Babbitt Column | Maker's Monetary and Fiscal Policy Advice in a Liquidity Crisis

Author: Cao Yin, general manager of the Digital Renaissance Foundation Director

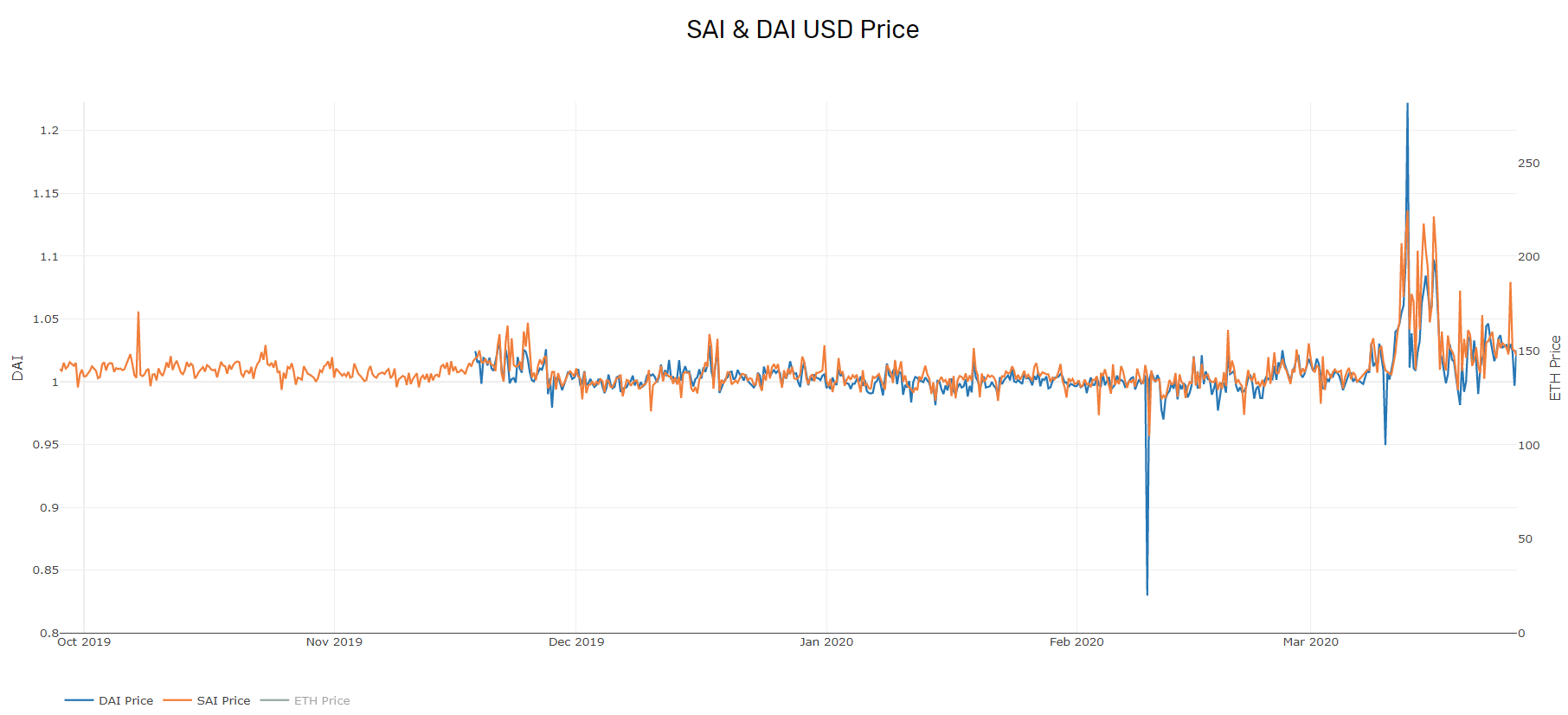

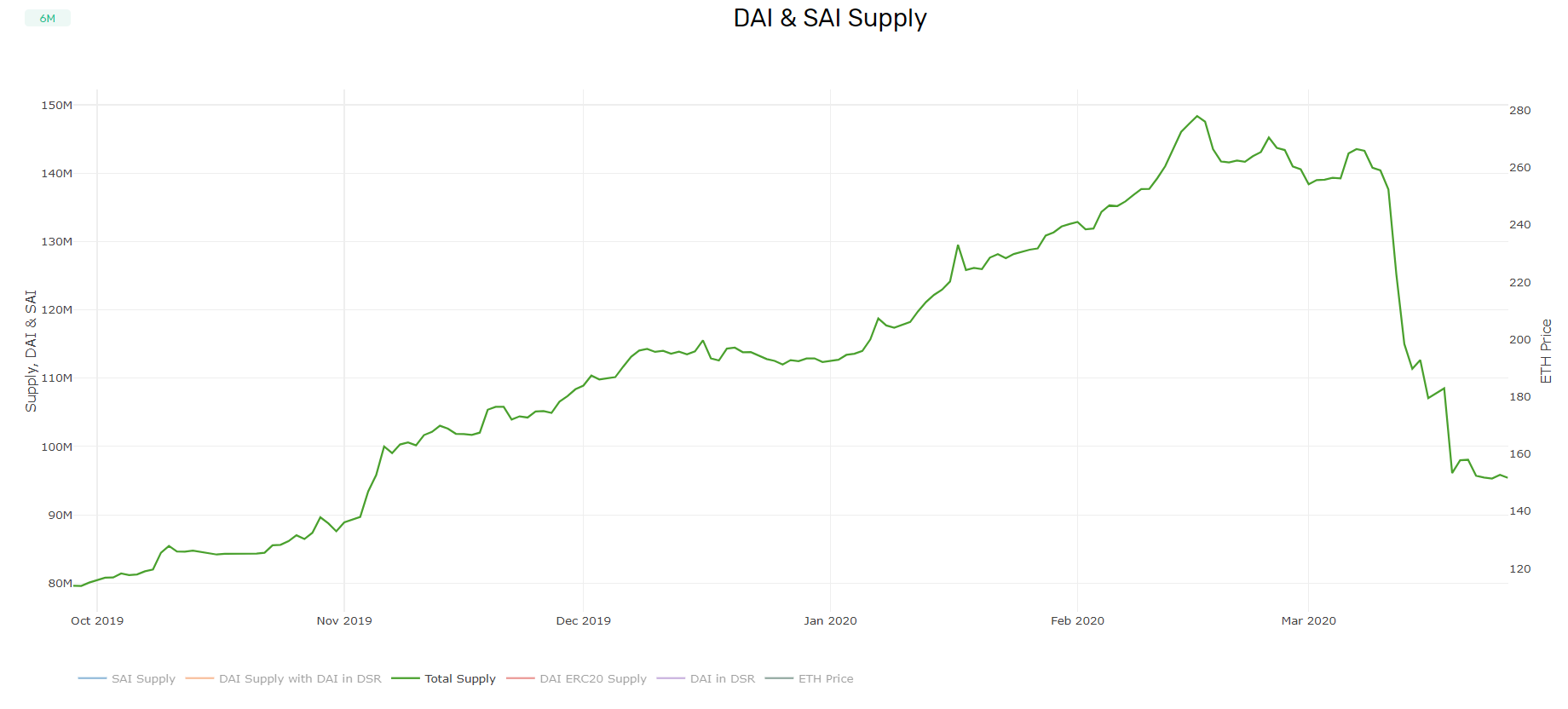

Since the price of Ethereum fell sharply on March 12th, MakerDAO's DAI supply has plummeted as the price of ETH plummeted, currently at 95,468,407 (March 25), which is 64% of the peak value of 148,369,256 before the crash. The result of the rapid decline in DAI supply is a 1: 1 peg decoupling between DAI and the US dollar. Since the plunge, DAI has maintained a premium, with a premium of US $ 1.1 at the highest, and the current market premium is around 1.03.

Figure: DAI historical price fluctuations

- Babbitt Column | Baishi: Can quantitative easing save the economy?

- Global crisis, market crash, but crypto regulations move in adversity

- Exchange Rollover Records: A Article Seeing 64 Rollover Accidents Since 2018

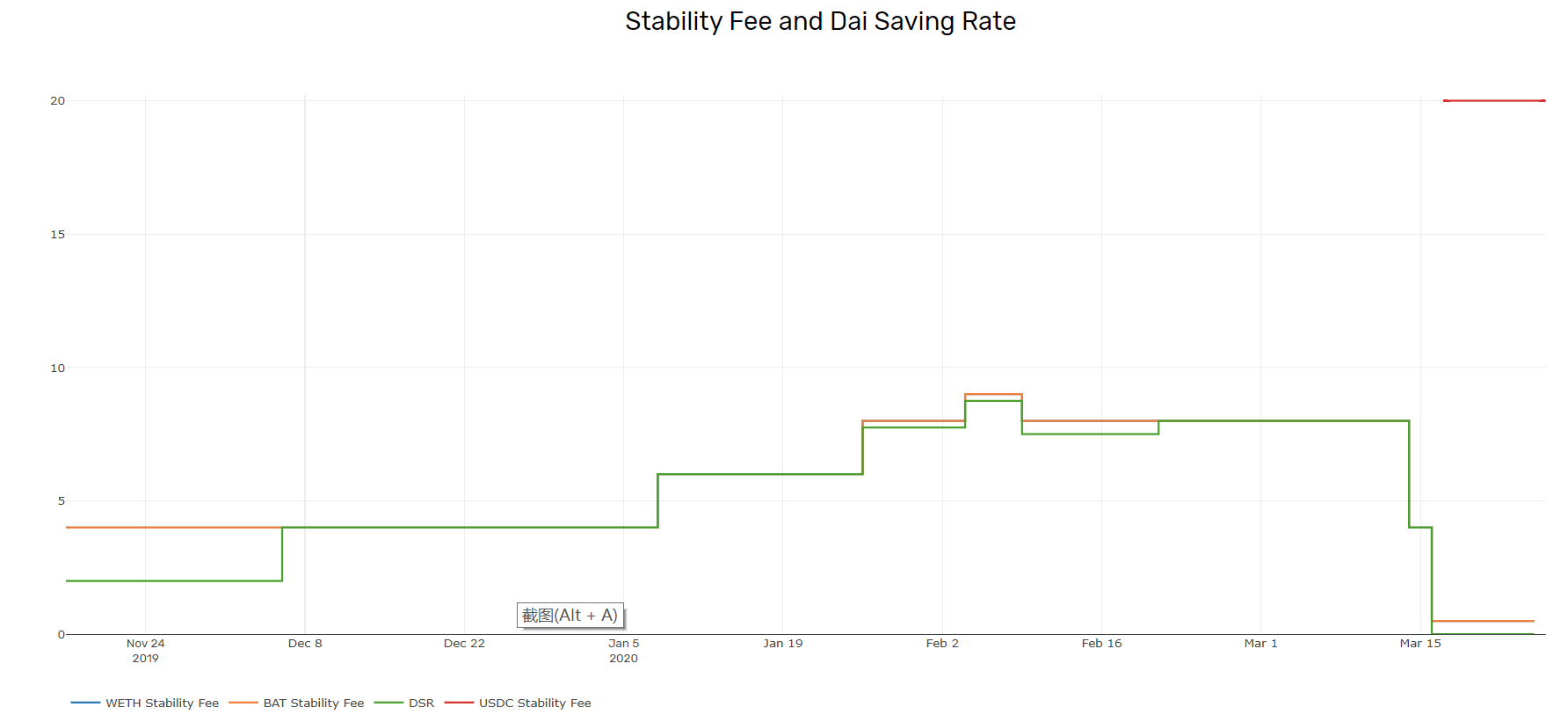

Maintaining the dollar peg of DAI is the number one goal of Maker's monetary policy. Therefore, in order to return to peg, the Maker community quickly adopted a radical monetary policy. On the 14th and 16th, the stability fee and DSR were lowered twice, the MCD stabilization fee was lowered from 8% to 0.5%, and the DSR was lowered from 8% to 0%. Moreover, the centralized USD stablecoin USDC was supplemented as collateral , But set a punitive stable fee rate of 20% and a mortgage rate of 125%. Maker hopes that this series of monetary policies can increase DAI supply, bring liquidity to the market, and return to peg.

However, the results of this series of monetary policy operations are not satisfactory. The ETH and BAT collaterals in MCD are still falling, and DAI Supply is still falling. The USDC, which originally thought it could provide a large amount of liquidity, only supplies 6,841,837 DAI, which only accounts for 34% of the USDC debt ceiling. Arbitrage is not positive.

Figure: Changes in the total DAI market

Figure: Changes in the total DAI market

At present, the supply and demand of DAI in the secondary lending market is unbalanced. The utilization rate of DAI on Compound is as high as 74.85%, while the utilization rate of USDC on Compound is only about 14%.

In the current situation, if ETH plunges again in the near future, the DAI premium will soar to an unacceptable level, resulting in Vault openers being unable to purchase DAI from the market to return debt. In the current market environment, crypto assets are highly probable as the international capital market soars.

Here, we want to explore why Maker's monetary policy would fail, and if the existing monetary policy fails, what other measures can solve the liquidity crisis of DAI in the current market environment, increase the market supply of DAI, and Pull the DAI back to a 1: 1 peg and provide experience for other mortgage stablecoin projects.

The "rope effect" of monetary policy makes it easy to tighten and hard to expand

In the world of fiat currencies, the "rope effect" of monetary policy has long plagued the monetary policy makers of central banks. The so-called "rope effect" means that the effect of monetary policy is as radial as a rope. The effect of tightening monetary policy during inflation is obvious, and the effect of expanding monetary policy during deflation is limited. When adopting a tightening monetary policy, reducing the amount of money and loans, the effect of controlling inflation was immediate. China experienced several severe inflations in the 1980s. At that time, the People's Bank of China adopted a tightening monetary policy. Inflation is contained.

But during periods of economic recession and deflation, monetary policy will fail. After the Asian financial crisis in 1997, China experienced deflation and the central bank adopted an expansionary monetary policy, but the price index did not improve and the economy did not recover. It was not until 2003 that China's economy emerged from cyclical deflation. Although expansionary monetary policy can reduce the cost of money creation, when the whole society remains pessimistic about future growth expectations, social investment will not increase, and under the currency mechanism of debt creation money, the amount of money creation will also decrease. In a crisis situation, there may even be situations when the central bank releases water and market liquidity disappears. This is what Keynes called a liquidity trap.

At present, DAI has seen the “rope effect” of monetary policy, and has fallen into a liquidity trap. Under Maker ’s existing monetary policy framework, monetary policy has been extended to near extremes, the stable rate is close to 0, and the DSR is already 0, but the DAI supply on the market is still not growing, and at the current DSR of 0, it is still About 23% of DAI remain in the DSR, which has caused the DAI premium in the secondary market to remain high.

In addition, during the deflation cycle, when the debtor expects the collateral price to continue to fall, he will be more inclined to return the debt in advance, retrieve the collateral, sell the collateral, and hold cash. With the epidemic gradually turning into an economic crisis and a financial crisis, the optimistic mood of halving the cryptocurrency market also reversed instantly. After the 3.12 crash, many digital currency investors believe that the ETH price will enter a highly volatile cycle and may continue to plummet at any time.

Under pessimistic expectations, Vault holders face double liquidity pressures. First, the price of ETH will fall. If ETH is the base, the asset-liability ratio will increase relative to DAI, so it is necessary to repay the loan in advance to get back ETH. Second, if the fiat currency is the basis, they will choose to redeem and sell the collateral, holding the fiat stable currency. Therefore, regardless of whether the holder of the vault is the currency standard or the fiat currency standard, redeeming collateral, closing the vault, and holding ETH or fiat stablecoins are rational choices under deflationary pressure.

USDC interest rates and mortgage rates are too high and there is no arbitrage

Maker's emergency introduction of USDC as collateral was designed to provide additional liquidity during times of crisis, maintain the peg of DAI and the US dollar, and facilitate Keeper's participation in collateral auctions. The motivation for USDC holders to pledge USDC to create DAI comes from arbitrage.

However, under the current USDC monetary policy of Maker, with a 20% stabilization fee and a 125% mortgage rate threshold, the USDC arbitrage window is very small. Assume that the DAI premium in the current market is USD 1.03, and the deposit interest rate of USDC on Compound is 0.5%. The USDC arbitrageur must buy back the USD-denominated DAI in 56 days to make a profit, but the current Maker monetary policy fails and the external environment Under turbulent circumstances, who is confident that DAI will reach parity within 56 days?

If they cannot return to parity within 56 days, USDC arbitragers will face interest rate losses on USDC stabilization fees. In addition, under the premise of a 125% mortgage rate, the utilization rate of the USDC participating in arbitrage is only 80%, which lowers the overall rate of return on arbitrage.

Under such harsh arbitrage conditions, few arbitrageurs are willing to participate in USDC / DAI arbitrage unless it is for public benefit purposes. After all, just buy and sell, there are not many risk-free and friction-free arbitrage opportunities in the digital currency market, why should arbitrageurs risk arbitrage DAI? Without the participation of USDC arbitrageurs, in the case of monetary policy failure, the "natural" Vault mortgage generation DAI cannot create a large number of DAI for Maker and bring the DAI back to the parity of the US dollar, then the significance of the urgent introduction of USDC as a crisis Facility What is it

Users leave, DeFi market competition

Maker is essentially a loan agreement without counterparties. At present, in addition to repaying Vault debts, there is no rigid need for DAI. The main use of Vault users to generate DAI is to increase leverage to make long digital currencies. However, compared with a year ago, there are now many more options available to lenders, such as Compound, dydx, lendf, and various CeFi loan services.

Even if only DeFi lending is considered, in addition to no counterparty risk, Maker does not have an advantage over other mainstream DeFi lending services in terms of loan variety diversity, mortgage rate threshold, and clearing friendliness. Lendf, for example, accepts a variety of collateral, including erc BTC, and can lend a variety of stablecoins. The mortgage rate threshold is also much lower than that of Maker. The clearing system also adopts a more friendly position-by-position settlement, rather than a full position. Liquidation, and liquidation penalties are lower than Maker. Even more unfortunately, the $ 0 auction of Maker collateral that occurred after the 3.12 plunge hurt a lot of Maker's hardcore fans. According to statistics, about one-third of Maker users suffered losses. Maker did not propose a compensation plan, making many Users hate Maker from anger, clear Vault, and switch to other DeFi loan services.

These competitors have stolen many DAI stocks and incremental users, which is one of the important reasons for the failure of Maker's monetary policy.

This Maker's monetary policy stress test provided many important inspirations for the mortgage stable currency's monetary policy to cope with the liquidity crisis, and will help Maker and other mortgage stable currency projects to better overcome the crisis in the future.

Suggested routine measures

- Rather than cyclical stimulation, it is better to release water in a cyclical manner

From the second half of last year to the mid-February boom cycle, Maker's DAI debt balance rose rapidly. In order to avoid over-inflation of debt, the Maker community has been conducting counter-cyclical monetary policy operations during this period, constantly increasing the stability fee and DSR of Maker, and controlling the total amount of DAI in the market.

Figure: Maker stabilization fee and DSR change

Figure: Maker stabilization fee and DSR change

Maybe Maker should perform procyclical operations during the boom period to keep low stable rates and DSR. Under the condition that Maker's overall balance sheet is healthy, the rope effect of monetary policy is used to expand the total amount of DAI to a new level in one fell swoop, creating sufficient liquidity reserves for future depression cycles. After this plunge, Maker's overall mortgage rate remains high, which means that Maker wasted a lot of monetary policy space during the boom cycle.

In addition, unlike the bank's partial reserve system, DAI is an excess mortgage system, and the currency multiplier is less than 1, which means that the effect of Maker's monetary policy was originally discounted, so it is more important to expand the monetary policy during the boom. Use your feet procyclically.

- Reduce USDC's interest rate and mortgage ratio to provide risk-free arbitrage

Since Maker has introduced USDC as an emergency collateral, it should make full use of USDC's liquidity tools. It can reduce the stable rate of USDC to 0, reduce the mortgage rate of USDC to 100%, and maintain the DAI debt ceiling of USDC. 20000000. This operation can create a risk-free arbitrage space for arbitrageurs under the premise of ensuring the decentralization of the DAI subject, and bring DAI back to the parity of the US dollar in the shortest time, making DAI a stable currency with a certain expansion flexibility, which can be tracked The market demand adjusts the supply, and by controlling the debt ceiling, it ensures that the DAI subject is decentralized and will not become a stablecoin endorsed by the fiat stablecoin.

- Reduce the threshold and expand the types of liquid collateral

The threshold for liquid collateral can be appropriately reduced, and more liquid collateral can be added. In fact, as long as the liquidation process is smooth, the risk of collateral liquidation is with the user, not with Maker. Let the user of the mortgaged asset borrow DAI to control the risk on his own. Maker does not have to do excessive risk control for the user.

Suggestions for non-routine measures

- Adopt "fiscal policy"

Currently Maker only has a monetary policy and no fiscal policy, so it is weak to deal with the liquidity crisis. When the sovereign government responds to the economic crisis, in addition to monetary policy tools, there are various expansionary fiscal policy tools, and mainly various fiscal policies, which expand government spending, stimulate overall social demand, and directly introduce liquidity to society.

Issuing "national debt" is the most feasible "fiscal policy" of Maker. The specific method is to first expand MKR to collateral, which can maintain a mortgage rate of 150%, but it needs to provide a stable rate of lower or even 0, and give reasonable The debt ceiling, then borrowed the MKR from the foundation to borrow DAI, and then put it on the market to sell arbitrage until the DAI returned to the parity of the US dollar. When the DAI is at par or negative premium, the Maker Foundation will use the "national debt" funds to buy back and destroy DAI, and redeem MKR, which is equivalent to the national debt repurchase operation. In addition, Maker's "national debt" policy can also play an expected management role, calming Vault holders' fear of DAI premiums, and putting liquidity into the market when liquidity disappears. The profits from arbitrage can be put into Maker's Surplus to destroy MKR and give back to the community.

Maker ’s current liquidity crisis also raises questions about our DeFi governance system. For the governance of Maker, I have done detailed research before, and Maker can be called a model of DeFi decentralized governance. But this time, we found that a considerable part of the challenges that Maker faced in the crisis stemmed from decentralized governance. We can't help asking whether a thorough decentralized governance system is really capable of operating a new currency? Are democratic decisions really correct? Was the right decision at the time correct in the future? Is there a perfect compatibility between De and Fi for the DeFi project? For your consideration.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin mining difficulty is reduced by 15.95% again: the drop is the second highest in history. Why is this?

- Leek flower | insist on fixed vote for two years, I did not expect that I still lose

- Observation | Bitcoin's Recent Market and Network Status Study: There is still significant downside risk in the currency market, but it may have reached the range of fixed investment layout

- "Bitcoin" search analysis: Google trend slightly decreases price and search correlation over 80%

- The market is nearing the "explosion" edge. Will Bitcoin easily return to $ 8,000?

- Opinion: sooner or later digital dollars, U.S. citizens' privacy may be violated

- The first in Beijing! The Blockchain Application Platform of Xicheng District Opens the Information Barriers of Multiple Departments, Citizens "Brush Faces" Can Do Things