Behind the Rush of Cryptocurrency Exchanges in Vietnam Over 16 Million Crypto Users with Trading Volume Higher than Singapore

16M Crypto Users in Vietnam, Trading Volume Surpassing SingaporeAuthor: Pomelo, ChainCatcher

The favorable conditions created by the potential population growth dividend, relatively tolerant regulatory policies, and low operating costs have made Vietnam a gold mine in the eyes of professionals in various industries.

In 2021, the explosive success of the blockchain gaming product Axie Infinity attracted attention from the Web3 industry to the Vietnamese market. Many even believe that Vietnam may become an important driving force for the next wave of cryptocurrency bull market, and the focus of cryptocurrency trading will gradually shift from the current South Korean and Japanese markets to emerging Southeast Asian markets such as Vietnam and the Philippines.

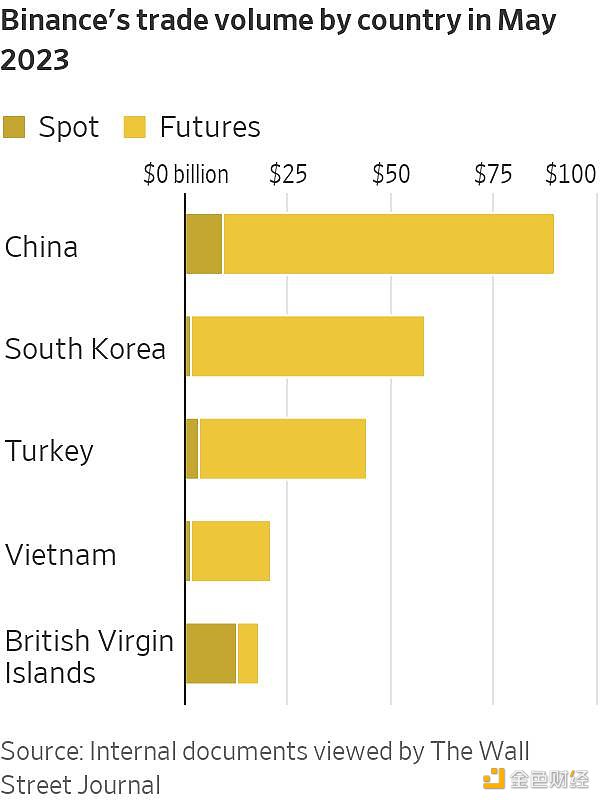

In early August, an exclusive article on “Binance’s operations in the Chinese market” published by The Wall Street Journal revealed that the Vietnamese market has risen to the top 5 in terms of trading volume on Binance. According to internal sources collected by The Wall Street Journal, in May 2023, Vietnamese investors traded approximately $20 billion on Binance, of which futures trading accounted for about 90%. The trading volume of Vietnamese users on Binance ranked fourth among many countries.

- LianGuai Daily | Former Vice Chairman of Jiangxi Provincial Political Consultative Conference, Xiao Yi, sentenced to life imprisonment; Coinbase has invested in Circle.

- Looking back at the decentralized storage track that has been neglected by the market from EthStorage

- What does Bitcoin being in an extreme oversold state mean?

The top 5 countries with the highest spot and futures trading volume on Binance in May 2023

This news quickly became the focus of local Vietnamese media outlets such as Coin68 and Coin98insight, implying that the Vietnamese market has become a key area that cannot be ignored in the cryptocurrency industry.

Compared to the top three countries, China, South Korea, and Turkey, it is quite intriguing that Vietnam has become the fourth largest trading volume country on Binance.

China, South Korea, and Turkey are not unfamiliar hotspots for cryptocurrency trading. Among them, China’s large user base in the cryptocurrency field and its ranking in terms of trading volume and number of users are not surprising. South Korea, due to its high unemployment rate and housing prices, severe class stratification, and young people viewing cryptocurrency investment as a hope for a comeback, is often regarded as the country with the most participants in speculative trading. Turkey, due to its persistently high inflation rate and the severe devaluation of its domestic currency, the lira, has led people to seek inflation-resistant assets. Stablecoins and Bitcoin are considered a good choice for Turkish people.

Although Vietnam is still an emerging market in the cryptocurrency field, various data shows that Vietnam’s number of cryptocurrency users is not lagging behind at all. Instead, it has consistently ranked first in cryptocurrency adoption in 2021 and 2022.

However, apart from Axie Infinity, there are not many reports and information about the Vietnamese market, resulting in very little understanding among users, and it has always been seen as a mysterious presence.

Since Vietnam has grown into an important region that cannot be overlooked in the cryptocurrency industry, it is now urgent to quickly understand the layout of Web3 projects and related companies in this market. As exchanges are the first point of contact for users to enter the cryptocurrency world, the trading activity of their users is often used to measure the popularity of cryptocurrency activities in the local market. So, how is the development of the cryptocurrency trading track in Vietnam?

In China, there are top exchanges such as Binance and OKEx, while in South Korea, there are Upbit and Bithumb. What are the trading platforms in the Vietnamese market? What are the criteria for local users to choose an exchange? This article will systematically analyze the current development status of the Vietnamese cryptocurrency market and the landscape of cryptocurrency exchanges.

The population dividend unleashes the growth potential of the Vietnamese cryptocurrency market, with the highest adoption rate for two consecutive years

In 2021, the phenomenon-level product Axie Infinity not only created employment and earning opportunities for people in Southeast Asian countries such as Vietnam and the Philippines, but also triggered a wave of Web3 entrepreneurship locally, giving rise to a number of globally influential Web3 projects such as the game guild Yield Guild Games (YGG) and Ancient8.

The commonality among these projects is that their founding teams are based in Vietnam. Their success has attracted attention from the cryptocurrency industry to this fertile ground in Vietnam, making it a goldmine for the Web3 industry. A large number of international capital and cryptocurrency enthusiasts have begun to enter Vietnam. Some venture capital institutions have even established special investment funds for Web3 projects created by Vietnamese teams, hoping to find the next Web3 blockbuster product like “Axie Infinity” in Vietnam.

According to the “2022 Vietnamese Cryptocurrency Market Report” released by Coin98 Insights in March this year, among the top 200 blockchain companies in the world, 7 were founded by Vietnamese, including Axie Infinity, Ancient8, Yield Guild Games, Coin98, Kyber Network, etc.

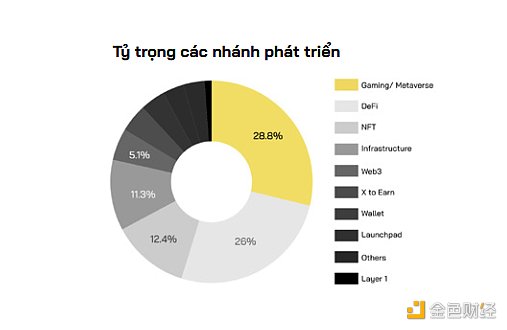

As of December 2022, there are more than 200 operational blockchain projects in Vietnam, with over 200 active blockchain projects covering multiple areas, including GameFi, DeFi, and NFT. Among them, games and metaverse projects account for 28.8%, DeFi accounts for 26.0%, NFT accounts for 12.4%, infrastructure accounts for 11.3%, and Web3 accounts for 5.1%.

Furthermore, the report also stated that the digital asset trading volume in Vietnam reached 112.6 billion USD from July 2021 to June 2022, surpassing Singapore’s 101 billion USD.

In the “Global Cryptocurrency Adoption Index” report released by blockchain data company Chainalysis, Vietnam ranked first in cryptocurrency adoption rate for two consecutive years in 2021 and 2022. In centralized services, DeFi, and P2P transactions, the Vietnamese market has demonstrated high purchasing power and population adoption rate. Hunter, a partner at Vietnamese crypto media BitouchNew, deeply understands this. He said that you can see people on the streets of Vietnam carrying black plastic bags exchanging Vietnamese dong (VND) for USDT, and USDT can also be used to pay rent and some living bills.

All these data fully demonstrate the potential and promising prospects of the cryptocurrency market in Vietnam. Currently, the development of the Vietnamese cryptocurrency market cannot be ignored. According to a report by MarketsandMarkets, the value of the Vietnamese blockchain-related market is expected to reach nearly 250 million USD by 2026, a five-fold increase from 2021.

However, for cryptocurrency companies, whether a market is profitable (such as lower costs), whether it can bring potential user growth, and whether the policies support it will all be important considerations for deciding whether to enter that market. In the current Vietnamese market, both cost and user growth seem to meet these expectations.

Firstly, in terms of cost, Vietnam can provide relatively cheap labor. According to Coin98 Insights report, the average salary of blockchain professionals in Vietnam is relatively low compared to the global average. For example, the average salary for blockchain HR in Vietnam is $30,000 per year, while in North America it is $42,000 per year. For the most important developer position in Web3 companies, the average monthly salary for management is $2526.

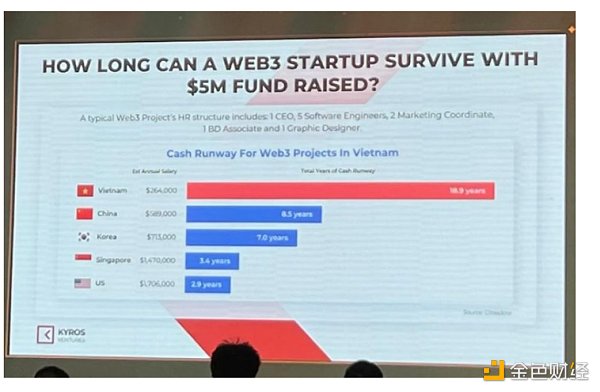

Among them, during the “GM Vietnam Blockchain Week” event held in Ho Chi Minh City in July this year, the organizer Kyros Ventures provided the following data:

Assuming a Web3 startup company with a 10-person structure (1 CEO, 5 engineers, 2 marketers, 1 BD, and 1 designer) has an initial funding of $5 million, if the headquarters are located in Vietnam, this configuration can enable the company to operate for 18 years. The same configuration can last for 8.5 years in China, only 3.4 years in Singapore, and only 2.9 years in the United States.

Secondly, the population growth dividend in Vietnam can bring potential user growth for cryptocurrency companies. In April this year, the population of Vietnam officially exceeded 100 million, becoming the third Southeast Asian country with a population of over 100 million after Indonesia and the Philippines. The majority of the population is young people, with the age group of 18-34 accounting for the majority, which perfectly matches the target audience for cryptocurrencies and provides an ideal soil for the adoption of cryptocurrencies.

In addition, Vietnam has a high mobile internet penetration rate, and the cost of users learning Web3 is relatively low. As long as companies take appropriate incentive measures, they can attract these people and potentially gain user growth. According to data, there are currently more than 16.6 million cryptocurrency holders in Vietnam, accounting for one-fifth of the total population, and 31% of them hold Bitcoin.

In terms of policies, currently, the Vietnamese government does not have a clear regulatory framework for cryptocurrencies, so such asset transactions are still in a gray area.

Although as early as 2018, the State Bank of Vietnam (SBV) explicitly prohibited all transactions related to cryptocurrencies through the banking system, it did not prevent Vietnamese users from using cryptocurrencies. In July 2021, the Prime Minister of Vietnam announced an initiative instructing the State Bank of Vietnam to research and conduct a pilot project on digital currencies, and also stated that cryptocurrencies and blockchain are technologies that Vietnam hopes to develop and master, which is conducive to building a digital government.

In addition, as the application and demand for cryptocurrencies in Vietnam continue to grow, the Vietnamese government has also begun to recognize the potential and importance of cryptocurrencies and is exploring how to regulate and manage the cryptocurrency market. In July last year, Vietnamese Prime Minister Pham Minh Chinh called on the Vietnamese government to study cryptocurrency regulation and include amendments to virtual currency in the anti-money laundering bill. However, the regulatory bill has been delayed in implementation.

Regarding the implementation of cryptocurrency regulation policies in Vietnam, Hunter mentioned that the complexity of the Vietnamese government’s structure means that it is not easy to formulate relevant cryptocurrency policies. It requires consultation and agreement from multiple government departments before any conclusion can be reached. Therefore, there is unlikely to be specific cryptocurrency policies in the short term.

It can be seen that Vietnam currently has a young and relatively low-cost labor force and is open to new technologies such as blockchain. The ambiguous regulatory policies also provide opportunities for the development of cryptocurrency-related projects.

What cryptocurrency trading platforms are there in the Vietnamese market?

As the first entry point for users to access the cryptocurrency world, exchanges are where most users and liquidity funds are concentrated in the cryptocurrency market. The trading volume and user activity of a platform are often important indicators of whether a market is prosperous. Vietnam, considered to have the most market potential, naturally became a gold mine in the eyes of cryptocurrency exchanges, and many of them flocked to establish a presence in Vietnam.

As early as 2019, Binance had already expanded into the Vietnamese market. Its CEO, Changpeng Zhao, also spoke at the Binance Vietnam Blockchain Week in 2020, stating, “Since 2018, Vietnam has been one of our markets with the highest user activity. Vietnamese users have shown great enthusiasm for blockchain-based financing and trading, and Vietnam is likely to become the next global blockchain innovation center.” In 2022, Changpeng Zhao appeared in Vietnam again and attended the Vietnamese NFT Summit held in Hanoi, signing a strategic partnership with the Vietnam Blockchain Association (VBA).

During the same period, well-known exchanges such as OKX, Huobi, and Bithumb also announced the opening of their Vietnamese platforms and entered the Vietnamese market. There are still exchanges making their presence in this market. In June of this year, the cryptocurrency trading platform Blofin announced the launch of a Vietnamese language page for its trading platform services in the Vietnamese market.

So, what trading platforms are available for users in Vietnam? What are the differences in products offered by these platforms for Vietnamese users, and what special privileges do they provide?

1. Mainstream international exchanges that early positioned themselves in Vietnam

Binance’s C2C supports buying and selling cryptocurrencies with Vietnamese Dong (VND) using credit cards

Binance’s C2C business launched its Vietnamese Dong (VND) buying and selling function as early as 2020 and supports users to directly buy and sell BTC, USDT, ETH, BNB, BUSD, and other cryptocurrencies using credit cards such as Visa.

According to its official Vietnamese page, Binance has listed over 350 cryptocurrencies with trading fees as low as 0.1%.

In 2022, Binance announced a strategic partnership with the Vietnam Blockchain Association (VBA) to jointly explore the research and application of blockchain technology and provide training for relevant talents in Vietnam.

OKX supports Vietnamese users to trade with VND

Compared to Binance, OKX has an earlier layout in the Vietnamese market. In 2018, its fiat trading zone opened VND trading services, supporting Vietnamese users to place VND trading orders and launching a Vietnamese version of its contract trading product.

MEXC is known for its variety of asset types in Vietnam

For MEXC users, the main reason for choosing MEXC among many exchanges is its rich assets. Various innovative projects can be found on MEXC. It is reported that MEXC currently supports trading of over 1500 cryptocurrencies. MEXC supported the Vietnamese language version since August 2019.

Bybit’s trading volume in the Vietnamese market doubled in 2022

According to the “Bybit Next Level 2022” performance report released by Bybit in September 2022, its total trading volume in the Vietnamese market doubled (109%).

According to an interview with its founder Ben, Bybit has been focusing on the Southeast Asian market since 2020.

What sets Bybit apart is that it does not require KYC for cryptocurrency trading, allowing investors to start trading with just an email and password. This makes Bybit an attractive choice for Vietnamese investors. In addition, the platform provides a channel for Vietnamese dong fiat currency deposits and withdrawals, offers zero fees for spot market trading in the short term, and has a dedicated customer service team to handle inquiries from Vietnamese customers.

Huobi had quietly cultivated the Vietnamese market

At the same time as OKX, Huobi’s OTC trading zone began to support VND issuance and launched a Vietnamese version of its contract trading platform in 2019. According to industry insiders, Vietnam was a key overseas market that Huobi focused on in 2022 and provided a series of preferential policies to support Vietnamese partners, such as generous commission ratios, attracting many professional traders with financial strength to join the platform. However, since October 2022, after being acquired by a fund under Hong Kong-based Matrixport, Huobi’s business in Vietnam has been temporarily suspended.

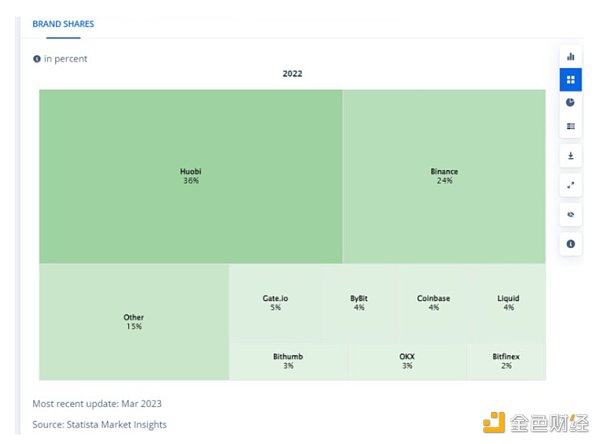

According to data from Statista, Huobi’s market share exceeded Binance’s for a short period of time in 2022.

BingX has established a foothold in the local market through cooperation with Vietnamese community KOLs.

The derivative trading platform BingX, formerly known as “BingBon,” was renamed in November 2021. Through cooperation with local Vietnamese community KOLs, it quickly gained a foothold in the Vietnamese market and has established offices in Vietnam. According to its year-end report in 2022, it has hired over 200 positions for its global offices in Germany, Turkey, South Korea, Vietnam, and other regions.

2. OTC Platforms Dominate in Vietnam

P2P Trading Platform Remitano

Remitano is a local Vietnamese peer-to-peer cryptocurrency trading platform established in 2014. It supports users to purchase assets such as BTC, USDT, ETH, and BNB in a peer-to-peer manner. Since the entry of other exchanges like Binance, this platform has become an important base for cryptocurrency trading in Vietnam and the main birthplace of Vietnamese OG players. However, due to the P2P trading model, each transaction requires confirmation from both parties, resulting in lower efficiency. As a result, it has faced competition from overseas exchanges.

Vietnamese OTC Trading Platform BitcoinVN

BitcoinVN is the largest local cryptocurrency OTC trading platform in Vietnam. The platform supports spot trading and fiat trading, including various fiat channels such as the Vietnamese dong.

In summary, there are only a few localized exchanges in Vietnam, most of which are OTC platforms.

Vietnamese Cryptocurrency Trading Landscape: Overseas Platforms Dominate, Users Prefer Large, Secure Exchanges

“The Vietnamese cryptocurrency market lacks mature local trading platforms and mainly relies on foreign brands. Local investors tend to choose foreign platforms,” is a consensus among industry insiders familiar with the Vietnamese market. Currently, several cryptocurrency trading platforms have opened Vietnamese versions. What is the current landscape of Vietnamese exchanges? What are the criteria for Vietnamese local investors in selecting exchanges?

In fact, the Vietnamese cryptocurrency market also follows the 80/20 rule, where the top exchanges occupy around 80% of the market share, while the remaining platforms share the remaining 20%.

The criteria for Vietnamese users in selecting exchanges are not much different from those in China. Mumu, a local Vietnamese person working in the cryptocurrency industry, stated that asset security and platform reliability are the primary factors for Vietnamese users when choosing a trading platform. Secondary factors include whether the website is user-friendly for Vietnamese users (such as supporting Vietnamese language and accepting Vietnamese dong or local bank deposits/withdrawals), the depth of asset liquidity on the platform, timely and professional customer service, trading fees, and the variety of supported assets.

In addition, she added that the mindset of many Vietnamese people is similar to that of Chinese people. Just as Chinese users choose trading platforms, Vietnamese users also prioritize industry-leading platforms that support Vietnamese versions.

Currently, the popular cryptocurrency platforms in the Vietnamese market are mostly platforms previously used by domestic users, such as Binance, Bybit, MEXC, etc.

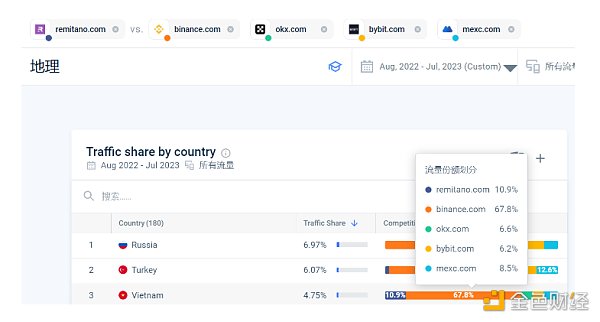

According to SimilarWeb’s statistics on the traffic share of 5 trading platform websites, in the past year, Binance’s official website search traffic accounted for about 70% of the overall website search traffic in the Vietnamese market, followed by Remitano with about 10%, and then MEXC, OKX, Bybit, etc.

Tam, a Vietnamese cryptocurrency OG user, is not surprised by this statistical data. He explained that based on personal experience and the data he has, this market share is basically consistent with his prediction. In Vietnam, Binance has the largest market share, followed by Bybit, OKX, MEXC, and local platform Remitano.

He explained that the reason for such a prediction is that Binance is currently the leading trading platform, relatively reliable in terms of security, supports a wide variety of cryptocurrencies, and is a comprehensive exchange (supporting spot and futures trading). It is also very user-friendly for Vietnamese users (with a Vietnamese language page and supports the use of Vietnamese credit and bank cards). Most Vietnamese users would choose Binance as their first choice. Remitano has many Vietnamese OG users, Bybit’s futures and other derivatives are excellent and have relatively low trading fees, OKX has an earlier layout in Vietnam, and MEXC supports a wide variety of assets. Of course, there are also some players who use other less well-known platforms or try some new platforms. However, this is not mainstream in Vietnam. Currently, the well-known and recognized platforms in Vietnam are mostly the leading platforms in the global cryptocurrency trading arena and some platforms that have entered the Vietnamese market for a while and can provide their own advantages.

It can be seen that the competition pattern in the Vietnamese cryptocurrency trading market has entered a white-hot stage. Currently, it is mainly dominated by overseas leading platforms. It is difficult for newly-entered trading platforms to break through in a short period of time without some strategies or unique advantages.

Entering Vietnam is still a good opportunity, and operational strategies need to be adapted to the local conditions

Although the current competition in the Vietnamese cryptocurrency trading market seems to be quite sufficient, for a market with population growth dividends, whether it is an exchange or other Web3 projects, entering the Vietnamese market is still a good opportunity.

Tina, who has studied the Vietnamese market, agrees with this view. He said that many Web3 companies are already focusing on the Vietnamese market, especially this year. At the GM Vietnam Blockchain Week event held by Coin98 and Kyros Ventures in July, you can see booths of well-known projects from all over the world, such as Polygon, Aptos, Coinbase, Chainlink, Avalanche, etc., and you can meet cryptocurrency enthusiasts from various countries. The conference is very international.

This is very different from the previous Korean blockchain events that I participated in. In the Korean events I participated in this year, most of the attendees were Koreans, and there were very few foreigners. In contrast, the conferences held in Vietnam this year have very international participants, and the discussions are also very in line with the industry’s frontier. For example, the BRC20 conference a few months ago, and some project initiators behind are Vietnamese or Vietnamese community members. Earlier in the same month, the Vietnam Blockchain Association and Spores Network announced a collaboration to launch the Web3 accelerator program SwitchUp in Vietnam, with more than 50 funds and international organizations investing to support Web3 startups in the Vietnamese region.

He also said that developers he encountered in Vietnam generally have good English proficiency, which makes Vietnam a very efficient place for projects that want to expand globally. There are also many projects and training programs in Vietnamese universities that collaborate with blockchain companies, which can provide high-quality Web3 talent. In addition, Vietnamese users are willing to spend money and time to understand the knowledge of the cryptocurrency industry. Many Vietnamese friends are willing to spend tens of thousands of dollars to participate in blockchain-related training courses and learn how to trade coins and related development knowledge in their spare time.

However, Web3 projects still need to develop operational strategies that cater to local user habits in order to achieve results in the Vietnamese market.

Tina explained that when it comes to social channels, Vietnamese users prefer to use Facebook rather than Twitter and YouTube, so Web3 companies entering Vietnam should prioritize Facebook. In addition, some crypto communities in Vietnam have strong appeal. For example, BingX quickly gained a foothold in the Vietnamese market by collaborating with the community.

He also added that Vietnamese crypto users do not invest a large amount of money, with an average of 100 USD per person. The disclosed data from Binance also shows that Vietnamese users prefer high-risk futures with a speculative nature. Companies should not neglect their services to users just because they invest small amounts of money. This is mainly because most crypto users who participate in investments are young people who have just entered the workforce and their current income is not high, resulting in relatively low investment amounts. However, this also means that as their wages increase, the amount of their investments will also increase in the future.

Of course, this does not mean that entering the Vietnamese market has no disadvantages. The current greatest uncertainty comes from government regulation. As there is currently no specific regulatory framework in place, Web3 projects are in a stage of wild development. Once regulatory policies are truly introduced, they will inevitably have an impact on some companies.

However, there is also a view that when regulations are truly introduced, they may have a short-term negative impact on the Web3 industry. But in the long run, clear regulations may encourage wider adoption, improve policies, and lay the foundation for the participation of individual investors and institutions, providing greater protection for investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What impact would it have if the US SEC approves Ethereum futures ETF?

- In-depth analysis of how the MEV market transitions from ‘zero-sum game’ to ‘separation of powers

- Ethereum Futures ETF may be approved what will happen to the price?

- Reviewing the impact of US bond yields on the cryptocurrency market over the past two years a similar autumn market may very likely occur, just like the spring market this year.

- Survival Skills in the Cryptocurrency Dark Forest Wallet Security Strategies and Risk Hierarchy Management

- The truth hidden in 6,599 blockchain case judgments the verdicts are a mystery, and the execution is even more challenging.

- Why is Bitcoin falling? Analysts point out 5 potential reasons