Observation | Bitcoin's Recent Market and Network Status Study: There is still significant downside risk in the currency market, but it may have reached the range of fixed investment layout

Written by: Marlie

Editor's Note: Original title was "OKEx Research | Bitcoin Market and Network Status"

The currency market is tricky. After March 12th, the binding between the currency market and the US stocks seemed to be undone, and a V-shaped reversal emerged. The V-shaped rally suggests that many people may be back after panic selling.

In a panic, all assets are related. When the bad news comes, people race to sell, and then spend some time assessing the situation before taking further action.

- "Bitcoin" search analysis: Google trend slightly decreases price and search correlation over 80%

- The market is nearing the "explosion" edge. Will Bitcoin easily return to $ 8,000?

- Opinion: sooner or later digital dollars, U.S. citizens' privacy may be violated

The essence of investment is to manage capital risks from future uncertainties-including not only the risk of losing money, but also the risk of missing opportunities. The difficulty of investing is that these two risks cannot be eliminated at the same time, and you must develop a definitive and executable strategy for this uncertainty.

In dealing with the future, we need to gain insights from observations of the status quo. This article records observations and reflections on Bitcoin's recent market and network status (2020/03/24).

When looking at Bitcoin, I don't really look at pure market indicators-I'm not a trader, but a cycle-oriented asset allocator. What does that mean? In my cryptocurrency investment, I trade infrequently and only do configuration; my configuration strategy depends on the market cycle and technology / ecological development cycle.

Closer to home, let's start with MVRV.

1 / MVRV

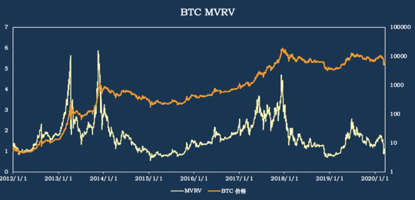

MVRV is composed of two parts, market value (MV) and realized market value (RV), which is the ratio of the two. The market value is easy to understand. Understanding the realization of market value is the key to understanding this indicator.

The realization of market value refers to the sum of the price of Bitcoin UTXO (when it is generated) in the market, which generally reflects the cost of holding coins by market participants-exchange transactions are not fully reflected by changes in UTXO, so it can only be "generalized" ".

MVRV can be simply understood as the current market price to cost ratio. As shown in the figure above, from the perspective of historical laws, when the MVRV is lower than 1, it is usually a good investment period. Regardless of the position, investors can make a fixed investment around MVRV = 1. Thinking about the position will be more complicated-it is closely related to the position weight, risk tolerance, cash flow status, investment experience and so on. For example, when my friend reminded me that MVRV = 1.3, I was thinking of lightening up.

As can be seen from the above figure, the MVRV of Bitcoin has recently dropped to 0.9, which is already a good point for fixed investment (at this time, I sent a reminder in the community). Now MVRV has rebounded to 1 with the rebound of BTC. Considering the rapid rebound and changes in the realization of market value, this rebound should be a return of funds in the field after the irrational panic has been eliminated.

2 / active addresses

At present, cryptocurrencies do not have a good pricing theory, which is also one of the limitations of its industrial development. However, with some indicators, we can observe the relative state of the price and value of Bitcoin, Ethereum or other cryptocurrencies. What I'm looking at here is the number of active Bitcoin addresses-the number of active addresses reflects the size of Bitcoin's users.

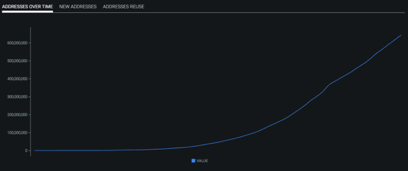

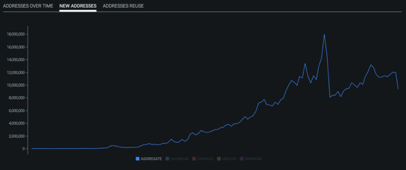

Bitcoin is both a stored-value tool and a payment tool. Especially as the latter, it has obvious network effects. The following figure clearly shows that there is a certain correspondence between the square of the number of active Bitcoin addresses and its value, which is in line with Metcalfe's law.

In the logarithmic coordinate system, we can see that there is a clear correspondence between the square of the number of active addresses and the price of Bitcoin. Based on the deviation of the above two data of bitcoin in 2015-2017, it can be speculated that the last bull market bitcoin experienced a period of first value return and then excessive fanaticism; at the same time, it seems that it can be speculated that there is not much deviation between the price and value of bitcoin.

The value of Bitcoin depends on the growth of users, or the common words in the digital currency field, and the growth of consensus. User growth fits the contagion model:

Each of our holders is actually a communicator of Bitcoin "virus", and some are super communicators, commonly known as "Milk Kings".

According to this model, under optimistic conditions (the ratio of the probability of contact times the probability of spread to the probability of healing is greater than 1), Bitcoin will be held by everyone in an exponential trend.

The two graphs above show the total Bitcoin address and the number of new addresses over time. It can be seen that although the number of new addresses is greatly affected by the market (in order to increase service), the increase and increase are increased with the increase in the total number of addresses, which is in line with the description of the appeal model. Assuming the market stays sideways, the number of active Bitcoin addresses and the price will completely diverge again, and the next big bull market is brewing as participants' confidence recovers.

3 / RVT

RVT is actually an indicator that combines the market's currency holding cost and network activity, and is the ratio of market value and on-chain transaction volume.

When it comes to network activity, you must understand what network activity means for different projects. For example, due to the differences in the meanings of network activity between Bitcoin and Ethereum, RVT cannot describe the two equally.

In the current stage of Bitcoin's development, it exists more as a speculative target and stored-value tool rather than a payment tool. Therefore, the on-chain transaction volume reflects the activity of the transaction market, rather than the use of payment tools or the degree of ecological prosperity. Based on this, we can use RVT to help us understand the state of the market.

The rollover of RVT (90D) at the top often means that the market is turning bears and bulls, and the market becomes active when the cost has not risen; as the price increases, under the action of people's transactions, the market cost starts to synchronize with the transaction volume Zooming in, RVT's continued maintenance at the bottom represents market enthusiasm. Although it is difficult to predict the top, investors need to become more conservative; after the bulls turn bears, the transaction volume shrinks more often than the market cost, so RVT will rise. With the continued shrinking trading volume, investors can consider more aggressive. The current extreme market conditions have reduced the market cost and enlarged the transaction volume. RVT has declined. It cannot be used as a signal to enter a bull market. It needs to be stabilized before observation.

4 / UTXO (<1 month)

Delphi uses the UTXO ratio of more than one year as an indicator to observe the state of the market cycle. I think that the UTXO ratio of less than one month may describe the market status clearly.

The increase of UTXO below one month represents more Holder participation in market transactions; sudden extreme market conditions will cause this value to rise abnormally. In this case, the impact of the underlying reasons on market conditions will be analyzed separately.

We saw the bull market in 2017, the ratio had reached 23%, this value should be a very dangerous sign as experience. In fact, it may be time to lower the position to be conservative (such as from 10% to 5%) when the UTXO ratio of less than one month exceeds 15%; when this value is near the low 10% for a long time , You can consider increasing the position by fixed investment (such as from 5% to 10%).

Comprehensive review

The past week is still a turbulent week. The market is digesting the impact of global central banks and the epidemic, and various types of assets are constantly being repriced. Rising volatility forces the fund to reduce its position size, adding greater selling pressure to an already feared market. Some of the world's largest market makers have also reduced their trading activities, as the increase in financing costs has squeezed the profit margins of their strategies, which has further reduced liquidity and increased price volatility.

The currency market has picked up recently, and participants' market sentiment has even become more optimistic. But I maintain my previous judgment that the bull market of the currency market will not arrive until the external environment is stable (not necessarily restored). From the perspective of bitcoin's market and network status, although the currency market still has great downside risks, it may have reached the range of fixed investment layout.

Disclaimer: This article records the author's observations and reflections on the recent market and network status of bitcoin. All content is not intended as investment advice for others. Investment should be considered independently and at your own risk.

Risk Tips: All articles of OKEx Research do not constitute investment recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspections of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The first in Beijing! The Blockchain Application Platform of Xicheng District Opens the Information Barriers of Multiple Departments, Citizens "Brush Faces" Can Do Things

- Interdisciplinary, industry-education integration: the first blockchain major in China is here

- How to use the Merrill Lynch clock to grasp blockchain investment? Global Top10 Crypto Fund Reveals Your Secrets | Babbitt Industry Class

- Search plunged into 90%, panic continued, and bitcoin bottomed out all the same signals?

- How to choose the cryptography technology? Preliminary Study on Security Model of Theoretical Capability Boundary

- Babbitt Column | Bitcoin is a risky asset, and hedging properties have never really been verified in the market

- Research report | How to invest in crypto assets under extreme conditions?