"Crypto World" under the epidemic: analysis report of the digital currency industry in the first quarter of 2020

Author: Mike

Produced by: Coin Circle Xiao Li & Star Media

Iran ’s military chief Sulaymani was attacked and killed. US-Iranian relations were tense again. Australia ’s forest fires burned for several months. More than 400 people were killed and new crown pneumonia swept the world. China used its national strength to fight the epidemic …

Iran ’s military chief Sulaymani was attacked and killed. US-Iranian relations were tense again. Australia ’s forest fires burned for several months. More than 400 people were killed and new crown pneumonia swept the world. China used its national strength to fight the epidemic …

- Global Blockchain Industry Development March Report: Digital currency supervision speeds up, and the monthly financing amount of the blockchain breaks 500 million US dollars

- QKL123 market analysis | BCH, BSV halved before BTC, how do miners react? (0408)

- Will Bitcoin have a 10-fold increase? Mining or the blue ocean market? And listen to mining giants explain mining evolution in detail | Babbitt Cloud Summit

2020, it seems destined to be a year of turmoil!

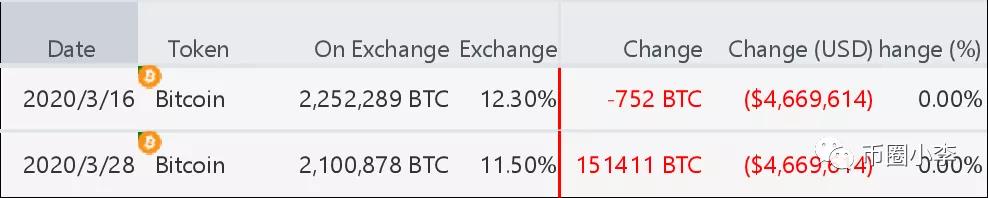

At the end of February, the number of domestically diagnosed cases and death rates both fell, and the epidemic prevention and control work showed an inflection point. I thought everything had passed, and as a result, the plot surprised us again: the epidemic situation in Europe and the United States broke out in large areas, the US stock market was melted four times, and the capital market was hit hard. This series of geopolitical tensions, the deterioration of the ecological climate, the outbreak of global public health events, and the overall downturn in the capital market have led to corporate failures, employee unemployment, and family conflicts. Press the "Restart button" every year.

Under the butterfly effect, it is difficult for the currency circle to stay out of it. Virtual currency mining practitioners, digital currency traders, and digital currency trading platforms have all suffered unprecedented impact. This report is mainly a review of the first three months of the 2020 currency circle. After the decline, we will review the illusion of the previous fanaticism and the changes in a small number of circles (mainly Bitcoin and stablecoins) in the digital currency market after the decline. In order to provide you with an auxiliary role in the judgment of the future market.

1. When the epidemic spreads to the financial market

In February of this year, while China was doing its utmost to fight the epidemic, Wall Street practitioners were immersed in China trapped by the epidemic, and the United States could take this opportunity to make a fortune, and the future economy will grow exponentially and be complacent.

American investment management company Investco predicts:

In the summer of 2020, the US economy will not only recover from the economic slowdown caused by the coronavirus, but the economic growth momentum will be stronger than ever.

S & P Global forecasts:

The global epidemic situation will stabilize in April 2020 and the scope will be further narrowed in May.

On February 12, the New York Times published a report entitled "Experts say that Wuhan coronavirus is more and more like an epidemic." Ten days later, the three major US stock indexes hit a record high.

It was not until March 13th, two days after the World Health Organization officially announced the global pandemic of this coronavirus, that JP Morgan released a new forecast: the US economy will shrink by 2% in the first quarter and 3% in the second quarter. At the same time, Goldman Sachs expects a 0.7% increase in the first quarter and zero growth in the second quarter. Economists at the Federal Reserve Bank of St. Louis predicted at the end of March that the number of unemployed people due to the recession caused by the corona virus will reach 47 million, pushing the unemployment rate in the United States to 32.1%, which is higher than the highest level during the Great Depression. More than a percentage point. Just two weeks after the above data was released, Goldman Sachs revised their forecasts. They believe that the world ’s largest economy will shrink by 34% in the second quarter. They wrote that by the middle of this year, the unemployment rate will soar from the previously predicted 9% to 15%. It took only two weeks from complete optimism to complete pessimism.

The traditional financial market crisis can be said to have arrived ahead of time with the help of the epidemic. As early as the end of last year, the United States has begun to expand its watch business. Large global hedge funds have also increased their short positions at the beginning of the year. The change is prepared, but I did not expect it to come so suddenly and so large.

Because the outbreak first broke out in Italy, under the double pressure of the European people ’s ideology and geographical constraints, the outbreak was not controlled, and began to spread from point to face, and began to affect European economic activities. The financial market as a prospect of real economic activities Role, it is bound to make tactical adjustments to the investment decisions of the impact of global health events-the first task: to implement risk reduction actions on risk assets. Immediately afterwards, Saudi Arabia and Russia broke into a petroleum war, which further exacerbated the deterioration of the capital market, forcing the long-lived century-old fuse to link up four times within a few weeks.

The epidemic, the oil war … When these uncertainties erupted on a large-scale and high-intensity concentration, they exacerbated the panic of investor uncertainty. This panic would directly reflect on the capital, market liquidity and financial product markets, and the global economy. Naturally, the flow of the United States is slowed down by these panic attacks, and as the international financial hegemony, the dollar ’s lack of liquidity is becoming more and more obvious.

Based on historical experience, we know that whether it is a first-tier market or a secondary market, when a financial crisis occurs, institutions (investors) will exchange cash for liquidity in a large amount, thereby reducing the risk of substantial asset shrinkage. In the past few years, the CME and Bakkt exchanges have served as institutional venues for bitcoin. During the period of stability, bitcoin has brought inflows of funds. When the crisis comes, bitcoin, as a liquid alternative investment product, is also Institutions maintain their liquidity and dedicate themselves. This time, Bitcoin, hailed as digital gold, once again demonstrated his strong liquidity. The difference is that the cryptocurrency market has reacted more tensely to the liquidity crisis, which also triggered a 3.12 panic plunge.

Two, changes in the mining industry

1. Mining machine market hit

The price of Bitcoin plunged from a high of 10,550 dollars in February to a low of 3,800 dollars, and the market's claims about the mine disaster began to flood the various media channels. Judging from the adjustment of the mining machine's computing power, mining revenue ratio, and computing power difficulty, this wave of sharp declines has indeed brought great pressure to some old miners.

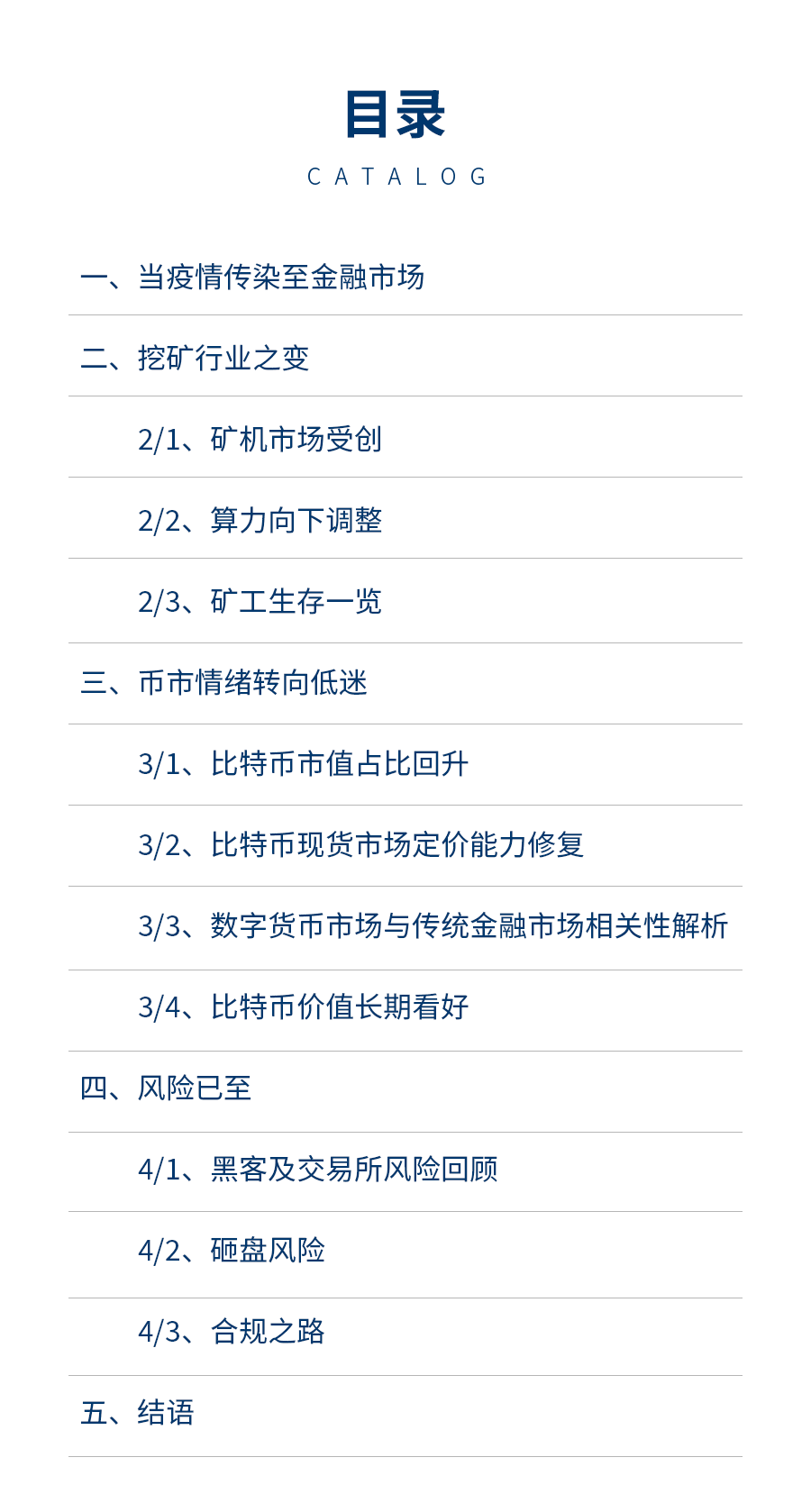

Judging from the mining machine models counted by F2pool and the proportion of electricity costs for running mining machines, taking BTC mining machine as an example, with electricity cost of US $ 0.05 / kWh as the standard, 16% of nearly 100 mining machines are forced Shut down, and once it fell below 7000 US dollars, there will be more than 30 old mining machines also in a state of loss, including the king of the mining machine ant s9. The current bitcoin price is US $ 6,600, 60% of the miners can reach US $ 1, and 45% of the miners can reach US $ 2. It seems that more than half of the miners are still profitable, but the reality is that once Bitcoin If the price drops further, only 17% of the mining machines can survive at a price of 3500. That is, most mining machines on the market with a computing power of about 40T will face shutdown, such as Ant T17.

F2pool mining machine model and electricity fee income statistics

2. Downward adjustment of computing power

Since the beginning of June last year, the continuous decline of Bitcoin has brought great pressure to the miners in the circle. Many media reported that there have been rumors that the miners have surrendered. With the longing for halving the price of Bitcoin, he had to increase the mining cost and iteratively update his mining equipment so that he might not be washed off.

Since 2019, bitcoin's computing power has fallen to a maximum difficulty of -7.10%. Later, when the bitcoin price bottomed out at $ 6,400, the computing power did not drop but increased slightly, constantly reaching new highs. The preparations have laid the foundation for profitability in the 1-2 rising market.

The latest difficulty of the pre-computed power will be adjusted on March 25, down -14.96% month-on-month, and the difficulty is expected to be 14T. This adjustment of computing power has received widespread attention, and there are even comments that the Bitcoin network is about to collapse. In fact, it can be clearly seen from the figure below that from 2011 to the current adjustment of computing power, Bitcoin's computing power has fallen by more than 11% only five times, and the difficulty of computing power of more than 11% has fallen. You will find that these large adjustments in computing power are mostly at the relative bottom of the market. In November 2011, the computing power decreased by 18.03%; in December 2012, the computing power decreased by 11.59%; in December 18, the computing power declined successively, with a range of 15.13 % And 19.56%. After these declines in computing power, the bitcoin price will open a low volatility market at the bottom. After the volatility market ends, it will open a strong upward market. This is undoubtedly good news for coin hoarders.

In contrast, during the period of high computing power, the correlation between the sharp increase in mining difficulty and the increase in currency price is extremely weak. In 2013 and 2017, the price of Bitcoin was under the top. The difference in the upward adjustment of computing power was nearly doubled, which was 30.01% and 17.44%, the close observation of the recent two price increase trend highs has even more minimal increase in computing power, only 14.23% and 7.08%. The reason for this is that every bitcoin rise comes in a menacing way. When the currency price rises, miners generally maintain the mentality of watching the currency price trend, and will wait until the decision to make strategic adjustments to make overweight mining behavior. , Then the existence of a certain period of time makes the correlation of upward adjustment of computing power decrease. Therefore, relative to the rise, the currency price has fallen sharply, and the miners only need to shut down and pull out the line without making any preparations, so that the calculation power can be adjusted downward quickly.

Changes in Bitcoin's computing power

It should also be noted that this sharp decline in computing power has a great relationship with the "halving" market. On the one hand, from the perspective of some miners ’intentions, you can see that before and after halving in the middle of 16 years, the adjustment of computing power remained at a level of small fluctuations, and the number of miners at that time was far less than today. Mine, the distribution and competition of interests are far less intense than today. So when this "halving" is about to occur, some miners who seize the next computing resources will have an incentive to cooperate with the market to influence the price of Bitcoin and force another part of the miners to surrender.

On the other hand, in terms of the miners' own emotions, this rise has given too much "halving" emotions, causing some miners to join the ranks of multi-bitcoin with leverage to become rich overnight, such as instalment debt mining Mine miners, when the lever is broken by the falling currency price, everyone's mentality undergoes a transition from rich to negative, then the profit-mining miners can only surrender in the face of unprofitable or even loss.

3. Survival of miners at a glance

On March 26th, the actual computing power decreased more than expected, at -15.95%, and the actual difficulty was 13.91T. The large reduction in computing power gave the surviving mining machines greater profits. The mining machine market As with the trading market, only those who survive will be able to get dividends not available to the exit. The next adjustment (after 14 days) is expected to be -16.10%, and the next difficulty adjustment will be 11.67T. The difficulty adjustment is also expected to indicate the number of miners leaving the field. If you follow the idea of forcing the old miner, can the old miner still get the chance to re-enter the market after the next difficulty adjustment? In order to obtain higher profit margins for the miners who survive after that, the market will clear out more old miners, so the probability of further decline in bitcoin price and maintaining low volatility is not low in this respect.

The new adjustment of BTC computing power ended on March 26

Although only 16% of the old mining machines are currently down, the new mining machines are not all smooth sailing. According to some industry insiders, the impact of the collapse of the digital currency market is even more affected by the increased leverage of miners. In the continued low price of the currency, the miners who borrowed to buy the miners had to mortgage the miners to obtain short-term liquidity. The miners who paid electricity in installments continued to mine with the utmost suspicion. The next trend of the currency price is related to these miners. life and death. In general, the removal of miners does not actually affect the existence of the Bitcoin network. Every time the old miners are cleared, it is also an upgrade of the industry's hardware. Continuous elimination is actually the maintenance of the mining ecology. After these crisis moments, the mining ecology will continue to improve defects, which can be seen as financial services for hedging tools or will guarantee the survival conditions of miners.

Finally, the factor of the sharp drop in the currency price is not limited to forcing miners to surrender. In other words, under the illusion that the cryptocurrency market is quietly squeezing into the world's largest financial market, miners have become the burial goods of giant whales.

3. The sentiment of the currency market turned into a downturn

1. The market share of bitcoin has rebounded

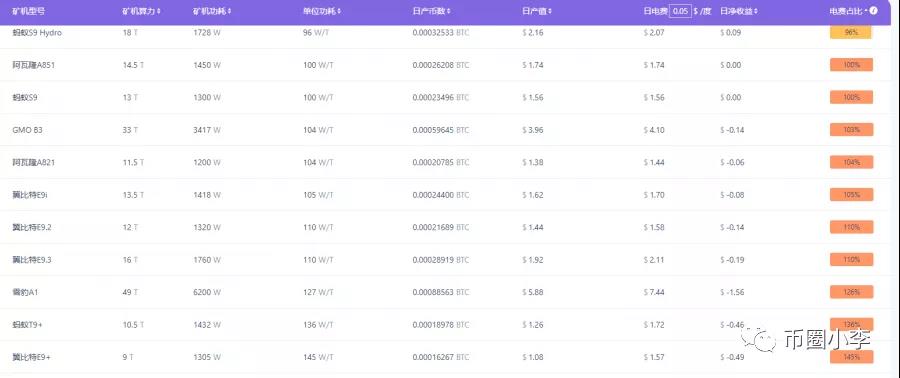

Judging from the total market value of Bitcoin, as the price of Bitcoin rose in April 19, the total market value of Bitcoin continued to increase. In 19 years, the price high accounted for 69.9% of the total market value of digital currency, and the upward trend was strong. In contrast, this round of January-February rise, led by mainstream currencies such as bsv and bch, dragged bitcoin prices along the way. These highly leveraged mainstream currencies have occupied a large amount of funds in the stock of the digital currency market. As the digital currency with the largest market share of digital currency, bitcoin, without new capital entering the market, it is simply a fancy to want the currency price to continue to rise.

When the surge wave faded, naked swimmers carrying high-leverage mainstream coins had nowhere to escape, and bitcoin's proportion of the total market value of digital currencies began to rise. We can see from the figure that the market share of Bitcoin rebounded slowly after the plunge, and the order of the digital currency market was reorganized. It should be understood that maintaining market order is a prerequisite for stable and lasting market development.

Ratio of total market value of digital currency

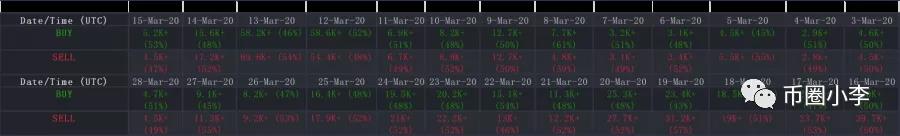

2. Fixing the pricing power of the Bitcoin spot market

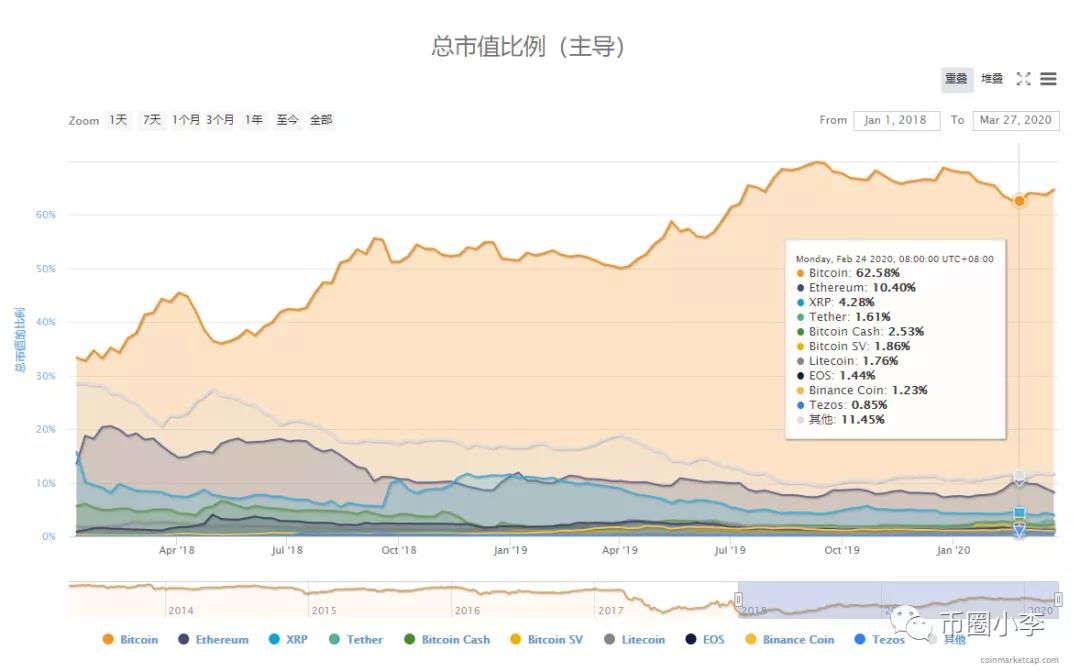

Before the 12th plunge, trading enthusiasm remained, and the total bitcoin level on all exchanges remained above 16% of the total supply. In the following days after the plunge, the exchange's currency holdings fell slightly, and with the external The environment has deteriorated further, and trading enthusiasm has been severely frustrated. In the past ten days, 154,000 bitcoins have flowed out of the exchange. While active funds have fallen sharply, short-term selling pressure has also decreased significantly.

Bitcoin's stock decline on exchanges

In recent days, the trading volume of Bitcoin, the largest exchange holding Coinbase, has decreased, reflecting a certain market downturn. The purchase volume of more than 50,000 coins from the 12th gradually shrank to only 4,000 coins, approaching the low point before the 12th plunge. During the same period, the trading volume of other large spot exchanges bitstamp and bitefinex also showed the same performance. Even though prices rebounded, market sentiment remained very depressed.

Coinbase transaction volume changes

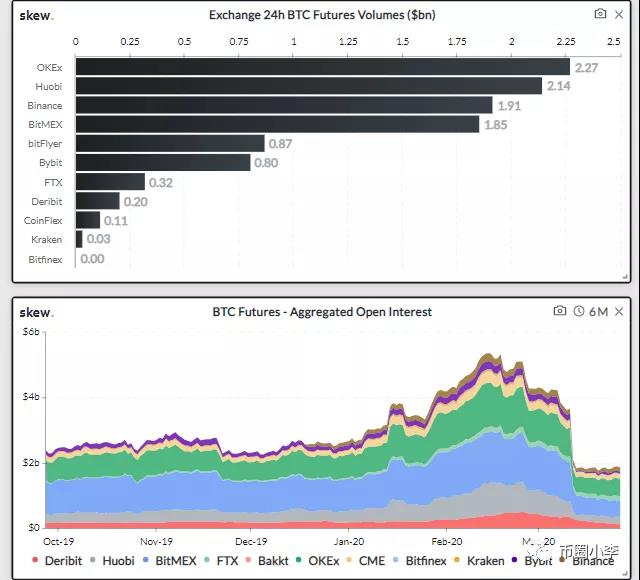

Based on the exchange's 24-hour bitcoin futures contract transaction volume and open interest, the futures market and the spot market generally experience the same dilemma, but in terms of decline, the dilemma of futures contracts is worse. Over the past six months, the criticism that the highly leveraged futures contracts have been used to manipulate currency prices has gradually ceased. The Bitcoin market has corrected the price fluctuations back to the spot market in a revised manner.

Changes in futures contract trading volume and total open positions

3. Analysis of the correlation between the digital currency market and traditional financial markets

The first remarks about the strong correlation between bitcoin prices and traditional financial markets appeared this year. The assassination of Iranian military generals began on January 3 this year. He was still speculating on the assassination of Iranian characters that morning, until it was confirmed that it was Sulaiman at noon. After Ninety, the position on the bitmex exchange closed more than 30 million short orders in more than ten minutes, and the price of Bitcoin was directly pulled from 6855 to 7200 US dollars. The next few days as the US sanctions on Iran fermented and geography Uncertainty in politics, there are constant rumors that buying OTC over the OTC and other politically turbulent regions makes OTC premiums high.

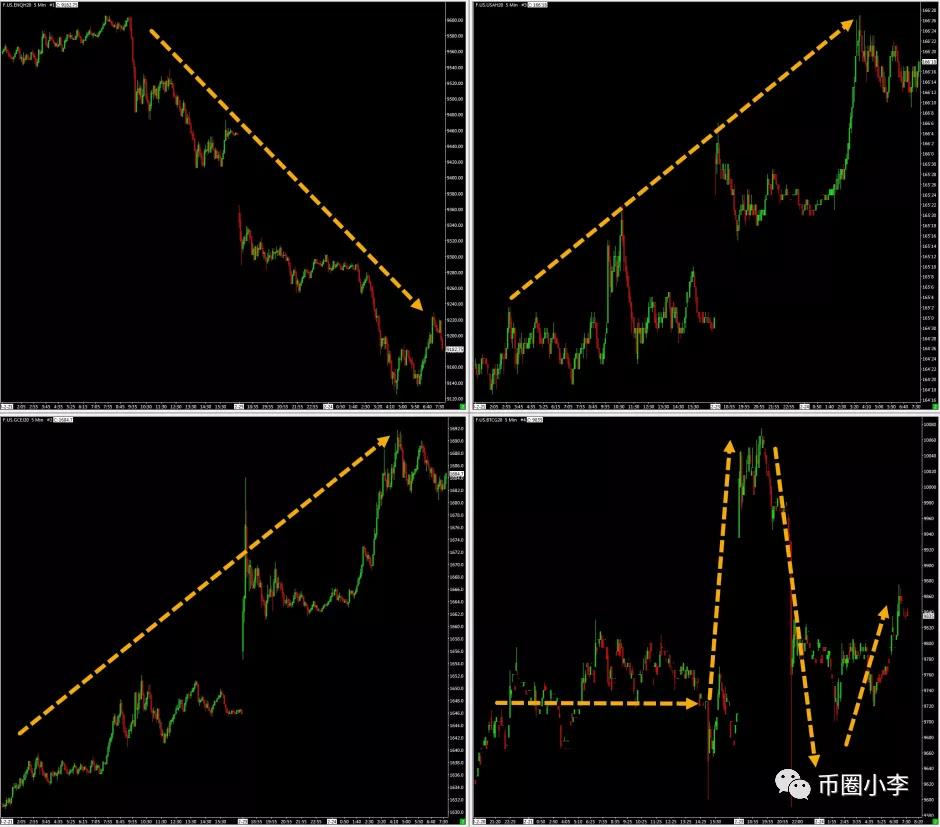

Next is another important time point. In the early morning of the 9th, after the US White House issued a message against Iran ’s counterattack on the US military base in Afghanistan, there was no casualties. Bitcoin was adjusted down to the 7700 line in the next two days. Keep mentioning. Under the attention of more and more people, many traders will stare at the trend of the traditional market, but as can be seen from the chart below, when the external environment does not change much, Bitcoin's time-sharing price trend still has its own ideas. Not at all related to US-listed technology stocks, government bonds, and gold.

Correlation analysis of the time-sharing trend of U.S. technology stocks, national debt gold and Bitcoin on Twitter (left and right up and down order)

At the same time, we compare the US stocks Dow Jones index from the recent bitcoin price trend. US stocks broke on the 9th for the first time this year. After the meltdown, rumors of lack of liquidity appeared in the traditional financial markets of the world, and the price of Bitcoin was after the first rebound. The turbulent trend started, and people who imagined that the trend of US stocks and bitcoin price were highly correlated began to be confused about the No. 9 US stock meltdown Bitcoin did not follow. However, the correlation between the subsequent plunge and the succession of U.S. stocks has increased, and some people have regained their confidence. The point of view of correlation has intensified.

Bitcoin price trend compared with Dow Jones price trend

In the long run, Bitcoin, as a new cryptocurrency digital asset, can be simply classified as an alternative asset within traditional financial assets. From this perspective, the correlation can be said to be negative, which is ideal for traditional institutions to configure risk portfolios. assets.

It is not that the relevance of bitcoin price movements to US stocks is not important, but that this part can only be used as a reference for doctrine, but it is not just their movements, but the logic behind them. Everyone knows that the trend of US stocks is based on the global financial market and the estimated performance of economic activities. After all, bitcoin is also affected by the same logic behind it, that is, panic and liquidity crisis. If you do n’t believe this set, then go back to the set of logic that the giant whale uses for the message. There is always a set for you.

But why is Bitcoin's decline more severe than the traditional market? Today, Bitcoin has only entered its tenth year, and the total market value of our entire digital currency market is only more than 100 billion US dollars. Under the infant characteristics of emerging industries and the strong supervision of governments of various countries, the digital currency market participates. The people are just a minority group, so the efficiency of the digital currency market is bound to show a weak state. Because the digital currency market is globally involved, overseas giant whales are scattered and more in number than domestic ones. There are giant whales besides giant dolphins, and giant dolphins are still alive, let alone small retail investors. In addition, there are many foreign data materials that China's currency speculators have no way to contact. These simple language barriers and network barriers have exacerbated this information asymmetry.

As a market with asymmetric information, the myth of wealth creation in the currency circle is the real initiator. Many ordinary investors flocked, and their overconfident mentality confuses themselves, simply thinking that they can take a slice of the soup, but they do not know how to escape in the end. It can be recalled that the early A-share market, the dominant players in the US stock market continue to rely on this information asymmetry to profit. Then, under the asymmetric information and unprotected mechanism, ordinary participants in the digital currency market feed themselves high-leverage feed, precisely positioning themselves as the target of the butcher's quick and accurate harvest.

Returning to the epidemic and the financial crisis, judging from the monetary and financial policies of various countries in the world and the G20 summit on the 26th, the global focus on anti-epidemic, with the full cooperation of various countries, the control of the epidemic is expected. At present, US stocks have stopped falling and rebounded, and gold has returned to the upward trajectory. More is that the liquidity crisis of the US stocks has temporarily stopped. The panic sentiment has bottomed out. The US stock market is still affected by the performance of major companies after the epidemic. The unemployment rate is high. Impact.

In order to protect the stock market, Trump urged the Fed to throw out loose fiscal and monetary policies one after another. From the US balance sheet, we can see that US assets have increased by 13% in the past week and by 22% in the past two weeks. After the 2008 US financial crisis, the US $ 4 trillion that stimulated the economy was amortized in the form of inflation. Under this situation, when the interest spread is zero, once economic activity stalls and enters a depression, no one will borrow and expand. The slowdown in currency circulation will inevitably shake the hegemony of the US dollar. By then, the credit and fiat currency system will face the challenges of gold, bitcoin, and physical necessities.

Total assets in the U.S. balance sheet

For the digital currency, the short-term liquidity crisis brought about by the panic of the epidemic has been lifted. As long as US corporate bonds can be stabilized, the future trend of US stocks will affect the short-term Bitcoin price trend from investment enthusiasm. In the long run, Bitcoin will reap great opportunities after the crisis.

4. The long-term value of Bitcoin

In addition to the value of Bitcoin itself, after the plunge of the entire network's pessimism about the stability of the digital currency market, focusing on the views of large institutions on digital currency can make us dispel a lot of doubts. Last year, after CME CME Group launched the Bakkt Exchange, which is a professional investment and trading institution, it quickly launched products that fit the market's needs, ranging from abundant spot delivery to cash delivery. This path is conventional, and the progress of all markets requires a slow process of discovery. At this stage of the digital currency market, if you want to enter the public's field of vision and have a long way to go, then large institutions entering the digital currency, that is, this market is valued, whether it is hedging risk on traditional financial assets or within its own market The game is good, it is very useful to attract public attention.

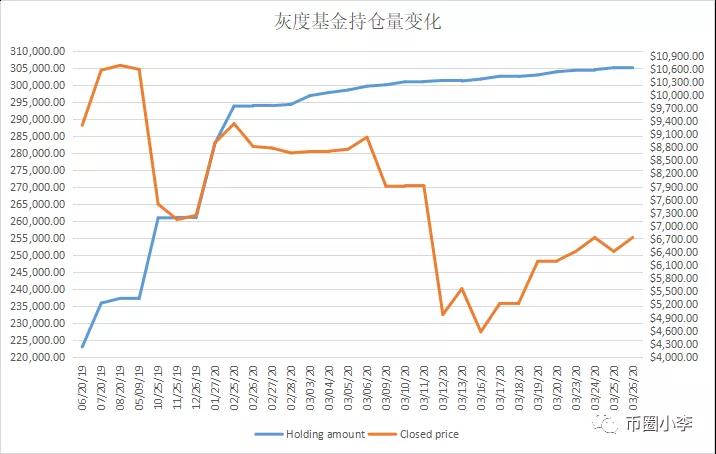

First of all, I will introduce you to the gray fund. In the past, some analysts also expressed some opinions on the gray fund premium index. This premium index can reflect the degree of foreign investors ’attention to digital currency to a certain extent. It is a leading indicator, but to Later, this became an arbitrage method. The rise and fall of currency prices have a weak effect on the gray fund's premium index. I personally prefer to analyze the views of institutional investors on Bitcoin from the number of their positions. As you can see from the picture below, when the gray price fell to 7-8000 US dollars last year, the increase in positions was postponed, and even the operation of buying high and selling low in small positions was made, which reflects the concerns of the gray fund on the market at that time. It exists. In contrast to this bitcoin price plunge, the Grayscale Fund increased 5,000 bitcoin positions within half a month after the plunge. Although the growth rate slowed down, this small change and the large number of holdings just reflected the institutions. Confidence.

On the other hand, the gray-scale fund holding 290,000 BTC in February is undoubtedly a giant whale. Under the rapid changes in the market, the institution as a rational person is unlikely to have psychological effects of disposal effects. According to the daily report released by Grayscale Fund, its premium index has not been greatly improved in the big rise, foreign buying sentiment is not strong, and the amount of admission funds does not seem to support them to simply buy digital currency, and this short Many bitcoin positions that have grown in just half a month come from their possibility of trading on the floor.

In the long run, the existence of unregulated and untrusted digital currency ETFs is not beneficial to the digital currency market.

Gray Fund Position Change and Bitcoin Price Trend

At the same time, after the bitcoin price bottomed at $ 3,800, Coinbase's bitcoin trading pair was once at a premium for a few days, which allowed us to see the confidence of foreign investors. Then, the sentiment of the domestic market can be learned by observing the status of stablecoins. At present, the mainstream stable coins in the market are USDT issued by Tether, BUSD issued by Binance, HUSD and TUSD issued by Huobi. The total market value of the latter two before and after the plunge is not much different. HUSD is due to the recovery mechanism. When the market has insufficient liquidity in the US dollar, it supplements the market with 100 million US dollars of funds, but then it is recovered after the market enthusiasm drops.

Let's focus on the data of USDT and BUSD. In the first three days after the plunge, the OTC transaction of the stablecoin USDT was too small, and it was difficult for domestic funds to deposit funds off-exchange, resulting in a premium of up to 7% and a strong bottoming mood. In addition, the market value of BUSD and both are climbing at an extremely fast rate. Tether issued more than 260 million US dollars in stable coins within 24 hours from March 18th to 19th. Its issuance volume increased by 27% in just one month, with a net increase of 1.4 billion U.S. dollars, and crossed the 6.2 billion U.S. dollar mark. The last time this increase occurred was in April of last year, the bottom of the bitcoin price increase in the middle of last year. The market value of BUSD has changed even more, and has doubled after the plunge, and is about to run towards 200 million US dollars.

Finally, it should be emphasized that even if the market value of the stablecoin market has been rising all the way to fundamentally give everyone a strong shot, the majority of investors should still pay attention to the "iron fist" risks facing stablecoins.

The risk has arrived

1. Hacker and exchange risk review

In this round of digital currency ups and downs, the risks of the digital currency market are frequent. Whether it is hacking or the maintenance of the exchange itself, it violates the interests of investors. The earliest risk warning this year came from hacking. At that time, a famous trader on Twitter issued a warning. He was suspended for a period of time due to the SIM card attack in early January. He went to the local operator to strengthen SIM card management. What is more, he did not suffer losses in this round of attack. Coincidentally, the hackers began to attack some large accounts again. On February 22nd, the second largest creditor Josh Jones of Mentougou was stolen digital currency worth $ 45 million due to the hacking of the SIM card. Also suspected of being hacked is that on February 13, IOTA ’s wallet was stolen $ 1.3 million, and the team announced the suspension of the mainnet; In addition, on February 19, Binance ’s sudden maintenance data push module, OKEX Exchange and BITMEX Exchange They were also successively attacked by DDOS.

In this wave of rising, the platform currency is rising wildly. FCoin, the only "victim" behind this destruction concept, everyone must remember. As early as February 11th, there were rumors that FCoin was inconsistent due to the destruction of the platform currency, and it continued to extend the maintenance time of the official website and pushed back the user's withdrawal until the 17th Zhang Jian issued the "Truth" announcement, indicating that the decision was wrong and the data was wrong, resulting in $ 68.6 million ~ 127 million US dollars of funds could not be redeemed, and finally ended up as a dump pot user. A similar situation occurred on the BITMEX exchange, the world's earliest contract exchange, that is, the newly launched XRP perpetual contract crashed on February 13th, and the price of the XRP contract fell from 0.33 to 0.13, a decrease of nearly 60%. BITMEX trading The Institute directly tweeted that the "prevention of the liquidation system is no problem" market. When there is a problem with these exchanges themselves, all they need to do is to throw the pot to the trader's attitude of finishing things, as if they are ignoring the participants of the currency circle.

In the 3.12 plunge, the widespread concern was the “collective downtime” of the exchanges BITMEX, OKEX, and Huobi. Short-term downtime prevented many investors from closing their positions in time and caused large losses in their accounts. BITMEX's explanation for the continuous short-term downtime of the exchange is that there are hardware problems in the provision of cloud services. Domestic OKEX and Huobi Exchange have made similar explanations for the system downtime of perpetual contracts.

In the course of the development of digital currency exchanges, there are a thousand ways to criticize the exchange's "pulling the network". Some participants have grown from historical lessons and are deeply aware of the risk coefficient of the exchange under extreme market conditions. Risk prevention has been made. But for those participants who do not have a deep understanding of this part of the risk, they must also embark on the road of defending their rights. Exchanges are responsible for user losses caused by the lack of system capacity of the exchange. What I have seen so far is that OKEX makes compensation for users of less than 20%, and bears the responsibility to reshape the corporate image. I believe that the future digital currency exchange Throughout the extreme market, the throughput will gradually improve. As a service provider, it also needs to grow step by step to build a better digital currency ecosystem. Exchanges with poor user experience are also forced to go out of market changes. Investors must not be short-sighted in the choice of exchanges, fundamentally protect their rights and avoid risks.

2. Risk of hitting the disk

In this skyrocketing, Plustoken has another 10,000 BTC transaction. In the past, various domestic project funds have been rampant and many investors have ran away. The country also reaffirmed that virtual digital currency transactions are not subject to law in the 315 financial consumer rights sector Protecting and investing in unregulated projects urgently require you to keep your eyes open. So what everyone is worried about is that the liquidity of the running capital market will affect the market trend. In the short term, it will have a certain impact. In the long run, this part of the currency sales will also cause a ripple at most.

In addition to worrying about ripples, what is more worrying is that the 140,000 bitcoins in Mentougou, which can stir up the waves, have been paid (200,000 bitcoins were recovered after the Mentougou incident, and 60,000 have been sold before). Judging from the order to postpone the submission of documents, the planned deadline was changed to July 1, 2020. Whether or not the market hit the deadline was related to the creditors ’compensation plan and the time of payment. The settlement plan of Mentougou implemented the plan. Their compensation scheme is divided into fiat currency compensation and bitcoin compensation, and the creditors ’arbitrage and the price and proportion of fiat currency compensation will affect the settlement committee ’s handling of 140,000 bitcoins. To put it simply, for example, if the price of fiat currency compensation is US $ 6,000, so when the bitcoin price is lower than US $ 6,000, the liquidation committee can only make a bid to pay the creditors, and when the bitcoin price is higher than US $ 6,000, the market sells off pressure. There will be relief.

3. The road to compliance

On the one hand, some sovereign countries, such as the United States, have adopted a conservative attitude towards the digital currency market; on the other hand, these countries are also actively exploring the future of digital currencies, continuously advancing research on sovereign digital currencies, and carefully promoting the development and creation of digital currencies. Better digital currency ecology.

At present, the official view of the United States on encrypted digital currency is to strictly monitor its scope of capabilities, and pay close attention to the encrypted digital currency market, which also contains concerns that the development of digital currency will affect the hegemony of the US dollar. There are four main reasons:

1. The Secret Service intervenes in digital currency. According to the US President ’s 2021 budget, he proposed to fight against international criminal organizations, including the use of encrypted digital currency by criminal organizations;

2. The latest public announcement by Fed Chairman Paul Power emphasized that the Fed will invest a lot of money in digital currency development, but whether to use cryptocurrencies is still to be studied; admitting that other countries ’research on digital currencies may affect the status of the US dollar and bring systemic risks;

3. The U.S. Intelligence Agency believes that it is necessary to prepare for a digital currency that may threaten to destroy the US dollar as a world reserve currency, thereby protecting the position of the United States in the global economy;

Fourth, the US Treasury Secretary Steven Mnuchin warned that strict regulations on bitcoin and digital currency will be implemented.

Unlike U.S. prevention, South Korea, as a relatively active digital currency country, first made compliance requirements for exchanges, mainly through real-name authentication and information security management system requirements to prevent anti-money laundering and anti-terrorist financing, because With the existence of regulation, investors with anonymity requirements may be greatly enthusiasm. Singapore and Hong Kong have adopted the same approach as South Korea. Although these two regions have also adopted legislation to regulate the cryptocurrency market, they have always adhered to an open attitude and obtained Singapore financial management from financial licenses (such as Huobi, OK and other companies). Bureau pays exempt licenses) and the exchange trading mechanism's attention can be seen that they are more concerned about ecological construction, providing a good infrastructure and a good layout for the digital currency market.

For the next digital currency market, under the strong supervision of sovereign countries, the importance of compliance will gradually be reflected, specifically in exchanges, asset management and auditing.

Wu, Conclusion

Whether in the short-term or long-term, the effects of the prevention and control of the epidemic situation and the degree of recovery of the real economy in the world will affect the future direction of Bitcoin and market confidence. Although Bitcoin claims to be a disruptive technology (subject), when he quietly entered the traditional financial market, as a "newcomer", the acceptance rule was his only choice in front of him. egg?

Note: The article is purely personal and is for reference only, and does not constitute any investment advice. Investment is risky and you must be cautious when entering the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis: The market's upward trend is blocked, and it falls slightly below $ 7200

- After the crisis, where is the Bitcoin price opportunity in 2020?

- Within 26 days, the price of Bitcoin has doubled: What is the real reason behind the big rally?

- The latest report of CoinMetrics: after halving BCH and BSV, miners will distribute more computing power to BTC in a short time

- BCH production cuts soon, shortcomings in computing power

- The dynasty of bitcoin miners: track S9 and S17 miners through nonce distribution

- March scan of data on the bitcoin chain: the month of the plunge and shuffle, all three HBO trends are revealed