Binance Research In-depth Study of Decentralized Sorters

Binance Research In-depth Study of Decentralized SortersAuthor: Binance Research, Compiled by: Lynn, MarsBit

1. Key Points

❖ Transaction ordering has become an increasingly serious problem in the second layer (L2) space. The main purpose of L2 rollups is to provide a secure place for cheap transactions. L2 rollups provide an execution layer for users, which then submits their transaction data to the higher-level first layer (L1), such as Ethereum’s Arbitrum, Optimism, zkSync, etc.

❖ The sequencer is an entity that has the authority to order these transactions into groups. The sequencer receives unordered transactions from users, processes them off-chain into groups, and then generates a batch of compressed ordered transactions. These transactions can then be included in blocks and sent to the parent L1.

❖ Rollups do not actually require sequencers; this is just a design choice to provide users with a better experience with lower fees and faster transaction confirmation speeds. For example, just as most rollups use Ethereum’s base layer for data availability, they can also use the base layer for ordering. However, Ethereum’s base layer may be relatively inefficient and expensive. This means that so far, every major L2 rollup project has found it more convenient, cheaper, and user-friendly to run a centralized sequencer.

- Dida Chain The ‘AMM Moment’ of Full-chain Gaming

- Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.

- Interpreting the Road to Web3 Gold Mining in the Central African Republic

❖ Since the sequencer controls the ordering of transactions, it has the authority to censor user transactions (although complete censorship is unlikely as users can directly submit transactions to L1). The sequencer can also extract maximum extractable value (MEV), which can cause economic losses to the user base. Additionally, validity can also be a major concern, i.e., if the only centralized sequencer goes down, users will be unable to use that sequencer, and the entire rollup will be affected.

❖ The solution to the problem is a shared, decentralized sequencer. A shared sequencer essentially provides decentralized services to rollups. In addition to addressing issues such as censorship, MEV extraction, and validity, a shared sequencer also introduces cross-rollup functionality, opening up various new possibilities. Espresso, Astria, and Radius are developing innovative shared sequencing solutions, each with their unique features in their respective architectures. Espresso seeks to leverage EigenLayer to bootstrap its network, while Astria maintains close ties to modular data availability network Celestia. Radius brings its unique encrypted mempool into the conversation.

2. Introduction

As the Ethereum L2 scaling ecosystem continues to grow, one aspect that is often overlooked is the sequencer. The sequencer is responsible for transaction ordering, and using a sequencer with rollups can provide a better user experience, lower costs, and faster transaction confirmations. However, the problem is that so far, all major Ethereum L2 companies have found it most convenient, user-friendly, and cost-effective to run their own unique centralized sequencer. Considering the power that sequencers have in transaction censorship, MEV extraction, and creating a single point of failure (i.e., validity issues), this could be seen as an undesirable outcome, and it does not align with the spirit of cryptocurrencies.

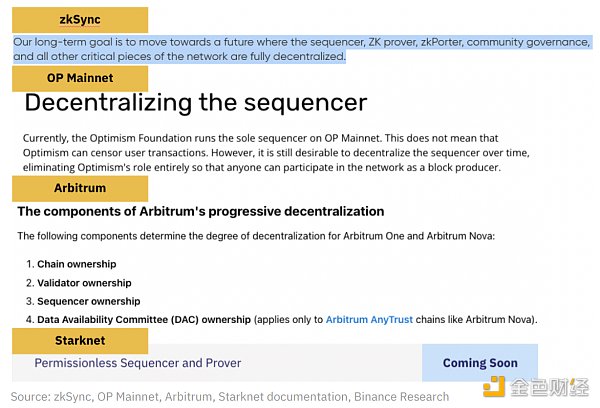

While most cryptocurrency companies have solved the decentralization problem of their respective sequencers and included it as part of their roadmap, there is still no real consensus on how to achieve decentralization. It should also be noted that Arbitrum and Optimism have launched their own solutions since the second half of 2021, but they have not made substantial progress in decentralized sequencers.

In this report, we will carefully examine the role of sequencers and the current state of the Ethereum rollup space. Then, we delve into projects that are researching solutions, namely decentralized shared ordering networks. We will provide detailed introductions to these projects and the unique aspects of their solutions. We also contemplate what this means for the future development of the Ethereum L2 rollup space.

3. What is a sequencer?

To take a step back, a blockchain is a distributed data ledger composed of transaction data with timestamps sorted by blocks. Initially, this transaction data is unordered and unorganized. After sorting, it can be organized into blocks and executed to create a new state of the blockchain. For a first layer (“L1”) blockchain like Ethereum, this transaction ordering happens within the Ethereum base layer itself.

In the most popular scalability solution for Ethereum, Layer-2 (“L2”) rollup, transaction ordering has become an increasingly serious issue. Remember, the main purpose of rollups is to provide users with a secure and cost-effective transaction venue. Simply put, L2 rollup provides an execution layer for users, and then submits their transaction data to the superior L1, such as Ethereum’s Arbitrum, Optimism, zkSync, etc. The batch of transactions submitted to L1 usually includes hundreds or thousands of compressed L2 transactions, reducing the cost of sending data to L1.

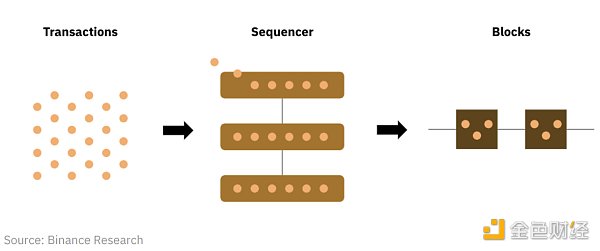

In the L2 rollup world, a sequencer is an entity with the authority to order transactions into groups. Sequencers receive unordered transactions from users, process them off-chain into groups, and generate batches of compressed and ordered transactions. These transactions can then be put into blocks and sent to the parent L1. Batched transactions can also be used on the Data Availability (“DA”) layer (usually Ethereum, for the majority of current rollups). It also provides users with soft commitment, meaning that after receiving a user’s transaction, the sequencer provides an almost instant receipt as a “soft confirmation” (1). “Hard confirmation” is received after the transaction is sent to the L1 layer.

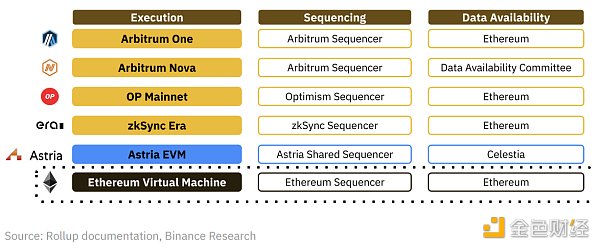

Figure 1: Application scope of sequencers?

Why do Rollups use sequencers, and why is it a problem?

Fundamentally, sequencers have a very clear goal: to improve user experience. Using sequencers for L2 transactions is like using the “fast lane,” meaning lower fees and faster transaction confirmations. In fact, sequencers can compress hundreds or thousands (2) of L2 transactions into a single L1 transaction, saving gas fees. Additionally, the soft confirmation provided by sequencers means that rollup transactions can offer quick block confirmations for users. This combination helps improve the user experience of using L2 rollups.

It is important to remember that rollups do not require an ordering mechanism; it is simply a design choice made for better user experience. For example, just like most rollups use Ethereum L1 to improve data availability, they can also use it for ordering. Ethereum Foundation’s Justin Drake recently referred to these as “rollup-based” (3). However, Ethereum’s base layer is likely to be relatively inefficient and expensive, especially considering the large volume of L2 transactions. Essentially, the transaction throughput of rollups will be limited by the data ordering rate of Ethereum L1. Users will also experience the same transaction confirmation delays as trading on Ethereum. This means that, so far, every major L2 scaling project has found it more convenient, cheaper, and easier for users to run a centralized ordering mechanism. Although L2 users can submit transactions directly to L1 to bypass the ordering mechanism, they have to pay transaction gas fees to L1, and the transactions may take longer to complete. This largely contradicts the original intention of using L2 rollup to execute transactions.

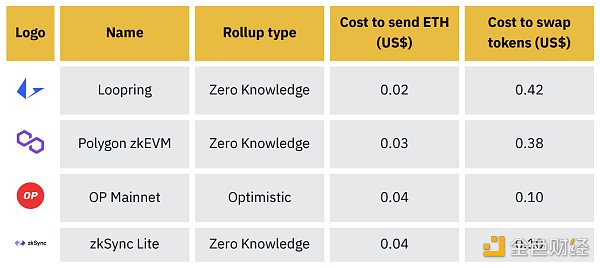

Figure 2: An ordering mechanism can help aggregate multiple transactions into a single L1 transaction, making the transaction costs on L2 several times lower than those on Ethereum L1.

Given that the ordering mechanism controls the order of transactions, theoretically it has the right to exclude user transactions from it (although users can submit transactions directly to L1 if they have the ability and willingness to pay gas fees). The ordering mechanism can also extract MEV (to be discussed later) from the transaction pool, which may cause economic losses to the user group. If there is only one ordering mechanism, as is the case with all major rollup transactions currently, the centralization risk will be greater. In this case, validity may become an issue, meaning that if the sole ordering mechanism fails, the entire rollup will be affected. A multi-ordering mechanism setup can reduce this risk.

In this setup, the ordering mechanism can be seen as a semi-trusted party for users. While the ordering mechanism cannot prevent users from using L2, it can delay their transactions, causing them to pay additional gas fees and extract value from their transactions.

Relevance of MEV

MEV is particularly important here. MEV refers to the value obtained from block production that goes beyond the first-order mining (or staking) block rewards and gas fees. It is the value extracted by manipulating transactions within the block, i.e., by including, excluding, and changing the order of transactions. For example, common forms of extracting MEV include front-running and sandwich attacks.

Given the role that ordering mechanisms play in L2 rollups, they have access to all off-chain user transactions. Additionally, as these sequencers are typically operated by the project itself or affiliated teams, such as the Optimism Foundation for OP Mainnet (4) and the Arbitrum Foundation for Arbitrum One and Nova (5), many users are concerned that they cannot see potential MEV extraction. Even without these concerns, the credibility and decentralization of these protocols will be impacted as they run their own centralized ordering mechanisms. The trustworthiness and decentralization of these protocols will certainly be questioned.

Market Status of Sorters

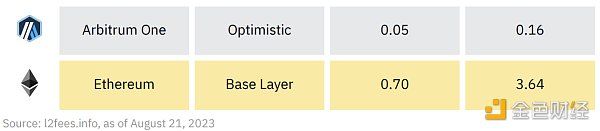

At the time of writing this article, all major Ethereum Layer 2 (L2) solutions rely on centralized sorters. As more Ethereum transactions move to L2 solutions, it seems that a significant number of transactions (those on L2) are influenced by centralized powers in the form of a single sorter, despite the decentralized nature of Ethereum’s validator set.

Figure 3: All top Ethereum L2 rollups use proprietary centralized sorters

As expected, most of these companies have addressed the decentralization issue of their respective sorters and have included it as part of their roadmap. While this is a positive signal that decentralization is part of the L2 vision, it should be noted that Arbitrum and Optimism have already launched their own solutions since the end of 2021 and have yet to make substantial progress in decentralized sorters.

Figure 4: All top rollups handle the decentralization issue of sorters in their documents

Most top companies seem to allocate resources to improving their core products and features rather than focusing on decentralization. This is not entirely a criticism, as it is understandable to prioritize decentralization to a lesser extent before having a competitive product in a competitive environment. However, with the maturation of network companies, this perspective is changing, and discussions are rapidly shifting towards sorter decentralization and improving trustworthiness.

Other Issues

It is worth emphasizing that there is some discussion about the level of risk associated with relying on centralized sorters.

As mentioned above, since sorters control the order of transactions, they can exclude user transactions and extract MEV (Miner Extractable Value). However, sorters cannot completely exclude users from rollup transactions. Users can bypass sorters and directly submit transactions to L1 (as long as they are willing to pay the increased gas cost). While improper behavior by sorters may result in transaction delays and additional costs for users, they ultimately cannot fully censor them. Prior to this, no major L2 company has been particularly focused on decentralizing its sorters, which is likely one of the reasons. Nevertheless, the reordering of transactions by sorters to extract MEV remains a problem, especially with private mempools like OP Mainnet(6).

Perhaps, a bigger issue lies in real-time responsiveness. Given that major rollup implementations are running a single centralized sorter, if these sorters encounter issues, the entire rollup implementation would be adversely affected. While users can still complete transactions by directly accessing L1, this is not a particularly sustainable method and is unlikely to work for most transactions. Remember, the whole point of using L2 rollups is to save transaction costs. Considering that one of the fundamental ideas behind cryptocurrencies is to avoid reliance on a single centralized provider (as in traditional finance), the centralization of sorters is obviously a significant problem that needs to be addressed, and it is one of the key unlocks that shared sorters will bring to the L2 rollup market.

4. Solution: Decentralized Shared Sorter

Overview

The new solution to address the issues mentioned above is a decentralized shared sorter. Although the solutions may vary for different projects, the basic concept is to replace the centralized sequencer. The term “shared” refers to multiple different rollups being able to use the same network, meaning transactions from multiple rollups are aggregated in a mempool before being sorted (which helps reduce the possibility of MEV extraction and front-running). The term “decentralized” refers to the concept of leader rotation, where transactions are not always sorted by a single actor but a leader is selected from a group of decentralized actors. This helps prevent censorship and provides validity guarantees.

This is similar to how various L1s operate with leader rotation mechanisms. In fact, building a decentralized sorting layer is similar to building a decentralized L1, as it requires constructing a set of validators. As we will see later in this section, different projects have taken different approaches to meet this requirement.

The shared sorter aims to mitigate MEV extraction issues, provide censorship resistance, and improve the validity guarantees of rollups, addressing the issues faced by centralized sorters (as described above). Additionally, there are two noteworthy points:

-

Decentralized as a service: The shared sorter solution aims to provide decentralized sorting services for any number of rollups. As a result, all these rollups can benefit from the censorship resistance and real-time capabilities provided by the decentralized network without having to build the network themselves. Given that this can be a costly and time-consuming process, this is a major selling point of the shared sorter network. It is worth noting that currently no company has decentralized its sequencer, and most of them have enough funds (7)(8)(9) to do so, indicating that this is not a completely trivial problem. If companies like Astria or Espresso could offer out-of-the-box decentralized sorter services, rollup companies can continue to focus on differentiation and optimizing performance to better serve different users.

-

Cross-rollup composability: Since these shared sorter solutions aim to handle transaction sorting for multiple rollups, they can provide unique interoperability guarantees that are currently unavailable. For example, users should be able to specify that transactions on Rollup 1 can only be included in a block if different transactions on Rollup 2 are also included in the same block. By enabling conditional transaction inclusion, shared sorters can unlock new possibilities, including atomic cross-rollup arbitrage.

Many projects are researching shared sorting solutions. We will focus on several of them and their strategies in the following sections.

Espresso

Espresso Systems is a company dedicated to building tools that bring Web3 into the mainstream, with a particular focus on L2 rollups and the Ethereum ecosystem. Before working on the shared sorter, they have been committed to improving blockchain privacy and have developed the CAPE (10) application. They have also contributed to open-source developer tools through initiatives like the Jellyfish (11) cryptographic library and Hyperplonk (12).

In November 2022, Espresso began sharing their work on the Espresso Sequencer.

-

Overview

-

The Espresso Sequencer is a decentralized shared ordering network designed for decentralized rollups, providing secure, high-throughput, low-latency transaction ordering and data availability.

-

Its design purpose is to handle decentralized ordering and data availability for rollups, acting as middleware between the rollup and the underlying L1.

-

The design of the Espresso Sequencer is agnostic to the virtual machine (“VM”), meaning it can be used for non-Ethereum VMs as well as zero-knowledge (“zk”) VMs and optimistic VMs.

-

How does it work?

-

The core of the sequencer is the HotShot consensus protocol. HotShot is based on the HotStuff (13) consensus protocol and combines the latest developments from various domains (14) (pacer, verifiable information distribution (“VID”), etc.).

-

HotShot is open and permissionless, it decentralizes power in the sequencer network, providing high throughput and fast finality while ensuring security and effectiveness. HotShot adopts a proof-of-stake (PoS) security model, and one of the key requirements Espresso team has for it is to achieve strong performance without affecting the scale of the validator set. Specifically, HotShot should be able to scale to include all Ethereum validators (currently over 700,000 (15)).

-

Espresso Systems aims to achieve Ethereum-level security for its sequencer by utilizing Ethereum’s existing validator set. This setup has two key reasons:

-

Security: The cost of launching a decentralized PoS consensus protocol is extremely high and requires a significant amount of energy. Even then, acquiring a sufficient number of network participants can be a major challenge. By using the same validators as Ethereum, the sequencer can achieve a level of security, effectiveness, and decentralization that would be difficult to achieve on its own. The Espresso sequencer can benefit from sharing the cryptographic economic security of the second-largest decentralized cryptocurrency, recognized just after Bitcoin.

-

Incentive alignment: Conceptually, it makes sense to have Ethereum L1 validators participate in running the protocol that the Ethereum L2 rollup operates on. In practice, in a centralized sequencer setup, almost all costs and MEV generated by the rollup could be captured by the sequencer. Without sharing this value (or sharing it very little) with L1 validators, there is a concern about the impact on the security of the rollup. For example, L1 validators could be bribed to fork the rollup and gain more profit than honestly managing the rollup contract. Decentralizing the sequencer and working with L1 validators ensures its security and reduces such concerns.

-

Espresso will seek to achieve Ethereum-level security for its sequencer by establishing this collaboration, especially with EigenLayer. Through EigenLayer repricing, users can stake their Ethereum and Ethereum liquidity staking tokens (“LST”) across multiple protocols, extending the economic security beyond Ethereum itself. By doing so, they can earn fees as a return, but they also agree to additional slashing conditions. Re-staking is a subsidized way to enter the system as stakers do not need to deploy additional capital, only use their previously staked Ethereum. This reduces the capital cost of securing other protocols, meaning the Espresso Sequencer can tap into Ethereum’s capital base and decentralized validator set without launching its own validator set.

-

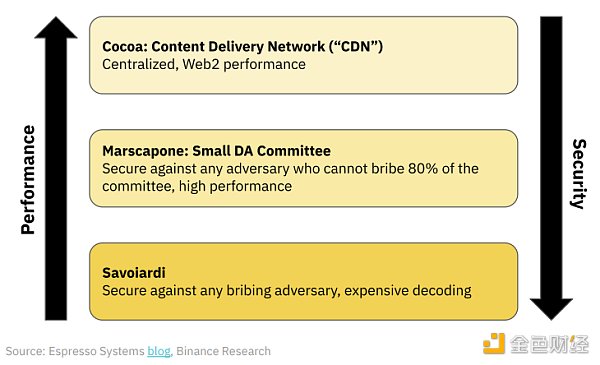

Tiramisu data availability (16)

-

As mentioned earlier, most rollups rely on L1 blockchains like Ethereum to provide data. However, this is not ideal as block space on L1 blockchains like Ethereum is scarce and expensive, resulting in high transaction fees for users – an undesirable outcome. Espresso Systems addresses this issue using its efficient Tiramisu data availability solution.

-

Like the classic Italian dessert, the Tiramisu solution has three novel layers. Together, they ensure data is provided to the parties that need it – in our case, the rollups ordering transactions.

-

The foundational layer of Tiramisu is called Savoiardi. It is an anti-bribery layer (similar to Ethereum’s danksharding proposal) that provides the highest level of security. However, due to this feature, it is the least user-friendly layer of the three. To address this issue, Espresso adds two additional layers to its solution.

-

Mascarpone is the middle layer that ensures efficient data recovery by electing a small data management committee.

-

Cocoa is appropriately named the “top-layer sprinkles” of the entire system. Cocoa helps Tiramisu provide “Web2-level performance” by providing a content delivery network for Tiramisu. This aids in efficient data recovery and significantly speeds up data propagation. Given that this layer is inherently centralized (17), it is entirely optional and Tiramisu can function perfectly without it. It helps accelerate data availability and can be easily modified or removed.

-

It should be noted that Espresso Systems designed its protocol with flexibility and modularity in mind, and rollup devices using its sequencer can use any other data availability solution if they don’t want to use Tiramisu.

Figure 5: Three Levels of Tiramisu Data Availability Solution

-

Famous Partners (18)

-

Since July, the Espresso Systems team has been continuously announcing partnerships. EigenLayer was the first company to announce such a partnership, given its importance in the Espresso Sequencer architecture, and it is worth paying close attention to its development. EigenLayer itself launched the first phase mainnet on June 14.

-

When announcing the Doppio testnet, Espresso also announced a partnership with Polygon zkEVM. This partnership represents the first end-to-end integration of the Espresso Sequencer with a full-featured zk-rollup (a fork of Polygon zkEVM). The test network allows users to submit transactions to the fork and then routes and sorts them through nodes running the Espresso HotShot protocol.

-

Espresso supports the integration of Injective’s sequencer into Cascade, an IBC (19) Cosmos SDK chain. Cascade is the first interchain Solana SVM rollup in the IBC ecosystem, allowing Solana contracts to be deployed on Injective and the wider IBC ecosystem for the first time. Integration with the Cascade testnet is expected to be completed by the end of 2023, with the mainnet expected to be completed by 2024.

-

AltLayer has also joined the Espresso Systems ecosystem. AltLayer is a rollup-as-a-service platform that allows developers to launch highly scalable startups with support for multiple virtual machines. Through this partnership, developers will be able to decide whether to use AltLayer’s solution and/or the Espresso Sequencer to launch their startups. The two teams will also collaborate on developing other integrated products to see how their designs complement each other.

-

Espresso Systems is partnering with Caldera to deploy an optimistic rollup based on the OP Stack, which uses the Espresso Sequencer and Tiramisu. Caldera enables developers to deploy custom rollups for their applications. After deploying this extension, future L2s built on Caldera will be able to easily choose Espresso Sequencer and Tiramisu as plug-in components for their extensions.

-

Spire, an L3 (Layer 3) as-a-service company, announced its integration with Espresso Sequencer and Tiramisu. Spire’s infrastructure allows developers to easily deploy their own L3 application chains on top of zkEVM L2. Spire will work with the Espresso team to integrate their solution into the Spire L3 framework. The test network is expected to be built by 2024.

-

Latest Updates

-

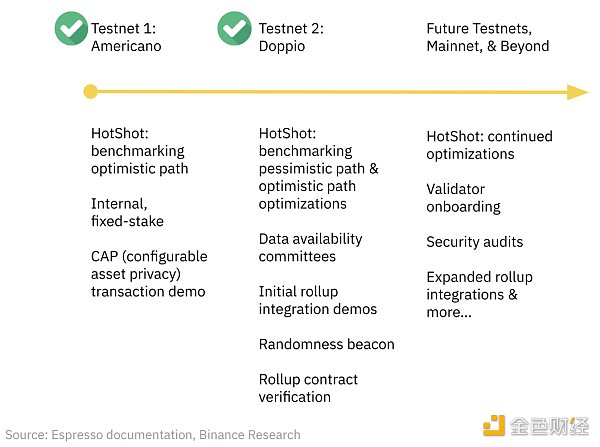

November 28, 2022: Americano is the first test network for Espresso Sequencer and HotShot. The original post contains more technical details, but it should be noted that this is an internal test network and is not open to the public.

Figure 6: Project Roadmap released with Americano testnet and initial announcement

-

July 20, 2023: Doppio is the second major milestone and test network for HotShot and Espresso Sequencer. At the same time, Espresso Systems released the whitepaper for the entire project. Doppio brings many efficiency improvements to HotShot, including Verifiable Information Decentralization (VID), a new view synchronization subprotocol, and signature aggregation of quorum certificates (20). Doppio also implements the first two layers of Tiramisu, and future testnets are expected to include the third layer and the final layer. Espresso Systems also announced the first end-to-end integration of its Sequencer with a full-featured zk-rollup, specifically a fork of Polygon zkEVM.

-

August 4, 2023: The Doppio test network is officially open to the public. Documentation on how users can submit transactions to the zkEVM fork has also been released. Performance benchmarks (21) have also been published, along with expected next steps. Specifically, they announced that they will start incorporating some rollup and rollup-as-a-service companies into their Sequencer. They also announced that they will contribute to the OP Stack through the concept validation work of Optimism leaders (following a recently accepted RFP (22)).

Astria

Astria is building a shared sorter network and is one of the leading companies in eliminating centralized sorters. Meanwhile, they are also developing Astria EVM, which will be the first rollup supported by their shared sorter network. This project will provide fast and censorship-resistant transaction ordering from their network and utilize Celestia for data availability. Celestia is a modular blockchain network and DA layer that Astria is familiar with. Founder Josh Bowen has worked on Celestia, and the project and its ecosystem are mentioned multiple times in Astria’s introductory blog.

-

Overview

-

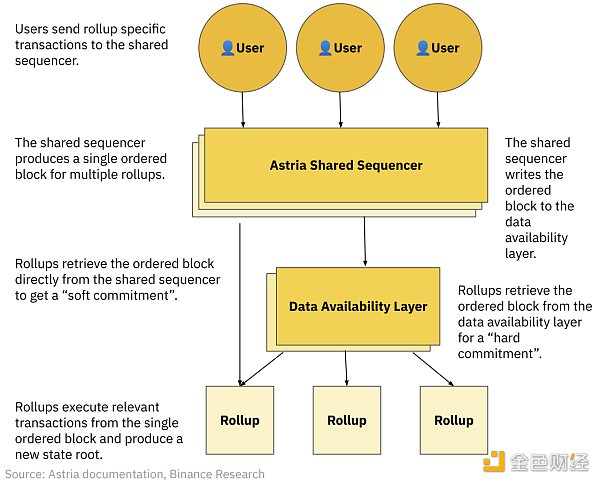

Astria’s shared sorter network allows multiple different rollups to share a single, permissionless, and decentralized sorter network. With this network, Astria offers an out-of-the-box solution that empowers rollups with censorship resistance, fast block confirmations, and atomic cross-rollup synthesis.

-

How does it work?

-

Astria’s shared sorter network itself is a middleware blockchain that achieves consensus on a set of ordered transactions using CometBFT (a fork of Tendermint Core). The design of this network is to accept transactions from multiple rollups and then sort them into a block and write them into the DA layer.

-

Rollups can immediately fetch sorted blocks from Astria after block creation, providing fast block confirmations to users through “soft commitments”. Alternatively, rollups can retrieve ordered blocks from the DA layer for “hard commitments” as once written into the DA layer, transaction orders are considered final. This provides users with the strictest finality, which can be particularly useful for high-value transactions.

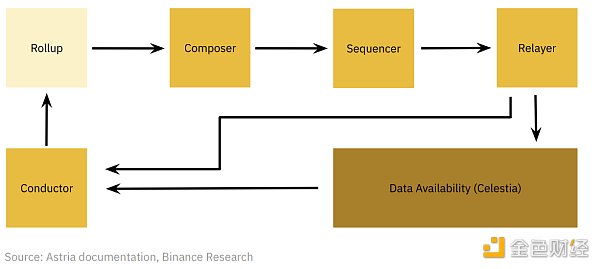

Figure 7: Astria’s shared sorter network

-

Astria EVM

-

As mentioned above, Astria EVM will be the first cryptocurrency powered by Astria’s shared sorter network.

-

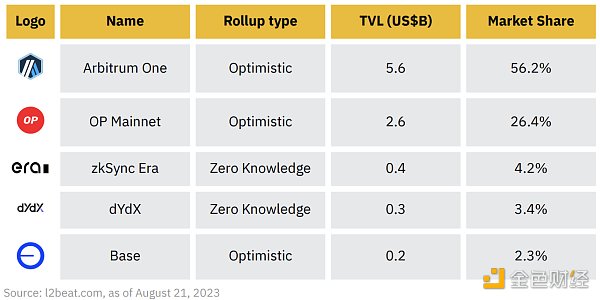

Currently, most rollup projects independently execute transactions and ordering, using Ethereum as the data availability layer. Astria EVM will focus on execution while utilizing Astria’s shared sorter for ordering and Celestia for the DA layer.

Figure 8: Focusing on the L2 process, we can see how rollups tend to leverage their proprietary sorters and Ethereum’s DA capabilities (we also show Ethereum L1 itself for comparison)

-

Astria’s EVM goal is to help launch Celestia’s rollup ecosystem by serving as a liquidity and bridge hub. This also means that the Astria team has a living test case to understand the best integration of rollups with their shared sorter network.

-

Vision

-

Astria’s future vision includes thousands of decentralized sovereign rollups, each tailored to unique use cases and applications.

-

Their shared sorter network plays a key role in their vision, simplifying the rollup development process. Their solution enables rollup developers to focus on innovative use cases while seamlessly integrating with decentralized networks, providing them with fast, censorship-resistant transaction ordering and cross-rollup synthesizability.

-

Astria Development Cluster

-

On August 16th, Astria released its development cluster, which includes all the different components needed to launch rollups on Astria’s shared sorter network. The cluster aims to make development and testing of the Astria network and integration with Astria as simple as possible.

-

The components include:

-

Astria Sorter: Block producing node for transaction ordering. The development cluster relies on a single node. In the mainnet, a decentralized set of nodes will be used.

-

Data Availability Layer: Local Celestia network providing hard finality.

-

Rollup: Geth rollup nodes for execution and state storage.

-

Composer: Retrieves pending transactions from the rollup’s mempool and submits them to Astria’s CometBFT mempool.

-

Conductor: Filters these program blocks for each rollup after receiving individual program blocks. These filtered blocks are then passed to rollup execution.

-

Relayer: Sends sequentially ordered data blocks to the conductor and data availability layer, Celestia.

-

Recently, Astria announced the deployment of rollup technology on their development cluster, and we will be watching which companies decide to deploy rollup technology.

Figure 9: Different components of the Astria development cluster

-

Latest updates

-

In April 2023, Astria announced a $5.5 million seed round investment (26).

-

As mentioned above, in August 2023, the team unveiled their development cluster.

-

The Astria team is also developing a Devnet to kickstart the work. It is expected to be completed in the coming weeks.

-

Their code is open-source, and further documentation can be found on their official GitHub page.

Radius

Radius is building a trustless shared ordering layer that uses encryption technology to decentralize the sorter, prevent censorship, and minimize harmful MEV. Their solution is blockchain agnostic and can be used for various types of rollups.

-

How does it work?

-

Radius utilizes an encrypted mempool to achieve its goal. Essentially, the contents of each user transaction are encrypted upon submission. When the sorter orders the transaction set, it cannot see the contents of each transaction, thus preventing the sorter from extracting MEV or conducting censorship.

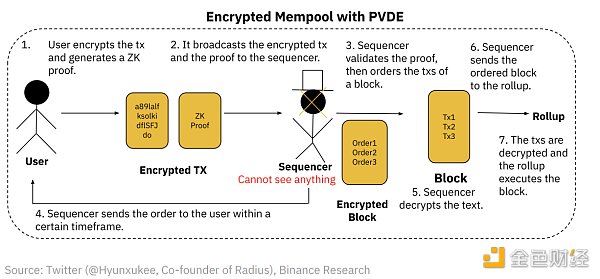

Figure 10: Radius transaction process

-

This ultimately means that Radius’ solution only requires a single sorter to address the issues of MEV and censorship. Since the transaction contents are encrypted, even a single sorter cannot act maliciously. This means there is no need to introduce a consensus mechanism, which could be advantageous from a speed and scalability perspective. This is also what sets Radius’ solution apart from Astria and Espresso solutions, which rely on consensus mechanisms to order transactions.

-

While the encrypted mempool on a single sorter addresses the two key issues of centralized sorters: MEV and censorship, it still has a single point of failure. To ensure real-time performance, Radius employs a decentralized sorter network with multiple sorters running concurrently. One of these sorters is chosen to operate as the ordering layer. Various suggestions (27) exist regarding how to select a single sorter, including secret election mechanisms and sorter group sharding.

-

Practical Verifiable Delayed Encryption (“PVDE”)

-

Radius adopts a zk-based encryption scheme PVDE (28) to create the encrypted mempool.

-

User transactions are temporarily encrypted based on time-locked puzzles. The sorter then orders the encrypted transactions. The sorter needs to unlock the puzzle to obtain the decryption key. This takes time and computational resources, preventing the sorter from prematurely decrypting transactions (i.e., before transaction ordering).

-

To prevent attacks, users generate ZK proofs to prove the validity of their transactions and decryption keys. The sorter can verify these proofs before ordering, effectively preventing meaningless decryption (i.e., attacks) and resource wastage.

-

MEV market

-

Radius also proposes an optimized block space design. They attempt to create an auction-based market (29) where traders submit bundles of cross-rollup MEV transactions. The transaction with the highest bid will be included in a block by the sorter, helping maximize cross-rollup arbitrage profits and creating a more efficient rollup market.

-

Latest updates

-

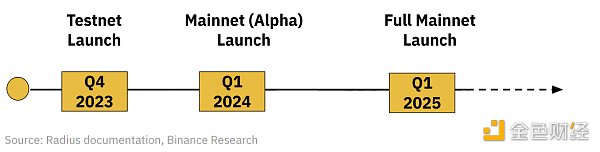

In June 2023, Radius announced the completion of a $1.7 million seed round funding.

-

Roadmap:

Others

Although we have introduced some of the larger and most famous projects in the field of shared sorting, there are also other projects that are developing similar or closely related solutions.

-

NodeKit: The NodeKit team is building NodeKit SEQ, a decentralized shared sorter built into a customized L1 blockchain.

-

They are also building NodeKit Chain, which is an EVM-based rollup.

-

Their Twitter page also shows that their solution will be launched on the Avalanche subnet (30).

-

AltLayer: AltLayer is a “rollup-as-a-service” platform that allows developers to launch highly scalable L2 rollups that support multiple virtual machines.

-

Although “rollup-as-a-service” companies are a separate field and are not within the scope of our coverage in this report, AltLayer’s decentralized sorter network (31) is worth mentioning.

-

AltLayer’s shared sorter network is called the Beacon Layer, which is a permissionless middleware blockchain. Nodes in the blockchain are called validators (similar to any PoS network).

-

When users want to create a rollup on AltLayer’s platform, they can specify the number of sorters required to run the rollup, the minimum amount of staking required for each sorter, and the set of tokens that can be used as collateral. AltLayer recommends that each rollup project have at least five different sorters.

-

Once a validator joins the beacon layer and provides the minimum collateral, they can act as sorters in different rollups. The beacon layer selects validators to be sorters for each rollup project based on their staking and some randomness. Like any PoS blockchain, validators risk having their stakes slashed if they behave improperly.

-

This process allows developers to deploy an encrypted rollup relatively quickly using AltLayer’s infrastructure and then use the beacon layer to ensure its decentralization. If you agree with the concept of rollup-centric future, services like AltLayer are definitely worth paying close attention to.

5. Outlook

Existing L2 rollups seem to have to make a choice. On the one hand, they can maintain the status quo and continue to use a single centralized sorter. On the other hand, they can start integrating with third-party shared sorting networks or develop their own internal solutions.

1. Continue to use a single centralized sorter as usual:

a. This is the simplest course of action and may also be the most financially cautious one. The monetization of sorters is an important source of revenue for all major scaling efforts (32) and undoubtedly an important part of the business model. In fact, the newly established L2 promotion company Base recently confirmed its intention to monetize sorters during Coinbase’s Q2 earnings conference call (33).

b. Maintaining a centralized sorter brings issues such as censorship, MEV extraction, and single point of failure risks, and it also contradicts the fundamental spirit of cryptocurrencies. Imagine a scenario where a key member of a major crypto organization mysteriously disappears or gets into serious trouble. If they are running a centralized sorter, it is likely to affect their encrypted rollup, daily operations, and user experience. If such a situation occurs, many other participants in the industry are likely to start seriously committing to decentralized sorters according to their roadmaps. This is a simple example that illustrates why the decentralization of sorters may be more important than it initially seems.

2. Integration with third-party shared ordering networks:

a. With the continuous development of shared ordering networks such as Espresso and Astria and the launch of the mainnet, this will become a major choice for existing networks. In fact, considering the integration of Espresso with Polygon zkEVM fork, some major network companies seem to be actively exploring this solution.

b. Compared to the risk of centralized management of sorters or the energy and cost required to develop internal solutions, outsourcing sorting work to experts is a wise choice for many companies.

c. One of the most important factors to consider here is the interoperability of the sample library. Compared to L2s running in their own proprietary “silos,” this may be one of the most obvious advantages of running L2s on shared sorters. As emphasized in the previous sections of this report, running on shared sorters and the interoperability it brings can unleash various new possibilities, including cross-rollup arbitrage and conditional transaction inclusion.

3. Development of internal proprietary solutions:

a. Since this may be the most time-consuming and expensive of the three solutions, it will be interesting to see which companies decide to go this route.

b. One key issue we have seen with large cryptocurrencies so far is the accumulation of token value. Most top Ethereum L2 companies have used ETH as the token for gas fees, which prevents their own native tokens from accumulating value. One possible solution is for rollup companies to develop internal sorting solutions, with token holders providing collateral; for example, users can stake their native rollup tokens and become sorters, charging fees for their services.

c. The downside of this approach is its impact on interoperability. Rollup systems running on shared sorters have better interoperability compared to systems running their own proprietary sorting solutions.

d. Optimism has announced its “Law of Chains,” which is a recent development worth considering. The Law of Chains is a set of guiding principles for chains within the OP Stack superchain ecosystem. Its essence is to establish a framework for these chains to work in a more unified manner. This is likely to extend to shared sorting solutions for OP Stack-based chains, which could be a solution to the interoperability issue discussed earlier (at least for OP Stack chains).

As second-tier cryptocurrencies continue to emerge in the cryptocurrency world, their scale and transaction volume are also growing, and issues surrounding centralization and interoperability will continue to ferment. This topic has been a focus of attention in the past year, and we expect it to continue to expand with the approaching one-year and two-year anniversaries of major cryptocurrency issuers and the launch of more cryptocurrency issuers.

We believe that at least some companies will choose to integrate with third-party sorter networks such as Espresso and Astria, but we also see other companies choosing to develop their own internal solutions. Some larger companies, especially those that have already launched native tokens, are likely to see value in developing their own solutions, which can maximize profits and increase the utility of their tokens. Whatever happens, this is a very important aspect that we need to pay close attention to and we will be interested to closely monitor it.

6. Conclusion

Users hope for and prefer faster transaction confirmations and lower fees. While centralized sequencers have been the main solution for L2 companies so far, ideally, both companies and users should have the option to choose the best decentralized version of this technology. This is exactly the key role played by companies such as Espresso Systems, Astria, Radius, etc., in the L2 narrative.

Two key driving factors here are decentralization and rollup interoperability. Decentralization is crucial for several reasons. It is the philosophical foundation of cryptocurrencies, just to name one. On a more practical level, centralized sequencers represent single points of failure that can impact the effectiveness of cryptographic rollups and pose a threat to their recovery capabilities. Not to mention the possibility of significant MEV extraction, some of which may be hidden from users and extracted in private mempools. The possibility of censorship (even temporary) and delayed transactions is also a concern that must be kept in mind, especially considering the strong desire for growth in this industry. Interoperability of cryptographic rollups is equally crucial, especially when people hold a view of the future of the crypto industry centered around cryptographic rollups. If there are more and more cryptographic rollups in the market, whether for specific applications or other purposes, these cryptographic rollups should be able to communicate and collaborate seamlessly with each other. Otherwise, how can we achieve a Web2-like user experience?

In the future, there will certainly be challenges, and some large companies may prefer to create their own proprietary solutions instead of using shared sequencing networks. One solution to address this issue is for shared sequencing networks to solve the problem of value accumulation and income distribution through economic mechanisms, as powerful network effects will eventually be achieved if many companies share a sequencer.

This topic will continue to heat up in the coming months, and we believe that there will be many new participants joining the market, both in the realm of rollups and shared sequencing. It will be very interesting to observe the choices made by different projects. We look forward to closely following this trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Quick look at the Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept at necessary high levels to control inflation.

- LianGuai Daily | Hong Kong police take action against money laundering activities, including cryptocurrencies; Social platform OnlyFans has purchased about $20 million worth of ETH.

- Weekly Preview | Hong Kong Exchange HashKeyExchange begins to serve retail investors; Optimism and Hedera will unlock tokens worth tens of millions of dollars

- Review of the PEPE dumping incident Is it a case of uneven distribution of profits or a premeditated run?

- What is Layer2, the source of controversy within the Ethereum community?

- Lybra V2 is about to go online, analyzing V2 functions and product expansion.

- Looking at the latest developments of THORChain from both the bullish and bearish perspectives liquidity exchange and lending.