Explanation of Six LSD Stablecoin Protocols: Could It Trigger a New Round of LSDFi Conflict?

LSD Stablecoin Protocols: Potential for New LSDFi Conflict?Author: flowie, ChainCatcher

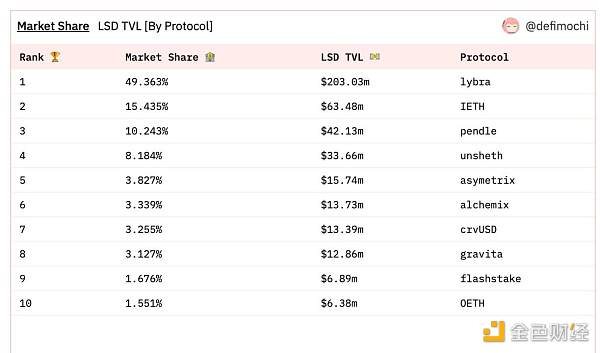

The LSD stablecoin protocol is sparking a new round of LSDFi battles. Recently, Lybra Finance, a protocol that mints interest-bearing stablecoins with LST as collateral, has been gaining momentum. After opening for IDO on April 22, it officially launched, and in just over a month, its native token LRB skyrocketed to a maximum of 40 times. At one point, TVL exceeded $200 million, with a market share of nearly 50%.

Lybra Finance is not the first protocol to eat crabs, as many protocols that support LSD stablecoins are emerging. The TVL of the LSD zero-interest lending stablecoin protocol Gravita is also rapidly rising to $21 million. On June 1st, the LSD stablecoin protocol Prisma Finance announced the completion of a new round of financing, with well-known project parties or founders such as Michael Egorov, the founder of Curve Finance, the founder of CoinGecko, OKX Ventures, Eden research director Adam Cochran of The Block, and the founder of Ankr participating in the investment.

- Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD

- How can cryptocurrency exchanges move towards compliance after heavy regulation?

- How to establish a compliant cryptocurrency exchange following the consecutive lawsuits against Binance and Coinbase?

In addition, Curve recently launched a community vote to support the excess-collateral stablecoin crvUSD minted with wstETH as collateral. Layer 1 blockchain Tenet Protocol, LSD protocol Agility, Raft, and other protocols that support LSD are also launching steadily. Stablecoins supported by LSD may be becoming a new trend in DeFi that cannot be ignored. This article takes stock of the DeFi protocols represented in it, attempting to understand the driving reasons behind the mechanisms and trends.

How do protocols that support LSD stablecoins get a share in LSDFi?

Before we understand the DeFi protocols that support LSD stablecoins, let’s briefly review the major types of stablecoins.

First, there are centralized stablecoins collateralized by legal tender such as the US dollar, such as USDT and USDC. These stablecoins are usually issued and managed by central institutions and generally maintain a 1:1 collateralization ratio. Second, there are decentralized over-collateralized stablecoins collateralized by Bitcoin, Ethereum, and other cryptocurrencies, such as DAI, BitUSD, and sUSD, with collateral ratios usually at 1:1.5 or 1:2, which means that to issue $1 stablecoin, cryptocurrencies worth $1.5 or $2 must be used as collateral. Third, there are algorithmic stablecoins that maintain stablecoin prices using algorithms, such as Frax and the collapsing UST. These stablecoins usually introduce elastic supply and incentive mechanisms to adjust supply and demand and maintain price stability, and the mechanisms are more complex.

The role of stablecoins that we are familiar with is to serve as a medium of exchange between legal tender and mainstream digital currencies and to avoid the risks of mainstream digital currency price fluctuations.

However, a new form of stablecoin has emerged in the cryptocurrency market, which is decentralized stablecoins that use liquidity collateralized derivatives (LCDs) such as st ETH, cbETH, Sfrx ETH, and rETH as collateral. These are mainly issued by decentralized protocols through over-collateralization. Compared with traditional stablecoins, their more obvious utility is, firstly, to release the liquidity of LCD tokens and, secondly, to provide LCD token appreciation scenarios, such as pledging, borrowing, and earning interest.

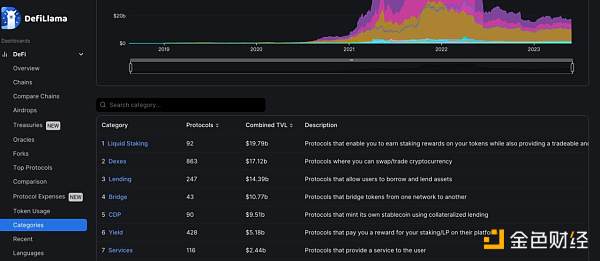

After the upgrade of Ethereum, the LSD market has grown rapidly, and its TVL market value exceeds 19 billion U.S. dollars, ranking first among all protocol categories in DeFi. The huge LSD assets have become one of the most important battlefields in DeFi. Stablecoin protocols supported by LSD are trying to get a piece of the pie through a combination of stablecoins, over-collateralization, arbitrage, and liquidation mechanisms. Judging from the representative projects, one focuses on earning interest on LSD stablecoins, and the other focuses more on interest-free loans on LSD stablecoins.

1. Lybra Finance – LSD Interest-bearing Stablecoin Protocol

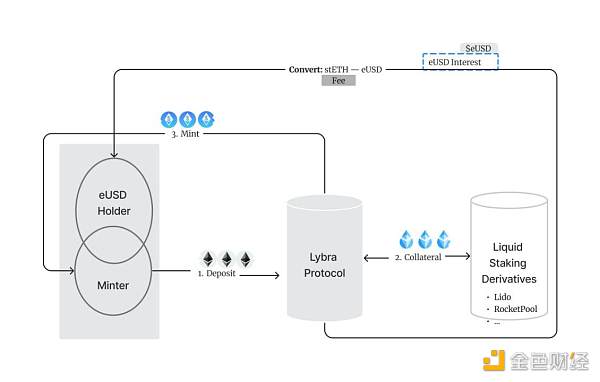

Lybra Finance has launched an interest-bearing stablecoin eUSD, which is pegged to the US dollar at a 1:1 ratio, and holding eUSD can earn 7.2% APY (annualized yield). There are two ways to obtain this eUSD. One is to exchange the mainstream stablecoins such as USDT, USDC, or FRAX held through decentralized exchanges into eUSD. The other is to deposit ETH or stETH into the Lybra Finance protocol as collateral to mint eUSD at zero cost. The minimum collateralization ratio is 150% (forced liquidation if lower), and it is best to ensure that it is above 200%.

The mechanism for Lybra Finance to pay interest to users and obtain revenue is that when a user deposits ETH into Lybra, Lybra will automatically pledge it in Lido and convert it into stETH to obtain revenue through pledging. Lybra takes a cut of this revenue as a fee, and the remaining revenue is used to pay interest to eUSD holders. The fee is charged at a rate of 1.5% annual fee based on the total circulation of eUSD.

Lybra gave an example on a white paper to explain how to calculate an account. Suppose Alice deposited 135,000,000 US dollars of ETH and minted 80,000,000 eUSD, and Bob deposited 15,000,000 US dollars of ETH and minted 7,500,000 eUSD. The current circulation of eUSD is 80,000,000 plus 7,500,000, a total of 87,500,000. The current collateral is 135,000,000 US dollars plus 15,000,000 US dollars, totaling 150,000,000 stETH.

After 1 year, Lybra generated 7,500,000 US dollars of stETH through LSD (5% of 150,000,000 US dollars).

Assuming Bob uses his 7,500,000 eUSD to purchase the additional stETH, the transaction fees for nearly 1 year are eUSD circulation (i.e., 87,500,000) * 1.5% = 1,312,500 eUSD, and the dividend is 7,500,000 eUSD – 1,312,500 eUSD = 6,187,500 eUSD, which is then distributed to all eUSD holders. The annualized interest rate is about 7.2%. For eUSD holders, the stablecoin deposit income is safer than the fluctuation of ETH assets pledged within a year.

Aside from the income mechanism, how eUSD maintains a peg to the US dollar is a key element. Overall, Lybra Finance uses over-collateralization, liquidation mechanisms, and arbitrage opportunities to ensure the stability of eUSD.

First of all, each eUSD requires stETH worth at least $1.5 as collateral, and over-collateralization is used to reduce the risk of default. Secondly, the Lybra protocol combines a liquidation mechanism to protect the system from the impact of insufficient collateral. If a user’s collateral ratio is lower than the safe collateral ratio, any user can voluntarily become a liquidator and purchase the liquidation part of the collateralized stETH by paying the corresponding eUSD. This mechanism ensures the stability of eUSD by reducing upward pressure. Recently, Lybra Finance also launched an LTV monitoring function to resist liquidation risks in volatile markets. When a user’s LTV drops below a certain threshold, it will automatically repay part of the user’s debt, and once the LTV returns to the predetermined level, this automatic repayment function will stop.

Furthermore, Lybra ensures the eUSD price remains anchored by providing arbitrage opportunities for users. If 1 eUSD > 1 USD, users can mint new eUSD by depositing ETH as collateral and then sell the newly minted eUSD on a DEX. As more eUSD is sold, the market supply increases, pushing the price back to $1. For users, buying back eUSD at a lower price or using it to repay a loan can result in a profit from the price difference.

When 1 eUSD < 1 USD, users can buy eUSD at a discount on the market and then exchange it for ETH/stETH worth $1 within the Lybra protocol. As eUSD demand increases, it drives the price back up to $1. Users can hold the redeemed ETH/stETH or sell it for a profit from the price difference.

In addition to issuing interest-bearing stablecoin eUSD, the Lybra Protocol also issued its native token LBR and launched an IDO on April 22, allocating 5 million LBR tokens (5% of the total supply).

As mentioned earlier, Lybra Protocol earns all revenue through staking, part of which is used to pay interest to eUSD holders and the rest as fees, which Lybra distributes to LBR holders. If a user holds 1% of LBR in the staking pool, they are entitled to 1% of the total fee revenue.

Overall, Lybra Protocol users can choose to earn interest by holding interest-bearing stablecoin eUSD, mint eUSD by collateralizing ETH to earn LRB rewards, or stake LRB as LP to provide liquidity and earn revenue.

Currently, the yield of Lybra’s eUSD mint pool is 27.82%, the yield of the LBR/ETH LP pool is 133.72%, the yield of the eUSD/USDC LP pool is 9.52%, and the yield of single LBR staking is 74.56%. Due to fluctuations in LBR’s price growth and protocol revenue, its yield fluctuates greatly.

Currently, Lybra Finance’s TVL has fallen to $182 million (highest over $200 million), and LRB’s price has dropped significantly to $1.22 (highest over $4).

Lybra Finance is an innovative model for a stablecoin and zero-interest lending, providing a solution for those who seek stability and a certain pledge return. However, it also means that users have to bear an additional layer of security risk and lose some of their pledge income due to the protocol’s deduction. Although Lybra Finance’s TVL and coin price have skyrocketed in the short term, it is worth paying attention to how Lybra Finance can ensure long-term sustainability.

Recently, Lybra Finance announced plans to launch the v2 testnet in mid-June to solve the current TVL growth bottleneck and lack of eUSD application scenarios through the following aspects: first, plan to expand the entire chain through LayerZero. According to the crypto KOL @qiaoyunzi1 analysis, the team has started talking to protocols on Arbitrum, and Layer 2 is the preferred direction for cross-chain. In the future, Lybra Finance may cross-chain eUSD to other alt-layer 1s to expand its scenarios. Second, add more LST asset types; third, update LBR’s Tokenomics and introduce VC investors to the Lybra protocol. In addition, changing the protocol’s revenue and charging mechanism allows LBR to introduce deflationary elements and increase the ownership period of esLBR (increased to 60 days), as well as allowing longer lock-in periods. In addition, introducing esLBR, a derivative of LBR liquidity pledge, into DAO governance allows the community to participate in protocol decision-making.

The Lybra Finance team is currently anonymous, and its recent rapid data surge has also sparked a lot of discussion. It was speculated to be a project under Lido, but later Lido clarified that the two were unrelated and reminded users to conduct project background checks before interacting.

2. Gravita – LSD interest-free lending stablecoin protocol

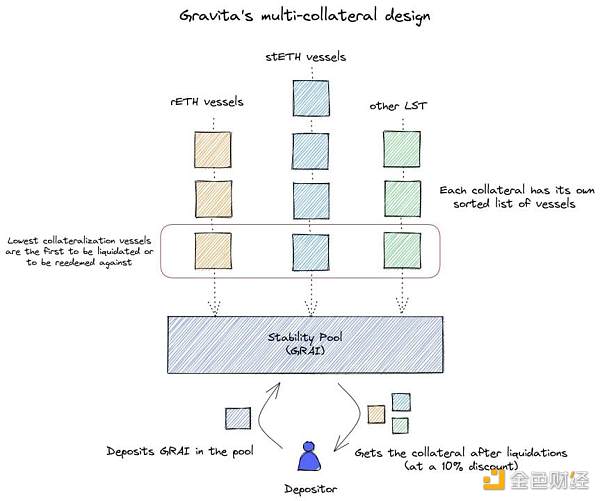

Gravita Protocol is a decentralized lending protocol built on Ethereum, which supports users to deposit wstETH (Lido), rETH (rocketpool), and blusd (ChickenBonds) to obtain Gravita’s native stablecoin GRAI as a reward. It also supports pledging and borrowing GRAI for consumption or depositing it into a stable pool to purchase LST collateral at a discounted price for liquidation. As a fork of Liquity, GRAI, the native stablecoin of Gravita, is a token with a similar volatility suppression mechanism to Liquity’s native stablecoin LUSD.

Gravita has set up independent lending and borrowing pools for each type of collateral, isolating their respective risks. Different collateral has different liquidation lines, and the highest LTV can reach 90%. For example, when the ETH price is $2,000, users can borrow up to 1800 GRAI, i.e., 2000 * 0.9. If the Ethereum price falls below 2000, it will be liquidated. Considering that LST has a higher risk, the LTV of LST collateral is lower.

Compared with Lybra Finance, which encourages users to hold interest-bearing stablecoins (eusd) to reduce LST yield risk (ignoring the additional contract risk), Gravita focuses more on increasing users’ capital turnover rate and meeting their capital turnover needs, especially for short-term borrowing needs, through low-fee and liquidation mechanisms.

On the one hand, when users use LST as collateral, their pledge APR should not be affected, but users can choose to use GRAI obtained from collateralized borrowing in other DeFi protocols for profit opportunities. This means that if the price of ETH remains stable or increases, the LTV will decrease over time, and the risk of user liquidation or redemption will also decrease.

On the other hand, Gravita has lower fee mechanisms and lower liquidation lines than MakerDao. Currently, using the Gravita protocol, the one-time maximum fee for positions over six months is only 0.5%. When users repay their debts before the expiration of six months (about 182 days), the fixed borrowing fee of 0.5% will be refunded proportionally according to the time used, but at least one week’s interest must be paid. MakerDao, on the other hand, has an annual fee that varies. In addition, Gravita’s LTV is about 85%, which translates to a liquidation line of about 116%, while MakerDao has a liquidation line of at least 160%.

Regarding how GRAI ensures that it is pegged to the US dollar, the upper limit of the GRAI price is $1.1, and the lower limit is $0.97. The maximum LTV of 90% creates an upper limit for the price of GRAI. When the market price of GRAI is $1.2, ETH holders can borrow by collateralizing Ethereum and minting GRAI at 90% LTV and sell it in the market for arbitrage. The profit from one arbitrage can reach nearly 8% (0.9 * 1.2). The protocol can redeem GRAI at a price of $0.97 to exchange for collateral (i.e., 1 GRAI is exchanged for collateral worth $0.97), which forms the price lower limit of the GRAI stablecoin.

Currently, Gravita’s TVL is steadily increasing beyond 21 million US dollars.

3. Agility – LSD Liquidity Allocation Platform + aUSD Trading Platform

Agility is positioned as an LSD liquidity allocation platform + aUSD trading platform to enable LSD holders to earn higher returns and release LSD liquidity. However, the LSD liquidity allocation system and aUSD trading platform have not yet been formally launched.

Agility currently supports ETH collateralization to generate aETH; and also supports multiple LSD collateralizations such as stETH, rETH and frxETH to generate aLSD. After receiving aETH and aLSD, users can choose to hold aLSD to receive corresponding LSD collateralization income; or use aLSD or aETH to participate in the LSD liquidity allocation system, provide liquidity to selected vaults and earn returns; in addition, users can also collateralize aLSD or aETH to mint the Agility native stablecoin aUSD for trading or hedging risks.

Here we will focus on Agility’s aUSD trading system. Similar to eUSD mentioned earlier, aUSD is also an over-collateralized stablecoin that allows users to collateralize aLSD or aETH to mint aUSD. Its initial collateralization ratio is 130%, and cannot be lower than 110%, otherwise it will be liquidated.

After receiving aUSD, users can trade or hedge, such as longing/shorting ETH, GMX, GNS, Pendle, Gear and other assets, longing/shorting LSD yield, option trading, and gambling games, etc. In its roadmap, Agility plans to attract external developers to build more aUSD trading scenarios, including external application scenarios for aUSD.

Agility also issued its native token AGI, and officially went public on 1inch/airswap on April 7th. On April 10th, Agility launched the “Fair Launch” and opened five mining pools for liquidity mining, including ETH, stETH, rETH, frxETH single currency mining pools, and AGI-WETH LP mining pool, ankrETH mining pool.

Initially high returns led Agility’s TVL to peak at nearly $500 million ($487 million) in the first two weeks of its launch. The governance token AGI price reached as high as $0.79 from the initial issue price of $0.04. However, it soon fell back, and the current TVL is only $2.25 million, and the price of AGI is only $0.015.

4, Prisma Finance – LSD Stablecoin Protocol

Prisma Finance is a very early project that only launched its official Twitter account in May. Its website is currently just a single-page introduction, and its team is anonymous. However, Prisma Finance has already announced the completion of a round of financing, although the specific amount has not been disclosed. Investors include Michael Egorov, the founder of Curve Finance, C2tP, the founder of Convex Finance, FRAX Finance, Conic Finance, Tetranode, Llama Airforce, the founder of CoinGecko, OKX Ventures, DeFiDad, MrBlock, Impossible Finance, 0x Maki, GBV, Agnostic Fund, Swell Network founder, Eden research director Adam Cochran from The Block, Ankr Founders, MCEG, and Eric Chen.

Based on the only introduction article available, Prisma Finance will support more LSD assets than Lybra Finance, such as wstETH (Lido), cbETH (Coinbase), rETH (Rocket Pool), sfrxETH (Frax Ether), and WBETH (Binance) as collateral to mint the over-collateralized stablecoin acUSD. Prisma’s over-collateralization model supports automatic repayment, allowing the use of Ethereum staking rewards to automatically repay debt.

In addition, users can stake their stablecoin in the Curve pool to obtain rewards in the form of PRISMA, Prisma Finance’s native token, in addition to Ethereum staking rewards in the form of CRV (Curve) and CVX (Convex Finance). Prisma mentioned that its codebase is based on the decentralized lending protocol Liquity. Liquity launched a stablecoin called LUSD pegged to the US dollar, and ETH holders can mint LUSD at zero interest by collateralizing ETH on Liquity.

Recently, the LSD stablecoin model of Lybra Finance has received a lot of attention due to its data growth, and Prisma Finance, an early project, not only has a similar model, but has also received financing from many well-known institutions. Many users are concerned about Prisma Finance’s further plans, especially the IDO schedule, but the Prisma Chinese community stated that there is currently no IDO schedule.

5, Raft – LSD Interest-Free Loan Stablecoin Protocol

Gravita Protocol supports users to deposit wstETH (Lido), rETH (rocketpool), and blusd (ChickenBonds) to receive Gravita’s native stablecoin GRAI as a reward. It also supports pledging and borrowing GRAI for consumption, or depositing it in the stable pool to purchase the liquidated LST collateral at a discount price.

Raft, like Gravita Protocol, is a decentralized lending protocol built on Ethereum. It has issued the stablecoin R, which allows users to deposit R or borrow R by collateralizing stETH or wstETH and earn staking rewards. R can also be used in other protocols in the ecosystem to increase capital utilization. Currently, the minimum collateralization ratio is 110% and users must borrow at least 3000 R. Raft charges a fee of 0.1%.

Raft allows users to leverage up to 11 times on stETH and provides a very simple operation process. Users only need to set the amount of stETH to deposit, the target leverage, and the slippage, and the system will automatically execute the operation. The maximum leverage of Raft is calculated based on the stETH collateralization ratio in Aave v3 and Maker, and the annual fee is calculated based on the difference between the stETH supply APY and the USDC borrowing APY on Aave v3, as well as the DAI stability fee.

According to Raft’s official website, investors in Raft include well-known market makers such as Wintermute, Jump, and GSR.

Raft was launched on June 5th and has achieved a TVL of $16.43 million in less than a day.

6. Tenet Protocol – Layer 1+ zero interest stablecoin lending protocol with liquidity staking

Tenet Protocol is a Layer 1 blockchain based on Cosmos that is EVM compatible. It is also a zero interest stablecoin lending protocol that provides multi-tiered earning opportunities for LSD holders.

First, users can stake LSD with Tenet network validators to earn staking rewards. Users can also borrow LSDC by collateralizing assets without any interest, and deploy and consume LSDC in the DeFi ecosystem while maintaining the original LSD asset returns. LSDC can be leveraged to release additional liquidity and utility.

In addition, users can also provide liquidity for LSDC in the stability module to earn additional rewards through liquidation in the Lucidity system and Tenet token rewards from the local reward pool. The minimum collateralization ratio for LSDC is 125% and users must borrow at least 500 LSDC. The stablecoin module of Tenet Protocol is also a fork of Liquity. Recently, Tenet Protocol announced that it is building full-chain expansion on LayerZero.

The Tenet Protocol team has extensive experience in product and marketing. Tenet Protocol’s CEO, Greg Gopman, was the former CMO of Ankr, growth executive of Kadena, and co-founder of Akash. COO Dan Peterson was the former revenue operations expert at Blockdaemon. CPO Alex Cheng was the former senior product manager at Tendermint-Cosmos and Composable Finance. CTO Dan Lashin was the former CTO of Minter.

Tenet Protocol has launched its testnet and will soon launch its mainnet on Ethereum. In May, Tenet Protocol launched its IDO with a price of $0.02, raising a total of $3.36 million.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After the heavy regulation, how can cryptocurrency exchanges move towards compliance?

- Stability AI founder Mostaque hits back at media’s allegations of plagiarism and salary arrears

- Comparison of Four New Decentralized Stablecoin Algorithms: Dai, GHO, crvUSD, and sUSD

- What are the concept tokens related to fair distribution that have experienced hundreds of times increase in value on FERC?

- Is the Hong Kong government the only one involved in self-indulgence? How do the people really feel about the licensing system?

- How to establish a compliant cryptocurrency exchange after Coinbase’s lawsuit

- Founder of Synthetix: Many design decisions are unavoidable choices, and forward-looking planning is almost impossible.