Arweave’s Composability Experiment Exploring a Better NFT Market

Arweave's NFT Market Experiment

Author: Spike @ Contributor of PermaDAO

Review: Kyle @ Contributor of PermaDAO

Introduction

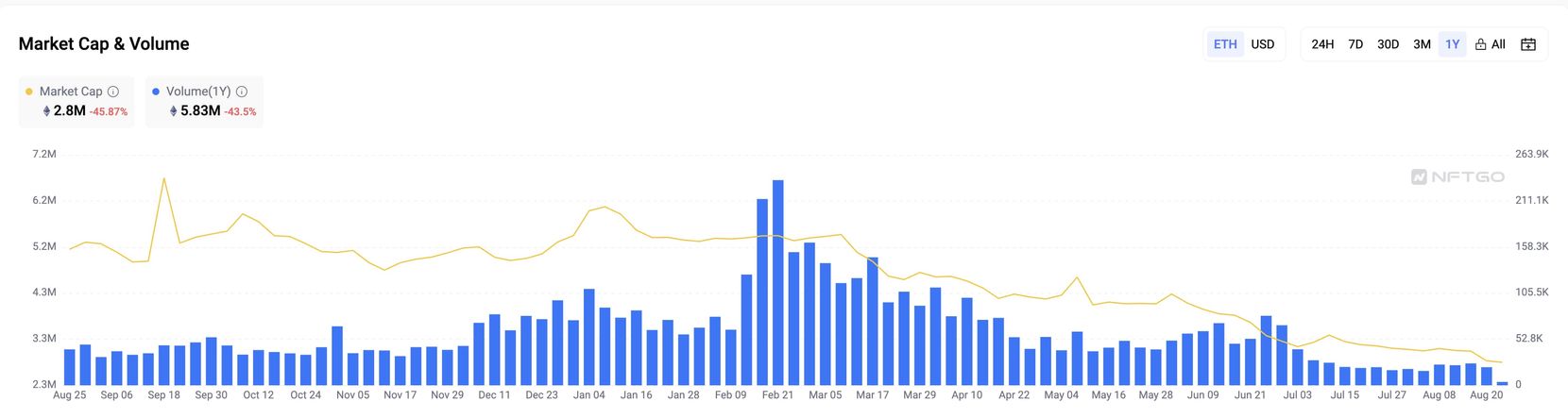

The cryptocurrency market in Q3 2023 is a battlefield for various Layer 2 solutions, while “traditional” sectors such as DeFi and NFTs have been relatively quiet, especially after Azuki’s self-destructive marketing. The NFT market has hit a bottom, and in the larger context of the Federal Reserve’s interest rate cycle, we are still in a period of liquidity shortage, with exponentially decreasing funds allocated to the NFT market.

- Should Polkadot’s market positioning and narrative be adjusted?

- The first debate of the Republican primary ended. Which candidates are friendly towards encryption?

- Wu’s Weekly Selection Tornado Cash Co-founder Arrested, HashKey to Open Retail Investors Next Week, and Top 10 News (0819-0825)

If we go back to Q2 2022, we can see that it was already a declining period in the first bear market. Combined with the downward spiral of Luna-UST at that time, the overall market trading volume dropped by over 50%, and NFT transaction volume also plummeted.

The current phase is nothing more than a hibernation period in this long winter, especially with the emergence of NFT composability in the Arweave field. It has surpassed the mere hype of NFT images and entered the realm of true NFT composability – atomic assets. Atomic assets can not only include PFPs but also incorporate FT (fungible tokens) and various types of RWA assets. Built on the Permaweb, it also allows for permanent storage of assets, freeing them from the long-term “pseudo-decentralized” operations that have plagued the industry.

NFT Market Segmentation: Finding Your Positioning

If we roughly divide the existing NFT market, it can be categorized into three types:

1. Exchange Extension: Binance NFT, Coinbase NFT. The main purpose of running NFT markets for them is to expand their market space, and their operating models are more similar to token markets (CEX/DEX).

2. Based on Trading Categories: Art: SuperRare vs. OpenSea as a representative of all categories. The main difference between them lies in the types of transactions, such as choosing specific art markets or covering all categories.

3. Public Chain Ecosystem: Typical examples include Magic Eden on Solana. Their value lies in building their own public chain ecosystems. They can be understood as NFT for the sake of NFT, and ecosystems for the sake of ecosystems, which are essential components of any public chain.

If a new NFT market wants to enter the scene at this time, it needs to clearly identify its positioning. It is more crucial to determine what kind of trading market it wants to become rather than what it wants to be like. In other words, is it going to compete with industry giants like OpenSea, exchanges like Binance, or complement other public chains?

Currently, the most realistic choice is to collaborate with project teams and embrace cross-chain interoperability. Project teams are willing to enter multiple new markets, and the desire of public chains for ecosystem development is ingrained. This way, they can temporarily avoid direct competition with OpenSea and exchanges, at least ensuring their survival.

For example, the total transaction volume of Magic Eden based on Solana once exceeded 1 billion US dollars. Its founder is Yin Zhuoxun, a former product manager at Coinbase. The combination of public chain and exchange background has enabled it to firmly occupy the ecological position of the single Solana public chain. In this context, OpenSea’s support for Solana network can be seen as a direct impact of the “catfish effect”.

After determining its positioning, we all face an unavoidable dilemma: how should we view OpenSea?

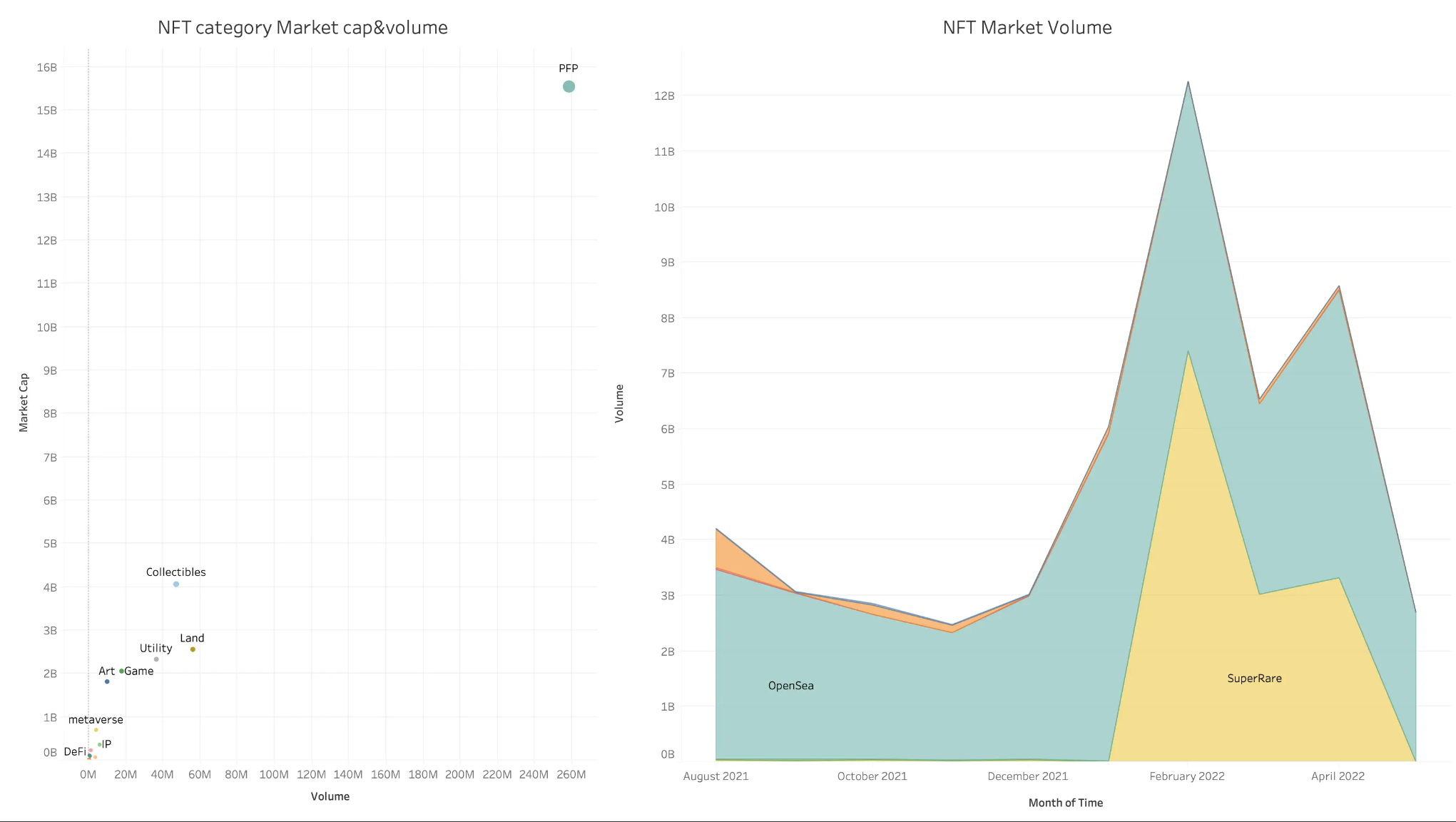

From the trajectory after the issuance of ApeCoin, the combination of NFT and DeFi is a feasible path, while other models are still waiting for the explosive period. The NFT marketplace is still the one that directly captures the maximum value of NFTs. So far, compared with the entertainment models in the real world, NFT is still in the very early stage of development, mainly reflected in two aspects: one is that the proportion of PFP-type NFTs is too large, and the other is that OpenSea occupies a disproportionately high transaction volume, even exceeding 90%.

According to the theory of innovation diffusion, the foundation of the monopolistic giants in the early stages of the market is not solid, and innovators still have room for development. After all, the entertainment content of the Z era, including music, game props, and even personal social platform content, all have the direct possibility of being turned into NFTs.

It can be said that OpenSea has been suffering for a long time, and we can even list the seven sins of this evil dragon.

No issuance of tokens, high listing fees, centralized storage, opaque review process, lack of proactive cross-chain capabilities, and, most importantly, monopoly.

The first six are the causes, and monopoly is the result. First of all, it must be acknowledged that OpenSea has made positive contributions to the industry. In the darkest moment of the extended bear market in 2017, OpenSea persevered. Without this perseverance, many well-known projects that we are familiar with today, including Sand and BAYC, would have died directly due to lack of liquidity.

But a project that does not issue tokens and even wants to directly IPO is truly not decentralized at all. It is everyone’s expectation to build a more decentralized NFT marketplace.

So why don’t we like OpenSea but can’t let go of it? Why are there so many dragon slayers but no one has succeeded?

To answer these questions, OpenSea’s biggest advantage lies in path dependence—we are already accustomed to trading on it. For example, if Alipay wants to change the user base of WeChat, it involves the usage habits of the entire social circle. If you are willing but I am not, then this matter cannot be pushed forward. The user stickiness of OpenSea has already formed in practice.

As it turns out, token+ and volume manipulation, represented by LooksRare, are effective for seizing the market, but there is still a long way to go to solidify real user volume. X2Y2 and Magic Eden may also face this problem:

In this case, how to defeat OpenSea will definitely be a long battle, but what we can be sure of is that there are several things we can do:

1. Unite more project parties and public chains, avoiding the edge of exchanges and OpenSea;

2. Become more decentralized, reducing centralization content every day;

3. Persevere and change user habits which cannot be achieved overnight.

If we compare it to existing mature products, such as WeChat for social networking, LianghuaiyLianGuail for payments, Sotheby’s for art, Google for search, and layered organization for organizations, we will find a more suffocating entanglement of paths. All these forms can be involved in Web 3.0, please note that it is involvement, not inclusion. In the decentralized world, there is no absolute concept of control.

For example, Friend.Tech for social networking in the Web3 era; Arweave for information storage in the Web3 era, which is the first step in building information retrieval; PermaDAO for organizations in the Web3 era; not to mention that any everLianGuaiy product already has payment functions, seamlessly connecting with Web3.

In this case, it is believed that OpenSea will be an example of the centralization of Web3. On the surface, it makes sense. First, OpenSea occupies more than 95% of the NFT trading market, even surpassing Binance’s 60% market share in the cryptocurrency exchange field, making it an absolute industry benchmark. Second, OpenSea is not really encrypted, this is industry consensus.

But from the internal mechanism, Web3 cannot be represented by OpenSea. This is like 8848 e-commerce platform being earlier than Alibaba, Yahoo being earlier than Google. Early entrants naturally have higher market share, but over time, only products that truly conform to the logic of this track can win.

This is not a matter of debate logic, just like what V God said, centralization is the necessary path to achieve decentralization. It is because the total market value of the early market is relatively small, just like crabs in a small pool, this is not a true ocean dominance.

OpenSea is not the only form of art platform in the Web3.0 era.

Even if OpenSea occupies the majority of the market share, even if the monthly transaction volume exceeds $3 billion. We can still believe that the current NFT market is still in its very early stages, even comparable to Bitcoin before 2011. The main reason is that our mainstream luxury consumption is still not in the NFT market.

Compared to the entire luxury goods market of $12.9 trillion, the gaming market of $180 billion, and the art market of $50 billion, the entire encrypted art market is only worth a few billion dollars. Even if we add other categories of NFT, it cannot shake the scale of the entire human consumer goods market.

Optimal Efficiency: The Advancement of Pure Trading Mode

Time is money, and tradability is always synonymous with liquidity. However, NFT is slightly more complex. Different from the unified pricing mechanism and quantity model of FT (fungible tokens), even within a single NFT series, there may be a huge difference between the floor price and the highest price, making them incomparable.

Market-making efficiency has been severely affected, and three solutions have emerged to address this problem:

1. Fragmentation. Starting from imitating fungible tokens, the high threshold of blue-chip deconstruction is aimed to increase the number of retail investors to generate enough liquidity and thereby change the current NFT market landscape.

2. DeFi-ization. One is to imitate the market-making model of fungible tokens, hoping to create enough liquidity in the NFT market by introducing various AMM models. The other is to adopt a lending mindset, using blue-chip NFTs as collateral to guide liquidity and bring retail investors into the pressure pool to support token prices.

3. Trader-ization. Strictly speaking, this is a summary of Blur market thinking, the core of which is to serve NFT traders, take meeting their special and professional needs as the first principle, and thus enhance the platform’s value.

It can be understood that the fragmentation of NFT is due to its own unstable value. In the case of series NFTs such as Crypto Punks, the token value is often unevenly distributed among each member, resulting in the turnover rate of the project being mainly contributed by popular members. However, on a larger scale, there is likely to be a problem with overall market liquidity, leading to a death spiral.

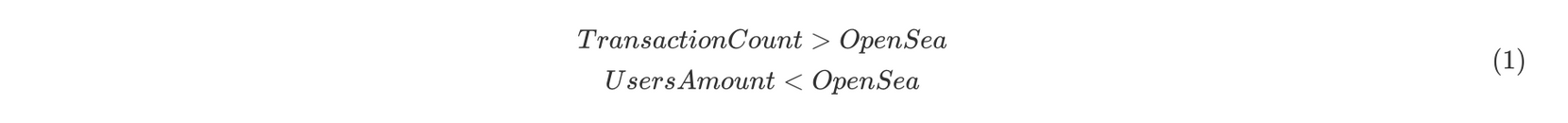

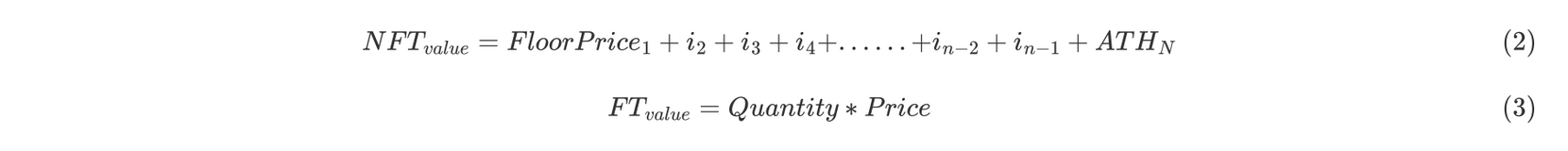

From the perspective of value discovery, the difference between NFT and FT lies in the formula for calculating their value. The calculation formula for NFT is shown in Formula 1, while FT is calculated by multiplying the token quantity and price, as shown in Formula 2.

Therefore, value discovery must be the premise of value transmission. NFTs first need to solve the pricing mechanism and then use liquidity to address the issue of transaction scale. The trading enthusiasm for NFT works is driven by participants’ maximum psychological expectations.

The representative of DeFi-ization is sudoAMM, which has not been very successful. According to Dune data, the trading volume is only about 100 million US dollars, and the number of transactions is about 100,000. Ultimately, NFT market-making efficiency cannot be compared with fungible tokens. In the case of a relatively small overall market size, it is difficult to generate enough liquidity.

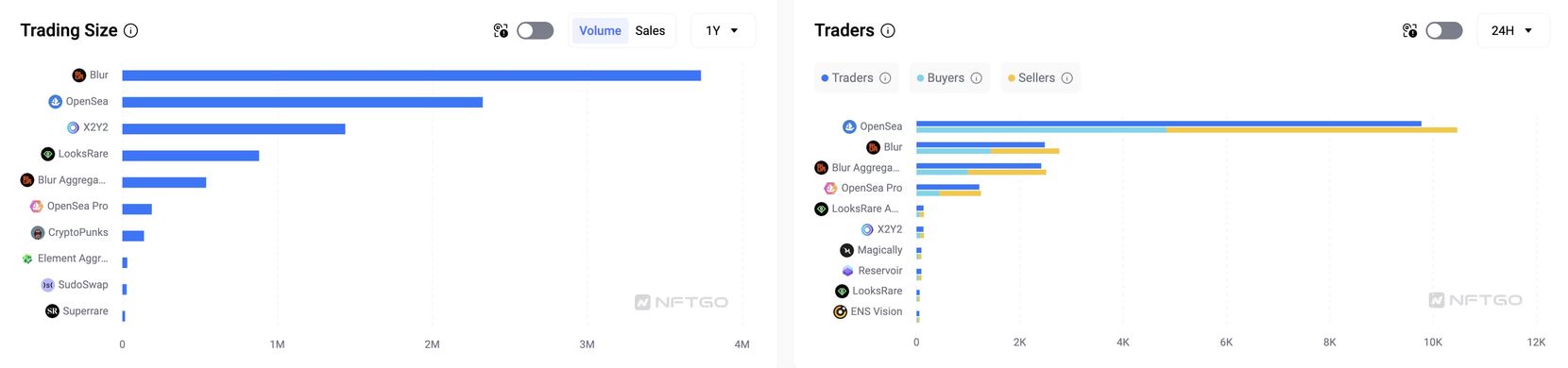

Lastly, Blur’s success lies in satisfying the professionalism of traders. Regardless of the platform’s market share in competition with OpenSea, even though the Blur token has dropped from $5 about a year ago to around $0.2, it has at least made a powerful counterattack against OpenSea in the name of decentralization.

In terms of trading volume, Blur far exceeds OpenSea, but in terms of the number of traders, both buyers and sellers on OpenSea are far larger than Blur by an order of magnitude, which indirectly verifies that Blur is more suitable for professional traders, similar to the difference between Curve and Uniswap.

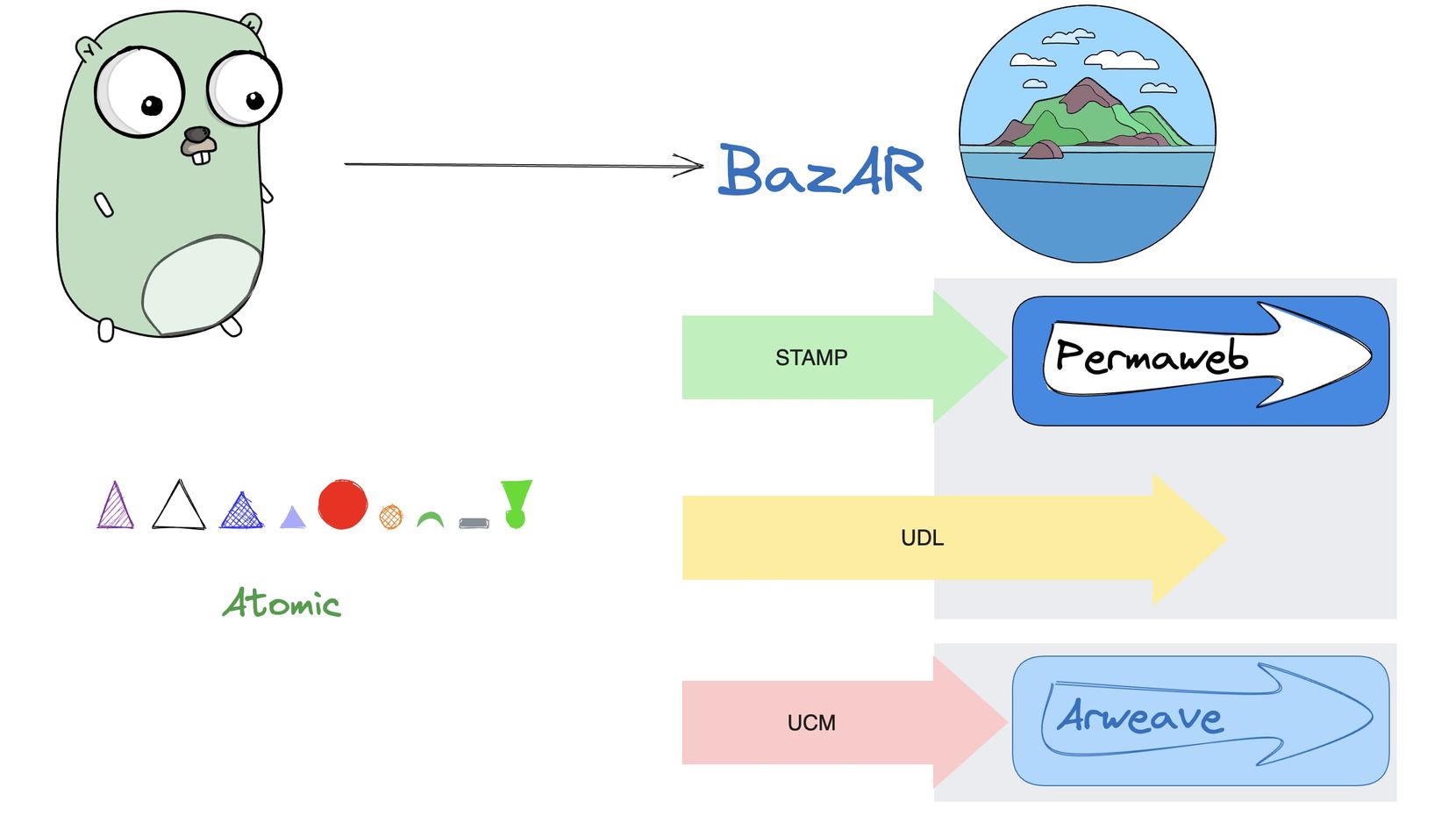

BazAR NFT: Native Composability

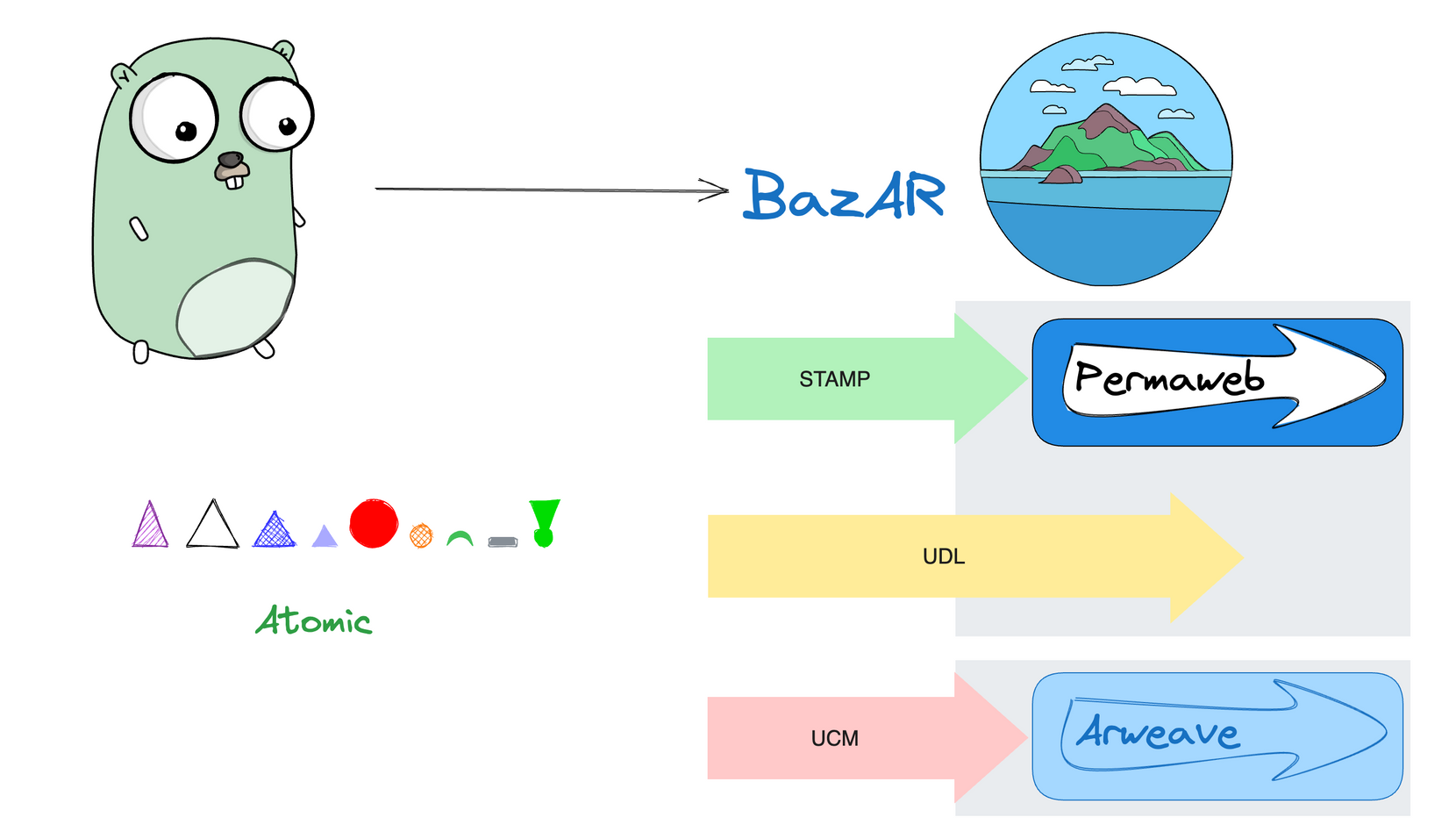

Arweave recently launched the NFT marketplace BazAR, which is mainly an experimental platform for verifying atomic asset transactions and recent major updates such as UCM/UDL/STAMP/$U that are built on the Permaweb. It is not intended to challenge Blur or OpenSea, which is the biggest difference compared to the aforementioned NFT platforms.

According to Sam, the founder of Arweave, atomic assets on Arweave can be understood as “asset data, metadata, and smart contracts all bundled into an Arweave ID.”

In this way, through smart contracts, atomic assets can be fundamentally endowed with infinite divisibility and tradability, and NFT data will be permanently saved, and transaction records will be updated accordingly. On BazAR, there are also some new changes:

1. $U can be used to purchase NFTs, which is equivalent to obtaining a discount on the storage fee on-chain, and PIXL tokens will be automatically distributed to users who purchase assets on the BazAR market every day;

2. Any NFT uploaded to BazAR can add UDL (Universal Content Protocol) to ensure that creators can track changes in NFTs and obtain continuous income from them to cope with the current royalty situation and protect the rights and interests of creators;

3. The BazAR platform meets the standards of the Universal Content Market (UCM), allowing users to eliminate any intermediaries and commission fees in the transaction process and interact with Permaweb natively;

4. In the NFT display list, users can use STAMP to rate different NFTs. STAMP is an evaluation system based on Arweave, and its tokens can circulate, allowing users to earn a share from the evaluation system.

It can be seen that BazAR’s technological composition focuses on the composability of NFTs, rather than being obsessed with NFT products or liquidity. It is more about exploring future NFT application scenarios. In the current NFT market, whether it is zero royalties or centralized storage, they are seriously harming the intrinsic value of NFTs.

Conclusion

If we believe that the virtualization process of humanity will further deepen, then how should we evaluate the market value of the Web 3.0 era?

If this value is ultimately proven to be unable to escape the control of centralized organizations, it will collapse. At that time, people will wake up from the dream.

These questions are not groundless worries, but problems that Web3’s future development must solve, just like the invention of Bitcoin. Digital gold is the value anchor for humanity to enter the information age, which is inevitable in history, and Bitcoin has taken on this value, which is rather accidental.

We return to the issue of BazAR. The current trend is that NFT itself has many problems, and we need better products to replace it, rather than being obsessed with immediate economic benefits. As Sam, the founder of Arweave, said, Arweave’s UCM standard can also be used to exchange homogeneous assets. If Uniswap X hopes to become a better aggregator, then Arweave and Permaweb are trying to create a never-ending stock exchange and Sotheby’s.

So the question here is how to choose the response measures in the face of developing problems. Of course, we can choose a perspective of denial and ridicule, watching a group of people “entertain themselves” and standing on the bank to reminisce about our own “cleverness”. But from a different perspective, we can solve it in the way of the encryption industry itself.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis There will be a sharp decline before the next rise, a bear market is approaching.

- The former secretary of the Fuzhou Municipal Party Committee, who supported mining, has been sentenced to life imprisonment, but it has also left us with many questions.

- The first debate of the Republican primary ended. Which candidates are friendly to cryptocurrencies?

- Is there really market manipulation by crypto market makers?

- Market Analysis A sharp drop is expected before the next rise, and a bear market is imminent.

- Can BTC hold the $26,000 support level? $1.9 billion BTC monthly options will tell you.

- Due to macroeconomic factors, the inflow of risk capital into cryptocurrencies further declined.