutions, enterprises, and individuals.

If you are interested, you will find that in the 2020 trend forecast of many research institutions, almost all mention the blockchain elements, and when predicting the development trend of the global blockchain in 2020, they have almost emphasized the Chinese factor without exception.

So, in the end, I want to say that the information released by Ant Financial on New Year's Day and Alibaba Dharma on January 2 involves blockchain information, and it is no accident. They are the leaders of the overall strategic acceleration in 2020.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoints | Difficult to Buy Insurance? Buying insurance in the blockchain era will be as easy as taxiing in the internet era

- Bitcoin: 2020 debut

- New Diss Chain in Blockchain Industry: Fundamentalism vs Industrial Trends

- Introduction | Liquidity and Bank Run Risks in DeFi

- Analysis | "Sea Urchin" Project-Digital Currency of the Bahamas Central Bank

- Is fiat digital currency a transnational Alipay?

- Blockchain builds an energy security ecosystem: digitalization of processes in the energy industry chain, multi-dimensional grid connection, and multiple sharing