Comparison of Four New Decentralized Stablecoin Algorithms: Dai, GHO, crvUSD, and sUSD

Comparison of Four New Decentralized Stablecoins: Dai, GHO, crvUSD, and sUSDTraditional finance’s view of DeFi cannot escape the “prodigal son will eventually return home” mentality, as they believe that the endgame of Crypto cannot avoid being acquired by traditional finance. This is because as long as the bottleneck between on-chain direction and application landing cannot be solved, there will always be a future of acquisition and regulation.

If classified according to isolating centralized risk, stablecoins can be divided into centralized stablecoins and decentralized stablecoins, which is also an important attribute of stablecoins in the era of centralized regulation. Furthermore, decentralization solves the concept of stablecoins’ “stability.” To truly reach the endgame of stablecoins, it is necessary to create one’s own demand scenarios, not just general equivalent currencies, and even create unique economic dynamics to truly reflect the value of decentralized stablecoins.

The following article will detail the characteristics and latest developments of the four most promising decentralized tokens in the market today: MakerDAO Endgame Plan, AAVE GHO, CRV crvUSD, and SNX V3 sUSD.

I. MakerDAO endgame plan

- What are the concept tokens related to fair distribution that have experienced hundreds of times increase in value on FERC?

- Is the Hong Kong government the only one involved in self-indulgence? How do the people really feel about the licensing system?

- How to establish a compliant cryptocurrency exchange after Coinbase’s lawsuit

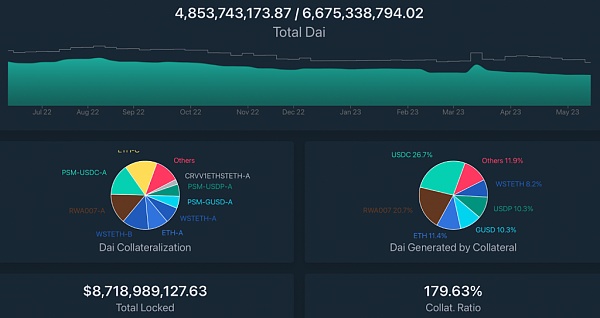

(A) USDC and RWA (Real World Assets) bring potential risks to MakerDAO

MakerDAO founder Rune Christensen mentioned in 2021 that USDC (USD stablecoin) is one of the biggest potential risks to DAI stablecoin. DAI is fundamentally different from USDT/USDC, with the former being issued in a decentralized manner and primarily collateralized by Ether, while the latter stablecoins have considerable friction with current regulatory systems, which is a significant risk for DAI.

In addition to stablecoin risks, Maker has been adding real-world asset-related collateral over the past few years, such as national bonds or corporate bonds. This has made Maker increasingly dependent on other real-world assets, cross-chain bridge assets, and assets that may come under pressure from regulatory and law enforcement agencies. Users have criticized Maker for leaving itself in an unstable position because these assets fundamentally undermine Maker’s goal of becoming an “anti-censorship stablecoin.”

Rune hopes that when he announces the “Clean Money” plan, Maker will be able to transfer assets from USDC to other bonds, thereby increasing its revenue and making it impossible for regulators or law enforcement agencies to shut down DAI.

(2) The Endgame Plan

Rune proposed “The Endgame Plan” in August last year, with the main goal of repairing and improving MakerDAO’s governance and ecosystem to achieve self-sustaining equilibrium, which is the so-called “endgame state.” (For more details on the “Endgame Plan,” readers can refer to this article.) In short, Rune believes that if the whole system reaches the “endgame state,” DAI can become an “unbiased world currency,” completely unaffected by external factors, and become the infrastructure of the cryptocurrency ecosystem and the world economy, in other words, Rune wants DAI to become the next Bitcoin.

According to the original proposal, several key parts are screened:

First, Rune wants to restructure the existing decentralized work ecosystem into a self-sustaining decentralized autonomous organization “MetaDAO,” which includes the complex things therein, and all others are “Maker Core,” allowing holders of MKR tokens to govern in a decentralized manner.

“Maker Core” will support collaboration with “MetaDAO,” which will also have its own profit model, governance token, and parallel governance process. Rune explains that MetaDAO is like a fast and flexible application layer Layer2, while Maker Core is slow, expensive, but is the secure cornerstone of deployment Layer1. Therefore, MetaDAO is responsible for trying innovation and taking on more risks, while the above is provided by L1 for security.

Next, since Maker has already embedded Ethereum heavily and relies on Ethereum as collateral, Endgame should move on to the next step, because Ethereum’s dependence and Ethereum’s dominance are fundamentally in line with Maker Core, and Endgame needs to fully utilize this symbiotic relationship to launch EtherDai (ETHD).

EtherDai (ETHD) can be seen as a new synthetic asset controlled by the Maker governance community, and integrates top liquidity collateral lending, which can be imagined as stETH of Lido Finance. Rune said that the key to the long-term survival and success of DeFi protocols is to accumulate as much collateralized ETH as possible, while Maker also needs to construct collateralized ETH products in order to maintain the status of top DeFi protocols and decentralized stablecoin protocols.

Simply put, EtherDai (ETHD) is a new asset generated through “pledged ETH” to help Maker acquire more “pledged ETH.” More mechanism details about ETHD will also be completed through MetaDAO, and Maker believes this product may be as important as DAI in the long run.

(3) Can yield farming increase the supply of DAI?

MetaDAO will also have a token called MDAO, which will have a total of 2 billion MDAO tokens distributed through pledge mining. Pledge mining is divided into three categories:

20%: DAI farming, which aims to promote DAI demand and wide token distribution effects.

40%: ETHD, that is, ETHD vault farming, which provides pledge income in addition to MDAO farming income.

40%: MKR, commission governance farming, allows the delegation of voting rights to favored delegates to obtain rewards.

These three asset allocations ensure the widespread and heterogeneous distribution of MetaDAO governance tokens, while remaining consistent with Maker and MKR holders, creating the broadest possible Maker ecosystem.

In short, by distributing MetaDAO tokens MDAO through pledge mining (yield farming), it will help increase the supply of DAI collateralized by decentralized assets, rather than demand for DAI; more user activity will be directed to the ETHD farm. In the endgame described by Rune, Maker will have more RWA as collateral, and the ultimate collateral asset type will be an on-chain + off-chain model.

(4) What is the definition of MetaDAO? What is the core operation?

As mentioned above, “Maker Core” will support collaboration with “MetaDAO,” which will also have its own profit model, governance tokens, and parallel governance processes.

MetaDAO can be further divided into three categories: Governors, Creators, and Protectors.

Governors: Responsible for organizing the decentralized human resources of Maker Core and increasing governance participation.

Creators: Responsible for the growth and innovation of the Maker ecosystem.

Protectors: Responsible for intermediating Maker Core with the real world, configuring RWA assets, and preventing RWA from physical and regulatory threats.

Finally, Rune also established three stages for Maker:

Pigeon Stance: Essentially, this was Maker’s state when the Endgame Plan was first introduced. This phase will last for two and a half years, during which Maker will focus on earning revenue and storing ETH for the next stage. After two and a half years, unless delayed or started early, the Eagle Stance phase will begin.

Eagle Stance: The plan is to reduce the amount of assets that can be seized to less than 25% of the total assets. If necessary, they plan to break the DAI’s peg to the US dollar at this time.

Finally, there is the Phoenix Stance, which will only be activated during periods of global instability or when collateral may be under attack. This situation could arise at any time and without warning. In this phase, all remaining assets that can be seized are sold to acquire more ETH. Finally, if the funding pool is insufficient to pay off debts, and the protocol surplus is not enough, MKR will be sold on the market to maintain the protocol’s solvency.

The above is the embryonic and general framework of the “Endgame Plan” proposed in August last year. In the months leading up to the writing of this article on 3/20, MakerDAO announced that the “Endgame Plan” would be divided into five phases.

Rune Christensen outlined the three main reform contents of the Endgame proposal, including clear specific rules (implemented immediately after passing the Maker governance MIP proposal), implementation of “governance participation incentives” by the end of 2023, and transfer of operational complexity from MakerDAO to SubDAO (implemented in 2024), among others.

Here, SubDAO is specifically mentioned. SubDAO will serve as a semi-independent professional department within MakerDAO, with main tasks including maintaining a decentralized front-end, allocating DAI collateral, dealing with operational efficiency risks, marginal decision-making, experimenting with innovative products and operating plans, and so on. SubDAO will use key governance processes and tools in MakerDAO to simplify its operations.

Under the framework of implementing Endgame, Maker will gradually no longer maintain its native treasury, but instead allow SubDAO to generate DAI in bulk from the Maker Protocol at a low benchmark interest rate and stable rate. SubDAO will also bear all costs, including staff, oracles, maintenance, upgrades, and other expenses, and bear the first loss in all collateral exposure.

Next, the five stages can be divided into:

Stage 1 Beta Release: Continuously improving MakerDAO’s core product – the DAI stablecoin, expanding its scope and availability. Plans to launch more types of DAI to meet the needs of different users.

Stage 2 SubDAO Launch: In this stage, MakerDAO will release six brand new SubDAO products to expand the MakerDAO ecosystem. At the same time, MakerDAO will integrate with external projects and partners, including introducing new synthetic assets, expanding lending, deposit options, and more financial derivatives, expanding its influence and availability in the decentralized finance ecosystem.

Stage 3 Governance AI Tool Release: After SubDAO is launched, MakerDAO will be committed to completely changing the governance within MakerDAO by introducing production-grade artificial intelligence tools. These tools will be supported by Alignment Artifacts and will improve decision-making and create a fair competitive environment between internal personnel and community members.

Stage 4 Governance Participation Reward Plan: As the governance ecosystem skillfully manages DAO through governance AI tools, MakerDAO will launch a governance participation reward plan, providing economic incentives to participants to promote community participation and consensus building.

Stage 5 Final Endgame State: The last stage will deploy a new blockchain, currently known as NewChain. The new chain will have the ability to use hard forks as a governance mechanism, and will also have optimized features, making it an “AI-assisted DAO governance process and AI tool user backend,” including smart contract generation, state rent, and protocol Internal MEV capture… and other features.

Rune also said that the launch of the new chain will be the last step in the Endgame release process. Once it is deployed, MakerDAO will permanently enter the endgame plan state, further significant changes will become impossible, and its core processes and power balance will remain decentralized, self-sufficient and permanent.

(5) Latest Progress

On May 8th, MakerDAO announced the SBlockingrk protocol, which aims to enhance the liquidity and yield of the DAI stablecoin, that is, end users deployed on Ethereum, DAI-centered DeFi products, all have ETH, stETH, DAI and sDAI supply and borrowing functions, and all DeFi users can use the SBlockingrk protocol. The SBlockingrk protocol is also an indispensable part of MakerDAO’s expansion of the Endgame plan, and the key direction will focus on reshaping DAI as a freely floating asset collateralized by real-world assets.

二、AaVE GHO

Aave, known as the king of non-custodial liquidity market protocols for lending and borrowing, allows depositors to provide liquidity and earn passive income by depositing assets into Aave’s public funding pool, while borrowers on the other side can borrow assets from the funding pool freely using various methods such as over-collateralization or unsecured loans. All lending activities on the platform can be conducted without any credit check, and not only is the liquidation efficiency high, but the default rate is far lower than that of traditional lending models. Additionally, Aave has no repayment deadline.

Aave was founded on Ethereum in 2017 and has since expanded into a large protocol that can cross 7 chains. On January 27 of this year, Aave V3 was officially launched on the Ethereum mainnet, completing the upgrade of the 7 major chains. As an old DeFi protocol, its token has risen nearly 60% since the beginning of this year.

Fast forwarding to July 2022, the Aave community released an ARC proposal to introduce GHO, a decentralized stablecoin that is pegged to the US dollar and generated by over-collateralization. This coin will not only be the first to be launched on the Aave protocol, but will also allow users to mint GHO based on the collateral they provide. As a DeFi leader, the news that AAVE is launching a stablecoin is sure to attract a lot of attention.

(一)GHO Development Stage

First phase: On July 28 of last year, the Aave community proposed to issue the stablecoin GHO. Users can earn interest by providing collateral in the AAVE protocol and generate Decentralized stablecoin GHO at the same time. When users want to redeem their collateral, they need to destroy the GHO they minted to do so. For AaveDAO, the GHO earnings belong to the DAO and the borrowing rate is determined by it. StkAAVE holders who participate in the AAVE security module pledge can enjoy discounted interest rates to generate GHO. Unlike DAI, the collateral for GHO can provide continuous income, and AAVE introduces the concept of a “facilitator,” which is designated by the AAVE community through governance, usually a protocol or institution. Facilitators can generate or destroy GHO without any collateral based on different strategies to regulate the market. For each facilitator, Aave Governance must also approve the so-called “bucket.” The bucket represents the upper limit of GHO that a specific facilitator can generate, and the AAVE protocol itself will act as the first facilitator.

Phase 2: The GHO proposal was approved on July 31, with a approval rate of 99.99% (501,000 AAVE). Aave implemented the creation of GHO stablecoin through a new Aave Improvement Proposal (AIP), which was managed by the Aave DAO when creating the stablecoin. Users are allowed to use the collateral they provide to mint GHO, and the borrowing income of GHO will belong to the Aave DAO. Aave and GHO are completely separate products. Aave also iterated and upgraded to Aave 3 with continuous research, market data analysis, and community feedback on capital efficiency, protocol security, decentralization, and user experience.

A brief explanation of the Aave 3 upgrade: the launch of Aave V3 will further improve capital efficiency, security, and cross-chain functions, promote the development of the entire protocol ecosystem, and enhance decentralization. These include: first, cross-chain asset flow (Portal), which promotes “cross-chain” transactions, allows assets to seamlessly transfer on the seven-chain Aave V3 market, and solves the problem of current differences in liquidity demand across chains; second, efficient mode (eMode), users can significantly increase the borrowing limit by using “similar” assets as collateral; third, isolation mode (Isolation Mode), newly listed assets labeled “isolated” will have a borrowing limit restriction and can only lend out specific assets and cannot be used as collateral with other assets at the same time.

Therefore, through the isolation mode (Isolation Mode), users can use multiple assets currently supported by the Aave protocol to generate GHO while reducing risks through collateral. Supply and borrowing limits also help reduce risk. For example, in a market downturn, as the price of the collateral contract rises, the demand for GHO will increase, and users will use other non-volatile collateral assets to borrow more GHO to repay their positions. This will increase the number of GHOs entering the market and reduce demand. At the same time, the efficient mode (eMode) can also allow stablecoin holders to exchange GHO at a ratio close to 1:1 with zero slippage. Asset cross-chain flow (Portal) allows GHO to be distributed across networks without trust and created on Ethereum with higher security. The entire process only requires simple message passing and does not require the use of bridges, thereby reducing overall risk.

Phase 3: On February 9th of this year, GHO officially launched on the Ethereum Goerli testnet to allow developers and community users to access its interface and detect potential workflow issues. The testnet supports four assets: DAI, USDC, AAVE, and LINK, and adds new facilitators to support FlashMinting mode, which can play the same role as flash loans and improve overall transaction efficiency.

FlashMinting and flash loans are best known for being the first protocol to offer “flash loans”. This allows users to complete borrowing and lending within a single block, making it possible for users to quickly arbitrage different markets. However, flash loans must be repaid within the same block they are taken out in, otherwise all transactions are rolled back. This means that if a user borrows funds using a flash loan and does not repay them, all of the transactions that took place using that loan are undone because they were never considered a “real” transaction. Flash loans are commonly used for arbitrage and only require a single gas fee and the cost of the flash loan protocol to use. This means that if there is a good arbitrage opportunity, using a flash loan can provide unlimited profits. However, because flash loans must be completed within a single block, they require the use of code and are therefore more difficult to use.

It is also worth noting the comprehensiveness of the auditing, as GHO has undergone four complete audits to ensure its security. For example, in the most recent audit by ABDK, the entire code was subjected to functional testing and security auditing. Out of 85 categories, only 6 modifications were suggested. According to the progress of GHO, there will be one more security audit before it is officially launched.

(II) Conclusion

In short, GHO allows users to use assets deposited in the AAVE protocol to generate over-collateralized loans. Therefore, an increase in demand for GHO will encourage more users to deposit assets in AAVE. In addition, stkAAVE holders who participate in the security module staking are eligible for discounted rates when minting GHO, further incentivizing more users to participate in staking. The increase in demand for AAVE resulting from GHO also makes AAVE more valuable, and the interest generated by GHO becomes a new source of revenue for the AAVE protocol. Therefore, launching GHO directly enhances the overall competitiveness of AAVE.

However, not all aspects of GHO are advantageous. Facilitators in AAVE have the right to mint GHO without any collateral, which creates the risk of GHO becoming unanchored if malicious actors intervene. Although AAVE has set up a bucket mechanism to limit the upper limit of GHO generated by facilitators, both are voted on by AAVE, and if there is collusion, it can lead to governance being increasingly centralized.

Finally, for acquiring a large number of AAVE holders at very low cost, GHO is essentially a perpetual motion machine, which may lead to the risk of AAVE market value cash-out by using GHO in the future.

Three, CRV crvUSD

Decentralized exchange Curve Finance was launched in 2020, with the CRV token being the platform’s native token. All liquidity providers who have provided liquidity to Curve have the opportunity to receive rewards in the form of its governance token CRV.

Curve differs from other DEXs on the market in that Curve mainly focuses on providing low-slippage trading services between different stablecoins (such as USDT, USDC, and DAI), allowing users to reduce token exchange losses during the exchange process. Therefore, Curve does not charge high fees to users. Curve’s source of profit lies in issuing stablecoins and lending platforms or financial derivative platforms.

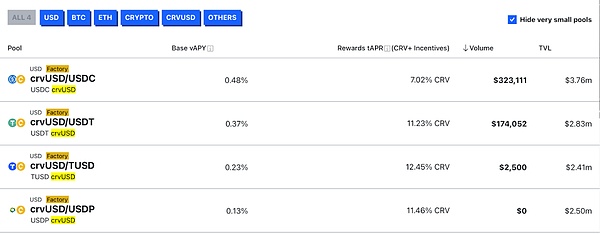

As of today (5/24), Curve’s lock-up volume is $4.02 billion. On May 4, it was announced that crvUSD had been deployed on the Ethereum mainnet, but the front-end UI interface has not yet been completed and is expected to be released soon. According to Etherscan data, the crvUSD smart contract was successfully deployed on the Ethereum mainnet at around 3:00 a.m. on May 4, and 20 million crvUSD were minted through 5 transactions in a short period of time.

Curve CEO Michael Egorov then borrowed 1 million crvUSD using 957.5 sfrxETH as collateral. It is worth mentioning that after the news of the deployment of the stablecoin crvUSD on the Ethereum mainnet, Curve Finance’s governance token CRV skyrocketed to $0.975 in a short period of time, an increase of 6% in 24 hours.

(I) Mining the crvUSD operation mechanism from the white paper

Last year, Curve released a white paper to explore the overall operation mechanism. The core principles of Curve are threefold: “Lending-Liquidation Automated Market-Maker Algorithm (LLAMMA)”, “PegKeeper”, and “Monetary Policy”. The first LLAMMA can be viewed as a dynamic lending and liquidation algorithm, which introduces an automated market maker into lending and liquidation. Therefore, it is different from normal collateralized stablecoins. Normal collateralized stablecoins, such as MakerDAO, belong to over-collateralization. Users need to collateralize enough collateral to the vault to borrow stablecoins in proportion to the collateral rate. If the collateral value drops to a certain extent, there will be a liquidation line. Once the liquidation line is exceeded, the collateral will be automatically sold by the system to repay the debt.

The LLAMMA proposed by Curve is still issued through over-collateralization, but instead of traditional lending and liquidation processes, a special purpose AMM is used. When the liquidation threshold is reached, the liquidation does not occur all at once, but is converted into a continuous liquidation/de-liquidation process.

For example, using ETH as collateral to borrow crvUSD. When the value of ETH is high enough, the collateral will not change, just like traditional collateral lending. When the ETH price falls and enters the liquidation range, ETH will be gradually sold off. After falling below the range, it will all be stablecoins, and it will not change as it continues to fall, just like other lending protocols.

However, if ETH rises in the middle of the liquidation range, Curve will use stablecoins to help users buy back ETH. If there is fluctuation in the middle of the liquidation range, then the liquidation and de-liquidation process will be repeated continuously, and ETH will be sold and bought continuously.

Compared with MakerDAO’s one-time liquidation lending protocol, if the market rebounds after liquidation, in MakerDAO, users will only have a residual value left after liquidation, while in Curve, they will buy back ETH during the rise.

The above is how LLAMMA solves the mechanism of liquidating collateral, and PegKeeper and Monetary Policy are the mechanisms that Curve Finance uses to anchor crvUSD to 1 USD.

In short, LLAMMA is the algorithm that Curve uses to liquidate collateral, and it reduces losses during liquidation by dispersing collateral in different price ranges. It dynamically liquidates collateral by generating arbitrage opportunities with greater changes in price than external prices. When the price falls, the collateral will become crvUSD, and when the price rises, it will become collateral again.

After the crvUSD lending interface was officially launched, the Curve front-end page can now see the complete data of the crvUSD liquidity pool, and the TVL of each liquidity pool is between 2 and 3 million US dollars.

IV. SNX V3 sUSD

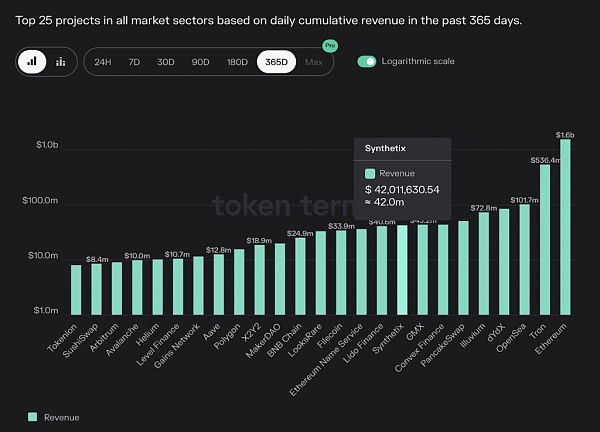

As an important partner of Optimism, Synthetix has been deployed on Optimism as early as July 2021. Then, Synthetix encouraged users to transfer pledged SNX to Optimism, and trading and income gradually shifted from the Ethereum mainnet to Optimism. According to defilama 5/26 data, Synthetix ranks second on Optimism and has a TVL of 149 million US dollars.

Synthetix’s revenue mainly comes from Synths spot trading and perpetual contract trading. Originally launched as a synthetic asset platform, Synthetix has a unique “debt pool” operating mechanism: users can borrow sUSD by pledging SNX, which is different from MakerDAO’s collateralized asset issuance of DAI. Although Synthetix will also liquidate when the SNX collateralization rate is insufficient (the current liquidation threshold is a collateralization rate of 160%), the logic is completely different.

In Synthetix, all users who pledge SNX to mint sUSD share a “debt pool”. When a user mints sUSD, the proportion of the minted sUSD to the total sUSD becomes the proportion of the user’s share of the entire debt pool, and all minted sUSD is the debt of the entire system. Because everyone shares the same debt pool, if other users increase the value of their assets through operations, it will increase the debt of the remaining users. For example, if a user’s asset appreciation rate is not higher than the system average, they will lose money.

It can be seen that Synths in Synthetix rely on the Chainlink oracle to provide prices, but the update of the oracle price on the chain will completely lag behind the price of the spot market, indirectly leading to the risk of front-running trading.

Synthetix realized this risk and in 2021, it directly used the oracle price feed exchange without considering the depth of the order book, and officially started the new narrative of atomic swaps. Atomic swaps allow users to price Synths through the combination of Chainlink and the DEX oracle Uniswap V3 (representing the latest spot price) and exchange assets in an atomic way. In short, under the composability of Synthetix, pledgers can also be protected from front-running attacks.

In June 2022, Synthetix announced that 1inch had integrated Synthetix’s atomic swaps, allowing trading users to enjoy better liquidity and SNX pledgers to receive additional fees.

The Synthetix Perps V2 plan was launched in December of the same year, which can reduce costs, increase scalability and capital efficiency.

From Synthetix to Synthetix V2 to the current Synthetix V3, the team has shown extremely efficient update capabilities, not only can meet various customized needs, but also reflects the ambition to make Synthetix a liquidity center.

Currently, the functionality of Synthetix V3 is being gradually rolled out, and it is a comprehensive reform of the protocol that the team has undertaken from scratch.

(I) Differences before and after the V3 upgrade

Improvement 1: Hooked stablecoin snxUSD Synthetix V3 will launch a new stablecoin snxUSD to address the scalability issues and possible de-anchoring of sUSD in the past. snxUSD before the upgrade: Even though most sUSD were minted by pledging SNX, Synthetix also enabled the over-collateralized WETH to mint snxUSD. However, because there was often a lack of arbitrage activities to bring the price back to $1 due to sUSD being slightly higher or lower than $1, few users used it. snxUSD after the upgrade: in the new version of Synthetix V3, snxUSD can be exchanged with some collateral at a ratio of 1:1, which allows users to limit the price of sUSD within a small range just by arbitrage. At the same time, this issuance method, which is designed to be convenient, may also increase the issuance of snxUSD.

Improvement 2: Reward distribution and liquidation snxUSD after the upgrade: With the reward manager, pool owners can distribute rewards to users based on their pledge ratio or reference factors such as pledge time, providing a more flexible value allocation scheme. Synthetix V3 also proposes a liquidation mechanism that distributes the collateral and debt of the liquidated position among other participants in the vault. If the entire vault is liquidated, all collateral will be seized and sold to repay the debt.

Improvement 3: Isolation of debt pools snxUSD before the upgrade: In the existing Synthetix V2, all transactions must go through a single SNX debt pool, and many functions are restricted due to the need to consider many existing risks, such as the snxUSD issuance method mentioned at the beginning. snxUSD after the upgrade: Synthetix V3 introduces the concept of pools, allowing stakeholders to customize risk exposure for specific markets, making the risk and return of the debt pool differentiated. Governance can decide the collateral types and limits for each pool, and even if there is a risk, it can be limited to a small range. It also provides SNX pledgers with the opportunity to take on higher risks for higher returns.

(2) Conclusion Currently, functions such as atomic trading are being used less frequently, but there is strong demand for Perp V2, Synthetix V3 will be more flexible to meet various customized needs, while limiting risks to a small range. The new stablecoin SNXUSD is easier to mint and the price is easier to anchor to $1.

The launch of Synthetix V3 represents an important milestone for the protocol, and whether this thorough reform can become a new narrative for the next generation of permissionless, derivative liquidity platforms of on-chain finance is promising.

5. Conclusion

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Founder of Synthetix: Many design decisions are unavoidable choices, and forward-looking planning is almost impossible.

- Protecting Investors? A Detailed Explanation of the SEC’s Lawsuit Against Binance

- Shapella in the Rearview Mirror: What’s Next for Ethereum After Major Upgrade?

- Thunes, a digital payment infrastructure platform, has completed a $60 million Series C funding round with Marshall Wace leading the investment.

- Summary of Uniswap V3 asset management, earnings, and structured product protocols

- Exploring the Scalability of Single-Chain Architectures: A Case Study of the Solana Validator Client Firedancer

- End of L1 Battle Marks the Start of a New Era for L2 Subdivision