LianGuai Daily | Former product leader of OpenSea sentenced to 3 months imprisonment for insider trading; Binance Labs invests in Pendle Finance.

Former OpenSea product leader sentenced to 3 months imprisonment for insider trading; Binance Labs invests in Pendle Finance.Today’s News Highlights:

Former OpenSea Product Lead Sentenced to 3 Months in Prison for Insider Trading

Curve Founder: CRV Buyers Who Violate the Cooperation Agreement Will Not Be Negatively Affected, but We Believe They Will Honor the 6-Month Lockup Commitment

Shanghai Woman in Her 80s Falls into Virtual Currency Investment Scam and Loses 4 Million Yuan in 20 Days

- Detailed explanation of the evolution of the MEV market from zero-sum game to separation of powers, the dark forest is being illuminated.

- Looking back at the decentralized storage track that has been ‘neglected’ by the market from EthStorage

- How to Tax Stablecoins?

Bitcoin Mining Difficulty Increases by 6.17% to 55.62T, Reaching a New All-Time High

The Wall Street Journal: Binance Faces Legal Risks of Violating U.S. Sanctions Against Russia

Aptos Introduces “Aptos Digital Asset Standard” with Simplified Token Management and the Ability to Create Composable NFTs

Balancer: More Than 97% of Risks Have Been Mitigated, 0.89% of Total TVL Still Faces Risks

Binance Labs Invests in Pendle Finance to Expand DeFi Yield Opportunities

Regulatory News

Former OpenSea Product Lead Sentenced to 3 Months in Prison

According to CoinDesk, Nate Chastain, former product lead at OpenSea, has been sentenced to 3 months in prison for insider trading. In May of this year, Chastain was convicted of telecommunications fraud and money laundering in a federal court in New York. Chastain used insider information to purchase at least 45 NFTs in advance and sold them on the platform’s homepage at 2 to 5 times the price. He concealed these transactions through multiple anonymous wallets and OpenSea accounts, making a profit of over $50,000.

Thailand Appoints Crypto Supporter Srettha Thavisin as Next Prime Minister, Promising to Distribute National Tokens Using Blockchain Technology

According to CoinDesk, real estate developer Srettha Thavisin has been appointed as the next prime minister of Thailand, giving control of the country to the Phalang Pracharat Party after a controversial election. Prior to entering politics, Srettha served as the CEO of real estate developer Sansiri, which has been an active participant in the country’s digital asset space. In 2021, Sansiri acquired a 15% stake in XSpring, a Thai digital asset service provider that operates a licensed ICO portal and a cryptocurrency brokerage in partnership with Krungthai Bank. In 2022, Sansiri launched the “SiriHub Token” on XSpring, a structure similar to a REIT that provides dividends from Sansiri Campus, one of the company’s major development projects.

The centerpiece of Srettha’s campaign is a promise to carry out a nationwide “airdrop” where every Thai citizen would receive 10,000 baht (approximately $300). A spokesperson for the party explained that the 10,000 baht would be distributed to all Thai citizens aged 16 and above and could only be used within a four-kilometer radius of their homes. The airdrop would utilize some form of national token rather than existing digital assets or cryptocurrencies, and vendors would be able to exchange them for cash at designated banks. The project has also faced criticism due to its estimated cost of up to 500 billion baht ($14.3 billion) and its use of blockchain technology in Thailand, where there are already digital banking initiatives in place.

The co-founder of decentralized derivative platform FWX.finance, Udomsak Rakwongwan, said that it is expected that the new government will continue to propose looser cryptocurrency regulations, which will lead to a surge in cryptocurrency projects in Thailand.

FBI: Traced 1580 BTC stolen by North Korean hacker group TraderTraitor

The Federal Bureau of Investigation (FBI) has warned cryptocurrency companies that it has traced 1580 BTC stolen by the North Korean hacker group TraderTraitor (also known as Lazarus Group and APT38). North Korea may attempt to cash out these bitcoins, which are worth over $40 million. These funds are currently held in 6 bitcoin addresses.

TraderTraitor is connected to several other cryptocurrency thefts, including the theft of $60 million worth of virtual currency from Alphapo on June 22, 2023; the theft of $37 million worth of virtual currency from CoinsLianGuaiid on June 22, 2023; and the theft of $100 million worth of virtual currency from Atomic Wallet on June 2, 2023. Additionally, the attacks on Harmony’s Horizon Bridge and Sky Mavis’ Ronin Bridge may also be related to TraderTraitor.

The FBI reminds private sector entities to check blockchain data related to these addresses and remain vigilant to prevent direct transactions or derivative transactions from these addresses.

US presidential candidate Robert Kennedy promotes Bitcoin on Twitter

US Democratic presidential candidate Robert Kennedy promoted Bitcoin on Twitter today, stating, “I have always been a defender of civil liberties, and Bitcoin is both an exercise of freedom and a guarantee of those freedoms.”

Robert Kennedy himself has confirmed that he does indeed hold Bitcoin and has announced that he accepts Bitcoin donations. He previously pledged to support the US dollar with Bitcoin at the Political Action Committee (LianGuaiC) Bridge the Divide event, and stated that his administration “will exempt capital gains tax on converting Bitcoin to US dollars.” He also stated that “Bitcoin is not a security and should not be regulated as such.”

NFT

Rarible announces permanent support for royalties, will no longer aggregate orders from platforms such as OpenSea after September 30

NFT trading platform Rarible announced on the X platform that it will permanently support royalties, so after September 30, Rarible will no longer aggregate orders from OpenSea, LooksRare, and X2Y2. Rarible states that the principle of royalties is at the core of decentralization, continuously confirming the value of creators in each transaction.

Project Updates

Curve founder: CRV buyers who violate the cooperation agreement will not be negatively affected, but it is believed that they will comply with the six-month lock-up commitment

According to Blockworks, Curve Finance founder Michael Egorov, in order to save his loan and possibly prevent a cascade liquidation in the entire DeFi space, has reached a series of over-the-counter (OTC) transactions with more than a dozen counterparties, selling a large amount of CRV in exchange for stablecoins to repay his debts. Although the terms of the transactions have not been formally disclosed, several individuals who claim to have had contact with Egorov publicly stated that these tokens were sold at a price of $0.40 per CRV (far below the market price at the time) with a lock-up period of 6 months. However, the lock-up does not seem to be enforced through legal or smart contract means. Egorov confirmed in a statement that buyers who violate the cooperation agreement will not be negatively affected, but he “believes they will” comply with the six-month lock-up commitment.

Observers have noticed that some participants have transferred their tokens to centralized exchanges, which typically indicates their intention to sell. Some projects’ communities have committed to a 6-month lock-up period by voting to delegate their CRV. Earlier news stated that DWF Lab spent 5 million USDT to purchase 12.5 million CRV from Egorov on August 1st, but transferred 2 million CRV to Binance on August 19th. The head of DWF Lab stated yesterday that the transfer to Binance was for trading purposes.

Data shows that the CRV price is currently at $0.47, with a 7-day decline of 15.1%.

Aptos launches “Aptos Digital Asset Standard” with simplified token management and the ability to create composable NFTs

According to the official X account, Aptos, a public chain associated with Facebook, announced the launch of the “Aptos Digital Asset Standard (DA)” which provides builders with flexibility, composability, and scalability, resulting in significant improvements to Aptos. The new standard focuses on real-world applicability, such as seamless airdrops, token soul binding, and high performance, fostering a dynamic, adaptive, and uncomplicated token ecosystem. By simplifying token management, improving user experience, and enabling the creation of composable NFTs, the new standard will unlock the full potential of projects for creators, developers, and users within the Aptos ecosystem.

BlockFi seeks to block FTX and Three Arrows Capital from recovering billions of dollars in transactions from last year

According to Bloomberg, bankrupt crypto lending firm BlockFi Inc. is seeking to prevent FTX and Three Arrows Capital from attempting to recover billions of dollars in transactions between the companies before their dissolution last year. BlockFi stated in court documents on Monday that it is a victim of FTX and therefore, FTX has no right to reclaim over $5 billion. Likewise, BlockFi accuses the collapsed Three Arrows Capital of borrowing money from lenders through fraudulent means and has no right to recover the repayments.

The filed documents advance an ongoing legal battle that could affect how much creditors of BlockFi, FTX, and Three Arrows Capital receive in their respective bankruptcy proceedings. BlockFi claims that lawsuits with FTX, Three Arrows Capital, and several other crypto companies could impact the $1 billion amount that its clients are owed. BlockFi’s creditors had previously accused management of ignoring danger signs before lending to FTX, but reached a settlement with the company last month, advancing a debt repayment plan.

StarkWare to open source Stone Prover on August 31st

StarkWare announced that it will open source the STARK Prover under the ALianGuaiche 2.0 license on August 31st and has renamed it “Stone Prover”. Developers will be able to independently review and utilize Stone Prover and build on top of it without the need for permission. StarkWare states that the open source Prover is an important step towards the decentralization of Starknet. Currently, StarkWare has already open sourced Cairo, LianGuaipyrus Full Node, and all versions of Starknet, and the upcoming Starknet sequencer being built will also be open sourced.

The Wall Street Journal: Binance Faces Legal Risks of Violating US Sanctions on Russia

According to The Wall Street Journal, Binance is helping Russians move funds abroad, which could exacerbate its massive legal problems in the United States. External data shows that Binance is still processing a large volume of ruble transactions. The company’s website, user screenshots, and messages in official chat groups show that customers can transfer funds from sanctioned Russian banks to Binance accounts through intermediaries, and Binance also supports ruble-to-digital token peer-to-peer transactions, which often involve banks blacklisted by the West. A recent review of Binance’s peer-to-peer service website showed that the site offers at least five sanctioned Russian banks (including Rosbank and Tinkoff Bank) as payment options for Russian customers. In addition, CCData shows that while the trading volume in Russia has declined compared to the peak in early 2022, it has rebounded in recent months in Binance’s major exchange business. CCData indicates that Binance processed $8 billion worth of ruble cryptocurrency transactions in July, most of which were Tether.

A spokesperson for Binance said, “Binance complies with global sanction rules and imposes sanctions on individuals, organizations, entities, and countries blacklisted by the international community, refusing access to Binance platform by such actors. Binance has no relationship with any banks in Russia or elsewhere in terms of its peer-to-peer services, and does not cooperate with partners from the traditional financial system on any sanction lists.”

Previously in May, Bloomberg reported that the US Department of Justice is investigating whether Binance has violated sanctions against Russia.

Balancer Multiple V2 Pools Vulnerable, Users Advised to Withdraw Affected LPs Immediately

Balancer reported that it has received reports of severe vulnerabilities affecting multiple V2 pools. Emergency mitigation procedures have been implemented to ensure the security of most of the total value locked (TVL), but some funds are still at risk. Users are advised to immediately withdraw affected LPs.

Later today, Balancer stated that more than 97% of the risks have been mitigated, while 0.89% of the total TVL is still at risk.

Shanghai Woman in Her 80s Trapped in Virtual Currency Investment “Ponzi Scheme,” Defrauded of 4 Million Yuan in 20 Days

According to Xinmin Evening News, a woman in her 80s in Shanghai fell into a virtual currency investment “Ponzi scheme” and was defrauded of 4 million yuan in 20 days, her house was mortgaged, and she incurred a huge amount of external debt. The Huangdu Police Station in Shanghai’s Jiading District has filed a case. Although the police have already taken control of four primary transfer cardholders, these suspects are mostly involved in “money laundering” or “running away,” either lacking funds or having limited involvement. Only a little over 10,000 yuan of the defrauded money has been recovered so far. All parties are reminded to be vigilant against “telecom fraud” and call for strengthened auditing throughout the entire lending process of financial institutions.

Russian investors launch class action lawsuit against Atomic Wallet for $100 million cryptocurrency theft

According to BNE IntelliNews, around 50 high net worth clients from Russia and the CIS region have filed a class action lawsuit against the cryptocurrency platform Atomic Wallet after their funds were stolen for $100 million. Although initial suspicions pointed to the Lazarus Group from North Korea, further investigations suggest that a Ukrainian group may be behind the attack.

Investment and Financing

Binance Labs invests in Pendle Finance to expand DeFi yield opportunities

Binance Labs has invested in the DeFi protocol Pendle Finance to support its tokenization and yield trading capabilities. Pendle Finance focuses on inclusivity and has developed multiple features to provide greater flexibility for yield management.

He Yi, co-founder and head of Binance Labs, commented, “Pendle Finance’s multi-chain expansion and innovative yield strategies align with our vision for the future of DeFi. We look forward to closely collaborating with Pendle Finance to support their efforts in reshaping a more inclusive DeFi ecosystem.”

Generative AI project Ideogram AI completes $16.5 million seed funding round with lead investments from a16z and others

According to the official X account, generative AI project Ideogram AI has announced its establishment and completed a $16.5 million seed funding round. The round was led by a16z and Index Ventures, with participation from AIX Ventures, Golden Ventures, Uber’s Chief Scientist Raquel Urtasun, Google’s Head of AI Jeff Dean, Berkeley Professor Pieter Abbeel, former Facebook employee Facebook, and GitHub co-founder Tom Preston-Werner. The company will share more details about its AI products tomorrow.

The project team, which includes AI experts Mohammad Norouzi, Jonathan Ho, William Chan, and Chitwan Saharia, developed denoising diffusion models for image and video generation at Google Brain. Ideogram AI aims to help people become more creative through generative AI.

Important Data

Bitcoin mining difficulty increases by 6.17% to 55.62T, reaching a new all-time high

According to BTC.com, the mining difficulty of Bitcoin experienced an adjustment today at 01:16 (block height 804384), increasing by 6.17% to 55.62T, reaching a new all-time high. The current average network hashrate is 398.32 EH/s.

The liquidation price of CRV on Aave V2 has dropped to 0.241 USDT

DefiLlama data shows that in the CRV lending on Aave V2, there are 123 million CRV tokens with a liquidation price of 0.241 USDT, which is worth approximately $30.3 million.

In addition, market data shows that CRV is currently priced at 0.472 USDT.

Crypto influencer Cobie ranks first on the friend.tech royalty income leaderboard with earnings of $144,400

According to CoinGecko data, as of August 22, the top account on the royalty income leaderboard of the decentralized social protocol friend.tech is held by crypto influencer Cobie, with earnings of $144,400. The second and third accounts belong to friend.tech founder Racer (earning $101,700) and crypto influencer Hsaka (earning $100,600), respectively.

Since the launch of the test version on August 11, 2023, the income of other friend.tech accounts on the leaderboard has ranged from $14,900 to $75,500. The average daily income ranges from $1,200 to $6,300. If the daily income remains at the current level, the annual average income will reach $453,200 to $2.3 million.

Data: In the past 9 days, Huang Licheng withdrew 2.128 million APE from Binance and staked it with BAYC and MAYC.

Twitter user EmberCN (@EmberCN) detected that Huang Licheng’s address has withdrawn a total of 2.128 million APE (approximately $3.82 million) from Binance in the past 9 days and staked the APE with BAYC and MAYC NFTs. The staking results are as follows: 129 BAYC + 1,302,126 APE deposited in the BAYC pool; 94 MAYC + 191,948 APE deposited in the BAYC pool; 1,035,800 APE deposited in the APE pool.

Data: A whale dumped 10,600 ETH on the chain early in the morning, resulting in a loss of $2.9 million.

According to data analyst Ember, a whale directly dumped 10,600 ETH (approximately $17.19 million) on the chain from 3:44 to 4:14 am today, with an average price of $1,622 per ETH.

Ember stated that the whale bought 22,600 ETH (approximately $42.85 million) at an average price of $1,896 per ETH from June 22 to August 18. This dump resulted in a loss of $2.9 million, and the whale still holds 12,000 ETH.

LianGuaiNews APP Points Mall Officially Launched

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

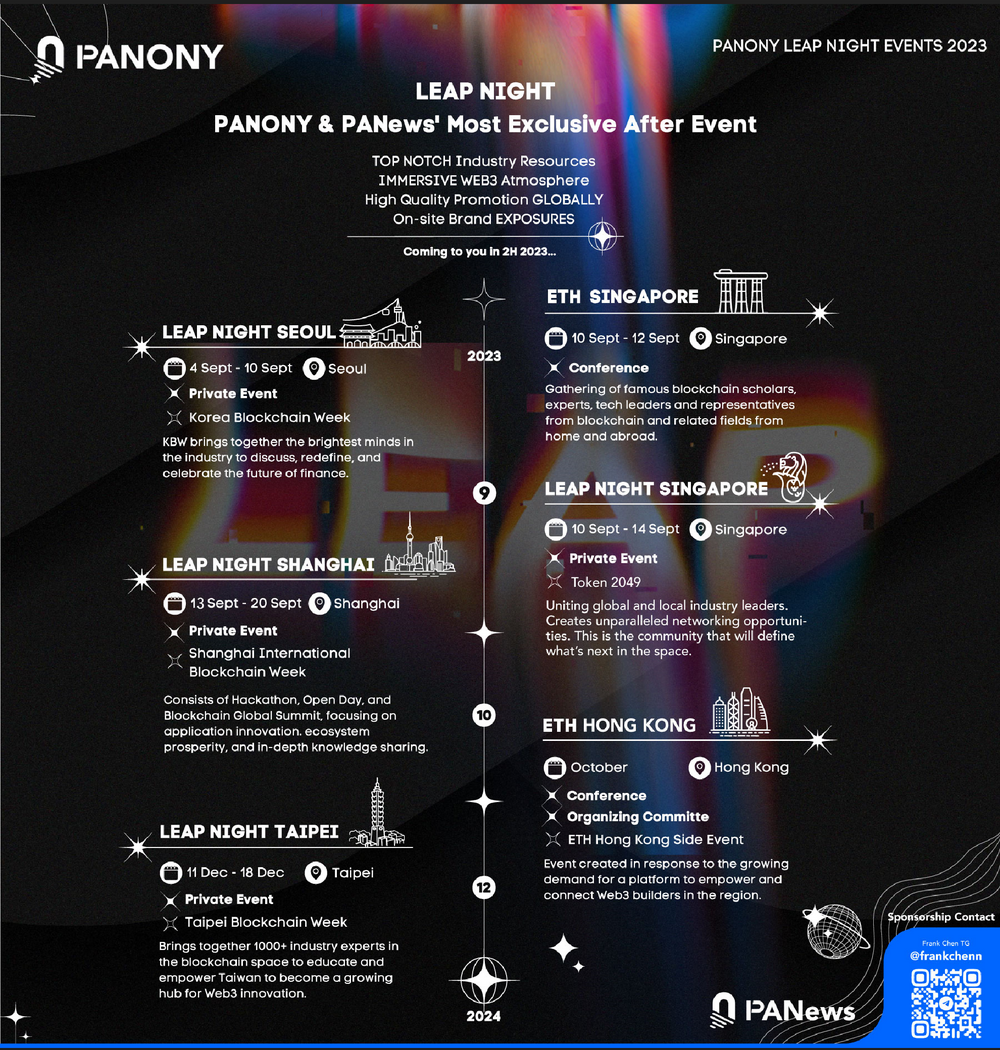

LianGuaiNews launches the global LEAP tour!

South Korea, Singapore, Shanghai, Taipei, from September to December, multiple locations gather to witness a new chapter in globalization!

📥Multiple events are being co-organized, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 10 Reasons to Believe in the Resurgence of the Cryptocurrency Bull Market

- Long Push An Analysis of ERC-4337 Market Use Cases based on Intentional Transactions

- Behind the Rush of Cryptocurrency Exchanges in Vietnam Over 16 Million Crypto Users with Trading Volume Higher than Singapore

- LianGuai Daily | Former Vice Chairman of Jiangxi Provincial Political Consultative Conference, Xiao Yi, sentenced to life imprisonment; Coinbase has invested in Circle.

- Looking back at the decentralized storage track that has been neglected by the market from EthStorage

- What does Bitcoin being in an extreme oversold state mean?

- What impact would it have if the US SEC approves Ethereum futures ETF?