Understanding Binance’s Decentralized Global Operating Model from SEC Lawsuit Documents

Binance's Global Operating Model explained through SEC lawsuit documents.Author: BlockingBitpushNews Asher Zhang

Recently, the lawsuit filed by SEC against Binance and Coinbase has caused a lot of discussion in the market. On the morning of June 6, CCTV-2 also reported on this matter. In response to SEC’s allegations, Binance seems determined to fight to the end. First, Binance’s official US account posted an article criticizing the lawsuit. Then, Binance founder CZ personally came out to publicly challenge: “Who protects you more? Binance or SEC?” The battle between the cryptocurrency market and SEC can be said to be in full swing.

As the “anger” rises, under the noise, many arguments have become increasingly meaningless. This article attempts to set aside some of the more controversial issues and focus on some interesting topics by analyzing some data and dialogues that are closer to the facts. For example, through SEC documents, we seem to be able to figure out the mysterious mode of Binance’s decentralized global operation; and in the 136-page lawsuit filed by SEC, what is Binance’s biggest weakness? Is the United States only targeting Binance.US?

Amid the clamor, looking at Binance’s mysterious operation from SEC’s lawsuit documents

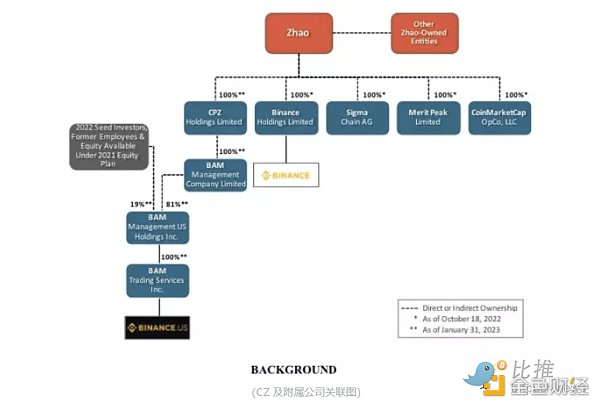

As the world’s largest cryptocurrency exchange, unlike traditional large companies, Binance does not have a well-known headquarters. It has always claimed to be globally decentralized, but such a huge encryption institution has always been “elusive” and quite mysterious. Now, through SEC’s lawsuit, everything seems to be becoming clearer. Let’s start with a figure provided by SEC showing CZ and related companies.

- 5 Misconceptions About the Metaverse

- Attacker’s liquidation price for BNB bridged to Venus Protocol is around $220. Venus governance proposal: Frozen, cannot be liquidated.

- Exchange sued by SEC: Future regulation in the US will be more transparent

The above picture shows the members of Zhao Changpeng’s encryption empire more intuitively, but how exactly does this encryption empire operate? According to SEC’s allegations: In order to evade the registration requirements of federal securities laws, in 2018, Binance hired several consultants to provide US legal risk advice. Their advice was for Binance to create a US entity, in which Binance is not only a technology supplier, but will also provide liquidity and market access to the platform. This not only retains the US market, but also can obtain license fees and service fees from the US entity payment; in addition, it can also provide fiat currency deposit and withdrawal functions through the OTC service of this entity. Binance can obtain fiat currency at any time without the need to establish a separate bank account; more importantly, Binance personnel can continue to operate in non-US locations to avoid enforcement risks (asset seizure).

From the specific operation, CZ created BAM Management and BAM Trading, which are controlled by CZ through a series of offshore companies, and cooperated with BAM Trading through Binance to establish the US entity Binance US. Specifically, BAM Trading is the operating company of Binance.US in the United States and has currency transfer licenses in 43 US jurisdictions (including this district); BAM Management is the parent company of BAM Trading, which is wholly owned by BAM Management ComBlockingny Limited in the Cayman Islands, which is in turn wholly owned by CPZ Holdings Limited in the British Virgin Islands, and CZ owns 81% of CPZ’s shares.

From the control method, CZ and Binance mainly control Binance.US by tightly grasping the finances of BAM Trading. According to the US SEC documents, at least until March 2022, CZ is the CEO of Binance and the chairman of the board of BAM Trading and BAM Management. Before December 2020, BAM Trading personnel could not control the company’s bank accounts, including the accounts used for funds deposited by customers on the Binance.US platform. Only CZ or Binance backend managers have signing authority over these accounts. Later, in order to avoid regulatory scrutiny, CZ appointed the CFO of BAM Trading as one of the signatories of customer accounts. As of May 2023, CZ still has signing authority over the accounts of BAM Trading that hold customer funds on the Binance.US platform. Before January 30, 2020, all expenditures of BAM Trading exceeding $30,000 required approval from CZ and Binance, including rent, franchise taxes, legal fees, Amazon Web Services (“AWS”) fees, etc.

When it comes to specific payment operations, CZ and Binance’s Shanghai finance team are mainly responsible for fund payments, and the CEO of BAM was not aware of their financial payments for a while, which may also be the reason why Binance has been accused of being a Chinese company. However, cracking down on a Chinese crypto company seems to be a great “political correctness” for the US government, which has led to the SEC’s lawsuit against Binance being far more stringent than that against Coinbase. According to the SEC’s complaint, Binance’s Shanghai finance team manages BAM Trading’s payments, including transferring funds between bank accounts and depositing cash when BAM trades. The Binance finance team can also make a large amount of fund transfers without the knowledge of BAM Trading. In June 2020, Trust Company B reminded the CEO of BAM that internal transfers of BAM Trading had increased from about $10 million per day to $1.5 billion, but the CEO was not aware of these transfers and could not verify them because she did not have account permissions. She could only turn to Binance for confirmation.

When BAM Trading runs out of operating funds, it is infused by Merit Peak, an OTC operator on Binance.com. Merit Peak Limited (“Merit Peak”) is a cryptocurrency asset trading company registered in the British Virgin Islands, with CZ as its controlling shareholder and several Binance employees responsible for its business. Merit Peak is an OTC operator on Binance.com and one of the earliest market makers on Binance.US platform. Through Merit Peak, CZ also provided over $16 million in funds to support the operation of the Binance.US platform to BAM Management.

In terms of market making on Binance.US, it is mainly controlled by Sigma Chain, which is mainly controlled by CZ. Sigma Chain is a cryptocurrency asset trading company registered in Switzerland, with CZ as its controlling shareholder and several Binance employees responsible for its business. One of Binance’s back-end managers is also the president of Sigma Chain, and she also has the signing authority for BAM Trading’s bank account. Sigma Chain is an active trader on both Binance platforms and calls itself the “main market maker” on Binance.com. After the launch of Binance.US platform, CZ instructed Sigma Chain to be one of its first market makers. In addition, since Binance.US platform started to provide OTC and OCBS services, Sigma Chain has been one of the trading parties on Binance.US platform.

What is Binance’s biggest “dead end”?

If the US SEC is only suing Binance and CZ, it’s just a lawsuit; if it’s just freezing Binance.US’s assets, Binance and CZ’s financial strength should be able to handle it; but what if the freezing order goes beyond that? According to The Block, in addition to Binance.US, the SEC is also seeking to freeze assets held by Binance and CZ.

The main reason for the SEC’s application to freeze Binance and CZ’s assets is the two main charges in the indictment: First, before 2021, Binance’s entity accounts sent billions of dollars in client assets to a US bank account owned by Merit Peak, which transferred all of the funds to trust company A, which appears to be related to the issuance of Binance stablecoin (BUSD); using Merit Peak as an intermediary to transfer platform clients’ funds to purchase BUSD created undisclosed counterparty risk for investors. Second, Merit Peak and Sigma Chain accounts were used to transfer tens of billions of dollars between BAM Trading, Binance, and related entities. For example, by 2021, at least $145 million had been transferred from BAM Trading to a Sigma Chain account, and another $45 million had been transferred from BAM Trading’s trust account B to a Sigma Chain account. From this account, Sigma Chain spent $11 million to buy a yacht.

The core of the SEC’s accusation is that Binance allegedly misappropriated customer funds through entities controlled by CZ, such as Merit Peak, Sigma Chain, and BAM Trading. It is likely that the evidence in the SEC’s hands is insufficient, so in addition to the freeze order, the SEC also hopes that a federal judge will order Binance Holdings, Binance.US Holdings, and CZ to provide sworn and verified accounting; and require a Washington, DC federal judge to order the return of assets, speed up the discovery of documents, authorize the preservation of documents and prohibit the destruction of evidence, and designate receivers for the assets of Binance, Binance.US, and CZ. The SEC is most likely trying to find evidence of Binance’s misappropriation of customer funds, while the latest official statement from Binance strongly denies the allegations.

On the afternoon of June 7, according to Blocking News, Coingraph News reported that a US court approved the SEC’s request to freeze the assets of Binance.US subsidiary BAM Management and BAM Trading; the court also ordered Binance.US to return all legal and cryptocurrency held in its account to its customers within ten days. Although this news has not been officially confirmed, it has essentially caused market panic. According to Blocking News, DeFillama data shows that Binance US users who used to withdraw 78 million US dollars due to concerns about SEC litigation and asset freezing. The total value of tokens held by Binance.US on the Ethereum chain is $321 million, indicating that the outflow is about 24% of the current TVL. If all of the SEC’s requests are granted by the judge, then the freeze order alone will be a disaster for Binance and CZ, because once the liquidity of the exchange is frozen, there will be no user transactions, and the exchange will naturally be worthless.

Long-arm jurisdiction, the SEC targets more than just Binance.US

From the SEC’s freeze order, it can be seen that Binance is expected to be difficult to simply withdraw from operations in other regions like other regions. The closure of Binance.US is probably inevitable, and it is expected that Binance and CZ Holdings will also be difficult to escape long-arm jurisdiction.

In the SEC indictment, the SEC accused CZ of publicly stating that the Binance.com platform does not serve Americans, but actually instructed Binance staff to assist certain high-net-worth American clients in evading control-by changing IP addresses through VPNs or setting up offshore companies to conduct KYC; In addition, CZ actively solicited American investors to trade on the Binance platform through his social media and other internet posts to retain American investors. In addition, CZ and Binance regularly track customer activity on the Binance.com platform. In an internal report in August 2019, Binance estimated that its platform had more than 1.47 million customers in the United States; by 2019, Binance had more than 3,500 American VIP traders. According to an internal report by Binance in March 2020, there were still about 159 American VIP customers on the Binance.com platform, accounting for nearly 70% of all VIP transaction volume worldwide; after Binance.US launched two years later (May 2021), American VIP customers still accounted for more than 63% of VIP customer transaction volume on Binance.com platform. From January to September 2021, more than 47,000 American investors traded BNB on the Binance.com platform.

According to the SEC, from June 2018 to July 2021, Binance generated at least $11.6 billion in revenue, most of which came from trading fees. The SEC also alleges that Changpeng Zhao disregarded federal securities laws, which allowed him to amass billions of dollars in wealth. The SEC’s aim in seeking a freeze order is undoubtedly to ultimately recover sufficient fines.

Despite being known as one of the most profitable exchanges, it remains to be seen whether Binance can withstand the SEC’s “heavy blow”. In addition, on June 5th, Silver Miller Law Firm and the joint law firm Kopelowitz Ostrow filed a class action lawsuit against Binance and its BAM Trading, alleging that they profited from transactions involving stolen cryptocurrencies and are facing a class action lawsuit. On June 7th, the Korean financial regulator stated that it has suspended the handling of a change report involving the appointment of Binance executives due to the impact of the SEC lawsuit. In the future, will the SEC’s actions be imitated by other “desperate” governments in other regions? The domino effect seems to be unfolding.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Explanation of Six LSD Stablecoin Protocols: Could It Trigger a New Round of LSDFi Conflict?

- Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD

- How can cryptocurrency exchanges move towards compliance after heavy regulation?

- How to establish a compliant cryptocurrency exchange following the consecutive lawsuits against Binance and Coinbase?

- After the heavy regulation, how can cryptocurrency exchanges move towards compliance?

- Stability AI founder Mostaque hits back at media’s allegations of plagiarism and salary arrears

- Comparison of Four New Decentralized Stablecoin Algorithms: Dai, GHO, crvUSD, and sUSD