Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

DePIN Track Overview: Disruptive Innovation or Pie in the Sky?Introduction

DePIN stands for Decentralized Physical Infrastructure Networks, which as the name suggests is a “decentralized network of hardware infrastructure”. In fact, this kind of decentralized hardware infrastructure has had a vague concept of practical application for a long time, for example, bitcoin mining machines are actually a kind of decentralized hardware network, and the electric grid management system of the web2 world also covers a certain concept of decentralized hardware facilities.

In order to accurately define the concept of DePIN in this article, we adopt Messari’s (https://messari.io/report/the-depin-sector-map) explanation of DePIN: A way of coordinating physical hardware facilities of multiple individual units in a blockchain-based, permissionless, trustless, and programmable form through token incentives. DePIN can also be described as Proof of Physical Network (PoPW) or Token Incentivized Physical Infrastructure Networks (TIPIN). In simple terms, it is a network composed of countless individual hardware units managed by token incentives, and this network can be used to serve specific projects.

Broadly speaking, the scope of DePIN is actually very wide. PoW mining machines are hardware infrastructure that maintains the operation of blockchain networks, but as the traditional PoW model is gradually being phased out, mining machines are not within the scope of this article. This article will focus more on the hardware network that provides specific services on top of the blockchain network, rather than the blockchain network itself. From another perspective, the entire web3 world is built on top of the DePIN network, because the operation of each node is based on individual units renting their own servers. With these two logics clarified, we can focus more on the research direction of this article: a network formed by hardware facilities that provide additional toB or toC services, but are managed and coordinated by blockchain networks.

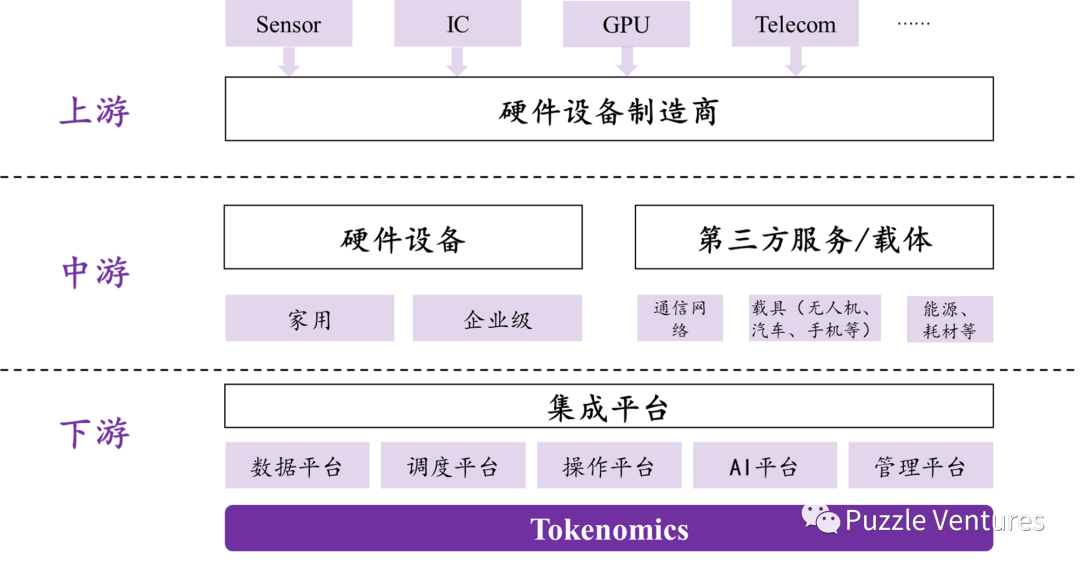

Figure 1

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million

As shown in Figure 1, the entire vertical ecological chain of DePIN is more complex than general web3 projects. In the upstream, the project party needs to consider the selection of hardware equipment manufacturers, especially for projects involving high-precision sensing devices and chips, and choose suitable partners from the perspectives of cost, quality, and scale production. In the midstream, the project party needs to consider the usage scenarios of hardware equipment and the integration with corresponding third-party service providers/carriers, which forms a threshold for the user’s own conditions. The necessity of resources such as network speed, electricity, and drone driving makes the overall usage cost of the user higher. In the downstream, the project party needs to establish a corresponding integration platform and design an economic model that conforms to the flywheel effect according to the project needs. This poses a high test to the project party’s cognition and experience. Overall, a complete DePIN project is a more complex and comprehensive web3 project.

DePIN’s Core Mechanism

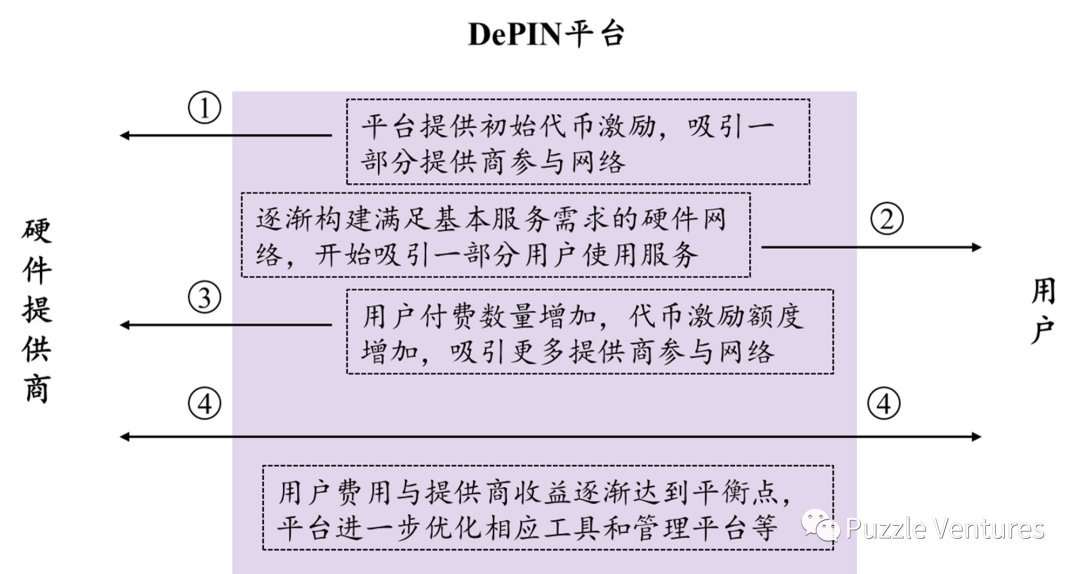

The basic mechanism for building a DePIN network is for individual hardware units to earn rewards by renting out the services provided by their hardware. To turn this mechanism into a decentralized global network, token economics are needed. Therefore, the entire economic flow can be summarized in Figure 2. This mechanism itself is different from the traditional hardware industry, where centralized hardware service providers often require a large upfront capital to purchase or build hardware facilities, and profits depend on future orders. This model can only be undertaken by large enterprises or government finance-led projects that have the potential risks and competition, while small and medium-sized enterprises can hardly participate. However, during DePIN’s early boot-strap period, it was a spiral-up dynamic mechanism in which users, providers, and platforms could participate and grow gradually while taking on relatively small risks. The most critical factor in this is the highly dynamic nature of token incentives, which can achieve dynamic balance based on the data of both supply parties, such as one-time rewards and Staking APR.

Figure 2

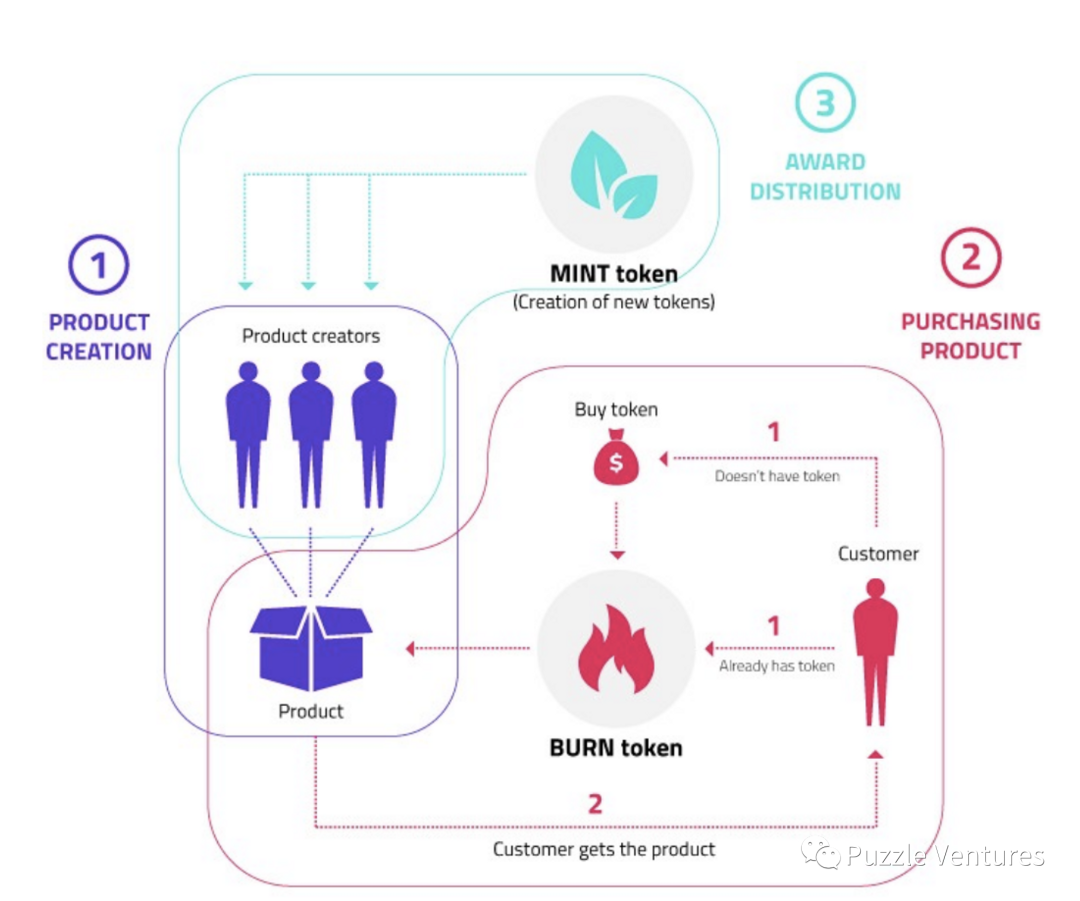

For example, Render Network is a decentralized GPU rendering service matching platform that links users who perform rendering jobs with users who have idle GPUs. In terms of token incentives, Render Network first designed a rendering power unit standard based on OctaneBench (OB) according to its experience in the rendering industry, and divided the participating idle GPU users into three levels based on their GPU rendering speed. The three levels are distinguished according to the different GPU levels. 100 RNDR tokens can pay for 2,500 OBh-20,000 OBh (depending on the GPU level used), which concretely means that 100 RNDR tokens can be used for 50-100 hours with one RTX 2070 graphics card or for 5-10 hours with 10 RTX 2070 graphics cards. This is the simplest initial token incentive model. After accumulating early users, Render Network gradually enters step 4, which is to further optimize and maintain the token revenue balance point. In terms of optimization, Render Network mainly starts from the perspective of scalability, such as optimizing algorithms to reduce queue time, and establishing local APIs to improve upload and work efficiency. In terms of token revenue balance, RNDR network voted for the Burn-and Mint Equilibrium (BME) model in February 2023.

Figure 3

The essence of this model is that users buy GPU rendering services through RNDR tokens, which are destroyed after the task is completed, while the rewards for service providers are distributed using newly created tokens. The newly distributed tokens will not only be based on completion metrics, but also include overall satisfaction and other factors. This way, RNDR tokens have a consumption scenario in the entire economy, and the supply-demand relationship can be adjusted based on the algorithm between the destroyed tokens and the newly minted tokens to adjust the balance, and the entire business model gradually evolves from simple C2C to more manageable B2C.

The Significance and Value of DePIN

The concept of DePIN was proposed because of its profound significance and value, which is meaningful for both the future form of the web3 industry and the theoretical development of technological and economic revolutions.

Unit Cost and Economies of Scale

DePIN’s crowdsourcing model can reduce the overall cost (or decentralize the cost), and can quickly scale up in a short period of time. In previous articles, we mentioned (link) that decentralized storage platforms like Filecoin and Arweave can be several tens to hundreds of times cheaper than Amazon S3 storage prices, and helium provides hotspot signals and Render Network provides GPU rendering services that are more price-competitive than traditional centralized service providers. Helium’s LongFi protocol has a range of 200 times that of Wi-Fi, and the total cost for a device that needs to receive packet updates every hour is $0.09 per year. In comparison, the total cost of using a large signal service provider like AT&T is about $36. On the other hand, DePIN also reduces costs in other areas, including labor costs, plant costs, and maintenance costs, which are almost non-existent due to its decentralized nature. Essentially, DePIN’s light asset model is a disruptive innovation to the heavy asset model of the traditional ICT industry.

However, the other side of the coin is instability and security risks. A completely permissionless hardware network that relies on token incentives to manage nodes is at least for now only an idealized concept. In practical applications, problems may be encountered in all aspects: the imbalance of income and expenditure caused by token fluctuations ultimately reaching the “shutdown price” and triggering a death spiral; operational errors caused by the lack of professionalism of individual nodes, leading to malfunctions; malicious node behavior, hacker problems, and so on. Therefore, solving these problems requires high business capabilities from the project team, as well as further improvement of the overall blockchain infrastructure. It can be foreseen that different levels of demand correspond to different levels of service providers , with businesses with high security and stability requirements using centralized large service providers, while data service requirements with high frequency and low requirements can use DePIN. In other words, the significance of DePIN is like that of DEX for traditional finance.

Reuse of idle resources

DePIN can centralize scattered idle resources and provide them to the most needed and valuable businesses. This topic is actually very interesting, because the reuse of idle resources can be said to create additional markets and value, and at the same time can drive individuals to generate additional income. From the current mainstream DePIN projects, the collected idle resources are mainly four types: hard disk storage space, communication traffic, GPU computing power, and energy. However, theoretically speaking, we can imagine that more similar idle resources can be centralized and reused in the future, such as cameras, screens, and brainpower. This is actually a globalization sharing economy attempt in the digital information field, and its essence is similar to the idle fund management in the financial field and the idle vehicle leasing in the transportation field.

But is this model of reusing idle resources a necessary factor for future economic development? Are completely overloaded workloads covering all hardware a state that we hope to achieve in the future? These are actually deeper ethical issues. On the one hand, the foundation of this large-scale sharing economy model is credit, so any design flaws in token incentives will cause a small group of people to take advantage of loopholes, and the majority of participants and users will suffer losses. On the other hand, large-scale access to hardware interfaces will bring about a reduction in privacy and data leakage issues in all aspects. Therefore, DePIN is not suitable for everyone to participate in under the existing infrastructure environment, and its market size limit is also lower than that of the sharing economy in non-digital information fields.

Regional efficiency

Regional efficiency refers to the fact that distributed hardware can provide higher short-term efficiency than centralized hardware service providers, mainly in the fields of game rendering and computing. This feature has not been proven and widely applied yet, but it is still worth considering its significance. In the current scenario of multiplayer blockchain games, when a scale of users is online at the same time, they need to call public RPC nodes to perform tasks such as executing smart contracts. When the node enters an overloaded state, it will cause delays or even downtime. This problem itself is a technical barrier to the scale application of blockchain, and there are currently some targeted measures, such as the execution environment rental adopted by Altlayer, L2s, gamefi dedicated servers, etc. Some DePIN projects are also trying to solve such problems through a higher density of hardware networks. For example, in the case of exaBITS, when the density of its cloud computing hardware layout is wide enough, it can call nearby servers in real time for game players based on their geographical location, and distribute and solve the computing or rendering needs of tens of thousands of players in a more average way. Similarly, when there is a large-scale computing demand such as GPU rendering or AI computation, a corresponding batch of hardware in the DePIN network can also meet the demand in a short time. From a theoretical point of view, the high-density and decentralized hardware deployed by DePIN can meet the short-term high-computing task needs in a timely manner, forming a regional efficiency improvement. Of course, this is only a hypothetical ideal state, and the distribution of professional game servers may reach a certain breadth to meet the needs of global players, and the comprehensive computing hardware brought by DePIN may not necessarily provide a better game experience than imagined. In any case, DePIN brings us a huge space for imagination, and larger icebergs will gradually emerge in the future.

Overview of DePIN

DePIN is a special track, partly because of its wide scope, and partly because many similar or similar projects can be roughly classified as DePIN. This article attempts to describe this track more clearly with a more detailed and three-dimensional split logic based on Messari’s DePIN Sector Map.

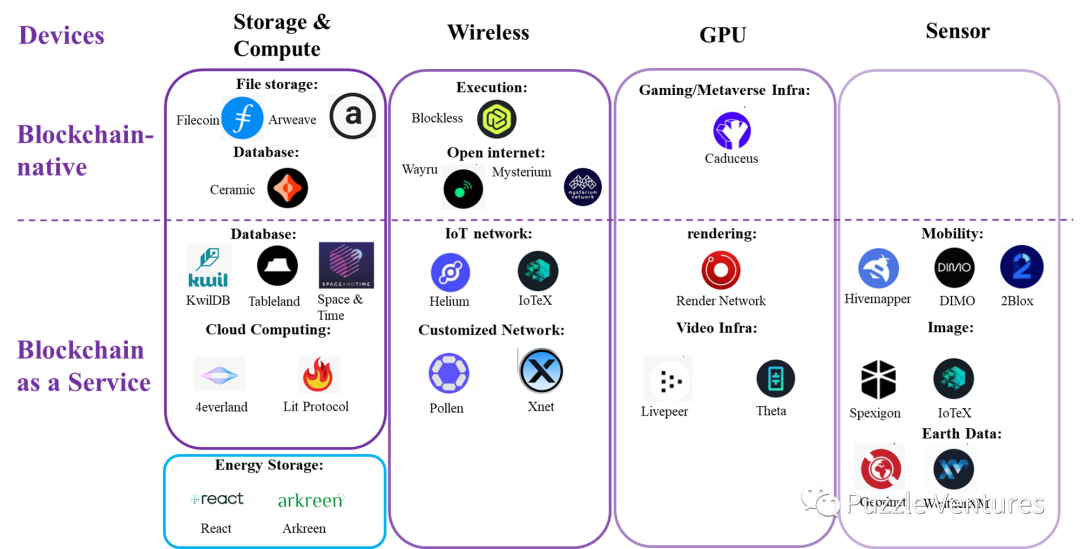

Figure 4

Ecosystem Dimension

First, the most important classification dimension in the DePIN track is: the two dimensions of being part of the blockchain network itself and using blockchain technology to achieve new business, which is not mentioned in the Messari report. There are two parts of the blockchain network ecosystem that can be adopted and optimized by DePIN, one is data storage, calling, and archiving, and the other is the possibility of L3 expansion. In terms of data storage, the independent storage layer represented by Filecoin and Arweave has become the mainstream paradigm, and the decentralized storage nodes built by such projects are a form of DePIN. The other part is some L3 layers that try to improve performance by renting external communication networks or GPU networks. These L3 layers are more inclined to customized solutions to solve a specific problem, but they do call external hardware facilities of the blockchain network in the process of solving the problem, so they can also be classified as DePIN. These two types of DePIN projects are to meet one or more needs of the blockchain ecosystem itself and can also be said to be part of the underlying network of the blockchain. The other dimension is built on top of the underlying blockchain network and uses Blockchain as a Service to build new businesses, such as the Internet of Things, cloud computing, energy storage, traffic data, geographic and weather data, image and video processing, etc. These projects are all modes that use blockchain as a coordination and management network to connect hardware providers and demanders and are the second dimension.

Device Dimension

Secondly, the DePIN track can be split into the dimension of devices. Overall, the hardware devices involved in DePIN currently mainly include PC or phone built-in hard disks, databases, servers, communication signals, and GPUs, while different categories of sensors and project-customized hardware are another market. The customized hardware mode led by Helium once swept the world, but now it has fallen into a vortex of questioning. According to the data disclosed by @Liron, Helium’s data service server revenue in June 2022 was only US$6,500, but the number of hotspots deployed globally was as high as 900,000. This huge imbalance between providers and user demand has also led to the value of the HNT token plummeting (since there is no additional source of income, it can only be maintained by reducing incentives with tokens). There is no problem with Helium’s hardware products and ideas. The core problem is that the customized hardware model involves upstream manufacturers, and the profit goal of upstream manufacturers is to sell more devices, while the profit goal of the Helium platform is also in a sense to earn fees through the sale of devices and registrations. In the absence of external income, it can only be transfused by existing device buyers or new device buyers, which completely violates the original intention of the DePIN network. Currently, Helium is trying to establish a “network of networks” that can be compatible with third-party wireless networks (5G, WiFI, CDN, VPN), but the current effect is unknown.

From Helium’s case, we can see that once the heavily customized hardware model is not well grasped in layout and development pace, it will cause a death spiral. Other more innovative devices include Spexigon’s drone photography, Geodnet’s space weather station, etc., which are full of imagination. When considering the success rate of these projects, we should focus on several indicators: 1. The cost of purchasing hardware and the return cycle, whether the project side focuses on selling hardware or providing services; 2. Are there definite, already cooperating service purchasers using the network? 3. Does the hardware itself match the home environment and not consume too many resources?

Domain Dimension

Finally, the DePIN track can also be split from the dimension of the domain, that is, what type of services are specifically provided. The Helium-led IoT and infinite communication fields are one, the GPU field led by GPU rendering and video transcoding is one, and the real-life data and image collection led by various sensors are one. Hivemapper establishes a map data update mechanism based on the hardware device of a driving recorder, Spexigon establishes a high-definition and stereoscopic image library based on a drone camera, and DIMO establishes a vehicle networking information system based on a car as the hardware device. These projects all have a common characteristic: unknown demand. In the more complete web2 ecology, some things like maps, photo shooting, and car information can be partially or completely replaced by many web2 products, and the only advantage of these projects is that users can receive token incentives. Token incentives are not all of web3, the significance of the DePIN era is to better combine web3 with people’s lives through hardware facilities to connect real life with web3, and the real demand explosion of DePIN may still need to wait for a better time.

Latest Developments and Potential Issues

In order to fully understand the development status of the DePIN project, we analyze the latest developments and community feedback of the two top projects–Helium and Render Network, and try to find potential development bottlenecks.

✦Helium

Helium completed more than US$300 million in financing in 2021-2022, and the early device sales once reached the emotion of FOMO. As of now (May 2023), Helium has deployed 460,000 hotspots worldwide, covering 192 countries and 77,000 cities, and is still adding hotspots every day. However, despite such a perfect start, Helium’s community reputation has gone from high to low, completing a dramatic turnaround from “difficult to obtain” to “low-priced and cheap.” The main problems include:

1. Miner income issue. The current HNT income of a mining machine with an average price of about $500 is around $20/month, which is extremely unbalanced between income and cost. Of course, after Helium migrated to Solana and converted to the new IOT token income, the situation of some miners has improved slightly, but it is still far from the expected level (as shown in Figure 5). According to the latest data statistics from Heliumtracker.io, the recent average daily income per hotspot is around $0.2, while the average daily income of $MOBILE in the 5G network is around $3.6, but the hotspot coverage of the 5G network requires higher requirements.

Figure 5

2. Professional miners do not have an advantage in entering the market. To operate a mature miner network, not only ordinary enthusiasts are needed, but also professional miner teams need to participate. However, Helium’s Proof of Coverage mechanism requires that the distance between hotspots be maintained at 500-1000 meters, which is not friendly to dense deployment, which also makes the traditional dense deployment of miner teams unable to take advantage of it in the Helium project.

3. Helium migrated to the Solana network on April 20th this year, and since then it has become a project that is biased towards the application layer network. However, Solana’s reputation and the FTX explosion incident have indirectly brought negative effects to Helium, and Helium’s abandonment of the development direction of L1 network construction has also caused some community backbone members to leave. From Helium’s official push, the benefits of migration are lower transaction costs, stronger market integration capabilities, and language changes to attract more developers (originally a niche Erlang), but the biggest problem is that it reduces the unique appeal of the Helium network and changes from an L1-level project to a Solana ecological project.

From the latest community feedback, this migration has brought many technical problems to ordinary participants, such as the conversion from IOT to HNT, and the failure to receive rewards, which are unfavorable factors for both new user participation and old user retention. Overall, Helium is a pioneer in the DePIN track, and it has once aroused high popularity and potential paradigm revolution, but based on Helium’s current operating status, it has not yet verified the future value of DePIN.

✦Render Network

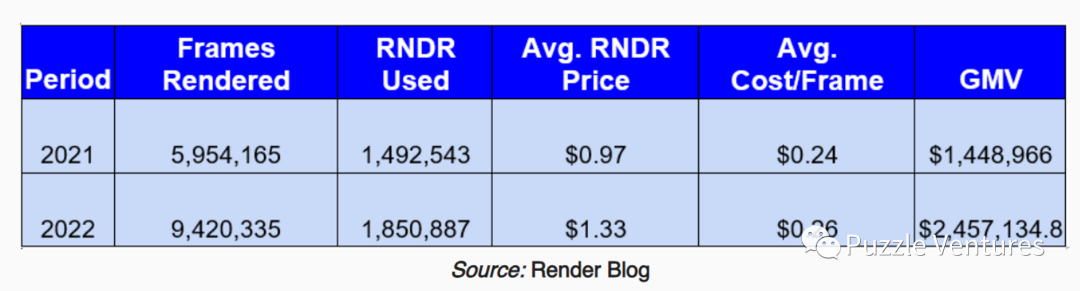

Render Network’s parent company OTOY is a leading rendering software project, and its web2 product Octane has been adopted by projects in the film and music fields, including Disney and music producers. The project concept of Render Network is to provide higher levels of decentralized rendering support for the future metaverse. From a demand perspective, Render Network provides a just-in-time solution for all projects that require rendering in the future metaverse (dynamic NFT, metaverse gaming), while Helium is more actively creating demand. As shown in Figure 6, Render Network completed 6 million and 9.4 million Frames in 2021 and 2022, respectively, and $RNDR also continued to circulate among them.

Figure 6

From the recent project dynamics, the adjustments made by the project party are all conducive to the long-term development of the project:

1. The RNP-001 proposal passed the BME token model mentioned earlier, which greatly improves the liquidity and supply-demand balance of the token. Although it is only a theoretical economic model optimization, it still has a great influence on boosting community confidence from the trend of $RNDR price.

2. The RNP-002 proposal passed the decision to migrate to Solana and explained the main considerations: developer community, TPS, liquidity, transaction costs, programming languages, and smart contract integration. This proposal is also from the project’s future expansion ability consideration, and finally obtained a 99.26% vote. After the RNP-002 proposal was passed, community satisfaction and token prices both increased positively (the token price rose by 43% within two days), which also proved the good relationship between Render Network and the community.

3. The RNP-003 proposal passed the Render Network Foundation’s token usage rights for team expansion and Grants needed for future development, which also received a high pass rate of 99.9%. Render Network uses some of the newly produced tokens to develop the project ecology while ensuring that participants receive sufficient rewards, which is in line with the interests of the community for the long-term ecological construction of the project.

Overall, Render Network is a benchmark project in the DePIN track, with both the experienced parent company OTOY and a foundation and token mechanism that conforms to the spirit of web3, while balancing project development and community interests and maintaining a good relationship with the community.

Summary

DePIN track is a track that can both be a “new wine in an old bottle” and a imaginative track that completely breaks through industry boundaries. The hardware network based on decentralized storage and computing is still an important underlying infrastructure of the entire web3 ecosystem, while also providing backend design with lower costs for the application layer. The hardware infrastructure network mainly composed of GPUs and sensors is attempting to establish a brand new service rental and matching market.

In the future, the key directions worth paying attention to include:

1. General entertainment DePIN

A general entertainment DePIN network composed of wearable hardware such as Gopro and AR glasses is an imaginative track. The essence of entertainment upgrade is experience upgrade, and the DePIN-based general entertainment network can not only enhance the immersive participation of entertainment (supply side), but also bring more stereoscopic and dynamic entertainment methods (demand side). The industry involved here includes sports, live broadcast, games, media, etc. It is worth looking forward to how to combine DePIN with these fields and create a positive flywheel mode.

2. Real-world data

The value that DePIN brings to society cannot be separated from the application of data elements. From the current development trend, sensors as the input and output ports of real-world data have formed an interaction mechanism with meteorological data, sports data, and image data, while more types of data can be captured through more ways in the future. In addition, some real-world data is difficult to capture through centralized systems. The decentralized nature of DePIN can more effectively capture those dispersed but important data, and the subsequent processes such as storage, use, and transformation of these data will gradually derive a complete industry chain, so the imagination space of its market size is relatively large.

Disclaimer: This research report is the author’s independent opinion based on the collation and analysis of public information, for reference and communication only, and does not constitute financial, investment or any other advice.

Article source: https://mp.weixin.qq.com/s/_uagOV-8dxNMktG99bhMpQ

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi on Bitcoin: Is BTCFi a breakthrough or a bubble?

- From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?

- Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.