Babbitt Column | Bitcoin is a risky asset, and hedging properties have never really been verified in the market

This article is a summary of the viewpoints of the topic on the topic of whether bitcoin is a safe-haven asset during the TokenInsight Global Super Industry Summit on March 20.

Bitcoin has always been considered as "digital gold". The public has high expectations for the risk aversion characteristics of Bitcoin. Why did the risk aversion characteristics of Bitcoin fail this time? Uncle Kai answers 7 related questions for this:

Question 1: What can be called a safe-haven asset?

- Research report | How to invest in crypto assets under extreme conditions?

- Opinion | BTC is likely to break $ 20,000 in 12 months, hedge funds begin to deploy cryptocurrencies significantly

- Behind "House N" in South Korea: Is Encryption Security Really Safe?

If the debate is to be fruitful and to avoid talking to others, first of all, it is very important to clarify the concept and scope of the "hedged assets" we are discussing.

Risk is a very broad concept. There are natural disaster risks (such as epidemics, earthquakes, etc.) in large categories, risks of social unrest (such as turmoil, war, etc.), and commercial risks inherent in the industry (such as those caused by abnormal changes in temperature in the plantation industry) Commercial risks), regulatory risks arising from regulatory compliance changes, operational risks of the company's daily operations (such as technical hacking, server failures due to operational errors, etc.), and risks arising from fluctuations in the prices of financial market assets.

Therefore, we discuss whether bitcoin is a safe-haven asset, and the last item we mainly address is the risk of asset price fluctuations in financial markets. The most important function of the financial market is price discovery, so various factors affecting prices, including most of the risks mentioned above, can be reflected in the price fluctuations of corresponding financial products under certain prerequisites. Therefore, we study risks, mainly starting from price fluctuations in financial markets. In other words, discussing whether Bitcoin is a safe-haven asset refers to discussing whether Bitcoin can be independent of the price movement of other financial assets when the financial market is volatile.

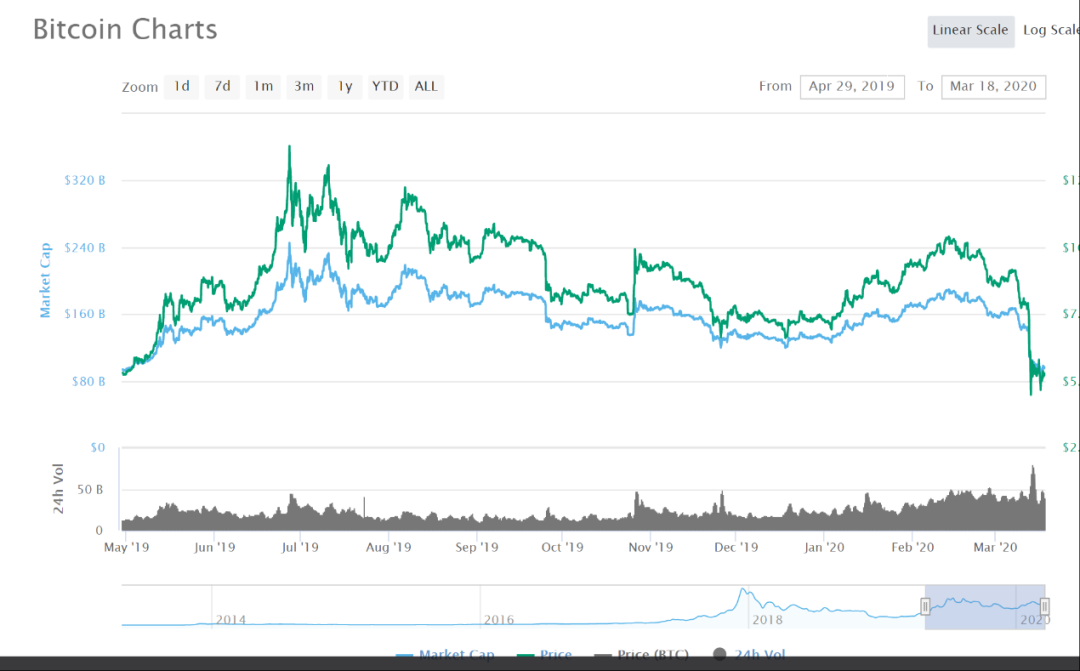

To test whether Bitcoin is a safe-haven asset, it can be seen by looking at the correlation between the Bitcoin price and the S & P index (the S & P 500 is generally used as a financial market barometer index). As shown below, it is clear that under the influence of this epidemic, Bitcoin has risen and fallen at the same time as the stock market, and it has not reflected the role of safe-haven assets at all.

Bitcoin is not a safe-haven asset, but a risky asset.

The yellow line is S & P 500, the blue line is Bitcoin, and the purple line is gold

Bitcoin's hedging properties have never really been proven in the market.

Bitcoin was born after the 2008 financial turmoil. Founder Satoshi Nakamoto designed one of the incentives for Bitcoin to see the central banks of various countries continue to print banknotes and release water to save the economy, so they decided to design a completely decentralized currency that issued a constant total amount. Since the financial turmoil in 2008, the global economy has been smooth sailing, and Bitcoin has never had the opportunity to truly accept the market test . The new crown virus detonated the turbulence of stock markets in various countries, which is the first real test of the characteristics of Bitcoin's safe-haven assets. Unfortunately, it failed the test.

Holding bitcoin avoids other types of risks that are different from fluctuations in financial assets. Bitcoin has unique characteristics, such as being based on distributed blockchain technology, a constant total supply, and a structure without borders and centers. Therefore, holding Bitcoin, assets will not be frozen and confiscated, and will not be seized. Fake, compared to sovereign currencies, Bitcoin is resistant to inflation. Therefore, Bitcoin can resist this kind of risk, but it is often mistaken by blind proponents that Bitcoin can also hedge the risk of market fluctuations.

In the current global stock market volatility, investors who originally thought that Bitcoin could become a safe-haven paradise. After the myth of Bitcoin's safe-haven assets shattered, it caused investors to panic and sold themselves to protect themselves. In response to the momentum of Bitcoin's rapid decline in a short period of time, it has fallen by 50% in one day and 2/3 in one week. It has become the investment product with the highest risk among all asset classes.

Special emphasis is placed on the risk of anti-inflation. In fact, this is not a characteristic of Bitcoin. Stocks, real estate, gold, and bonds with an inflation rate can all be effective anti-inflation investment tools.

It is not correct to use the normal conditions of the market to determine Bitcoin's hedging properties . The so-called raising soldiers for thousands of days, the role of hedging assets should be reflected when risks come, otherwise it is worthy of the name of hedging. Just like you usually buy auto accident insurance, if the insurance company stipulates that only the normal state policy will work, and the abnormal state does not cover it, what is the meaning of this policy?

The early Bitcoin participants were mainly geeks, gray or black industries, speculators and believers, and the small number of participants in the market was small, so the price of Bitcoin was completely independent of the economic environment. This is a special period, and judging the hedging attributes of Bitcoin is very one-sided.

As the number of Bitcoin users increases, the volume increases, especially the influx of derivatives and institutional customers, resulting in an increasingly tight connection between Bitcoin and the traditional financial world through capital flows. Most institutions and professional investors do not consider Bitcoin as a safe-haven asset, but instead position Bitcoin as a high-risk financial alternative asset.

The main reason for the sharp drop in Bitcoin this time is because of the lack of liquidity in the world. Everyone is panicking to switch to cash. Therefore, first discard high-risk assets, and Bitcoin belongs to this category, in exchange for low-risk assets. Such as national debt, US dollars, and so on.

It is worth mentioning that in the digital currency industry, the emergence of stablecoin has also significantly weakened the few remaining hedging functions of Bitcoin. Since 17 years, as more and more stablecoins have been issued and used, users have more regarded stablecoins as a more safe-haven product than Bitcoin. This also explains why in the recent extreme market, Bitcoin has fallen sharply, while stablecoins such as USDT have a premium of 8%.

Two important conditions are needed: pricing and volume.

Compared with other financial assets, the biggest drawback of Bitcoin is that it does not have a recognized anchor value base. So far no one in the world can come up with a convincing Bitcoin pricing model. Everyone's intrinsic real value to Bitcoin is still in the clouds. Such as gold, real estate and stocks, they all have a recognized pricing basis and can calculate their intrinsic value. Even if their prices fluctuate due to the influence of the extreme external environment, they still float around value after all.

This is just like the onset of a big storm. Even if a ship with an anchor shakes up and down, it will not be blown away by the storm. At this time, Bitcoin is a ship without an anchor. Where the wind blows, the ship will be blown. Such a volatile investment product like Bitcoin is difficult to become a real safe-haven asset.

Another bitcoin lack is the market size. The Bitcoin market is too small. The total market value of Bitcoin is 100 billion U.S. dollars, which is similar to the market value of Tesla. It is less than 1/10 of the market value of Apple's stock, not to mention the real safe-haven assets in trillions of dollars. In front of it, Bitcoin is a baby. Taking gold as a reference, the global daily trading volume of gold (including derivatives and ETFs) is about 300 billion U.S. dollars, which is 6 times the bitcoin's daily evaluation of 50 billion U.S. dollars.

If the stock market under the financial turmoil is compared to a ship that is about to sink, the ship will sink, and only a lifebuoy of Bitcoin is not enough. Even with the small market size of bitcoin, even if it has the conditions, it cannot afford the function of safe-haven assets and cannot save the entire ship.

There is a fundamental reason for the small amount of Bitcoin: there is no accepted pricing model; its application scenarios are limited; most of the regulatory attitude remains vigilant; products cannot face the public; especially ETFs have been unable to pass regulatory approvals, etc. The challenge that cannot be overcome in a short period of time.

Question 7. What is the enlightenment and impact of the myth of Bitcoin's safe-haven assets?

This bloody reality, piercing the myth of Bitcoin's safe-haven assets, will change users' positioning of digital currencies. When discussing the category of bitcoin, it is often referred to as "synthetic assets": gold has commodities and hedging attributes, currency payment and measurement price attributes, and securities investment and speculative attributes. Now, due to the emergence of stablecoins and the large price fluctuations of Bitcoin itself, the currency's attributes have been misrepresented. This bitcoin's plunge has also made digital gold's title incompatible, and finally its securities attributes remain. This will inevitably reduce the willingness of some investors to hold Bitcoin, which is generally a negative impact.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cryptocurrency rankings in the U.S. released! Richest cities hold $ 55,000 in crypto assets per capita

- Five Questions on New Infrastructure: Blockchain plays an important role and investment volume is insufficient

- Bybit New Product Launch Conference-Anyway, have an appointment with you

- Major Korean Exchanges Announce "Cooperate with Investigation of Room N"

- Opinion | Under the epidemic, the "hidden disease" of the supply chain is exposed, blockchain + supply chain or "hidden machine"

- Global stablecoin may face regulatory storm, IOSCO has stepped in

- QKL123 market analysis | The liquidation of the "Mentougou" case is imminent, where is the nearly 140,000 bitcoin going? (0326)