Search index analysis: Bitcoin may be a "relative safe-haven asset"

Bitcoin search index analysis reveals that Bitcoin may be a "relative safe-haven asset."

Bitcoin has fallen from nearly $20,000 to the current $8,000, and Google’s search for “Bitcoin” has been declining. From 2016 to the present, the relevance of "Bitcoin"'s Google search heat and bitcoin price is 0.69. The global Bitcoin search index and bitcoin prices both reached their maximum in December 2017. But is the situation in different countries consistent?

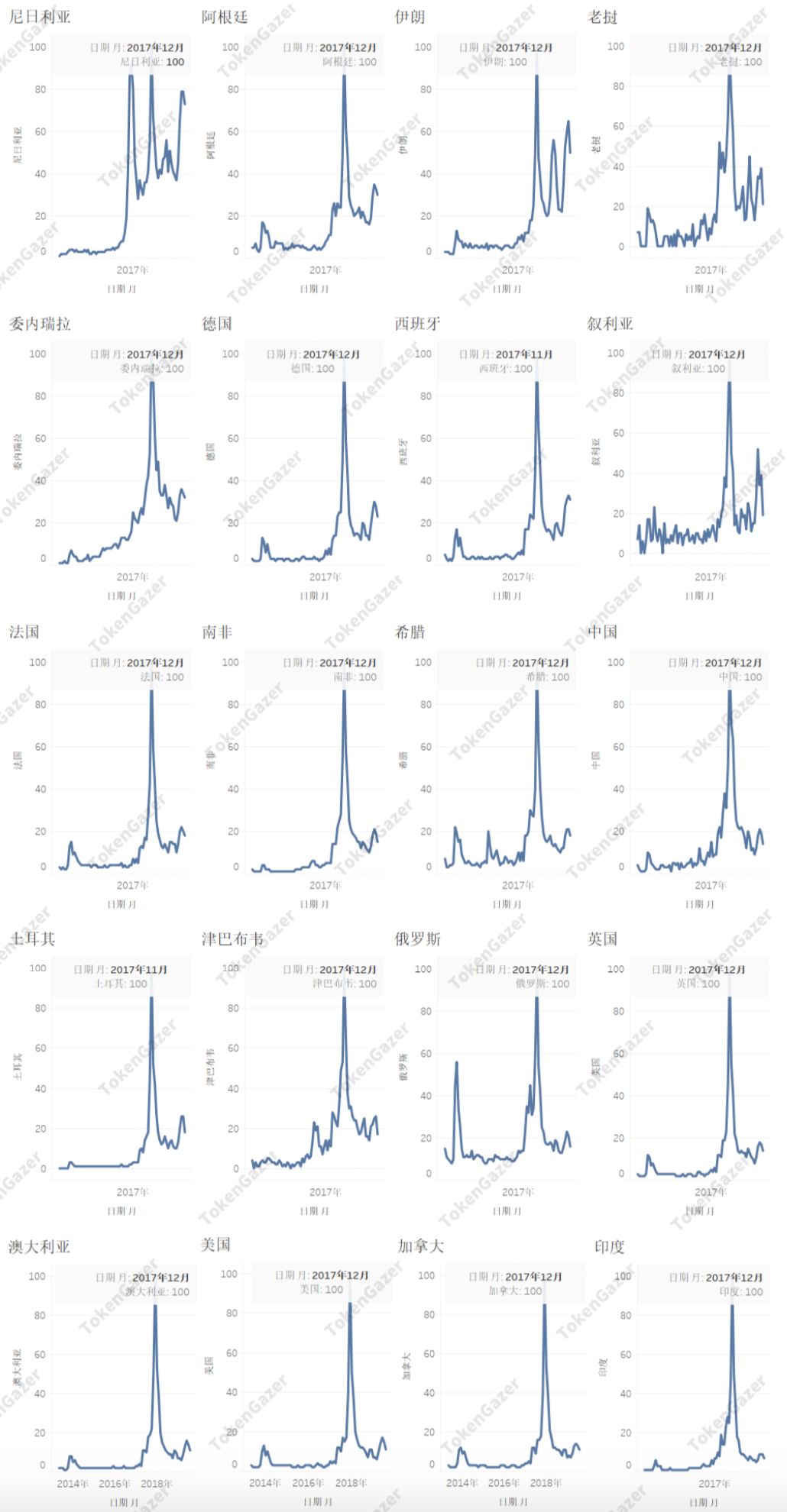

We selected 20 countries for analysis based on geographical and developmental conditions. As you can see from the chart below, the “Bitcoin” Google search index for these countries reached a maximum of 100 at the highest bitcoin price in December 2017, and then the search index fell as the price fell.

- Jia Nan Zhi Zhi will join forces with Babbitt to stage "Wuzhen Surprise Night", Kong Jianping confirmed attending the speech

- The data shows that miners have caused fluctuations in BTC prices, which led to a fall in BTC prices in 2018.

- Getting Started | What is a Multi-Cured Dai Deposit Rate – DSR

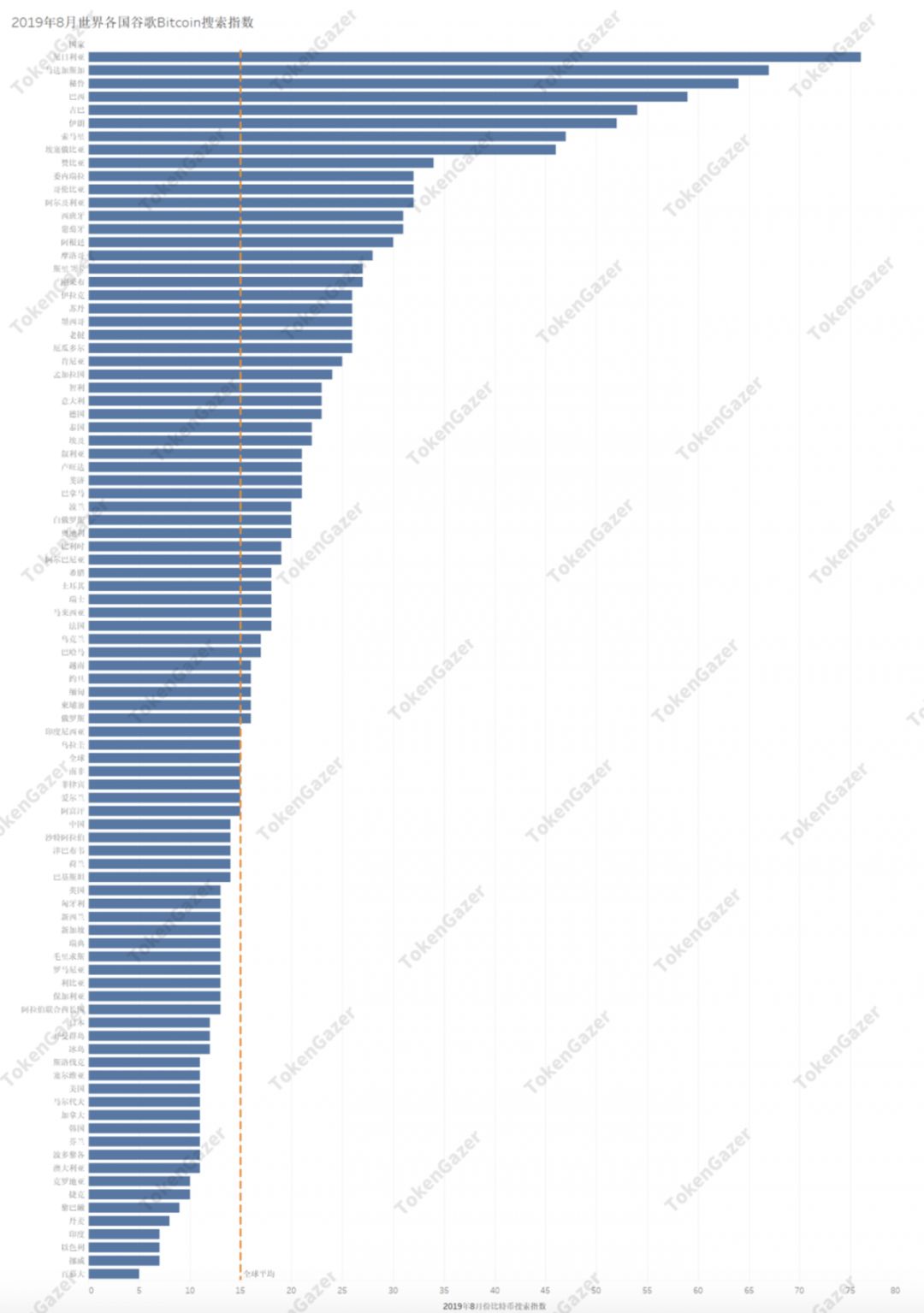

Is the situation consistent after that? the answer is negative. The highest value of the Bitcoin search index in each country is 100. Now Nigeria has a search index of 76, ranking first in the world, which means that the search fever is only 24% lower than the highest point. Bermuda's search index is only 5, and the search fever is 95% lower than the highest point. Bitcoin search heat varies from country to country, and we try to analyze the causes of this gap.

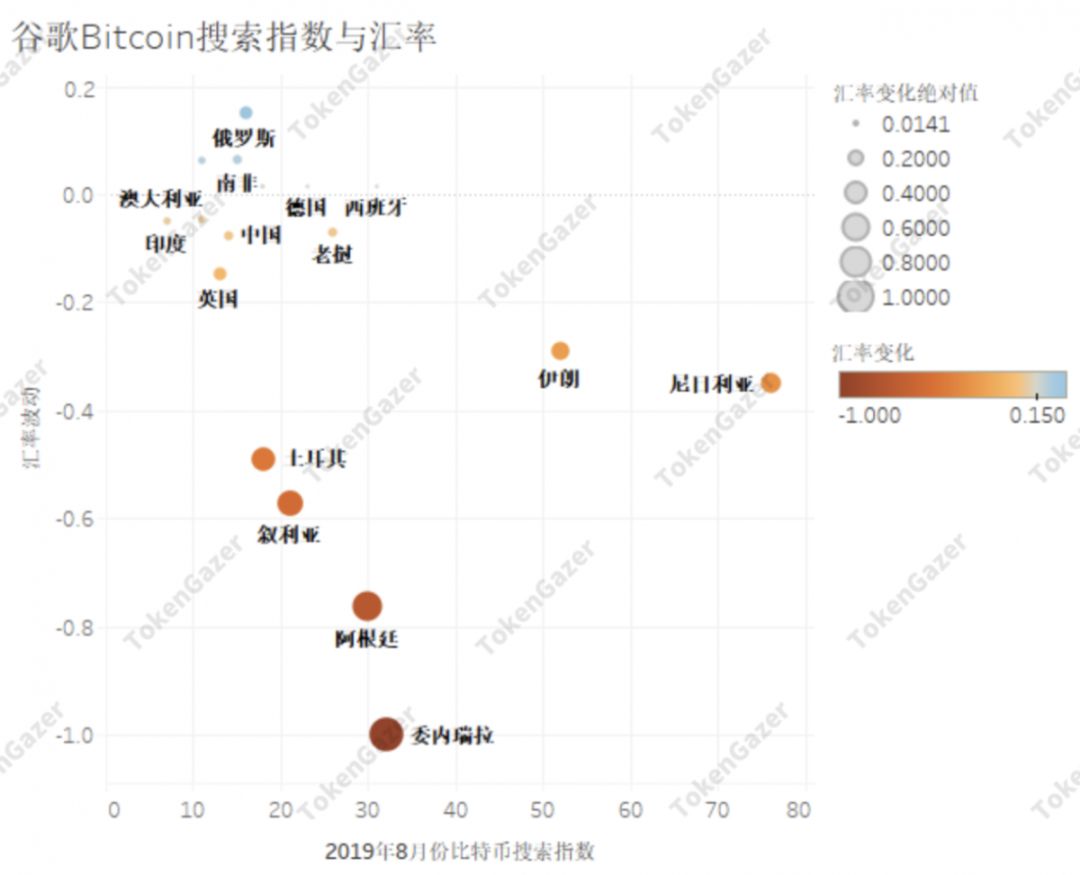

The relationship between the exchange rate of the French currency and the search index is strong. The most recently reported countries with statutory currencies depreciating against the US dollar are Argentina, Turkey, and Venezuela. The Bitcoin search index is above average. From 2016 to the present, the bitcoin search index of Syria, Iran and Nigeria, which are other currencies depreciating, is also relatively high. Venezuela’s currency depreciation is close to 100%, and according to reports in February this year, the local bitcoin premium exceeded 40%, indicating that Bitcoin plays a role in local value storage.

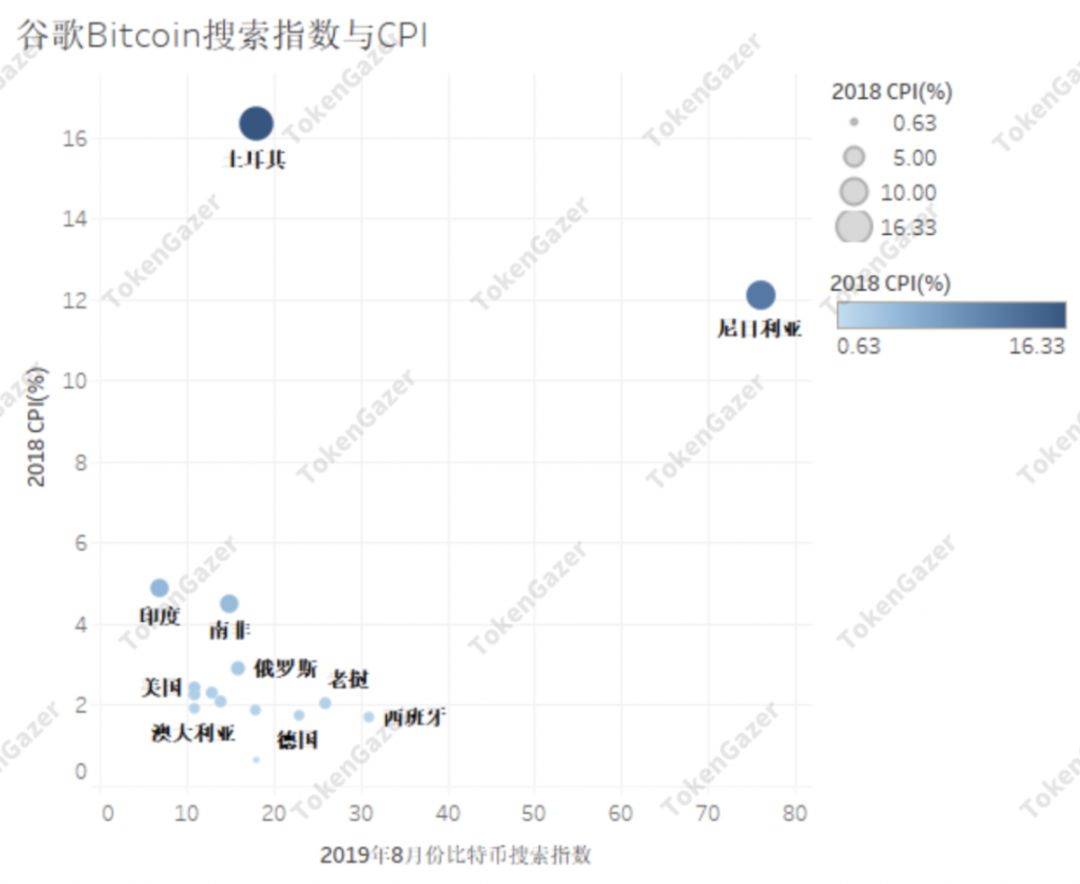

The countries with higher CPI have higher bitcoin search index of Turkey and Nigeria than the global average, and Nigeria's search index ranks first in the world. It should be said that the Bitcoin search index has a certain relationship with the CPI. In the case of a very high CPI, the Bitcoin search index is relatively high; if the CPI is at a normal level, such as 5% or less, there is no correlation between the two.

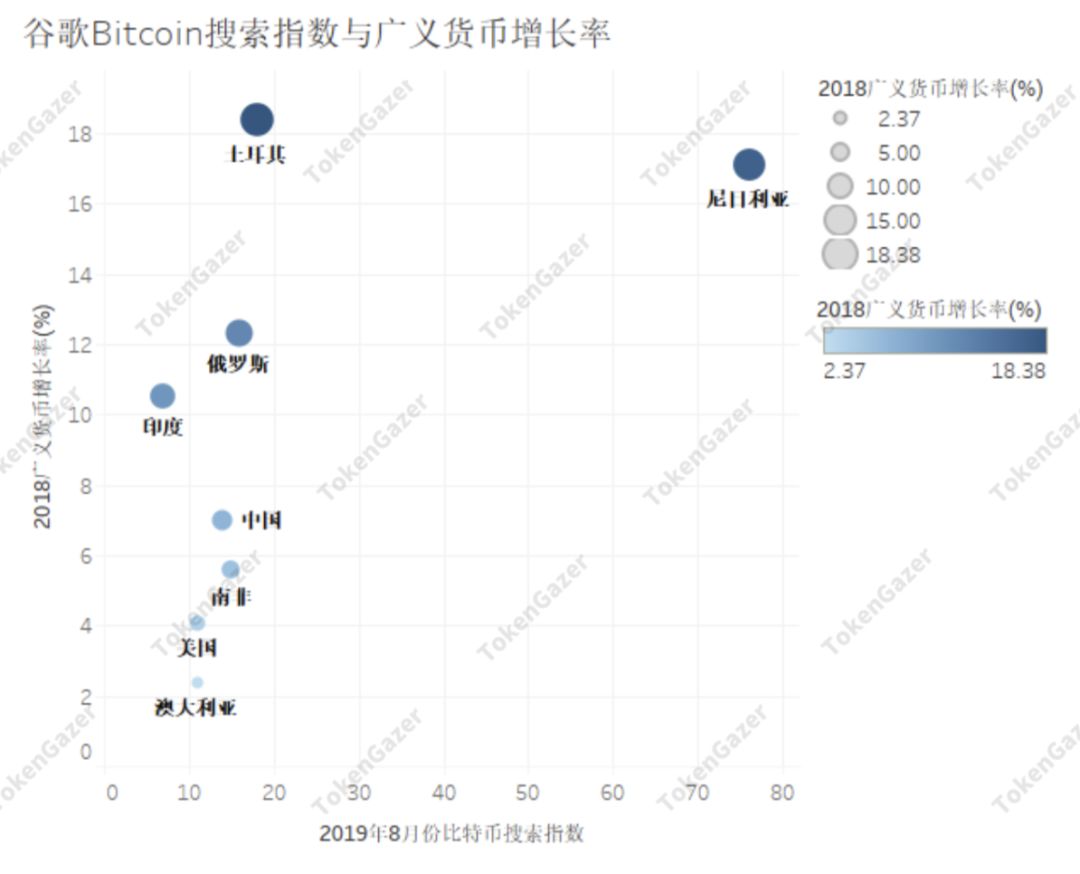

There is also a certain correlation between broad money growth and currency depreciation and CPI. Nigeria, which has the highest bitcoin search index, has a broad money growth rate of more than 16%. However, the relationship between currency growth and the Bitcoin search index is not as good as the exchange rate change. The broad money growth rate of India and Russia is also above 10%, but the Bitcoin search index is near the middle value.

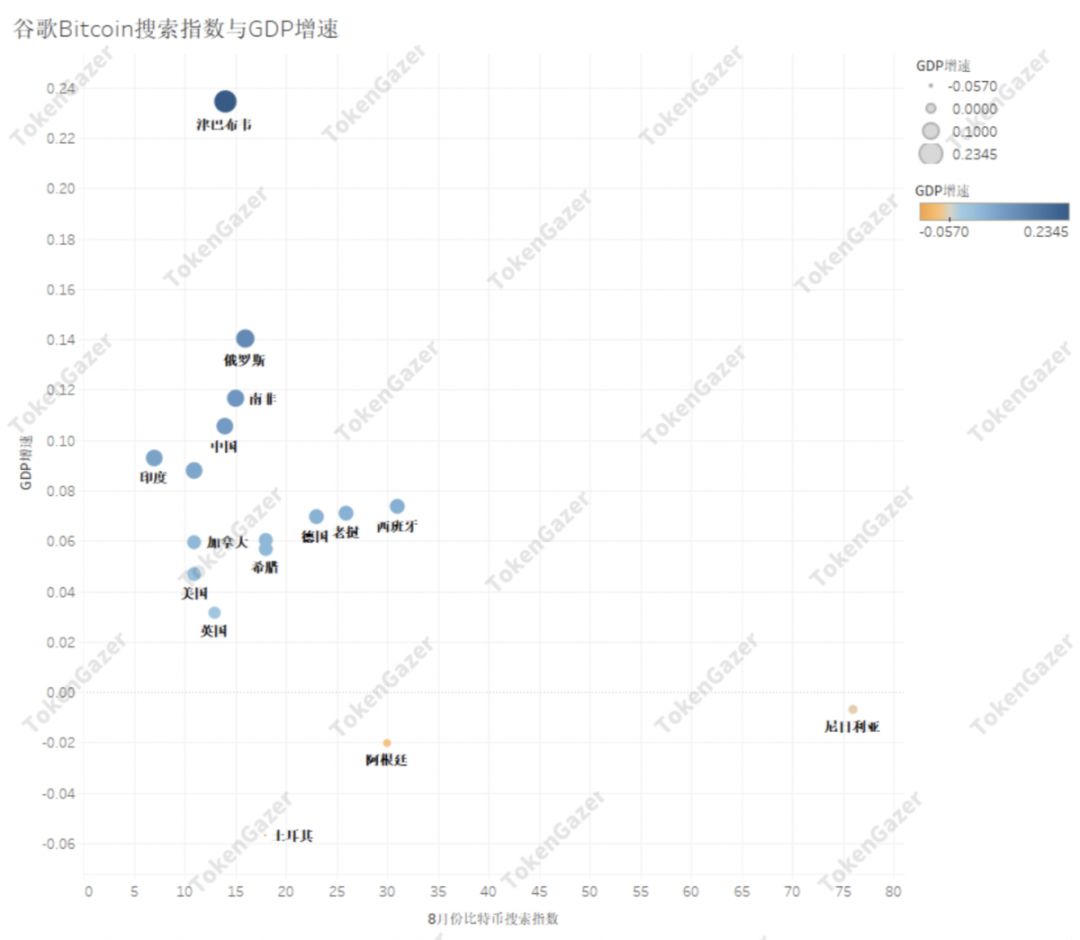

The correlation between GDP growth rate and Bitcoin search index is not strong. For example, Zimbabwe and the UK have huge growth rates, but their bitcoin search index is relatively close. However, Nigeria, Argentina, and Turkey have indeed had problems with GDP decline in recent years. Their Bitcoin search index is above average.

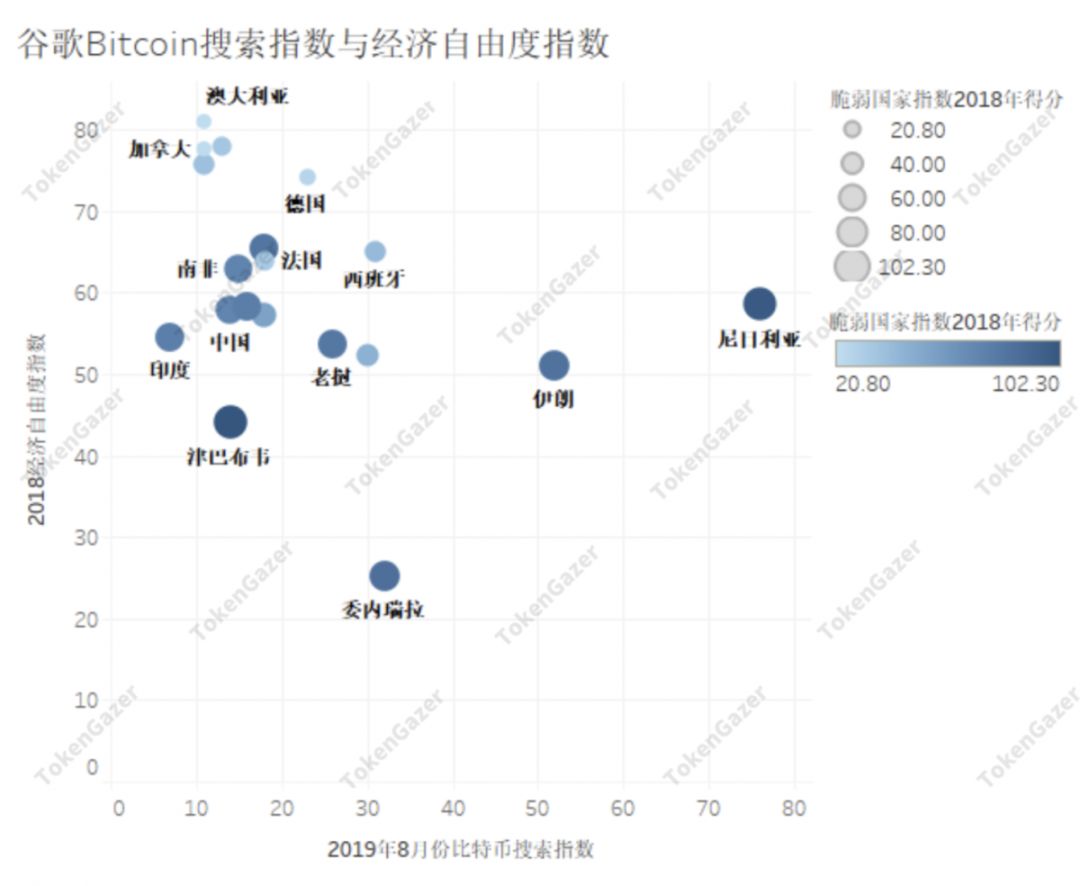

The economic freedom index has a certain relationship with the Bitcoin search index. Venezuela, Iran, Argentina and other economic freedom scores are lower, and the Bitcoin search index is relatively high. However, the bitcoin search index of Zimbabwe with low economic freedom is below the average, and the two are not one-to-one correspondence.

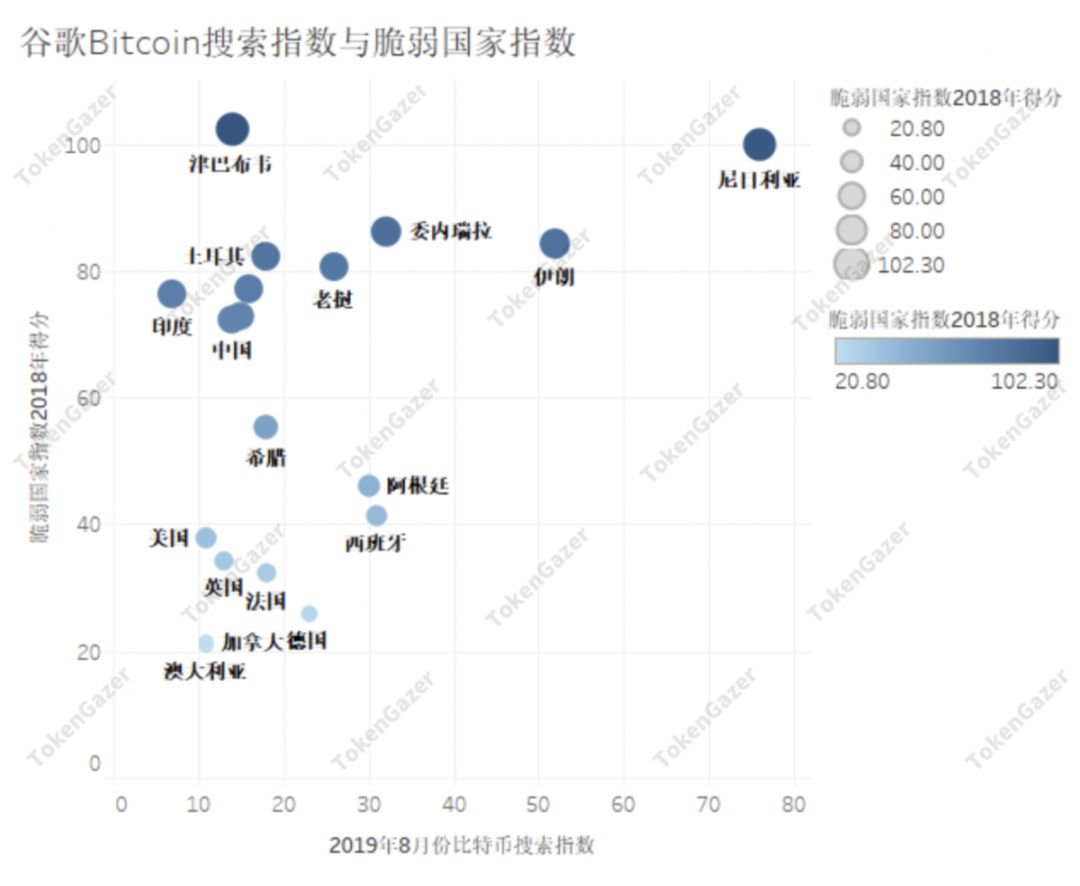

Similarly, Zimbabwe’s fragile country index is also relatively high, but the Bitcoin search index is below the average. Countries with higher vulnerability indices such as Nigeria, Venezuela, Iran, and Laos have higher bitcoin search indices, and there is a certain correlation between the two, but there are exceptions.

Both the Google Bitcoin Search Index and Bitcoin prices reached their highest level in December 2017, and the correlation between the two from 2016 to the present is 0.69. In our selected countries, the Google Bitcoin search index is the highest at the highest price, but the trend is very different. Through analysis, we find that the fragile country index, economic freedom, GDP growth rate, CPI, broad money growth rate, and currency exchange rate changes have an impact on a country's bitcoin search index. The correlation between the depreciation of the French currency and the Bitcoin search index is the best. In the countries we observed, all countries with more depreciation of the French currency have higher bitcoin search indices.

From the correlation analysis of the above Google search index, when some regions encounter large-scale currency depreciation and the national vulnerability index is high, Bitcoin provides a "relative safe-haven asset" option, and the macro environment is more stable. In economically developed regions, this perception of using bitcoin as a safe-haven asset will be relatively low. Therefore, Bitcoin is still a typical liquidity risk asset due to various factors such as its volatility and policy, but in some cases it can also be regarded as a relative safe-haven asset option.

Copyright Information and Disclaimer

Unless otherwise stated herein, all content is original and researched and produced by TokenGazer. No part of this content may be reproduced in any form or in any other publication without the express consent of TokenGazer.

TokenGazer's logos, graphics, logos, trademarks, service marks and titles are TokenGazer Inc.'s service marks, trademarks (whether registered or not) and/or trade dress. All other trademarks, company names, logos, service marks and/or trade dress ("Third Party Trademarks") mentioned, displayed, quoted or otherwise indicated herein are the exclusive property of their respective owners. . You may not copy, download, display, use as a meta-tag, misuse or otherwise utilize a mark or third-party mark without the prior written permission of TokenGazer or the owner of such third party mark. .

This document is for informational purposes only and all information contained herein should not be used as a basis for investment decisions.

This document does not constitute investment advice or assist in determining specific investment objectives, financial conditions and other investor needs. If investors are interested in investing in digital assets, they should consult their own investment advisors. Investors should not rely on this article for legal, tax or investment advice.

The asset prices and intrinsic values mentioned in this study are not static. The past performance of an asset cannot be used as a basis for future performance of any of the assets described herein. The value, price or income of certain investments may be adversely affected by exchange rate fluctuations.

Certain statements contained herein may be TokenGazer's assumptions about future expectations and other forward-looking statements, and known and unknown risks and uncertainties that may cause actual results, performance or events and statements and Suppose there is a substantial difference.

In addition to forward-looking statements as a result of contextual derivation, there are words of “may, future, should, may, can, expect, plan, intend, anticipate, believe, estimate, predict, potential, predict or continue” Similar expressions identify forward-looking statements. TokenGazer is not obligated to update any forward-looking statements contained herein, and Buyer shall not place excessive reasons on such statements, which merely represent opinions prior to the deadline. While TokenGazer has taken reasonable care to ensure that the information contained herein is accurate, TokenGazer makes no representations or warranties, either expressed or implied, including the liability of third parties, for its accuracy, reliability or completeness. You should not make any investment decisions based on these inferences and assumptions.

Investment risk warning

Price fluctuations: In the past, digital currency assets have single-day and post-price fluctuations.

Market acceptance: Digital assets may never be widely adopted by the market, in which case single or multiple digital assets may lose most of their value.

Government regulations: The regulatory framework for digital assets remains unclear, and regulatory and regulatory restrictions on existing applications may have a significant impact on the value of digital assets.

Source: TokenGazer

This article is the original content of TokenGazer, please indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Zuckerberg's moment: Why did Libra's founding members go out collectively?

- QKL123 market analysis | Bitcoin halved 200 days, Sino-US trade relations eased (1012)

- Avalanche (Avalanche) token free access guide, ETH holders are blessed

- Chen Chun, an academician of the Chinese Academy of Engineering: Data collaboration technology under the chain is an important direction for the development of the alliance chain

- Facebook is again "retired"! The Libra Association’s six payment industry members now have only one

- Marcus responded to Libra members' exit door, and Nick Szabo said he did not learn from the lessons of the Bitcoin pioneers.

- DevCon sees the fourth day: Chainlink pushes the new currency predictor; OpenLibra is beaten