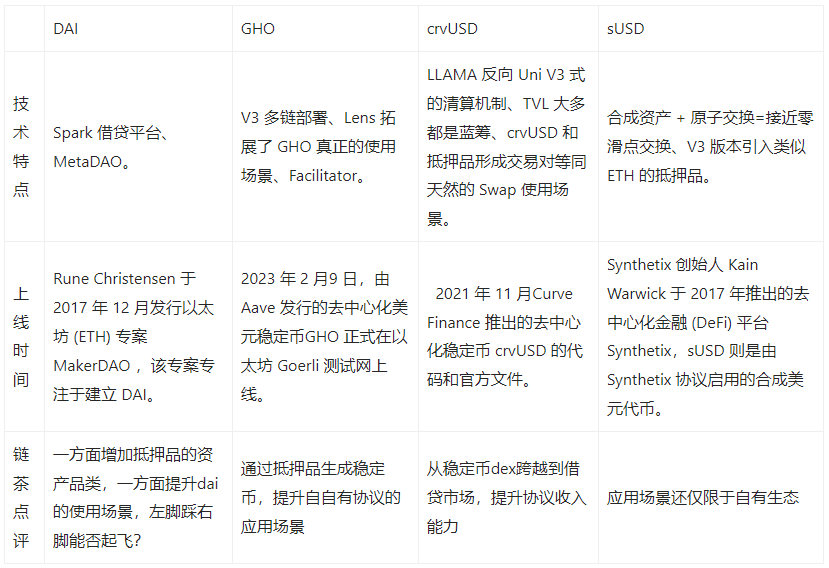

Comparison of Stablecoins on New Decentralized Algorithms: Dai, GHO, crvUSD, and sUSD

Comparison of Stablecoins on Decentralized Algorithms: Dai, GHO, crvUSD, sUSDBy Chole

The traditional finance circle’s view of DeFi cannot be separated from the idea that “the wanderer will eventually return home.” They believe that the end of crypto cannot avoid being assimilated by traditional finance. As long as the bottleneck between on-chain applications and landing cannot be solved, there will always be the possibility of being acquired or regulated.

If classified by the isolation of centralized risks, stablecoins can be divided into centralized stablecoins and decentralized stablecoins. This is also an era where centralized regulation is approaching step by step, and whether it is decentralized is one of the important attributes of stablecoins. Furthermore, after decentralization is resolved, there is still the concept of “stability” in stablecoins. To truly reach the endgame of stablecoins, it is necessary to create its own demand scenarios, not only as a general equivalent currency, but even to create unique economic activities to truly reflect the value of decentralized stablecoins.

The following text will detail the characteristics and latest developments of the four most promising decentralized tokens on the market today: MakerDAO Endgame Plan, AAVE GHO, CRV crvUSD, and SNX V3 sUSD.

- How can cryptocurrency exchanges move towards compliance after heavy regulation?

- How to establish a compliant cryptocurrency exchange following the consecutive lawsuits against Binance and Coinbase?

- After the heavy regulation, how can cryptocurrency exchanges move towards compliance?

1. MakerDAO Endgame Plan

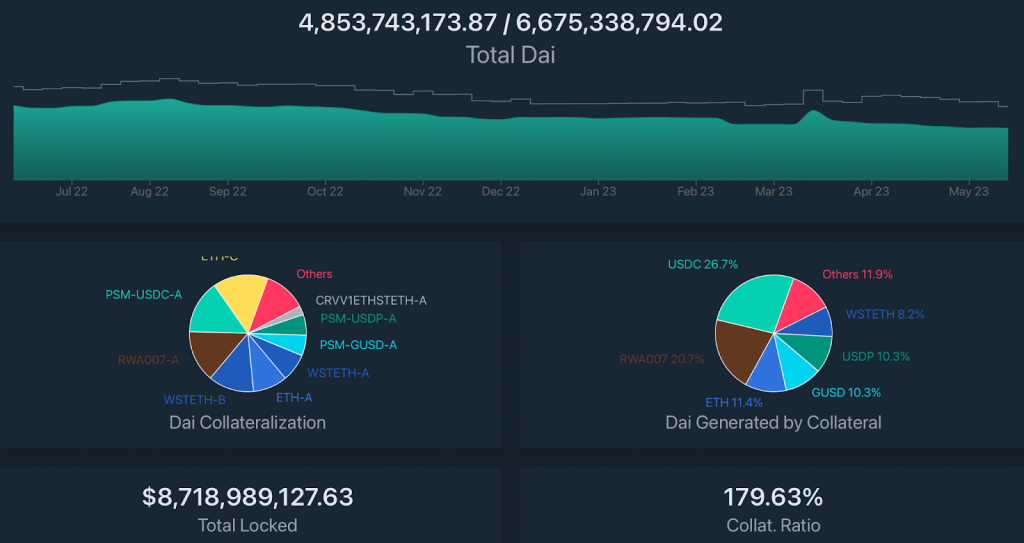

USDC and RWA (Real World Assets) bring potential risks to MakerDAO

MakerDAO founder Rune Christensen specifically mentioned in 2021 that USDC (US dollar stablecoin) is completely one of the biggest potential risks for DAI stablecoin. DAI is fundamentally different from USDT/USDC. The former is issued in a decentralized manner, and the main collateral is Ether, while the latter stablecoins such as USDT/USDC have considerable friction with current regulatory systems, which is a major risk for DAI.

In addition to stablecoin risks, Maker has been continuously adding real-world assets as collateral in the past few years, such as national bonds or corporate bonds, which has made Maker increasingly dependent on other real-world assets, cross-chain bridge assets, and assets that may be under pressure from regulatory agencies and law enforcement agencies. This has also caused users to criticize Maker for putting itself in an unsustainable situation because these assets fundamentally undermine Maker’s goal of becoming an “anti-censorship stablecoin.”

When Rune announced the “Clean Money” plan, Maker was able to transfer assets from USDC to other bonds to increase its earnings, making it impossible for regulators or law enforcement to shut down DAI.

Endgame Plan Launched

In August of last year, Rune proposed “The Endgame Plan,” which aimed to repair and improve MakerDAO and its governance and ecosystem, allowing the whole to reach a self-sustaining balance, the so-called “endgame state” (for more details on the proposal, readers can refer to this article). In short, Rune believes that if the whole reaches the “endgame state,” DAI can become the “world’s fair currency,” completely unaffected by external factors, and become the infrastructure of both the crypto ecosystem and the world economy. In other words, Rune wants to make DAI the next Bitcoin.

According to the original proposal, several key parts were screened:

First, Rune wanted to restructure the existing decentralized work ecosystem into a decentralized autonomous organization that could run on its own, “MetaDAO,” which included its complexity, and everything else was “Maker Core,” allowing holders of MKR tokens to govern in a decentralized manner.

“Maker Core” will support collaboration with “MetaDAO,” which will have its own revenue model, governance token, and parallel governance process. Rune explained that MetaDAO is like a fast and flexible Layer2 application layer, while Maker Core is slow, expensive, but a secure foundation for deployment. Therefore, MetaDAO is responsible for trying out innovations and taking on more risks, while L1 provides security for the above.

Next, since Maker has already embedded heavily in Ethereum and relies on Ethereum as collateral, Endgame should move on to the next step, because Ethereum’s dependence and dominant position fundamentally coincide with Maker Core, and Endgame needs to fully leverage this symbiotic relationship to launch EtherDai (ETHD).

EtherDai (ETHD) can be seen as a new synthetic asset controlled by the Maker governance group, integrating top liquidity collateralized borrowing and lending, and can be imagined as stETH in Lido Finance. Rune said that the key to the long-term survival and success of DeFi protocols is to accumulate as much collateralized ETH as possible, while Maker also needs to build collateralized ETH products to maintain the status of top DeFi protocols and decentralized stablecoin protocols.

Simply put, EtherDai (ETHD) is a new asset generated through “staked ETH” to help Maker acquire more “staked ETH.” The future mechanism details of ETHD will also be completed through MetaDAO, and Maker believes that this product may be as important as DAI in the long run.

Does the yield farm increase the supply of DAI?

MetaDAO will also have a token MDAO, which will have a total of 2 billion MDAO tokens, which will be distributed through staking mining. Staking mining is divided into three categories:

20%: DAI Farm, aimed at promoting DAI demand and broad token distribution effects.

40%: ETHD, which is the ETHD Vault Farming, which provides staking revenue in addition to MDAO farming revenue.

40%: MKR, a delegated governance farm, where delegating voting rights to favored proxies can earn rewards.

These three asset allocations ensure the broad and heterogeneous distribution of MetaDAO governance tokens, while remaining consistent with Maker and MKR holders, maximizing a broader Maker ecosystem.

In short, by distributing the MetaDAO token MDAO through staking mining (yield farming), it will be beneficial to increase the supply of DAI collateralized by decentralized assets, rather than demand for DAI; more user activity will be directed towards the ETHD farm. And in the endgame described by Rune, Maker will have more RWA as collateral, which means that the final collateral asset type will be an on-chain + off-chain model.

What is the definition of MetaDAO? What is the core operation?

As mentioned earlier, “Maker Core” will support collaboration with “MetaDAO,” which will also have its own profit model, governance token, and parallel governance process.

MetaDAO can be further divided into three categories: Governors, Creators, and Protectors.

Governors: Responsible for organizing decentralized manpower of Maker Core and increasing governance participation

Creators: Responsible for the growth and innovation of the Maker ecosystem

Protectors: Responsible for intermediating between Maker Core and the real world, configuring RWA assets, and avoiding physical and regulatory threats to RWA

Finally, Rune has set up three stages for Maker:

Pigeon Stance: Essentially the state of Maker when the endgame plan was first proposed. This stage will last for two and a half years, during which Maker will focus on earning revenue and storing ETH for the next stage. After two and a half years, unless the start is delayed or brought forward, the Eagle Stance stage will begin.

Eagle Stance: The amount of assets that can be pledged will be reduced to less than 25% of the total assets. If necessary, they plan to break the peg between DAI and the US dollar at this time.

Finally, there is the Phoenix Stance, which will only be activated during periods of global instability or when collateral is at risk of attack. This situation could arise at any time and without warning. In this stage, all remaining pledgeable assets are sold to obtain more ETH. Finally, if the fund pool is insufficient to pay off the debt and the protocol surplus is not enough, MKR will be sold on the market to maintain the protocol’s solvency.

The above is the prototype and general framework of the “Endgame Plan” proposal put forward in August last year. A few months before this article was written on March 20, MakerDAO announced that the “Endgame Plan” would be divided into five phases.

Rune Christensen outlined three main reforms in the Endgame proposal, including specific and clear rules (to be implemented immediately after the Maker governance MIP proposal is passed), the implementation of “governance participation incentives” by the end of 2023, and the transfer of operational complexity from MakerDAO to SubDAO (to be implemented in 2024), etc.

Here, SubDAO is specifically mentioned. SubDAO will serve as a semi-independent professional department in MakerDAO, whose main tasks include maintaining a decentralized front end, allocating DAI collateral, handling operational efficiency risks, marginal decision-making, testing innovative products and operating plans, etc. SubDAO will use key governance processes and tools in MakerDAO to simplify its operations.

Under the framework of implementing the Endgame, Maker will gradually no longer maintain its native treasury, but will allow SubDAO to generate DAI in bulk from the Maker Protocol at a low benchmark interest rate and stable rate. SubDAO will also bear all costs, including staff, oracles, maintenance, upgrades, and other expenses, and bear the first loss in all collateral exposure.

Next, the five stages can be divided as follows:

Phase 1 Beta Release: Continuously improve MakerDAO’s core product – the DAI stablecoin – to increase its usability and usage. The plan is to introduce more types of DAI to meet the needs of different users.

Phase 2 SubDAO Launch: In this phase, MakerDAO will launch six new SubDAO products to expand its ecosystem. At the same time, MakerDAO will integrate with external projects and partners, including introducing new synthetic assets, expanding borrowing and deposit options, and more financial derivatives, to expand its influence and usability in the decentralized finance ecosystem.

Phase 3 Governance AI Tool Release: After the launch of SubDAO, MakerDAO will focus on thoroughly changing the governance within MakerDAO by introducing production-grade artificial intelligence tools. These tools are supported by Alignment Artifacts and will improve decision-making and create a fair competitive environment among internal personnel and community members.

Phase 4 Governance Participation Rewards Program: As the governance ecosystem manages the DAO proficiently through governance AI tools, MakerDAO will launch a governance participation rewards program to provide economic incentives to participants to promote community involvement and consensus building.

Phase 5 Final Endgame Status: The final phase will deploy a new blockchain, currently referred to as NewChain. The new chain will have the ability to use hard forks as a governance mechanism and will also have optimized features that make it an “AI-assisted DAO governance process and AI tool user backend,” including smart contract generation, state rent, and protocol-native MEV capture, among other features.

Rune also mentioned that the launch of the new chain will be the last step in the Endgame release process. Once it is deployed, MakerDAO will permanently enter the endgame plan state, and further significant changes will become impossible, with its core processes and power balance remaining decentralized, self-sufficient, and permanently immutable.

Latest Progress

On May 8, MakerDAO announced the SBlockingrk protocol, which aims to enhance the liquidity and yield of the DAI stablecoin. This means that end-users deployed on Ethereum, DAI-centered DeFi products, all have the supply and borrowing functionality of ETH, stETH, DAI, and sDAI, and all DeFi users can use the SBlockingrk protocol.

The SBlockingrk protocol is also an indispensable part of MakerDAO’s Endgame plan, with a focus on reshaping DAI as a freely floating asset collateralized by real-world assets.

II. AaVE GHO

Aave, the unmanaged liquidity market protocol known as the king of Defi lending, allows depositors to provide liquidity and earn passive income by depositing assets into Aave’s public pool. On the other end, borrowers can borrow assets from the pool using various methods, including over-collateralization or uncollateralized borrowing, and all credit activities on the platform can be carried out without any credit checks. Not only is the liquidation efficiency high, but the bad debt rate is also much lower than that of traditional lending models, and Aave does not even have repayment deadlines.

Aave was founded on Ethereum in 2017 and has since expanded into a large protocol that spans seven chains. On January 27th of this year, Aave V3 was officially launched on the Ethereum mainnet, completing the upgrade of the seven major chains. As a veteran DeFi protocol, its own token has risen by nearly 60% this year alone.

Back in July 2022, the Aave community released an ARC proposal to introduce GHO, a native, decentralized, over-collateralized stablecoin pegged to the U.S. dollar. The currency will not only be the first to be launched on the Aave protocol, but will also allow users to mint GHO based on the collateral they provide. As a lending leader in the DeFi space, the news of AAVE’s stablecoin launch is sure to attract a lot of attention.

GHO Development Stages

Phase I: In July of last year, the Aave community proposed the issuance of the stablecoin GHO. Users can earn interest by providing collateral in the AAVE protocol while generating the decentralized stablecoin GHO. When users want to redeem their collateral, they need to destroy the minted GHO to redeem it.

For AaveDAO, GHO income belongs to the DAO and the borrowing interest rate is determined by it. stkAAVE holders participating in AAVE’s security module pledging can enjoy discounted interest rates to generate GHO.

Unlike DAI, GHO’s collateral can provide sustained income, and AAVE introduces the concept of a “facilitator,” which is designated by the AAVE community through governance and is usually a protocol or institution. Facilitators can generate or destroy GHO without any collateral based on different strategies to regulate the market, and for each facilitator, Aave Governance must also approve the so-called “bucket.”

The reserve represents the GHO upper limit that a specific promoter can generate and the AAVE protocol itself will be the first promoter.

Phase 2: On July 31st of last year, the GHO proposal was approved with a 99.99% approval rate (501,000 AAVE). Aave implemented the creation of GHO stablecoins through the new Aave Improvement Proposal (AIP), and Aave DAO was responsible for managing them when creating stablecoins, allowing users to mint GHO using collateral they provided. The borrowing income from GHO will belong to Aave DAO, and Aave and GHO will be completely separated into two products.

Aave also iterated and upgraded to Aave 3 with continuous research, market data analysis, and community feedback in capital efficiency, protocol security, decentralization, and user experience.

Here is a brief explanation of the Aave 3 upgrade. The launch of Aave V3 will further improve capital efficiency, security, and cross-chain functionality, promote the development of the entire protocol ecosystem, and enhance decentralization. Including: First, cross-chain asset flow (Portal), promoting “cross-chain” transactions, allowing assets to seamlessly transfer on the Aave V3 market on seven chains, solving the problem of the different liquidity needs of each chain; Second, efficient mode (eMode), users can significantly increase the borrowing limit by using “similar” assets as collateral; Third, isolation mode, new assets labeled as “isolated” will have restrictions on the borrowing limit and can only be borrowed with specific assets and cannot be used as collateral with other assets at the same time.

Therefore, through the isolation mode, users can use multiple assets currently supported by the Aave protocol to generate GHO while reducing risks through collateral. The supply and borrowing limits also help reduce risk. For example, in the case of a sluggish market, as the price of the collateral contract rises, the demand for GHO increases, and users will borrow more GHO using other non-volatile collateral assets to repay positions. This will increase the number of GHOs entering the market and reduce demand.

At the same time, the efficient mode (eMode) can also allow stablecoin holders to exchange GHO at a ratio close to 1:1 with zero slippage. The cross-chain flow of assets (Portal) allows GHO to be distributed across networks without trust and created on a more secure Ethereum. The entire process only requires simple message passing without the use of bridges, reducing overall risk.

Phase Three: On February 9th of this year, GHO officially went live on the Ethereum Goerli testnet for developers and community users to access its interface and detect potential workflow issues. The testnet supports four assets: DAI, USDC, AAVE, and LINK, and has added new facilitators to support FlashMinting, which can have the same effect as a flash loan, increasing overall transaction efficiency.

In simple terms, Aave’s most well-known reason for FlashMinting and flash loans is that it was the first protocol to provide “flash loans” services, allowing users to complete borrowing and lending within the “same block”, enabling users to quickly conduct arbitrage operations. However, flash loans can only complete all operations within one block, and if the funds are not repaid, all operations will be reversed.

In simple terms, if users borrow funds with flash loans but do not repay them, the funds will automatically roll back to their original location because the transaction is a failed work item that cannot evolve into a “real fact” within one block. Flash loans are commonly used for arbitrage and only require payment of the cost of a single GAS fee and the cost of the flash loan protocol. If there are good arbitrage opportunities, users can use flash loans to obtain unlimited high profits, but because flash loans need to complete all operations within one block, they require the use of code to complete flash loan operations, which has a relatively high threshold of use.

Finally, it is worth mentioning the completeness of the audits. GHO has undergone four complete audits to ensure its security. In the latest audit by ABDK, all code was subjected to functional testing and security audits, and a total of 6 modification suggestions were made in 85 categories. According to GHO’s progress, there will be one more security audit before it officially goes live.

Conclusion

In simple terms, GHO is a collateralization tool that allows users to mint in excess of the AAVE protocol’s assets. Therefore, the demand growth of GHO will encourage more users to deposit assets into AAVE. Furthermore, stkAAVE holders who participate in the security module’s staking can obtain discounted interest rates to mint GHO, which further incentivizes more users to participate in staking. At the same time, the rising demand for AAVE makes its price more favorable, and the interest generated by GHO becomes a new source of income for the AAVE protocol. Therefore, for AAVE, launching GHO directly enhances the overall competitiveness of AAVE to a great extent.

However, not all aspects of AAVE are advantageous. Facilitators in AAVE have the ability to mint GHO without any collateral, which is too centralized. If interested parties intervene, it could lead to the risk of GHO being unanchored. Although AAVE has set up a bucket mechanism to limit the amount of GHO that facilitators can generate, both are determined by AAVE voting. If there is a conflict of interest, it could lead to increasingly centralized governance.

Finally, for holders who obtain large amounts of AAVE at very low costs, GHO is equivalent to an endless money-making machine, which could lead to the risk of a massive AAVE sell-off through GHO, causing a crash in the AAVE market value in the future.

Three, CRV crvUSD

Curve Finance, a decentralized exchange, was launched in 2020. CurveDAO token (CRV) is the native token of this platform. All liquidity providers who provide liquidity to Curve have the opportunity to receive rewards in the form of CRV governance tokens.

Unlike other DEXs on the market, Curve focuses mainly on providing low-slippage trading services between different stablecoins (such as USDT, USDC, and DAI), allowing users to reduce token exchange losses during the exchange process. Therefore, Curve does not charge users high fees. Curve’s profit comes from issuing stablecoins and providing lending and financial derivative platforms.

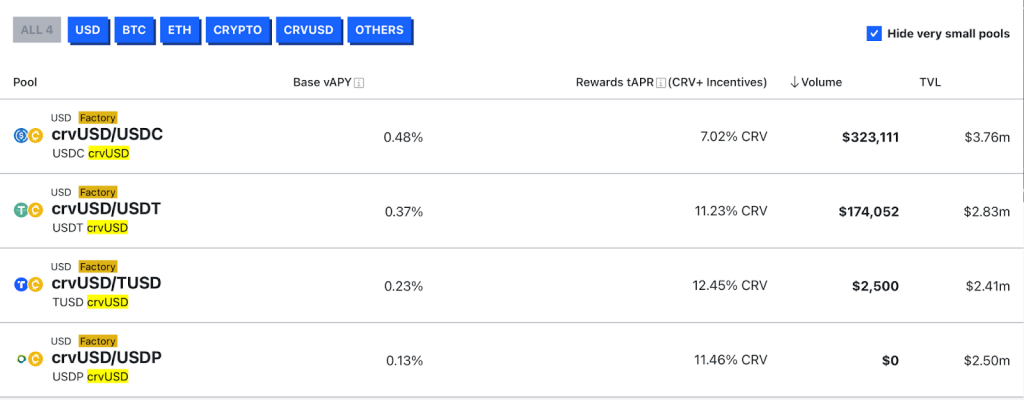

As of today (5/24), Curve has a lock-up amount of $4.02 billion. On May 4, Curve tweeted that crvUSD had been deployed on the Ethereum mainnet, but the UI interface was not yet complete and was expected to be released soon. According to Etherscan data, the crvUSD smart contract was successfully deployed on the Ethereum mainnet at around 3am on May 4, and 20 million crvUSD was minted through 5 transactions in a short period of time.

Curve CEO Michael Egorov then used 957.5 sfrxETH as collateral to borrow 1 million crvUSD. It is worth mentioning that after the news of the deployment of the stablecoin crvUSD on the Ethereum mainnet was announced, Curve Finance’s governance token CRV soared to $0.975 in a short period of time, up 6% in 24 hours.

Exploring the Operation Mechanism of crvUSD from the White Paper

Curve released a white paper last year discussing its overall operation mechanism, which has three core principles: “Lending – Liquidity Automated Market Maker Algorithm (LLAMMA)”, “PegKeeper”, and “Monetary Policy”. The first LLAMMA can be seen as a dynamic lending liquidation algorithm, which is a kind of automated market maker introduced into lending liquidation, so it is different from ordinary mortgage lending stablecoins. Normal mortgage lending stablecoins, such as MakerDAO, are over-collateralized. Users need to mortgage enough collateral to the treasury to borrow a corresponding proportion of stablecoins according to the collateralization ratio. If the collateral value drops to a certain extent, there will be a liquidation line. Once the liquidation line is exceeded, the collateral will be automatically sold by the system to repay the debt.

The LLAMMA proposed by Curve is still issued through over-collateralization, but uses a special purpose automated market maker to replace traditional lending and liquidation processes. When the liquidation threshold is reached, liquidation will not occur all at once, but is converted into a continuous liquidation/de-liquidation process.

For example, using ETH as collateral to borrow crvUSD. When the value of ETH is high enough, it is the same as traditional mortgage lending, and the collateral will not change. When the ETH price falls and enters the liquidation range, ETH will gradually be sold off. After falling below the liquidation range, it will all be stablecoins, and further declines will not change, which is the same as other lending protocols.

However, in the middle of the liquidation range, if ETH rises, Curve will use stablecoins to help users buy back ETH. If there is fluctuation in the middle of the liquidation range, the liquidation and de-liquidation process will be repeated continuously, and ETH will be sold and bought back continuously.

Compared with MakerDAO’s one-time liquidation lending protocol, if the market rebounds after liquidation, in MakerDAO, users will only be left with a little residual value after liquidation, while in Curve, they will buy back ETH during the rise.

The above is how LLAMMA solves the mechanism of liquidating collateral, while PegKeeper and Monetary Policy are the mechanisms used by Curve Finance to anchor crvUSD to 1 USD.

In short, LLAMMA is the algorithm that Curve uses for collateral liquidation. It reduces losses during liquidation by diversifying collateral in different price ranges. It generates arbitrage opportunities by larger changes in price than external prices to dynamically liquidate collateral. When the price drops, the collateral becomes crvUSD, and when the price rises, it becomes collateral again.

After the crvUSD lending interface was officially launched, the complete data of the crvUSD liquidity pool can now be seen on the Curve frontend page, and the TVL of each liquidity pool is currently between 2 and 3 million US dollars.

IV. SNX V3 sUSD

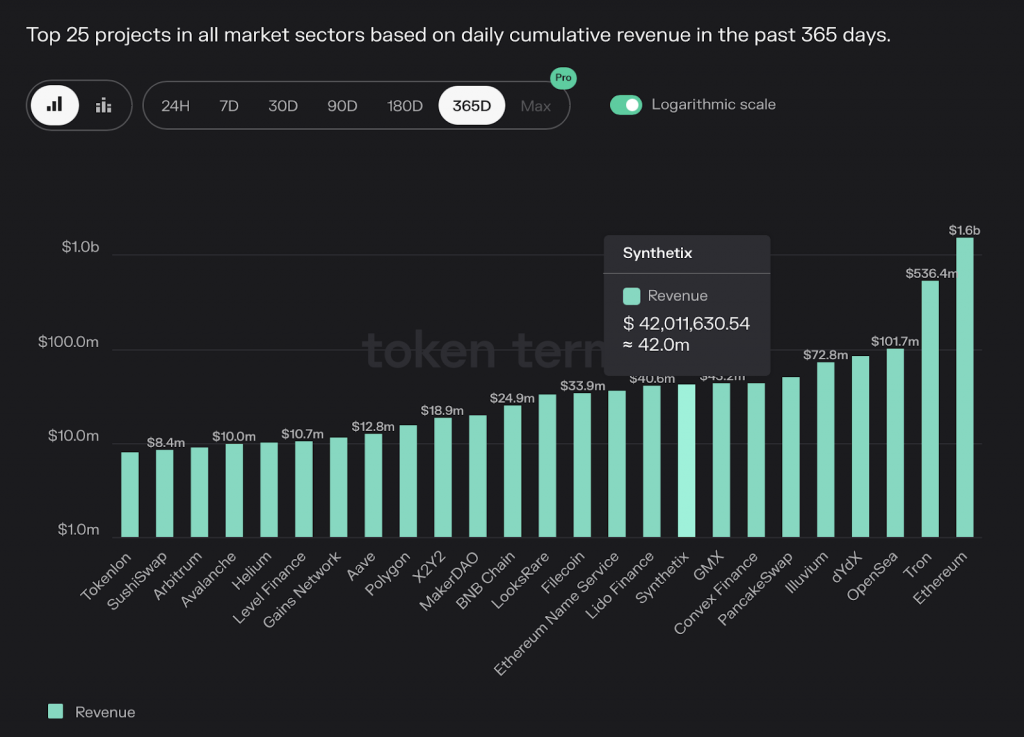

As an important partner of Optimism, Synthetix has been deployed to Optimism as early as July 2021. Subsequently, Synthetix encouraged users to transfer their staked SNX to Optimism, and transactions and revenue gradually shifted from the Ethereum mainnet to Optimism. According to defilama data on May 26, Synthetix ranked second on Optimism with a TVL of 149 million US dollars.

Synthetix’s revenue mainly comes from Synths spot trading and perpetual contract trading. At the beginning, it was launched in the market with the positioning of a synthetic asset platform, and it also set up a very special “debt pool” operation mechanism: users can borrow sUSD by pledging SNX, which is different from MakerDAO’s collateral asset casting DAI. Although Synthetix also performs liquidation when the SNX collateral ratio is insufficient (the current liquidation line is a collateral ratio of 160%), the essential logic is completely different.

In Synthetix, all users who pledge SNX to cast sUSD share a common “debt pool”. When a user casts sUSD, the proportion of the cast sUSD quantity to the total sUSD quantity becomes the proportion of the user’s share of the entire debt pool, and all cast sUSD is the debt of the entire system. Also, because everyone shares a common debt pool, if other users increase the value of their assets through operations, it will lead to an increase in the debt of the remaining users. For example, if a user’s asset appreciation rate is not higher than the system average, they will lose money.

It can be seen that Synth in Synthetix relies on the oracle Chainlink to provide prices, but the price update of the oracle on the chain will completely lag behind the price of the spot market, indirectly leading to the risk of front-running trading.

Synthetix realized this risk and directly used the price feed exchange through the oracle in 2021, without considering the depth of the no-slippage transaction, officially starting the new narrative of Atomic Swap.

Atomic swaps allow users to price Synths via a combination of Chainlink and DEX oracle Uniswap V3 (representing the latest spot price) to atomically exchange assets. In simpler terms, Synthetix composability also protects stakers from frontrunning attacks.

In June 2022, Synthetix announced that 1inch had integrated Synthetix’s atomic swaps, providing trading users with better liquidity and SNX stakers with additional fees.

The Synthetix Perps V2 scheme was launched in December of the same year, which can reduce costs, improve scalability, and fund efficiency.

From Synthetix to Synthetix V2 to the current Synthetix V3, the team has demonstrated highly efficient updating capabilities, not only to meet various customized needs but also to reflect their ambition to make Synthetix a liquidity center.

Currently, the functionality of Synthetix V3 is gradually being rolled out, which is a complete reform of the protocol from scratch by the team.

Differences before and after V3 upgrade

Improvement 1: Tied stablecoin snxUSD

Synthetix V3 will launch a new stablecoin snxUSD to solve the scalability issues of sUSD in the past, which could even become unanchored.

Before the upgrade, snxUSD: Even though most sUSDs are minted by pledging SNX, Synthetix also opened up the function of over-collateralized WETH minting snxUSD. However, due to the lack of arbitrage activities to bring the price back to $1 when sUSD is slightly higher or lower than $1, only a few users use it.

After the upgrade, snxUSD: In the new version of Synthetix V3, snxUSD can be exchanged with some collateral at a ratio of 1:1, which allows users to limit the price of sUSD within a small range through arbitrage activities alone. At the same time, this minting method designed for convenience may also increase the issuance of snxUSD.

Improvement 2: Reward distribution and liquidation

After the upgrade, snxUSD: Pool owners can use the reward manager to distribute rewards to users, providing a more flexible value allocation plan according to their pledge ratio or reference to their pledge time, etc.

Synthetix V3 also proposes a liquidation mechanism, where collateral and debt of a liquidated position are distributed among other participants in the treasury. If the entire treasury is liquidated, all collateral will be seized by the system and sold to repay debt.

Improvement Three: Isolation of Debt Pools

Before the upgrade, snxUSD: In the existing Synthetix V2, all transactions had to go through a single SNX debt pool, which restricted many of the functions due to various risks, such as the snxUSD minting method mentioned at the beginning.

After the upgrade, snxUSD: Synthetix V3 introduces the concept of pools, allowing stakeholders to customize risk exposure for specific markets, which differentiates the risk and return of debt pools. Governance can decide the collateral type and limit for each pool, and even if there are risks, they can be limited to a small scale. It also provides SNX stakers with the opportunity to take on higher risk for higher returns.

Conclusion

Currently, features such as atomic trades are less frequently used, but there is strong demand for Perp V2. Synthetix V3 will be more flexible, meeting various customized needs, while limiting risks to a small scale. The new stablecoin snxUSD is easier to mint, and its price is easier to anchor to $1.

The launch of Synthetix V3 represents an important milestone for the protocol, and whether this radical reform can become the new narrative for the next generation of on-chain financial products, such as permissionless derivative liquidity platforms, remains to be seen.

5. Conclusion

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Stability AI founder Mostaque hits back at media’s allegations of plagiarism and salary arrears

- Comparison of Four New Decentralized Stablecoin Algorithms: Dai, GHO, crvUSD, and sUSD

- What are the concept tokens related to fair distribution that have experienced hundreds of times increase in value on FERC?

- Is the Hong Kong government the only one involved in self-indulgence? How do the people really feel about the licensing system?

- How to establish a compliant cryptocurrency exchange after Coinbase’s lawsuit

- Founder of Synthetix: Many design decisions are unavoidable choices, and forward-looking planning is almost impossible.

- Protecting Investors? A Detailed Explanation of the SEC’s Lawsuit Against Binance